International

Semi Shock: ASML Craters As Orderbook Plummets After China Frontrunning Ends With A Bang

Semi Shock: ASML Craters As Orderbook Plummets After China Frontrunning Ends With A Bang

Exactly three months ago, AI stocks were soaring,…

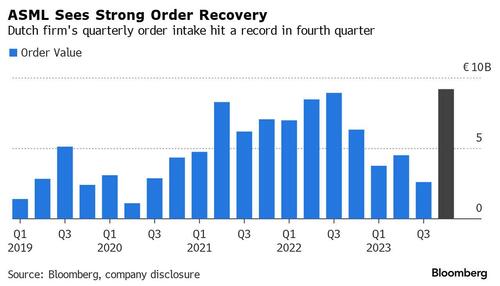

Exactly three months ago, AI stocks were soaring, semiconductor names were flying and the tech sector was euphoric after Dutch chip giant ASML - the world’s sole producer of equipment needed to make the most advanced chips and Europe’s most valuable technology company - reported a record surge in its orderbook (just days after its Asian peer Taiwan Semi did the same)...

... and which the market immediately concluded, in its infinite stupidity, that this was the definitive confirmation of a flood of demand for AI chips and infrastructure with Bloomberg pouring oil on the fire, saying that the ASML results were "a sign that the semiconductor industry may be recovering" adding that "chipmakers are increasingly optimistic the sector’s outlook following a slump that dates back to the Covid-19 pandemic, with TSMC last week projecting strong revenue growth in 2024."

Not so fast, we countered and as we clearly warned in a January article titled "Tech Euphoria Sparked By ASML Surge To All-Time High On Flood Of Chinese Orders... There's Just One Problem"...

Tech Euphoria Sparked By ASML Surge To All-Time High On Flood Of Chinese Orders... There's Just One Problem https://t.co/ScGoWO2Ayy

— zerohedge (@zerohedge) January 24, 2024

... the reason for the surge in ASML orders was that China, and its proxies in Taiwan and other Asian countries, has been flooding the market with chip purchase orders ahead of Biden's escalating China chip sanctions, knowing that the door is closing amid a barrage of sanctions limiting exports of high tech chips - and chipmaking devices - and that it needs to buy today what it may need for the next few years, if not indefinitely. (as explained in "Behind The Tech Meltup: A One-Time Chinese Chip Buying Frenzy To Frontrun Export Curbs").

And sure enough, China accounted for 39% of ASML’s sales in the fourth quarter and became the Veldhoven-based company’s largest market in 2023! Before speculation of chip sanctions, China accounted for only 8% in January to March.

So what? Well, such one-time buying spurts are - as the name implies - one-time... and as we reported 3 months ago, ASML has been targeted by the US effort to curb exports of cutting-edge technology to China, and Bloomberg reported that ASML exports to China have now effectively been halted, vaporizing whatever portion of the order backlog is thanks to China. This led us to conclude the following:

And so with China now scrubbed from the list of ASML clients - forget being its top customer - the question is who will fill the void. Luckily, demand for AI is keeping the chip sector afloat... or so the experts say, the same experts who fawned over ASML's result today which sparked a buying frenzy in the shares, which soared over 9% today, the biggest increase since November 2022, and hitting an all time high.

Good luck keeping that all time high with your largest customer now barred from future purchases by the State Department. As for "record AI chip demand", this quarter will prove very informative how much is real and how much is vapor once the volatility from China's erratic orderflow is finally removed.

So fast forward three months when "this quarter" is now in the history books, and this morning we got confirmation that everything we said was correct (and that the market, in its infinite stupidity wisdom, was wrong. Case in point: on Wednesday, ASML stock was one of the worst performers among the European tech sector, after the largest European company posted orders that fell short of analysts’ expectations, as Taiwanese chipmakers held off buying the Dutch firm’s most advanced machines.

Bookings at Europe’s most valuable technology firm fell 61% in the first quarter from the previous three months to €3.6 billion ($3.8 billion), wildly missing the market's ridiculous estimates of €4.63 billion, just as we said it would.

