Government

Inside The Disinformation Industry

Inside The Disinformation Industry

Authored by Freddie Sayers via UnHerd.com,

“Our team re-reviewed the domain, the rating will not change…

Authored by Freddie Sayers via UnHerd.com,

“Our team re-reviewed the domain, the rating will not change as it continues to have anti-LGBTQI+ narratives…

The site authors have been called out for being anti-trans. Kathleen Stock is acknowledged as a ‘prominent gender-critical’ feminist.”

This was part of an email sent to UnHerd at the start of January from an organisation called the Global Disinformation Index. It was their justification, handed down after a series of requests, for placing UnHerd on a so-called “dynamic exclusion list” of publications that supposedly promote “disinformation” and should therefore be boycotted by all advertisers.

They provided examples of the offending content: Kathleen Stock, whose columns are up for a National Press Award this week, Julie Bindel, a lifelong campaigner against violence against women, and Debbie Hayton, who is transgender. Apparently the GDI equates “gender-critical” beliefs, or maintaining that biological sex differences exist, with “disinformation” — despite the fact that those beliefs are specifically protected in British law and held by the majority of the population.

The verdicts of “ratings agencies” such as the GDI, within the complex machinery that serves online ads, are a little-understood mechanism for controlling the media conversation. In UnHerd’s case, the GDI verdict means that we only received between 2% and 6% of the ad revenue normally expected for an audience of our size. Meanwhile, neatly demonstrating the arbitrariness and subjectivity of these judgements, Newsguard, a rival ratings agency, gives UnHerd a 92.5% trust rating, just ahead of the New York Times at 87.5%.

So, what are these “ratings agencies” that could be the difference between life and death for a media company? How does their influence work? And who funds them? The answers are concerning and raise serious questions about the freedom of the press and the viability of a functioning democracy in the internet age.

Disinformation only really became a discussion point in response to the Trump victory in 2016, and was then supercharged during the Covid era: Google Trends data shows that worldwide searches for the term quadrupled between June and December 2016, and had increased by more than 30 times by 2022. In response to the supposed crisis, corporations, technology companies and governments all had to show they were taking some form of action. This created a marketplace for enterprising start-ups and not-for-profits to claim a specialism in detecting disinformation. Today, there are hundreds of organisations who make this claim, providing all sorts of “fact-checking” services, including powerful ratings agencies such as GDI and Newsguard. These companies act as invisible gatekeepers within the vast machinery of online advertising.

How this works is relatively straightforward: in UnHerd’s case, we contract with an advertising agency, which relies on a popular tech platform called “Grapeshot”, founded in the UK and since acquired by Larry Ellison’s Oracle, to automatically select appropriate websites for particular campaigns. Grapeshot in turn automatically uses the “Global Disinformation Index” to provide a feed of data about “brand safety” — and if GDI gives a website a poor score, very few ads will be served.

The Global Disinformation Index was founded in the UK in 2018, with the stated objective of disrupting the business model of online disinformation by starving offending publications of funding. Alongside George Soros’s Open Society Foundation, the GDI receives money from the UK government (via the FCDO), the European Union, the German Foreign Office and a body called Disinfo Cloud, which was created and funded by the US State Department.

Perhaps unsurprisingly, its two founders emerged from the upper echelons of “respectable” society. First, there is Clare Melford, whose biography published by the World Economic Forum states that she had previously “led the transition of the European Council on Foreign Relations from being part of George Soros’s Open Society Foundation to independent status”. She set up the GDI with Daniel Rogers, who worked “in the US intelligence community”, before founding a company called “Terbium Labs” that used AI and machine learning to scour the internet for illicit use of sensitive data and then sold it handsomely to Deloitte.

Together, they have spearheaded a carefully intellectualised definitional creep as to what counts as “disinformation”. Back when it was first set up in 2018, they defined the term on their website as “deliberately false content, designed to deceive”. Within these strict parameters, you can see how it might have appeared useful to have dedicated fact-checkers identifying the most egregious offenders and calling them out. But they have since broadened the definition to encompass anything that deploys an “adversarial narrative” — stories that may be factually true, but pit people against each other by attacking an individual, an institution or “the science”.

