UVA Health researchers have discovered a potential explanation for some of the most perplexing mysteries of COVID-19 and long COVID. The surprising findings could lead to new treatments for the difficult acute effects of COVID-19, long COVID and possibly other viruses.

Researchers led by UVA’s Steven L. Zeichner, MD, PhD, found that COVID-19 may prompt some people’s bodies to make antibodies that act like enzymes that the body naturally uses to regulate important functions – blood pressure, for example. Related enzymes also regulate other important body functions, such as blood clotting and inflammation.

Doctors may be able to target these “abzymes” to stop their unwanted effects. If abzymes with rogue activities are also responsible for some of the features of long COVID, doctors could target the abzymes to treat the difficult and sometimes mysterious symptoms of COVID-19 and long COVID at the source, instead of merely treating the downstream symptoms.

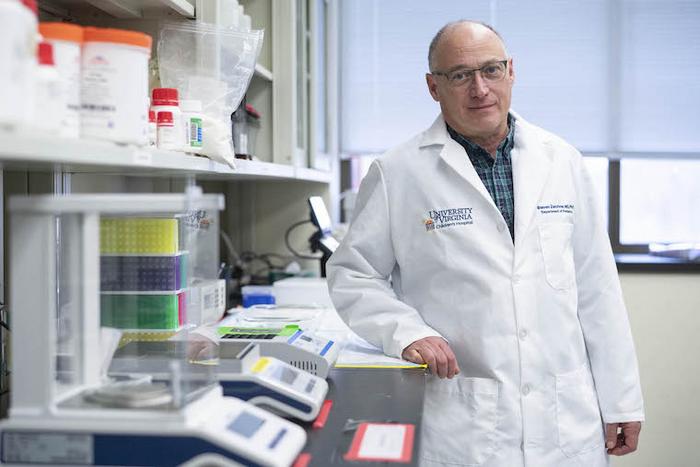

“Some patients with COVID-19 have serious symptoms and we have trouble understanding their cause. We also have a poor understanding of the causes of long COVID,” said Zeichner, a pediatric infectious disease expert at UVA Children’s. “Antibodies that act like enzymes are called ‘abzymes.’ Abzymes are not exact copies of enzymes and so they work differently, sometimes in ways that the original enzyme does not. If COVID-19 patients are making abzymes, it is possible that these rogue abzymes could harm many different aspects of physiology. If this turns out to be true, then developing treatments to deplete or block the rogue abzymes could be the most effective way to treat the complications of COVID-19.”

Understanding COVID-19 Abzymes

SARS-CoV-2, the virus that causes COVID, has protein on its surface called the Spike protein. When the virus begins to infect a cell, the Spike protein binds a protein called Angiotensin Converting Enzyme 2, or ACE2, on the cell’s surface. ACE2’s normal function in the body is to help regulate blood pressure; it cuts a protein called angiotensin II to make a derivative protein called angiotensin 1-7. Angiotensin II constricts blood vessels, raising blood pressure, while angiotensin 1-7 relaxes blood vessels, lowering blood pressure.

Zeichner and his team thought that some patients might make antibodies against the Spike protein that looked enough like ACE2 so that the antibodies also had enzymatic activity like ACE2, and that is exactly what they found.

Recently, other groups have found that some patients with long COVID have problems with their coagulation systems and with another system called “complement.” Both the coagulation system and the complement system are controlled by enzymes in the body that cut other proteins to activate them. If patients with long COVID make abzymes that activate proteins that control processes such as coagulation and inflammation, that could explain the source of some of the long COVID symptoms and why long COVID symptoms persist even after the body has cleared the initial infection. It also may explain rare side effects of COVID-19 vaccination.

To determine if antibodies could be having unexpected effects in COVID patients, Zeichner and his collaborators examined plasma samples collected from 67 volunteers with moderate or severe COVID on or around day 7 of their hospitalization. The researchers compared what they found with plasma collected in 2018, prior to the beginning of the pandemic. The results showed that a small subset of the COVID patients had antibodies that acted like enzymes.

While our understanding of the potential role of abzymes in COVID-19 is still in its early stages, enzymatic antibodies have already been detected in certain cases of HIV, Zeichner notes. That means there is precedent for a virus to trigger abzyme formation. It also suggests that other viruses may cause similar effects.

Zeichner, who is developing a universal coronavirus vaccine, expects UVA’s new findings will renew interest in abzymes in medical research. He also hopes his discovery will lead to better treatments for patients with both acute COVID-19 and long COVID.

“We now need to study pure versions of antibodies with enzymatic activity to see how abzymes may work in more detail, and we need to study patients who have had COVID-19 who did and did not develop long COVID,” he said. “There is much more work to do, but I think we have made a good start in developing a new understanding of this challenging disease that has caused so much distress and death around the world. The first step to developing effective new therapies for a disease is developing a good understanding of the disease’s underlying causes, and we have taken that first step.”

Findings Published

The researchers have published their findings in the scientific journal mBio, a publication of the American Society for Microbiology. The research team consisted of Yufeng Song, Regan Myers, Frances Mehl, Lila Murphy, Bailey Brooks, and faculty members from the Department of Medicine, Jeffrey M. Wilson, Alexandra Kadl, Judith Woodfolk.

“It’s great to have such talented and dedicated colleagues here at UVA who are excited about working on new and unconventional research projects,” said Zeichner.

Zeichner is the McClemore Birdsong Professor in the University of Virginia School of Medicine’s Departments of Pediatrics and Microbiology, Immunology and Cancer Biology; the director of the Pendleton Pediatric Infectious Disease Laboratory; and part of UVA Children’s Child Health Research Center.

The abzyme research was supported by UVA, including the Manning Fund for COVID-19 Research at UVA; the Ivy Foundation; the Pendleton Laboratory Fund for Pediatric Infectious Disease Research; a College Council Minerva Research Grant; the Coulter Foundation; and the National Institutes of Health’s National Institute of Allergy and Infection Diseases, grant R01 AI176515. Additional support came from the HHV-6 Foundation.

To keep up with the latest medical research news from UVA, subscribe to the Making of Medicine blog at http://makingofmedicine.virginia.edu.

Journal

mBio

DOI

10.1128/mbio.00541-24