International

Guest Contribution: “Monetary Policy Reaction to Geopolitical Risks: Some Nonlinear Evidence”

Today we are pleased to present a guest contribution by Jamel Saadaoui (University of Strasbourg) and William Ginn (LabCorp, Artificial Intelligence)….

Today we are pleased to present a guest contribution by Jamel Saadaoui (University of Strasbourg) and William Ginn (LabCorp, Artificial Intelligence).

How do geopolitical risk shocks affect monetary policy? After the global financial crisis, international trade relations have been increasingly influenced by geopolitical considerations. Indeed, it is now widely recognized that geopolitical risks and bilateral political tensions can have a strong influence on the functioning of the economy (Caldara and Iacoviello, 2022). Geopolitical risk shocks affect the economy through different channels. Some of them are inflationary, such as the commodity price channel, especially the oil price (Mignon and Saadaoui, 2024) [Econbrowser post] and the currency channel (Gopinath, 2015). Furthermore, other channels are deflationary, such as the consumer sentiment channel and the financial condition channel (Forbes and Warnock, 2012). It is difficult to determine ex-ante whether geopolitical risk shocks are inflationary or deflationary. Recent research suggests that geopolitical shocks tend to be inflationary throughout history (Caldara et al., 2022).

Based on a panel of 20 economies, William Ginn and I develop and estimate an augmented panel Taylor rule via linear and nonlinear local projections (LP) regression models. First, the linear model suggests that the interest rate remains relatively unchanged in the event of a geopolitical risk shock. Second, the result turns out to be different in the nonlinear model, where the policy reaction is muted during an expansionary state, which is operating in a manner proportional to the transitory shock. However, geopolitical risks can amplify the policy reaction during a non-expansionary period.

To consider the global impact of geopolitical risk, we use a rich data set for industrial production, consumer price index (CPI), short-term interest rate, GPR, and EPU for 20 economies that represent around 82% of global GDP to analyze the effect of GPR on interest rates. These twenty economies include the following: Brazil (BRA), Switzerland (CHE), Chile (CHL), Canada (CAN), China (CHN), Columbia (COL), Czech Republic (CZE), Euro zone (19 countries; EUR), United Kingdom (GBR), Hungary (HUN), Ireland (IRL), India (IND), Israel (ISR), Japan (JPN), Mexico (MEX), South Korea (KOR), Poland (POL), Russia (RUS), Sweden (SWE) and the United States (USA). We use monthly data that cover January 1999 to February 2022.

The international data for the explained and explanatory variables of the 20 economies are shown in Figure 1. In the output growth data, we can clearly see three episodes of global slowdown, namely the Internet Bubble in 2001, the Global Financial Crisis in 2008-2009, and the pandemic in 2020. The graphs for inflation show a more dispersed situation over time and between countries, except for the global financial crisis and after the pandemic. In terms of monetary tightening and loosening, we also observe that the monetary cycles induced by the global financial crisis (easing) and after the pandemic (tightening) are the most synchronized episodes. Furthermore, Economic Policy Uncertainty is larger after the pandemic. During the most recent period, we can observe elevated levels of GPR due to the War in Ukraine. More generally, the GPR has known large spikes around 2001 due to 9/11 and after 2009 due to rising tensions between the United States and China and the election of Donald Trump, as discussed in Mignon and Saadaoui (2024).

Figure 1: International Data

The Taylor rule is designed to capture the reaction of central banks to deviations in inflation and output (Taylor, 1993). By examining the rule in expansionary and non-expansionary states, this research may offer insight into how central banks adjust interest rates in response to economic conditions in the presence of geopolitical shocks. The LP model, developed by Jordà (2005), is used to estimate an augmented Taylor rule based on a GPR shock. Periods marked by high GPR have potentially adverse consequences for an economy. Central banks, when implementing monetary policy, consider the prevailing economic conditions, including states of uncertainty and geopolitical tensions. The Taylor rule provides a framework for central banks to adjust interest rates based on economic indicators, where we test whether this adjustment can be influenced by the level of the GPR.

Figure 2: Linear LP model

Note: the shock is a one standard deviation shock to changes in GPR. Confidence intervals at 90%.

