Uncategorized

$1 Billion In Tax Refunds Remain Unclaimed As May 17 Filing Deadline Approaches

$1 Billion In Tax Refunds Remain Unclaimed As May 17 Filing Deadline Approaches

Authored by Naveen Athrappully via The Epoch Times (emphasis…

Authored by Naveen Athrappully via The Epoch Times (emphasis ours),

The IRS is reminding taxpayers who have not filed their 2020 returns to do so quickly or risk losing out on unclaimed refunds.

Nearly 940,000 Americans have unclaimed refunds from the 2020 tax year worth an estimated $1 billion, the IRS said on March 25. The individuals face a May 17 deadline to submit their returns.

The median refund is $932. American citizens typically have up to three years to file and claim refunds, after which the money goes to the U.S. Treasury.

Since taxpayers may find it difficult to gather information necessary to file returns for 2020, the IRS outlined three ways to access such information:

- Taxpayers who are missing their W-2, 1098, 1099, or 5498 forms can request copies from their employer, bank, or other payers.

- Those who are unable to get these forms from employers, banks, or other payers can order a free wage and income transcript at IRS.gov using the agency’s online tool. The agency noted that this will be the quickest and easiest option for many individuals.

- A third way is for the individual to file a 4506-T form with the IRS, requesting a “wage and income transcript.” Taxpayers can then use information to file their returns. The agency warned that written requests for such transcripts can take several weeks. As such, taxpayers are encouraged to try out other options first.

Usually, the deadline to claim old refunds is around the regular tax deadline, which is April 15 this year. The three-year window for the 2020 returns had been extended to May 17 due to the COVID-19 pandemic.

“We want taxpayers to claim these refunds, but time is running out for people who may have overlooked or forgotten about these refunds. There’s a May 17 deadline to file these returns so taxpayers should start soon to make sure they don’t miss out,” said IRS Commissioner Danny Werfel.

Since taxpayers faced “extremely unusual situations” during the pandemic, some of them may have forgotten about a potential refund on their 2020 returns, he stated.

“People may have just overlooked these, including students, part-time workers, and others. Some people may not realize they may be owed a refund. We encourage people to review their files and start gathering records now.”

In addition to missing out on refunds, failure to file the 2020 return could also result in some taxpayers losing out on the earned income tax credit, which was worth as much as $6,600 in 2020.

“The IRS reminds taxpayers seeking a 2020 tax refund that their funds may be held if they have not filed tax returns for 2021 and 2022,” the agency said.

“In addition, any refund amount for 2020 will be applied to amounts still owed to the IRS or a state tax agency and may be used to offset unpaid child support or other past due federal debts, such as student loans.”

The state with the highest number of individuals estimated to have 2020 refunds due was Texas, with 93,400 taxpayers. This was followed by California with 88,200; Florida with 53,200; and New York with 51,400.

Processing Refunds

The IRS usually takes up to 21 days to process refunds for returns filed electronically. It can take four weeks or more if traditional mail was used. The processing time can be extended in case the returns require extra review or corrections. The fastest way to get refunds is through direct deposit.

In certain cases, taxpayers may not receive the refund amount they were expecting. This could be due to the agency identifying errors on tax returns, or if the refund was used to pay off certain state or federal debts owed, or if the refund from a joint return was used to pay off a spouse’s debts.

In case of errors corrected by the IRS, the agency will send a notice to the taxpayer clarifying the changes.

Tax refunds are critical for many American households as they represent the largest annual cash injection into their budgets. Many families use the refunds to boost their savings or cut down debts.

According to a January survey conducted by Credit Karma, 37 percent of taxpayers who expect to receive a refund plan on using some or all of the money to pay for necessities. Over half of the respondents said they were looking to file their taxes early to get faster refunds.

Thirty-one percent of taxpayers surveyed said they would need their refund to make ends meet.

“That number jumps to 40 percent for millennials and 38 percent for Gen Z taxpayers,” the survey report stated.

