Uncategorized

Bitcoin’s resilience tested: Price up 577% amid pandemics, war and corporate embrace

Quick Take As we approach the Bitcoin halving and bid farewell to the current epoch, it is crucial to reflect on the events that have transpired since…

Quick Take

As we approach the Bitcoin halving and bid farewell to the current epoch, it is crucial to reflect on the events that have transpired since the previous halving in May 2020. The world has witnessed a series of significant events that have shaped the economic landscape and influenced the adoption of Bitcoin.

The COVID-19 pandemic, which began in March 2020, had a detrimental effect on the global economy throughout the entire cycle. The aftermath of the pandemic has led to severe inflation and currency debasement, the effects of which are still felt today.

In August 2020, Michael Saylor, then CEO of MicroStrategy, made a bold move by adopting Bitcoin, resulting in the company accumulating more than 1% of the total Bitcoin supply as of April 2024. The FASB introduced rules that will positively influence corporate adoption by establishing fair value accounting for Bitcoin in corporate treasuries.

El Salvador made history by making Bitcoin legal tender and implementing a dollar-cost averaging (DCA) approach to acquiring the digital asset.

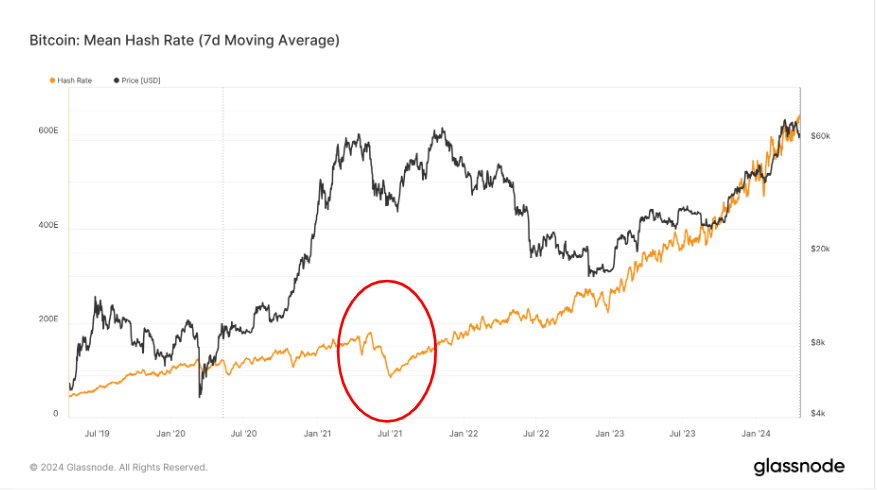

China’s ban on Bitcoin in the summer of 2021 caused a significant drop in the hash rate, which plummeted by approximately 50%.

Geopolitical tensions escalated, with multiple wars and invasions occurring, most notably Russia’s invasion of Ukraine in February 2022 and the recent conflict in the Middle East.

The introduction of Bitcoin ordinals paved the way for the launch of Runes at block 840,000.

This cycle also marked the first time that the balance of Bitcoin on exchanges decreased, indicating a shift in investor behavior.

In this cycle, the digital asset exchange FTX collapsed alongside several crypto lending platforms like Celsius and BlockFi.

In January 2024, the launch of Bitcoin ETFs became an instant success, further solidifying Bitcoin’s position in the financial world.

Other notable events included the highest inflation and interest rates in recent history, reminding us that while the future remains unpredictable, the limited supply of 21 million Bitcoin remains a constant.

Despite the challenges and events that have unfolded, Bitcoin has surged an impressive 577% since the last halving.

The post Bitcoin’s resilience tested: Price up 577% amid pandemics, war and corporate embrace appeared first on CryptoSlate.

bitcoin crypto pandemic covid-19 cryptoUncategorized

The bifurcation of the new vs. existing home markets continues

– by New Deal democratThe bifurcation of the new vs. existing home markets continued in March, per the report on existing home sales and prices yesterday….

- by New Deal democrat

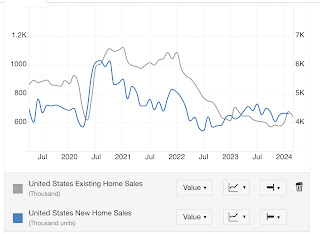

The bifurcation of the new vs. existing home markets continued in March, per the report on existing home sales and prices yesterday. Remember that, unlike existing homeowners, house builders can vary square footage, amenities, lot sizes, and offer price and/or mortgage incentives to counteract the effect of interest rate hikes.

On a seasonally adjusted basis, existing home sales declined from 438,000 to 419,000 in March. But this is well within the seasonally adjusted range of the past 16 months (gray, right scale in the graph below){also, note I am using Trading Economics graphs due to restrictions put on FRED by the Realtors; also note difference in scales):

Uncategorized

Economic Warning From The NFIB

The latest National Federation of Independent Business (NFIB) survey was an economic warning that departed widely from more robust governmental reports….

