International

Nvidia! Turnaround for Nel, Saturn Oil & Gas, Lufthansa, TUI?

Apaton’s Andre Will-Laudien evaluates Nvidia, hydrogen expert Nel ASA, Canada’s Saturn Oil & Gas and travel companies TUI and Lufthansa.

The post Nvidia!…

It looks like a peak is forming in artificial intelligence. The most prominent share here is Nvidia (NDAQ:NVDA). With a spectacular rally, the value has surged by more than 100 per cent in just six months. However, the share price is now stuttering, and there have been no new highs for days.

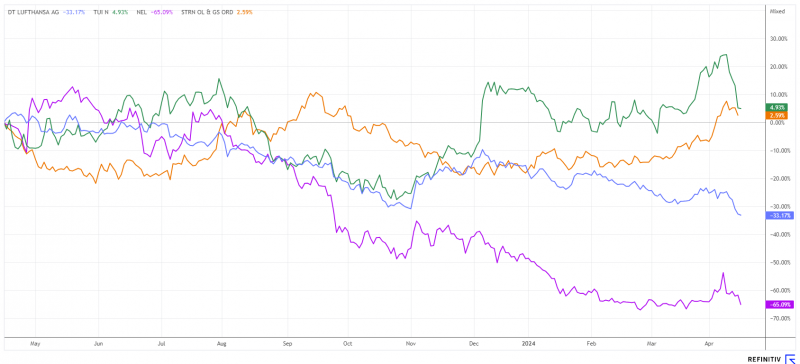

The charts for TUI and Lufthansa also show an upward reversal. The latest wage negotiations have tightened the cost structure considerably. Also, a significant amount of revenue has been lost because of the numerous strikes. And now the Middle East crisis is flaring up, making the entire region a risk for holidaymakers. However, the rise in oil prices is giving oil companies a new lease of life. Here is a list of interesting investments.

Nel ASA – The planned turnaround is a long time comingThe Norwegian pioneer in electrolysers has shrunk to a market capitalization of €730 million in recent weeks. This puts Nel ASA (PINL:NLLSF) at a price-to-sales ratio of 4.4 for 2024. After numerous cancellations of major orders, the operating breakeven point is now expected to be reached in 2027. Although revenue for the first quarter of 2024 increased from NOK 409 million to NOK 532 million, a loss of NOK 74 million remained. Management announced that it will continue to invest in expanding organizational and production capacity while working on larger, more complex projects. This strategy, although it could promote growth in the long term, is a burden on the company’s profitability in the short term.

After a share price fall of over 80% in the past 3 years, the chartist can currently recognize some turnaround attempts. From a technical chart perspective, however, the situation now looks much better than at the beginning of the year. Nel ASA has already recovered 10% from its low, but yesterday’s loss is again weighing on the picture. Those who buy cautiously now should only do so with a long-term horizon in mind. Over a three-year period, however, triple-digit returns beckon.

Saturn Oil & Gas – Higher oil prices provide cash flowIn addition to the political efforts to shape the energy transition through alternative energies, the undersupply in Germany as an industrial location has shown just how important traditional coal, oil, and gas facilities still are today. Without any need, energy prices in Central Europe have risen dramatically because of the misguided subsidy policy. Unfortunately, the sun does not always shine, and the wind can fail to blow. Regardless of the economic outlook one may project, the long-term geopolitical landscape will likely keep energy prices elevated for a while longer.

Canadian oil producer Saturn Oil & Gas (TSX:SOIL) has increased its production capacity in Saskatchewan and Alberta to over 26,500 barrels of oil equivalent by the end of 2023. It expects EBITDA of C$355 million over the course of the year at estimated WTI oil prices of US$80. With more than 800 developed drilling locations, the company is able to generate nearly C$100 million in operating earnings (EBITDA) before interest, taxes, depreciation and amortization per quarter. If the expected cash flows are added at a discount rate of 10%, the safest resource indication yields a net cash value of C$6.11 per share, and even C$14.70 if the estimated reserves are included. It is no wonder that analysts rate the share with average price targets of C$5.15 and a “Buy” rating. The aim is to reduce the existing debt of around C$413 million by 2026. With spot prices above U$83 and ongoing geopolitical conflicts, cash flow is likely to be higher than expected. This will generate ongoing surpluses of unimagined proportions and simultaneously release funds that can be used to further develop the properties.