Figure 3: Non-linear LP model (Transition variable: twelve-month centered movingaverage of the output growth rate) – Baseline

Figure 4: Non-linear LP model (Transition variable: recession dummy)

Overall, the linear LP (Figure 2) model demonstrates a negative relationship between the monetary policy reaction and the GPR shocks, where the policy reaction declines and is statistically insignificant. The non-linear model (Figure 3 and 4) demonstrates that a GPR shock results in a muted interest rate policy response during an expansionary state. There is no policy dilemma where the interest rate response is operating in a manner that is proportional to the transitory nature of the shock and considering the effect of monetary policy comes with a lag. The impact of a GPR shock on monetary policy turns out to be different during a non-expansionary state. The findings show that the response becomes accommodative and is statistically significant for numerous periods. This last result is robust to the choice of the transition variable (GDP, OG with HP filter, dummy variables for recessions, EPU). That being said, this more accommodative monetary policy after geopolitical risk shocks is observed in the group of more independent central banks and in the group of emerging countries (Figure 5 to 8).

Figure 5: Baseline model Non-linear LP – Advanced Economies: CAN, CHE, DNK, EUR, GBR, JPN, KOR, NOR, SWE, USA

Figure 6: Baseline model Non-linear LP – Emerging Economies: BRA, CHL, CHN, COL, HUN, IND, ISR, MEX, POL, RUS

Figure 7: Baseline model Non-linear LP – More independent central banks (Central Bank Independence – Dincer and Eichengreen, 2014): CAN, CHL, EUR, HUN, MEX, NOR, RUS, SWE

Figure 8: Baseline model Non-linear LP – Less independent central banks (Central Bank Independence – Dincer and Eichengreen, 2014): CHN, COL, DNK, GBR, IND, ISR, JPN, KOR, POL, USA

Main references

Caldara, D., Conlisk, S., Iacoviello, M. and Penn, M. (2022), ‘Do geopolitical risks raise or lower inflation’, Federal Reserve Board of Governors.

Caldara, D. and Iacoviello, M. (2022), ‘Measuring geopolitical risk’, American Economic Review 112(4), 1194–1225.

Dincer, N. N., & Eichengreen, B. (2014), ‘Central Bank Transparency and Independence: Updates and new measures’, International Journal of Central Banking 10(1), 189-259.

Mignon, V. and Saadaoui, J. (2024), ‘How do political tensions and geopolitical risks impact oil prices?’, Energy Economics 129, 107219.

* The authors thank Menzie Chinn for a useful suggestion and Elena Pesavento for guidance on state-dependent local projections. The interested readers can find the last version of the paper on SSRN: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4762672

This post written by Jamel Saadaoui and William Ginn.

recession consumer sentiment pandemic monetary policy federal reserve euro trump recession gdp interest rates oil south korea india brazil mexico japan canada sweden poland czech hungary russia ukraine chinaInternational

Japanese Preprint Calls For mRNA VaccinesTo Be Suspended Over Blood Bank Contamination Concerns

Japanese Preprint Calls For mRNA VaccinesTo Be Suspended Over Blood Bank Contamination Concerns

Authored by Naveen Athrappully via The Epoch…

Authored by Naveen Athrappully via The Epoch Times (emphasis ours),

Receiving blood transfusion from COVID-19-vaccinated individuals could pose a medical risk to unvaccinated recipients since numerous adverse events are being reported among vaccinated people worldwide, according to a recent study from Japan.

The preprint review, published on March 15, examined whether receiving blood from COVID-19-vaccinated individuals is safe or poses a health risk. Many nations have reported that mRNA vaccine usage has resulted in “post-vaccination thrombosis and subsequent cardiovascular damage, as well as a wide variety of diseases involving all organs and systems, including the nervous system,” it said.

Repeated vaccinations can make people more vulnerable to COVID-19, it said. If the blood contains spike proteins, it becomes necessary to remove these proteins prior to administration, and there is no such technology currently available, the authors wrote.

Contrary to earlier expectations, genes and proteins from genetic vaccines have been found to persist in the blood of vaccine recipients for “prolonged periods of time.”

In addition, “a variety of adverse events resulting from genetic vaccines are now being reported worldwide.” This includes a wide range of diseases related to blood and blood vessels.

Some studies have reported that the spike protein in the mRNA vaccines is neurotoxic and capable of crossing the blood-brain barrier, the review stated. “Thus, there is no longer any doubt that the spike protein used as an antigen in genetic vaccines is itself toxic.”

Moreover, people who have taken multiple shots of mRNA vaccines can have several exposures to the same antigen within a small time frame, which may lead to them being “imprinted with a preferential immune response to that antigen.”

This has resulted in COVID-19 vaccine recipients becoming “more susceptible to contracting COVID-19.”

Given such concerns, medical professionals should be aware of the “various risks associated with blood transfusions using blood products derived from people who have suffered from long COVID and from genetic vaccine recipients, including those who have received mRNA vaccines.”

The impact of such genetic vaccines on blood products as well as the actual damage caused by them are currently unknown, the authors wrote.

