Uncategorized

WSJ debacle fueled US lawmakers’ ill-informed crusade against crypto

The Wall Street Journal corrected its misreporting about crypto funding Hamas, but it was too late to stop lawmakers from amplifying false claims.

…

The Wall Street Journal corrected its misreporting about crypto funding Hamas, but it was too late to stop lawmakers from amplifying false claims.

Following October’s tragic events in Israel, a narrative linking Hamas funding to cryptocurrencies emerged from The Wall Street Journal in an Oct. 10 story authored by the paper’s Angus Berwick and Ian Talley. It fueled Sen. Elizabeth Warren’s crusade against the crypto sector. Subsequent insights from Chainalysis and Elliptic cast serious doubt on the claims, demanding a more judicious examination of the accusations levied against the crypto industry.

At the heart of this discourse is an underlying issue — the United States' precarious position on crypto regulations. The narrative surrounding Hamas's crypto funding is emblematic of the U.S. government’s broader inability to grasp the nuanced dynamics of cryptocurrencies. The hasty generalizations and lack of thorough analysis in the WSJ reporting echo a disturbing trend of misinformation that can foster misguided regulations, a concern gravely shared.

Contrastingly, other regions like the European Union and Asia have taken a more balanced and informed approach towards crypto regulation. Their endeavors to understand and integrate this new financial frontier stand in stark contrast to the reactionary stance by some U.S. regulators. The recent acknowledgment by a member of the Securities & Exchange Commission on the missteps regarding the LBRY lawsuit epitomizes this disconnect.

Related: Elizabeth Warren uses Hamas as her newest scapegoat in war on crypto

The assertions made by the WSJ and amplified by Warren exemplify premature judgements of the crypto sector made without a comprehensive understanding of the facts at hand. Both Elliptic and BitOK clarified their methodologies, essentially discrediting the inflated figures flaunted by WSJ. This not only questions the integrity of the reporting but also the subsequent political maneuvering by Sen. Warren, which dangerously hinges on dubious data.

On Oct. 27, the WSJ issued a correction related to its initial story, a positive step in rolling back the misinformation. However, the damage from the misreporting was already amplified in a Senate hearing on Oct. 26, when members cited the inflated figure of "more than $130 million" in crypto donations to terrorist organizations. The episode highlights the ripple effects misinformation can have, especially in a sensitive domain like crypto regulation, and the essential role of precise, evidence-based reporting in fostering informed discussions and policies.

Refutation could not be stronger.

— Balaji (@balajis) October 25, 2023

Will WSJ’s @AABerwick and @IanTalley correct the record?

“There is no evidence to support the assertion that Hamas has received significant volumes of crypto donations.” https://t.co/uHhhjrf49b pic.twitter.com/2CApmwGCsd

WSJ blinked. pic.twitter.com/kXrMwg5snJ

— nic carter (@nic__carter) October 27, 2023

The scenario unveils a perilous pathway where misinformation can catalyze a cascade of ill-informed policy decisions. The unfounded aggression towards the crypto sector, spurred by misleading narratives, threatens to stifle innovation and alienate a burgeoning industry that holds immense potential for economic growth and financial inclusivity.

The WSJ correction was a positive step towards transparency. Yet, the delay in issuing that correction — even as the misinformation was being used in political circles — arguably shows a woeful disregard for truth. This scenario is not only detrimental to the crypto industry but also erodes trust in media and political institutions, which is foundational to a functioning democracy.

Related: IRS proposes unprecedented data-collection on crypto users

The U.S. is at a crossroads. Policymakers can either delve deeper into a dark abyss of ignorance and reactionary regulation, or they can foster an environment conducive to discourse and understanding. Their choice will significantly impact the crypto industry and the country's position as a frontrunner in the global financial ecosystem.

It is imperative that the media do a better job of shedding misinformation and embrace a more nuanced, evidence-based approach toward the crypto industry. Giving credence to unfounded accusations will only serve to undermine America’s standing in the global arena and obstruct the immense potential harbored by cryptocurrencies. The time is ripe for informed discourse to supplant misguided narratives.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

crypto cryptoUncategorized

A detailed look at manufacturing, and an update on frieght

– by New Deal democratAs I wrote on Monday, the big question for this year is whether the recessionary effects of the Fed rate hikes have just been…

- by New Deal democrat

As I wrote on Monday, the big question for this year is whether the recessionary effects of the Fed rate hikes have just been delayed, or whether, because the rate hikes have stopped, so has the headwind they normally produce. Watching manufacturing and construction, especially housing construction, is what I expect to supply the answer.

Uncategorized

Argentinians Buy Bitcoin to Combat Inflation, Pass Friendly Legislation

Argentina’s plummeting economy has seen citizens turn to Bitcoin as a store of value. The legislature passes friendly laws as the pro-Bitcoin president…

The below is an excerpt from a recent edition of Bitcoin Magazine Pro, Bitcoin Magazine's premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

As the Argentine economy is racked by record inflation, its people are turning to Bitcoin as a way to protect their economic security.

The Argentine Republic is currently experiencing the worst inflation rates in the world. The nation’s economy has experienced low levels of inflation, somewhere around 25%, for decades; yet the pandemic sharpened a downward trend to devastating effect. The inflation rate hit 70% in 2022 and reached 100% the following February, but 2023 proved to be an absolutely murderous year for Argentina's economy. Inflation rates crossed the 200% point around the time that Bitcoin-friendly president Javier Milei first took office in December, and the rate currently sits at a mind-boggling 274%. With figures like this, ordinary citizens’ wages and life savings have evaporated practically overnight, and people are looking towards more radical solutions to get their lives on track.

In a particularly encouraging development, ordinary citizens are turning to Bitcoin in record numbers for its classic use-case as a store of value. Already a nation with a high rate of Bitcoin acceptance, Argentina has doubled down on the decentralized currency as the most popular local exchange reports 20-month highs in trading volume. Lemon Cash, the exchange in question, claimed that Bitcoin transactions in the first full week of March 2024 were more than double the average rate throughout 2023. Belo, another prominent exchange based in the country, reported year-to-year increases that were closer to tenfold. A particularly interesting wrinkle in the development is that Bitcoin is not only replacing dollars, but also dollar-backed stablecoins which saw trading volumes decrease by 60-70%. Belo’s CEO Manuel Beaudroit stated that “The user decides to buy Bitcoin when they see the news that the currency is going up, while stablecoin is more pragmatic and many times used for transactional purposes, as a vehicle to make payments abroad”.

Ironically, Bloomberg claims, some of President Milei’s economic positions have actually influenced the switch from the dollar to Bitcoin, but through some unexpected and indirect means. The radical libertarian has begun his administration with a series of broad-reaching reforms to try and control the situation, reducing spending and attempting to dismantle or privatize a variety of state-owned businesses. A particular goal of his administration to date has been to build a budget surplus for the federal government, for a variety of reasons: using these funds more deliberately, reaching targets based on agreements with the International Monetary Fund (IMF) and of course beginning a positive trend in Argentina’s economic statistics. A component of this surplus policy has been to build a similar reserve of American greenbacks, reducing their circulation within the country. The exchange rate of pesos to dollars took a serious hit, and the once-popular store of value became less attractive than the skyrocketing Bitcoin.

Reports from Chainalysis put some hard numbers onto these general trends: Argentina leads all of Latin America in transaction volume, and is second place overall in terms of grassroots adoption. Representatives from Lemon Cash estimated in this report that the number of Argentinians using Bitcoin or other digital currencies is around 5M, out of a population of 45M! Such impressive figures are not merely the result of a brief period of economic misfortune, but should instead be considered as a sort of tipping point: Bitcoin acceptance has been quietly growing for years, and now the crisis is providing the jump for it to become a fully mainstream fiat alternative. The rate of growth has been so prodigious that an unexpected “cousin” of the industry has even been developing, with crypto-related scam and phishing activity increasing fivefold. Clearly, the market is full of people new to Bitcoin’s chaotic ecosystem.

Relevant to the rise of unsavory activity targeting new Bitcoin users, Argentina is beginning to pass some new regulations over the industry. The Senate unanimously passed a new law in March, opening up a new set of standards that virtual asset service providers must adhere to. The standards are generally related to various consumer protection and anti-fraud precautions, with the country’s main securities agency set to enforce these new standards. The existing Bitcoin community has reacted to these new laws with consternation, fearing that this legislation will lead to market consolidation. Large operations, after all, would have the resources to comply with these new requirements immediately, while smaller startups may find themselves swamped. Still, legislators are also working on a series of tax exemptions for digital asset holders, that may hopefully help smooth over some of this animosity.

