Uncategorized

Movie theater chain seeks sale after recovering from bankruptcy

Popular dine-in movie theater chain is reportedly seeking another sale after emerging from bankruptcy three years ago.

The Covid-19 pandemic of 2020 devastated hundreds of businesses in the U.S., forcing several establishments to file for bankruptcy, such as retailers, restaurants, real estate firms and energy companies.

Most people remember the names of many of the restaurants that fell into bankruptcy, including Chuck E. Cheese, Souplantation, Sweet Tomatoes, HomeTown Buffet and Old Country Buffet. Several retail chains, such as JC Penney, Bed Bath & Beyond and a list of movie theater operators also filed Chapter 11.

Related: KFC rolls out new menu item to challenge McDonald’s, Burger King

Pandemic caused movie theater bankruptcies

Movie theater operator CMX Cinemas filed for Chapter 11 bankruptcy in April 2020 after the Covid-19 pandemic devastated the industry.

Regal Cinemas owner Cineworld also struggled during the pandemic and afterward, as it closed over 50 Regal theaters and filed bankruptcy in September 2022. Cineworld, the second largest theater operator behind AMC, emerged from bankruptcy July 31, 2023.

The movie theater industry has struggled to lure people back into their brick-and-mortar properties after the Covid-19 pandemic, as movie fans have been reluctant to return to indoor theaters after the healthcare disaster. The smaller crowds in movie venues since the pandemic began has led to more theater operators filing bankruptcy.

Iconic movie theater chain Metropolitan Theatres Corp. filed for Chapter 11 bankruptcy protection to reorganize its business affairs, which will include restructuring and possibly rejecting theater leases, company president David Corwin wrote in a bankruptcy declaration.

The Los Angeles-based movie theater chain on Feb. 29 filed its Subchapter V bankruptcy petition in the U.S. Bankruptcy Court for the Central District of California in Los Angeles.

Some movie theater chains that filed for Chapter 11 protection because of the effects of the Covid-19 pandemic , however, emerged from reorganization and are thriving in the business.

Alamo Drafthouse chain seeking a sale

Dine-in movie theater chain Alamo Drafthouse Cinema has bucked the trend of distressed multiplexes across the nation, as its recent success may have made it attractive for an acquisition. The Austin, Texas, company is seeking a buyer for its 41-theater chain, with 17 franchise-owned sites, located in 13 states, Deadline reported.

Word of the company inquiring about a possible sale came from several unnamed Deadline sources, who also said no asking price has been revealed and there have been no bidders yet.

Alamo Drafthouse, founded in 1997, reportedly generated $134 million at the box office in 2023, which was more than a 25% increase over 2022.

The dine-in movie theater chain in March 2021 filed for Chapter 11 bankruptcy suffering from the effects of the Covid-19 pandemic and emerged from bankruptcy in June 2021 after a sale to an investment group that included Altamont Capital Partners, Fortress Investment Group and founder Tim League.

The theater chain presents the latest motion picture releases, foreign language films or cinematic classics. The theaters' seats have tables in front of them for guests' food and drinks that are delivered to their seats. Some theaters also have recliner chairs.

Each location's menu serves burgers, pizzas, salads, snacks and desserts, and the bar features selections from local craft breweries, as well as innovative cocktails, according to the theater chain's website.

Related: Veteran fund manager picks favorite stocks for 2024

bankruptcy pandemic covid-19 stocks real estateUncategorized

Movie theater chain rises after bankruptcy, reportedly seeks sale

Popular dine-in movie theater chain is reportedly seeking another sale after emerging from bankruptcy three years ago.

The Covid-19 pandemic of 2020 devastated hundreds of businesses in the U.S., forcing several establishments to file for bankruptcy, such as retailers, restaurants, real estate firms and energy companies.

Most people remember the names of many of the restaurants that fell into bankruptcy, including Chuck E. Cheese, Souplantation, Sweet Tomatoes, HomeTown Buffet and Old Country Buffet. Several retail chains, such as JC Penney, Bed Bath & Beyond and a list of movie theater operators also filed Chapter 11.

Related: KFC rolls out new menu item to challenge McDonald’s, Burger King

Pandemic caused movie theater bankruptcies

Movie theater operator CMX Cinemas filed for Chapter 11 bankruptcy in April 2020 after the Covid-19 pandemic devastated the industry.

Regal Cinemas owner Cineworld also struggled during the pandemic and afterward, as it closed over 50 Regal theaters and filed bankruptcy in September 2022. Cineworld, the second largest theater operator behind AMC, emerged from bankruptcy July 31, 2023.

The movie theater industry has struggled to lure people back into their brick-and-mortar properties after the Covid-19 pandemic, as movie fans have been reluctant to return to indoor theaters after the healthcare disaster. The smaller crowds in movie venues since the pandemic began has led to more theater operators filing bankruptcy.