As Bloomberg notes, the world's top chipmakers like Taiwan Semi and Samsung Electronics held off new orders as manufacturer clients work through stockpiles of hardware used in smartphones, computers and cars. That’s hurting ASML, which also forecast sales this quarter below analyst expectations. And why did TSMC and Samsung over-order? Simple: they too, were expecting the flood of Chinese last-ditch orders, and were looking to frontrun it.

Well they did... and now everyone has a huge surplus of equipment!

Investors had expected TSMC to book significant EUV tools in the first quarter, according to Redburn Atlantic analyst Timm Schulze-Melander (but not according to ZeroHedge). The disappointment in orders leaves earnings and revenue for next year “vulnerable,” he said, confirming what we said one quarter ago when everyone was rushing to buy the stock on a one-off surge in orders.

The level of EUV orders is “extremely low,” indicating major ASML clients like TSMC, Samsung and Intel didn’t increase investments in the high-end equipment, Oddo BHF analyst Stephane Houri said. ASML saw the biggest slump in demand for its top-end extreme ultraviolet machines. Orders for them plunged to €656 million in the period from €5.6 billion in the previous quarter.

In other words, the frontrunning of China's order book is now dead and buried.

And now comes the hangover, ASML now sees sales in the current quarter between €5.7 billion and €6.2 billion, missing estimates of €6.5 billion before demand picks up. And while the company scrambled to reassure the market that "nothing is fucked here", and pushed demand into the second half as every company does when it misses quarterly expectations...

“Our outlook for the full year 2024 is unchanged, with the second half of the year expected to be stronger than the first half, in line with the industry’s continued recovery from the downturn,” Chief Executive Officer Peter Wennink said in a statement Wednesday. “We see 2024 as a transition year.”

... the market was less than willing to buy the BS this time, and with the company admitting that as much as 15% of China sales this year will be affected by the new export control measures - 50% is a more realistic number - the stock finally tumbled as the hangover finally arrives, if with a three month delay, and today the stock tumbled more than 6%....

... the biggest one day drop since last June.

Government

“We Have 15,000 Samples In Wuhan … Could Do Full Genomes Of 700 CoVs”: Rand Paul Drops COVID Bombshell

"We Have 15,000 Samples In Wuhan … Could Do Full Genomes Of 700 CoVs": Rand Paul Drops COVID Bombshell

Last week Senator Rand Paul (R-KY)…

Last week Senator Rand Paul (R-KY) wrote in a Tuesday op-ed that officials from 15 federal agencies "knew in 2018 that the Wuhan Institute of Virology was trying to create a coronavirus like COVID-19."

These officials knew that the Chinese lab was proposing to create a COVID 19-like virus and not one of these officials revealed this scheme to the public. In fact, 15 agencies with knowledge of this project have continuously refused to release any information concerning this alarming and dangerous research.

Government officials representing at least 15 federal agencies were briefed on a project proposed by Peter Daszak’s EcoHealth Alliance and the Wuhan Institute of Virology. -Rand Paul

Paul was referring to the DEFUSE project, which was revealed after DRASTIC Research uncovered documents showing that DARPA had been presented with a proposal by EcoHealth Alliance to perform gain-of-function research on bat coronavirus.

New documents released by Drastic Research show Peter Daszak and the EcoHealth Alliance had applied for funds that would allow them to further modify coronavirus spike proteins and find potential furin cleavage sites.

— Rep. Gallagher Press Office (@RepGallagher) September 23, 2021

Rep. Gallagher explains why that's so important. pic.twitter.com/6aEPyuW7Go

Now, Paul points to an email between EcoHealth's Daszak and "Fauci Flunky" David Morens from April 26, 2020 (noted days before by the House Select Subcommittee on the Coronavirus Pandemic), when the lab-leak hypothesis was gaining traction against Fauci - who funded EcoHealth research in Wuhan, and Daszak's orchestrated denials and the forced "natural origin" narrative.

In it, Daszak laments the "real and present danger that we are being targeted by extremists" (for pointing out that they were manipulating bat covid down the street from where a bat covid pandemic broke out), and called Donald Trump "shockingly ignorant."

He also told David that he would restrict communications "to gmail from now on," and planned to mount a response to an NIH request which appears to suggest moving out of Wuhan - to which Daszak says "Even that would be a loss - we have 15,000 samples in freezers in Wuhan and could do the full genomes of 700+ Co Vs we've identified if we don't cut this thread."

