Uncategorized

March 2024 Monthly

Rarely are officials able

to achieve the proverbial economic soft-landing when higher interest rates help

cool price pressures without triggering a significant…

Rarely are officials able to achieve the proverbial economic soft-landing when higher interest rates help cool price pressures without triggering a significant rise in unemployment or a contraction. Yet, without declaring victory, the Federal Reserve's confidence that this will be achieved has risen. Still, its increased confidence is unlikely to lead to a rate cut this month.

To appreciate where things stand begins with recognizing that what has characterized the first two months of the year is a reaction and correction to what happened in Q4 23.

The decline in interest rates in the last few months of 2023, in turn, helped lift the stock market. The S&P 500 rallied 11.25% in Q4 23, it best quarterly performance in three years. Much focus is on the narrow breadth of the market, as the Magnificent 7 (Apple, Amazon, Nvidia, Tesla, Microsoft, Meta, and Alphabet) which has replaced the FANG (Facebook, Amazon, Apple, Netflix, and Google) lead the way. Yet, the Russell 2000, which is an index of the shares of the 2000 smallest companies, gained 13.5% in Q4 23.

Falling interest rates knocked a leg out from the under the dollar. The greenback fell against all the major currencies in Q4 23. JP Morgan’s Emerging Market Currency Index had its best quarter of the year, rising 2.35% against the dollar in the last three months of 2023.

As is common in the capital markets, the pendulum of sentiment swings dramatically. Since the start of the year, the pendulum has swung back and this is true of Europe, Canada, and the United States. The market now recognizes the first cut will come later and the magnitude of rate cuts this year well be less aggressive than thought likely at the end of last year.

The first Fed rate cut has been pushed out of March and a rate cut is no longer fully discounted until July. The market has converged with the median in the Federal Reserve's December Summary of Economic Projections that anticipated three cuts would be appropriate this year. As recently as mid-January, the Fed funds futures market had 6 1/2 cuts discounted. The market has reduced the extent of ECB cuts to about 95 bp (from 160 bp at the end of January and 190 in late 2023). The Bank of England is now expected to cut rates twice and possibly three times this year (65 bp), which is about 105 bp less than was discounted at the end of last year. The extent of Bank of Canada rate cuts this year has been more than halved to around 75 bp from 160 bp in late December 2023. We suspect that the interest rate adjustment is nearly over.

Paradoxically, equities have continued to rally. The S&P 500 and NASDAQ have set new record highs, though the Russell 2000 is lagging. Lower interest rate expectations were previously cited by the bulls, and now the idea that economic activity may be stronger said to be inflaming the animal spirits. Japan's Nikkei has surpassed the 1989-1990 highs to reach new records. Europe's Stoxx 600 also set record-highs last month.

The US Q4 23 GDP grew by 3.2% at an annualized rate. Most economists had expected something closer to 2%. Moreover, the strong pace was achieved with moderating price pressures. The GDP deflator was halved to 1.6% (from 3.3%). Also, unit labor costs, which are a key competitive metric, combining labor compensation and productivity, fell in H2 23. To say the same thing, productivity gains more than offset the increase in wages/salaries and benefits.

A combination of stronger than expected US economic data and guidance by Federal Reserve officials encouraged the market to temper its aggressiveness. The economy appears a reasonably a strong start to the new year. In early February, the government reported that the economy grew over 350k jobs in January, which was nearly twice what economists expected. In the three months through January, US businesses created almost 750k jobs, the most in a three-month period since September-November 2022.

Not only were there more people working, but they were getting paid more. Average hourly earnings rose by 0.6% in January. That was twice as much as economists expected and the most in two years. The year-over-year rate stood at 4.5%. It continues to exceed the Consumer Price Index, which helps underpin demand.

The strength of the consumer is a key factor that helped avoid a recession that looked likely. Government deficit spending is arguably another crucial factor. The US budget deficit was around 6.5% of GDP last year. Some funds, such as within the Chips Act provisions, are slowly being distributed. More actual spending is in the pipeline.