GDI founder Clare Melford explained in an interview at the LSE in 2021 how this expanded definition was more “useful”, as it allowed them to go beyond fact-checking to targeting anything on the internet that they deem “harmful” or “divisive”:

“A lot of disinformation is not just whether something is true or false — it escapes from the limits of fact-checking. Something can be factually accurate but still extremely harmful… [GDI] leads you to a more useful definition of disinformation… It’s not saying something is or is not disinformation, but it is saying that content on this site or this particular article is content that is anti-immigrant, content that is anti-women, content that is antisemitic…”

Larger traffic websites are rated using humans, she explains, but most are rated using automated AI. “We actually instantiate our definition of disinformation — the adversarial narrative topics — within the technology,” explains Melford. “Each adversarial narrative is given its own machine-learning classifier, which then allows us to search for content that matches that narrative at scale… misogyny, Islamophobia, anti-Semitism, anti-black content, climate change denial, etc.”

Melford’s team and algorithm are essentially trained to identify and defund any content she finds offensive, not disinformation. Her personal bugbears are somewhat predictable: content supporting the January 6 “insurrections”, the pernicious influence of “white men in Silicon Valley”, and anything that might undermine the global response to the “existential challenge of climate change”.

The difficulty, however, is that most of these issues are highly contentious and require robust, uncensored discussion to find solutions. Challenges to scientific orthodoxy are particularly important, as the multiple failures of the official response to Covid-19 amply demonstrated. Indeed, one of the examples of GDI’s good work that Melford highlighted in her LSE talk was an article on a Spanish website in June 2021 about the Delta variant of Covid-19. “Official data: a third of deaths from the Delta variant in the United Kingdom were among the vaccinated,” reads the headline, next to an advertisement for Chipotle Mexican Grill. “This is clearly untrue,” she said breezily, “and Chipotle has been caught next to this ad unwittingly, and unfortunately for them have funded this highly dangerous disinformation about vaccines”.

This was, however, far from an accurate description. The statistic being reported comes from a June 2021 Public Health England report into Covid variants that sets out the 42 known deaths from the Delta variant from January to June: 23 were unvaccinated, 7 vaccinated with one shot and 12 fully vaccinated. In other words, 29% were fully vaccinated — around a third — and 17% partially vaccinated, making a total of 45% vaccinated. The headline claiming a third were vaccinated, it turns out, was not spreading “dangerous disinformation” at all — if anything, it underplayed the story.

Examples like this are far from rare. The GDI still hosts an uncorrected 2020 blog about the “evolution of the Wuhan lab conspiracy theory” surrounding Covid-19’s origins, which concludes that “cutting off ads to these fringe sites and their outer networks is the first action needed”.

This is despite the fact that Facebook and other tech companies long ago corrected similar policies and conceded that it was a legitimate hypothesis that should never have been censored.

In the US, a number of media organisations have started to take action against GDI’s partisan activism, prompted by a GDI report in 2022 that listed the 10 most dangerous sites in America. To many, it looked simply like a list of the country’s most-read conservative websites. It even included RealClearPolitics, a well-respected news aggregator whose polling numbers are among the most quoted in the country. The “least risk of disinformation” list was, predictably enough, populated by sites with a liberal inclination.

In recent months, a number of American websites have launched legal challenges against GDI’s labelling system, which they claim infringes upon their First Amendment rights. In December, The Daily Wire and The Federalist teamed up with the attorney general of Texas to sue the state department for funding GDI and Newsguard. A separate initiative to prevent the Defense Department from using any advertiser that uses Newsguard, GDI or similar entities has been successful, and is now part of federal law.

But GDI is a British company and, on this side of the Atlantic, the Conservative Government continues to fund it. A written question from MP Philip Davies last year revealed that £2.6 million was given in the period up to last year, and that there is still “frequent contact” between the GDI and the FCDO “Counter Disinformation and Media Development” unit.

Yesterday, I was invited to give evidence to the House of Lords Communication and Digital Committee during which I outlined the extent of the threat to the free media of self-appointed ratings agencies such as the Global Disinformation Index. The reality, as I told Parliament, is that GDI is merely the tip of the iceberg. At a time when the news media is so distrusted and faces a near-broken business model, the role of government should be to prevent, not encourage, and most certainly not fund, consolidations of monopoly power around certain ideological viewpoints.