With around 161.5 million shares, the current market capitalization is just under C$450 million. Therefore, Saturn Oil is only valued at around 1.5 times free cash flow for 2024. Information on the first quarter of 2024 will be available at the beginning of May. As earnings outside the hedge book will be higher than expected, the share price will likely continue to rise further. It is important to overcome the chart resistance at around C$2.85; then, follow-up purchases should follow quickly.

Lufthansa and TUI – Travel is becoming more complicated againWhile there was hope for a good tourism year at the beginning of the year, things are turning out differently than expected, with numerous strikes and flight cancellations. With the travel backlog from the Coronavirus years now cleared, TUI (OTCPK:TUIFF) and Lufthansa (OTCQX:DLAKF) have also been able to repay government aid. However, the average price increase of 40% has, in turn, led consumers to rethink, and today, not all prices quoted are paid so easily. Household budgets are under considerable pressure due to the general increase in the cost of living, especially from government fees and taxes. An improvement in the short term is hardly to be expected with declining economic growth.**

German households are paying several hundred per cent more than the rest of the world in energy prices, which is self-inflicted. Tighter household budgets are having a particularly negative impact on the consumption of luxury goods and are significantly reducing travel budgets. After the disappointing earnings in the first quarter, analysts are now hoping for a recovery by mid-year. On the Refinitiv Eikon platform, only 6 of 22 analysts still recommend the Lufthansa share as a “Buy,” but the price expectation is still quite high at €8.65. From a technical perspective, a trend reversal in the share is not expected for the time being. Yesterday’s support break at €6.50 is significant and likely to trigger further stop-loss selling. Things look a little better for TUI. The stock is currently trading at a 2025 P/E ratio of 5.6, with slight revenue increases of 5% still being consensus. There are also 7 “Buy” recommendations out of 11 estimates with a 12-month price target of €9.90 – a 50% premium to the traded price. Nevertheless, the price should not fall below the support level of €6. The sector is currently only for the most resilient investors.

(Source: REFINITIV) Conflict of interestPursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as “Relevant Persons”) currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a “Transaction”). Transactions may thereby influence the respective price of the shares or other financial instruments of the company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk noticeApaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.

Join the discussion: Head over to the Bullboards at Stockhouse’s stock forums and message boards to share your market outlook and hear what everyone is saying about these and other stocks.

The material provided in this article is for information only and should not be treated as investment advice. For full disclaimer information, please click here.

The post Nvidia! Turnaround for Nel, Saturn Oil & Gas, Lufthansa, TUI? appeared first on The Market Online Canada.

economic growth coronavirus tsx stocks recovery oil canada europe germany albertaInternational

AI chatbots refuse to produce ‘controversial’ output − why that’s a free speech problem

AI chatbot makers’ restrictive use policies hinder people’s access to information.

Google recently made headlines globally because its chatbot Gemini generated images of people of color instead of white people in historical settings that featured white people. Adobe Firefly’s image creation tool saw similar issues. This led some commentators to complain that AI had gone “woke.” Others suggested these issues resulted from faulty efforts to fight AI bias and better serve a global audience.

The discussions over AI’s political leanings and efforts to fight bias are important. Still, the conversation on AI ignores another crucial issue: What is the AI industry’s approach to free speech, and does it embrace international free speech standards?

We are policy researchers who study free speech, as well as executive director and a research fellow at The Future of Free Speech, an independent, nonpartisan think tank based at Vanderbilt University. In a recent report, we found that generative AI has important shortcomings regarding freedom of expression and access to information.

Generative AI is a type of AI that creates content, like text or images, based on the data it has been trained with. In particular, we found that the use policies of major chatbots do not meet United Nations standards. In practice, this means that AI chatbots often censor output when dealing with issues the companies deem controversial. Without a solid culture of free speech, the companies producing generative AI tools are likely to continue to face backlash in these increasingly polarized times.