The US deficit was twice the size of the Eurozone’s (3.3%), and larger than the UK’s (4.5%), Japan’s (5.2%), and Canada’s (1.2%) budget shortfalls. Projecting this year’s deficit requires making numerous assumptions, but many economists expect the deficit to be around 6% of GDP. That may still be twice as high as the Eurozone’s and higher than most others.

The Eurozone and UK are experiencing economic stagnation, and this looks likely to persist through most of the year. Inflation in both areas is likely to fall sharply in the coming months and this will allow the central banks to begin cutting interest rates. Japanese inflation is also falling, and the core rate slipped looks poised to below the 2% target. Despite the moderation in prices and an economy that looks weak at the start of 2024 after contracting in the past two quarters, we expect the Bank of Japan to raise its overnight interest rate from below zero (-0.10%) in April, though there is a risk could be at this month’s meeting (March 19).

China’s economy is underperforming Beijing’s expectations regardless of what the official data may show. There are promises of more supportive measures. At the same time, what China does appear to be doing well, like EV and battery production, solar panels, and processed rare earths, threatens its trading partners. An index of the 300 largest stocks on the Shanghai and Shenzhen exchange fell to five-year lows in early February before staging an impressive 13%+ rally, encouraged by formal and informal help from Beijing.

Weak economic impulses and the elevated geopolitical tensions make for a poor international backdrop. The risks are set to escalate. US aid to Ukraine may be in jeopardy, but Kyiv’s F-16, now with trained pilots, give it the capability to project deep into Russia. Meanwhile, a secondary consequence of Israel and the Hamas conflict is the loss of control of the Red Sea. Shipping costs have risen, especially between Europe and Asia. Oil prices have become more volatile, but net-net have risen by slightly more than 7% since the end of last year, while gyrating in about a $10-range below $80 a barrel. The average retail price of gasoline in the US is nearly 7% higher than at the end of last year, after falling nearly 20% in the last four months of 2024.

At first, Fed interest rate cuts may be explained not so much an easing policy as maintaining the same level of restraint as inflation falls. In effect, without a cut in the nominal interest rate, the real interest rate, would be too high to navigate a soft-landing. It is the real rate, economists argue, that is the key signal for businesses, investors, and policymakers. Later, as growth slips below 2%, the rate cuts will begin providing more monetary support to the economy. In Europe, labor markets have remained strong, giving officials more time for price pressures to moderate. The Swiss National Bank meets on March 21. With core inflation at 1.2% in January and growth weak, there is a reasonable risk that the SNB delivers the first rate cut among the high-income countries.

Lastly, we note three regularities during presidential election years. First, in the past 18 presidential cycles, going back to 1952, the economy has contracted twice (1980 and 2020). Second, the S&P 500 has fallen three times (1960, 2000, and 2008). Third, the Dollar Index (DXY), a basket of leading currencies, has mostly risen in the dozen presidential election years since the end of Bretton Woods. The record was perfect from 1976 through 2000. However, in the five elections since, the Dollar Index has falling in three times (2004, 2012, and 2020).

Most emerging market currencies fell against the dollar in February. The Mexican peso led with around a 0.9% gain, closely followed by the Peruvian sol. A few Asian currencies (Indonesian rupiah, South Korean won, Philippine peso, and Indian rupee) appreciated by about 0.15% to 0.40%. The Polish zloty was the only currency from central Europe to have gained (about 0.20%). The JP Morgan Emerging Market Currency Index fell by about 1.2% to bring the year's loss to slightly more than 3%. The MSCI Emerging Markets Currency Index rose by 0.20% after falling nearly 1% in January.

Rising by 4.6%, the MSCI Emerging Markets Index for equities, recouped what was lost in January. It outperformed the MSCI World Index of developed markets, which rose by about 4.1% in February. The premium emerging market bonds pay over US Treasuries, measured by the JP Morgan Emerging Bond Index narrowed slightly below 310 bp in February from 336 bp at the end of January. It is the tightest spread since May 2021.

Bannockburn's World Currency Index, a GDP-weighted basket of the currencies of the last dozen economies fell by about 0.65% in February. This reflected the weakness of all the foreign currencies but the Mexican peso, South Korean won, and Indian rupee, which together account for slightly more than 8% of the BWCI. All the G10 currencies in the index fell, led by the yen's 2% slump.

