Uncategorized

Trendy sneaker company receives a dire Nasdaq warning

The trendy label seems to have lost its luster with a once-enthusiastic consumer base.

It seems like almost every day you check on the newest business headlines, a new company is either liquidating, filing for bankruptcy protection, getting delisting warnings, or somehow spiraling into what seems like a hopeless death of despair.

This is thanks in part to the continued Covid consolidation, whereby brands at anything less than their best performance over the past year have been forced to fold under the immense pressure of current market conditions.

Related: Kroger launches trendy new brand Costco doesn't have

As Covid forced — or expedited — seemingly unnatural migration patterns, many previously high-foot traffic metropolitan areas were largely abandoned for months or even years on end. High rents in these places were no longer justifiable, and a lack of incoming revenue forced many stores to shutter suddenly and ask for help.

To be sure, some retailers thrived during this period of consolidation. Giants like Walmart (WMT) , Target (TGT) , and Amazon (AMZN) rapidly gobbled up smaller competition and it now seems like every plaza has at least one of the five largest retailers in the U.S.

Other retailers like TJ Maxx, thrived as consumers finally returned to stores seeking deals and off-mall accessibility. So while retailers like Macy's (M) shuttered and crumbled, TJX was happy to sell some of its overstock labels for a fraction of the price.

Popular sneaker label gets a warning

One such company that thrived before the pandemic was Allbirds (BIRD) , a smaller brand that built comfortable shoes made of sustainable materials best suited for walking and commuting.

San Francisco Chronicle/Hearst Newspapers via Getty Images/Getty Images

A darling during the late 2010s when almost everybody went into the office every day, Allbirds catered to the crowd who wanted to look presentable at work but feel good in their feet -- and good about what they were doing for the planet. Allbirds' best-selling shoe, the Runners, are made from either wool or sustainable eucalyptus with cushioned midsoles for the perfect all-day temperature and support. They start at $98.

But Allbirds has struggled with declining sales and profit in recent years, as upscale and presentable commuters are no longer in vogue and shoppers instead opt for comfort over everything else, as is the case with Crocs (CROX) and Birkenstock.

The company tried to make a pivot to other activewear, as with women's leggings but soon found out that was a slippery slope with incumbents like Lululemon (LULU) ready to eat any newcomers' lunch — sustainable or not.

So in April, Allbirds received a noncompliance warning from Nasdaq, where it is currently listed and trades for under $1. Since the stock has traded below $1 for over 30 days, Nasdaq warned Allbirds it must get its stock price up — or be at risk of being delisted from the exchange.

It has 180 days, or until September 30, to make that change. In order to avoid delisting, it must trade for above $1 for at least 10 business days straight.

Allbirds said it "will consider actions," to take in order to avoid delisting, "but no decisions about a response have been made at this time."

Earlier in 2024, Allbirds said it will shutter between 10-15 brick-and-mortar locations in the U.S., but it still expects revenue to decline 25% or more in the fiscal year.

bankruptcy pandemic nasdaqUncategorized

Part 1: Current State of the Housing Market; Overview for mid-April 2024

Today, in the Calculated Risk Real Estate Newsletter: Part 1: Current State of the Housing Market; Overview for mid-April 2024

A brief excerpt: This 2-part overview for mid-April provides a snapshot of the current housing market.

I always like to star…

A brief excerpt:

This 2-part overview for mid-April provides a snapshot of the current housing market.There is much more in the article.

I always like to start with inventory, since inventory usually tells the tale!

...

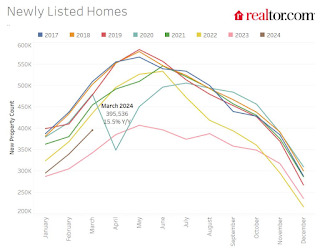

Here is a graph of new listing from Realtor.com’s March 2024 Monthly Housing Market Trends Report showing new listings were 15.5% year-over-year in March. This is still well below pre-pandemic levels. From Realtor.com:

However, providing a boost to overall inventory, sellers turned out in higher numbers this March as newly listed homes were 15.5% above last year’s levels. This marked the fifth month of increasing listing activity after a 17-month streak of decline.Note the seasonality for new listings. December and January are seasonally the weakest months of the year for new listings, followed by February and November. New listings will be up year-over-year in 2024, but still below normal levels.