In addition to encouraging 2020 tax year nonfilers to file their returns, the IRS has launched an effort to identify high-income taxpayers who have not filed their income taxes since 2017. Over 125,000 such instances have been identified, with taxes being owed in many of these cases.

The initiative was launched late last month, with the agency sending compliance letters to these 125,000 taxpayers.

“The mailings include more than 25,000 to those with more than $1 million in income, and over 100,000 to people with incomes between $400,000 and $1 million between tax years 2017 and 2021,” the agency stated.

Mr. Werfel said that if someone hasn’t filed a tax return in recent years, “this is the time to review their situation and make it right. … For those who owe, the risk will just grow over time as will the potential for penalties and interest. These non-filers should review information on IRS.gov that can help and consider talking to a trusted tax professional as soon as possible.”

Uncategorized

While the Austin housing market isn’t sizzling, agents say it is still warm

Despite an uptick in inventory, Austin metro area home prices are holding steady and giving agents confidence in the strength of the market

It is nearly April, which means temperatures in the Austin metropolitan area are heating up — and so is the housing market.

But like the temperatures, which are far from the triple-digit figures the residents of the Texas state capital will see in the coming months, local real estate professionals say that even though the market is warming up, it is nowhere near the frenzy at the height of the COVID-19 pandemic.

“The market is still strong,” said Wendy Cash, a broker at Austin area-based Century 21 Hellmann Stribling. “Buyers are still buying and sellers are still selling. We definitely noticed a downturn last year, which coincided with interest rates going up, and buyers just put the brakes on things and wanted to wait to see what was going to happen.

“When interest rates took a dig late in the fall, buyers came back out of the woodwork and started buying again. But I don’t thing we are ever going to see something like we did during the pandemic again.”

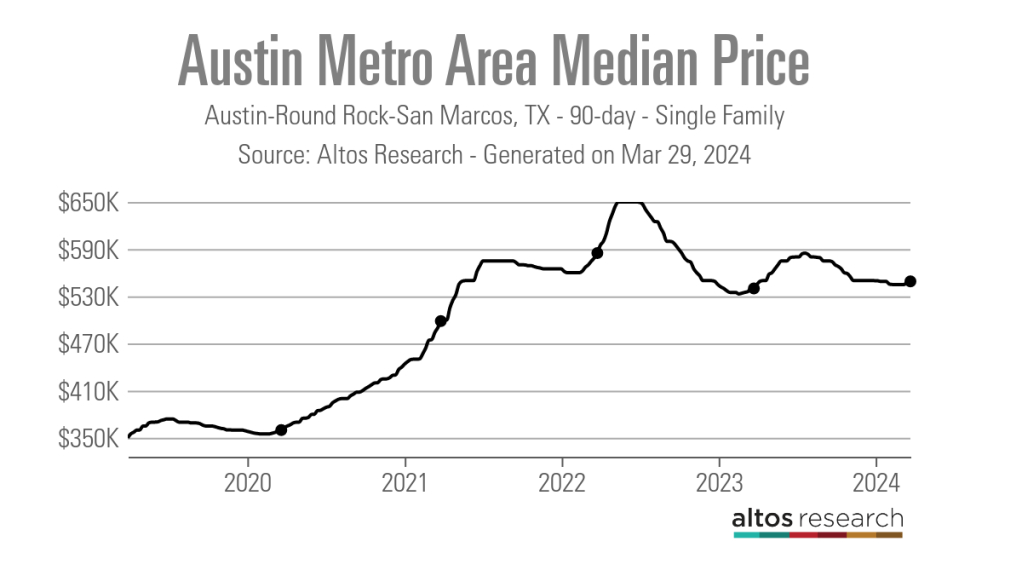

From 2020 until the middle of 2022, the Austin metro area was turning heads for its massive influx of homebuyers and its exponential home price growth. In early March 2020, prior to the onset of the pandemic, the 90-day average median list price for a single-family home in the area was $357,000. By late May 2022, this figure had risen to $650,000, according to data from Altos Research.