Iconic movie theater chain Metropolitan Theatres Corp. filed for Chapter 11 bankruptcy protection to reorganize its business affairs, which will include restructuring and possibly rejecting theater leases, company president David Corwin wrote in a bankruptcy declaration.

The Los Angeles-based movie theater chain on Feb. 29 filed its Subchapter V bankruptcy petition in the U.S. Bankruptcy Court for the Central District of California in Los Angeles.

Some movie theater chains that filed for Chapter 11 protection because of the effects of the Covid-19 pandemic , however, emerged from reorganization and are thriving in the business.

Alamo Drafthouse chain seeking a sale

Dine-in movie theater chain Alamo Drafthouse Cinema has bucked the trend of distressed multiplexes across the nation, as its recent success may have made it attractive for an acquisition. The Austin, Texas, company is seeking a buyer for its 41-theater chain, with 17 franchise-owned sites, located in 13 states, Deadline reported.

Word of the company inquiring about a possible sale came from several unnamed Deadline sources, who also said no asking price has been revealed and there have been no bidders yet.

Alamo Drafthouse, founded in 1997, reportedly generated $134 million at the box office in 2023, which was more than a 25% increase over 2022.

The dine-in movie theater chain in March 2021 filed for Chapter 11 bankruptcy suffering from the effects of the Covid-19 pandemic and emerged from bankruptcy in June 2021 after a sale to an investment group that included Altamont Capital Partners, Fortress Investment Group and founder Tim League.

The theater chain presents the latest motion picture releases, foreign language films or cinematic classics. The theaters' seats have tables in front of them for guests' food and drinks that are delivered to their seats. Some theaters also have recliner chairs.

Each location's menu serves burgers, pizzas, salads, snacks and desserts, and the bar features selections from local craft breweries, as well as innovative cocktails, according to the theater chain's website.

Related: Veteran fund manager picks favorite stocks for 2024

bankruptcy pandemic covid-19 stocks real estateUncategorized

$1 Billion In Tax Refunds Remain Unclaimed As May 17 Filing Deadline Approaches

$1 Billion In Tax Refunds Remain Unclaimed As May 17 Filing Deadline Approaches

Authored by Naveen Athrappully via The Epoch Times (emphasis…

Authored by Naveen Athrappully via The Epoch Times (emphasis ours),

The IRS is reminding taxpayers who have not filed their 2020 returns to do so quickly or risk losing out on unclaimed refunds.

Nearly 940,000 Americans have unclaimed refunds from the 2020 tax year worth an estimated $1 billion, the IRS said on March 25. The individuals face a May 17 deadline to submit their returns.

The median refund is $932. American citizens typically have up to three years to file and claim refunds, after which the money goes to the U.S. Treasury.

Since taxpayers may find it difficult to gather information necessary to file returns for 2020, the IRS outlined three ways to access such information:

- Taxpayers who are missing their W-2, 1098, 1099, or 5498 forms can request copies from their employer, bank, or other payers.

- Those who are unable to get these forms from employers, banks, or other payers can order a free wage and income transcript at IRS.gov using the agency’s online tool. The agency noted that this will be the quickest and easiest option for many individuals.

- A third way is for the individual to file a 4506-T form with the IRS, requesting a “wage and income transcript.” Taxpayers can then use information to file their returns. The agency warned that written requests for such transcripts can take several weeks. As such, taxpayers are encouraged to try out other options first.

Usually, the deadline to claim old refunds is around the regular tax deadline, which is April 15 this year. The three-year window for the 2020 returns had been extended to May 17 due to the COVID-19 pandemic.

“We want taxpayers to claim these refunds, but time is running out for people who may have overlooked or forgotten about these refunds. There’s a May 17 deadline to file these returns so taxpayers should start soon to make sure they don’t miss out,” said IRS Commissioner Danny Werfel.

Since taxpayers faced “extremely unusual situations” during the pandemic, some of them may have forgotten about a potential refund on their 2020 returns, he stated.

“People may have just overlooked these, including students, part-time workers, and others. Some people may not realize they may be owed a refund. We encourage people to review their files and start gathering records now.”

In addition to missing out on refunds, failure to file the 2020 return could also result in some taxpayers losing out on the earned income tax credit, which was worth as much as $6,600 in 2020.

“The IRS reminds taxpayers seeking a 2020 tax refund that their funds may be held if they have not filed tax returns for 2021 and 2022,” the agency said.

“In addition, any refund amount for 2020 will be applied to amounts still owed to the IRS or a state tax agency and may be used to offset unpaid child support or other past due federal debts, such as student loans.”

The state with the highest number of individuals estimated to have 2020 refunds due was Texas, with 93,400 taxpayers. This was followed by California with 88,200; Florida with 53,200; and New York with 51,400.