There are always people that need to sell due to the so-called 3 D’s: Death, Divorce, and Disease. Also, in certain times, some homeowners will need to sell due to unemployment or excessive debt (neither is much of an issue right now).

And there are homeowners who want to sell for a number of reasons: upsizing (more babies), downsizing, moving for a new job, or moving to a nicer home or location (move-up buyers). It is some of the “want to sell” group that has been locked in with the golden handcuffs over the last couple of years, since it is financially difficult to move when your current mortgage rate is around 3%, and your new mortgage rate will be in the 6 1/2% to 7 1/2% range.

But time is a factor for this “want to sell” group, and eventually some of them will take the plunge. That is probably why we are seeing more new listings now.

Uncategorized

Popular shoe company gets a dire warning

The trendy label seems to have lost its luster with a once-enthusiastic consumer base.

It seems like almost every day you check on the newest business headlines, a new company is either liquidating, filing for bankruptcy protection, getting delisting warnings, or somehow spiraling into what seems like a hopeless death of despair.

This is thanks in part to the continued Covid consolidation, whereby brands at anything less than their best performance over the past year have been forced to fold under the immense pressure of current market conditions.

Related: Kroger launches trendy new brand Costco doesn't have

As Covid forced — or expedited — seemingly unnatural migration patterns, many previously high-foot traffic metropolitan areas were largely abandoned for months or even years on end. High rents in these places were no longer justifiable, and a lack of incoming revenue forced many stores to shutter suddenly and ask for help.

To be sure, some retailers thrived during this period of consolidation. Giants like Walmart (WMT) , Target (TGT) , and Amazon (AMZN) rapidly gobbled up smaller competition and it now seems like every plaza has at least one of the five largest retailers in the U.S.

Other retailers like TJ Maxx, thrived as consumers finally returned to stores seeking deals and off-mall accessibility. So while retailers like Macy's (M) shuttered and crumbled, TJX was happy to sell some of its overstock labels for a fraction of the price.

Popular sneaker label gets a warning

One such company that thrived before the pandemic was Allbirds (BIRD) , a smaller brand that built comfortable shoes made of sustainable materials best suited for walking and commuting.

San Francisco Chronicle/Hearst Newspapers via Getty Images/Getty Images

A darling during the late 2010s when almost everybody went into the office every day, Allbirds catered to the crowd who wanted to look presentable at work but feel good in their feet -- and good about what they were doing for the planet. Allbirds' best-selling shoe, the Runners, are made from either wool or sustainable eucalyptus with cushioned midsoles for the perfect all-day temperature and support. They start at $98.

But Allbirds has struggled with declining sales and profit in recent years, as upscale and presentable commuters are no longer in vogue and shoppers instead opt for comfort over everything else, as is the case with Crocs (CROX) and Birkenstock.

The company tried to make a pivot to other activewear, as with women's leggings but soon found out that was a slippery slope with incumbents like Lululemon (LULU) ready to eat any newcomers' lunch — sustainable or not.

So in April, Allbirds received a noncompliance warning from Nasdaq, where it is currently listed and trades for under $1. Since the stock has traded below $1 for over 30 days, Nasdaq warned Allbirds it must get its stock price up — or be at risk of being delisted from the exchange.

It has 180 days, or until September 30, to make that change. In order to avoid delisting, it must trade for above $1 for at least 10 business days straight.

Allbirds said it "will consider actions," to take in order to avoid delisting, "but no decisions about a response have been made at this time."

Earlier in 2024, Allbirds said it will shutter between 10-15 brick-and-mortar locations in the U.S., but it still expects revenue to decline 25% or more in the fiscal year.

bankruptcy pandemic nasdaqUncategorized

March CPI: Should We Be Worried?

