International

Cheap grocery chain adds a fancy Whole Foods-style feature

The food market, which operates across the northeast and mid Atlantic, is adding a crowd pleaser.

Routine, weekly trips to the grocery store are rapidly becoming a thing of the past.

And that's largely because the grocery landscape is changing as a whole.

Related: Target makes (another) self-checkout change customers will hate

Increasingly, consumer taste and demands are becoming more niche. Some prefer to shop exclusively online thanks to new delivery services like Instacart and Amazon (AMZN) grocery delivery.

Others frequent superstores like Walmart (WMT) or Target (TGT) where they can hit all their errands – pharmacy, pet supplies, party favors, cosmetics, and groceries – at once. Often, these stores offer deeper discounts and better value, particularly if a customer prefers buying in bulk.

Other customers prefer instead to make the trek to a specialty grocer, such as a Wegmans, Whole Foods, The Fresh Market, or Sprouts which tend to carry more niche, holistic, or gourmet items for even the pickiest of palates.

Often, these specialty stores will carry an outsized number of organic produce, or items that one might have to ordinarily place a special order for ahead of time at another store or restaurant, like sushi, poke bowls, hand-made mozzarella, organic smoothies, or international candies.

But increasingly, everyday markets and grocery stores are beginning to add in specialty conveniences in an effort to attract more customers through their doors – or please the existing ones. Florida-based Publix, for example, has been adding new features like burrito bars, fresh deli sandwich stations, salad bars, ramen bars, and freshly cooked pizzas to some of its stores for a renewed upscale experience.

Weis Markets adds unique new feature

The issue with many of these specialty stores, of course, is that only a few items can ring up a pricey bill. It's not exactly feasible for the average family of four, for example, to shop each week for their essentials at The Fresh Market. The bill would be pricey, and not every kid prefers or appreciates fresh organic burrata cheese on his or her cauliflower crust pizza for a packable lunch.

MediaNews Group/Reading Eagle via Getty Images/Getty Images

So everyday grocery stores have been adding some more modern conveniences to their aisles in an effort to attract a clientele that appreciates the finer things but still wants to save money.

Weis Markets announced it would be adding technologically advanced salad bars to some of its stores, which will allow customers to create their own bespoke ready to eat meals, hot and fresh, while they get their grocery shopping done.

The salad bars are made by Picadeli of Sweden and utilize artificial intelligence to create "fresher, safer, and more craveable," salad bars using locally sourced ingredients that are typically very veggie-heavy. Red meat is not on the menu, the company proudly touts.

"The push pre-pandemic was for more bulk foods, more service stations, [and then] the pandemic got everybody really concerned” about safety, Weis Markets Director of Produce Kevin Weaver said. “And now the pendulum is swinging back to ‘I want more choice, I want to be able to customize.’ And so service departments are making a resurgence and salad bars are making a resurgence.”

The salad bars will feature closable hoods, which will protect ingredients and keep them fresher longer. Weis Markets will start out by introducing the Picadeli stations into of their stores, many of which will be located in Maryland.

Two stores have already received the new installations, in York and Bellefonte, Pa., and the following are slated to install them soon:

- Parkville, Md.

- Perry Hall, Md.

- Baltimore, Md.

- Frederick, Md.

- Huntingdon Valley, Pa.

- Clarks Summit, Pa.

Picadeli currently operates its salad bars in other popular areas around the U.S., include Acme grocery stores, Giant, Safeway, Coborn's, and Maryville University in Missouri.

sweden pandemicGovernment

Victor Davis Hanson: Gaming The 2024 Campaign

Victor Davis Hanson: Gaming The 2024 Campaign

Authored by Victor Davis Hanson via American Greatness,

We have seen enough of the Biden-Trump…

Authored by Victor Davis Hanson via American Greatness,

We have seen enough of the Biden-Trump race so far to predict what lies ahead over the next seven months of the campaign. Currently, the polls are about dead even. Trump, however, for now enjoys small leads in the majority of the fickle swing/purple states that will likely decide the election.

So here is what we should expect:

Biden

Biden has three major vulnerabilities and three major assets. His fate will depend on how these criteria play out.

First, on the negative side of the ledger, Biden suffers continual mental and physical decline, which is accelerating exponentially. His work week is now more off than on. Aides pray that he can get through a teleprompter without complete incoherence. His speech is so slurred, his syntax so bizarre that he seems to speak a language that is mostly indecipherable.