BWCI fell to a 20-day low in early Q4 23. It rebounded by about 2.25% in November and December 2023 and reached a four-month high at the end of the year. As the greenback recovered in January and February, BWCI fell by about 1.75%. It snapped a six-week slide by rising in the final week of the month. Now that market expectations have converged with Federal Reserve's projections from the end of last year, and official comments still seem to endorse those view, we suspect the key driver in recent weeks has largely run its course. Weak economic data may reinforce the cap on rates, sap the dollar's strength and allow the BWCI to recover.

U.S. Dollar: The market, as it did a few times last year, ran well ahead of the Federal Reserve, only to converge later. That adjustment now appears over. Official comments do not suggest a meaningful change in views since the December's Summary of Economic Projections, which anticipated 75 bp of cuts this year. The Fed's forecast will be updated at the March 20 meeting. There will also be an update on the unwinding of the balance sheet. It appears money market funds and others have born most of the adjustment with bank reserves little changed. Still, some tapering before stopping seems likely, perhaps beginning in Q2. Meanwhile, even though the January job growth was nearly twice the forecast, economic activity is slowing, and this may also help cap yields and the dollar in the weeks ahead. The Fed's facility launched last year (Bank Term Funding Program) will stop new loans (one-year) on March 11. The focus has shifted away from the systemically important banks and toward regional banks, where commercial real estate exposure is significant. The index of shares of large US banks is essentially is up a little less than 1% while the index of regional bank shares is off 10% this year. The Dollar Index rose from around 100.60 in late December to 105.00 in mid-February. The recovery appears over, and in the pullback, we anticipate in March, the Dollar Index could fall toward 102.00.

Euro: Economic activity in the region

has stagnated since late 2022, and while things do not appear to have gotten

worse, growth impulses seem faint at best. Unemployment, however, remains near

record lows despite the tightening of the monetary policy and the lack of

growth. This seems to embolden the European Central Bank to wait until

inflation falls further toward target before easing monetary policy. And prices

pressures are set to fall sharply in the coming months that will likely lead to a

sub-2% rate in the second quarter. The preliminary February rate stood at 2.6%,

down from 2.8% at the end of last year and 8.5% in February 2023. The ECB will

update its forecasts in March. In December, it had forecast this year's growth

at 0.8% and inflation at 2.7%. Both seem to be vulnerable to downward

revisions. The European Parliament elections in June will increasingly dominate

the officials’ bandwidth. Immigration challenges and farm prices have emerged

as key issues. The euro fell from about $1.1140 late last year to around $1.07

in mid-February. A recovery may have begun, perhaps there may be scope toward $1.0950-$1.1000 area, but suspect a new, higher trading range is more likely

than a sustained uptrend.

(As of March 1, indicative closing prices, previous in

parentheses)

Spot: $1.0835 ($1.0855) Median

Bloomberg One-month forecast: $1.0880 ($1.0875) One-month

forward: $1.0865 ($1.0850) One-month implied vol: 5.5% (6.2%)

Japanese Yen: Japan continues to have

a negative policy rate, debt-to-GDP of over 250% and central bank's balance

sheet more than 125% of GDP, an exchange rate that is extremely undervalued and

yet inflation core inflation, has fallen back to 2%. Moreover,

the economy contracted in Q3 23 and Q4 23, and is off to a weak start to 2024,

with a 7.5% decline in January's industrial output. Nevertheless, we still

the Bank of Japan is committed to lifting the target rate from -0.10%, which is

likely in April, after the results of the spring wage round (March 15) and as

the government subsidies for electricity and gas for households end, ahead

of the income tax cut. Bank of Japan Governor Ueda has emphasized the rise of

services prices, but we suspect that the negative rate is seen to hamper

monetary policy. He appears committed to lift rates barring some new shock.