"... and could do the full genomes of 700+ CoVs [coronaviruses]"

— Rand Paul (@RandPaul) April 16, 2024

Which means Daszak, funded by Fauci, lied when he said "every single one of the SARSr-CoV sequences @EcoHealthNYC discovered in China is already published."

In 2016 Peter Daszak (the man Fauci’s NIH was funding) openly talked about the gain of function research being done in China.

— MAZE (@mazemoore) April 9, 2024

The research Fauci said never happened.

Daszak actually talked about creating a killer virus. pic.twitter.com/iYseialw6Z

Daszak lies even when the facts are in full view and the lies are obvious.

— Richard H. Ebright (@R_H_Ebright) April 13, 2024

He has no shame, and he has no decency.

And Anthony Fauci concealed the '700 unknown coronaviruses' in Wuhan.

Nor did Fauci ever publicly admit COVID-19 could have been one of those 700 unknowns.

— Rand Paul (@RandPaul) April 16, 2024

Meanwhile, an EcoHealth progress report referenced "two chimeric bat SARS-like CoVs constructed on a WIV-1 backbone."

— Rebecca (@Rebecca21951651) April 13, 2024

About that Gmail thing...

Have you also subpoenaed their Gmail accounts? https://t.co/s03cElB0Cv pic.twitter.com/ZDvpwCHsAp

— zerohedge (@zerohedge) April 17, 2024

This is crazy

— Elon Musk (@elonmusk) April 16, 2024

Crazy indeed!

Amazing! Imagine masquerading as a hero during a pandemic that killed millions that he helped create. Then he had the audacity to harm more with a vaccine and blame the unvaccinated for the pandemic. The more the pieces come together, the more evil this man looks. And I thought…

— Emily (@eekymom) April 16, 2024

Fauci Funded Seamless Ligation, a Technique Used for HIDING Human Fingerprints on Lab-Created Bugs

— ????·Bryne (@riss1130) April 16, 2024

pic.twitter.com/zmoaXncDd3

International

EM Debt 2024: Solid Beginnings

Emerging markets (EM) debt performed well in the first quarter of 2024, and we anticipate more of the same in the next quarter, thanks to a benign global…

Emerging markets (EM) debt performed well in the first quarter of 2024, and we anticipate more of the same in the next quarter, thanks to a benign global macro backdrop, solid EM credit fundamentals, improving technical conditions, and still-decent valuations.

We continue to believe that there are attractive opportunities for investors to increase exposure to long-duration securities to lock in attractive real and nominal yields.

Despite strong performance this year, we also see selective value in high-beta, high-yield credit because we believe the global market environment will be conducive to its outperformance.

We also continue see scope for fundamental differentiation and prefer countries with easier access to multilateral and bilateral funding (including frontier and distressed credit).

Meanwhile, the corporate credit space continues to exhibit a combination of differentiated fundamental drivers, favorable supply technical conditions, and attractive relative valuations to select sovereign curves. We are seeking investment opportunities where corporate credit fundamentals and attractive spreads coincide. Short-maturity bonds have outperformed, but opportunities in longer bonds are appearing. We continue to focus on issuers with low refinancing needs, robust balance sheets, and positive credit trajectories.

Below, we break down some of our largest active positions by beta bucket, which is how we allocate our risk budget.

A View of the Potential Opportunities: Overweight/Underweight

High-Beta Bucket

In the high-beta bucket, our largest overweight positions are in Egypt, Ukraine, and Ghana, and our largest underweight positions are in Rwanda, Kenya, and Nigeria.

Egypt (overweight): Significant external financing—which was unlocked through the recently announced International Monetary Fund (IMF) package and foreign direct investment (FDI) deal—is more than adequate to meet Egypt’s needs. The external sector could also prove resilient following the sharp depreciation of the Egyptian pound. We also believe there is room for further spread compression toward peers in the high-beta bucket and curve steepening.

Ukraine’s potential restructuring could be more favorable to eurobond holders than previously anticipated.

Ukraine (overweight): We have increased our overweight based on a potential restructuring that we have interpreted as more favorable for eurobond holders than previously anticipated. Multilateral and bilateral support also remains strong.

Ghana (overweight): We believe the restructuring process is regaining momentum. The prospect of lower core rates and the rally in high-yield names could support recovery values.

Rwanda (underweight): Imbalances in the external sector and unattractive valuations make Rwanda vulnerable.

Kenya (underweight): Spreads have tightened to levels at which we believe there is better value in other high-beta names.

Nigera (underweight): Valuations are tight relative to peers.

Medium-Beta Bucket

In the medium-beta bucket, our largest overweight positions are in Ivory Coast, Guatemala, and Benin, and our largest underweight positions are in Bahrain, Romania, and Dominican Republic.

Ivory Coast (overweight): We believe valuations are favorable relative to peers. The country’s debt is also supported by strong fundamentals and support from development partners, including the IMF. We also believe Senegal’s peaceful post-election political transition will bolster confidence in the Ivory Coast’s political process ahead of its own elections next year.

Benin (overweight): We believe the country’s bonds will continue to be supported by strong fundamental performance and prudent macroeconomic policies. The country will also receive further support from the IMF under the Resilience and Sustainability Facility in late 2024.

Guatemala (overweight): Macroeconomic conditions are strong and valuations are attractive, and although President Bernardo Arévalo will likely face political obstacles, we believe strong leverage ratios and low fiscal deficits will keep Guatemala a strong credit.

Dominican Republic’s valuations are at their tightest levels since 2007.

Bahrain (underweight): Weak fiscal reform efforts, a deterioration in regional geopolitical risks, and tight valuations make us cautious.

Romania (underweight): We are concerned about deteriorating fiscal risks and political noise ahead of this year’s elections. Romania has already been a prolific issuer this year and is running the risk of an abundance of supply.

Dominican Republic (underweight): Although fundamentals continue to be among the strongest in the region, valuations are at their tightest levels since 2007.

Low-Beta Bucket

In the low-beta bucket, our largest overweight positions are in Saudi Arabia, Bermuda, and Paraguay and our largest underweight positions are in Poland, Uruguay, and Indonesia.

Saudi Arabia (overweight): Efforts to diversify the economy away from the energy sector remain largely on track. Oil prices are supportive of the current investment spend, and we see value in Saudi Arabia relative to some of its regional peers.

We believe Paraguay is on an improving fundamental trajectory.

Bermuda (overweight): Bermuda’s bonds have similar valuations to those of Peru and Chile, but we believe the country has a stronger fundamental trajectory with less institutional uncertainty.

Paraguay (overweight): Although Paraguay has lagged year-to-date, we believe the country is on an improving fundamental trajectory and has attractive valuations for the low-beta bucket.

Poland (underweight): Although the medium-term policy framework looks more favorable under the new government, we remain cautious near term due to an increase in political noise following last year’s elections.

Uruguay (underweight): Credit fundamentals in Uruguay remain strong, but bond prices have compressed materially since the COVID-19 pandemic, and we believe this results in limited scope for additional spread tightening.

Indonesia (underweight): Valuations are unappealing. The country’s fundamental outlook became murkier after presidential elections in February, and there is risk of fiscal slippage should the new government increase spending. In addition, a slowdown in the windfall from commodity exports and a persistently strong U.S. dollar could weaken external positions.

Marco Ruijer, CFA, is a portfolio manager on William Blair’s emerging markets debt team.

Want more insights on the economy and investment landscape? Subscribe to our blog.

The post EM Debt 2024: Solid Beginnings appeared first on William Blair.

bonds pandemic covid-19 emerging markets pound spread recovery oil poland ukraineInternational

How drugmakers are handling new pressure to recycle plastic injection pens as millions of new patients begin using GLP-1s

On plastic chairs made from discarded obesity and diabetes drug pen injectors, Novo Nordisk is literally sitting on its blockbuster GLP-1 solution. The…

On plastic chairs made from discarded obesity and diabetes drug pen injectors, Novo Nordisk is literally sitting on its blockbuster GLP-1 solution. The cafeteria in its newest site in Denmark is full of chairs and other furniture made from discarded and recycled diabetes and obesity single-use pens.

