Uncategorized

Economic Warning From The NFIB

The latest National Federation of Independent Business (NFIB) survey was an economic warning that departed widely from more robust governmental reports….

The latest National Federation of Independent Business (NFIB) survey was an economic warning that departed widely from more robust governmental reports. In a recent analysis of small businesses, we discussed the importance those business owners play in the economy.

“It is crucial to understand that small and mid-sized businesses comprise a substantial percentage of the U.S. economy. Roughly 60% of all companies in the U.S. have less than ten employees.

Small businesses drive the economy, employment, and wages. Therefore, the NFIB’s statements are highly relevant to the economy’s current state compared to the headline economic data from Government sources.”

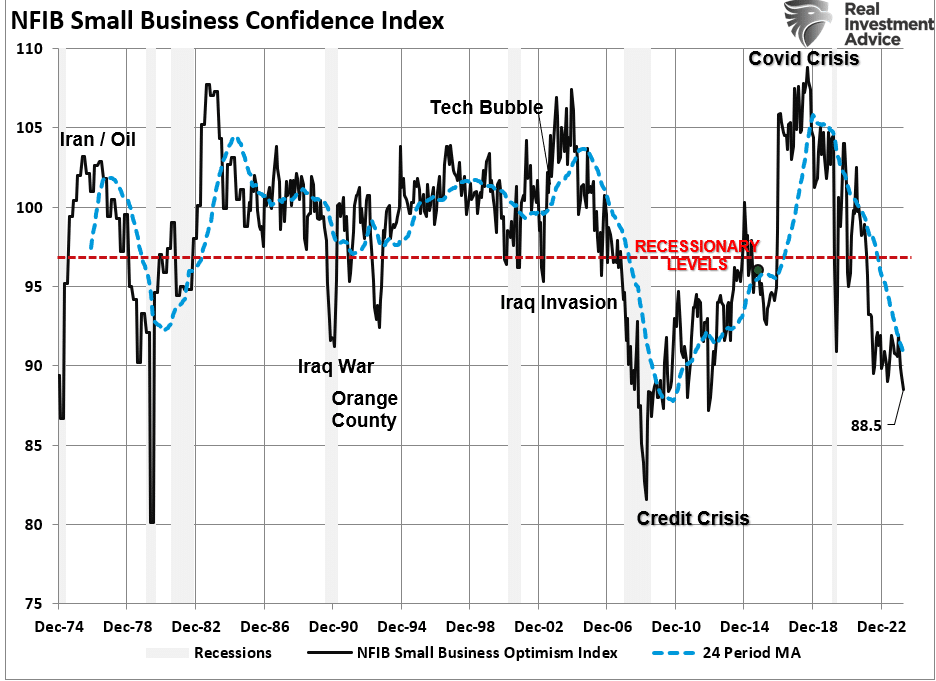

While recent government data on economic growth and employment remain robust, the NFIB small business confidence survey declined in its latest reading. Not only did it fall to the lowest level in 11 years, but, as far as an economic warning goes, it remained at levels historically associated with a recessionary economy.

The decline in confidence should be unsurprising given the largest deviation of interest rates from their 5-year average since 1975. Higher borrowing costs impede business growth for small businesses, as they don’t have access to the bond market like major companies.

Therefore, as the economy slows and interest rates rise, small business owners turn to their local banks for operating loans. However, higher rates and tighter lending standards make access to capital more difficult.

Of course, given that capital is the lifeblood of any business, decisions on hiring, capital expenditures, and expansion hang in the balance.

Economic Warning – Capital Expenditures

It should be unsurprising that if the economy were expanding as quickly as headline data suggests, business owners would be expending capital to increase capacity to meet rising demand. However, in the most recent NFIB report, the percentage of business owners planning capital expenditures over the 3-6 months dropped to the lowest level since the pandemic-driven shutdown.

Again, given that small businesses comprise about 50% of the economy, there is more than just a casual relationship between their capital expenditure plans (CapEx) and real gross private investment, which is part of the GDP equation.

In other words, if small businesses cut back on CapEx, this will eventually translate into slower rates of private investment and, ultimately, economic growth in coming quarters.

As shown, the correlation between small business CapEx plans and economic growth should not be dismissed. While mainstream economists are becoming increasingly optimistic about an “economic reflation,” the economic warning between real GDP and CapEx suggests caution.

