For patients with certain types of cancer, CAR T cell therapy has been nothing short of life changing. Developed in part by Carl June, Richard W. Vague Professor at Penn Medicine, and approved by the Food and Drug Administration (FDA) in 2017, CAR T cell therapy mobilizes patients’ own immune systems to fight lymphoma and leukemia, among other cancers.

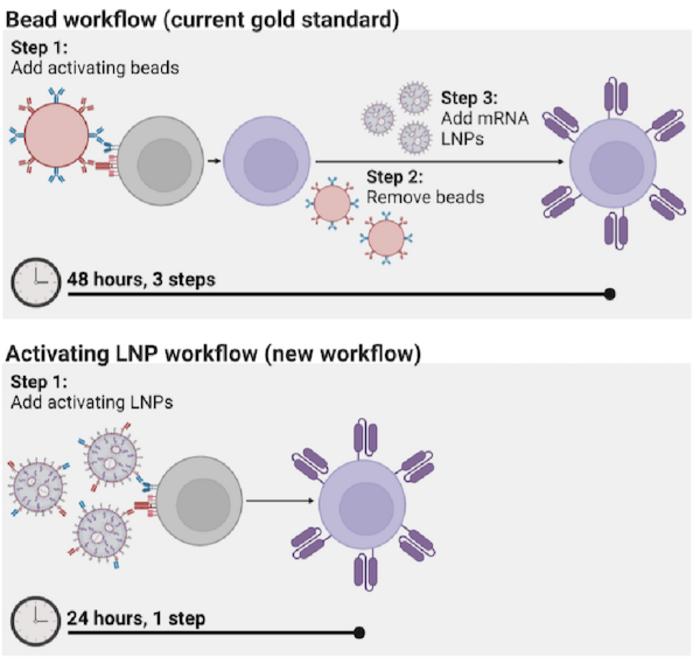

However, the process for manufacturing CAR T cells themselves is time-consuming and costly, requiring multiple steps across days. The state of the art involves extracting patients’ T cells, then activating them with tiny magnetic beads, before giving the T cells genetic instructions to make chimeric antigen receptors (CARs), the specialized receptors that help T cells eliminate cancer cells.

Now, Penn Engineers have developed a novel method for manufacturing CAR T cells, one that takes just 24 hours and requires only one step, thanks to the use of lipid nanoparticles (LNPs), the potent delivery vehicles that played a critical role in the Moderna and Pfizer-BioNTech COVID-19 vaccines.

In a new paper in Advanced Materials, Michael J. Mitchell, Associate Professor in Bioengineering, describes the creation of “activating lipid nanoparticles” (aLNPs), which can activate T cells and deliver the genetic instructions for CARs in a single step, greatly simplifying the CAR T cell manufacturing process. “We wanted to combine these two extremely promising areas of research,” says Ann Metzloff, a doctoral student and NSF Graduate Research Fellow in the Mitchell lab and the paper’s lead author. “How could we apply lipid nanoparticles to CAR T cell therapy?”

In some ways, T cells function like a military reserve unit: in times of health, they remain inactive, but when they detect pathogens, they mobilize, rapidly expanding their numbers before turning to face the threat. Cancer poses a unique challenge to this defense strategy. Since cancer cells are the body’s own, T cells don’t automatically treat cancer as dangerous, hence the need to first “activate” T cells and deliver cancer-detecting CARs in CAR T cell therapy.

Until now, the most efficient means of activating T cells has been to extract them from a patient’s bloodstream and then mix those cells with magnetic beads attached to specific antibodies — molecules that provoke an immune response. “The beads are expensive,” says Metzloff. “They also need to be removed with a magnet before you can clinically administer the T cells. However, in doing so, you actually lose a lot of the T cells, too.”

