International

How England’s scrapped Sure Start centres boosted the health and education of disadvantaged children

I worked with Sure Start and saw the good it brought to communities.

The Sure Start programme was launched in 1999, with centres set up in communities across England to offer support to the most disadvantaged families.

These centres had significant investment and a broad remit that focused on improving the lives of families. They offered support for families with children aged up to five, as well as high-quality play, learning and childcare experiences for children.

They also provided healthcare and advice about family health and child health, as well as development and support for people with special needs. But after 2010, funding was cut significantly and many of the centres closed.

Now, a report from the Institute for Fiscal Studies (IFS) has laid out some of their benefits. The research found that access to a Sure Start centre significantly improved the GCSE results of disadvantaged children.

This builds on other research that has shown that Sure Start also had significant long-term health benefits. This research suggests that at its peak, Sure Start prevented 13,000 hospitalisations of children aged 11-15.

These findings come as no surprise to those who, like me, worked in the early Sure Start local programmes and saw the value of their family-led ethos. In my current role at Sheffield Hallam University, I am the director of a nursery and early years research centre which maintains this approach – and my research with colleagues has shown the benefits that it brings to both parents and children.

How Sure Start worked

There was no set model for how Sure Start local programmes should deliver the services they offered. This led to delivery plans being developed with the local community. The support offered was tailored to the challenges that local families were facing.

I was lucky enough to be the community development worker for a small children-and-families charity that led an early Sure Start local programme. As this developed, it kept the community at its heart. At its peak, the programme combined a 60-place day-nursery, a women’s health project, and training for parents. Health visitors and midwives working on the sames site provided wraparound support for children and families.

During this period, I was constantly struck by the huge changes that families made in their lives after receiving the support they needed at the time they needed it. I believe this was partly due to the early programmes having nurseries on site. This created a daily point of contact with families, building trust and relationships which then supported families’ – and particularly mothers’ – engagement with other services.

Having access to early years provision meant that special needs were identified early, and children had access to support services before they reached school age. This was a positive factor highlighted in the IFS report.

Learning from Sure Start

The nursery and early years research centre I now direct was opened by Sheffield Hallam University during the pandemic in a disadvantaged area. This project is the result of a partnership with Save the Children UK.

Drawing on the successes of Sure Start, the nursery was established with the motto “changing lives through relationships”. It had the explicit aim of building trust with families so that we can understand their challenges and work on solutions together.

The university runs the nursery, and together with Save the Children provides additional support to parents. This includes a breakfast club, training and volunteering opportunities, and links to health and wellbeing support. We also direct people to the services offered by the local authority family hub, which is based on site.

This “one-stop shop” approach means there is a team that can offer support across a range of issues, without families having to re-tell their stories to different agencies each time.

There are numerous case studies of parents making changes in their lives through the support at the nursery. A number of our parents have developed the confidence to train as community researchers, for example, while some are training to deliver a nurture course to other parents in the community. One of our parents who has experience of homelessness is now advising homeless charities.

I have always been convinced of the benefit of Sure Start’s approach, and the recent IFS findings add further evidence of its value. The families that we work with are facing multiple challenges, from food and fuel poverty to insecure work and housing. Now would seem to be a critical moment for this approach to be brought back, so that a future generation of children can benefit.

Sally Pearse does not work for, consult, own shares in or receive funding from any company or organisation that would benefit from this article, and has disclosed no relevant affiliations beyond their academic appointment.

uk pandemicGovernment

Sky-high waiting times don’t make people trust the NHS any less – why that’s potentially bad news for Rishi Sunak

When the public sees an institution is failing, they generally lose trust in it. Not so with the health service.

The National Health Service (NHS) in England has long enjoyed high levels of popular support and trust. This was heightened during the COVID-19 pandemic, as people across the nation stood in the streets at the same time every week to clap for the NHS.

The culmination was when a 99-year-old retired army officer, Captain (later Sir) Thomas Moore, began fundraising for the NHS by walking around his garden. He eventually raised an estimated £38 million in public donations.