They rightly fear that any young attractive woman or even preteen might earn a trademark Biden weird call-out, a hair- or accustomed ear-blow, or even an attempted presidential too-long hug or neck nibble.

Steps pose an existential threat, given that the president is one trip away from oblivion. Biden is not even the diminished Biden of 2020, when, in his basement, he at least manipulated the COVID-19 lockdown to mask his infirmities and abbreviated schedules.

The odds are 50/50 whether Biden will even make it over the next five months to the August Democratic Convention. And, assuming that he does, can he rein in efforts to push him off the ticket?

Second, the Biden family is corrupt. Hunter still faces spring- and summer-long felony exposure in connection with his Biden-family brand of tax cheating. Joe knows that his own documents, first-hand witnesses, bank statements, Hunter’s emails, and testimonies from Hunter’s associates reveal that the otherwise talentless but high-living Biden extended family was surviving only by the sale of Senator, Vice President, and future President Joe Biden’s name—and his known willingness to pay fast and loose with legal and ethical constraints.

There is still some chance that, in the current impeachment investigations and trial, more incriminating evidence will emerge or turned witnesses will offer proof of Biden’s criminality. For now, Biden’s lawbreaking is completely dismissed by Attorney General Merrick Garland and by special counsel Robert Hur’s satirical-comedy-worthy argument that even overwhelming evidence pointing to Joe Biden’s criminal behavior cannot be prosecuted because of the president’s dementia.

Third, the hard-left Biden agenda is completely underwater. Not a single Biden administration issue or policy—the border, crime, inflation, energy, foreign policy, race relations, education—polls even 50 percent. Worse, Biden never addresses the inflation created by his massive spending program, the lawlessness in our streets since 2021, the spiking cost of gasoline, or the humiliation abroad, from Kabul to Kyiv to the Chinese balloon. His idea of how to combat inflation is akin to combating obesity by gaining 100 pounds, losing two, and—presto—announcing that obesity was abated.

He spiked racial polarization, proved indifferent to an epidemic of anti-Semitism, and fueled the national debt (an additional $1 trillion every 100 days).

Now Biden is warring on the Supreme Court—a dangerous precedent given that an assassin has already shown up at Justice Kavanaugh’s home, given that mobs have massed at various justices’ residences with impunity, given Sen. Schumer’s prior personal threats at the very doors of the court to Justices Kavanaugh and Gorsuch, and given left-wing rhetoric about packing the court.

All candidate Biden can do is either deny an open border, inflation, crime, racial tensions, and the Kabul humiliation—or claim that the successful policies of Trump, out of power for nearly four years, were responsible for all that crashed on Biden’s watch.

Biden, however, enjoys some natural advantages, most notably incumbency.

(Note that this was not much of an advantage to Trump himself in 2020, given the wild cards of the COVID-19 pandemic, the disastrous nationwide lockdown, and the mysterious workings of the Trump-hating administrative state. We remember the 11th-hour Pfizer declaration that there would be no pre-election announcement, as planned, of the success of Trump’s Operation Warp Speed vaccination initiative. Then, there was indeed an announcement—immediately after the election. And then there was the mysterious CIA/FBI arming of the Biden campaign, on the eve of the last debate and just days before Election Day, with the fake anti-Trump rebuttal of “Russian laptop disinformation.”)

Biden will pull every lever of incumbency, working the office of the presidency in the most Machiavellian and cynical of ways:

a) hoping to lower gas prices by not filling up the strategic petroleum reserve, jawboning illiberal and “pariah” oil producers to pump what he claims he hates, ordering Ukraine not to hit Russian refineries, and appeasing enemies like Iran to keep its oil flowing,

b) unconstitutionally sidestepping rulings of the Supreme Court to ensure more pre-election illegal student-loan-cancellation giveaways,

c) prodding the supposedly independent Federal Reserve to lower interest rates before November,

d) pressuring Mexico to tamp down illegal entries for a few months to serve their shared interests in defeating Trump.

A second asset is his army of satellites.

These include left-wing justices, weaponized federal, state, and local prosecutors, and Trump-biased jury pools. The left expects these to do what the effort to remove Trump’s name from the ballot did not: destroy the Republican candidate, financially and health-wise, and bind him with the Lilliputian ropes of Fani Willis, Letitia James, Alvin Bragg, and Jack Smith, who are eager to convict him through weaponized judges, juries, and a venomous media. They also include compromised election officials in urban counties in key swing states.

Biden cannot win unless 70-80 percent of voters in the key swing states do not vote on Election Day. Instead, their ballots must be mailed in, harvested, and curated without accustomed audit and without verification of whether voters are registered US citizens or have voted only once and done so legally.

And—his third major asset—Biden will also have billions of dollars more than Trump to pound home these themes in endless ads, social media shenanigans, and news censorship and blackouts.

Biden feels that he nevertheless must make the election hinge on destroying a monstrous, demonic, and hideous Donald Trump through any means necessary. Biden’s is not a positive campaign but will be waged by despising Donald Trump and all who support him. Expect more of those “semi-fascists”/ “ultra-MAGA” Phantom-of-the-Opera Biden hate speeches.

In the next seven months, the Biden effort will play out with three narratives:

-

Trump is a January 6th insurrectionist and dictator and will “destroy democracy,” though apparently without weaponizing the FBI or removing his opponents’ names from ballots or siccing right-wing prosecutors on his enemies.

-

Trump purportedly will kill women by banning all abortions while relegating non-whites to the pre-civil-rights era - despite leaving abortion up to the states, and likely gaining more Latino and Black voters than any prior Republican presidential candidate.

-

Then we will hear that Trump is a felon who belongs in jail.

All this is the message of the Biden campaign, period.

Trump

Trump likewise has both assets and liabilities. His vulnerabilities are mirror images of Biden’s advantages: he lacks incumbency and the powers that come with it; he does not have an army of officials on his side; and he will have a financial disadvantage.

We have no idea how many gag orders remain. How many late-summer days will Trump spend stuck in court? How many hundreds of millions of his dollars will be expropriated by out-of-control anti-Trump left-wing judges? Can Trump—or any candidate—successfully run with a $1 billion overhead in legal fees and fines and with critical days on the campaign trail diverted to left-wing, media-frenzied, blue-city courtrooms?

In addition, Trump is sometimes his own worst enemy. Trump, one could say, is running mostly against Trump. He knows that if he sticks solely to the agenda, contrasting Biden’s failures with his own past stellar record and future contract with America, he can win. He realizes that he must take the high road and talk idealistically rather than going low and getting angry.

But who could be expected to do so after being the victim of two unfair impeachments, left-wing lies like Russian collusion and disinformation, efforts to railroad him into prison with outrageously politicized legal vendettas, and attempts to remove his name from the ballot?

Trump’s advantages are clear.

First, his record: on foreign policy, inflation, and the economy. But most important for the election is his ability to connect with people.

So far, the split-screen differences between candidate Trump and President Biden have proved overwhelmingly to Trump’s advantage: Biden in New York schmoozing at a black-tie night with celebrities and ex-presidents to haul in $26 million in campaign cash from the hyper-rich, while Trump is with middle-class NYPD rank-and-file at a rainy wake for a murdered cop—killed by a repeat felon released without bail.

Or Trump buying fast food and milkshakes amid a mostly black Atlanta Chick-fil-A crowd, while Biden dines with the venomous Robert De Niro and the zillionaire Jeff Bezos at a White House dinner, with the celebrities’ trophy girls vying to get the most stares at their multi-thousand-dollar designer clothes—as if they were on the red carpet at the Oscars rather than in the people’s house.

What can Trump do to make the best use of all this?

He must magnanimously reach out to former rivals such as Haley, even as she continues to demonize him, and to DeSantis as well. He must unite the House Republicans to keep their razor-thin majority at all costs. He must campaign nonstop among poor whites, blacks, and Latinos, appealing to shared class concerns rather than the racial obsessions and psychodramas of the bicoastal elite.

He should skip the ad hominem invective, forget the past rivalries with his primary opponents, and assume a corrupt media does not deserve a minute of his time. If he does this, he can win.

But if he climbs down into the mud with his leftist opponents, trades insults, wrestles with his opponents, and obsesses about fake news and the crooked media, he will likely lose.

Aside from Trump’s temperament, we must always remember that the answers to two other fundamental questions will determine the outcome of the election:

-

Can the Republicans monitor the balloting and return it to the environment of 2016 rather than 2020?

-

Can Trump convince millions of minorities, independents, and former Biden voters that there are plenty of reasons to vote for someone they may not like—including the very future of the United States as a free republic as envisioned by the Founders, rather than an increasingly weak, anemic, cranky socialist has-been?

Finally, we must also remember that, ultimately, the outcome of the election could be determined by unpredictable events.

What happens if the Gaza War expands to Lebanon, Syria, and Iran, as Israel is attacked from all directions? Or the military of the United States is attacked in the Middle East, as in the past?

What will be the status of Ukraine by November—static, safer, or absorbed by Russia—and who will be praised or blamed for what ensues?

Will China risk attacking or blockading Taiwan on the theory that it will never be gifted a more ossified president than Biden?

Will the left unleash another late-season October surprise like the 2016 Access Hollywood tape or the 2020 “Russian disinformation” laptop farce? And will these desperate gambits resonate or boomerang?

And, lastly, will the candidates in October and November resemble the candidates of today? These are the two oldest candidates ever to run for president. Will Trump still be vibrant at 78? Will Biden still be upright at 81?

Will Biden’s feebleness still earn him sympathy, or at least respectful silence? Or will it devolve to the point that the public, worn out by his lapses, concludes that Joe Biden would not be able to keep any job in America—except the Presidency of the United States?

Government

Deborah Birx Gets Her Close-Up

Deborah Birx Gets Her Close-Up

Authored by Bill Rice via The Brownstone Institute,

Most Americans will remember Dr. Deborah Birx as the…

Authored by Bill Rice via The Brownstone Institute,

Most Americans will remember Dr. Deborah Birx as the “scarf lady” who served on the White House’s Covid Response Team beginning in February 2020.

According to a recently-released (but little-seen) 24-minute mini-documentary, it was Birx – even more so than Anthony Fauci – who was responsible for government “guidelines,” almost all of which proved to be unnecessary and disastrous for the country.

According to the documentary, the guidelines ran counter to President Trump’s initial comments on Covid, but ultimately “toppled the White House (and Trump) without a shot being fired.”

The mini-documentary (“It Wasn’t Fauci: How the Deep State Really Played Trump”) was produced by Good Kid Productions. Not surprisingly, the scathing 24-minute video has received relatively few views on YouTube (only 46,500 since it was published 40 days ago on Feb. 26).

I learned of the documentary from a colleague at Brownstone Institute, who added his opinion that “Birx (is) far more culpable than Fauci in the Covid disaster…Well worth the time to see the damage an utter non-scientist, CIA-connected, bureaucrat can do to make sure things are maximally bad.”

I agree; the significant role played by Birx in the catastrophic national response to Covid has not received nearly enough attention.

Brought in from out of Nowhere…

From the video presentation, viewers learn that Birx was added to the White House’s Coronavirus Task Force as its coordinator in latter February 2020.

Birx worked closely with Task Force chairman Vice President Mike Pence, a man one suspects will not be treated well by future historians.

According to the documentary, “career bureaucrats” like Birx somehow seized control of the executive branch of government and were able to issue orders to mayors and governors which effectively “shut down the country.”

These bureaucrats were often incompetent in their prior jobs as was Birx, who’d previously served as a scientist (ha!) in the Army before leading the government’s effort to “fight AIDS in Africa” (via the PEPFAR Program).

When Birx was installed as coordinator of Covid Response she simply rehashed her own playbook for fighting AIDS in Africa, say the filmmakers.

The three tenets of this response were:

-

“Treat every case of this virus as a killer.”

-

“Focus on children,” who, the public was told, were being infected and hospitalized in large numbers and were a main conduit for spreading the virus.

-

“Get to zero cases as soon as possible.” (The “Zero Covid” goal).

The documentary primarily uses quotes from Scott Atlas, the White House Task Force’s one skeptic, to show that all three tenets were false.

Argued Atlas: Covid was not a killer – or a genuine mortality risk – to “99.95 percent” of the population. Children had virtually zero risk of death or hospitalization from Covid. And there was no way to get to “zero cases.”

Atlas Didn’t Shrug, but was Ignored…

Furthermore, the documentary convincingly illustrates how the views of Atlas were ignored and how, at some point, his ability to speak to the press was curtailed or eliminated.

For example, when Atlas organized a meeting for President Trump with Covid-response skeptics (including the authors of the Great Barrington Declaration) this meeting was schedule to last only five minutes.

The documentary also presents a report from the inspector general of the Department of State that was highly critical of Birx’s management style with the African “AIDS relief” program she headed.

Among other claims, the report said she was “dictatorial” in her dealings with subordinates and often “issued threats” to those who disagreed with her approach.

Shockingly, this highly-critical report was published just a month before she was appointed medical coordinator of the Coronavirus Task Force.

A particularly distressing sound bite from Birx lets viewers hear her opinion on how controversial “guidance” might be implemented with little pushback.

According to Birx, she intentionally buried the more draconian elements of the lockdowns in text at the end of long documents, theorizing (correctly apparently) that most reporters or readers would just “skim” the document and would not focus on how extreme and unprecedented these mandates actually were.

The documentary points out that Birx’s prescriptions and those of President Trump were often in complete conflict.

Birx, according to the documentary, once pointed this out to Vice President Pence, who told her to keep doing what she believed.

Indeed, the Vice President gave Birx full use of Air Force 2 so she could more easily travel across the country, spreading her lockdown message to governors, mayors, and other influencers.

Several Covid skeptic writers, including Jeffrey Tucker of Brownstone Institute, have noted that President Trump himself went from an opponent of draconian lockdowns to an avid supporter of these responses in a period of just one or two days (the pivotal change happened on or around March 10th, 2020, according to Tucker).

Whoever or whatever caused this change in position, it does not seem to be a coincidence that this about-face happened shortly after Birx – a former military officer – was named to an important position on the Task Force.

(Personally, I don’t give Anthony Fauci a pass as I’ve always figured he’s a “dark master” at manipulating members of the science/medical/government complex to achieve his own desired results.)

This documentary highlights the crucial role played by Deborah Birx and, more generally, how unknown bureaucrats can make decisions that turn the world upside-down.

That is, most Americans probably think presidents are in charge, but, often, they’re really not. These real rulers of society, one suspects, would include members of the so-called Deep State, who have no doubt installed sycophants like Fauci and Birx in positions of power.

I definitely recommend this 24-minute video...

A Sample of Reader Comments…

I also enjoyed the Reader Comments that followed this video. The first comment is from my Brownstone colleague who brought this documentary to my attention:

“… As I said, things can change over the period of 20 years but in the case of Birx/Fauci, I do not believe so. I have never seen people entrenched in the bureaucracy change.”

Other comments from the people who have viewed the mini-documentary on YouTube:

“Pence needs to be held accountable.”

“What does Debbie’s bank account look like?”

“(The) final assessment of President Trump at the 23:30 mark is, while painful, accurate. He got rolled.”

“This is very hard to find on YouTube. You can literally search the title and it doesn’t come up.”

“Excellent summary, hope this goes viral. Lots of lessons to learn for future generations.”

“Eye opening. Great reporting.”

Post from One Month Ago…

“37 likes after 3 years of the most controversial and divisive action in recent history. How can this be?”

“Oh never mind. YouTube hid it from the public for years.”

“Probably hasn’t been taken down yet for that reason, relatively low views.”

“Thanks for this! Sounds like everyone below President Trump was on a power trip and I didn’t think it was possible to despise Pence more than I already do.”

“…the backing of CDC, legacy media, WHO and government schools, business folding in fear are ALL responsible. Accountability for every person and agency is paramount!”

“Should be noted that her work on AIDS in Africa was just as useless and damaging.”

“First, any mature, adult woman who speaks with that much vocal fry should be immediately suspect. And the glee with which she recounts her role at undermining POTUS is remarkable and repulsive. This woman should NEVER be allowed to operate the levers of power again.”

* * *

Republished from the author’s Substack

International

Goldman Soars On “Near-Perfect” Top To Bottom Beat As Solomon Sees Rebound In Dealmaking

Goldman Soars On "Near-Perfect" Top To Bottom Beat As Solomon Sees Rebound In Dealmaking

With JPMorgan tumbling on Friday on a net interest…

With JPMorgan tumbling on Friday on a net interest income miss and disappointing guidance, suffering its worst earnings-day slump in decades, financials needed a solid report this morning and got it from the bank that once was the envy of all its Wall Street peers before a series of catastrophic decisions saw it lose most of its vaunted trading floor amid a disastrous foray into consumer subprime lending. Yes, the Goldman Sachs formerly known as the Vampire Squid, is soaring this morning after reporting stellar Q1 results that beat across the board and saw profit surge 28% in Q1 - even as analysts expected a decline from a year ago - driven by strong performance in its marquee trading business as well as a resurgence in underwriting and dealmaking.

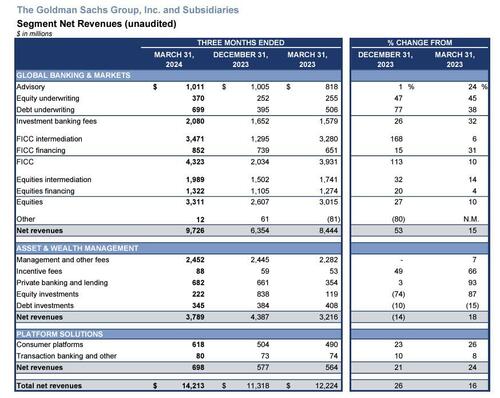

Here's what Goldman reported for the first quarter:

- Net revenue $14.21 billion, +16% y/y, beating est. $12.98 billion

- FICC sales & trading revenue $4.32 billion, +10% y/y, beating estimates of $3.64 billion

- Global Banking & Markets net revenues $9.73 billion, +15% y/y, beating estimates of $8.46 billion

- Investment banking revenue $2.09 billion, beating estimates of $1.82 billion

- Equities sales & trading revenue $3.31 billion, +9.8% y/y, beating estimates of $2.96 billion

- Advisory revenue $1.01 billion, +24% y/y, beating estimates of $874.4 million

- Equity underwriting rev. $370 million, +45% y/y, beating estimates of $331.4 million

- Debt underwriting rev. $699 million, +38% y/y, beating estimates of $611.1 million

Looking below the line we find more of the same:

- Net Income $4.1BN, up 28% from $3.2BN a year earlier and beating estimates by almost $1BN

- EPS $11.58, beating est of 8.56, and up 32 vs. $8.79

And visually:

Some more details:

- Net interest income $1.61 billion, -9.7% y/y, beating estimates of $1.47 billion

- Platform Solutions pretax loss $117 million, estimate loss $260.5 million

- Total deposits $441 billion, +3% q/q

- Loans $184 billion, +3.4% y/y, estimate $185.39 billion

- Provision for credit losses $318 million vs. recovery $171 million y/y, below the estimate $503.4 million

- Total operating expenses $8.66 billion, +3% y/y, higher than the estimate $8.47 billion

- Compensation expenses $4.59 billion, +12% y/y, higher than the estimate $4.29 billion

- Assets under management $2.85 trillion, +6.6% y/y, estimate $2.92 trillion

- Total AUS net outflows $15 billion vs. inflows $57 billion y/y, estimate inflows $34.13 billion

Turning to the bank's trading group, results here were stellar:

- Global Banking & Markets net revenues $9.73 billion, +15% y/y, estimate $8.46 billion

- FICC sales & trading revenue $4.32 billion, +10% y/y, estimate $3.64 billion, and "reflected significantly higher net revenues in financing and higher net revenues in intermediation"

- Equities sales & trading revenue $3.31 billion, +9.8% y/y, estimate $2.96 billion "reflected higher net revenues in intermediation and slightly higher net revenues in financing"

Some more details here:

- FICC intermediation reflected significantly higher net revenues in mortgages and higher net revenues in currencies and credit products, partially offset by lower net revenues in commodities and slightly lower net revenues in interest rate products

- FICC financing was a record and primarily reflected significantly higher net revenues from mortgages and structured lending

- Equities intermediation reflected significantly higher net revenues in derivatives.

- Equities financing net revenues were slightly higher; record average prime balances.

The bank's investment bank also did a great job, with Global Banking & Markets net revenues $9.73 billion, +15% y/y, and smashing estimates of $8.46 billion. Investment banking revenue of $2.09 billion, also beat estimates of $1.82 billion

- Advisory revenue $1.01 billion, +24% y/y, estimate $874.4 million, and reflected an increase in completed mergers and acquisitions transactions

- Equity underwriting rev. $370 million, +45% y/y, estimate $331.4 million, and reflected an increase in initial public and secondary offerings

- Debt underwriting rev. $699 million, +38% y/y, estimate $611.1 million, and reflected a significant increase in leveraged finance activity

Trading has been a bright spot for the bank in recent years. Market swings during the coronavirus pandemic, the effect of Russia’s full-scale invasion of Ukraine in shaking up commodities markets and the trading of macro products stimulated by central bank interest rate rises have all helped to buoy the business.

Analysts had expected revenues in Goldman’s equity and fixed-income businesses to fall in the first quarter. Instead, both reported 10% increases compared with a year earlier. And while fees from FICC trading fell, it beat estimates with Goldman saying it benefited from higher revenues in mortgages, currencies and credit trading in the quarter.

Investment banking, meanwhile, had its best quarter in two years, with revenues of $2.1bn. This was up 32% from a year earlier, although still well below the peak achieved during the pandemic-era boom in dealmaking. Expect more gains here: the M&A market has finally started to pick up after a slowdown that has proved far more enduring than many on Wall Street anticipated. The number of takeovers worth at least $10bn more than doubled in the first three months of 2024.

Strong public market debuts from social media company Reddit and artificial intelligence infrastructure group Astera Labs have also raised hopes for a revival in the global initial public offering markets after two years of subdued activity.

Goldman’s asset and wealth management division, the cornerstone of Solomon’s efforts to diversify the Wall Street bank away from volatile investment banking and trading, posted revenue of $3.79 billion, up 18% from a year earlier. Management fees climbed 7% as the bank is seeking to shift growth to those fees instead of windfalls from balance-sheet investments. The bank also noted a pre-tax margin of 23% in that business.

Of note here is that while Goldman made a profit in Q 1private equity, it continued to lose money in public equities, to wit:

- Private: 1Q24 ~$330 million, compared to 1Q23 ~$35 million

- Public: 1Q24 ~$(110) million, compared to 1Q23 ~$85 million

Debt investments, meanwhile, reflected lower net interest income due to a reduction in the debt investments balance sheet.

Summarizing the wealth management data for 1Q24:

- Total assets of $190 billion

- Loan balance of $45 billion, of which $33 billion related to Private banking and lending

- Net interest income of $691 million

- Total Wealth management client assets of ~$1.5 trillion

- Pre-tax margin of 23%

The bank's solid Q1 performance helped draw a line under a challenging 12 months for Goldman in which its results were hit by losses tied to its pullback from consumer lending. CEO David Solomon, who last year faced criticism for his management of the bank, said the first-quarter results reflected “the earnings power of Goldman Sachs”.

Commenting on the quarter, Solomon said the company is in the early stages of reopening of capital markets, and that IPOs showed investment risk appetite growing. Some more comments:

- Expects solid demand for underwriting to continue this year.

- Continue to be constructive on the health of the US economy.

- That said, he continues to see headwinds, including concerns about inflation, the commercial real estate market and escalating geopolitical tensions.

- Unlike Jamie Dimon, Solomon was less pessimistic but noted that markets expect a soft landing but the trajectory is still uncertain.

- Very focused at the moment on organic execution of wealth management strategy; could be a time in future where something interesting might come up.

Solomon has refocused Goldman’s strategy on its core investment banking and trading businesses and invested in asset and wealth management to generate more stable revenues.

The reversal from the bank's disappointing 2023 was most apparent in one key metric: the bank reported return-on-equity of 14.8% for the first three months, in line with its longer-term targets and nearly double the dismal 7.5% it posted for 2023. The results also included a $78 million charge for an additional Federal Deposit Insurance Corp. special assessment stemming from last year’s regional-bank failures.

The figures were “a near-perfect print”, Oppenheimer analyst Chris Kotowski wrote in a note to clients. Goldman’s stock rose about 5 per cent in early trading.

Goldman shares, which were roughly flat for the year heading into earnings, climbed about 2% to $397.00 at 7:25 a.m. in New York

-

International3 weeks ago

International3 weeks agoParexel CEO to retire; CAR-T maker AffyImmune promotes business leader to chief executive

-

Spread & Containment1 month ago

Spread & Containment1 month agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

Government1 week ago

Government1 week agoClimate-Con & The Media-Censorship Complex – Part 1

-

International1 day ago

International1 day agoWHO Official Admits Vaccine Passports May Have Been A Scam

-

Spread & Containment7 days ago

Spread & Containment7 days agoFDA Finally Takes Down Ivermectin Posts After Settlement

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoVaccinated People Show Long COVID-Like Symptoms With Detectable Spike Proteins: Preprint Study

-

Uncategorized1 week ago

Uncategorized1 week agoCan language models read the genome? This one decoded mRNA to make better vaccines.

-

Uncategorized1 week ago

Uncategorized1 week agoWhat’s So Great About The Great Reset, Great Taking, Great Replacement, Great Deflation, & Next Great Depression?