Vague and broad use policies

Our report analyzed the use policies of six major AI chatbots, including Google’s Gemini and OpenAI’s ChatGPT. Companies issue policies to set the rules for how people can use their models. With international human rights law as a benchmark, we found that companies’ misinformation and hate speech policies are too vague and expansive. It is worth noting that international human rights law is less protective of free speech than the U.S. First Amendment.

Our analysis found that companies’ hate speech policies contain extremely broad prohibitions. For example, Google bans the generation of “content that promotes or encourages hatred.” Though hate speech is detestable and can cause harm, policies that are as broadly and vaguely defined as Google’s can backfire.

To show how vague and broad use policies can affect users, we tested a range of prompts on controversial topics. We asked chatbots questions like whether transgender women should or should not be allowed to participate in women’s sports tournaments or about the role of European colonialism in the current climate and inequality crises. We did not ask the chatbots to produce hate speech denigrating any side or group. Similar to what some users have reported, the chatbots refused to generate content for 40% of the 140 prompts we used. For example, all chatbots refused to generate posts opposing the participation of transgender women in women’s tournaments. However, most of them did produce posts supporting their participation.

Vaguely phrased policies rely heavily on moderators’ subjective opinions about what hate speech is. Users can also perceive that the rules are unjustly applied and interpret them as too strict or too lenient.

For example, the chatbot Pi bans “content that may spread misinformation.” However, international human rights standards on freedom of expression generally protect misinformation unless a strong justification exists for limits, such as foreign interference in elections. Otherwise, human rights standards guarantee the “freedom to seek, receive and impart information and ideas of all kinds, regardless of frontiers … through any … media of … choice,” according to a key United Nations convention.

Defining what constitutes accurate information also has political implications. Governments of several countries used rules adopted in the context of the COVID-19 pandemic to repress criticism of the government. More recently, India confronted Google after Gemini noted that some experts consider the policies of the Indian prime minister, Narendra Modi, to be fascist.

Free speech culture

There are reasons AI providers may want to adopt restrictive use policies. They may wish to protect their reputations and not be associated with controversial content. If they serve a global audience, they may want to avoid content that is offensive in any region.

In general, AI providers have the right to adopt restrictive policies. They are not bound by international human rights. Still, their market power makes them different from other companies. Users who want to generate AI content will most likely end up using one of the chatbots we analyzed, especially ChatGPT or Gemini.

These companies’ policies have an outsize effect on the right to access information. This effect is likely to increase with generative AI’s integration into search, word processors, email and other applications.

This means society has an interest in ensuring such policies adequately protect free speech. In fact, the Digital Services Act, Europe’s online safety rulebook, requires that so-called “very large online platforms” assess and mitigate “systemic risks.” These risks include negative effects on freedom of expression and information.

This obligation, imperfectly applied so far by the European Commission, illustrates that with great power comes great responsibility. It is unclear how this law will apply to generative AI, but the European Commission has already taken its first actions.

Even where a similar legal obligation does not apply to AI providers, we believe that the companies’ influence should require them to adopt a free speech culture. International human rights provide a useful guiding star on how to responsibly balance the different interests at stake. At least two of the companies we focused on – Google and Anthropic – have recognized as much.

Outright refusals

It’s also important to remember that users have a significant degree of autonomy over the content they see in generative AI. Like search engines, the output users receive greatly depends on their prompts. Therefore, users’ exposure to hate speech and misinformation from generative AI will typically be limited unless they specifically seek it.

This is unlike social media, where people have much less control over their own feeds. Stricter controls, including on AI-generated content, may be justified at the level of social media since they distribute content publicly. For AI providers, we believe that use policies should be less restrictive about what information users can generate than those of social media platforms.

AI companies have other ways to address hate speech and misinformation. For instance, they can provide context or countervailing facts in the content they generate. They can also allow for greater user customization. We believe that chatbots should avoid merely refusing to generate any content altogether. This is unless there are solid public interest grounds, such as preventing child sexual abuse material, something laws prohibit.

Refusals to generate content not only affect fundamental rights to free speech and access to information. They can also push users toward chatbots that specialize in generating hateful content and echo chambers. That would be a worrying outcome.

Jordi Calvet-Bademunt is affiliated with The Future of Free Speech. The Future of Free Speech is a non-partisan, independent think tank that has received limited financial support from Google for specific projects. However, Google did not fund the report we refer to in this article. In all cases, The Future of Free Speech retains full independence and final authority for its work, including research pursuits, methodology, analysis, conclusions, and presentation.