Officials will try to convince businesses and investors that exiting negative

interest rates is not the beginning of tightening sequence. Monetary policy

settings are still very accommodative. The effective overnight rate has been

hovering near -0.05%, or about half as negative as the target. The BOJ owns almost 2/3 of

the equity ETFS, which account for around a quarter its assets. The Nikkei

rallied more than 28% in 2023 and is up about 19.25% here in 2024. Even for

unhedged, dollar-based investors, the return is half again as much as the

S&P has generated in the first two months of the year. The exchange rate

remains sensitive to US interest rates. If US 10-year yields continue to rise,

the JPY152 area, which capped the dollar in the last two years, will be

challenged again. Japanese official verbal intervention has injected a note of

caution into the market. One the one hand, the dollar rose in the first eight weeks of the year before the small (~0.25%) loss in the weekend ending March 1. This speaks to a one-way market. On the other hand, the two-year low in the

benchmark three-month volatility reflects an orderly market.

Spot: JPY150.10 (JPY148.15) Median

Bloomberg One-month forecast: JPY148.45 (JPY145.65) One-month

forward: JPY149.45 (JPY147.45) One-month implied vol: 7.7% (8.2%)

British Pound: The US jobs data and the CPI pushed sterling out of the $1.26-$1.28 trading range in February. The low was set after the employment report near $1.2520. However, sterling recovered and finished the month in the old range. The British economy contracted for the second consecutive quarter in Q4 24, meeting the Bank of England's definition of a recession. The market looked past it, and sterling settled higher on the day of the GDP report (February 15). Chancellor of the Exchequer Hunt delivers the Spring Budget on March 6. The prime minister and chancellor have been hinting at tax cuts ahead of what is expected to be an election later this year. The most impactful cuts would for the national health system or income taxes. Depending on the spending cuts that may also be announced, many look for GBP15-GBP20 bln of tax cuts. The personal allowance has been frozen since 2021, and un-freezing them may have a greater impact than a small tax cut. Also, there has been some suggestion that the fuel duty increase scheduled to start later in March could be scrapped, but the Tory's would receive less recognition for canceling a tax hike than a tax cut. Meanwhile, inflation is likely to fall sharply in the coming months as the large jump in February-May 2023 (11.4% an annualized pace) drops out, and even with conservative assumptions, the year-over-year pace is likely to fall below 2%. This may encourage the market to bring forward the first rate cut, which the overnight index swaps do not have fully discounted until August. Sterling, as we saw in Q4 23, need not be adversely impacted by the shift in expectations. With the downside break worth less than a cent, sterling could test the upper end of the old range, seen near $1.28. The high from late last year was almost $1.2830.

Spot: $1.2655 ($1.2705) Median Bloomberg One-month forecast: $1.2670 ($1.2655) One-month forward: $1.2660 ($1.2735) One-month implied vol: 5.8% (6.6%)

Canadian Dollar: Unlike Japan and the UK, Canada managed to avoid contracting for the second consecutive quarter in Q4 23. It grew by around 1.1% at an annualized, offsetting in full the revised 0.5% contraction (from -1.1% initially) in Q3 23. The economic impulses will likely remain subdued through mid-year but without the economy contracting, the central bank does not have much of a sense of urgency to cut rates. Still, like the eurozone and UK, Canadian inflation rose sharply early last year (6% annualized in the first five months of 2023), In the five months through January, Canada's CPI actually declined slightly (not risen slower). Even if that pace is not maintained, and CPI rises by an average of 0.2% a month from February through May, it may slip below 2%. The underlying rates softened in January after stagnating in Q4 23. The swaps market does not have the first cut fully discounted until July and it has a little more than three cuts fully discounted this year. At the end of January, the market had the first cut priced in for June and anticipated 100 bp in cuts in 2024. The Bank of Canada meets on March 6 and there is practically no chance of a rate cut. The Canadian dollar has fallen every week but one so far this year and the advancing week was about 0.02%. Two-thirds of this year's 2.1% depreciation of the Canadian dollar took place in January. The US dollar rose to its best level since mid-December in late February, slightly above CAD1.3600. A move above CAD1.3625 signals another leg up, but in lieu of that a consolidative phase is likely that can re-test the CAD1.3450 area seen in late January/early February. Benchmark three-month implied volatility is near 5%, a four-year low. It was flirting with 4% before the pandemic.

