Money-Market Fund Assets Crash ‘Most Since Lehman’ As Bank Deposits Rose Last Week

Money-Market Fund Assets Crash ‘Most Since Lehman’ As Bank Deposits Rose Last Week

Money-market funds saw the largest weekly outflow since…

Money-market funds saw the largest weekly outflow since Lehman (Q3 2008), plunging $99BN...

Source: Bloomberg

The outflows were all from institutional funds (retail funds saw another inflow)...

Source: Bloomberg

Presumably this was driven by tax-extension deadline payments - or else something serious is happening.

Total bank deposits - on a seasonally-adjusted basis - dropped for the second week in a row (-$$8.7BN)...

Source: Bloomberg

Non-seasonally-adjusted, total deposits saw inflows for the 3rd week in a row (+$20.6BN)...

Source: Bloomberg

Is this the start of a major reversal... or just the one-off tax flows?

Source: Bloomberg

Domestically, excluding foreign banks, there were deposit inflows on both an SA and NSA basis...

Source: Bloomberg

Which has narrowed the delta between SA and NSA deposit outflows since SVB to just $38BN (the outflows are still over $200BN total)...

Source: Bloomberg

On the other side of the ledger, bans increased their lending volumes modestly last week - after 2 weeks of shrinkage - op around $9BN...

Source: Bloomberg

The Fed's balance sheet shrank by around $19BN last week, but usage of its emergency funding facility for banks remained at record highs around $109BN...

Source: Bloomberg

Bank reserves at The Fed and US equity market appear to be converging back together...

Source: Bloomberg

The key warning sign continues to trend lower (Small Banks' reserve constraint), supported above the critical level by The Fed's emergency funds (for now).

Source: Bloomberg

Notably above, Large bank cash is surging (as those money-market fund outflows move?) - is it time to sacrifice another small bank for the greater good?

Source: Bloomberg

Finally, if you're wondering why regional banks were clubbed like a baby seal this week... wonder no more...

Source: Bloomberg

They have a $109BN (at least) hole in their balance sheets that needs to be filled by March-ish...

...(and with rates going higher, good luck!)

Tl;dr:...

- QT is shrinking Fed BS.

— zerohedge (@zerohedge) October 20, 2023

- Shrinking Fed BS means commercial bank deposits have to drop.

- Since deposits (especially at small banks) refuse to drop (normally they would be reallocated to risk but high rates make that unattractive), small bank deposits will be forced to drop. pic.twitter.com/OpWwQs4x5t

Spread & Containment

A top Disney World rival is planning to implement ‘surge pricing’

The popular theme park attraction is planning to follow in the footsteps of its competitor, and fans may not be happy about the move.

Disney World rival Legoland may be the next popular institution to implement a major change to its pricing that consumers have recently been extremely resistant to.

Scott O’Neil, the CEO of Merlin Entertainments, which owns Legoland, Madame Tussauds and Peppa Pig Theme Park, just revealed in a new interview with The Financial Times that his company is currently developing a dynamic pricing model, better known as “surge pricing,” for its attractions. Dynamic pricing is when the price of a product/service is adjusted based on the time of day and other factors such as consumer habits and demographics.

Related: Wendy’s is planning a major price change, and customers aren’t happy

O’Neil claims in the interview that the change will make customers pay more for tickets at its attractions during peak summer weekends than on rainy weekends in the off-season. The change will take place at its top 20 global attractions by the end of the year, and in major U.S. attractions next year.

“If [an attraction] is in the UK, it’s August peak holiday season, sunny and a Saturday, you would expect to pay more than if it was a rainy Tuesday in March,” said O’Neil.

O’Neil also revealed during the interview that the dynamic pricing model will help the company make up for the money it lost during the Covid pandemic as it experienced a decrease in foot traffic at its attractions.

In a recent report of the company's performance, Merlin Entertainments reveals that it's seeing a normalization of consumer demand at its theme parks.

“With no material COVID-19 related attraction closures remaining, our operational footprint has now largely returned to pre-pandemic levels,” said the company in the report.

If Legoland implements dynamic pricing, it won’t be the first major theme park to do so. Since 2018, Disney has used dynamic pricing to charge more money for tickets at its theme parks on busy days and less for days with lower attendance. Disneyland and Disney World are notorious for increasing their ticket prices on weekends and holidays to help push fans to visit the attractions on days with decreased demand.

The idea of dynamic pricing has recently caused an uproar amongst consumers. Fast-food chain Wendy’s (WEN) recently angered its customers last month after its CEO Kirk Tanner revealed during an earnings call in February that the company “will begin testing more enhanced features like dynamic pricing” as early as 2025.

Social media users called Wendy’s “greedy” for its plan to test out the change and even threatened to boycott its restaurants.

After facing backlash, Wendy’s later claimed in a statement that its CEO’s comments about dynamic pricing during the earnings call was “misconstrued.”

“This was misconstrued in some media reports as an intent to raise prices when demand is highest at our restaurants,” reads the statement. “We have no plans to do that and would not raise prices when our customers are visiting us most.”

Related: Veteran fund manager picks favorite stocks for 2024

stocks pandemic covid-19 testing ukUncategorized

AstraZeneca advances Fasenra’s marketing with new campaign that’s on TikTok for first time

People living with severe asthma are literally stepping away from social media and into active outdoor lives in AstraZeneca’s newest campaign for its…

People living with severe asthma are literally stepping away from social media and into active outdoor lives in AstraZeneca’s newest campaign for its asthma medication Fasenra.

A video optical effect shows people climbing out of their homes into scenes where they are hiking or playing basketball in the “Stepping Back Out” TV, digital and social effort.

