Government

The New York Fed Consumer Credit Panel: A Foundational CMD Data Set

As the Great Financial Crisis and associated recession were unfolding in 2009, researchers at the New York Fed joined colleagues at the Board of Governors…

As the Great Financial Crisis and associated recession were unfolding in 2009, researchers at the New York Fed joined colleagues at the Board of Governors and Philadelphia Fed to create a new kind of data set. Household liabilities, particularly mortgages, had gone from being a quiet little corner of the financial system to the center of the worst financial crisis and sharpest recession in decades. The new data set was designed to provide fresh insights into this part of the economy, especially the behavior of mortgage borrowers. In the fifteen years since that effort came to fruition, the New York Fed Consumer Credit Panel (CCP) has provided many valuable insights into household behavior and its implications for the macro economy and financial stability.

The CCP was one of the first data sets drawn from credit bureau data, one of the earliest features of the Center for Microeconomic Data (CMD), and the primary source material for some of the CMD’s most important contributions to policy and research. Here we review a few of the main household debt themes over the past fifteen years, and how our analyses contributed to their understanding.

The New York Fed Consumer Credit Panel

The CCP is drawn from anonymized credit bureau data provided by Equifax and includes quarterly information on the liabilities of a dynamic panel of individuals (5 percent of the population with a credit report—approximately 14.2 million individuals in 2023:Q4) and their household members (an additional 11.5 percent/ 32.9 million individuals) beginning in the first quarter of 1999. The data are unique in many ways, but the dynamic panel structure was among the most important features since, in each quarter, the data provide a representative picture of credit outcomes of the U.S. population.

The data include all the major forms of household debt: mortgage and home equity lines of credit, credit cards, auto loans, and student loans. For each individual we observe the opening and closing of accounts, balances and credit limits on existing accounts, payment status on all forms of debt, and other features of the credit report, such as the individual’s credit score. In addition, we know the individual’s location (to the census block) and year of birth. More details on the data are available in Lee and van der Klaauw (2010).

The Great Financial Crisis and Recovery

The CCP immediately became an invaluable resource in understanding the extreme challenges that American households were facing even as the financial system and the economy began to recover. In one of the first analyses using the data, The Financial Crisis at the Kitchen Table, we documented the enormous run-up and subsequent decline in household debt and payment delinquencies between 2007 and 2009. In addition, we showed in numerous Liberty Street Economics posts that households had gone from borrowing heavily prior to the peak in home prices to defaulting and paying off debt at a rapid pace beginning in 2007.

The deleveraging process finally concluded in 2013 (see the chart below), but not before millions of households had lost their homes through foreclosure or lost access to credit through bankruptcy. (Stay turned for our forthcoming post on the long-term consequences for those families.) The fact that the CCP presents a comprehensive picture of household balance sheets also enabled us to identify a then little-known dimension of the housing market boom and bust—the behavior of real estate speculators. Perhaps most importantly, the CCP now provides an early warning signal for stresses in the household sector—something that was not available before the GFC. It also reveals the households and neighborhoods where those stresses may occur.

Total Cash Flow from Household Debt Turned Slightly Positive in 2013

Student Debt

As the mortgage and housing markets began to return to a more stable footing after 2012, a new issue for household finance began to emerge: student debt. By 2012, student debt was the second largest household liability and the CCP provided insights into the rapid growth and performance of that stock of debt over the subsequent decade. These analyses were especially valuable because of the paucity of other information on student borrowing: While the federal government plays a dominant role in the market, only the CCP provided the kind of information needed to assess the role of student debt on household balance sheets and provided information about how student debt has become an increasingly important determinant of well-being.

By 2012 Student Debt Became the Second Largest Household Liability behind Mortgage Debt

Over time, the issues that our analyses pointed to became a central point of policy debate, and our work provided valuable evidence on the effects of various proposals.