Of course, if small businesses are unwilling to increase CapEx, it is because there is a lack of demand to justify those expenditures. Therefore, if CapEx is falling, we should expect economic warnings from employment and sales.

Something Amiss With Sales

Many reasons feed into a small business owner’s decision NOT to invest in their business. As noted above, tighter bank lending standards and increased borrowing costs certainly weigh on that decision. However, if “business is booming,” business owners will find the capital needed to meet increased demand. However, looking deeper into the NFIB data, we find rising concerns about the “demand” side of the equation.

The NFIB publishes several data points from the survey concerning the “concerns” small business owners have. These cover many concerns, from government regulations to taxes, labor costs, sales, and other concerns confronting business owners. When it comes to the “demand” side of the equation, there are three crucial categories:

- Poor sales (demand),

- Cost of labor (the most significant expense to any business), and

- Is it a “Good time to expand?” (Capex)

In the chart below, I have inverted “Good time to expand,” so it correlates with rising concerns about the cost of labor and poor sales. What should be obvious is that the average of these concerns escalates as economic growth weakens (recessionary periods) and falls during economic recoveries. Currently, these rising concerns should provide an economic warning to economists.

Examining sales and employment figures can help us understand why business owners remain pessimistic about the overall economy. The chart below shows the NFIB members’ sales expectations over the next quarter compared to the previous quarter. The black line is the average of both with a long-term median.

Unsurprisingly, business owners are always optimistic that sales will improve in the next quarter. However, actual sales tend to fall short of those expectations. The two have a very high correlation, which is why the average of both provides valuable information. Sales expectations and actual sales are well below levels typically witnessed during recessions. With sales (demand) weak, there is little need to increase production (supply) substantially.

Here is the economic warning to pay attention to. Real retail sales comprise about 40% of personal consumption expenditures (PCE), roughly 70% of the economic growth rate. The decline in the average of actual and expected sales of small businesses suggests weaker retail sales and, by extension, a slower economic growth rate.

Employment Warning

The demand side of the economic equation is crucially important. If the demand for a business owner’s products or services declines, there is little need to increase employment. Therefore, if economic growth was as robust as headlines suggest, why are small businesses’ plans to increase employment declining sharply?

Furthermore, when demand falls, business owners look to cut operating costs to protect profitability. While cutting future employment is part of that equation, so are plans to raise worker compensation.

The last chart is crucial. The U.S. is a consumption-based economy. However, consumers can not consume without producing something first. Production must come first to generate the income needed for that consumption. The cycle is displayed below.

As employees receive fewer compensation increases (raises, bonuses, etc.) amid rising living costs, they cut consumption, which translates into slower economic growth rates. In turn, business owners cut employment and compensation further. It is a virtual spiral that historically ends in recession.

While this time could certainly be different, the economic warnings from the NFIB survey should not be dismissed. The data could explain why the Fed is adamant about cutting rates.

The post Economic Warning From The NFIB appeared first on RIA.

recession pandemic economic growth fed gdp interest ratesUncategorized

Realtor.com Reports Active Inventory UP 29.1% YoY; New Listings Up 7.2% YoY

What this means: On a weekly basis, Realtor.com reports the year-over-year change in active inventory and new listings. On a monthly basis, they report total inventory. For March, Realtor.com reported inventory was up 23.5% YoY, but still down almost…

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report: Weekly Housing Trends View—Data Week Ending April 13, 2024

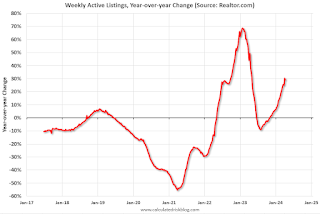

• Active inventory increased, with for-sale homes 29.1% above year-ago levels.Here is a graph of the year-over-year change in inventory according to realtor.com.

For the 23rd week in a row, there were more homes listed for sale compared with the previous year, giving homebuyers a wider selection to choose from. However, this week’s increase was not as high as the 30.4% growth seen last week, possibly suggesting a slowdown in inventory growth. This could be due to the continued impact of high mortgage rates, which might be discouraging some sellers from listing their homes.

• New listings–a measure of sellers putting homes up for sale–were up this week, by 7.2% from one year ago.