Spot: CAD1.3560 (CAD 1.3455) Median Bloomberg One-month forecast: CAD1.3515 (CAD1.3475) One-month forward: CAD1.3555 (CAD1.3445) One-month implied vol: 4.9% (5.0%)

Australian Dollar: The Australian dollar recorded the low of the year so far with the US January CPI on February 13 slightly below $0.6450. This seems to have completed the pullback after the six-cent rally in the last two months of 2023. Provided the $0.6490 area holds, there may be scope back to $0.6600-$0.6625. Since the start of the year, changes in the exchange rate have been highly correlated with changes in gold (near 0.80, the upper end of where the correlations over the past five years. Reserve Bank Governor Bullock did not rule out higher rates, but the derivative's market clearly expects the next move to be a cut. The market is nearly a 75% chance of a cut in June, while a quarter-point move is not fully discounted until September. At the end of January, the market had nearly a 70% chance of a May cut and a 95% chance of a June cut. Still the slight tick-up in the January monthly CPI to 3.6% from 3.4%, the two-year low print in December will reinforce the cautious approach by the RBA when it meets on March 19. February's employment report is due the next day. Growth will likely remain subdued in 0.2%-0.3% a quarter here in H1 24.

Spot: $0.6530 ($0.6575) Median Bloomberg One-month forecast: $0.6575 ($0.6635) One-month forward: $0.6535 ($0.6585) One-month implied vol: 7.9% (9.0%)

Mexican Peso: The Mexican economy eked out a 0.1%

expansion in Q4 23. Based only a small set of high-frequency data points for

the new year, it looks economic activity has increased a little. Inflation is

continuing to moderate. The central bank appears to have adopted what could be

considered an easing bias. Still, with the market pushing out expectations for

the first Fed cut, Banxico may not sense a great urgency to cut. However, there

is another consideration. If it does not cut on March 21, the next opportunity

would be May 9. The national election is June 2. This may be too close to shift policy for comfort. The short-dated cetes

(T-bills) already seem to be anticipating a cut. The dollar traded between

approximately MXN16.9950 to MXN17.2855. It is the narrowest monthly range in

almost a decade. This is also reflected in the options market, where implied

volatility has fallen to four-year lows, below 9%. The peso was the strongest currency in February, gaining about 0.9% against the US

dollar. In region, the Peruvian sol was second with

about a 0.35% gain and the Brazilian real was virtually flat. Still, we remain

concerned that market positioning leaves it vulnerable to a sell-off ahead of

the election.

Spot: MXN17.02 (MXN17.16) Median Bloomberg One-Month forecast: MXN17.12 (MXN17.33) One-month forward: MXN17.11 (MXN17.25) One-month implied vol: 7.4% (10.3%)

Chinese Yuan: Officials succeeded in maintaining a steady yuan (against the dollar) and stopping the six-month rout of the CSI 300. Beijing did not push hard to strengthen the currency but did manage to keep it in a narrow range (approximately CNH7.1765-CNY-7.1995). That is the narrowest monthly range since July 2015. Although the reference rate that the People's Bank of China sets daily allows the dollar to trade a little above CNY7.24, the CNY7.20 has proved a formidable cap. We suspect it is tactical and not strategic on the part of officials. That means that if the dollar continues to appreciate against the other major currencies, especially the Japanese yen, the risk is that the dollar breaks higher against the yuan too. It is difficult to know the intent of officials, but above CNY7.20 could signal a return to the previous range (roughly CNY7.25-CNY7.30). Reports that China's sovereign wealth funds and large asset managers were buying equities encouraged others to do so as well. The CSI 300 rose 7% in the holiday-shortened month, the biggest rally since January 2023, and offset the January decline in full. Starting March 5, two important conferences begin. They are the country's legislature, a 3000-person strong National People's Congress and an advisory group, Chinese People's Political and Consultative Conference. This year's growth target (5%?) is expected to be announced. There will be personnel changes, and new economic pronouncement. We think more stimulus and "reforms" will be forthcoming. At the same time, economic tensions with the US and Europe are high and Chinese forces have continued to be aggressive toward Taiwan, the Philippines, Japan's the Senkaku Islands/Diaoyutai Qundao (disputed by both China and Taiwan), as well as Nepal and Bhutan.