The use of scene-changing videos was driven by insights from patients who want to engage in the activities they see on social media while they’re stuck inside feeling sick or worried about asthma triggers, said Matt Gray, AstraZeneca’s executive director of US marketing for Fasenra.

“You’re scrolling through social media and seeing your friends doing things or places you want to be, and yet you’re just scrolling,” he said. The message is, “OK, Fasenra can help you get back into that.”

AstraZeneca is also marketing Fasenra on TikTok for the first time. The initial TikTok video is shortened from the longer TV ad, and it focuses on basketball. By adding TikTok, the goal is to reach a younger age demographic and an expanding multi-generational one in addition to using a city as the background, Gray said.

“We realized that we were missing a bit of our demographic, so we’ve done a bit more to bring back in this city setting, and using the basketball imagery, which is not a bad thing this time of year,” Gray said, referring to the March Madness NCAA college basketball tournament currently underway.

It seems to be working. In the four weeks since the basketball TikTok was posted, the ad has almost six million impressions.

AstraZeneca’s been promoting both the condition of eosinophilic asthma and its Fasenra treatment for six years. The brand work began with a TV scientist explainer campaign, followed by a whispered-voice campaign during the Covid-19 years. Last year’s “Move Forward” work aimed to emphasize condition control for both patients and healthcare providers. Its unbranded work included personified eosinophils “Behaving Badly” and celebrity social media work with actor Tony Hale, best known for “Arrested Development.” The “Behaving Badly” campaign is still running, but the Hale campaign is not.

Gray said the campaigns have helped raise awareness of eosinophilic asthma and Fasenra. About 25 million people in the US have asthma, with an estimated 1.3 million having severe uncontrolled asthma, and the majority (about 20%) of those with eosinophilic asthma.

Fasenra sales topped $1.55 billion in 2023, up 11% from $1.4 billion the previous year.

treatment medication covid-19Uncategorized

Measuring Fed Inflation Credibility

What do households (not economists) think inflation will be in three years? I use the deviation of forecast from target as a proxy measure for credibility…

What do households (not economists) think inflation will be in three years? I use the deviation of forecast from target as a proxy measure for credibility regarding inflation.

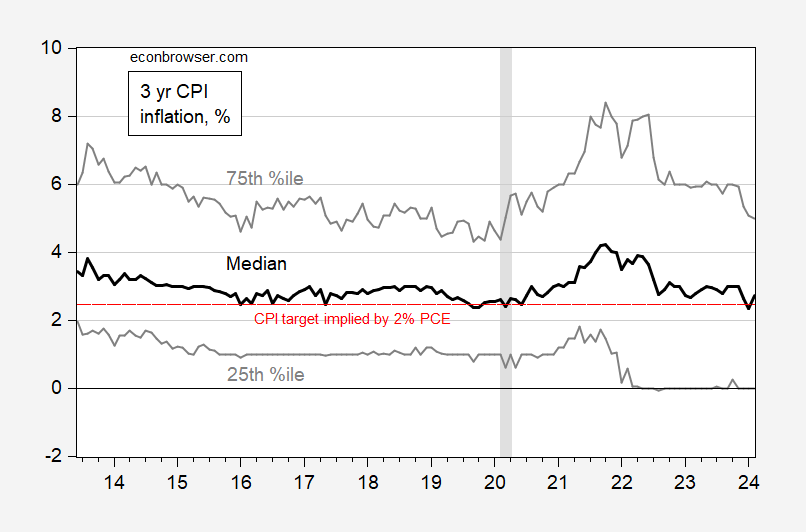

Figure 1: Median 3 year CPI inflation forecast (black), 25th, 75th percentile (gray), in %. CPI inflation consistent with 2% PCE inflation target (red dashed line). NBER defined peak-to-trough recession dates shaded gray. Source: NY Fed, NBER, and author’s calculations.

As of February 2024, the inflation rate expected 3 years out is lower than it was in January 2021. While expected CPI inflation has declined, dispersion of forecasts has increased slightly.

Figure 2: Median 3 year CPI inflation forecast deviation from CPI inflation consistent with 2% PCE inflation target (black), interquartile range (sky bule), in %.. NBER defined peak-to-trough recession dates shaded gray. Source: NY Fed, NBER, and author’s calculations.

Maximal uncertainty, as measured by the interquartile range in 3 year inflation was reached in mid-2022. It’s now dropped to to rates last seen at the exit from the pandemic-induced recession.

Note that some have questioned the use of the earlier framework, pre-New Monetary Strategy laid out in August 2020 (see here for one reader’s critique). I’ll note that as far as I can tell, market commentators are still using the target in the old sense of the word (a sense that seems buttressed by Papell and Prodan-Boul’s recent examination of the various vintages of the SEP), rather than FAIT with, say, a 3 year window, as that would imply we should be seeing an implied target rate of deflation at about 0.8% per annum.

recession pandemic fed recession

-

Spread & Containment2 weeks ago

Spread & Containment2 weeks agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

Uncategorized1 month ago

Uncategorized1 month agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International2 weeks ago

International2 weeks agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized1 month ago

Uncategorized1 month agoApparel Retailer Express Moving Toward Bankruptcy

-

International3 days ago

International3 days agoParexel CEO to retire; CAR-T maker AffyImmune promotes business leader to chief executive

-

International2 weeks ago

International2 weeks agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoKey Events This Week: All Eyes On Core PCE Amid Deluge Of Fed Speakers

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoA Blue State Exodus: Who Can Afford To Be A Liberal