Made primarily of lipids, the same water-repellent molecules that constitute household cooking fats like butter and olive oil, lipid nanoparticles have proven tremendously effective at delivering delicate molecular payloads. Their capsule-like shape can enclose and protect mRNA, which provides instructions for cells to manufacture proteins. Due to the widespread use of the COVID-19 vaccines, says Metzloff, “The safety and efficacy of lipid nanoparticles has been shown in billions of people around the world.”

To incorporate LNPs into the production of CAR T cells, Metzloff and Mitchell wondered if it might be possible to attach the activating antibodies used on the magnetic beads directly to the surface of the LNPs. Employing LNPs this way, they thought, might make it possible to eliminate the need for activating beads in the production process altogether. “This is novel,” says Metzloff, “because we’re using lipid nanoparticles not just to deliver mRNA encoding CARs, but also to initiate an advantageous activation state.”

Over the course of two years, Metzloff carefully optimized the design of the aLNPs. One of the primary challenges was to find the right ratio of one antibody to another. “There were a lot of choices to make,” Metzloff recalls, “since this hadn’t been done before.”

By attaching the antibodies directly to LNPs, the researchers were able to reduce the number of steps involved in the process of manufacturing CAR T cells from three to one, and to halve the time required, from 48 hours to just 24 hours. “This will hopefully have a transformative effect on the process for manufacturing CAR T cells,” says Mitchell. “It currently takes so much time to make them, and thus they are not accessible to many patients around the world who need them.”

CAR T cells manufactured using aLNPs have yet to be tested in humans, but in mouse models, CAR T cells created using the process described in the paper had a significant effect on leukemia, reducing the size of tumors, thereby demonstrating the feasibility of the technology.

Metzloff also sees additional potential for aLNPs. “I think aLNPs could be explored more broadly as a platform to deliver other cargoes to T cells,” she says. “We demonstrated in this paper one specific clinical application, but lipid nanoparticles can be used to encapsulate lots of different things: proteins, different types of mRNA. The aLNPs have broad potential utility for T cell cancer therapy as a whole, beyond this one mRNA CAR T cell application that we’ve shown here.”

This study was conducted at the University of Pennsylvania School of Engineering and Applied Science and is supported by the U.S. National Institutes of Health Director’s New Innovator Award (DP2 TR002776), a U.S. National Science Foundation CAREER Award (CBET-2145491), an American Cancer Society Research Scholar Grant (RSG-22-122-01-ET), and a Burroughs Wellcome Fund Career Award at the Scientific Interface. Further support for this paper and the researchers involved came from the Emerson Collective, U.S. National Science Foundation Graduate Research Fellowships, a U.S. National Institutes of Health Ruth L. Kirschstein National Research Service Award (F31CA260922), the National Institute of Dental and Craniofacial Research of the US National Institutes of Health (T90DE030854), the University of Pennsylvania Fontaine Fellowship, the Norman and Selma Kron Research Fellowship, and the Robert Wood Johnson Foundation Health Policy Research Scholars Program. The researchers thank the Human Immunology Core at the University of Pennsylvania (RRID: SCR_022380) for assistance with primary human T cell procurement. The HIC is supported in part by NIH P30 AI045008 and P30 CA016520.

Additional co-authors include Marshall S. Padilla, Ningqiang Gong, Margaret M. Billingsley, Xuexiang Han, David Mai, Christian G. Figueroa-Espada, Ajay S. Thatte, Rebecca M. Haley, Alvin J. Mukalel and Alex G. Hamilton of Penn Engineering; Maria Merolle of Penn Vet; and Mohamad-Gabriel Alameh, Neil C. Sheppard, Carl June and Drew Weissman of the Perelman School of Medicine.

Journal

Advanced Materials

DOI

10.1002/adm

Method of Research

Experimental study

Subject of Research

Cells

Article Title

Antigen Presenting Cell Mimetic Lipid Nanoparticles for Rapid mRNA CAR T Cell Cancer Immunotherapy

Article Publication Date

28-Feb-2024