But this isn’t simply a matter for the media. Both companies and those in the advertising sector also need to act: it cannot be good marketing for brands to target only half the population. Last year, Oracle announced it was cutting ties with GDI on free speech grounds, but as we discovered, it seems they are still collaborating via the Grapeshot plaform: is Larry Ellison aware of this?

At its heart, the disinformation panic is becoming a textbook example of how a “solution” can do more harm than the problem it is designed to address. Educated campaigners such as Clare Melford may think they are doing the world a service, but in fact they are acting as intensifying agents, lending legitimacy to a conspiratorial world view in which governments and corporations are in cahoots to censor political expression. Unless something is done to stop them, they will continue to sow paranoia and distrust — and hasten us towards an increasingly radicalised and divided society.

Government

World Bank Report Highlights Advantage Of Central Bank Gold Revaluation Accounts

World Bank Report Highlights Advantage Of Central Bank Gold Revaluation Accounts

By Jan Nieuwenhuijs of Gainesville Coins

Recently the World…

By Jan Nieuwenhuijs of Gainesville Coins

Recently the World Bank released a handbook for asset managers on why to invest in gold. At Gainesville Coins I have written numerous articles on gold revaluation accounts and how these can be deployed by central banks to absorb losses in case of emergency. The World Bank has taken notice of my research as they allude to this practice in a chapter on reserve accounting and reference to my work.

The World Bank publication underlines the fact that gold is the only financial asset without counterparty risk, and due to its scarcity relative to fiat currencies its price in the long run always increases. Central banks that own gold for an extended period can reap the benefits of their gold revaluation account without having to sell any gold.

Introduction

The Gold Investing Handbook for Asset Managers document published earlier this year by the World Bank Treasury is an interesting read for investors. It covers the gold market structure, optimal portfolio assessments, geopolitical aspects, a trading and liquidity guide, and a discussion on gold accounting, among other subjects.

The World Bank Treasury is tasked to manage the World Bank’s finances and contribute to the Bank’s twin goals of “ending extreme poverty and promoting shared prosperity.” As such it acts as a trusted advisor to its member countries to support financial stability and provide “thought leadership in the broader treasury and financial management arena.” With this mission in mind the Bank’s Treasury writes that:

Throughout history, gold has played a vital role as a financial asset in the global financial system. ... In the modern era, gold continues to play a critical role in the global financial system, serving as a hedge against inflation, a safe haven asset, and a reserve asset for central banks. … The role of gold in the global financial system has evolved over time, with changes in monetary policy, economic conditions, and technological advancements influencing demand and supply dynamics. Despite these changes, gold remains a crucial component of the global financial system and is likely to continue to play an essential role in the future. … The market disruptions brought about by the 2008 Global Financial Crisis (GFC), the US and China trade war, Brexit, and the COVID-19 pandemic, as well as a prolonged period of negative real interest rates and geopolitical uncertainties caused by financial sanctions imposed on Russia to freeze its foreign reserves, reinforced the strategic importance of gold as a buffer against financial instability.

Central Bank Gold Revaluation Accounts

After the central banks of advanced economies such as the Netherlands and Germany stated their gold revaluation accounts (GRAs) guarantee their solvency in 2013, the World Bank now joins the discussion on GRAs. On page 57 of its report there is a summary of my article on how the central bank of Curaçao and Saint Martin utilized its GRA to cover losses in 2021.

Simplified, a GRA is an accounting entry on the liability side of a central bank’s balance sheet that records unrealized gains in gold. Because central banks are the root of the modern money tree, they can use these entries to pay for expenses. A GRA, if sufficient, can prevent a central bank from going into negative capital in times of financial stress without having to sell gold (for more details read my article here).

All in all, the World Bank’s reporting of GRAs is bullish for gold as it once again confirms gold’s position front and center in the monetary system. Gold—as per International Monetary Fund (IMF), the World Bank’s sister institute—is the only universally accepted financial asset that is not someone else’s liability. From the IMF (BPM6):

Financial assets are economic assets that are financial instruments. Financial assets include financial claims and, by convention, monetary gold held in the form of gold bullion … A financial claim is a financial instrument that has a counterpart liability. Gold bullion is not a claim and does not have a corresponding liability. It is treated as a financial asset, however, because of its special role as a means of financial exchange in international payments by monetary authorities and as a reserve asset held by monetary authorities.

