“[…] chlorogenic acid appears to be a promising candidate for the management of osteoporosis.”

BUFFALO, NY- March 26, 2024 – A new research paper was published in Aging (listed by MEDLINE/PubMed as “Aging (Albany NY)” and “Aging-US” by Web of Science) Volume 16, Issue 5, entitled, “Chlorogenic acid prevents ovariectomized-induced bone loss by facilitating osteoblast functions and suppressing osteoclast formation.”

Osteoporosis is a common bone disease in aging populations, principally in postmenopausal women. Anti-resorptive and anabolic drugs have been applied to prevent and cure osteoporosis and are associated with different adverse effects. Du-Zhong is usually applied in Traditional Chinese Medicine to strengthen bone, regulate bone metabolism, and treat osteoporosis. Chlorogenic acid is a major polyphenol in Du-Zhong.

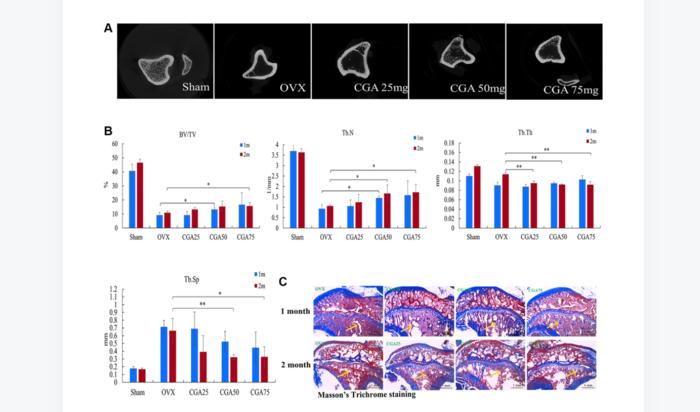

In this new study, researchers Chien-Yi Ho, Chih-Hsin Tang, Trung-Loc Ho, Wen-Ling Wang, and Chun-Hsu Yao from China Medical University, China Medical University Hospital and Asia University found chlorogenic acid to enhance osteoblast proliferation and differentiation. Chlorogenic acid also inhibited RANKL-induced osteoclastogenesis. Notably, ovariectomy significantly decreased bone volume and mechanical properties in the ovariectomized (OVX) rats. Administration of chlorogenic acid antagonized OVX-induced bone loss.

“Taken together, chlorogenic acid seems to be a hopeful molecule for the development of novel anti-osteoporosis treatment.”

Read the full paper: DOI: https://doi.org/10.18632/aging.205635

Corresponding Authors: Wen-Ling Wang, Chun-Hsu Yao

Corresponding Emails: supercocono1@mail.cmu.edu.tw, chyao@mail.cmu.edu.tw

Keywords: chlorogenic acid, osteoporosis, ovariectomized, osteoclast, osteoblast

Click here to sign up for free Altmetric alerts about this article.

About Aging:

Aging publishes research papers in all fields of aging research including but not limited, aging from yeast to mammals, cellular senescence, age-related diseases such as cancer and Alzheimer’s diseases and their prevention and treatment, anti-aging strategies and drug development and especially the role of signal transduction pathways such as mTOR in aging and potential approaches to modulate these signaling pathways to extend lifespan. The journal aims to promote treatment of age-related diseases by slowing down aging, validation of anti-aging drugs by treating age-related diseases, prevention of cancer by inhibiting aging. Cancer and COVID-19 are age-related diseases.

Aging is indexed by PubMed/Medline (abbreviated as “Aging (Albany NY)”), PubMed Central, Web of Science: Science Citation Index Expanded (abbreviated as “Aging‐US” and listed in the Cell Biology and Geriatrics & Gerontology categories), Scopus (abbreviated as “Aging” and listed in the Cell Biology and Aging categories), Biological Abstracts, BIOSIS Previews, EMBASE, META (Chan Zuckerberg Initiative) (2018-2022), and Dimensions (Digital Science).

Please visit our website at www.Aging-US.com and connect with us:

- X, formerly Twitter

- YouTube

- Spotify, and available wherever you listen to podcasts

Click here to subscribe to Aging publication updates.

For media inquiries, please contact media@impactjournals.com.

Aging (Aging-US) Journal Office

6666 E. Quaker Str., Suite 1B

Orchard Park, NY 14127

Phone: 1-800-922-0957, option 1

###

Journal

Aging-US

DOI

10.18632/aging.205635

Method of Research

Experimental study

Subject of Research

Cells

Article Title

Chlorogenic acid prevents ovariectomized-induced bone loss by facilitating osteoblast functions and suppressing osteoclast formation

Article Publication Date

9-Mar-2024