What ensued next was a rapid cooldown, which saw the median list price fall by more than $100,000 by mid-February 2023 to $533,000.

“April and May of 2022 is when we felt the first slowdown,” said Scott Michaels, an Austin-based Compass agent. “Looking at the number, 2023 was the lowest year in the past 28 years for sales, so it was a bit of an oddity compared to what we’d seen in the second half of 2020, all of 2021 and the first half of 2022.”

While Austin has made headlines in recent months for the number of homebuyers looking to move away from the metro area, local real estate professionals say that buyer demand remains strong.

“Interest rates have come down a little bit and kind of settled. We aren’t seeing the volatility we were, and I think that has made buyers a little more willing to make the leap and purchase a home,” Cash said. “Then, obviously, spring is kind of your traditional selling season, so there are more buyers typically in the spring, plus not as many people pulled the trigger last fall, so we have that pent-up demand.”

Michaels also noted that his business is still seeing a steady stream of out-of-town buyers.

“We are still seeing people move from all over the country, whether it is first-time or move-up buyers within Austin or people from Dallas, Houston, and then feeder markets like California, New York, Chicago, and we are seeing quite a few from the Seattle region right now,” Michaels said.

Agents highlight the stability of the Austin metro area’s median list price, which has hovered around $550,000 since early November 2023, as evidence of the still-strong level of demand in the market.

“Overall, things are kind of continuing from where they were in 2023 with a very modest change in the median sales price. And closed sales were also up about 1%, so overall just a little bit more of the same,” said Clare Losey, housing economist for the Austin Board of Realtors.

“What we saw during the COVID pandemic was just really unsustainable over a long-term basis. We had artificial demand that was induced by the pandemic itself — low interest rates, work from home, vacation homes — and it really drove demand that we otherwise would not have seen if the pandemic had not happened.”

Additionally, Austin’s median list price has remained stable even as inventory has risen drastically from the troughs it reached in the spring months of 2021 and 2022.

As of March 22, 2024, the 90-day average median number of active single-family listings in the Austin metro area was 6,895 — up from an all-time low of 1,070 listings in April 2021. In November 2023, this figure actually surpassed its pre-pandemic level at 8,527 listings.

“I think we are pretty balanced,” Cash said. “Technically we are still in a seller’s market. I feel like the market we are in, from an inventory standpoint, feels similar to last year.”

According to Losey, much of the new inventory coming on the market in Austin is suitable for first-time homebuyers.

“It is going to be a more popular homebuying season for first-time buyers,” Losey said. “There is just more inventory on the market that is within the most affordable price range, meaning homes priced under $300,000. In February, we saw an overall uptick of 45% in new listings on a year-over-year basis, but we saw a 27% increase in homes prices under $300,000.”

Even with the uptick in inventory, agents say they are still seeing properties receive multiple offers and go for more than the asking price.

“I occasionally see houses go for over ask, but not like they did during the pandemic,” Cash said. “A house may go for $10,000 or $20,000 over, and the multiple offers are like two or three offers and not the 15 to 20 offers.”

Michaels added that properties in popular neighborhoods that are priced correctly are still going within the first week they hit the market.

“If you are in an area where there is more inventory on the market, it may tend to sit a little bit longer,” Michaels said. “If it is priced at a higher price point, it may also sit a bit longer because your buyer pool is smaller, so that is a challenge for more of the luxury properties that are going up.”

While the Austin housing market may have cooled down from its post-pandemic heyday, local professionals remain bullish about the future of their metro area and housing market.

