Government

Beige Book Reveals Economy In Far Worse Shape Than White House Claims

Beige Book Reveals Economy In Far Worse Shape Than White House Claims

There was something odd about the latest Beige book (which was prepared…

There was something odd about the latest Beige book (which was prepared based on information collected on or before April 8, 2024, so before the latest CPI print): if accurate, it would suggest that the rosy economic picture painted by the White House is woefully incorrect, whether on purpose or not (spoiler alert: it is on purpose).

Reading the Beige Book, we find that contrary to the official GDP print which claims the economy is cruising at a brisk 3%, ten out of twelve Districts experienced "either slight or modest" economic growth, while the other two reported no changes in activity.

What is more concerning for the economy where spending amounts for 70% of all economic growth, the Beige Book found that consumer spending "barely increased" overall, but reports were quite mixed across Districts and spending categories:

- Several reports mentioned weakness in discretionary spending, as consumers' price sensitivity remained elevated.

- Auto spending was buoyed notably in some Districts by improved inventories and dealer incentives, but sales remained sluggish in other Districts.

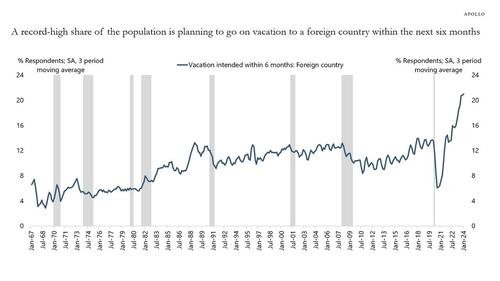

- Tourism activity increased modestly, on average, which is odd considering the recent Conference Board survey found a record number of people planned on traveling abroad. Almost as if they lied...

- Manufacturing activity declined slightly, as only three Districts reported growth in that sector.

- Contacts reported slight increases in nonfinancial services activity, on average, and bank lending was roughly flat overall.

- Residential construction increased a little, on average, and home sales strengthened in most Districts. In contrast, nonresidential construction was flat, and commercial real estate leasing fell slightly.

- The economic outlook among contacts was cautiously optimistic, on balance.

Next, we turn to employment, where contrary to the BLS claims that jobs are soaring month after month (even if they are all part-time workers, mostly going to illegal aliens), the Beige Book found that employment rose at a slight pace overall, with nine Districts reporting very slow to modest increases, and the remaining three Districts reporting no changes in employment.

Not surprisingly, most Districts noted increases in labor supply - which makes sense in a country where 10 million Biden voters illegals have entered in the past year. Yet despite the improvements in "labor supply", many Districts described persistent shortages of qualified applicants for certain positions, including machinists, trades workers, and hospitality workers. Guess you can only have so many gardeners and construction workers. Several Districts reported improved retention of employees, and others pointed to staff reductions at some firms.

There's more: contrary to the surging wages of the post-covid era, the Beige Book found that Multiple Districts said that annual wage growth rates had recently returned to their historical averages. On balance, contacts expected that labor demand and supply would remain relatively stable, with modest further job gains and continued moderation of wage growth back to pre-pandemic levels.

Last but not least, the Beige Book commented on inflation and found that price increases were modest, on average, running at about the same pace as in the last report, as disruptions in the Red Sea and the collapse of Baltimore's Key Bridge caused some shipping delays but so far did not lead to widespread price increases. Movements in raw materials prices were mixed, but six Districts noted moderate increases in energy prices. Another widely known fact: several Districts reported sharp increases in insurance rates, for both businesses and homeowners.

Most ominously, another frequent comment was that firms' ability to pass cost increases on to consumers had weakened considerably in recent months, resulting in smaller profit margins. That's hardly the stuff soft- or no-landings are made of.

Inflation also caused strain at nonprofit entities, resulting in service reductions in some cases.

On balance, contacts expected that inflation would hold steady at a slow pace moving forward. At the same time, contacts in a few Districts—mostly manufacturers—perceived upside risks to near-term inflation in both input prices and output prices.