Following some ups and downs around Easter, sellers kept putting homes on the market at a faster rate compared with last year, with a 7.2% increase in newly listed homes. However, this growth rate is slower than what we’ve seen since early February.

Inventory was up year-over-year for the 23rd consecutive week following 20 consecutive weeks with a YoY decrease in inventory.

Uncategorized

Huge Bond Wagers Make Some Hedge Funds Too-Big-To-Fail, IMF Warns

Huge Bond Wagers Make Some Hedge Funds Too-Big-To-Fail, IMF Warns

Who could have seen this coming?

btw this is where the next really big…

Who could have seen this coming?

btw this is where the next really big crash will start https://t.co/XcK2RezYEk

— zerohedge (@zerohedge) February 1, 2024

Bloomberg's Ye Xie reports that a small group of funds has accumulated such large short wagers in the Treasury market that they could destabilize the broader financial system during times of stress, according to the International Monetary Fund.

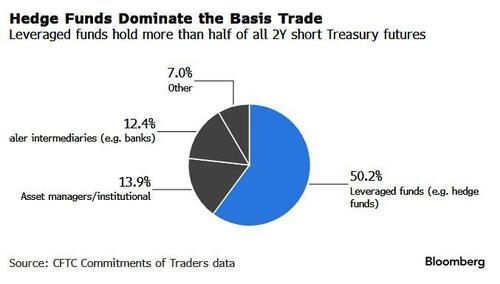

“A concentration of vulnerability has built up, as a handful of highly leveraged funds account for most of the short positions in Treasury futures,” the IMF said in its Global Financial Stability Report released this week.

“Some of these funds may have become systemically important to the Treasury and repo markets, and stresses they face could affect the broader financial system.”

The IMF’s comments came in a section discussing the so-called basis trade, which contributed to turmoil in the world’s biggest bond market at the time of the pandemic outbreak in 2020.

In this trade, hedge funds exploit tiny differences between the prices of cash Treasuries and futures, using large sums of money borrowed from the repurchase-agreement market to amplify returns. Because of this leverage and reliance on short-term funding, the bet has drawn increasing scrutiny from regulators. And now the IMF is highlighting another risk: concentrated positions.

As of December, about half the two-year Treasury short positions in the futures market were in the hands of eight traders or less, according to the IMF. It was at a similar level at the end of 2019, just before a surge in funding costs in the early days of the pandemic spurred traders to unwind the positions, which helped boost volatility in bonds at a time of upheaval across financial markets.

Source: IMF’s Global Financial Stability Report

The use of basis trades swelled along with the Federal Reserve’s interest-rate hikes, which potentially make the strategy more profitable by widening the price gap between the cash and futures markets.

A Fed study last month estimated that hedge funds have amassed at least $317 billion in Treasury holdings related to basis trades since the first quarter of 2022, although the size is “significantly” less than it previously estimated.

In December, the SEC required the funds and brokerages to centrally clear far more of their US Treasuries transactions, a move to bolster oversight of basis trades.

Source: IMF’s Global Financial Stability Report

Since then, there are signs that use of the trade may be waning: Commodity Futures Trading Commission data shows a decline in leveraged funds’ short positions in bond futures.

The concentration in these bets has also diminished.

In two-year futures, net short positions controlled by eight traders or less have dropped to about 38% of total open interest, from 50% in early January, according to CFTC data compiled by Bloomberg.

Source: CFTC's Commitments of Traders data

Note: Data show percentage of two-year Treasury short futures contracts held on a net basis

Despite that unwinding, the IMF noted the short positions of leveraged funds remain large, which means they may still loom as a risk.

As the Fed shrinks its holdings of Treasuries, a process known as quantitative tightening, it also may reduce the liquidity in the financial system, potentially triggering a jump in funding costs and leading the basis trade to unravel, the IMF said.

“Basis trade investors rely on low repo haircuts and low repo rates to leverage their positions and increase basis trade profitability,” the report said.

“A spike in repo rates — triggered, for example, by surprises in quantitative tightening — can render the trade unprofitable and could trigger the forced selling of Treasury securities and a brisk unwinding of futures positions as funds seek to quickly delever.”

Which explains, as we noted previously, why the SEC is now scrambling to figure out just how much capital is truly allocated to basis trades within multi-manager/multi-strat hedge funds, but based on our quick look at regulatory leverage, the actual amount allocated to basis is orders of magnitude greater than $550BN, more likely in the $2+ trillion ballpark across the entire global hedge fund industry.