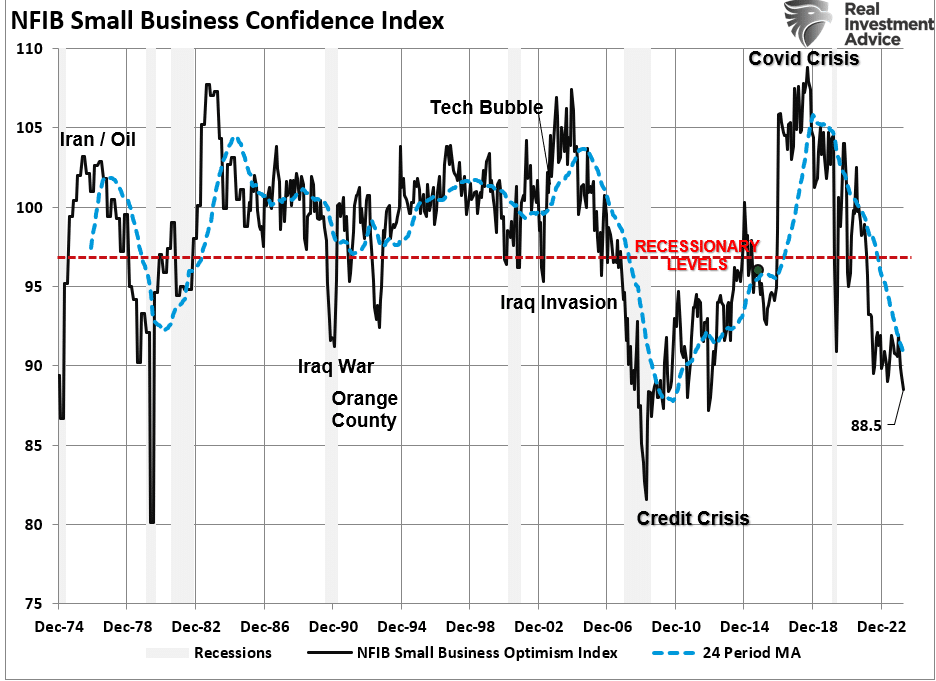

The latest National Federation of Independent Business (NFIB) survey was an economic warning that departed widely from more robust governmental reports. In a recent analysis of small businesses, we discussed the importance those business owners play in the economy.

“It is crucial to understand that small and mid-sized businesses comprise a substantial percentage of the U.S. economy. Roughly 60% of all companies in the U.S. have less than ten employees.

Small businesses drive the economy, employment, and wages. Therefore, the NFIB’s statements are highly relevant to the economy’s current state compared to the headline economic data from Government sources.”

While recent government data on economic growth and employment remain robust, the NFIB small business confidence survey declined in its latest reading. Not only did it fall to the lowest level in 11 years, but, as far as an economic warning goes, it remained at levels historically associated with a recessionary economy.

The decline in confidence should be unsurprising given the largest deviation of interest rates from their 5-year average since 1975. Higher borrowing costs impede business growth for small businesses, as they don’t have access to the bond market like major companies.

Therefore, as the economy slows and interest rates rise, small business owners turn to their local banks for operating loans. However, higher rates and tighter lending standards make access to capital more difficult.

Of course, given that capital is the lifeblood of any business, decisions on hiring, capital expenditures, and expansion hang in the balance.

Economic Warning – Capital Expenditures

It should be unsurprising that if the economy were expanding as quickly as headline data suggests, business owners would be expending capital to increase capacity to meet rising demand. However, in the most recent NFIB report, the percentage of business owners planning capital expenditures over the 3-6 months dropped to the lowest level since the pandemic-driven shutdown.

Again, given that small businesses comprise about 50% of the economy, there is more than just a casual relationship between their capital expenditure plans (CapEx) and real gross private investment, which is part of the GDP equation.

In other words, if small businesses cut back on CapEx, this will eventually translate into slower rates of private investment and, ultimately, economic growth in coming quarters.

As shown, the correlation between small business CapEx plans and economic growth should not be dismissed. While mainstream economists are becoming increasingly optimistic about an “economic reflation,” the economic warning between real GDP and CapEx suggests caution.

Of course, if small businesses are unwilling to increase CapEx, it is because there is a lack of demand to justify those expenditures. Therefore, if CapEx is falling, we should expect economic warnings from employment and sales.

Something Amiss With Sales

Many reasons feed into a small business owner’s decision NOT to invest in their business. As noted above, tighter bank lending standards and increased borrowing costs certainly weigh on that decision. However, if “business is booming,” business owners will find the capital needed to meet increased demand. However, looking deeper into the NFIB data, we find rising concerns about the “demand” side of the equation.