Processing Refunds

The IRS usually takes up to 21 days to process refunds for returns filed electronically. It can take four weeks or more if traditional mail was used. The processing time can be extended in case the returns require extra review or corrections. The fastest way to get refunds is through direct deposit.

In certain cases, taxpayers may not receive the refund amount they were expecting. This could be due to the agency identifying errors on tax returns, or if the refund was used to pay off certain state or federal debts owed, or if the refund from a joint return was used to pay off a spouse’s debts.

In case of errors corrected by the IRS, the agency will send a notice to the taxpayer clarifying the changes.

Tax refunds are critical for many American households as they represent the largest annual cash injection into their budgets. Many families use the refunds to boost their savings or cut down debts.

According to a January survey conducted by Credit Karma, 37 percent of taxpayers who expect to receive a refund plan on using some or all of the money to pay for necessities. Over half of the respondents said they were looking to file their taxes early to get faster refunds.

Thirty-one percent of taxpayers surveyed said they would need their refund to make ends meet.

“That number jumps to 40 percent for millennials and 38 percent for Gen Z taxpayers,” the survey report stated.

In addition to encouraging 2020 tax year nonfilers to file their returns, the IRS has launched an effort to identify high-income taxpayers who have not filed their income taxes since 2017. Over 125,000 such instances have been identified, with taxes being owed in many of these cases.

The initiative was launched late last month, with the agency sending compliance letters to these 125,000 taxpayers.

“The mailings include more than 25,000 to those with more than $1 million in income, and over 100,000 to people with incomes between $400,000 and $1 million between tax years 2017 and 2021,” the agency stated.

Mr. Werfel said that if someone hasn’t filed a tax return in recent years, “this is the time to review their situation and make it right. … For those who owe, the risk will just grow over time as will the potential for penalties and interest. These non-filers should review information on IRS.gov that can help and consider talking to a trusted tax professional as soon as possible.”

Uncategorized

While the Austin housing market isn’t sizzling, agents say it is still warm

Despite an uptick in inventory, Austin metro area home prices are holding steady and giving agents confidence in the strength of the market

It is nearly April, which means temperatures in the Austin metropolitan area are heating up — and so is the housing market.

But like the temperatures, which are far from the triple-digit figures the residents of the Texas state capital will see in the coming months, local real estate professionals say that even though the market is warming up, it is nowhere near the frenzy at the height of the COVID-19 pandemic.

“The market is still strong,” said Wendy Cash, a broker at Austin area-based Century 21 Hellmann Stribling. “Buyers are still buying and sellers are still selling. We definitely noticed a downturn last year, which coincided with interest rates going up, and buyers just put the brakes on things and wanted to wait to see what was going to happen.

“When interest rates took a dig late in the fall, buyers came back out of the woodwork and started buying again. But I don’t thing we are ever going to see something like we did during the pandemic again.”

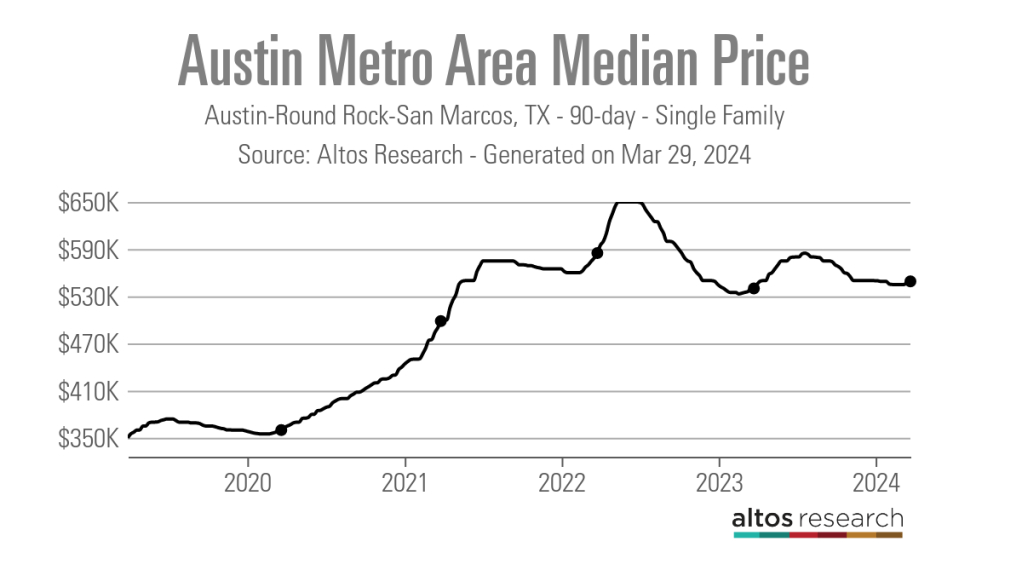

From 2020 until the middle of 2022, the Austin metro area was turning heads for its massive influx of homebuyers and its exponential home price growth. In early March 2020, prior to the onset of the pandemic, the 90-day average median list price for a single-family home in the area was $357,000. By late May 2022, this figure had risen to $650,000, according to data from Altos Research.