As millions of prescriptions get written, leading to even more millions of discarded pens, the average person may also someday sit on a chair made from the upcycled byproducts of a trending obesity treatment.

It won’t be easy, though. Beyond the expense and complexity of recycling contaminated medical waste like injection pens, in the medical waste big picture, injector pens are a smaller part of the larger problem.

Helping to spur pharma recycling are the many new users of Novo Nordisk’s Wegovy and Eli Lilly’s Zepbound, who are starting to raise their voices. Reddit threads for both drugs include many questions and comments about the wastefulness of the one-time pens.

“Does anyone else feel guilty about the plastic syringes we just throw away? Must be millions filling up the landfills right now,” one user wrote recently.

Patient interest in recycling is also building in Europe, where some programs and test pilots are already running.

“Particularly in European countries, we are seeing greater interest from patients,” said Katrine DiBona, Novo Nordisk corporate VP for global public affairs and sustainability. “We depend on patients having interest and the willingness to take them back.”

Novo Nordisk has a ReMed program, featured recently on its social media channels with videos of piles of bright plastic pellets and the modern furniture the pens are upcycled into. ReMed is currently the most extensive upcycling plastic pen effort among the fledgling trials and plans across pharma.

The pilot began in five Denmark cities in 2020 during the Covid-19 pandemic, but evolved into the now-established national program. It’s collected 2.4 million of Novo’s pens in Denmark to date, currently with a 50% recycling rate, but aiming for an 85% rate by the end of 2024.

Eli Lilly, Sanofi and Merck joined ReMed last year, and the effort has expanded into the UK, Brazil, France and Japan. There are still no plans set for the US.

“It’s not feasible to collect pens all around the world, and then we fly them to Denmark, and then process them here,” DiBona said. “The numbers are clear. Within Europe, we can ground transport to Denmark for the backend solution. And it’s still a positive business case from a CO2 and environmental perspective. But the minute we start going into different regions, we need a regional back end solution.”

Separately, Eli Lilly is working with Sanofi on a pilot program in France called Recypen, a Lilly spokesperson said. On its own, Lilly is also running a recycling pilot in five cities in Germany and with more partners on “several take back and recycling pilots” in the US and in Europe.

The pharma companies’ efforts mirror those made by industries in general struggling with balancing convenience and consumer demand for environmental responsibility.

“This is not unique to the healthcare space right now. We are seeing a major shift and trends in adopting a circular economy across industries,” said Jamie Pero Parker, sustainability lead and innovation advisor at RTI International, which does research in medical waste and medical device recycling. “The issues come in different flavors, but they’re happening pretty much everywhere.”

Still, though the efforts and collaborations are nascent, Novo Nordisk is hopeful ongoing patient sentiment will help change the future.

“We moved the market to disposable devices. And I think increasingly that will become a challenge from an environmental point of view and also a scalability point of view when you get into large millions of patients,” Novo Nordisk CEO Lars Fruergaard Jørgensen said at the JP Morgan Healthcare Conference in January, according to an AlphaSense transcript. “I think there’ll be a day where a patient as a consumer would not fancy throwing out a device after having used it once.”

treatment pandemic covid-19 brazil japan european europe uk france germany-

International4 weeks ago

International4 weeks agoParexel CEO to retire; CAR-T maker AffyImmune promotes business leader to chief executive

-

Government2 weeks ago

Government2 weeks agoClimate-Con & The Media-Censorship Complex – Part 1

-

Spread & Containment3 days ago

Spread & Containment3 days agoWHO Official Admits Vaccine Passports May Have Been A Scam

-

Spread & Containment1 week ago

Spread & Containment1 week agoFDA Finally Takes Down Ivermectin Posts After Settlement

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoVaccinated People Show Long COVID-Like Symptoms With Detectable Spike Proteins: Preprint Study

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoCan language models read the genome? This one decoded mRNA to make better vaccines.

-

Uncategorized1 week ago

Uncategorized1 week agoWhat’s So Great About The Great Reset, Great Taking, Great Replacement, Great Deflation, & Next Great Depression?

-

Spread & Containment4 weeks ago

Spread & Containment4 weeks agoJapanese Preprint Calls For mRNA VaccinesTo Be Suspended Over Blood Bank Contamination Concerns