Uncategorized

Huge Bond Wagers Make Some Hedge Funds Too-Big-To-Fail, IMF Warns

Huge Bond Wagers Make Some Hedge Funds Too-Big-To-Fail, IMF Warns

Who could have seen this coming?

btw this is where the next really big…

Who could have seen this coming?

btw this is where the next really big crash will start https://t.co/XcK2RezYEk

— zerohedge (@zerohedge) February 1, 2024

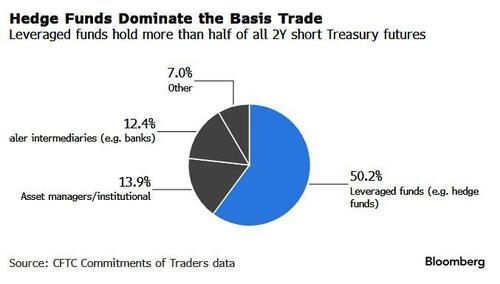

Bloomberg's Ye Xie reports that a small group of funds has accumulated such large short wagers in the Treasury market that they could destabilize the broader financial system during times of stress, according to the International Monetary Fund.

“A concentration of vulnerability has built up, as a handful of highly leveraged funds account for most of the short positions in Treasury futures,” the IMF said in its Global Financial Stability Report released this week.

“Some of these funds may have become systemically important to the Treasury and repo markets, and stresses they face could affect the broader financial system.”

The IMF’s comments came in a section discussing the so-called basis trade, which contributed to turmoil in the world’s biggest bond market at the time of the pandemic outbreak in 2020.

In this trade, hedge funds exploit tiny differences between the prices of cash Treasuries and futures, using large sums of money borrowed from the repurchase-agreement market to amplify returns. Because of this leverage and reliance on short-term funding, the bet has drawn increasing scrutiny from regulators. And now the IMF is highlighting another risk: concentrated positions.

As of December, about half the two-year Treasury short positions in the futures market were in the hands of eight traders or less, according to the IMF. It was at a similar level at the end of 2019, just before a surge in funding costs in the early days of the pandemic spurred traders to unwind the positions, which helped boost volatility in bonds at a time of upheaval across financial markets.

Source: IMF’s Global Financial Stability Report

The use of basis trades swelled along with the Federal Reserve’s interest-rate hikes, which potentially make the strategy more profitable by widening the price gap between the cash and futures markets.

A Fed study last month estimated that hedge funds have amassed at least $317 billion in Treasury holdings related to basis trades since the first quarter of 2022, although the size is “significantly” less than it previously estimated.

In December, the SEC required the funds and brokerages to centrally clear far more of their US Treasuries transactions, a move to bolster oversight of basis trades.

Source: IMF’s Global Financial Stability Report

Since then, there are signs that use of the trade may be waning: Commodity Futures Trading Commission data shows a decline in leveraged funds’ short positions in bond futures.

The concentration in these bets has also diminished.

In two-year futures, net short positions controlled by eight traders or less have dropped to about 38% of total open interest, from 50% in early January, according to CFTC data compiled by Bloomberg.

Source: CFTC's Commitments of Traders data

Note: Data show percentage of two-year Treasury short futures contracts held on a net basis

Despite that unwinding, the IMF noted the short positions of leveraged funds remain large, which means they may still loom as a risk.

As the Fed shrinks its holdings of Treasuries, a process known as quantitative tightening, it also may reduce the liquidity in the financial system, potentially triggering a jump in funding costs and leading the basis trade to unravel, the IMF said.

“Basis trade investors rely on low repo haircuts and low repo rates to leverage their positions and increase basis trade profitability,” the report said.

“A spike in repo rates — triggered, for example, by surprises in quantitative tightening — can render the trade unprofitable and could trigger the forced selling of Treasury securities and a brisk unwinding of futures positions as funds seek to quickly delever.”

Which explains, as we noted previously, why the SEC is now scrambling to figure out just how much capital is truly allocated to basis trades within multi-manager/multi-strat hedge funds, but based on our quick look at regulatory leverage, the actual amount allocated to basis is orders of magnitude greater than $550BN, more likely in the $2+ trillion ballpark across the entire global hedge fund industry.

And there you have it: all the basis trade is, is the latest manifestation of the "collecting pennies in front of a steamroller" trade, because when it works it generates 10% returns every year like clockwork, with the only gating factor being how much leverage a hedge fund has access to.