“In order to avoid these risks and prevent further expansion of blood contamination and complication of the situation, we strongly request that the vaccination campaign using genetic vaccines be suspended and that a harm–benefit assessment be carried out as early as possible.”

Repeated vaccination of genetic vaccines can also end up causing “alterations in immune function” among recipients. This raises the risk of serious illnesses due to opportunistic infections or pathogenic viruses, which would not have been an issue if the immune system were normal, the review said.

“Therefore, from the perspective of traditional containment of infectious diseases, greater caution is required in the collection of blood from genetic vaccine recipients and the subsequent handling of blood products, as well as during solid organ transplantation and even surgical procedures in order to avoid the risk of accidental blood-borne infection,” it stated.

The review was funded by members of the Japanese Society for Vaccine-related Complications and the Volunteer Medical Association. Authors did not declare any conflict of interest.

Dangers With Blood Transfusions

The review pointed out that the genetic vaccination status of blood donors is not collected by organizations even though the use of such blood may pose risks to patients. As such, authors recommended that when blood products are derived from such people, “it is necessary to confirm the presence or absence of spike protein or modified mRNA as in other tests for pathogens.”

“If the blood product is found to contain the spike protein or a modified gene derived from the genetic vaccine, it is essential to remove them,” it stated. “However, there is currently no reliable way to do so.”

Since “there is no way to reliably remove the pathogenic protein or mRNA, we suggest that all such blood products be discarded until a definitive solution is found.”

The authors pointed out that cases of encephalitis among people who received blood from dengue vaccine recipients were reported as recently as last year. This suggests that the present system of tracking and managing blood products “is not adequate.”

Since genetic vaccines were implemented on a global scale for a massive population, “it is expected that the situation will already be complicated” compared to previous drug disasters.

As such, there is an “urgent need” for legislation and international treaties related to the management of blood products, the authors wrote.

The issue of blood transfusion from COVID-19 vaccine recipients has been highly controversial. In 2022, a court in New Zealand ruled against the parents of a sick infant son after they refused blood transfusions from vaccinated people.

The parents had asked the health system to allow blood transfusion from unvaccinated individuals, with donors who were already prepared to contribute. In its ruling, the court stripped the parents of medical custody of their son.

In Canada, doctors have also reported the trend of people’s resistance to vaccinated blood transfusions. Speaking to CBC in 2022, Dr. Dave Sidhu, the southern Alberta medical lead for transfusion and transplant medicine, said that parents of sick children were requesting unvaccinated blood.

“We’re seeing it about once or twice a month, at this stage. And the worry is of course that these requests might increase,” he said at the time.

In Wyoming, Rep. Sarah Penn (R-Wyo.) has sponsored a bill mandating that blood donated by people who have taken COVID-19 shots be labeled. Doing so will allow recipients who do not wish to accept such blood to reject them.

In an interview with Cowboy State Daily, Ms. Penn said, “For various reasons, many people have purposefully strived to keep the mRNA therapies out of their bodies, even to the point that some lost their livelihoods … Their concerns are warranted.”

International

The Realpolitik Grand Divergence

The diverging relationship between economic performance and political success in the U.S. highlights a shift from the past, where a strong economy positively…

