From CoreLogic: US Serious Mortgage Delinquency Rate Drops to All-Time Low in August• The share of U.S. borrowers who were in serious mortgage delinquency (90 days...

Is A Financial Crisis Already Here? US Banks Are Closing 100s Of Branches And Laying Off 1000s Of Workers Authored by Michael Snyder via The...

Borrowers are realizing the responsibility of new debts too late.

The journey to a more transparent marketplace can start with mortgage servicers who go above and beyond simply suggesting a pre-foreclosure sale to distressed...

Waste Of The Day: Nevada Sitting On $91 Million Meant To Help Homeowners Authored by Adam Andrzejewski via RealClear Wire, While homeowners...

Is This Market Breaking From The Bottom Up? By Peter Tchir of Academy Securities Revisiting Maslow, “Safe” Assets and Bubbles It has...

Totaling over $2 trillion, the CARES Act was the largest economic stimulus package in American history, but confusion, delays, and even fraudulent activities...

Mortgage-backed securities are tradable investment vehicles made of groups of mortgages that offer interest payments similar to bonds.

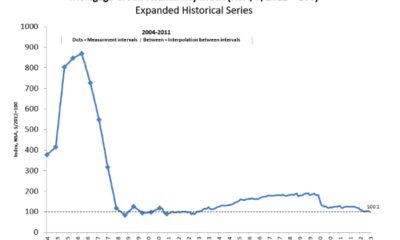

Today, in the Calculated Risk Real Estate Newsletter: Q2 Update: Delinquencies, Foreclosures and REO A brief excerpt: In 2021, I pointed out that with the end...

HousingWire recently spoke with Michael Chew, SVP of Fulfillment, Asset/Rental Management at Consolidated Analytics, about REO assets, the economic factors...

AirBnBust: New York "Effectively Bans" Short-Term Rentals Last week, we wrote that the bursting of the AirBnB bubble will also pop the broader...

Today, in the Calculated Risk Real Estate Newsletter: Fannie Mae Single-Family Mortgage Serious Delinquency Rate Lowest since 2002 Brief excerpt: Fannie Mae reported that the Single-Family...

Forbearance plans dramatically dropped since 2020; about two-thirds of borrowers are still in forbearance because of COVID-19 effects: MBA

The share of mortgage loans in forbearance decreased by five basis points in June 2023 relative to May 2023 to 0.44% from 0.49%.

San Fran's CRE Apocalypse: The City's Two Biggest Hotels Have Defaulted The marxist shit(covered)show that is San Francisco is imploding before...

The Fed Blew Up Another Real Estate Bubble And It's Losing Air Authored by Michael Maharrey via SchiffGold.com, In March, I warned that...

Recent years brought new stresses on the construction industry — COVID-19 shutdowns, supply chain woes, labor shortages and bank failures have slowed...

Back-To-Office Trend Fades, Worsening Potential 'Doom Loop' For Big Downtowns Like Chicago's Authored by Mark Glennon via Wirepoints.org, Reversal...

Soaring Rates Lead To Slowest Growth In Household Debt In Two Years As Mortgage Originations Plummet Total household debt rose by $148 billion,...

From the seasonal bottom on April 14 to now — a whole month — total active inventory has only grown by 14,913.

Fed's Waller Drops Bombshell: 'Climate Change Risks Not Material To US' This will not go down well with the climate alarmists and ESG grifters... No...

A key source of affordable housing inventory was cut in half over the last three years, resulting from efforts to keep delinquent borrowers in homes.

Fannie Mae reported that the Single-Family Serious Delinquency decreased to 0.59% in March from 0.62% in February. The serious delinquency rate is down from 1.01% in...

Home Foreclosures And Missed Credit Card Payments Surge As Consumers Buckle In the first quarter of this year, home foreclosures surged, as...

Manhattan Office Vacancy Hits Record As Marquee LA Office Tower Sells At 50% Loss It's not as if the trade we defined as the "Big Short...

We need to understand the credit channels in the U.S. today and why they’re so different than the period of 2002-2008.

Fannie Mae reported that the Single-Family Serious Delinquency decreased to 0.62% in February from 0.64% in January. The serious delinquency rate is down from 1.11% in...

California Hospital Refuses Transplant Surgery For Unvaccinated Woman With End-Stage Kidney Disease Authored by Allan Stein via The Epoch...

Freddie Mac reported that the Single-Family serious delinquency rate in January was 0.66%, unchanged from 0.66% December. Freddie's rate is down year-over-year from 1.06% in January...

Facing "Unprecedented Challenges" And Soaring Rates, PIMCO-Owned Landlord Defaults On $1.7 Billion In Office Mortgages Amid the recent record...