The inflation hawks took March’s CPI as cause for celebration, inflation may not be dead yet. There is no doubt that it was a disappointing report for…

The inflation hawks took March’s CPI as cause for celebration, inflation may not be dead yet. There is no doubt that it was a disappointing report for those hoping we could put the pandemic inflation behind us, but there still is not much basis for thinking the Fed needs to get out the nukes and start shooting big-time.

The key point to remember is that this inflation continues to be driven overwhelmingly by rent. We know that rental inflation will be falling because we have data on marketed units, the ones that change hands, that show sharply lower rental inflation and in some cases, such as the BLS index for new tenants, actually deflation.

The CPI rental indexes will follow the index for new tenants, but with a lag. That lag is proving longer than had generally been expected, but there is no reason to question the basic logic. If people who change apartments are seeing lower rental inflation, it is pretty hard to tell a story where this doesn’t eventually show up in lower rental inflation for people who stay in the same unit.

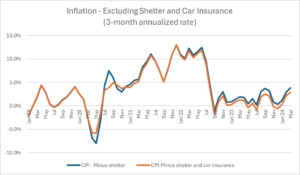

If we just look at the inflation rate excluding shelter, we have been skating close to, or even under, the Fed’s 2.0 percent target for most of 2023. The figure below shows annualized rates over the prior three months from 2019.

Source: Bureau of Labor Statistics and author’s calculations.

There definitely has been some acceleration in this measure in the last few months, but hardly an extraordinary one. We saw even larger upticks in inflation by this measure in the past, for example twice in 2019. Rent is typically a stabilizing factor in the overall inflation rate, precisely because the rate of rental inflation changes slowly.

There is another item that has played a big role in pushing inflation higher in recent years, auto insurance. The story is that premiums have risen sharply in recent years because of higher payouts in claims. (Profits have risen some as well, but we know payouts are most of the story from comparing the CPI measure which picks up gross payments, with the measure in the PCE deflator, which pulls out claims.)

Some of the story with premiums is higher costs due to higher prices for auto repairs, but much of it is simply more claims. Auto theft shot up in the pandemic but is now coming down. More long-term, people are seeing more damage due to climate-related events such as floods and hurricanes. That will be an ongoing problem.

To be clear, higher auto insurance premiums are a big deal in the sense that people have to bear these costs out of their pockets, however it is not part of a conventional inflation picture. The Fed will not be lowering auto insurance premiums by raising interest rates. The solution to climate-related damage is to try to limit climate change, but if that is off the agenda for political reasons, then people will just have to get used to higher-priced auto insurance, among other things.

Anyhow, if we pull auto insurance out of the story, in addition to rent, inflation was well below the Fed’s target for most of 2023 and actually negative at several points. We still get the acceleration in recent months to a 2.9 percent annualized rate as of March, but this hardly seems like something worth getting terribly excited over given the past behavior of this index.

In short, there is still plenty of reason for believing that the pandemic inflation is behind us. For now, the March report gave the inflation hawks some fresh meat, but a more careful look suggests that it doesn’t change the basic picture of inflation being largely under control.

The post March CPI: Should We Be Worried? appeared first on Center for Economic and Policy Research.

fed pandemic interest rates-

International3 weeks ago

International3 weeks agoParexel CEO to retire; CAR-T maker AffyImmune promotes business leader to chief executive

-

Spread & Containment4 weeks ago

Spread & Containment4 weeks agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

International1 month ago

International1 month agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

International1 month ago

International1 month agoWalmart launches clever answer to Target’s new membership program

-

Government4 days ago

Government4 days agoClimate-Con & The Media-Censorship Complex – Part 1

-

Spread & Containment2 days ago

Spread & Containment2 days agoFDA Finally Takes Down Ivermectin Posts After Settlement

-

Uncategorized1 week ago

Uncategorized1 week agoVaccinated People Show Long COVID-Like Symptoms With Detectable Spike Proteins: Preprint Study

-

Uncategorized5 days ago

Uncategorized5 days agoCan language models read the genome? This one decoded mRNA to make better vaccines.