“Our data demonstrated, for the first time, the antioxidant activity of geraniol and its function to attenuate brain hippocampus injury induced in vivo by D-galactose.”

BUFFALO, NY- April 10, 2024 – A new research paper was published in Aging (listed by MEDLINE/PubMed as “Aging (Albany NY)” and “Aging-US” by Web of Science) Volume 16, Issue 6, entitled, “Geraniol attenuates oxidative stress and neuroinflammation-mediated cognitive impairment in D galactose-induced mouse aging model.”

D-galactose (D-gal) administration was proven to induce cognitive impairment and aging in rodents’ models. Geraniol (GNL) belongs to the acyclic isoprenoid monoterpenes. GNL reduces inflammation by changing important signaling pathways and cytokines, and thus it is plausible to be used as a medicine for treating disorders linked to inflammation. In this new study, researchers Peramaiyan Rajendran, Fatma J. Al-Saeedi, Rebai Ben Ammar, Basem M. Abdallah, Enas M. Ali, Najla Khaled Al Abdulsalam, Sujatha Tejavat, Duaa Althumairy, Vishnu Priya Veeraraghavan, Sarah Abdulaziz Alamer, Gamal M. Bekhet, and Emad A. Ahmed from King Faisal University, Kuwait University, Center of Biotechnology of Borj-Cedria, Saveetha University, Alexandria University, and Assiut University examined the therapeutic effects of GNL on D-gal-induced oxidative stress and neuroinflammation-mediated memory loss in mice.

“Life expectancy in the 21st century is rising, resulting in more age-related illnesses, such as memory impairment and Alzheimer’s disease. In this study, GNL was studied for its protective effect on D-gal-induced aging in mice.”

The study was conducted using six groups of mice (6 mice per group). The first group received normal saline, then D-gal (150 mg/wt) dissolved in normal saline solution (0.9%, w/v) was given orally for 9 weeks to the second group. In the III group, from the second week until the 10th week, mice were treated orally (without anesthesia) with D-gal (150 mg/kg body wt) and GNL weekly twice (40 mg/kg body wt) four hours later. Mice in Group IV were treated with GNL from the second week up until the end of the experiment. For comparison of young versus elderly mice, 4 month old (Group V) and 16-month-old (Group VI) control mice were used.

“We evaluated the changes in antioxidant levels, PI3K/Akt levels, and Nrf2 levels. We also examined how D-gal and GNL treated pathological aging changes.”

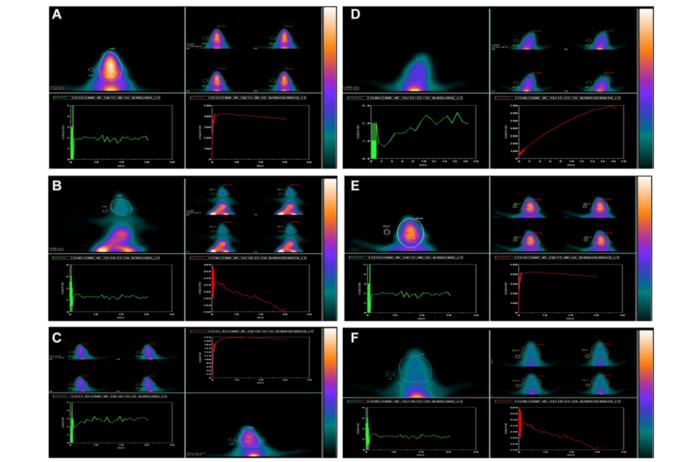

Administration of GNL induced a significant increase in spatial learning and memory with spontaneously altered behavior. Enhancing anti-oxidant and anti-inflammatory effects and activating PI3K/Akt were the mechanisms that mediated this effect. Further, GNL treatment upregulated Nrf2 and HO-1 to reduce oxidative stress and apoptosis. This was confirmed using 99mTc-HMPAO brain flow gamma bioassays.

“Thus, our data suggested GNL as a promising agent for treating neuroinflammation-induced cognitive impairment.”

Read the full paper: DOI: https://doi.org/10.18632/aging.205677

Corresponding Authors: Peramaiyan Rajendran, Fatma J. Al-Saeedi

Corresponding Emails: prajendran@kfu.edu.sa, fatma.alsaeedi@ku.edu.kw

Keywords: D-galactose, geraniol, cognitive disorder, Nrf2, 99mTc-HMPAO, apoptosis

Click here to sign up for free Altmetric alerts about this article.

About Aging:

Aging publishes research papers in all fields of aging research including but not limited, aging from yeast to mammals, cellular senescence, age-related diseases such as cancer and Alzheimer’s diseases and their prevention and treatment, anti-aging strategies and drug development and especially the role of signal transduction pathways such as mTOR in aging and potential approaches to modulate these signaling pathways to extend lifespan. The journal aims to promote treatment of age-related diseases by slowing down aging, validation of anti-aging drugs by treating age-related diseases, prevention of cancer by inhibiting aging. Cancer and COVID-19 are age-related diseases.

Aging is indexed by PubMed/Medline (abbreviated as “Aging (Albany NY)”), PubMed Central, Web of Science: Science Citation Index Expanded (abbreviated as “Aging‐US” and listed in the Cell Biology and Geriatrics & Gerontology categories), Scopus (abbreviated as “Aging” and listed in the Cell Biology and Aging categories), Biological Abstracts, BIOSIS Previews, EMBASE, META (Chan Zuckerberg Initiative) (2018-2022), and Dimensions (Digital Science).

Please visit our website at www.Aging-US.com and connect with us:

- X, formerly Twitter

- YouTube

- Spotify, and available wherever you listen to podcasts

Click here to subscribe to Aging publication updates.

For media inquiries, please contact media@impactjournals.com.

Aging (Aging-US) Journal Office

6666 E. Quaker Str., Suite 1B

Orchard Park, NY 14127

Phone: 1-800-922-0957, option 1

###

Journal

Aging-US

DOI

10.18632/aging.205677

Method of Research

Experimental study

Subject of Research

Animals

Article Title

Geraniol attenuates oxidative stress and neuroinflammation-mediated cognitive impairment in D galactose-induced mouse aging model

Article Publication Date

20-Mar-2024