However, during a crisis, such as the Sept 2019 repo fiasco or the March 2020 crash, it all goes to hell... and the Fed rushes to bail out not just bank but hedge funds which are now so tightly interwoven in the financial fabric (via ultra loose and generous Prime Brokerage linkages) that central banks have no choice but to bail out everyone, including the billionaires who run the hedge funds that have put on trillions of basis trades on!

...and The IMF is worried.

Uncategorized

Realtor.com Reports Active Inventory UP 29.1% YoY; New Listings Up 7.2% YoY

What this means: On a weekly basis, Realtor.com reports the year-over-year change in active inventory and new listings. On a monthly basis, they report total inventory. For March, Realtor.com reported inventory was up 23.5% YoY, but still down almost…

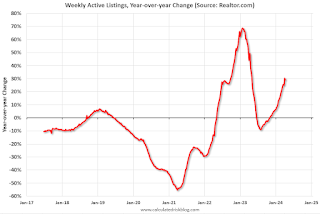

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report: Weekly Housing Trends View—Data Week Ending April 13, 2024

• Active inventory increased, with for-sale homes 29.1% above year-ago levels.

For the 23rd week in a row, there were more homes listed for sale compared with the previous year, giving homebuyers a wider selection to choose from. However, this week’s increase was not as high as the 30.4% growth seen last week, possibly suggesting a slowdown in inventory growth. This could be due to the continued impact of high mortgage rates, which might be discouraging some sellers from listing their homes.

• New listings–a measure of sellers putting homes up for sale–were up this week, by 7.2% from one year ago.

Following some ups and downs around Easter, sellers kept putting homes on the market at a faster rate compared with last year, with a 7.2% increase in newly listed homes. However, this growth rate is slower than what we’ve seen since early February.

Here is a graph of the year-over-year change in inventory according to realtor.com.

Here is a graph of the year-over-year change in inventory according to realtor.com. Inventory was up year-over-year for the 23rd consecutive week following 20 consecutive weeks with a YoY decrease in inventory.

Uncategorized

“We’re not shoving anything down anyone’s throat,” Ford exec says about EVs

The Ford family member says that political uncertainty is complicating his business.

Running a car company is already hard, but Ford (F) Executive Chairman Bill Ford says that the current political landscape is making it hard to balance Ford's offerings of electric, internal combustion and hybrid-electric vehicles.

Speaking to journalist Carol Cain at a recent Detroit Free Press event, the Ford executive said that the Blue Oval expects the move to electrification to have its hurdles, but unclear policy decisions by made it hard to envision a clear path for the industry at large.

“Our planning timeframe as a company is a lot longer than election cycles,” Ford said. “The problem is when we’re whipsawed back and forth… we can’t turn on a dime.”

Ford calls these policy issues political 'hurricanes,' as the stormy weather impedes on the ability of not only his car company, but also the competition's ability to determine what products are right to pursue.

However, Ford says that instead of looking at policy and the politicians that draw them up, he allows the free market and the buying power of consumers to guide them.

“The one thing that drives us crazy, we really can’t deal with is this yes-no, back-and-forth kind of thing,” Ford said. “As long as we’re in an election cycle, it just becomes harder. We shouldn’t let Washington decide, we should let customers decide.”

Despite what many detractors would like to believe, Ford strongly insists that car companies, like the one that bears his last name, are not trying to force you into an electric car.

“We’re not shoving anything down anybody’s throat,” Ford said during the event.

More Business of EVs:

- A full list of EVs and hybrids that qualify for federal tax credits

- Here’s why EV experts are flaming Joe Biden’s car policy

- The EV industry is facing an unusual new problem

Additionally, the Blue Oval chair said that he does not believe EVs are going to be a key issue during this presidential election cycle.

“I don’t believe that the average voter is going to have [EVs] on their top three list,” he said.

Bill Ford has made comments in the past about how cars bearing his family name are politicized. In an October 2023 interview with the New York Times, he called the debacle surrounding American car buyer’s adoption of electric cars to be “politicized” and compared it to the politically-motivated hysteria associated with the COVID-19 vaccine.

“Blue states say EVs are great and we need to adopt them as soon as possible for climate reasons. Some of the red states say this is just like the vaccine, and it’s being shoved down our throat by the government, and we don’t want it," Ford said. “I never thought I would see the day when our products were so heavily politicized, but they are.”

Politics aside, Ford is shifting its EV strategy towards a "small vehicle platform" underpinning three new models. The first of these models is due in 2026 and is anticipated to sell for around $25,000.

Related: Veteran fund manager picks favorite stocks for 2024

stocks covid-19 vaccineUncategorized

Bankrupt nationwide retailer closes several more stores

The Philadelphia-based national retail chain will close more stores in bankruptcy.

Huge retail chains such as Target (TGT) , Walmart (WMT) and Walgreens Boots Alliance (WBA) since the Covid pandemic have closed some of their stores for a variety of reasons, but financial distress leading to bankruptcy has not been the case for these companies.

Theft and organized crime were identified as the reasons why Target in October 2023 closed nine stores in four states. Walgreens in early 2022 and 2021 closed seven stores in San Francisco because of crime. Walmart in 2023 closed 24 stores in 14 states and Washington, blaming underperformance and theft as central reasons for the closures.

Related: Iconic ice cream brand files for Chapter 11 bankruptcy

99 Cents Only liquidating in Chapter 11

However, retailer 99 Cents Only is the latest chain to file for Chapter 11 bankruptcy with plans to liquidate all 371 of its stores in California, Texas, Arizona and Nevada. As it liquidates the merchandise in its stores, the company said it will be selling its 377 real estate assets, including 44 owned and 333 leased properties.

Struggling drugstore chain Rite Aid is trying to stay afloat after filing Chapter 11 bankruptcy to reorganize and close underperforming stores and those with leases that no longer make economic sense.

Rite Aid closes more stores

The bankrupt drugstore chain on April 16 filed a notice in the U.S. Bankruptcy Court for the District of New Jersey seeking to close 13 additional stores located in the East and Midwest. The notice identified six stores in Pennsylvania, three in Ohio, two in New Jersey and one each in New York and Virginia.

Stores are located in Philadelphia, Pittsburgh, Morrisville, New Castle, Pottstown, and Glenolden, Pa.; Toledo, Massillon and Lakewood, Ohio; Berlin and Toms River, N.J.; Flushing, N.Y., and Virginia Beach, Va.

The additional store closures bring the amount of shuttered locations to 322 of the original 2,100 stores that were open when the company filed for Chapter 11 bankruptcy on Oct. 15, 2023.

Also Read: Las Vegas Strip casino signs superstar 90s R&B band for shows

Rite Aid, which listed $3.3 billion in debt in its petition, filed bankruptcy facing tight co from rivals including CVS (CVS) , Walgreens Boots Alliance (WBA) , Walmart (WMT) , Costco (COST) , Amazon (AMZN) and investor Mark Cuban's CostPlus Drug.

The company was also a defendant in a civil lawsuit filed against it by the Department of Justice in March 2023. The agency alleged that the chain's pharmacists inappropriately filled opioid prescriptions, contributing to the opioid epidemic.

The bankruptcy filing provided an automatic stay of any further legal action against the debtor in the lawsuit. The company seeks to negotiate a less expensive settlement, which could have amounted to more than $1 billion without the bankruptcy filing.

The drugstore chain has filed several notices for additional store closures since its Oct. 17 motion to reject store leases and close 154 stores. In November and December, it filed notices to reject 55 more stores and in late December and early January, it sought another 45 closures.

The Philadelphia-based drugstore chain filed notices on April 2 to close 30 stores, April 3 to close six locations and April 9 to close 17 stores. The lion's share of closures were in California with 18 of the stores set to be closed. The closure list included 13 in New York, 12 in Pennsylvania, three in New Jersey, two in Michigan, two in Ohio, and one each in Maryland, Massachusetts and Virginia.

The company had also filed a notice to close stores located in Michigan and Ohio on Feb. 27.

bankruptcy pandemic real estate-

International4 weeks ago

International4 weeks agoParexel CEO to retire; CAR-T maker AffyImmune promotes business leader to chief executive

-

Government2 weeks ago

Government2 weeks agoClimate-Con & The Media-Censorship Complex – Part 1

-

International4 days ago

International4 days agoWHO Official Admits Vaccine Passports May Have Been A Scam

-

Spread & Containment1 week ago

Spread & Containment1 week agoFDA Finally Takes Down Ivermectin Posts After Settlement

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoVaccinated People Show Long COVID-Like Symptoms With Detectable Spike Proteins: Preprint Study

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoCan language models read the genome? This one decoded mRNA to make better vaccines.

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoWhat’s So Great About The Great Reset, Great Taking, Great Replacement, Great Deflation, & Next Great Depression?

-

International4 weeks ago

International4 weeks agoJapanese Preprint Calls For mRNA VaccinesTo Be Suspended Over Blood Bank Contamination Concerns