Turning to the specific regional Feds, we found these summaries notable:

- Boston: Business activity expanded at a modest pace in recent weeks, and prices rose slightly. Employment was flat overall, but one retailer reported significant layoffs. Convention and tourism activity grew at a robust pace. Home sales increased on a year-over-year basis, marking a turnaround. The outlook ranged from cautiously optimistic to bullish.

- New York: On balance, regional economic activity remained flat. Labor market conditions were solid and continued to normalize as labor supply and labor demand came into better balance. Consumer spending was unchanged after a weak first quarter. Housing markets strengthened, with the spring selling season picking up beyond the seasonal norm. The pace of selling price increases remained modest.

- Philadelphia: On balance, business activity was flat in the current Beige Book period—after declining slightly last period. Employment edged up, despite staffing and recruitment efforts slowing to a crawl. Wage and price inflation continue to moderate; however, housing affordability continues to be a concern. Overall, the outlook is positive, as firms remained optimistic about expectations for future growth.

- Cleveland: District business activity increased modestly, as did employment. Firms anticipated greater ease filling open positions, including those that have been particularly challenging, because of increased labor availability. Wage pressures continued to normalize, and some contacts reduced starting wages for new roles. Cost and price pressures changed little.

- Richmond: The regional economy grew at slight pace since our previous report. Consumer spending on retail goods was mixed but spending on travel and tourism was up slightly. Fifth District port activity slowed and was impacted by the collapse of the Francis Scott Key Bridge. Employment growth slowed from a moderate to a modest rate in recent weeks, but wages continued to grow moderately. Price growth also remained moderate.

- Atlanta: The Sixth District economy grew modestly. Labor markets continued to stabilize; wage pressures eased. Many nonlabor costs moderated. Retail sales were steady, but consumers remained price conscious. Tourism remained robust. Commercial real estate conditions slowed. Transportation activity was mixed. Manufacturing grew slightly. Loan demand was flat. Energy activity improved.

- Chicago: Economic activity increased slightly. Employment increased modestly; business and consumer spending rose slightly; nonbusiness contacts saw no change in activity; and manufacturing and construction and real estate activity were flat. Prices and wages rose moderately, while financial conditions were stable. Prospects for 2024 farm income were unchanged.

- St. Louis: Economic activity has continued to increase slightly since our previous report. Prices have increased modestly, as contacts are broadly feeling the pressures of increases in both labor and non-labor costs. The outlook was neutral to slightly optimistic, which is generally unchanged from our previous report, but better than one year ago.

- Minneapolis: District economic activity grew slightly. Employment grew some, but labor demand was softer. Wage pressures were present but continued to ease, while price pressures ticked up. Consumer spending was mostly flat, and manufacturing slowed modestly. Commercial and residential construction improved slightly. Agricultural conditions were steady at low levels.

- Kansas City: The District economy expanded modestly. Demand for auto loans and residential mortgages rose as borrowing rates declined. Demand for HELOC also increased as a means to consolidate or refinance household debt. Job gains were modest even as worker availability improved slightly.

- Dallas: The Eleventh District economy expanded modestly. While activity in services and housing grew, manufacturing output, retail sales, and loan demand declined slightly. Employment growth slowed as wages, input costs, and selling prices grew at a moderate pace. Overall, Texas firms noted an uptick in uncertainty.

- San Francisco: Economic activity continued to grow at a slight pace, employment levels were little changed, and prices and wages rose slightly. Retail sales were unchanged, and demand for services grew modestly. Demand for manufactured products changed little, and conditions in agriculture were mixed. Real estate activity was slightly down. Financial sector conditions were largely unchanged.

More in the full beige book

International

“We Have 15,000 Samples In Wuhan … Could Do Full Genomes Of 700 CoVs”: Rand Paul Drops COVID Bombshell

"We Have 15,000 Samples In Wuhan … Could Do Full Genomes Of 700 CoVs": Rand Paul Drops COVID Bombshell

Last week Senator Rand Paul (R-KY)…

Last week Senator Rand Paul (R-KY) wrote in a Tuesday op-ed that officials from 15 federal agencies "knew in 2018 that the Wuhan Institute of Virology was trying to create a coronavirus like COVID-19."

These officials knew that the Chinese lab was proposing to create a COVID 19-like virus and not one of these officials revealed this scheme to the public. In fact, 15 agencies with knowledge of this project have continuously refused to release any information concerning this alarming and dangerous research.

Government officials representing at least 15 federal agencies were briefed on a project proposed by Peter Daszak’s EcoHealth Alliance and the Wuhan Institute of Virology. -Rand Paul

Paul was referring to the DEFUSE project, which was revealed after DRASTIC Research uncovered documents showing that DARPA had been presented with a proposal by EcoHealth Alliance to perform gain-of-function research on bat coronavirus.

New documents released by Drastic Research show Peter Daszak and the EcoHealth Alliance had applied for funds that would allow them to further modify coronavirus spike proteins and find potential furin cleavage sites.

— Rep. Gallagher Press Office (@RepGallagher) September 23, 2021

Rep. Gallagher explains why that's so important. pic.twitter.com/6aEPyuW7Go

Now, Paul points to an email between EcoHealth's Daszak and "Fauci Flunky" David Morens from April 26, 2020 (noted days before by the House Select Subcommittee on the Coronavirus Pandemic), when the lab-leak hypothesis was gaining traction against Fauci - who funded EcoHealth research in Wuhan, and Daszak's orchestrated denials and the forced "natural origin" narrative.

In it, Daszak laments the "real and present danger that we are being targeted by extremists" (for pointing out that they were manipulating bat covid down the street from where a bat covid pandemic broke out), and called Donald Trump "shockingly ignorant."

He also told David that he would restrict communications "to gmail from now on," and planned to mount a response to an NIH request which appears to suggest moving out of Wuhan - to which Daszak says "Even that would be a loss - we have 15,000 samples in freezers in Wuhan and could do the full genomes of 700+ Co Vs we've identified if we don't cut this thread."

"... and could do the full genomes of 700+ CoVs [coronaviruses]"

— Rand Paul (@RandPaul) April 16, 2024

Which means Daszak, funded by Fauci, lied when he said "every single one of the SARSr-CoV sequences @EcoHealthNYC discovered in China is already published."

In 2016 Peter Daszak (the man Fauci’s NIH was funding) openly talked about the gain of function research being done in China.

— MAZE (@mazemoore) April 9, 2024

The research Fauci said never happened.

Daszak actually talked about creating a killer virus. pic.twitter.com/iYseialw6Z

Daszak lies even when the facts are in full view and the lies are obvious.

— Richard H. Ebright (@R_H_Ebright) April 13, 2024

He has no shame, and he has no decency.

And Anthony Fauci concealed the '700 unknown coronaviruses' in Wuhan.

Nor did Fauci ever publicly admit COVID-19 could have been one of those 700 unknowns.

— Rand Paul (@RandPaul) April 16, 2024

Meanwhile, an EcoHealth progress report referenced "two chimeric bat SARS-like CoVs constructed on a WIV-1 backbone."

— Rebecca (@Rebecca21951651) April 13, 2024

About that Gmail thing...

Have you also subpoenaed their Gmail accounts? https://t.co/s03cElB0Cv pic.twitter.com/ZDvpwCHsAp

— zerohedge (@zerohedge) April 17, 2024

This is crazy

— Elon Musk (@elonmusk) April 16, 2024

Crazy indeed!

Amazing! Imagine masquerading as a hero during a pandemic that killed millions that he helped create. Then he had the audacity to harm more with a vaccine and blame the unvaccinated for the pandemic. The more the pieces come together, the more evil this man looks. And I thought…

— Emily (@eekymom) April 16, 2024

Fauci Funded Seamless Ligation, a Technique Used for HIDING Human Fingerprints on Lab-Created Bugs

— ????·Bryne (@riss1130) April 16, 2024

pic.twitter.com/zmoaXncDd3

International

Semi Shock: ASML Craters As Orderbook Plummets After China Frontrunning Ends With A Bang

Semi Shock: ASML Craters As Orderbook Plummets After China Frontrunning Ends With A Bang