Curiously absent from these proceedings, however, is President Milei. The man espoused some pro-Bitcoin views on the campaign trail, and has a general economic philosophy that aligns with some of Bitcoin’s core fundamentals, but nevertheless he has held little public presence in many of Bitcoin’s developments. Even the incidental rise of Bitcoin fueled by his own policies have not led him to make public statements on the situation. Still, Milei has had his hands full from a far-reaching series of economic reforms and austerity policies, balancing the confidence of global markets with a concerning rise in poverty across several metrics. Milei has managed to slow the ballooning inflation somewhat, but at great cost: reduced government spending is pushing more citizens over the brink. As Reuters reported, the crisis is far from over, with sales, activity and production all on a downward slope.

In other words, it seems likely that Milei personally has Bitcoin on the back burner, as he has a much greater priority in getting the economy under control and tempering the possibility of social unrest. His general popularity is holding up despite these adversities, but a contentious issue like bitcoinization may simply be a battle he is unwilling to start. Once things calm down, we may look forward to his endorsement of Bitcoin once again, but nothing is truly certain. Still, despite his lack of direct Bitcoin-friendly initiatives, the legislature is still making positive moves in its own right. It seems very unlikely that Argentina will turn actively hostile to Bitcoin in the face of this inflation, such as with Nigeria’s crackdown amidst a lagging currency.

Ultimately, the future of Bitcoin in Argentina is up to the Bitcoiners themselves. Economic crisis has presented the community with record highs in adoption, and Bitcoin is well past a household name. Will this trend continue as the economy recovers? Will a fledgling community of Bitcoin-related businesses and developers end up transformed into a dynamic and profitable industry? There are too many variables to say for certain. Nevertheless, Bitcoin is a chaotic market that was itself founded in the wake of the United States’ own economic woes of the 2008 collapse. The worldwide community has displayed an innovative and enterprising spirit that can lead to success in even the most marginal situations. Bitcoin has been on the rise globally, in other words, and there’s no reason to doubt that it won’t keep rising in Argentina too.

bitcoin pandemic currencies cryptoUncategorized

Long Volatility Trade May Be A Widow-Maker No More

Long Volatility Trade May Be A Widow-Maker No More

Authored by Simon White, Bloomberg macro strategist,

An unusual combination of divergences…

Authored by Simon White, Bloomberg macro strategist,

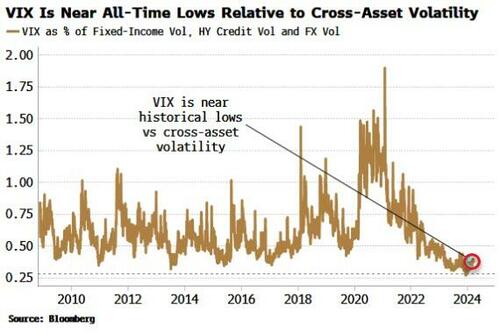

An unusual combination of divergences in the stock-market volatility space suggests the VIX is at elevated risk of pricing higher, and this may even happen with rising rather than falling equity prices. Volatility of volatility is near 10-year lows making call options on the VIX cheap.

Buying the VIX is the quintessential widow-maker trade. It is rare for the gauge to rise, with most of such instances over the last 20 years episodic and occurring when the market was falling. Most of the time, the market rises and volatility falls - there is an entire sub-industry devoted to exploiting and perpetuating this, which has swollen further in size in recent years with the boom in zero-days-to-expiry (0DTE) trading.

Not only is the VIX near its post-pandemic lows, it has also never been more out of step with cross-asset volatility – FX, fixed-income and credit (which is saying something as FX and credit vol are themselves near historic lows).

Markets are interlinked: rates impact stock valuations, high-yield credit sits just above equity in the capital structure, and so on. The question is how long can equity volatility remain the relative outlier?

There’s always a risk of becoming the next widow, but there are enough factors in play to suggest a heightened risk of a rise in the VIX.