Spot: CNY7.1970 (CNY7.1775) Median Bloomberg One-month forecast: CNY7.1815 (CNY7.1640) One-month forward: CNY7.1070 (CNY7.0950) One-month implied vol 4.8% (4.7%)

Uncategorized

Comments on February Employment Report

The headline jobs number in the February employment report was above expectations; however, December and January payrolls were revised down by 167,000 combined. The participation rate was unchanged, the employment population ratio decreased, and the …

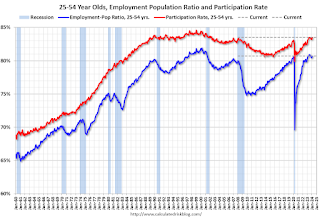

Prime (25 to 54 Years Old) Participation

Since the overall participation rate is impacted by both cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.

The 25 to 54 years old participation rate increased in February to 83.5% from 83.3% in January, and the 25 to 54 employment population ratio increased to 80.7% from 80.6% the previous month.

Average Hourly Wages

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees from the Current Employment Statistics (CES).

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees from the Current Employment Statistics (CES). Wage growth has trended down after peaking at 5.9% YoY in March 2022 and was at 4.3% YoY in February.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:"The number of people employed part time for economic reasons, at 4.4 million, changed little in February. These individuals, who would have preferred full-time employment, were working part time because their hours had been reduced or they were unable to find full-time jobs."The number of persons working part time for economic reasons decreased in February to 4.36 million from 4.42 million in February. This is slightly above pre-pandemic levels.

These workers are included in the alternate measure of labor underutilization (U-6) that increased to 7.3% from 7.2% in the previous month. This is down from the record high in April 2020 of 23.0% and up from the lowest level on record (seasonally adjusted) in December 2022 (6.5%). (This series started in 1994). This measure is above the 7.0% level in February 2020 (pre-pandemic).

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 1.203 million workers who have been unemployed for more than 26 weeks and still want a job, down from 1.277 million the previous month.

This is close to pre-pandemic levels.

Job Streak

| Headline Jobs, Top 10 Streaks | ||

|---|---|---|

| Year Ended | Streak, Months | |

| 1 | 2019 | 100 |

| 2 | 1990 | 48 |

| 3 | 2007 | 46 |

| 4 | 1979 | 45 |

| 5 | 20241 | 38 |

| 6 tie | 1943 | 33 |

| 6 tie | 1986 | 33 |

| 6 tie | 2000 | 33 |

| 9 | 1967 | 29 |

| 10 | 1995 | 25 |

| 1Currrent Streak | ||

Summary:

The headline monthly jobs number was above consensus expectations; however, December and January payrolls were revised down by 167,000 combined. The participation rate was unchanged, the employment population ratio decreased, and the unemployment rate was increased to 3.9%. Another solid report.

Uncategorized

Immune cells can adapt to invading pathogens, deciding whether to fight now or prepare for the next battle

When faced with a threat, T cells have the decision-making flexibility to both clear out the pathogen now and ready themselves for a future encounter.

How does your immune system decide between fighting invading pathogens now or preparing to fight them in the future? Turns out, it can change its mind.

Every person has 10 million to 100 million unique T cells that have a critical job in the immune system: patrolling the body for invading pathogens or cancerous cells to eliminate. Each of these T cells has a unique receptor that allows it to recognize foreign proteins on the surface of infected or cancerous cells. When the right T cell encounters the right protein, it rapidly forms many copies of itself to destroy the offending pathogen.

Importantly, this process of proliferation gives rise to both short-lived effector T cells that shut down the immediate pathogen attack and long-lived memory T cells that provide protection against future attacks. But how do T cells decide whether to form cells that kill pathogens now or protect against future infections?

We are a team of bioengineers studying how immune cells mature. In our recently published research, we found that having multiple pathways to decide whether to kill pathogens now or prepare for future invaders boosts the immune system’s ability to effectively respond to different types of challenges.

Fight or remember?

To understand when and how T cells decide to become effector cells that kill pathogens or memory cells that prepare for future infections, we took movies of T cells dividing in response to a stimulus mimicking an encounter with a pathogen.