And there you have it: all the basis trade is, is the latest manifestation of the "collecting pennies in front of a steamroller" trade, because when it works it generates 10% returns every year like clockwork, with the only gating factor being how much leverage a hedge fund has access to.

However, during a crisis, such as the Sept 2019 repo fiasco or the March 2020 crash, it all goes to hell... and the Fed rushes to bail out not just bank but hedge funds which are now so tightly interwoven in the financial fabric (via ultra loose and generous Prime Brokerage linkages) that central banks have no choice but to bail out everyone, including the billionaires who run the hedge funds that have put on trillions of basis trades on!

...and The IMF is worried.

Uncategorized

“We’re not shoving anything down anyone’s throat,” Ford exec says about EVs

The Ford family member says that political uncertainty is complicating his business.

Running a car company is already hard, but Ford (F) Executive Chairman Bill Ford says that the current political landscape is making it hard to balance Ford's offerings of electric, internal combustion and hybrid-electric vehicles.

Speaking to journalist Carol Cain at a recent Detroit Free Press event, the Ford executive said that the Blue Oval expects the move to electrification to have its hurdles, but unclear policy decisions by made it hard to envision a clear path for the industry at large.

“Our planning timeframe as a company is a lot longer than election cycles,” Ford said. “The problem is when we’re whipsawed back and forth… we can’t turn on a dime.”

Ford calls these policy issues political 'hurricanes,' as the stormy weather impedes on the ability of not only his car company, but also the competition's ability to determine what products are right to pursue.

However, Ford says that instead of looking at policy and the politicians that draw them up, he allows the free market and the buying power of consumers to guide them.

“The one thing that drives us crazy, we really can’t deal with is this yes-no, back-and-forth kind of thing,” Ford said. “As long as we’re in an election cycle, it just becomes harder. We shouldn’t let Washington decide, we should let customers decide.”

Despite what many detractors would like to believe, Ford strongly insists that car companies, like the one that bears his last name, are not trying to force you into an electric car.

“We’re not shoving anything down anybody’s throat,” Ford said during the event.

More Business of EVs:

- A full list of EVs and hybrids that qualify for federal tax credits

- Here’s why EV experts are flaming Joe Biden’s car policy

- The EV industry is facing an unusual new problem

Additionally, the Blue Oval chair said that he does not believe EVs are going to be a key issue during this presidential election cycle.

“I don’t believe that the average voter is going to have [EVs] on their top three list,” he said.

Bill Ford has made comments in the past about how cars bearing his family name are politicized. In an October 2023 interview with the New York Times, he called the debacle surrounding American car buyer’s adoption of electric cars to be “politicized” and compared it to the politically-motivated hysteria associated with the COVID-19 vaccine.

“Blue states say EVs are great and we need to adopt them as soon as possible for climate reasons. Some of the red states say this is just like the vaccine, and it’s being shoved down our throat by the government, and we don’t want it," Ford said. “I never thought I would see the day when our products were so heavily politicized, but they are.”

Politics aside, Ford is shifting its EV strategy towards a "small vehicle platform" underpinning three new models. The first of these models is due in 2026 and is anticipated to sell for around $25,000.

Related: Veteran fund manager picks favorite stocks for 2024

stocks covid-19 vaccine-

International4 weeks ago

International4 weeks agoParexel CEO to retire; CAR-T maker AffyImmune promotes business leader to chief executive

-

Government2 weeks ago

Government2 weeks agoClimate-Con & The Media-Censorship Complex – Part 1

-

International5 days ago

International5 days agoWHO Official Admits Vaccine Passports May Have Been A Scam

-

Spread & Containment1 week ago

Spread & Containment1 week agoFDA Finally Takes Down Ivermectin Posts After Settlement

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoVaccinated People Show Long COVID-Like Symptoms With Detectable Spike Proteins: Preprint Study

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoCan language models read the genome? This one decoded mRNA to make better vaccines.

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoWhat’s So Great About The Great Reset, Great Taking, Great Replacement, Great Deflation, & Next Great Depression?

-

Uncategorized2 days ago

Uncategorized2 days agoRed States Fight Growing Efforts To Give “Basic Income” Cash To Residents