Yet, since the peak of the pandemic, the difficulties facing the NHS have been laid bare. Waiting times in accident and emergency and referral times for specialist treatment remain staggeringly high.

As researchers on trust, this led us to a question: do high waiting times mean people trust the NHS less? Trust is hugely important to society, as it tells us so much about people’s faith in the integrity of institutions.

We put this to the test. In monthly samples of approximately 500 respondents from July 2022 to July 2023, we looked at trust in major British political and public institutions such as parliament, the police, and the NHS. The NHS had the highest levels of support by far. On a seven-point scale, trust in the NHS was a full two points higher than trust in parliament.

One might say that trust in parliament is low because the public views the institution as having major performance problems. Polls show more than half of those surveyed believe parliament does not reflect the “full range of people and views of the British electorate”, and a majority of respondents also state that the Westminster parliament does either a “fairly bad” or a “very bad” job in holding the government of the day to account.

But the same does not appear to be true for the NHS. Higher waiting times, a strong indicator that the system is not functioning at its best, do not make people in England trust the NHS less, even though they may at some point be required to trust the NHS with their life.

Identifying with the NHS

Public administration specialists find that a person’s familiarity with an organisation such as the NHS, and whether they “identify” with its mission, can be as important as performance in determining whether they trust it.

Virtually every voter has had an experience with the NHS, and our research elsewhere finds deep sympathy with its employees, who are judged to be underpaid. Further polling during the service’s 75th anniversary found “the health service makes more people proud to be British than our history, our culture, our system of democracy or the royal family”.

Conservative politician Nigel Lawson once said “the NHS is the closest thing the English people have now to a religion”. So it’s clear that people do identify with the NHS. Voters also do not seem at all willing to abandon the faith of “free at the point of use” nationalised healthcare. Rather, citizens largely want a government that will fix their trusted institution.

Work by polling company Survation shows that for the NHS, voters do prioritise “reducing waiting times for NHS operations and procedures” and “making it easier to get GP appointments” – but they also don’t seem to think NHS staff are responsible. The same poll showed fewer than 10% of respondents believe that a priority for the NHS should be “reducing waste and creating efficiencies in NHS services”.

There is little sign, therefore, of the public being responsive to Prime Minister Rishi Sunak’s contentious claims that the NHS waiting times and other woes are at least partially related to industrial action.

It is likely that voters will punish the Conservatives for their poor performance on managing the NHS in the upcoming election. But that doesn’t mean Labour will get a free pass. Voters want the next government to sort things out – but the solutions to NHS problems are increasingly complex.

Thomas J. Scotto is the Co-I on this UKRI/ ESRC (grant number ES/W011913/1) and Japan Society for the Promotion of Science (JSPS, grant number JPJSJRP 20211704) funded research.

Steve Pickering is the PI on this UKRI/ ESRC (grant number ES/W011913/1) and Japan Society for the Promotion of Science (JSPS, grant number JPJSJRP 20211704) funded research.

Martin Ejnar Hansen does not work for, consult, own shares in or receive funding from any company or organisation that would benefit from this article, and has disclosed no relevant affiliations beyond their academic appointment.

army pandemic covid-19 treatment japanInternational

How India’s economy has fared under ten years of Narendra Modi

Modi has aimed to improve the lives of ordinary Indians, but some are still finding jobs hard to come by.

More than 960 million Indians will head to the polls in the world’s biggest election between April 19 and early June. The ruling Bharatiya Janata Party (BJP), which is led by Prime Minister Narendra Modi, is seeking a third term in office. And the polls suggest it will achieve this objective.

If one was to go by economic growth figures alone, the Modi government’s performance has been impressive. When Modi came to power in 2014, economic growth was sluggish. A series of high-profile corruption cases led to a loss of investor confidence in the Indian economy.

But between 2014 and 2022, India’s gross domestic product (GDP) per capita (a measure of income per head) rose from US$5,000 (£4,000) to over US$7,000 – an increase of roughly 40% in eight years. These calculations use purchasing power parity, a way of comparing general purchasing power over time and between countries.

This growth occurred in spite of an ill-advised attempt early on in Modi’s first term to take ₹500 (£4.80) and ₹1000 (£9.60) notes out of circulation. Scrapping the notes led to an acute cash shortage, slowing the growth in per capita GDP from 6.98% in 2016 to 5.56% in 2017.

According to the International Monetary Fund, India’s economy is projected to grow at a rate of 6.5% in 2024. That is higher than China’s projected growth of 4.6%, and exceeds that of any other large economy. The UK’s economy, for example, is expected to grow by 0.6% in 2024.

However, recent estimates also suggest that inequality in India is at an all-time high. Growth, when it has occurred, has seemingly been unequal. A key challenge facing the Modi government in its next term will be to convert higher growth into productive jobs while also curbing the excess wealth of India’s economic and political elites.

All smoke and mirrors?

India’s economic performance is hard to assess as the government has not published official data on poverty and employment since 2011. This has led analysts to use alternate data sources that are not as reliable as the large and nationally representative consumption and employment surveys of the Indian government’s statistical agency.

As a consequence, one gets wildly varying estimates of poverty. Less than two months before the elections, the Indian government released a factsheet that suggests poverty in India had fallen to a historic low in 2022.

The results were based on a large consumption survey carried out by the Indian government. But the actual data behind the government’s estimates was not released for independent analysis.

The lack of transparency with data has led to a situation where no one really knows what the true estimates of poverty and inequality are. This is a sorry state for a country known for its pioneering household surveys that in the past were far ahead of their time.

The new welfarism

In its second term, the Modi government placed greater emphasis on delivering public goods and social welfare programmes in a less corrupt manner. This saw the launch of a massive rural road construction programme and the enrolment of roughly 99% of Indian adults in Aadhaar, a digital ID system linked to fingerprints and iris scans.

The Aadhaar rollout, in particular, has allowed national and state governments to distribute benefits to the poor directly through their Aadhaar-linked bank accounts. It has also helped to curb leakage in the delivery of subsidies to poor households, which has long been the bane of India’s welfare delivery.

Essential goods such as toilets and cooking cylinders, which are normally privately provisioned, were supplied in large numbers by the government. This led to what Indian economist and the former Chief Economic Advisor to the government, Arvind Subramanian, called “New Welfarism” in India.

The delivery of welfare programmes occurred most rapidly during the pandemic. For example, the government’s food subsidy bill increased by nearly five times between 2019–2020 and 2021–2022, ensuring people were able to access affordable food grains.

There have been other areas of success too. The proportion of Indian villages with access to electricity climbed from 88% in 2014 to 99.6% in 2020. And 71.1% of people in India now own an account at a financial institution, up from 48.3% in 2014.

These massive transfers of cash, along with the greater provision of goods and services to India’s poor, have led to the BJP enjoying increased popularity among marginalised groups. Historically, these groups have tended to vote for the opposition Congress Party.

The lack of good jobs

The Modi government has grown India’s economy. But it has not been as successful in creating productive jobs for the large proportion of India’s labour force who are unskilled and poor.

Around 40% of workers remain in agriculture, and only about 20% work in manufacturing jobs or business services such as IT. Pre-poll surveys suggest that increasing unemployment and inflation are sources of concern for many voters.

The weak record of the Modi government in creating jobs is surprising given that it has floated many initiatives to kickstart manufacturing. The Make in India programme, which was launched as soon as Modi came to power in 2014, aimed to reduce the costs of doing business in India.

This was followed by the more recent production-linked incentive scheme in November 2023. The scheme offered US$24 billion in industrial incentives to boost domestic production in key manufacturing sectors from electronic products to drones. However, manufacturing’s share of output remained the same in 2022 as it was when Modi first took office.

For India to emulate the labour-intensive industrialisation success of China, deeper structural reforms are needed in the country’s product, labour and credit markets. But this will be politically difficult to do as it involves taking on India’s powerful conglomerates and trade unions.

As the Modi government seeks a third term in office, a key challenge that lies ahead is creating productive jobs outside of agriculture for the country’s increasingly educated and aspirational youth.

Kunal Sen receives funding from ESRC, British Academy and DFID.

unemployment pandemic subsidies economic growth credit markets congress gdp unemployment india uk chinaInternational

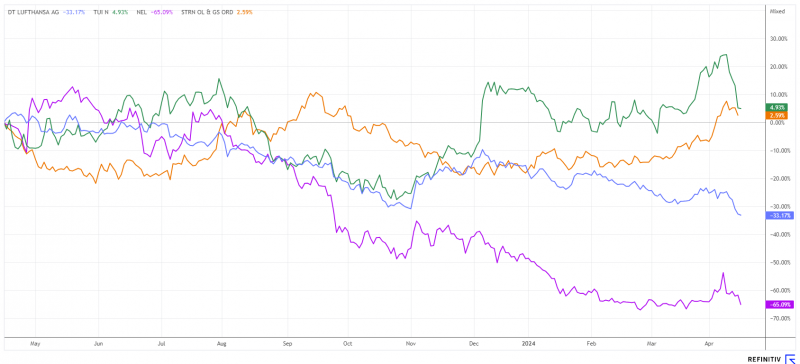

Nvidia! Turnaround for Nel, Saturn Oil & Gas, Lufthansa, TUI?

Apaton’s Andre Will-Laudien evaluates Nvidia, hydrogen expert Nel ASA, Canada’s Saturn Oil & Gas and travel companies TUI and Lufthansa.

The post Nvidia!…

It looks like a peak is forming in artificial intelligence. The most prominent share here is Nvidia (NDAQ:NVDA). With a spectacular rally, the value has surged by more than 100 per cent in just six months. However, the share price is now stuttering, and there have been no new highs for days.

The charts for TUI and Lufthansa also show an upward reversal. The latest wage negotiations have tightened the cost structure considerably. Also, a significant amount of revenue has been lost because of the numerous strikes. And now the Middle East crisis is flaring up, making the entire region a risk for holidaymakers. However, the rise in oil prices is giving oil companies a new lease of life. Here is a list of interesting investments.

Nel ASA – The planned turnaround is a long time comingThe Norwegian pioneer in electrolysers has shrunk to a market capitalization of €730 million in recent weeks. This puts Nel ASA (PINL:NLLSF) at a price-to-sales ratio of 4.4 for 2024. After numerous cancellations of major orders, the operating breakeven point is now expected to be reached in 2027. Although revenue for the first quarter of 2024 increased from NOK 409 million to NOK 532 million, a loss of NOK 74 million remained. Management announced that it will continue to invest in expanding organizational and production capacity while working on larger, more complex projects. This strategy, although it could promote growth in the long term, is a burden on the company’s profitability in the short term.

After a share price fall of over 80% in the past 3 years, the chartist can currently recognize some turnaround attempts. From a technical chart perspective, however, the situation now looks much better than at the beginning of the year. Nel ASA has already recovered 10% from its low, but yesterday’s loss is again weighing on the picture. Those who buy cautiously now should only do so with a long-term horizon in mind. Over a three-year period, however, triple-digit returns beckon.

Saturn Oil & Gas – Higher oil prices provide cash flowIn addition to the political efforts to shape the energy transition through alternative energies, the undersupply in Germany as an industrial location has shown just how important traditional coal, oil, and gas facilities still are today. Without any need, energy prices in Central Europe have risen dramatically because of the misguided subsidy policy. Unfortunately, the sun does not always shine, and the wind can fail to blow. Regardless of the economic outlook one may project, the long-term geopolitical landscape will likely keep energy prices elevated for a while longer.

Canadian oil producer Saturn Oil & Gas (TSX:SOIL) has increased its production capacity in Saskatchewan and Alberta to over 26,500 barrels of oil equivalent by the end of 2023. It expects EBITDA of C$355 million over the course of the year at estimated WTI oil prices of US$80. With more than 800 developed drilling locations, the company is able to generate nearly C$100 million in operating earnings (EBITDA) before interest, taxes, depreciation and amortization per quarter. If the expected cash flows are added at a discount rate of 10%, the safest resource indication yields a net cash value of C$6.11 per share, and even C$14.70 if the estimated reserves are included. It is no wonder that analysts rate the share with average price targets of C$5.15 and a “Buy” rating. The aim is to reduce the existing debt of around C$413 million by 2026. With spot prices above U$83 and ongoing geopolitical conflicts, cash flow is likely to be higher than expected. This will generate ongoing surpluses of unimagined proportions and simultaneously release funds that can be used to further develop the properties.

With around 161.5 million shares, the current market capitalization is just under C$450 million. Therefore, Saturn Oil is only valued at around 1.5 times free cash flow for 2024. Information on the first quarter of 2024 will be available at the beginning of May. As earnings outside the hedge book will be higher than expected, the share price will likely continue to rise further. It is important to overcome the chart resistance at around C$2.85; then, follow-up purchases should follow quickly.

Lufthansa and TUI – Travel is becoming more complicated againWhile there was hope for a good tourism year at the beginning of the year, things are turning out differently than expected, with numerous strikes and flight cancellations. With the travel backlog from the Coronavirus years now cleared, TUI (OTCPK:TUIFF) and Lufthansa (OTCQX:DLAKF) have also been able to repay government aid. However, the average price increase of 40% has, in turn, led consumers to rethink, and today, not all prices quoted are paid so easily. Household budgets are under considerable pressure due to the general increase in the cost of living, especially from government fees and taxes. An improvement in the short term is hardly to be expected with declining economic growth.**

German households are paying several hundred per cent more than the rest of the world in energy prices, which is self-inflicted. Tighter household budgets are having a particularly negative impact on the consumption of luxury goods and are significantly reducing travel budgets. After the disappointing earnings in the first quarter, analysts are now hoping for a recovery by mid-year. On the Refinitiv Eikon platform, only 6 of 22 analysts still recommend the Lufthansa share as a “Buy,” but the price expectation is still quite high at €8.65. From a technical perspective, a trend reversal in the share is not expected for the time being. Yesterday’s support break at €6.50 is significant and likely to trigger further stop-loss selling. Things look a little better for TUI. The stock is currently trading at a 2025 P/E ratio of 5.6, with slight revenue increases of 5% still being consensus. There are also 7 “Buy” recommendations out of 11 estimates with a 12-month price target of €9.90 – a 50% premium to the traded price. Nevertheless, the price should not fall below the support level of €6. The sector is currently only for the most resilient investors.

(Source: REFINITIV) Conflict of interestPursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as “Relevant Persons”) currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a “Transaction”). Transactions may thereby influence the respective price of the shares or other financial instruments of the company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk noticeApaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.

Join the discussion: Head over to the Bullboards at Stockhouse’s stock forums and message boards to share your market outlook and hear what everyone is saying about these and other stocks.

The material provided in this article is for information only and should not be treated as investment advice. For full disclaimer information, please click here.

The post Nvidia! Turnaround for Nel, Saturn Oil & Gas, Lufthansa, TUI? appeared first on The Market Online Canada.

economic growth coronavirus tsx stocks recovery oil canada europe germany alberta-

International4 weeks ago

International4 weeks agoParexel CEO to retire; CAR-T maker AffyImmune promotes business leader to chief executive

-

Government2 weeks ago

Government2 weeks agoClimate-Con & The Media-Censorship Complex – Part 1

-

International4 days ago

International4 days agoWHO Official Admits Vaccine Passports May Have Been A Scam

-

Spread & Containment1 week ago

Spread & Containment1 week agoFDA Finally Takes Down Ivermectin Posts After Settlement

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoVaccinated People Show Long COVID-Like Symptoms With Detectable Spike Proteins: Preprint Study

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoCan language models read the genome? This one decoded mRNA to make better vaccines.

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoWhat’s So Great About The Great Reset, Great Taking, Great Replacement, Great Deflation, & Next Great Depression?

-

Uncategorized2 days ago

Uncategorized2 days agoRed States Fight Growing Efforts To Give “Basic Income” Cash To Residents