Jacob Mchangama is affiliated with The Future of Free Speech. The Future of Free Speech is a non-partisan, independent think tank that has received limited financial support from Google for specific projects. However, Google did not fund the report we refer to in this article. In all cases, The Future of Free Speech retains full independence and final authority for its work, including research pursuits, methodology, analysis, conclusions, and presentation.

spread pandemic covid-19 india european europeInternational

United Airlines warns of major consequences of Boeing 737 Max blowout

United Airlines has just revealed that Boeing’s safety issues will continue to have a domino effect on its operations.

United Airlines (UAL) has just warned investors that Boeing’s continued safety issue with its 737 Max 9 aircraft fleet has cost the airline millions of dollars in profits and has forced it to significantly shrink its aircraft delivery forecast for 2024, which could spell trouble for travelers during a historic airline travel season.

“The grounding of the Boeing MAX 9 fleet negatively impacted our earnings by more than $200 million and without it, we would have had a profitable quarter,” said United CEO Scott Kirby during a call that discussed the company’s first-quarter earnings.

Related: Major airlines may be unable to meet record-high travel demand this year

On Jan. 5 an Alaska Airlines flight was forced to make an emergency landing after a door plug blew off of the Boeing 737 Max 9 aircraft mid-flight. Video of the incident, which was filmed by passengers on the plane went viral and led to an investigation by the Federal Aviation Administration which looked into Boeing’s safety and quality control practices and halted the production of its 737 Max expansion.

United Airlines reported a net loss of $124 million during the first quarter of 2024 compared to the $194 million net loss it faced during the same time period in 2023.

United Airlines Chief Financial Officer Mike Leskinen warned during the earnings call that Boeing’s continued jet delivery delays, which is the result of its safety issues, has created “an impractical bow wave of aircraft deliveries” for United to address, and its aircraft delivery forecast for this year will be cut as a result.

“In 2024, we now expect to take delivery of 61 narrowbody aircraft and five widebody aircraft,” said Leskinen during the call. “This compares to our contractual deliveries of 183 narrowbody aircraft at year-end and the 101 aircraft we were planning for at the start of the year. Due to these fleet changes, we now expect full year 2024 total capital expenditures to be approximately $6.5 billion, down from $9 billion at the start of the year.”

Shutterstock

United Airlines is also facing a safety probe of its own from the FAA after the airline has faced multiple incidents involving safety issues such as a wheel falling off of its Boeing 777 aircraft as it was heading to Osaka, Japan on March 7. Also, on March 15, a United Airlines flight, which was a Boeing 737-800 aircraft, was revealed to be missing an external panel after it landed in Medford, Oregon.

During the earnings call, United Airlines President Brett Hart claimed that the FAA probe will cause the airline to experience even more aircraft delivery delays.

“These reviews are being taken very seriously and we will see this as an opportunity to further strengthen our commitment to safety,” said Hart during the call. “As we work through this safety review with the FAA, certain certifications will be delayed. As a result of this, we expect a small number of aircraft scheduled for delivery in the second quarter to be delayed. We expect this to have a minimal impact to our 2024 capacity plans.”

United Airlines’ aircraft issues come amid a year that is expected to have record-high airline travel. According to a December report from the International Air Transport Association, a record 4.7 billion people are expected to travel in 2024, which the association claims is “an historic high that exceeds the pre-pandemic level of 4.5 billion recorded in 2019.”

Related: Veteran fund manager picks favorite stocks for 2024

stocks pandemic japanSpread & Containment

London Marathon: how visually impaired people run

Running is empowering for many blind and partially sighted people, but they can face a range of societal barriers to get involved.

In this weekend’s London Marathon, nearly 50,000 runners will hit the capital’s streets in one of the world’s most iconic races. For the visually impaired (VI) runners on the start line, their approach to this famous route will differ from their sighted counterparts. Just as there are misconceptions about blindness itself, many people are confused about how VI people run.

Some assume that all VI runners are blind with no usable vision, have superhuman compensatory skills and are passively guided around running routes by sighted guides. The reality is that, like all runners, VI runners have diverse experiences, preferences and needs.