Three trends suggest that a turning point in equity volatility is near:

-

Divergence between the VIX and skew structure;

-

Implied and realized correlation nearing their effective lower bound; and

-

Stresses in state-by-state US unemployment.

The market has become increasingly bullish in recent months, especially so after making new highs. That’s led to leveraged market chasing – call buying – and reduced hedging activity, i.e. less put buying. The rally chasing spurred some truly epic moves in the call skew of certain sectors. The metals and mining and staples sectors saw the biggest rises in their call skews, with both hitting series highs.

However, since 2020, it’s the relationship between call and put skew that’s tracked the VIX almost perfectly, with the index typically falling when call skew is outpacing put skew. In other words, when there is more leveraged activity in calls relative to puts, the VIX tends to be repressed (the VIX is a weighted-average of implied volatility in the S&P across all strikes).

Now, though, put skew is outperforming call skew. As the chart above shows, that typically coincides with a rising VIX.

At the same time, the realized and implied correlation of the S&P is very depressed. Realized correlation is close to going below 10%, a level it rarely breaches, and when it does it is typically followed by a sharp move higher. Moreover, implied correlation - so called as it is implied from the Markowitz portfolio model - has never been lower.

Correlation is being driven lower by the dominance of the largest stocks and by dispersion selling. The latter involves selling volatility on the index versus buying vol on individual stocks. As the Magnificent Seven - or whatever your favored cohort of AI-related stocks is - drive higher, the dispersion selling has the effect of pinning the index. The biggest stocks go up, while the rest are impaired by how much they can move, pushing correlation down.

In theory, index correlation could go negative, but it has never happened. The reason is that stocks are not completely random and are driven by common macro-based factors, such as interest rates. Correlation is thus so low today that it can only really go one way, and when it does, history shows the move is likely to be abrupt. Something has to give.

It’s not only the market sounding a warning about stock-market vol, but the economy too. A fairly reliable indication of rising equity volatility has been when we see a number of US states experiencing stress in their employment markets at the same time.

The chart below shows the percentage of US states whose unemployment rate is higher over the past year. As we can see, while increases in equity vol don’t always coincide with rising state unemployment, almost all the spikes higher in the percentage of states experiencing worsening unemployment coincide with episodes of higher VIX.

Today is - so far, along with the mid 1990s - an outlier, with more than half of US states seeing rising unemployment while the VIX remains near its lows.

There is a proviso here. The household survey, from which the unemployment rate is derived, may be under-reporting employment growth due to underestimating immigration. A recent Brookings paper suggests that the household survey is using too low an estimate for the civilian population, which could well explain its divergence from the establishment survey (payrolls). It might also bias state unemployment rates too high if estimates of the size of the workforce are too low.

Nonetheless, this measure bears close scrutiny, especially in confluence with the endogenous market-based signs of higher equity vol mentioned above.

Being long volatility is rarely comfortable. Given the structure of the market, the path of least resistance is down. This also means the volatility curve is typically steep – as it is today – meaning an investor wears negative carry to hold the position. One way to mitigate this is through call options on the VIX. These are relatively cheap, with the VVIX – the vol of vol – near 10-year lows.

The reflex is to expect higher equity vol to come with lower stock prices. But the two had a positive correlation for much of the second half of the 1990s. The current backdrop of still-supportive liquidity, a non-recessionary economy and investor call buying could lead to a situation of rising volatility and higher equity prices. That might make long volatility trades a less likely money-losing proposition.

-

Spread & Containment2 weeks ago

Spread & Containment2 weeks agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

Uncategorized1 month ago

Uncategorized1 month agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International3 weeks ago

International3 weeks agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

International5 days ago

International5 days agoParexel CEO to retire; CAR-T maker AffyImmune promotes business leader to chief executive

-

Uncategorized1 month ago

Uncategorized1 month agoApparel Retailer Express Moving Toward Bankruptcy

-

International3 weeks ago

International3 weeks agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized1 month ago

Uncategorized1 month agoKey Events This Week: All Eyes On Core PCE Amid Deluge Of Fed Speakers

-

Uncategorized1 month ago

Uncategorized1 month agoA Blue State Exodus: Who Can Afford To Be A Liberal