Household Debt during the Pandemic and Beyond

Many of the concerns that had manifested themselves in the first decade of the CCP were very much in the forefront of economic policy discussions as the COVID-19 pandemic hit the U.S. in 2020. Seeking to avoid a wave of defaults and consumer distress, officials provided monetary and fiscal stimulus, placed moratoria on foreclosures, offered forbearance on many mortgages and student loans, and encouraged lenders to work with borrowers on their other obligations. To help provide greater clarity on how the pandemic and these policies were affecting households, we acquired monthly CCP updates that allowed high-frequency analyses, and these proved themselves invaluable in charting the patterns of hardship and the incidence of the policy benefits. In particular, widespread forbearances were unprecedented and the CCP enabled us to follow borrowers whose mortgages and student loan payments were paused.

As the forbearance programs largely wound down, we were able to take a look back at who benefited and a look ahead at what might come next for these borrowers. In the end, student loan forbearance lasted far longer than that for mortgages, and we were able to document important impacts of this policy. As policy discussion turned to the idea of permanent student loan forgiveness we were able to provide deep insights into who would benefit and how much in general and based on the specifics of the White House plan. We also were able to show that the unique combination of economic outcomes and policy interventions during COVID had a profound impact on household balance sheets and cash flows, including reductions in credit card debt and delinquency rates, that continues to affect the macroeconomy today.

A Large Impact on Research and a Bright Future

In addition to these major areas of enduring interest, the CCP has shown its value in many other ways. The current attention to rising credit card and auto loan delinquencies is a contemporary example and there will continue to be many more. In the meantime, CCP data have been used in hundreds of research studies, deepening understanding of how household liabilities affect welfare and the economy. The initial idea of the CCP was to give policymakers insight into household debt developments in order to avoid a repeat of the events of the Great Financial Crisis. But the scope of analysis using CCP data has also begun to extend beyond household debt to study trends, such as migration, small business finance, gentrification, and disaster resilience. We remain committed to using the data to help us understand the underpinnings and disparities in household finances and to allow us to monitor developments on a high-frequency basis.

Andrew F. Haughwout is the director of Household and Public Policy Research in the Federal Reserve Bank of New York’s Research and Statistics Group.

Donghoon Lee is an economic research advisor in Consumer Behavior Studies in the Federal Reserve Bank of New York’s Research and Statistics Group.

Daniel Mangrum is a research economist in Equitable Growth Studies in the Federal Reserve Bank of New York’s Research and Statistics Group.

Joelle Scally is a regional economic principal in the Federal Reserve Bank of New York’s Research and Statistics Group.

Wilbert van der Klaauw is the economic research advisor for Household and Public Policy Research in the Federal Reserve Bank of New York’s Research and Statistics Group.

How to cite this post:

Andrew Haughwout, Donghoon Lee, Daniel Mangrum, Joelle Scally, and Wilbert van der Klaauw , “The New York Fed Consumer Credit Panel: A Foundational CMD Data Set,” Federal Reserve Bank of New York Liberty Street Economics, April 17, 2024, https://libertystreeteconomics.newyorkfed.org/2024/04/the-new-york-fed-consumer-credit-panel-a-foundational-cmd-data-set/.

Disclaimer

The views expressed in this post are those of the author(s) and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the author(s).