In our research, we’ve conducted in-depth interviews with eight blind and partially sighted runners about their running practices. Some navigate routes independently, while others run with a guide – using a tether, holding their elbow or running in close proximity.

VI running can be a rich and creative experience, engaging all the senses. But, as one of our participants stated, this process is not innate: “People say, ‘Oh your smell becomes better, your hearing becomes better’. I don’t think it does, I just think you tune into it a little bit more… it just becomes more of a natural thing.”

As research on the runner-guide partnership shows, it can take practice and trying different strategies for runners to make sense of their surroundings and figure out what works for them.

Through touch, hearing, smell and usable vision, VI runners actively develop unique relationships with the routes they run. Our participants described how they identify landmarks, such as the sound of a river or the feel of changing terrain, to construct maps inside their heads. As one runner explains: “I could subconsciously tell you where every crack on the pavement is.”

Barriers to running

With VI people being one of the most inactive minority groups, running can be inclusive, empowering and provide a range of social and physical benefits.

But there are a number of societal barriers to VI people getting and staying involved in running. Ableist assumptions about who can and cannot run, are frequently internalised by VI people themselves.

One of our participants, who is blind from birth, explained: “I’d never even considered running before really… I just thought I couldn’t do it.” Having acquired sight loss in adulthood, another participant said: “I thought I’d never be able to run again, which was a massive blow when I first started losing my sight.”

To combat these assumptions and spread awareness about opportunities, runners like Kelly Barton and her guides share running content online. A recent video of her 250th parkrun, which she completed without being tethered to a guide, attracted national media coverage.

Our participants reported struggling to find guide runners, who can support VI people to run safely by guiding them along a route using verbal instructions, tethers or physical contact.

One VI runner who owns a guide dog contacted a local running event for a guide and was told they “haven’t found a guide yet, but we’ve got a dog sitter”. While there are local groups connecting VI runners and guides in some areas, such as VI Runners Bristol, this is not consistent across the UK.

The challenge of finding guides was also exacerbated during the pandemic. In the US, an innovative project using guide dogs trained for running has led to positive outcomes for both runners and dogs. But such projects are not yet widespread and require additional training for the guide dogs.

For VI runners who prefer running indoors, the treadmills used in many gyms are inaccessible. The charity Thomas Pocklington Trust and UK Coaching are working to address this through the inclusive facilities toolkit.

How you can get involved

For many VI runners, including our participants, parkrun has become a popular place to get started. The event’s inclusive ethos and specific efforts to encourage VI runners have created a welcoming and accessible environment.

The Great Run Series has introduced VI runners challenges at the Bristol 10K and Manchester Half Marathon, the only dedicated events for severely sight-impaired runners and guides in the UK.

If you are in search of a guide, British Blind Sport and England Athletics operate a database to connect VI runners with guides licensed by England Athletics. And if you are a sighted runner thinking about becoming a guide, you can complete a sight loss awareness and guide running workshop to get listed on the database.

Prospective runners and guides can also connect informally through parkruns, running clubs, local VI organisations or running organisations like Achilles International.

The authors do not work for, consult, own shares in or receive funding from any company or organisation that would benefit from this article, and have disclosed no relevant affiliations beyond their academic appointment.

spread pandemic uk-

International4 weeks ago

International4 weeks agoParexel CEO to retire; CAR-T maker AffyImmune promotes business leader to chief executive

-

Government2 weeks ago

Government2 weeks agoClimate-Con & The Media-Censorship Complex – Part 1

-

International4 days ago

International4 days agoWHO Official Admits Vaccine Passports May Have Been A Scam

-

Spread & Containment1 week ago

Spread & Containment1 week agoFDA Finally Takes Down Ivermectin Posts After Settlement

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoVaccinated People Show Long COVID-Like Symptoms With Detectable Spike Proteins: Preprint Study

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoCan language models read the genome? This one decoded mRNA to make better vaccines.

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoWhat’s So Great About The Great Reset, Great Taking, Great Replacement, Great Deflation, & Next Great Depression?

-

International4 weeks ago

International4 weeks agoJapanese Preprint Calls For mRNA VaccinesTo Be Suspended Over Blood Bank Contamination Concerns