Exactly three months ago, AI stocks were soaring,…

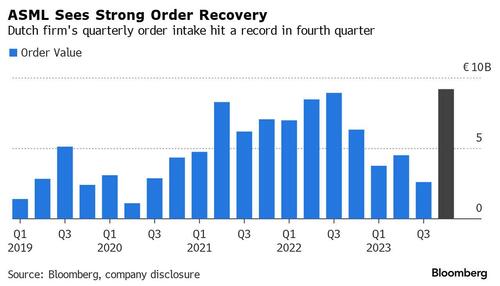

Exactly three months ago, AI stocks were soaring, semiconductor names were flying and the tech sector was euphoric after Dutch chip giant ASML - the world’s sole producer of equipment needed to make the most advanced chips and Europe’s most valuable technology company - reported a record surge in its orderbook (just days after its Asian peer Taiwan Semi did the same)...

... and which the market immediately concluded, in its infinite stupidity, that this was the definitive confirmation of a flood of demand for AI chips and infrastructure with Bloomberg pouring oil on the fire, saying that the ASML results were "a sign that the semiconductor industry may be recovering" adding that "chipmakers are increasingly optimistic the sector’s outlook following a slump that dates back to the Covid-19 pandemic, with TSMC last week projecting strong revenue growth in 2024."

Not so fast, we countered and as we clearly warned in a January article titled "Tech Euphoria Sparked By ASML Surge To All-Time High On Flood Of Chinese Orders... There's Just One Problem"...

Tech Euphoria Sparked By ASML Surge To All-Time High On Flood Of Chinese Orders... There's Just One Problem https://t.co/ScGoWO2Ayy

— zerohedge (@zerohedge) January 24, 2024

... the reason for the surge in ASML orders was that China, and its proxies in Taiwan and other Asian countries, has been flooding the market with chip purchase orders ahead of Biden's escalating China chip sanctions, knowing that the door is closing amid a barrage of sanctions limiting exports of high tech chips - and chipmaking devices - and that it needs to buy today what it may need for the next few years, if not indefinitely. (as explained in "Behind The Tech Meltup: A One-Time Chinese Chip Buying Frenzy To Frontrun Export Curbs").

And sure enough, China accounted for 39% of ASML’s sales in the fourth quarter and became the Veldhoven-based company’s largest market in 2023! Before speculation of chip sanctions, China accounted for only 8% in January to March.

So what? Well, such one-time buying spurts are - as the name implies - one-time... and as we reported 3 months ago, ASML has been targeted by the US effort to curb exports of cutting-edge technology to China, and Bloomberg reported that ASML exports to China have now effectively been halted, vaporizing whatever portion of the order backlog is thanks to China. This led us to conclude the following:

And so with China now scrubbed from the list of ASML clients - forget being its top customer - the question is who will fill the void. Luckily, demand for AI is keeping the chip sector afloat... or so the experts say, the same experts who fawned over ASML's result today which sparked a buying frenzy in the shares, which soared over 9% today, the biggest increase since November 2022, and hitting an all time high.

Good luck keeping that all time high with your largest customer now barred from future purchases by the State Department. As for "record AI chip demand", this quarter will prove very informative how much is real and how much is vapor once the volatility from China's erratic orderflow is finally removed.

So fast forward three months when "this quarter" is now in the history books, and this morning we got confirmation that everything we said was correct (and that the market, in its infinite stupidity wisdom, was wrong. Case in point: on Wednesday, ASML stock was one of the worst performers among the European tech sector, after the largest European company posted orders that fell short of analysts’ expectations, as Taiwanese chipmakers held off buying the Dutch firm’s most advanced machines.

Bookings at Europe’s most valuable technology firm fell 61% in the first quarter from the previous three months to €3.6 billion ($3.8 billion), wildly missing the market's ridiculous estimates of €4.63 billion, just as we said it would.

As Bloomberg notes, the world's top chipmakers like Taiwan Semi and Samsung Electronics held off new orders as manufacturer clients work through stockpiles of hardware used in smartphones, computers and cars. That’s hurting ASML, which also forecast sales this quarter below analyst expectations. And why did TSMC and Samsung over-order? Simple: they too, were expecting the flood of Chinese last-ditch orders, and were looking to frontrun it.

Well they did... and now everyone has a huge surplus of equipment!