Government

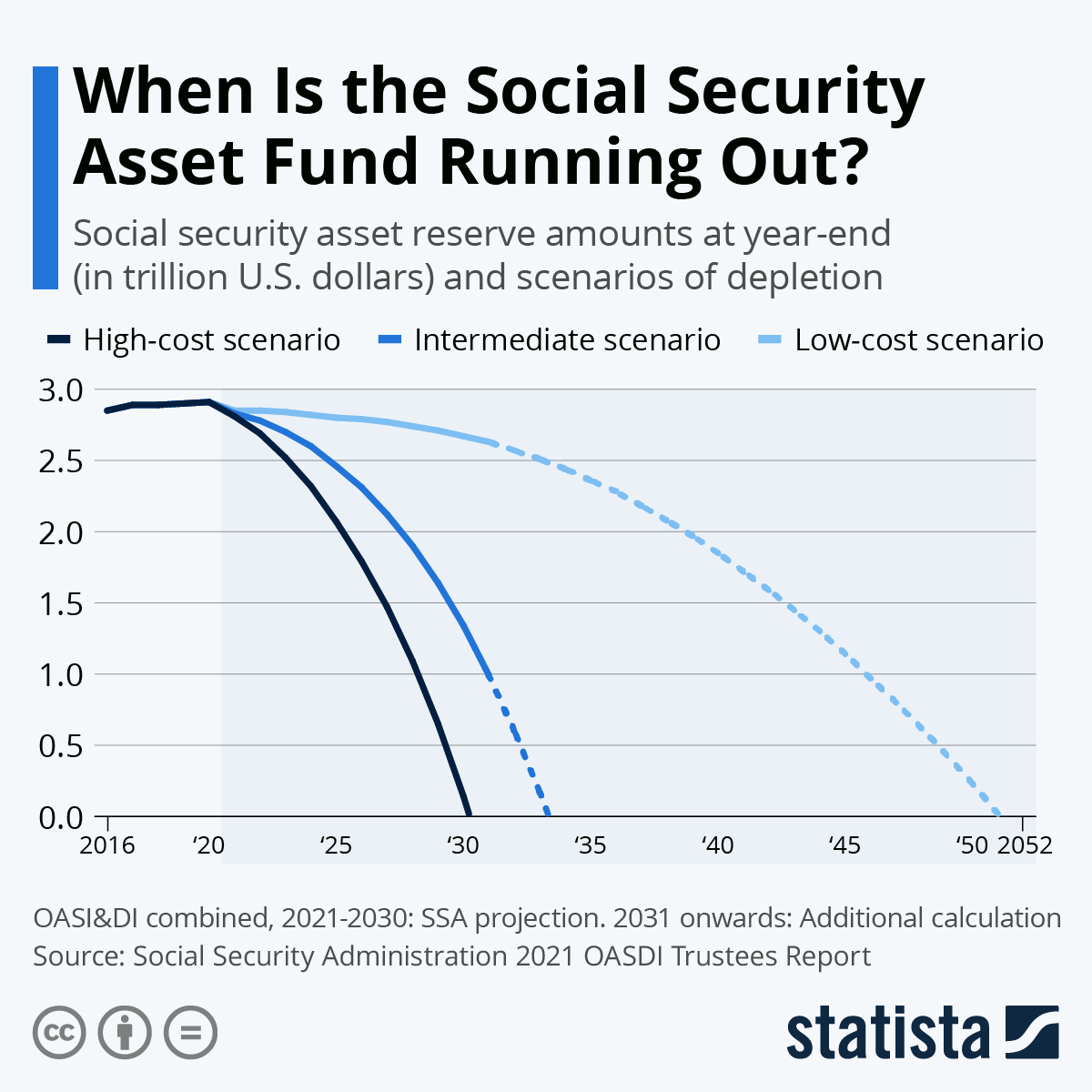

When Is The Social Security Trust Fund Running Out?

When Is The Social Security Trust Fund Running Out?

A social safety net is synonymous with a failsafe for many, but in the case of the U.S….

A social safety net is synonymous with a failsafe for many, but in the case of the U.S. Social Security system, additional action is needed to ensure it stays that way.

The annual OASDI trustees report by the Social Security Administration, covering old-age, survivors and disability insurance, shows that under the present circumstances, the asset reserve dedicated to the benefit program could be depleted sooner rather than later.

As Statista's Katharina Buchholz reports, under the report’s intermediate scenario, asset funds would run out sometime in 2034, while this could happen as soon as 2031 if the administration was to shoulder a high volume of costs in the upcoming years.

Under the low-cost scenario, the fund could remain solvent until 2066. The intermediate date was moved forward in the course of the COVID-19 pandemic, which seriously diminished Social Security’s income in payroll taxes.

You will find more infographics at Statista

The system’s expenditures have been above its income for some time – with the difference being taken out of the asset fund and the interest it creates - but the gap has been widening over the years.

As Baby Boomers retire and Americans are having fewer children, the balance between those who are working and funding social security and those who are receiving old age, survivor or disability benefits continues to tip.