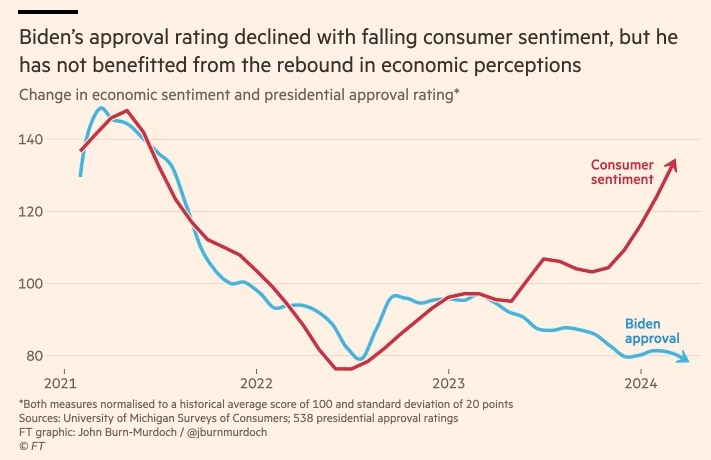

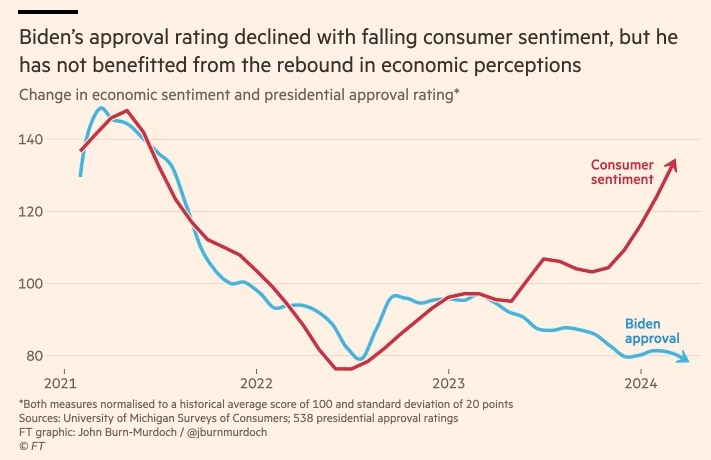

The diverging relationship between economic performance and political success in the U.S. highlights a shift from the past, where a strong economy positively impacted incumbent approval ratings. President Biden’s approval ratings remain unaffected despite recent economic improvements, suggesting a decoupling of economic sentiment and political fortunes. This phenomenon, which contrasts with stable economic-political linkages in Europe, is attributed to the U.S.’s heightened partisan divide, where political allegiance increasingly dictates economic perception, challenging the traditional belief that “It’s the economy, stupid” in American politics.

Key Points:

- President Clinton’s political advisor, James Carville, highlighted the economy’s role in political success during 1992 presidential campaign with assertion, “It’s the economy, stupid.”

- Voter sentiment has traditionally linked to economic performance, affecting incumbent party success.

- Recent trends show a disconnect between the U.S. economy’s health and President Biden’s approval ratings.

- The COVID-19 pandemic and inflation crisis may have influenced this anomaly, yet the shift predates these events.

- Research indicates a decoupling of economic sentiment and presidential approval in the U.S. since Obama’s tenure.

- This phenomenon seems unique to the U.S., with European governments’ popularity still tied to economic conditions.

- U.S. political polarization may explain the decoupling, with partisan views influencing economic perceptions.

- Studies suggest that political biases skew individual economic assessments (confirmation bias) impacting presidential approval.

- The current U.S. political climate suggests economic policy impact on electoral decisions is diminishing.

- Contrasts with Europe, where economic sentiment is more uniform across political lines, suggesting a more rational political-economic relationship.

Source: Financial Times

european europe pandemic covid-19International

The Grand Realpolitik Divergence

The diverging relationship between economic performance and political success in the U.S. highlights a shift from the past, where a strong economy positively…

The diverging relationship between economic performance and political success in the U.S. highlights a shift from the past, where a strong economy positively impacted incumbent approval ratings. President Biden’s approval ratings remain unaffected despite recent economic improvements, suggesting a decoupling of economic sentiment and political fortunes. This phenomenon, which contrasts with stable economic-political linkages in Europe, is attributed to the U.S.’s heightened partisan divide, where political allegiance increasingly dictates economic perception, challenging the traditional belief that “it’s the economy, stupid” in American politics.

Key Points:

- President Clinton’s political advisor, James Carville, highlighted the economy’s role in political success during 1992 presidential campaign with assertion, “It’s the economy, stupid.”

- Voter sentiment has traditionally linked to economic performance, affecting incumbent party success.

- Recent trends show a disconnect between the U.S. economy’s health and President Biden’s approval ratings.

- The COVID-19 pandemic and inflation crisis may have influenced this anomaly, yet the shift predates these events.

- Research indicates a decoupling of economic sentiment and presidential approval in the U.S. since Obama’s tenure.

- This phenomenon seems unique to the U.S., with European governments’ popularity still tied to economic conditions.

- S. political polarization may explain the decoupling, with partisan views influencing economic perceptions.

- Studies suggest that political biases skew individual economic assessments, impacting presidential approval.

- The current U.S. political climate suggests economic policy impact on electoral decisions is diminishing.

- Contrasts with Europe, where economic sentiment is more uniform across political lines, suggesting a more rational political-economic relationship.

Source: Financial Times

european europe pandemic covid-19-

Spread & Containment2 weeks ago

Spread & Containment2 weeks agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

Uncategorized1 month ago

Uncategorized1 month agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International2 weeks ago

International2 weeks agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized1 month ago

Uncategorized1 month agoApparel Retailer Express Moving Toward Bankruptcy

-

International2 weeks ago

International2 weeks agoWalmart launches clever answer to Target’s new membership program

-

International2 days ago

International2 days agoParexel CEO to retire; CAR-T maker AffyImmune promotes business leader to chief executive

-

Uncategorized1 month ago

Uncategorized1 month agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoKey Events This Week: All Eyes On Core PCE Amid Deluge Of Fed Speakers