“Austin is just one of the premier areas of the country where people want to live or relocate to for a variety of reasons,” Michaels said. “There is great job growth, it is a vibrant city, there are beautiful rolling hills, the lakes, but also people are just sick of sitting on the sidelines and waiting for a market shift. They’ve been waiting for almost two years now, so they are just ready to pull the trigger and make the jump, and we are here for them.”

real estate housing market pandemic covid-19 interest ratesUncategorized

Real personal income and spending: if last month was “Goldilocks”, this month was close to “anti-Goldilocks”

– by New Deal democratPersonal income and spending has become one of the two most important monthly reports I follow, because it nets out the impacts…

- by New Deal democrat

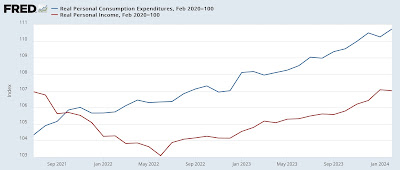

In February, nominally income rose 0.3%, while nominal spending rose a sharp 0.8%. Prices as measured by the PCE deflator increased 0.3% for the month, meaning that in real terms income were unchanged and spending (after rounding) rose 0.4%. Since just before the pandemic real incomes are up 7.0%, and spending is up 10.7% (NOTE: Data in all graphs below except for YoY comparisons, and the personal saving rate, is normed to 100 as of just before the pandemic):

On a YoY basis, the PCE price index is up 2.5%, just above January’s three year low of 2.4%. In the previous 16 months, the YoY measure had been declining at the rate of 0.25%/month, suggesting that it would hit the Fed’s 2.0% target this spring:

This month’s slight increase is probably just noise due to rounding, as the monthly change in the YoY rate was only 0.02%.

As I indicated above, for the past 50+ years, real spending on services has generally increased even during recessions. It is real spending on goods which declines. Last month real services spending rose 0.6%, while real goods spending rose 0.1%:

As per form, real services spending has risen consistently since the pandemic, while goods spending has been somewhat of a mirror image of gas prices, which peaked in June 2022.

Uncategorized

America’s Minsky Moment Approaches

America’s Minsky Moment Approaches

Authored by Michael Wilkerson via The Epoch Times,

Named after American economist Hyman Minsky, the idea…

Authored by Michael Wilkerson via The Epoch Times,

Named after American economist Hyman Minsky, the idea behind a Minsky moment is that a financial markets crisis (especially in credit markets) is caused by a sudden and systemic collapse in asset prices, usually after a sustained period of speculative investment, excessive borrowing, and widespread financial risk taking.

In other words, it’s the moment when the music stops playing, investors stop buying, and the Ponzi game ends abruptly. It’s a hard crash.

America may be on the brink of its Minsky moment.

This process, which moves from slowly, slowly, to suddenly and now, goes back decades.

The confrontation with reality that was required to put America’s economic house back in order after the global financial crisis of 2008–09 was deferred to a later date by politicians, central bankers, and government officials alike, presumably when they would no longer be around.

Instead of taking the painful but necessary steps of liquidation—i.e., allowing more over-levered and risk-heavy banks and financial firms to fail, and for the economy to take the short-term pain, then move on—the U.S. government and the Federal Reserve kicked the can down the road by massive money-supply expansion and unproductive government spending.

The same playbook from the financial crisis (i.e., money printing and fiscal excess) was used again in 2020 in response to the pandemic. As the monetary authorities had but one instrument in their toolbox—the blunt-force cudgel of money-supply growth—it was the go-to solution.

As the saying goes, when the only tool available is a hammer, every problem looks like a nail. In both instances—the financial crisis and COVID periods), the U.S. Congress went on a massive spending spree, not realizing (or, as political animals with short time horizons, not caring) that excess and repeated deficit spending, and the debt creation needed to fund it, would eventually spiral out of control and doom future generations.

While a more serious collapse of the bubble—a monetary Great Reset—was avoided in 2008–09, the underlying conditions were not resolved.

The monetary and fiscal actions taken at the time only postponed the crisis and, worse, further inflated a massive bubble that is destined to eventually burst.

We are still living in this bubble, evidenced by all-time highs in equity and crypto markets, speculation in numerous asset classes from real estate to collectibles to memecoins, and “get what you can while you can” borrowing by governments, households, and corporates alike.

Given the increasing magnitude (in both nominal and real terms) of the debt problem, a financial crisis in 2024 or 2025 will have much worse consequences than anything that would have happened at the time of the financial crisis 15 years ago.

On the eve of the 2008 crisis, U.S. federal debt to GDP was around 64 percent, the same level as in 1995. This allowed some flexibility. As of the most recent quarter, the ratio of debt to GDP is now nearly double that, at 122 percent.

On this measure, the United States is now among the top 10 most indebted countries in the world, a peer group that includes economically hobbled nations such as Venezuela, Greece, Italy, and sclerotic Japan.

The level of U.S. national debt, quickly approaching $35 trillion in coming months, now requires more than $1.1 trillion in interest payments annually just to service it. And this number doesn’t include state and municipal debt or the unfunded liabilities and entitlements such as Medicare and Social Security that now comprise the substantial majority of the federal budget, limiting anyone’s ability to shrink the deficit through a reduction in discretionary spending.

The deficit for 2024 is tracking at $1.7 trillion, adding to the existing cumulative U.S. deficit of $22 trillion since 2001. The deficit matters in part because high deficits relative to GDP are strongly correlated with persistent inflation.

Since 2020, the United States has run the highest levels of deficits (as a percent of GDP) since World War II. Those deficits produced high inflation, but they also reversed and became budget surpluses shortly after the war ended. This was made possible because of the productivity miracle that was mid-twentieth century America.

The United States of 2024 has no equivalent productivity boost waiting in the wings. Artificial intelligence is one bright spot, but other tech (crypto in particular), energy, and mining industries are each being chased off-shore through regulatory interference.

Manufacturing is attempting a comeback, but only represents 11 percent of GDP. Bureaucratic, tax, monetary (the U.S. dollar remains too high to be competitive), and other barriers persist. The continued growth (as a percent of GDP) of financial advisors, personal injury attorneys, and tax accountants needed to navigate the impossible IRS tax code hardly comprise the revolutionary army needed to make the American economy great again.

When the Minsky moment arrives, the U.S. government will have no ability to confront it save for a resumption of quantitative easing and other forms of money printing.

With the bond markets in turmoil, investors will be increasingly reluctant to buy more U.S. debt. Foreign buyers have already begun reducing their exposure, and now account for only 30 percent by value of U.S. Treasurys held, compared with 45 percent in 2013.

If this divestment trend suddenly accelerates, the United States will be forced to monetize its debt through Federal Reserve purchases of U.S. Treasurys. This will be highly inflationary, even as economic conditions are weakening and unemployment is rising.

The U.S. Department of the Treasury and the Federal Reserve have already committed to a “whatever it takes” approach to crisis management. When the Minsky moment arrives, and the bond markets are in meltdown, the “whatever it takes” will primarily be a firehose of liquidity (more money created out of thin air) to the banking system with an alphabet soup of program names.

As a result, the United States will be forced to accept significantly higher levels of inflation. The alternatives are just too severe. The U.S. government, as the issuer of the world’s reserve currency, cannot default. There is a practical limit on how high it can take the visible tax rate. Its only alternative is the hidden tax of ever-higher inflation.

To avoid this outcome, U.S. productivity would have to dramatically increase such that the ratio of debt to GDP falls back in line. This seems an impossibility. The higher the ratio of debt to GDP, the greater the anchor-like drag on the national economic ship.

-

Spread & Containment2 weeks ago

Spread & Containment2 weeks agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

International1 week ago

International1 week agoParexel CEO to retire; CAR-T maker AffyImmune promotes business leader to chief executive

-

International3 weeks ago

International3 weeks agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized1 month ago

Uncategorized1 month agoApparel Retailer Express Moving Toward Bankruptcy

-

International3 weeks ago

International3 weeks agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized1 month ago

Uncategorized1 month agoKey Events This Week: All Eyes On Core PCE Amid Deluge Of Fed Speakers

-

Uncategorized1 month ago

Uncategorized1 month agoA Blue State Exodus: Who Can Afford To Be A Liberal

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoEvidence And Insights About Gold’s Long-Term Uptrend