Investors had expected TSMC to book significant EUV tools in the first quarter, according to Redburn Atlantic analyst Timm Schulze-Melander (but not according to ZeroHedge). The disappointment in orders leaves earnings and revenue for next year “vulnerable,” he said, confirming what we said one quarter ago when everyone was rushing to buy the stock on a one-off surge in orders.

The level of EUV orders is “extremely low,” indicating major ASML clients like TSMC, Samsung and Intel didn’t increase investments in the high-end equipment, Oddo BHF analyst Stephane Houri said. ASML saw the biggest slump in demand for its top-end extreme ultraviolet machines. Orders for them plunged to €656 million in the period from €5.6 billion in the previous quarter.

In other words, the frontrunning of China's order book is now dead and buried.

And now comes the hangover, ASML now sees sales in the current quarter between €5.7 billion and €6.2 billion, missing estimates of €6.5 billion before demand picks up. And while the company scrambled to reassure the market that "nothing is fucked here", and pushed demand into the second half as every company does when it misses quarterly expectations...

“Our outlook for the full year 2024 is unchanged, with the second half of the year expected to be stronger than the first half, in line with the industry’s continued recovery from the downturn,” Chief Executive Officer Peter Wennink said in a statement Wednesday. “We see 2024 as a transition year.”

... the market was less than willing to buy the BS this time, and with the company admitting that as much as 15% of China sales this year will be affected by the new export control measures - 50% is a more realistic number - the stock finally tumbled as the hangover finally arrives, if with a three month delay, and today the stock tumbled more than 6%....

... the biggest one day drop since last June.

International

EM Debt 2024: Solid Beginnings

Emerging markets (EM) debt performed well in the first quarter of 2024, and we anticipate more of the same in the next quarter, thanks to a benign global…

Emerging markets (EM) debt performed well in the first quarter of 2024, and we anticipate more of the same in the next quarter, thanks to a benign global macro backdrop, solid EM credit fundamentals, improving technical conditions, and still-decent valuations.

We continue to believe that there are attractive opportunities for investors to increase exposure to long-duration securities to lock in attractive real and nominal yields.

Despite strong performance this year, we also see selective value in high-beta, high-yield credit because we believe the global market environment will be conducive to its outperformance.

We also continue see scope for fundamental differentiation and prefer countries with easier access to multilateral and bilateral funding (including frontier and distressed credit).

Meanwhile, the corporate credit space continues to exhibit a combination of differentiated fundamental drivers, favorable supply technical conditions, and attractive relative valuations to select sovereign curves. We are seeking investment opportunities where corporate credit fundamentals and attractive spreads coincide. Short-maturity bonds have outperformed, but opportunities in longer bonds are appearing. We continue to focus on issuers with low refinancing needs, robust balance sheets, and positive credit trajectories.

Below, we break down some of our largest active positions by beta bucket, which is how we allocate our risk budget.

A View of the Potential Opportunities: Overweight/Underweight

High-Beta Bucket

In the high-beta bucket, our largest overweight positions are in Egypt, Ukraine, and Ghana, and our largest underweight positions are in Rwanda, Kenya, and Nigeria.

Egypt (overweight): Significant external financing—which was unlocked through the recently announced International Monetary Fund (IMF) package and foreign direct investment (FDI) deal—is more than adequate to meet Egypt’s needs. The external sector could also prove resilient following the sharp depreciation of the Egyptian pound. We also believe there is room for further spread compression toward peers in the high-beta bucket and curve steepening.

Ukraine’s potential restructuring could be more favorable to eurobond holders than previously anticipated.

Ukraine (overweight): We have increased our overweight based on a potential restructuring that we have interpreted as more favorable for eurobond holders than previously anticipated. Multilateral and bilateral support also remains strong.

Ghana (overweight): We believe the restructuring process is regaining momentum. The prospect of lower core rates and the rally in high-yield names could support recovery values.

Rwanda (underweight): Imbalances in the external sector and unattractive valuations make Rwanda vulnerable.

Kenya (underweight): Spreads have tightened to levels at which we believe there is better value in other high-beta names.

Nigera (underweight): Valuations are tight relative to peers.

Medium-Beta Bucket

In the medium-beta bucket, our largest overweight positions are in Ivory Coast, Guatemala, and Benin, and our largest underweight positions are in Bahrain, Romania, and Dominican Republic.

Ivory Coast (overweight): We believe valuations are favorable relative to peers. The country’s debt is also supported by strong fundamentals and support from development partners, including the IMF. We also believe Senegal’s peaceful post-election political transition will bolster confidence in the Ivory Coast’s political process ahead of its own elections next year.

Benin (overweight): We believe the country’s bonds will continue to be supported by strong fundamental performance and prudent macroeconomic policies. The country will also receive further support from the IMF under the Resilience and Sustainability Facility in late 2024.

Guatemala (overweight): Macroeconomic conditions are strong and valuations are attractive, and although President Bernardo Arévalo will likely face political obstacles, we believe strong leverage ratios and low fiscal deficits will keep Guatemala a strong credit.

Dominican Republic’s valuations are at their tightest levels since 2007.

Bahrain (underweight): Weak fiscal reform efforts, a deterioration in regional geopolitical risks, and tight valuations make us cautious.

Romania (underweight): We are concerned about deteriorating fiscal risks and political noise ahead of this year’s elections. Romania has already been a prolific issuer this year and is running the risk of an abundance of supply.

Dominican Republic (underweight): Although fundamentals continue to be among the strongest in the region, valuations are at their tightest levels since 2007.

Low-Beta Bucket

In the low-beta bucket, our largest overweight positions are in Saudi Arabia, Bermuda, and Paraguay and our largest underweight positions are in Poland, Uruguay, and Indonesia.

Saudi Arabia (overweight): Efforts to diversify the economy away from the energy sector remain largely on track. Oil prices are supportive of the current investment spend, and we see value in Saudi Arabia relative to some of its regional peers.

We believe Paraguay is on an improving fundamental trajectory.

Bermuda (overweight): Bermuda’s bonds have similar valuations to those of Peru and Chile, but we believe the country has a stronger fundamental trajectory with less institutional uncertainty.

Paraguay (overweight): Although Paraguay has lagged year-to-date, we believe the country is on an improving fundamental trajectory and has attractive valuations for the low-beta bucket.

Poland (underweight): Although the medium-term policy framework looks more favorable under the new government, we remain cautious near term due to an increase in political noise following last year’s elections.

Uruguay (underweight): Credit fundamentals in Uruguay remain strong, but bond prices have compressed materially since the COVID-19 pandemic, and we believe this results in limited scope for additional spread tightening.

Indonesia (underweight): Valuations are unappealing. The country’s fundamental outlook became murkier after presidential elections in February, and there is risk of fiscal slippage should the new government increase spending. In addition, a slowdown in the windfall from commodity exports and a persistently strong U.S. dollar could weaken external positions.

Marco Ruijer, CFA, is a portfolio manager on William Blair’s emerging markets debt team.

Want more insights on the economy and investment landscape? Subscribe to our blog.

The post EM Debt 2024: Solid Beginnings appeared first on William Blair.

bonds pandemic covid-19 emerging markets pound spread recovery oil poland ukraine-

International4 weeks ago

International4 weeks agoParexel CEO to retire; CAR-T maker AffyImmune promotes business leader to chief executive

-

Government2 weeks ago

Government2 weeks agoClimate-Con & The Media-Censorship Complex – Part 1

-

International3 days ago

International3 days agoWHO Official Admits Vaccine Passports May Have Been A Scam

-

Spread & Containment1 week ago

Spread & Containment1 week agoFDA Finally Takes Down Ivermectin Posts After Settlement

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoVaccinated People Show Long COVID-Like Symptoms With Detectable Spike Proteins: Preprint Study

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoCan language models read the genome? This one decoded mRNA to make better vaccines.

-

Uncategorized1 week ago

Uncategorized1 week agoWhat’s So Great About The Great Reset, Great Taking, Great Replacement, Great Deflation, & Next Great Depression?

-

Spread & Containment4 weeks ago

Spread & Containment4 weeks agoJapanese Preprint Calls For mRNA VaccinesTo Be Suspended Over Blood Bank Contamination Concerns