Specifically, we tracked the activity of a gene called T cell factor 1, or TCF1. This gene is essential for the longevity of memory cells. We found that stochastic, or probabilistic, silencing of the TCF1 gene when cells confront invading pathogens and inflammation drives an early decision between whether T cells become effector or memory cells. Exposure to higher levels of pathogens or inflammation increases the probability of forming effector cells.

Surprisingly, though, we found that some effector cells that had turned off TCF1 early on were able to turn it back on after clearing the pathogen, later becoming memory cells.

Through mathematical modeling, we determined that this flexibility in decision making among memory T cells is critical to generating the right number of cells that respond immediately and cells that prepare for the future, appropriate to the severity of the infection.

Understanding immune memory

The proper formation of persistent, long-lived T cell memory is critical to a person’s ability to fend off diseases ranging from the common cold to COVID-19 to cancer.

From a social and cognitive science perspective, flexibility allows people to adapt and respond optimally to uncertain and dynamic environments. Similarly, for immune cells responding to a pathogen, flexibility in decision making around whether to become memory cells may enable greater responsiveness to an evolving immune challenge.

Memory cells can be subclassified into different types with distinct features and roles in protective immunity. It’s possible that the pathway where memory cells diverge from effector cells early on and the pathway where memory cells form from effector cells later on give rise to particular subtypes of memory cells.

Our study focuses on T cell memory in the context of acute infections the immune system can successfully clear in days, such as cold, the flu or food poisoning. In contrast, chronic conditions such as HIV and cancer require persistent immune responses; long-lived, memory-like cells are critical for this persistence. Our team is investigating whether flexible memory decision making also applies to chronic conditions and whether we can leverage that flexibility to improve cancer immunotherapy.

Resolving uncertainty surrounding how and when memory cells form could help improve vaccine design and therapies that boost the immune system’s ability to provide long-term protection against diverse infectious diseases.

Kathleen Abadie was funded by a NSF (National Science Foundation) Graduate Research Fellowships. She performed this research in affiliation with the University of Washington Department of Bioengineering.

Elisa Clark performed her research in affiliation with the University of Washington (UW) Department of Bioengineering and was funded by a National Science Foundation Graduate Research Fellowship (NSF-GRFP) and by a predoctoral fellowship through the UW Institute for Stem Cell and Regenerative Medicine (ISCRM).

Hao Yuan Kueh receives funding from the National Institutes of Health.

stimulus covid-19 yuan vaccine stimulusUncategorized

Stock indexes are breaking records and crossing milestones – making many investors feel wealthier

The S&P 500 topped 5,000 on Feb. 9, 2024, for the first time. The Dow Jones Industrial Average will probably hit a new big round number soon t…

The S&P 500 stock index topped 5,000 for the first time on Feb. 9, 2024, exciting some investors and garnering a flurry of media coverage. The Conversation asked Alexander Kurov, a financial markets scholar, to explain what stock indexes are and to say whether this kind of milestone is a big deal or not.

What are stock indexes?

Stock indexes measure the performance of a group of stocks. When prices rise or fall overall for the shares of those companies, so do stock indexes. The number of stocks in those baskets varies, as does the system for how this mix of shares gets updated.

The Dow Jones Industrial Average, also known as the Dow, includes shares in the 30 U.S. companies with the largest market capitalization – meaning the total value of all the stock belonging to shareholders. That list currently spans companies from Apple to Walt Disney Co.

The S&P 500 tracks shares in 500 of the largest U.S. publicly traded companies.

The Nasdaq composite tracks performance of more than 2,500 stocks listed on the Nasdaq stock exchange.

The DJIA, launched on May 26, 1896, is the oldest of these three popular indexes, and it was one of the first established.

Two enterprising journalists, Charles H. Dow and Edward Jones, had created a different index tied to the railroad industry a dozen years earlier. Most of the 12 stocks the DJIA originally included wouldn’t ring many bells today, such as Chicago Gas and National Lead. But one company that only got booted in 2018 had stayed on the list for 120 years: General Electric.

The S&P 500 index was introduced in 1957 because many investors wanted an option that was more representative of the overall U.S. stock market. The Nasdaq composite was launched in 1971.