2021 marked the first year when interest earned on the fund could no longer bridge social security’s spending gap, sending the asset reserve into a downward spiral.

Because Social Security services are funded by the payroll tax on a pay-as-you-go basis, the income-cost gap equals the amount the administration would no longer be able to pay out if the fund would in fact be depleted. In order to stop funds from running low, Congress would have to act to provide additional revenue to Social Security, for example by raising the dedicated payroll tax, to lower its cost by cutting benefits or attempt a combination of both.

Government

A Generation Lost To Climate Anxiety

A Generation Lost To Climate Anxiety

Authored by David Zaruk via RealClear Politics,

In a far-reaching new essay in The New Atlantis, the…

Authored by David Zaruk via RealClear Politics,

In a far-reaching new essay in The New Atlantis, the environmental researcher Ted Nordhaus makes a damning and authoritative case that while the basic science of CO2 and climate is solid, it has been abused by the activist class in service of a wildly irresponsible and unscientific climate catastrophism.

This reckless alarmism, saturated across the mainstream media and endlessly amplified by it, has had profound societal consequences. It has both distorted public understanding of the massive benefits the carbon economy makes possible and grossly exaggerated the risks of extreme events it allegedly makes more likely.

As a result it has rendered reasonable debate on climate policy impossible, even as it has given cynical politicians an easy scapegoat for every social ill, drawing attention away from regulatory and institutional failures and laying blame instead at the feet of fossil fuel companies and other evil “emitters.”

Perhaps most perniciously, as Nordhaus details, the doomsday prophesying of climate extremists has created hardened skeptics on one side who are increasingly suspicious of all public “expertise”, while at the same time infecting true believers on the other side with a crippling, pathological fatalism that has come to be referred to as “climate anxiety.”

Climate Anxiety

If there’s any flaw in Nordhaus’ damning and comprehensive analysis it’s that he undersells just how much damage the advent of “climate anxiety” has done already—and how much more it’s likely to do in years to come.

Yes, there’s the obvious cases of obnoxious and lawbreaking behavior, from climate iconoclasts defacing priceless works of art, to interrupting Broadway shows and sporting events, to gluing themselves to buses and holding up traffic on major thoroughfares.

But it runs much deeper than that.

Consider recent headlines: From Vox: “What to do when you’re completely overwhelmed by climate anxiety.” From The Guardian: “Climate anxiety adds to teenagers’ fears.” And the New York Times: “How Climate Change is Changing Therapy.” And perhaps most depressing of all, from the BBC: “Climate anxiety: 'I don't want to burden the world with my child.” The trend is so wide now that they have given it a name: birth strike.

And the data backs up the headlines—like the recent Finnish study of 6,000 subjects that showed people with “woke” beliefs have higher rates of depression.

Developed countries are already facing real increases in mental health issues, many of them human-made and bound up in everything from the opioid crisis to the COVID pandemic. The manufacture of climate anxiety as an issue allegedly on par with those others is a dangerous distraction that draws resources away from solving these other mental health challenges.

Innovative Solutions or More Activism?

Most of the real action on forestalling or mitigating the negative externalities created by the carbon economy is happening within industry itself. But instead of fueling a new generation of innovators and entrepreneurs to help produce these better, cleaner technologies, climate catastrophism has Gen Z curled up in a collective ball, while the likes of NPR tells its privileged listeners to "Let yourself feel the feelings — all of them" about our coming climate doom.

Influencers like Greta Thunberg are motivating the young to pursue careers in political activism instead of research and innovation. It is easier to make the world angry through protest than to make it better by finding solutions.

Climate fear-mongering has created a dread so powerful it’s putatively putting people off of having children altogether, at a time when advanced countries are already facing precipitously declining fertility rates.

This bleak picture raises the question of exactly what’s in it for the eco-extremist purveyors of gloom. For Nordhaus, it’s akin to a religious mission. “Apocalyptic claims about an unfolding emergency, rather, serve a millenarian agenda”, he writes, “that variously demands that we abolish capitalism, bring about an end to economic growth, power the global economy entirely with wind and solar energy, feed the global population only with small-scale organic agriculture, and cut global emissions in half over the next decade or two.”

He doesn’t need to add that actually enacting that list of prescriptions would be both extremely unwise and largely impossible (and catastrophic).

Political Opportunism

Nordhaus doesn’t go far enough. Because it doesn’t really matter whether drastic policy proposals would actually work if the real goal is just acquiring enough political power to dictate them.

Left-wing political leaders have been using the specter of a “climate emergency” to justify the expansion of their powers for years—limiting consumer choice with product bans, picking winners and losers with boondoggle subsidies, and using lawfare to try and put energy companies out of business by abusing “public nuisance” laws, just to name a few.

Even the political right is getting in on the action. Just recently a bipartisan group of U.S. Senators introduced the PROVE IT Act, a bill that pairs the Democrats’ long love of climate panic with Republicans' newfound love of protectionism and industrial policy.

Anyone who is paying close enough attention knows that these kinds of power plays are cynical, shortsighted, and counterproductive, but what we are collectively starting to realize is how much they’ve been enabled by the literal derangement of generations of well-intentioned folks by climate catastrophism.

The bitter irony is that there is good evidence the climate “experts” know better—like a recent study of 2,066 people that found that higher levels of scientific knowledge about the environment and climate change was associated with less climate anxiety.

When the famous teenage eco-activist Greta Thunberg snarled and sobbed at a UN climate conference that those in power had “stolen her childhood” she was absolutely right – just not in the way she thought...

All is not Lost

As the media reported children weeping in the streets during highly managed Extinction Rebellion or Just Stop Oil campaigns, shouldn’t there be some other direction for us to take? How can we motivate the next generation to be a force for innovation and positive change rather than feed them a steady diet of nihilism, hate, and anxiety? There are certain things that can be done to frame the future of humanity in a more positive light.

Here are some ideas on how to stop malignant activism from eroding the hopes of humanity:

-

Young people need positive mentors who are standing up to the pessimism with positive solutions. Scientists, professors, influencers need to focus on developing answers rather than acrimony.

-

Positive stories need to be told. While the media focused on Greta as she sucked the hope out of the youth, other young people, like Boyan Slat, whose Ocean Cleanup achievements were legitimately inspirational, were largely ignored. Too bad the media is now funded largely by climate catastrophe foundations that promulgate pessimism. A new approach to media reporting, more transparent, more balanced, is overdue.

-

Tech, business, and medical research sectors have venture capitalists who provide competitions and seed capital for young innovators to develop their ideas. Many recipients leave university to develop their ideas into successful companies. Very little like this exists for environmental health researchers. Rather there are a large number of bitter, under-funded postdocs who amplify the negativism.

-

Tort reform in the US is necessary. Nordhaus highlighted how law firms were benefiting from the amplified public hatred of fossil fuel companies. Their lucrative anonymous payments to scientists, NGOs, foundations, filmmakers and the media via dark, donor-advised funds is poisoning an already toxic political arena.

-

There needs to be better communication on the achievements and success stories of capitalism. The idea that the only solution to these climate challenges is to dismantle industry, restrict global trade, and block free markets is simply ludicrous.

These are a few of the necessary steps to help the public find a balance between humanity and environmental concerns. On climate issues, there needs to be more hope than horror, more imagination than resignation, and more inspiration than anxiety. With better stories and more responsible storytellers, the climate narrative can be reshaped from one of bitter acrimony to a challenge for innovators to once again push humanity forward.

International

How drugmakers are handling new pressure to recycle plastic injection pens as millions of new patients begin using GLP-1s

On plastic chairs made from discarded obesity and diabetes drug pen injectors, Novo Nordisk is literally sitting on its blockbuster GLP-1 solution. The…

On plastic chairs made from discarded obesity and diabetes drug pen injectors, Novo Nordisk is literally sitting on its blockbuster GLP-1 solution. The cafeteria in its newest site in Denmark is full of chairs and other furniture made from discarded and recycled diabetes and obesity single-use pens.

As millions of prescriptions get written, leading to even more millions of discarded pens, the average person may also someday sit on a chair made from the upcycled byproducts of a trending obesity treatment.

It won’t be easy, though. Beyond the expense and complexity of recycling contaminated medical waste like injection pens, in the medical waste big picture, injector pens are a smaller part of the larger problem.

Helping to spur pharma recycling are the many new users of Novo Nordisk’s Wegovy and Eli Lilly’s Zepbound, who are starting to raise their voices. Reddit threads for both drugs include many questions and comments about the wastefulness of the one-time pens.

“Does anyone else feel guilty about the plastic syringes we just throw away? Must be millions filling up the landfills right now,” one user wrote recently.

Patient interest in recycling is also building in Europe, where some programs and test pilots are already running.

“Particularly in European countries, we are seeing greater interest from patients,” said Katrine DiBona, Novo Nordisk corporate VP for global public affairs and sustainability. “We depend on patients having interest and the willingness to take them back.”

Novo Nordisk has a ReMed program, featured recently on its social media channels with videos of piles of bright plastic pellets and the modern furniture the pens are upcycled into. ReMed is currently the most extensive upcycling plastic pen effort among the fledgling trials and plans across pharma.

The pilot began in five Denmark cities in 2020 during the Covid-19 pandemic, but evolved into the now-established national program. It’s collected 2.4 million of Novo’s pens in Denmark to date, currently with a 50% recycling rate, but aiming for an 85% rate by the end of 2024.

Eli Lilly, Sanofi and Merck joined ReMed last year, and the effort has expanded into the UK, Brazil, France and Japan. There are still no plans set for the US.

“It’s not feasible to collect pens all around the world, and then we fly them to Denmark, and then process them here,” DiBona said. “The numbers are clear. Within Europe, we can ground transport to Denmark for the backend solution. And it’s still a positive business case from a CO2 and environmental perspective. But the minute we start going into different regions, we need a regional back end solution.”

Separately, Eli Lilly is working with Sanofi on a pilot program in France called Recypen, a Lilly spokesperson said. On its own, Lilly is also running a recycling pilot in five cities in Germany and with more partners on “several take back and recycling pilots” in the US and in Europe.

The pharma companies’ efforts mirror those made by industries in general struggling with balancing convenience and consumer demand for environmental responsibility.

“This is not unique to the healthcare space right now. We are seeing a major shift and trends in adopting a circular economy across industries,” said Jamie Pero Parker, sustainability lead and innovation advisor at RTI International, which does research in medical waste and medical device recycling. “The issues come in different flavors, but they’re happening pretty much everywhere.”

Still, though the efforts and collaborations are nascent, Novo Nordisk is hopeful ongoing patient sentiment will help change the future.

“We moved the market to disposable devices. And I think increasingly that will become a challenge from an environmental point of view and also a scalability point of view when you get into large millions of patients,” Novo Nordisk CEO Lars Fruergaard Jørgensen said at the JP Morgan Healthcare Conference in January, according to an AlphaSense transcript. “I think there’ll be a day where a patient as a consumer would not fancy throwing out a device after having used it once.”

treatment pandemic covid-19 brazil japan european europe uk france germany-

International4 weeks ago

International4 weeks agoParexel CEO to retire; CAR-T maker AffyImmune promotes business leader to chief executive

-

Government1 week ago

Government1 week agoClimate-Con & The Media-Censorship Complex – Part 1

-

International3 days ago

International3 days agoWHO Official Admits Vaccine Passports May Have Been A Scam

-

Spread & Containment1 week ago

Spread & Containment1 week agoFDA Finally Takes Down Ivermectin Posts After Settlement

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoVaccinated People Show Long COVID-Like Symptoms With Detectable Spike Proteins: Preprint Study

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoCan language models read the genome? This one decoded mRNA to make better vaccines.

-

Uncategorized1 week ago

Uncategorized1 week agoWhat’s So Great About The Great Reset, Great Taking, Great Replacement, Great Deflation, & Next Great Depression?

-

Spread & Containment3 weeks ago

Spread & Containment3 weeks agoJapanese Preprint Calls For mRNA VaccinesTo Be Suspended Over Blood Bank Contamination Concerns