Gold has no counterparty risk and can’t be arbitrarily devalued. Hence, the IMF lists gold at the very top of reserve assets, which makes gold the hardest asset for central banks to own and creates significant unrealized gains over time through the debasement of the currency they issue. And as I have explained previously these unrealized gains can be turned into realized gains to pay for expenses.

Conclusion

In the past years more and more central banks from both the global South and North—and international financial institutions like the World Bank—are pitching gold as an imperative asset with multiple functions. Gold is a safe haven asset, inflation hedge, backup currency, its revaluation accounts can be used, etcetera.

If one looks at the order of the IMF’s list of reserve assets the similarities with Exter’s inverse pyramid is easily seen. Gold truly underpins the global financial system. In my view, though, the value of all financial assets resting on gold has grown too large in the past decades. For stabilizing the pyramid (financial system), the value of the gold needs to increase accordingly.

But we will explore these imbalances more in depth in my next article.

Further Reading

- German Central Bank Doesn’t Rule Out Gold Revaluation

- Governor Dutch Central Bank States Gold Revaluation Account Is Solvency Backstop

- How a Central Bank in the Caribbean Recently Used Its Gold Revaluation Account to Cover Losses

- German Central Bank: Gold Revaluation Account Underlines Soundness of Balance Sheet

- How Central Banks Can Use Gold Revaluation Accounts in Times of Financial Stress

International

Netflix Reports Blowout Q1 Results & Sub Adds, But Warns Gains Will Slow, Will End Reporting Of Quarterly Subs; Stock Slides

Netflix Reports Blowout Q1 Results & Sub Adds, But Warns Gains Will Slow, Will End Reporting Of Quarterly Subs; Stock Slides

After suffering…

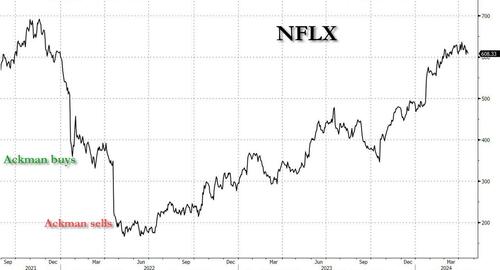

After suffering a historic collapse at the end of 2021, when in the span of five months Netflix lost 75% of its value, and when Ackman first bought then immediately dump the stock just around the generational bottom, the company has enjoyed a stellar recovery over the past two year when it rose by nearly 300%, from a low of $166 to a recent high of price of $636, just shy of the record hit in late 2021.

It is therefore not surprising that after this tremendous ascent and nearly 3x return, that both Goldman and UBS agree that Netflix remains a very crowded long with investors very bullish. According to UBS, "the bull thesis continues to revolve around the residual impact of password sharing and they are just scratching the surface on the scale of the ads business" while "the rationalization of content spend and direct-to-consumer efforts from competitors will also be a tailwind for Netflix." Goldman chimes in that positioning and sentiment skew more long - as NFLX’s multiple is approaching multi-year highs - with stock up ~28% YTD and short interest back at 10 year lows.

That said, UBS cautions that stretched positioning and the stock near $620 cause some to pause, but given they are the first one out of the gate, the stock could benefit from investors using it as a safety play.

On the earnings print, investors will be focused on:

- magnitude of upside to sub net adds

- pricing updates as estimates are underpinned by price increases eventually hitting;

- tailwinds from paid sharing and if there are legs left versus already in run rate;

- updates on scaling in ad business progress into 2H/2025, and consistent message on revenue re-acceleration;

- updates to margin expectations (~2-3pts y/y annual OM expansion) and spending plans given pullback at peers; and

- updates on live content/sports strategy.

And here are the main bogeys:

- Q1 Subscriber Adds: 8MM (heard a wide range of estimate - some higher, up to 10MM, some lower, 7-8MM, Goldman expects +7MM)

- Q1 Revenue Growth adjusted for FX: +16-17%

- Q1 Reported Revenue Growth: +14%

- Q1 EBIT: $2.4B, +40% y/y

- Q2 Subscriber Adds: 4M

- Q2 Revenue Growth adjusted for FX: +17%

- Q2 Reported Revenue Growth: +16%

- Q2 EBIT: $2.4BN

- FY24 Operating Margin: reiterate guide at 24%

- FY24 FCF Guide: $6BN

With that in mind, and considering that options are pricing in a roughly 7% swing after hours today, here is what NFLX reported for its first quarter:

- EPS $5.28, beating the estimate $4.52, and more than double the $2.88

- Revenue $9.37 billion, up a whopping 15% y/y, and beating the estimate $9.26 billion

- Revenue was above the company's guidance as paid net additions (9.3M vs. 1.8M in Q1’23) were higher than we forecast.

- Streaming paid net change +9.33 million smashed estimates of 4.84 million, were just shy of the highest whisper number of 10 million and were far above the +1.75 million subs added a year ago. This was the best start of the year since 2020!

- UCAN streaming paid net change +2.53 million vs. +100,000 y/y, beating estimates of +988,580

- EMEA streaming paid net change +2.92 million vs. +640,000 y/y, beating estimates of +1.58 million

- LATAM streaming paid net change +1.72 million vs. -450,000 y/y, beating estimates of +837,467

- APAC streaming paid net change +2.16 million, +48% y/y, beating estimates of +1.48 million

- Operating margin 28.1% vs. 21% y/y, estimate 25.7%

- Operating income $2.63 billion, a whopping +54% increase y/y, and beat estimates of $2.43 billion

- Free cash flow $2.14 billion, +0.9% y/y, and also beat estimate $1.87 billion

Bottom line: Q1 subscriber adds smashed estimates in what was the best Q1 for NFLX since 2020 when the pandemic led to an unprecedented growth surge.

Netflix ended Q1 with total streaming paid memberships of 269.6 million, up 16% y/y, and well above the estimate of 264.52 million. The subs are in line with what it guided last quarter when it said that "paid net additions to be down sequentially but to be up versus Q1’23 paid net adds of 1.8M."

About 40% of Netflix’s new customers are selecting the advertising option in markets where it’s available, the company said. The advertising tier is still minuscule relative to online video giants like YouTube.

Netflix has successfully rebounded from a post-covid slowdown in 2021 and 2022 to grow at its fastest rate since the early days of the coronavirus pandemic. That is due largely to its crackdown on people who were using someone else’s account. The company estimated more than 100 million people were using an account for which they didn’t pay. While executives at Netflix feared a backlash from customers, the company has been able to convince millions of moochers to pay for access.

Looking ahead, for Q2 Netflix sees the following:

- Revenue $9.49 billion, missing the estimate $9.51 billion

- EPS $4.68, beating the estimate $4.54

- Operating margin 26.6%, beating estimate 25.4%

Drilling down into the Q2 forecast reveals:

- revenue growth of 16% which equates to 21% growth on a F/X neutral basis due primarily to price changes in Argentina and the devaluation of the local currency relative to the US dollar.

- paid net additions should be lower in Q2’24 vs. Q1’24 due to typical seasonality

- the company also forecasts global ARM to be up year-over-year on a F/X neutral basis in Q2. This is what the quarterly subs look like historically and vs WS estimates:

For the full year, NFLX sees revenue growth between 13% and 15%, boosted its operating margin outlook to 25%, beating the estimate of 24.1%, and above the 24% expected previously; the company still sees free cash flow about $6 billion, estimate $6.49 billion

And here are the results and projections summarized:

And here is the regional detail: for the third consecutive quarter, EMEA (Europe, the Middle East and Africa) accounted for the largest share of Netflix’s growth in the quarter. The company added almost 3 million customers in that region, following the 5 million added last quarter. The average amount Netflix makes per customer has increased only modestly in the past year, at $16.64, and rising 3%.

Yet despite the blowout numbers this quarter, something bad may be on deck because NFLX reported that starting next year with 1Q 2025 earnings, the company will stop reporting quarterly membership numbers and ARM; to counter that, the company will also start providing annual revenue outlook. Here is the explanation, straight from the quarterly report:

As we’ve noted in previous letters, we’re focused on revenue and operating margin as our primary financial metrics — and engagement (i.e. time spent) as our best proxy for customer satisfaction. In our early days, when we had little revenue or profit, membership growth was a strong indicator of our future potential. But now we’re generating very substantial profit and free cash flow (FCF). We are also developing new revenue streams like advertising and our extra member feature, so memberships are just one component of our growth. In addition, as we’ve evolved our pricing and plans from a single to multiple tiers with different price points depending on the country, each incremental paid membership has a very different business impact. It’s why we stopped providing quarterly paid membership guidance in 2023 and, starting next year with our Q1'25 earnings, we will stop reporting quarterly membership numbers and ARM.

We’ll continue to provide a breakout of revenue by region each quarter and the F/X impact to complement our financials. For guidance, we’ll add annual revenue guidance on top of what we already provide today: our annual operating margin and free cash flow forecast and forecasts for quarterly revenue, operating income, net income, and EPS. We’ll also announce major subscriber milestones as we cross them.

Instead of subs, NFLX - like Musk - plans on providing more details on overall engagement: "we’ve been providing progressively more information on engagement, starting with our Top 10 weekly and most popular lists and more recently our bi-annual report into viewing on Netflix (which covers ~99% of all video watch time on our service). This is more information than any of our competitors provide, and we expect to provide even more over time."

Netflix finished the quarter with gross debt of $14B and cash and cash equivalents of $7B; curiously, it boosted the revolving credit facility to $3 billion from $1 billion. NFLX expects to refinance its upcoming debt maturities and we don’t currently have plans to lever up to buy back stock as we value balance sheet flexibility

Expectations for Netflix’s first quarter had soared in recent days, as one analyst after another published rosy forecasts. Pouring some cold water on expectations, NFLX said subscriber gains will be lower this period, even as revenue will increase 16%, or more than expected.

Netflix also said it will stop reporting paid quarterly membership and revenue per subscriber, starting with the first quarter of 2025. Those metrics have long been the primary way Wall Street evaluated the company’s performance, but Netflix has tried to shift the focus to traditional measures like sales and profit. Management will continue to report major subscriber milestones.

“The movement to no longer disclose quarterly subscriptions from next year will not go down well,” Paolo Pescatore, founder and analyst at PP Foresight, said in an email. “More so given the subscriber growth that the streaming king has seen over the last year.”

To be sure, new customers have had plenty to watch. Netflix has delivered a new hit every couple weeks so far this year, including limited series such as Fool Me Once and Griselda, the dramas The Gentleman and 3 Body Problem and the reality show Love Is Blind. The streaming service accounts for 8.1% of TV viewing in the US, and is a leading TV network in most of the world’s major media markets.

“With more than two people per household on average, we have an audience of over half a billion people,” the company said in its letter. “No entertainment company has ever programmed at this scale and with this ambition before.”

Yet even skeptical analysts have been impressed with the company’s recent performance, lifting their price targets for investors. To sustain its growth going forward, Netflix has also introduced a cheaper, advertising-supported version of its service targeting cost-conscious customers. It’s also begun to invest in live programming, including stand-up specials, wrestling and an upcoming boxing match.

Turning to the once-problematic cash flow statement, the company generated cash from operating activities of $2.2B in Q1, and free cash flow of $2.1B (both flat with Q1’23).

During the quarter, NFLX paid down $400M of senior notes with cash on hand and repurchased 3.6M shares for $2B. The company finished the quarter with gross debt of $14B and cash and cash equivalents of $7B.

NFLX is still forecasting full year 2024 free cash flow of approximately $6B and cash content spend of up to $17B.

Finally, here is the explanation for why NFLX is boosting its revolver:

We’re modestly evolving our capital allocation strategy to better reflect our investment grade status. Going forward, rather than anchoring to $10-$15B of gross debt and minimum cash equivalent to two months of revenue, we’ll maintain financial policies consistent with a solid investment grade credit rating. In particular, we’ll continue to prioritize profitable growth by reinvesting in our business, maintain a healthy balance sheet and ample liquidity, and return excess cash (beyond several billion dollars of minimum cash and any used for selective M&A) to shareholders through share repurchases.

As part of this evolution, we’ve upsized our revolving credit facility from $1B to $3B. This will bolster our access to liquidity, and enable us to improve our cash efficiency, over time. We also expect to refinance our upcoming debt maturities and we don’t currently have plans to lever up to buy back stock as we value balance sheet flexibility

The recent growth lifted Netflix shares back toward record highs, giving the company a market value of more than $260 billion. It set an all-time closing high of $691.69 in November 2021, although today's earnings will likely slow down the recent gains: while the result were solid, and the beat was across the board, the stock initially spiked then, and at last check NFLX was down about $20 from its closing price of $610, and about $100 below its record high from Nov 2021.

International

How England’s scrapped Sure Start centres boosted the health and education of disadvantaged children

I worked with Sure Start and saw the good it brought to communities.

The Sure Start programme was launched in 1999, with centres set up in communities across England to offer support to the most disadvantaged families.

These centres had significant investment and a broad remit that focused on improving the lives of families. They offered support for families with children aged up to five, as well as high-quality play, learning and childcare experiences for children.

They also provided healthcare and advice about family health and child health, as well as development and support for people with special needs. But after 2010, funding was cut significantly and many of the centres closed.

Now, a report from the Institute for Fiscal Studies (IFS) has laid out some of their benefits. The research found that access to a Sure Start centre significantly improved the GCSE results of disadvantaged children.

This builds on other research that has shown that Sure Start also had significant long-term health benefits. This research suggests that at its peak, Sure Start prevented 13,000 hospitalisations of children aged 11-15.

These findings come as no surprise to those who, like me, worked in the early Sure Start local programmes and saw the value of their family-led ethos. In my current role at Sheffield Hallam University, I am the director of a nursery and early years research centre which maintains this approach – and my research with colleagues has shown the benefits that it brings to both parents and children.

How Sure Start worked

There was no set model for how Sure Start local programmes should deliver the services they offered. This led to delivery plans being developed with the local community. The support offered was tailored to the challenges that local families were facing.

I was lucky enough to be the community development worker for a small children-and-families charity that led an early Sure Start local programme. As this developed, it kept the community at its heart. At its peak, the programme combined a 60-place day-nursery, a women’s health project, and training for parents. Health visitors and midwives working on the sames site provided wraparound support for children and families.

During this period, I was constantly struck by the huge changes that families made in their lives after receiving the support they needed at the time they needed it. I believe this was partly due to the early programmes having nurseries on site. This created a daily point of contact with families, building trust and relationships which then supported families’ – and particularly mothers’ – engagement with other services.

Having access to early years provision meant that special needs were identified early, and children had access to support services before they reached school age. This was a positive factor highlighted in the IFS report.

Learning from Sure Start

The nursery and early years research centre I now direct was opened by Sheffield Hallam University during the pandemic in a disadvantaged area. This project is the result of a partnership with Save the Children UK.

Drawing on the successes of Sure Start, the nursery was established with the motto “changing lives through relationships”. It had the explicit aim of building trust with families so that we can understand their challenges and work on solutions together.

The university runs the nursery, and together with Save the Children provides additional support to parents. This includes a breakfast club, training and volunteering opportunities, and links to health and wellbeing support. We also direct people to the services offered by the local authority family hub, which is based on site.

This “one-stop shop” approach means there is a team that can offer support across a range of issues, without families having to re-tell their stories to different agencies each time.

There are numerous case studies of parents making changes in their lives through the support at the nursery. A number of our parents have developed the confidence to train as community researchers, for example, while some are training to deliver a nurture course to other parents in the community. One of our parents who has experience of homelessness is now advising homeless charities.

I have always been convinced of the benefit of Sure Start’s approach, and the recent IFS findings add further evidence of its value. The families that we work with are facing multiple challenges, from food and fuel poverty to insecure work and housing. Now would seem to be a critical moment for this approach to be brought back, so that a future generation of children can benefit.

Sally Pearse does not work for, consult, own shares in or receive funding from any company or organisation that would benefit from this article, and has disclosed no relevant affiliations beyond their academic appointment.

uk pandemic-

International4 weeks ago

International4 weeks agoParexel CEO to retire; CAR-T maker AffyImmune promotes business leader to chief executive

-

Government2 weeks ago

Government2 weeks agoClimate-Con & The Media-Censorship Complex – Part 1

-

International4 days ago

International4 days agoWHO Official Admits Vaccine Passports May Have Been A Scam

-

Spread & Containment1 week ago

Spread & Containment1 week agoFDA Finally Takes Down Ivermectin Posts After Settlement

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoVaccinated People Show Long COVID-Like Symptoms With Detectable Spike Proteins: Preprint Study

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoCan language models read the genome? This one decoded mRNA to make better vaccines.

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoWhat’s So Great About The Great Reset, Great Taking, Great Replacement, Great Deflation, & Next Great Depression?

-

Uncategorized2 days ago

Uncategorized2 days agoRed States Fight Growing Efforts To Give “Basic Income” Cash To Residents