What ensued next was a rapid cooldown, which saw the median list price fall by more than $100,000 by mid-February 2023 to $533,000.

“April and May of 2022 is when we felt the first slowdown,” said Scott Michaels, an Austin-based Compass agent. “Looking at the number, 2023 was the lowest year in the past 28 years for sales, so it was a bit of an oddity compared to what we’d seen in the second half of 2020, all of 2021 and the first half of 2022.”

While Austin has made headlines in recent months for the number of homebuyers looking to move away from the metro area, local real estate professionals say that buyer demand remains strong.

“Interest rates have come down a little bit and kind of settled. We aren’t seeing the volatility we were, and I think that has made buyers a little more willing to make the leap and purchase a home,” Cash said. “Then, obviously, spring is kind of your traditional selling season, so there are more buyers typically in the spring, plus not as many people pulled the trigger last fall, so we have that pent-up demand.”

Michaels also noted that his business is still seeing a steady stream of out-of-town buyers.

“We are still seeing people move from all over the country, whether it is first-time or move-up buyers within Austin or people from Dallas, Houston, and then feeder markets like California, New York, Chicago, and we are seeing quite a few from the Seattle region right now,” Michaels said.

Agents highlight the stability of the Austin metro area’s median list price, which has hovered around $550,000 since early November 2023, as evidence of the still-strong level of demand in the market.

“Overall, things are kind of continuing from where they were in 2023 with a very modest change in the median sales price. And closed sales were also up about 1%, so overall just a little bit more of the same,” said Clare Losey, housing economist for the Austin Board of Realtors.

“What we saw during the COVID pandemic was just really unsustainable over a long-term basis. We had artificial demand that was induced by the pandemic itself — low interest rates, work from home, vacation homes — and it really drove demand that we otherwise would not have seen if the pandemic had not happened.”

Additionally, Austin’s median list price has remained stable even as inventory has risen drastically from the troughs it reached in the spring months of 2021 and 2022.

As of March 22, 2024, the 90-day average median number of active single-family listings in the Austin metro area was 6,895 — up from an all-time low of 1,070 listings in April 2021. In November 2023, this figure actually surpassed its pre-pandemic level at 8,527 listings.

“I think we are pretty balanced,” Cash said. “Technically we are still in a seller’s market. I feel like the market we are in, from an inventory standpoint, feels similar to last year.”

According to Losey, much of the new inventory coming on the market in Austin is suitable for first-time homebuyers.

“It is going to be a more popular homebuying season for first-time buyers,” Losey said. “There is just more inventory on the market that is within the most affordable price range, meaning homes priced under $300,000. In February, we saw an overall uptick of 45% in new listings on a year-over-year basis, but we saw a 27% increase in homes prices under $300,000.”

Even with the uptick in inventory, agents say they are still seeing properties receive multiple offers and go for more than the asking price.

“I occasionally see houses go for over ask, but not like they did during the pandemic,” Cash said. “A house may go for $10,000 or $20,000 over, and the multiple offers are like two or three offers and not the 15 to 20 offers.”

Michaels added that properties in popular neighborhoods that are priced correctly are still going within the first week they hit the market.

“If you are in an area where there is more inventory on the market, it may tend to sit a little bit longer,” Michaels said. “If it is priced at a higher price point, it may also sit a bit longer because your buyer pool is smaller, so that is a challenge for more of the luxury properties that are going up.”

While the Austin housing market may have cooled down from its post-pandemic heyday, local professionals remain bullish about the future of their metro area and housing market.

“Austin is just one of the premier areas of the country where people want to live or relocate to for a variety of reasons,” Michaels said. “There is great job growth, it is a vibrant city, there are beautiful rolling hills, the lakes, but also people are just sick of sitting on the sidelines and waiting for a market shift. They’ve been waiting for almost two years now, so they are just ready to pull the trigger and make the jump, and we are here for them.”

real estate housing market pandemic covid-19 interest rates-

Spread & Containment2 weeks ago

Spread & Containment2 weeks agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

International1 week ago

International1 week agoParexel CEO to retire; CAR-T maker AffyImmune promotes business leader to chief executive

-

International3 weeks ago

International3 weeks agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

International3 weeks ago

International3 weeks agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized1 month ago

Uncategorized1 month agoKey Events This Week: All Eyes On Core PCE Amid Deluge Of Fed Speakers

-

Uncategorized1 month ago

Uncategorized1 month agoA Blue State Exodus: Who Can Afford To Be A Liberal

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoEvidence And Insights About Gold’s Long-Term Uptrend

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoA Global, Digital Coup d’État