The NFIB publishes several data points from the survey concerning the “concerns” small business owners have. These cover many concerns, from government regulations to taxes, labor costs, sales, and other concerns confronting business owners. When it comes to the “demand” side of the equation, there are three crucial categories:

- Poor sales (demand),

- Cost of labor (the most significant expense to any business), and

- Is it a “Good time to expand?” (Capex)

In the chart below, I have inverted “Good time to expand,” so it correlates with rising concerns about the cost of labor and poor sales. What should be obvious is that the average of these concerns escalates as economic growth weakens (recessionary periods) and falls during economic recoveries. Currently, these rising concerns should provide an economic warning to economists.

Examining sales and employment figures can help us understand why business owners remain pessimistic about the overall economy. The chart below shows the NFIB members’ sales expectations over the next quarter compared to the previous quarter. The black line is the average of both with a long-term median.

Unsurprisingly, business owners are always optimistic that sales will improve in the next quarter. However, actual sales tend to fall short of those expectations. The two have a very high correlation, which is why the average of both provides valuable information. Sales expectations and actual sales are well below levels typically witnessed during recessions. With sales (demand) weak, there is little need to increase production (supply) substantially.

Here is the economic warning to pay attention to. Real retail sales comprise about 40% of personal consumption expenditures (PCE), roughly 70% of the economic growth rate. The decline in the average of actual and expected sales of small businesses suggests weaker retail sales and, by extension, a slower economic growth rate.

Employment Warning

The demand side of the economic equation is crucially important. If the demand for a business owner’s products or services declines, there is little need to increase employment. Therefore, if economic growth was as robust as headlines suggest, why are small businesses’ plans to increase employment declining sharply?

Furthermore, when demand falls, business owners look to cut operating costs to protect profitability. While cutting future employment is part of that equation, so are plans to raise worker compensation.

The last chart is crucial. The U.S. is a consumption-based economy. However, consumers can not consume without producing something first. Production must come first to generate the income needed for that consumption. The cycle is displayed below.

As employees receive fewer compensation increases (raises, bonuses, etc.) amid rising living costs, they cut consumption, which translates into slower economic growth rates. In turn, business owners cut employment and compensation further. It is a virtual spiral that historically ends in recession.

While this time could certainly be different, the economic warnings from the NFIB survey should not be dismissed. The data could explain why the Fed is adamant about cutting rates.

The post Economic Warning From The NFIB appeared first on RIA.

recession pandemic economic growth fed gdp interest ratesUncategorized

Realtor.com Reports Active Inventory UP 29.1% YoY; New Listings Up 7.2% YoY

What this means: On a weekly basis, Realtor.com reports the year-over-year change in active inventory and new listings. On a monthly basis, they report total inventory. For March, Realtor.com reported inventory was up 23.5% YoY, but still down almost…

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report: Weekly Housing Trends View—Data Week Ending April 13, 2024

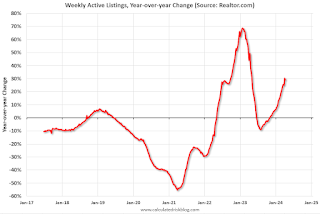

• Active inventory increased, with for-sale homes 29.1% above year-ago levels.Here is a graph of the year-over-year change in inventory according to realtor.com.

For the 23rd week in a row, there were more homes listed for sale compared with the previous year, giving homebuyers a wider selection to choose from. However, this week’s increase was not as high as the 30.4% growth seen last week, possibly suggesting a slowdown in inventory growth. This could be due to the continued impact of high mortgage rates, which might be discouraging some sellers from listing their homes.

• New listings–a measure of sellers putting homes up for sale–were up this week, by 7.2% from one year ago.

Following some ups and downs around Easter, sellers kept putting homes on the market at a faster rate compared with last year, with a 7.2% increase in newly listed homes. However, this growth rate is slower than what we’ve seen since early February.

Inventory was up year-over-year for the 23rd consecutive week following 20 consecutive weeks with a YoY decrease in inventory.

-

International4 weeks ago

International4 weeks agoParexel CEO to retire; CAR-T maker AffyImmune promotes business leader to chief executive

-

Government2 weeks ago

Government2 weeks agoClimate-Con & The Media-Censorship Complex – Part 1

-

International5 days ago

International5 days agoWHO Official Admits Vaccine Passports May Have Been A Scam

-

Spread & Containment2 weeks ago

Spread & Containment2 weeks agoFDA Finally Takes Down Ivermectin Posts After Settlement

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoVaccinated People Show Long COVID-Like Symptoms With Detectable Spike Proteins: Preprint Study

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoCan language models read the genome? This one decoded mRNA to make better vaccines.

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoWhat’s So Great About The Great Reset, Great Taking, Great Replacement, Great Deflation, & Next Great Depression?

-

Uncategorized3 days ago

Uncategorized3 days agoRed States Fight Growing Efforts To Give “Basic Income” Cash To Residents