You can buy shares in an index fund that mirrors a particular index. This approach can diversify your investments and make them less prone to big losses.

Index funds, which have only existed since Vanguard Group founder John Bogle launched the first one in 1976, now hold trillions of dollars .

Why are there so many?

There are hundreds of stock indexes in the world, but only about 50 major ones.

Most of them, including the Nasdaq composite and the S&P 500, are value-weighted. That means stocks with larger market values account for a larger share of the index’s performance.

In addition to these broad-based indexes, there are many less prominent ones. Many of those emphasize a niche by tracking stocks of companies in specific industries like energy or finance.

Do these milestones matter?

Stock prices move constantly in response to corporate, economic and political news, as well as changes in investor psychology. Because company profits will typically grow gradually over time, the market usually fluctuates in the short term, while increasing in value over the long term.

The DJIA first reached 1,000 in November 1972, and it crossed the 10,000 mark on March 29, 1999. On Jan. 22, 2024, it surpassed 38,000 for the first time. Investors and the media will treat the new record set when it gets to another round number – 40,000 – as a milestone.

The S&P 500 index had never hit 5,000 before. But it had already been breaking records for several weeks.

Because there’s a lot of randomness in financial markets, the significance of round-number milestones is mostly psychological. There is no evidence they portend any further gains.

For example, the Nasdaq composite first hit 5,000 on March 10, 2000, at the end of the dot-com bubble.

The index then plunged by almost 80% by October 2002. It took 15 years – until March 3, 2015 – for it return to 5,000.

By mid-February 2024, the Nasdaq composite was nearing its prior record high of 16,057 set on Nov. 19, 2021.

Index milestones matter to the extent they pique investors’ attention and boost market sentiment.

Investors afflicted with a fear of missing out may then invest more in stocks, pushing stock prices to new highs. Chasing after stock trends may destabilize markets by moving prices away from their underlying values.

When a stock index passes a new milestone, investors become more aware of their growing portfolios. Feeling richer can lead them to spend more.

This is called the wealth effect. Many economists believe that the consumption boost that arises in response to a buoyant stock market can make the economy stronger.

Is there a best stock index to follow?

Not really. They all measure somewhat different things and have their own quirks.

For example, the S&P 500 tracks many different industries. However, because it is value-weighted, it’s heavily influenced by only seven stocks with very large market values.

Known as the “Magnificent Seven,” shares in Amazon, Apple, Alphabet, Meta, Microsoft, Nvidia and Tesla now account for over one-fourth of the S&P 500’s value. Nearly all are in the tech sector, and they played a big role in pushing the S&P across the 5,000 mark.

This makes the index more concentrated on a single sector than it appears.

But if you check out several stock indexes rather than just one, you’ll get a good sense of how the market is doing. If they’re all rising quickly or breaking records, that’s a clear sign that the market as a whole is gaining.

Sometimes the smartest thing is to not pay too much attention to any of them.

For example, after hitting record highs on Feb. 19, 2020, the S&P 500 plunged by 34% in just 23 trading days due to concerns about what COVID-19 would do to the economy. But the market rebounded, with stock indexes hitting new milestones and notching new highs by the end of that year.

Panicking in response to short-term market swings would have made investors more likely to sell off their investments in too big a hurry – a move they might have later regretted. This is why I believe advice from the immensely successful investor and fan of stock index funds Warren Buffett is worth heeding.

Buffett, whose stock-selecting prowess has made him one of the world’s 10 richest people, likes to say “Don’t watch the market closely.”

If you’re reading this because stock prices are falling and you’re wondering if you should be worried about that, consider something else Buffett has said: “The light can at any time go from green to red without pausing at yellow.”

And the opposite is true as well.

Alexander Kurov does not work for, consult, own shares in or receive funding from any company or organization that would benefit from this article, and has disclosed no relevant affiliations beyond their academic appointment.

dow jones sp 500 nasdaq stocks covid-19-

Uncategorized2 weeks ago

Uncategorized2 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoIndustrial Production Decreased 0.1% in January

-

International1 month ago

International1 month agoWar Delirium

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges