Uncategorized

Wire bonder equipment market size to increase by USD 219.24 million: APAC will account for 84% of the market’s growth during the forecast period – Technavio

Wire bonder equipment market size to increase by USD 219.24 million: APAC will account for 84% of the market’s growth during the forecast period – Technavio

PR Newswire

NEW YORK, Feb. 1, 2023

NEW YORK, Feb. 1, 2023 /PRNewswire/ — The Wire Bonder E…

Wire bonder equipment market size to increase by USD 219.24 million: APAC will account for 84% of the market's growth during the forecast period - Technavio

PR Newswire

NEW YORK, Feb. 1, 2023

NEW YORK, Feb. 1, 2023 /PRNewswire/ -- The Wire Bonder Equipment Market by Product, End-user and Geography - Forecast and Analysis 2023-2027 report has been published by Technavio. Market growth is estimated to accelerate at a CAGR of 3.3% and register an incremental growth of USD 219.24 million during the forecast period. The report provides a comprehensive analysis of growth opportunities at regional levels, new product launches, the latest trends, and the post-pandemic recovery of the global market. Download a PDF Sample Report.

Regional Analysis

By region, the global wire bonder equipment market is segmented into APAC, North America, Europe, South America, and Middle East and Africa. APAC will account for 84% of the market's growth during the forecast period. The setting up of new semiconductor manufacturing facilities is driving the growth of the regional market.

Company Profiles

The wire bonder equipment market report includes information on the key products and recent developments of leading vendors, including:

- BE Semiconductor Industries NV: The company offers wire bonder equipment such as datacom 2200 Evo.

- Corintech Ltd: The company offers wire bonder equipment such as ASM AB350 automatic wire bonder.

- DIAS Automation HK Ltd: The company offers wire bonder equipment such as RB 630 ultrasonic wire bonder.

- F & K DELVOTEC Bondtechnik GmbH: The company offers wire bonder equipment such as F and K M17 series.

- F & S BONDTEC Semiconductor GmbH: The company offers wire bonder equipment such as series 53, series 58 and series 86 wire bonders.

- Hesse GmbH

- HYBOND Inc.

- Kulicke and Soffa Industries Inc.

- Micro Point Pro Ltd.

- Palomar Technologies Inc.

- Powertech Technology Inc.

- Toray Industries Inc.

- To gain access to more vendor profiles available with Technavio, buy the report!

Market Dynamics

The market is driven by factors such as rising electronics production across the world, rising electronic content in automobiles, and an increase in the number of OSAT vendors. However, the shortage of skilled and trained personnel is hindering the market growth.

Competitive analysis

The competitive scenario categorizes companies based on various performance indicators. Some of the factors considered include the financial performance of companies over the past few years, growth strategies, product innovations, new product launches, investments, and growth in market share, among others. Request a Sample

Market segmentation

- By product, the market is segmented into ball bonders, stud-bump bonders, and wedge bonders. The ball bonders segment accounted for the largest share of the market.

- By geography, the market is segmented into APAC, North America, Europe, South America, and Middle East and Africa. APAC held the largest share of the market.

Related Reports:

Semiconductor IP Market by Application, End-user, Form Factor, and Geography - Forecast and Analysis 2023-2027: The semiconductor IP market is estimated to grow at a CAGR of 5.91% between 2022 and 2027. The size of the market is forecast to increase by USD 1,978.77 million. The growing demand for mobile computing devices is notably driving the market growth, although factors such as integration and verification problems of semiconductor IP may impede the market growth.

Blue Laser Diode Market by Type, Application, and Geography - Forecast and Analysis 2023-2027: The blue laser diode market is estimated to grow at a CAGR of 13.48% between 2022 and 2027. The size of the market is forecast to increase by USD 257.25 million. The advances in laser projectors are notably driving the market growth, although factors such as the declining demand for Blu-ray disc players and DVD players may impede the market growth.

Technavio's library includes over 17,000+ reports, covering more than 2,000 emerging technologies. Subscribe to our "Basic Plan" at just USD 5,000 and get lifetime access to Technavio Insights

What are the key data covered in this wire bonder equipment market report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the growth of the wire bonder equipment market between 2023 and 2027

- Precise estimation of the size of the wire bonder equipment market and its contribution to the parent market

- Accurate predictions about upcoming trends and changes in consumer behavior

- Growth of the wire bonder equipment market across APAC, North America, Europe, South America, and Middle East and Africa

- A thorough analysis of the market's competitive landscape and detailed information about vendors

- Comprehensive analysis of factors that will challenge the growth of wire bonder equipment market vendors

Wire Bonder Equipment Market Scope | |

Report Coverage | Details |

Page number | 158 |

Base year | 2022 |

Historic period | 2017-2021 |

Forecast period | 2023-2027 |

Growth momentum & CAGR | Accelerate at a CAGR of 3.3% |

Market growth 2023-2027 | USD 219.24 million |

Market structure | Fragmented |

YoY growth 2022-2023 (%) | 3.1 |

Regional analysis | APAC, North America, Europe, South America, and Middle East and Africa |

Performing market contribution | APAC at 84% |

Key countries | US, China, Japan, India, and Germany |

Competitive landscape | Leading Vendors, Market Positioning of Vendors, Competitive Strategies, and Industry Risks |

Key companies profiled | Accelonix Ltd., ASM Pacific Technology Ltd., BE Semiconductor Industries NV, Bergen Group, Cirexx International, Corintech Ltd., DIAS Automation HK Ltd., F and K DELVOTEC Bondtechnik GmbH, F and S BONDTEC Semiconductor GmbH, Hesse GmbH, HYBOND Inc., Kulicke and Soffa Industries Inc., Micro Point Pro Ltd., Palomar Technologies Inc., Powertech Technology Inc., Toray Industries Inc., TPT Wirebonder GmbH and Co. KG, Ultrasonic Engineering Co. Ltd, WestBond Inc., and Yamaha Motor Co. Ltd. |

Market dynamics | Parent Market Analysis; Market growth inducers and obstacles; Fast-growing and slow-growing segment analysis for the forecast period |

Customization purview | If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

Browse for Technavio "Information Technology" Research Reports

Table of Contents

1 Executive Summary

- 1.1 Market overview

- Exhibit 01: Executive Summary – Chart on Market Overview

- Exhibit 02: Executive Summary – Data Table on Market Overview

- Exhibit 03: Executive Summary – Chart on Global Market Characteristics

- Exhibit 04: Executive Summary – Chart on Market by Geography

- Exhibit 05: Executive Summary – Chart on Market Segmentation by Product

- Exhibit 06: Executive Summary – Chart on Market Segmentation by End-user

- Exhibit 07: Executive Summary – Chart on Incremental Growth

- Exhibit 08: Executive Summary – Data Table on Incremental Growth

- Exhibit 09: Executive Summary – Chart on Vendor Market Positioning

2 Market Landscape

- 2.1 Market ecosystem

- Exhibit 10: Parent market

- Exhibit 11: Market Characteristics

3 Market Sizing

- 3.1 Market definition

- Exhibit 12: Offerings of vendors included in the market definition

- 3.2 Market segment analysis

- Exhibit 13: Market segments

- 3.3 Market size 2022

- 3.4 Market outlook: Forecast for 2022-2027

- Exhibit 14: Chart on Global - Market size and forecast 2022-2027 ($ million)

- Exhibit 15: Data Table on Global - Market size and forecast 2022-2027 ($ million)

- Exhibit 16: Chart on Global Market: Year-over-year growth 2022-2027 (%)

- Exhibit 17: Data Table on Global Market: Year-over-year growth 2022-2027 (%)

4 Historic Market Size

- 4.1 Global wire bonder equipment market 2017 - 2021

- Exhibit 18: Historic Market Size – Data Table on Global wire bonder equipment market 2017 - 2021 ($ million)

- 4.2 Product Segment Analysis 2017 - 2021

- Exhibit 19: Historic Market Size – Product Segment 2017 - 2021 ($ million)

- 4.3 End-user Segment Analysis 2017 - 2021

- Exhibit 20: Historic Market Size – End-user Segment 2017 - 2021 ($ million)

- 4.4 Geography Segment Analysis 2017 - 2021

- Exhibit 21: Historic Market Size – Geography Segment 2017 - 2021 ($ million)

- 4.5 Country Segment Analysis 2017 - 2021

- Exhibit 22: Historic Market Size – Country Segment 2017 - 2021 ($ million)

5 Five Forces Analysis

- 5.1 Five forces summary

- Exhibit 23: Five forces analysis - Comparison between 2022 and 2027

- 5.2 Bargaining power of buyers

- Exhibit 24: Chart on Bargaining power of buyers – Impact of key factors 2022 and 2027

- 5.3 Bargaining power of suppliers

- Exhibit 25: Bargaining power of suppliers – Impact of key factors in 2022 and 2027

- 5.4 Threat of new entrants

- Exhibit 26: Threat of new entrants – Impact of key factors in 2022 and 2027

- 5.5 Threat of substitutes

- Exhibit 27: Threat of substitutes – Impact of key factors in 2022 and 2027

- 5.6 Threat of rivalry

- Exhibit 28: Threat of rivalry – Impact of key factors in 2022 and 2027

- 5.7 Market condition

- Exhibit 29: Chart on Market condition - Five forces 2022 and 2027

6 Market Segmentation by Product

- 6.1 Market segments

- Exhibit 30: Chart on Product - Market share 2022-2027 (%)

- Exhibit 31: Data Table on Product - Market share 2022-2027 (%)

- 6.2 Comparison by Product

- Exhibit 32: Chart on Comparison by Product

- Exhibit 33: Data Table on Comparison by Product

- 6.3 Ball bonders - Market size and forecast 2022-2027

- Exhibit 34: Chart on Ball bonders - Market size and forecast 2022-2027 ($ million)

- Exhibit 35: Data Table on Ball bonders - Market size and forecast 2022-2027 ($ million)

- Exhibit 36: Chart on Ball bonders - Year-over-year growth 2022-2027 (%)

- Exhibit 37: Data Table on Ball bonders - Year-over-year growth 2022-2027 (%)

- 6.4 Stud-bump bonders - Market size and forecast 2022-2027

- Exhibit 38: Chart on Stud-bump bonders - Market size and forecast 2022-2027 ($ million)

- Exhibit 39: Data Table on Stud-bump bonders - Market size and forecast 2022-2027 ($ million)

- Exhibit 40: Chart on Stud-bump bonders - Year-over-year growth 2022-2027 (%)

- Exhibit 41: Data Table on Stud-bump bonders - Year-over-year growth 2022-2027 (%)

- 6.5 Wedge bonders - Market size and forecast 2022-2027

- Exhibit 42: Chart on Wedge bonders - Market size and forecast 2022-2027 ($ million)

- Exhibit 43: Data Table on Wedge bonders - Market size and forecast 2022-2027 ($ million)

- Exhibit 44: Chart on Wedge bonders - Year-over-year growth 2022-2027 (%)

- Exhibit 45: Data Table on Wedge bonders - Year-over-year growth 2022-2027 (%)

- 6.6 Market opportunity by Product

- Exhibit 46: Market opportunity by Product ($ million)

7 Market Segmentation by End-user

- 7.1 Market segments

- Exhibit 47: Chart on End-user - Market share 2022-2027 (%)

- Exhibit 48: Data Table on End-user - Market share 2022-2027 (%)

- 7.2 Comparison by End-user

- Exhibit 49: Chart on Comparison by End-user

- Exhibit 50: Data Table on Comparison by End-user

- 7.3 OSAT - Market size and forecast 2022-2027

- Exhibit 51: Chart on OSAT - Market size and forecast 2022-2027 ($ million)

- Exhibit 52: Data Table on OSAT - Market size and forecast 2022-2027 ($ million)

- Exhibit 53: Chart on OSAT - Year-over-year growth 2022-2027 (%)

- Exhibit 54: Data Table on OSAT - Year-over-year growth 2022-2027 (%)

- 7.4 IDM - Market size and forecast 2022-2027

- Exhibit 55: Chart on IDM - Market size and forecast 2022-2027 ($ million)

- Exhibit 56: Data Table on IDM - Market size and forecast 2022-2027 ($ million)

- Exhibit 57: Chart on IDM - Year-over-year growth 2022-2027 (%)

- Exhibit 58: Data Table on IDM - Year-over-year growth 2022-2027 (%)

- 7.5 Market opportunity by End-user

- Exhibit 59: Market opportunity by End-user ($ million)

8 Customer Landscape

- 8.1 Customer landscape overview

- Exhibit 60: Analysis of price sensitivity, lifecycle, customer purchase basket, adoption rates, and purchase criteria

9 Geographic Landscape

- 9.1 Geographic segmentation

- Exhibit 61: Chart on Market share by geography 2022-2027 (%)

- Exhibit 62: Data Table on Market share by geography 2022-2027 (%)

- 9.2 Geographic comparison

- Exhibit 63: Chart on Geographic comparison

- Exhibit 64: Data Table on Geographic comparison

- 9.3 APAC - Market size and forecast 2022-2027

- Exhibit 65: Chart on APAC - Market size and forecast 2022-2027 ($ million)

- Exhibit 66: Data Table on APAC - Market size and forecast 2022-2027 ($ million)

- Exhibit 67: Chart on APAC - Year-over-year growth 2022-2027 (%)

- Exhibit 68: Data Table on APAC - Year-over-year growth 2022-2027 (%)

- 9.4 North America - Market size and forecast 2022-2027

- Exhibit 69: Chart on North America - Market size and forecast 2022-2027 ($ million)

- Exhibit 70: Data Table on North America - Market size and forecast 2022-2027 ($ million)

- Exhibit 71: Chart on North America - Year-over-year growth 2022-2027 (%)

- Exhibit 72: Data Table on North America - Year-over-year growth 2022-2027 (%)

- 9.5 Europe - Market size and forecast 2022-2027

- Exhibit 73: Chart on Europe - Market size and forecast 2022-2027 ($ million)

- Exhibit 74: Data Table on Europe - Market size and forecast 2022-2027 ($ million)

- Exhibit 75: Chart on Europe - Year-over-year growth 2022-2027 (%)

- Exhibit 76: Data Table on Europe - Year-over-year growth 2022-2027 (%)

- 9.6 South America - Market size and forecast 2022-2027

- Exhibit 77: Chart on South America - Market size and forecast 2022-2027 ($ million)

- Exhibit 78: Data Table on South America - Market size and forecast 2022-2027 ($ million)

- Exhibit 79: Chart on South America - Year-over-year growth 2022-2027 (%)

- Exhibit 80: Data Table on South America - Year-over-year growth 2022-2027 (%)

- 9.7 Middle East and Africa - Market size and forecast 2022-2027

- Exhibit 81: Chart on Middle East and Africa - Market size and forecast 2022-2027 ($ million)

- Exhibit 82: Data Table on Middle East and Africa - Market size and forecast 2022-2027 ($ million)

- Exhibit 83: Chart on Middle East and Africa - Year-over-year growth 2022-2027 (%)

- Exhibit 84: Data Table on Middle East and Africa - Year-over-year growth 2022-2027 (%)

- 9.8 China - Market size and forecast 2022-2027

- Exhibit 85: Chart on China - Market size and forecast 2022-2027 ($ million)

- Exhibit 86: Data Table on China - Market size and forecast 2022-2027 ($ million)

- Exhibit 87: Chart on China - Year-over-year growth 2022-2027 (%)

- Exhibit 88: Data Table on China - Year-over-year growth 2022-2027 (%)

- 9.9 US - Market size and forecast 2022-2027

- Exhibit 89: Chart on US - Market size and forecast 2022-2027 ($ million)

- Exhibit 90: Data Table on US - Market size and forecast 2022-2027 ($ million)

- Exhibit 91: Chart on US - Year-over-year growth 2022-2027 (%)

- Exhibit 92: Data Table on US - Year-over-year growth 2022-2027 (%)

- 9.10 Japan - Market size and forecast 2022-2027

- Exhibit 93: Chart on Japan - Market size and forecast 2022-2027 ($ million)

- Exhibit 94: Data Table on Japan - Market size and forecast 2022-2027 ($ million)

- Exhibit 95: Chart on Japan - Year-over-year growth 2022-2027 (%)

- Exhibit 96: Data Table on Japan - Year-over-year growth 2022-2027 (%)

- 9.11 India - Market size and forecast 2022-2027

- Exhibit 97: Chart on India - Market size and forecast 2022-2027 ($ million)

- Exhibit 98: Data Table on India - Market size and forecast 2022-2027 ($ million)

- Exhibit 99: Chart on India - Year-over-year growth 2022-2027 (%)

- Exhibit 100: Data Table on India - Year-over-year growth 2022-2027 (%)

- 9.12 Germany - Market size and forecast 2022-2027

- Exhibit 101: Chart on Germany - Market size and forecast 2022-2027 ($ million)

- Exhibit 102: Data Table on Germany - Market size and forecast 2022-2027 ($ million)

- Exhibit 103: Chart on Germany - Year-over-year growth 2022-2027 (%)

- Exhibit 104: Data Table on Germany - Year-over-year growth 2022-2027 (%)

- 9.13 Market opportunity by geography

- Exhibit 105: Market opportunity by geography ($ million)

10 Drivers, Challenges, and Trends

- 10.1 Market drivers

- 10.2 Market challenges

- 10.3 Impact of drivers and challenges

- Exhibit 106: Impact of drivers and challenges in 2022 and 2027

- 10.4 Market trends

11 Vendor Landscape

- 11.1 Overview

- 11.2 Vendor landscape

- Exhibit 107: Overview on Criticality of inputs and Factors of differentiation

- 11.3 Landscape disruption

- Exhibit 108: Overview on factors of disruption

- 11.4 Industry risks

- Exhibit 109: Impact of key risks on business

12 Vendor Analysis

- 12.1 Vendors covered

- Exhibit 110: Vendors covered

- 12.2 Market positioning of vendors

- Exhibit 111: Matrix on vendor position and classification

- 12.3 ASM Pacific Technology Ltd.

- Exhibit 112: ASM Pacific Technology Ltd. - Overview

- Exhibit 113: ASM Pacific Technology Ltd. - Business segments

- Exhibit 114: ASM Pacific Technology Ltd. - Key offerings

- Exhibit 115: ASM Pacific Technology Ltd. - Segment focus

- 12.4 BE Semiconductor Industries NV

- Exhibit 116: BE Semiconductor Industries NV - Overview

- Exhibit 117: BE Semiconductor Industries NV - Business segments

- Exhibit 118: BE Semiconductor Industries NV - Key offerings

- Exhibit 119: BE Semiconductor Industries NV - Segment focus

- 12.5 Corintech Ltd.

- Exhibit 120: Corintech Ltd. - Overview

- Exhibit 121: Corintech Ltd. - Product / Service

- Exhibit 122: Corintech Ltd. - Key offerings

- 12.6 DIAS Automation HK Ltd.

- Exhibit 123: DIAS Automation HK Ltd. - Overview

- Exhibit 124: DIAS Automation HK Ltd. - Product / Service

- Exhibit 125: DIAS Automation HK Ltd. - Key offerings

- 12.7 F and K DELVOTEC Bondtechnik GmbH

- Exhibit 126: F and K DELVOTEC Bondtechnik GmbH - Overview

- Exhibit 127: F and K DELVOTEC Bondtechnik GmbH - Product / Service

- Exhibit 128: F and K DELVOTEC Bondtechnik GmbH - Key offerings

- 12.8 F and S BONDTEC Semiconductor GmbH

- Exhibit 129: F and S BONDTEC Semiconductor GmbH - Overview

- Exhibit 130: F and S BONDTEC Semiconductor GmbH - Product / Service

- Exhibit 131: F and S BONDTEC Semiconductor GmbH - Key offerings

- 12.9 Hesse GmbH

- Exhibit 132: Hesse GmbH - Overview

- Exhibit 133: Hesse GmbH - Product / Service

- Exhibit 134: Hesse GmbH - Key offerings

- 12.10 HYBOND Inc.

- Exhibit 135: HYBOND Inc. - Overview

- Exhibit 136: HYBOND Inc. - Product / Service

- Exhibit 137: HYBOND Inc. - Key offerings

- 12.11 Kulicke and Soffa Industries Inc.

- Exhibit 138: Kulicke and Soffa Industries Inc. - Overview

- Exhibit 139: Kulicke and Soffa Industries Inc. - Business segments

- Exhibit 140: Kulicke and Soffa Industries Inc. - Key offerings

- Exhibit 141: Kulicke and Soffa Industries Inc. - Segment focus

- 12.12 Micro Point Pro Ltd.

- Exhibit 142: Micro Point Pro Ltd. - Overview

- Exhibit 143: Micro Point Pro Ltd. - Product / Service

- Exhibit 144: Micro Point Pro Ltd. - Key offerings

- 12.13 Palomar Technologies Inc.

- Exhibit 145: Palomar Technologies Inc. - Overview

- Exhibit 146: Palomar Technologies Inc. - Product / Service

- Exhibit 147: Palomar Technologies Inc. - Key offerings

- 12.14 Toray Industries Inc.

- Exhibit 148: Toray Industries Inc. - Overview

- Exhibit 149: Toray Industries Inc. - Business segments

- Exhibit 150: Toray Industries Inc. - Key offerings

- Exhibit 151: Toray Industries Inc. - Segment focus

- 12.15 TPT Wirebonder GmbH and Co. KG

- Exhibit 152: TPT Wirebonder GmbH and Co. KG - Overview

- Exhibit 153: TPT Wirebonder GmbH and Co. KG - Product / Service

- Exhibit 154: TPT Wirebonder GmbH and Co. KG - Key offerings

- 12.16 WestBond Inc.

- Exhibit 155: WestBond Inc. - Overview

- Exhibit 156: WestBond Inc. - Product / Service

- Exhibit 157: WestBond Inc. - Key offerings

- 12.17 Yamaha Motor Co. Ltd.

- Exhibit 158: Yamaha Motor Co. Ltd. - Overview

- Exhibit 159: Yamaha Motor Co. Ltd. - Business segments

- Exhibit 160: Yamaha Motor Co. Ltd. - Key news

- Exhibit 161: Yamaha Motor Co. Ltd. - Key offerings

- Exhibit 162: Yamaha Motor Co. Ltd. - Segment focus

13 Appendix

- 13.1 Scope of the report

- 13.2 Inclusions and exclusions checklist

- Exhibit 163: Inclusions checklist

- Exhibit 164: Exclusions checklist

- 13.3 Currency conversion rates for US$

- Exhibit 165: Currency conversion rates for US$

- 13.4 Research methodology

- Exhibit 166: Research methodology

- Exhibit 167: Validation techniques employed for market sizing

- Exhibit 168: Information sources

- 13.5 List of abbreviations

- Exhibit 169: List of abbreviations

Technavio is a leading global technology research and advisory company. Their research and analysis focus on emerging market trends and provides actionable insights to help businesses identify market opportunities and develop effective strategies to optimize their market positions. With over 500 specialized analysts, Technavio's report library consists of more than 17,000 reports and counting, covering 800 technologies, spanning across 50 countries. Their client base consists of enterprises of all sizes, including more than 100 Fortune 500 companies. This growing client base relies on Technavio's comprehensive coverage, extensive research, and actionable market insights to identify opportunities in existing and potential markets and assess their competitive positions within changing market scenarios.

Contact

Technavio Research

Jesse Maida

Media & Marketing Executive

US: +1 844 364 1100

UK: +44 203 893 3200

Email: media@technavio.com

Website: www.technavio.com/

View original content to download multimedia:https://www.prnewswire.com/news-releases/wire-bonder-equipment-market-size-to-increase-by-usd-219-24-million-apac-will-account-for-84-of-the-markets-growth-during-the-forecast-period---technavio-301734389.html

SOURCE Technavio

Uncategorized

Mortgage rates fall as labor market normalizes

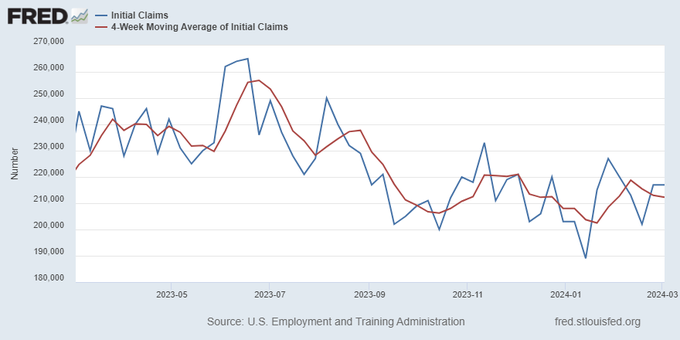

Jobless claims show an expanding economy. We will only be in a recession once jobless claims exceed 323,000 on a four-week moving average.

Everyone was waiting to see if this week’s jobs report would send mortgage rates higher, which is what happened last month. Instead, the 10-year yield had a muted response after the headline number beat estimates, but we have negative job revisions from previous months. The Federal Reserve’s fear of wage growth spiraling out of control hasn’t materialized for over two years now and the unemployment rate ticked up to 3.9%. For now, we can say the labor market isn’t tight anymore, but it’s also not breaking.

The key labor data line in this expansion is the weekly jobless claims report. Jobless claims show an expanding economy that has not lost jobs yet. We will only be in a recession once jobless claims exceed 323,000 on a four-week moving average.

From the Fed: In the week ended March 2, initial claims for unemployment insurance benefits were flat, at 217,000. The four-week moving average declined slightly by 750, to 212,250

Below is an explanation of how we got here with the labor market, which all started during COVID-19.

1. I wrote the COVID-19 recovery model on April 7, 2020, and retired it on Dec. 9, 2020. By that time, the upfront recovery phase was done, and I needed to model out when we would get the jobs lost back.

2. Early in the labor market recovery, when we saw weaker job reports, I doubled and tripled down on my assertion that job openings would get to 10 million in this recovery. Job openings rose as high as to 12 million and are currently over 9 million. Even with the massive miss on a job report in May 2021, I didn’t waver.

Currently, the jobs openings, quit percentage and hires data are below pre-COVID-19 levels, which means the labor market isn’t as tight as it once was, and this is why the employment cost index has been slowing data to move along the quits percentage.

3. I wrote that we should get back all the jobs lost to COVID-19 by September of 2022. At the time this would be a speedy labor market recovery, and it happened on schedule, too

Total employment data

4. This is the key one for right now: If COVID-19 hadn’t happened, we would have between 157 million and 159 million jobs today, which would have been in line with the job growth rate in February 2020. Today, we are at 157,808,000. This is important because job growth should be cooling down now. We are more in line with where the labor market should be when averaging 140K-165K monthly. So for now, the fact that we aren’t trending between 140K-165K means we still have a bit more recovery kick left before we get down to those levels.

From BLS: Total nonfarm payroll employment rose by 275,000 in February, and the unemployment rate increased to 3.9 percent, the U.S. Bureau of Labor Statistics reported today. Job gains occurred in health care, in government, in food services and drinking places, in social assistance, and in transportation and warehousing.

Here are the jobs that were created and lost in the previous month:

In this jobs report, the unemployment rate for education levels looks like this:

- Less than a high school diploma: 6.1%

- High school graduate and no college: 4.2%

- Some college or associate degree: 3.1%

- Bachelor’s degree or higher: 2.2%

Today’s report has continued the trend of the labor data beating my expectations, only because I am looking for the jobs data to slow down to a level of 140K-165K, which hasn’t happened yet. I wouldn’t categorize the labor market as being tight anymore because of the quits ratio and the hires data in the job openings report. This also shows itself in the employment cost index as well. These are key data lines for the Fed and the reason we are going to see three rate cuts this year.

recession unemployment covid-19 fed federal reserve mortgage rates recession recovery unemploymentUncategorized

Inside The Most Ridiculous Jobs Report In History: Record 1.2 Million Immigrant Jobs Added In One Month

Inside The Most Ridiculous Jobs Report In History: Record 1.2 Million Immigrant Jobs Added In One Month

Last month we though that the January…

Last month we though that the January jobs report was the "most ridiculous in recent history" but, boy, were we wrong because this morning the Biden department of goalseeked propaganda (aka BLS) published the February jobs report, and holy crap was that something else. Even Goebbels would blush.

What happened? Let's take a closer look.

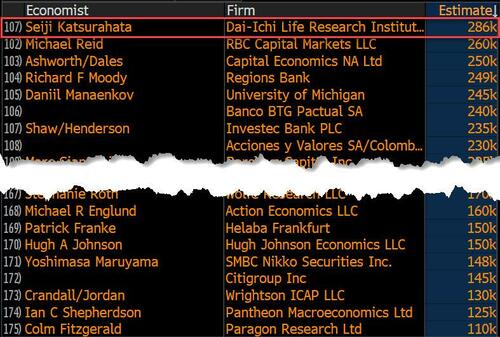

On the surface, it was (almost) another blockbuster jobs report, certainly one which nobody expected, or rather just one bank out of 76 expected. Starting at the top, the BLS reported that in February the US unexpectedly added 275K jobs, with just one research analyst (from Dai-Ichi Research) expecting a higher number.

Some context: after last month's record 4-sigma beat, today's print was "only" 3 sigma higher than estimates. Needless to say, two multiple sigma beats in a row used to only happen in the USSR... and now in the US, apparently.

Before we go any further, a quick note on what last month we said was "the most ridiculous jobs report in recent history": it appears the BLS read our comments and decided to stop beclowing itself. It did that by slashing last month's ridiculous print by over a third, and revising what was originally reported as a massive 353K beat to just 229K, a 124K revision, which was the biggest one-month negative revision in two years!

Of course, that does not mean that this month's jobs print won't be revised lower: it will be, and not just that month but every other month until the November election because that's the only tool left in the Biden admin's box: pretend the economic and jobs are strong, then revise them sharply lower the next month, something we pointed out first last summer and which has not failed to disappoint once.

In the past month the Biden department of goalseeking stuff higher before revising it lower, has revised the following data sharply lower:

— zerohedge (@zerohedge) August 30, 2023

- Jobs

- JOLTS

- New Home sales

- Housing Starts and Permits

- Industrial Production

- PCE and core PCE

To be fair, not every aspect of the jobs report was stellar (after all, the BLS had to give it some vague credibility). Take the unemployment rate, after flatlining between 3.4% and 3.8% for two years - and thus denying expectations from Sahm's Rule that a recession may have already started - in February the unemployment rate unexpectedly jumped to 3.9%, the highest since February 2022 (with Black unemployment spiking by 0.3% to 5.6%, an indicator which the Biden admin will quickly slam as widespread economic racism or something).

And then there were average hourly earnings, which after surging 0.6% MoM in January (since revised to 0.5%) and spooking markets that wage growth is so hot, the Fed will have no choice but to delay cuts, in February the number tumbled to just 0.1%, the lowest in two years...

... for one simple reason: last month's average wage surge had nothing to do with actual wages, and everything to do with the BLS estimate of hours worked (which is the denominator in the average wage calculation) which last month tumbled to just 34.1 (we were led to believe) the lowest since the covid pandemic...

... but has since been revised higher while the February print rose even more, to 34.3, hence why the latest average wage data was once again a product not of wages going up, but of how long Americans worked in any weekly period, in this case higher from 34.1 to 34.3, an increase which has a major impact on the average calculation.

While the above data points were examples of some latent weakness in the latest report, perhaps meant to give it a sheen of veracity, it was everything else in the report that was a problem starting with the BLS's latest choice of seasonal adjustments (after last month's wholesale revision), which have gone from merely laughable to full clownshow, as the following comparison between the monthly change in BLS and ADP payrolls shows. The trend is clear: the Biden admin numbers are now clearly rising even as the impartial ADP (which directly logs employment numbers at the company level and is far more accurate), shows an accelerating slowdown.

But it's more than just the Biden admin hanging its "success" on seasonal adjustments: when one digs deeper inside the jobs report, all sorts of ugly things emerge... such as the growing unprecedented divergence between the Establishment (payrolls) survey and much more accurate Household (actual employment) survey. To wit, while in January the BLS claims 275K payrolls were added, the Household survey found that the number of actually employed workers dropped for the third straight month (and 4 in the past 5), this time by 184K (from 161.152K to 160.968K).

This means that while the Payrolls series hits new all time highs every month since December 2020 (when according to the BLS the US had its last month of payrolls losses), the level of Employment has not budged in the past year. Worse, as shown in the chart below, such a gaping divergence has opened between the two series in the past 4 years, that the number of Employed workers would need to soar by 9 million (!) to catch up to what Payrolls claims is the employment situation.

There's more: shifting from a quantitative to a qualitative assessment, reveals just how ugly the composition of "new jobs" has been. Consider this: the BLS reports that in February 2024, the US had 132.9 million full-time jobs and 27.9 million part-time jobs. Well, that's great... until you look back one year and find that in February 2023 the US had 133.2 million full-time jobs, or more than it does one year later! And yes, all the job growth since then has been in part-time jobs, which have increased by 921K since February 2023 (from 27.020 million to 27.941 million).

Here is a summary of the labor composition in the past year: all the new jobs have been part-time jobs!

But wait there's even more, because now that the primary season is over and we enter the heart of election season and political talking points will be thrown around left and right, especially in the context of the immigration crisis created intentionally by the Biden administration which is hoping to import millions of new Democratic voters (maybe the US can hold the presidential election in Honduras or Guatemala, after all it is their citizens that will be illegally casting the key votes in November), what we find is that in February, the number of native-born workers tumbled again, sliding by a massive 560K to just 129.807 million. Add to this the December data, and we get a near-record 2.4 million plunge in native-born workers in just the past 3 months (only the covid crash was worse)!

The offset? A record 1.2 million foreign-born (read immigrants, both legal and illegal but mostly illegal) workers added in February!

Said otherwise, not only has all job creation in the past 6 years has been exclusively for foreign-born workers...

... but there has been zero job-creation for native born workers since June 2018!

This is a huge issue - especially at a time of an illegal alien flood at the southwest border...

... and is about to become a huge political scandal, because once the inevitable recession finally hits, there will be millions of furious unemployed Americans demanding a more accurate explanation for what happened - i.e., the illegal immigration floodgates that were opened by the Biden admin.

Which is also why Biden's handlers will do everything in their power to insure there is no official recession before November... and why after the election is over, all economic hell will finally break loose. Until then, however, expect the jobs numbers to get even more ridiculous.

Uncategorized

Economic Earthquake Ahead? The Cracks Are Spreading Fast

Economic Earthquake Ahead? The Cracks Are Spreading Fast

Authored by Brandon Smith via Alt-Market.us,

One of my favorite false narratives…

Authored by Brandon Smith via Alt-Market.us,

One of my favorite false narratives floating around corporate media platforms has been the argument that the American people “just don’t seem to understand how good the economy really is right now.” If only they would look at the stats, they would realize that we are in the middle of a financial renaissance, right? It must be that people have been brainwashed by negative press from conservative sources…

I have to laugh at this notion because it’s a very common one throughout history – it’s an assertion made by almost every single political regime right before a major collapse. These people always say the same things, and when you study economics as long as I have you can’t help but throw up your hands and marvel at their dedication to the propaganda.

One example that comes to mind immediately is the delusional optimism of the “roaring” 1920s and the lead up to the Great Depression. At the time around 60% of the U.S. population was living in poverty conditions (according to the metrics of the decade) earning less than $2000 a year. However, in the years after WWI ravaged Europe, America’s economic power was considered unrivaled.

The 1920s was an era of mass production and rampant consumerism but it was all fueled by easy access to debt, a condition which had not really existed before in America. It was this illusion of prosperity created by the unchecked application of credit that eventually led to the massive stock market bubble and the crash of 1929. This implosion, along with the Federal Reserve’s policy of raising interest rates into economic weakness, created a black hole in the U.S. financial system for over a decade.

There are two primary tools that various failing regimes will often use to distort the true conditions of the economy: Debt and inflation. In the case of America today, we are experiencing BOTH problems simultaneously and this has made certain economic indicators appear healthy when they are, in fact, highly unstable. The average American knows this is the case because they see the effects everyday. They see the damage to their wallets, to their buying power, in the jobs market and in their quality of life. This is why public faith in the economy has been stuck in the dregs since 2021.

The establishment can flash out-of-context stats in people’s faces, but they can’t force the populace to see a recovery that simply does not exist. Let’s go through a short list of the most faulty indicators and the real reasons why the fiscal picture is not a rosy as the media would like us to believe…

The “miracle” labor market recovery

In the case of the U.S. labor market, we have a clear example of distortion through inflation. The $8 trillion+ dropped on the economy in the first 18 months of the pandemic response sent the system over the edge into stagflation land. Helicopter money has a habit of doing two things very well: Blowing up a bubble in stock markets and blowing up a bubble in retail. Hence, the massive rush by Americans to go out and buy, followed by the sudden labor shortage and the race to hire (mostly for low wage part-time jobs).

The problem with this “miracle” is that inflation leads to price explosions, which we have already experienced. The average American is spending around 30% more for goods, services and housing compared to what they were spending in 2020. This is what happens when you have too much money chasing too few goods and limited production.

The jobs market looks great on paper, but the majority of jobs generated in the past few years are jobs that returned after the covid lockdowns ended. The rest are jobs created through monetary stimulus and the artificial retail rush. Part time low wage service sector jobs are not going to keep the country rolling for very long in a stagflation environment. The question is, what happens now that the stimulus punch bowl has been removed?

Just as we witnessed in the 1920s, Americans have turned to debt to make up for higher prices and stagnant wages by maxing out their credit cards. With the central bank keeping interest rates high, the credit safety net will soon falter. This condition also goes for businesses; the same businesses that will jump headlong into mass layoffs when they realize the party is over. It happened during the Great Depression and it will happen again today.

Cracks in the foundation

We saw cracks in the narrative of the financial structure in 2023 with the banking crisis, and without the Federal Reserve backstop policy many more small and medium banks would have dropped dead. The weakness of U.S. banks is offset by the relative strength of the U.S. dollar, which lures in foreign investors hoping to protect their wealth using dollar denominated assets.

But something is amiss. Gold and bitcoin have rocketed higher along with economically sensitive assets and the dollar. This is the opposite of what’s supposed to happen. Gold and BTC are supposed to be hedges against a weak dollar and a weak economy, right? If global faith in the dollar and in the U.S. economy is so high, why are investors diving into protective assets like gold?

Again, as noted above, inflation distorts everything.

Tens of trillions of extra dollars printed by the Fed are floating around and it’s no surprise that much of that cash is flooding into the economy which simply pushes higher right along with prices on the shelf. But, gold and bitcoin are telling us a more honest story about what’s really happening.

Right now, the U.S. government is adding around $600 billion per month to the national debt as the Fed holds rates higher to fight inflation. This debt is going to crush America’s financial standing for global investors who will eventually ask HOW the U.S. is going to handle that growing millstone? As I predicted years ago, the Fed has created a perfect Catch-22 scenario in which the U.S. must either return to rampant inflation, or, face a debt crisis. In either case, U.S. dollar-denominated assets will lose their appeal and their prices will plummet.

“Healthy” GDP is a complete farce

GDP is the most common out-of-context stat used by governments to convince the citizenry that all is well. It is yet another stat that is entirely manipulated by inflation. It is also manipulated by the way in which modern governments define “economic activity.”

GDP is primarily driven by spending. Meaning, the higher inflation goes, the higher prices go, and the higher GDP climbs (to a point). Eventually prices go too high, credit cards tap out and spending ceases. But, for a short time inflation makes GDP (as well as retail sales) look good.

Another factor that creates a bubble is the fact that government spending is actually included in the calculation of GDP. That’s right, every dollar of your tax money that the government wastes helps the establishment by propping up GDP numbers. This is why government spending increases will never stop – It’s too valuable for them to spend as a way to make the economy appear healthier than it is.

The REAL economy is eclipsing the fake economy

The bottom line is that Americans used to be able to ignore the warning signs because their bank accounts were not being directly affected. This is over. Now, every person in the country is dealing with a massive decline in buying power and higher prices across the board on everything – from food and fuel to housing and financial assets alike. Even the wealthy are seeing a compression to their profit and many are struggling to keep their businesses in the black.

The unfortunate truth is that the elections of 2024 will probably be the turning point at which the whole edifice comes tumbling down. Even if the public votes for change, the system is already broken and cannot be repaired without a complete overhaul.

We have consistently avoided taking our medicine and our disease has gotten worse and worse.

People have lost faith in the economy because they have not faced this kind of uncertainty since the 1930s. Even the stagflation crisis of the 1970s will likely pale in comparison to what is about to happen. On the bright side, at least a large number of Americans are aware of the threat, as opposed to the 1920s when the vast majority of people were utterly conned by the government, the banks and the media into thinking all was well. Knowing is the first step to preparing.

The second step is securing your own financial future – that’s where physical precious metals can play a role. Diversifying your savings with inflation-resistant, uninflatable assets whose intrinsic value doesn’t rely on a counterparty’s promise to pay adds resilience to your savings. That’s the main reason physical gold and silver have been the safe haven store-of-value assets of choice for centuries (among both the elite and the everyday citizen).

* * *

As the world moves away from dollars and toward Central Bank Digital Currencies (CBDCs), is your 401(k) or IRA really safe? A smart and conservative move is to diversify into a physical gold IRA. That way your savings will be in something solid and enduring. Get your FREE info kit on Gold IRAs from Birch Gold Group. No strings attached, just peace of mind. Click here to secure your future today.

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoIndustrial Production Decreased 0.1% in January

-

International15 hours ago

International15 hours agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges