International

The Haven-Volatility Dog Has Not Yet Barked

The Haven-Volatility Dog Has Not Yet Barked

Authored by Simon White, Bloomberg macro strategist,

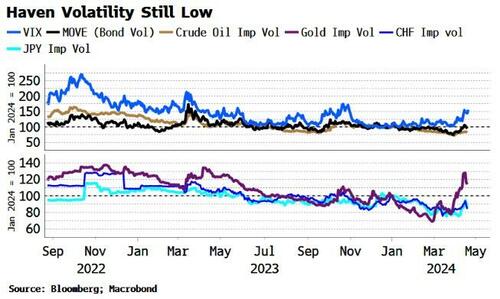

Implied volatility of traditional havens…

Authored by Simon White, Bloomberg macro strategist,

Implied volatility of traditional havens such as the Swiss franc and US Treasuries remains remarkably subdued despite the situation in the Middle East, even as the former has outperformed most other havens, including the dollar. However, vol is beginning to pick up, in a sign risks are beginning to be more fully priced in.

Volatility is typically episodic. Most of the time it is low or falling, but then punctuated by episodes of extreme fear when it spikes, before beginning to trend lower again. It is a good metaphor for human behavior: ignore a potential risk up until the last minute - either believing it’s not really a danger, or pretending it’s not there at all and hoping it will go away, i.e. the ostrich effect – and then panic when said risk does turn out to be major problem (the UK government’s response to the pandemic is a good example).

Recency bias perhaps explains why markets have been surprisingly calm in the face of the ratcheting up of tensions in the Middle East. The geopolitical backdrop across the world has been increasingly quarrelsome, but it has not so far led to a major multi-regional conflagration. With any luck that persists, but the generally still-contained volatility in most markets is perhaps not fully reflective of the underlying risks.

The chart below shows the implied volatility of bonds, the Swiss franc, the yen and crude oil has barely risen this year (all series are normalized to 100 at the start of the 2024).

We are seeing call skew in oil rising showing tail-risk probabilities are rising, even though at-the-money vol remains low.

The Swiss franc has been catching a bid, but that has so far not led to a significant marking up of its vols, while the yen is not acting as the haven it once did.

The VIX (blue line in top panel of chart) and gold volatility (purple line, bottom panel) have started to rise, but that has been more about inflation rather than geopolitical risks.

Generally, though, assets are not at panic stations, and therefore hedging portfolio risks is still cheap.

International

Walmart making major store changes in key areas

The super retailer will roll out further adaptations to modify the shopping experience.

If you've been paying attention to the news recently, you've probably noticed that the retail industry is fighting a public battle on seemingly all fronts.

A sharp consolidation of retailers was brought about thanks to the onset and after effects of the covid pandemic. When things shut down, customers put hobbies and other specialty interests on the back burner in favor of staying home.

Related: Amazon fixes a shopping problem for rival retailers

Many still carried on with their hobbies, like crafts, pets, and home improvement, but a lot of those supplies could be procured online for either a fraction of the cost or effort.

That meant stores that catered to those interests, like Joann Fabrics, Bed Bath & Beyond, Party City, and Petco are still reeling from a pullback in post pandemic spending and declining foot traffic.

Instead, some of the larger retailers, like Walmart (WMT) , Target (TGT) , and Amazon (AMZN) , have made up more than their share of ground. Already strong before covid and poised well financially to both scale up online operations and gobble up empty lots of brick and mortar space, the retail giants have enjoyed soaring success in the past four years.

Walmart struggles with common retail issue

But it hasn't all been easy for the retail giants. A drop off in the work force meant they suddenly had fewer employees to carry out essential operations duties, like manning the check out lines and assisting customers with returns and other questions.

Plus, an uptick in inventory shrink, or the retail term for loss of inventory due in part to theft, hit highs across the United States. Operating with a skeleton staff of already overworked retail employees, plus an increasingly dangerous work environment, meant retailers had to get creative and cut corners somewhere.

This often came in the form of self-checkout kiosks. Most retail giants had some form of self-service before the pandemic, but after shopping in person at superstores came roaring back to life, understaffed stores couldn't keep up with the crush of customers. So many scaled up their self-checkout capabilities, offering customers the opportunity to scan their own items and save time waiting in line.

But self-checkout is a slippery slope. Sure, it frees up employees to focus on other essential duties, but the kiosks aren't exactly foolproof, and soon customers were both purposefully and accidentally forgetting to ring up their items. This obviously led to an uptick in shrink, and many customers grew frustrated with the cumbersome process.

Target began limiting self-checkout to 10 items or fewer. And recently, Walmart has begun updating its self-checkout policy in some key cities.

At least two Walmart locations as of April 17 will shutter their self-checkout capabilities in an effort to mitigate the growing frustration.

"We believe the change will improve the in-store shopping experience and give our associates the chance to provide more personalized and efficient service," Walmart spokesperson Brian Little said.

The two store locations affected are:

- Cleveland Steelyard: Cleveland, OH

- St. Louis-area Supercenter, St. Louis, MO

Walmart says the self-checkout kiosks will be removed outside of normal store operation hours and will officially be gone within the next several weeks. In 2023, three Walmart stores removed their self-checkout kiosks in New Mexico for similar reasons.

Still, Walmart has plenty of self-checkout kiosks across its nearly 5,000 stores in the U.S. and says it has no plans to make such reductions on a nationwide scale.

mexico pandemicInternational

Five Ride-Hailing Stocks to Consider Purchasing

Five ride-hailing stocks to consider purchasing are aided by software applications that help the world of mobility. Since 2009, when Uber Technologies,…

Five ride-hailing stocks to consider purchasing are aided by software applications that help the world of mobility.

Since 2009, when Uber Technologies, Inc. (NYSE: UBER) introduced the first ride-hailing app, transportation has been dramatically disrupted by creating a low-cost and convenient form of motorized mobility. Now, instead of ordering a taxi ride, many customers opt for not only for Uber but for other ride-sharing services such as Lyft (NASDAQ: LYFT), Didi (NYSE: DIDI), Grab (NASDAQ: GRAB), Swvl Holdings Corp. (NASDAQ: SWVL) and privately owned companies like Bolt or Cabify.

Ride-hailing apps have become a staple on almost every phone device worldwide. Many praise the service for its ease of use, pricing transparency and convenience. As a result, the taxi business’s lack of adaptability to market changes led to its decline despite efforts to adapt. In the United States alone, nearly a third of its population, 86.7 million, is expected to use ride-hailing applications by 2027, according to research by eMarketer.

With constant efforts to adapt to evolving customer needs, ride-hailing is the future. Beyond expanding into different regions, ride-hailing has also diversified its offerings beyond passenger transportation to include food delivery, package delivery and health care services. This diversification aims to broaden its revenue streams and provide unique value to app users. At the same time, investment and experimentation with new technologies, such as autonomous vehicle deliveries, position ride-hailing as a growth industry in the next decade.

Five Ride-Hailing Stocks to Consider Purchasing Helped by Market Trends

The software application industry is huge. According to Yahoo Finance, it has a market capitalization of $1.858 trillion, about 253 companies and almost 709,000 employees.

Over the last decade, ride-hailing, which encompasses e-hailing, car sharing and car rental services, has evolved into a substantial global industry. According to a report from Mordor Intelligence, the market’s total size is currently estimated at $194.98 billion in 2024 and is projected to soar to $296.57 billion over the next five years. Despite experiencing a downturn during the COVID-19 pandemic, the market is now rebounding, with a surge in demand for ride-hailing services worldwide.

Five Ride-Hailing Stocks to Consider Purchasing: UBER

The first way to consider purchasing ride-hailing stocks is through Uber Technologies Inc.

Uber is a software application technology company, formerly known as Ubercab, Inc., founded in 2009 and headquartered in San Francisco, California. The company employs over 30,400 people, with 6.8 million monthly active drivers who collectively make 28 million trips per day and serve over 150 million monthly active users in 10,000-plus cities across 70 countries. Uber also develops and operates proprietary technology applications in the United States, Canada, Latin America, Europe, the Middle East, Africa and Asia. It does not operate in China or Southeast Asia. The company also had $150 billion in annualized run-rate gross booking for the quarter ending in Dec. 2023.

Uber operates across three segments: mobility, delivery, and freight, providing diverse transportation options and financial partnerships. The mobility segment offers ride-sharing, car-sharing, micro-mobility, rentals, public transit, taxis and more. The delivery segment facilitates ordering from restaurants, grocery stores, and retailers, including a white-label Delivery-as-a-Service for businesses and advertising. Lastly, the freight segment manages a digital marketplace connecting shippers and carriers for streamlined logistics, including upfront pricing and shipment booking.

Some ride services also include Uber Rent, Uber Reserve, Uber Green, UberX, UberXSaver, Hourly Uber Intercity, Uber Comford, Uber XL, Uber Black, Auto, Bike and Bicycle.

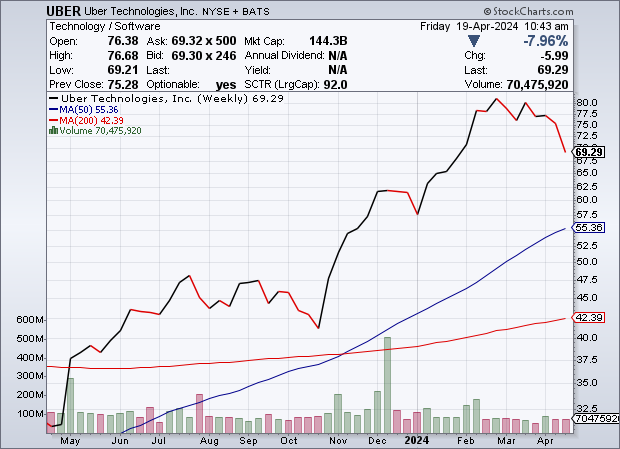

“We think the fundamentals here on UBER are strong, and definitely strong enough to keep driving the shares higher from here, especially when you consider that last quarter’s earnings per share growth was a whopping 128% versus the prior year,” wrote Jim Woods and Dr. Mark Skousen in the February 26, 2024, issue of Fast Money Alert, recommending to buy the stock.

In the latest Q4 and Full Year 2023 press release results, Uber recorded a 22% increase in gross bookings year over year (YoY), as well as 24% and 15% growth in trips and monthly active platform customers year over year, respectively. Additionally, the company had a net income of $1.4 billion and income from operations of $652 million in Q4. The first-quarter 2024 results conference call for Uber is set for Wednesday, May 8, at 8 a.m. Eastern Time.

“2023 was an inflection point for Uber, proving that we can continue to generate strong, profitable growth at scale,” said Dara Khosrowshahi, CEO of Uber in a press release from February 7, 2024. “Our audiences are larger and more engaged than ever, with our platform powering an average of nearly 26 million daily trips last year.”

The 17% annual revenue growth, 19% gross bookings increase and 24% trip increase further support Uber’s growth.

In the meantime, Uber is looking for other ways to grow its revenue. One of the ways is displaying more high-margin ads that could provide the company with additional revenue sources. UBER expects to reach over $1 billion in ad revenue in 2024, according to the Wall Street Journal. As a part of this strategy, Uber is trying to use personalized ads and experiment with push alerts.

Uber boasts a market capitalization of $149.7 billion, with a price-to-earnings ratio of 82.69 as of April 2024. The stock shows good performance with a +16.84% year-to-date (YTD) return and +5.29% on the S&P 500, according to Yahoo Finance. The stock has a strong buy evaluation from the analysts.

The stock also received an overall rating of 85/100, according to Stock Rover. Uber performs particularly well in efficiency (85), financial strategy (81) and momentum (86) ratings, while it lags on growth (65) and valuation (22) ratings.

In March 2024, the Wall Street Journal reported on the potential doubling of reservation fares as a result of booking fees introduced by Uber and Lyft to airport airlines, hotels, car rental companies and other locations.

Uber’s major competitors include Intuit Inc. (NASDAQ: INTU), Servicenow Inc. (NYSE: NOW) and Sap (NYSE: SAP).

Chart courtesy of StockCharts.com

Five Ride-Hailing Stocks to Consider Purchasing: Lyft Inc.

The second way to consider purchasing ride-hailing stocks is through Lyft, Inc. (NASDAQ: LYFT.

Lyft is a U.S.-based technology company incorporated in 2007 and headquartered in San Francisco, California. The company operates a peer-to-peer marketplace for on-demand ridesharing in the United States and Canada.

Lyft, employing around 3,000 people, operates multimodal transportation networks via its platform and mobile apps, connecting drivers and riders through ridesharing, car rentals and shared bikes/scooters. Additionally, the company provides enterprise solutions like concierge transportation, subscription plans, commuter programs and university-safe rides.

“Shares of Lyft Inc. (LYFT) are showing new upside momentum after the second-largest ride-sharing company posted better-than-expected quarterly results while also upping forward guidance,” said Bryan Perry in the March 8, 2024 issue of Hi-Tech Trader. He recommended buying it given its strong Q4 performance.

Despite the net loss of $26.3 million, revenue of $1.2 billion was in line (+4% year over year). Additionally, gross booking grew by 17% year over year ($3.7 billion). Lyft also saw 191 million rides in Q4, marking growth of 26% year over year. In 2023, there were 709 million rides overall, an increase of 18% year over year.

“In 2023, the Lyft team set ambitious goals and the results speak for themselves. We reached the highest level of annual riders in our history, delivered over 700 million rides, and helped drivers take home over $8 billion,” said CEO David Risher in a press release from February 13, 2024.

The press release originally had a typo that mistakenly projected earnings margin to expand by 500 basis points, while in reality, it was only 50 basis points. The addition of an extra zero to this key metric meant that the stock of Lyft increased by more than 60% after hours. Its CEO Risher responded to this mistake during a Bloomberg Television interview saying, “First of all, it’s on me.”

Despite the press release error, both RBC and Angus analysts upgraded the stock. They cited the strong leadership of Lyft’s CEO on cost and execution, which made the company leaner and more efficient.

“We’ve entered 2024 with a lot of momentum and a clear focus on operational excellence, which positions the company to drive meaningful margin expansion and our first full year of positive free cash flow,” said its CFO Erin Brewer.

Lyft further has new initiatives in store to boost its revenue.

“This year we’ve already launched a new pay standard for drivers and expanded Women+ Connect to over 240 markets — and it’s only Feb. 13,” said Risher in a press release referring to the plans for Lyft in the upcoming year. Lyft is also set to host its first Investor Day on June 6, 2024, in New York City.

The company currently boasts a market capitalization of $6.921 billion and has a forward P/E ratio of 20.6. According to Yahoo Finance, 32 analysts recommend to Hold the stock, while seven recommend to Buy. In terms of performance, the stock’s year-to-date performance was up by 15.48% and up by 5.29% on the S&P 500.

Skepticism about the buy option is also reflected in the rating versus peers’ evaluation of Stock Rover, which received an overall rating of 40 out of 100. Despite increased driver supply, the use of competitive pricing, and cost-cutting, analysts remain wary about the liquidity of Lyft’s stock.

As reported by Zacks Equity Research, key risks associated with buying the stock at the moment include the impact of potential hikes in labor costs. Furthermore, the workforce reduction of 13% of Lyft employees in November 2022, as well as liquidity concerns raised in Q4 2023, show difficulty in meeting the company’s debt obligation. Such factors can influence the stock in the future.

The main competitors of Lyft, according to Stock Rover, include monday.com Ltd. (NASDAQ: MNDY), Elastic N.V. (NYSE: ESTC) and Dayforce Inc. (NYSE: DAY).

Chart courtesy of StockCharts.com

Five Ride-Hailing Stocks to Consider Purchasing: Grab

The third way to consider purchasing ride-hailing stocks is through Grab Holdings Limited (NASDAQ: GRAB). Grab Holdings Limitedis a Singaporean software application company founded in 2012. The super app ecosystem provides ridesharing and ride-hailing services, food and grocery delivery, and financial services in eight South Asian countries, including Cambodia, Indonesia, Malaysia, Myanmar, the Philippines, Singapore, Thailand and Vietnam.

The company partners with riders and merchants, connecting them with customers and charging commission fees. Around 89% of its revenue comes from ridesharing and food delivery. It employs around 12,000 people.

GRAB released its unaudited Q4 and full-year 2023 financial results on February 22, 2024. The Q4 results showed revenue growth of 30% year over year to $653 million.

“2023 was a pivotal year for us. We generated over $11 billion of earnings for our partners, achieved strong top-line growth as we exited the year with Mobility GMV above pre-COVID levels and Deliveries GMV growth re-accelerating, and reached Adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) profitability in the year,” said Grab’s Group Chief Executive Officer and Co-Founder Anthony Tan, in a press release.

In terms of full-year 2023 results, the company recorded revenue growth of 65% YoY, attributed to growth across all segments, continued incentive optimization, and a business model change for delivery offerings in one of the markets. Additionally, per the press release, the company’s Board of Directors has authorized the repurchase of up to $500 million of GRAB’s Class A ordinary shares.

Furthermore, in an article published by the Wall Street Journal on Feb. 23, Grab’s Chief Financial Officer Peter Oey revealed that this year the company plans to focus on artificial intelligence (AI), organic growth and building new products to boost its revenue and increase its efficiency. One of the recent adoptions of such technology includes an AI translation for its Help Center.

According to Yahoo Finance, the company’s market capitalization is $12.665 billion. The stock’s year-to-date performance on the S&P 500 was up by 5.29%. As of April 2024, a total of 22 analysts suggest a strong buy or buy option for the stock.

The company’s main competitors, according to Stock Rover, include Dynatrace Inc. (NYSE: DT), DocuSign Inc. (NASDAQ: DOCU) and Bentley Systems Incorporated (NASDAQ: BSY). It also competes with privately held companies like Foodpanda and Gojek.

Chart courtesy of StockCharts.com

Five Ride-Hailing Stocks to Consider Purchasing: Didi Global Inc.

The fourth way to consider purchasing ride-hailing stocks is through Didi Global.

Didi Global Inc. (DIDIY) is a China-based software application company founded in 2012 and headquartered in Beijing. Employing over 20,000 people, the company operates a mobility tech platform that provides ride-hailing and other services in China, Brazil, Mexico and elsewhere.

DIDIY provides ride-hailing, taxi-hailing, chauffeur, hitch and other shared mobility services, along with auto solutions like leasing and maintenance. Additionally, it offers electric vehicle leasing, bike sharing, freight services, food delivery and financial services. It also has a strategic partnership with XPENG Inc. to promote smart electric vehicle adoption and technologies.

As of Q1 2023, the company had 587 million annual active users in the last 12 months and 45 million average daily transactions in March 2023.

“Benefitting from the recovery in domestic demand for mobility services, our businesses have grown steadily in the third quarter as we further strengthened our strategic focus on mobility. At the same time, we have made significant progress in exploring new opportunities in mobility, developing autonomous driving technology, and our international businesses,” said Chairman and Chief Executive Officer Will Wei Cheng, of DiDi, in a press release on November 13, 2023.

According to the unaudited Q4 and Full Year 2023 financial results, the company reported a full year total revenue of $26.5 billion (RMB 192.4 billion), an increase of 36.6% from 2022. The net income for 2023 finished around $69 million (RMB 0.5 billion).

“In 2023, the potential of the mobility market continued to be realized. Benefiting from this, our business maintained its healthy growth and saw continued efficiency improvements. We are fully confident in our future progress,” Cheng stated in a press release. He added that in 2024, DIDIY plans to continue to focus on its core businesses, promote the healthy development of its domestic and international businesses, as well as foster technological, product and service innovations.

Compared to its peers, the company scores 87/100 on Stock Rover. The company performs well on valuation (72), momentum (85) and financial strategy (86) ratings. Additionally, analysts rated the stock as a strong buy.

In recent news[1] reported by Reuters on March 14, 2024, the Chinese company will face a U.S. investor lawsuit over its initial public offering (IPO). In a 54-page decision, Judge Kaplan found DiDi officials aimed to defraud investors by concealing a Chinese order to delay its 2021 IPO due to cybersecurity issues, with investors alleging the company raised over $4.4 billion fraudulently in the June 30 IPO. This means that the company is essentially valued at less than one-third of its IPO worth.

Therefore, investors should be aware of the heavy risks involved prior to investing due to some of its legal and regulatory issues. TipRanks summarizes the risks involved in its risk factors analysis.

The company’s main competitors, according to Seeking Alpha, include Grab Holdings Limited (NASDAQ: GRAB), Lyft, Inc. (NASDAQ: LYFT) and Avis Budget Group, Inc. (NASDAQ: CAR).

Chart courtesy of StockCharts.com

Five Ride-Hailing Stocks to Consider Purchasing: Swvl Holdings

The fifth way to consider purchasing ride-hailing stocks is through Swvl Holdings.

Swvl Holdings Corp. (NASDAQ: SWVL), founded in 2017, is a provider of mass transit ridesharing services based in Dubai, United Arab Emirates. It operates in 115 cities across Europe, Africa, Asia, the Middle East, and Latin America.

SWVL offers various services including B2C Swvl Retail, which provides riders with a network of minibusses and other vehicles running on fixed or semi-fixed routes within cities; Swvl Travel, which allows riders to book rides on long-distance intercity routes on vehicles available through the Swvl platform or through third-party services; and Swvl Business, a transport as a service enterprise product for businesses, schools, municipal transit agencies and other customers.

“I’m proud of the Swvl team and how we managed this transformation in only a few months, despite the macroeconomic downturn, achieving all the objectives set in our portfolio optimization strategy,” said Mostafa Kandil, CEO of Swvl.

In September 2023, the company announced through its press release the sale of one of its subsidiaries, Urbvan, which it acquired in July 2022, to Kolors, a tech platform focusing on intelligent intercity mobility of bus transportation in Latin America. SWVL received $12 million for the sale. This move reflects the company’s strategic focus on growing higher-priority markets.

Based on its financial results for the first half of 2023 released on December 27, 2023, in H1 2023, the company recorded an operating cash inflow of $2.2 million, gross profit of $1.8 million, operating profit of $13.4 million and net profit of $2.1 million, resulting in an increase in total equity to $5.0 million from $2.6 million, as of December 31, 2022.

According to Yahoo Finance, the company’s market capitalization was $51.412 million and P/E ratio of 0.56, as of April 2024. In terms of performance, the stock is doing well with +352.21% YTD and +5.29% on the S&P 500. The stock is undervalued.

Investors should be wary of the financial risks and keep an eye on the latest financial results of the company.

Chart courtesy of StockCharts.com

The Innovation Future of Ride-Hailing

Over the past decade, ride-hailing has been on the rise, and there is no sign of the market slowing down. As companies continue to introduce innovative ideas into the industry, embracing the electric vehicle (EV) revolution, experimenting with autonomous vehicles, enhancing personalization features, and integrating artificial intelligence (AI), they are creating new revenue opportunities. This is achieved by increasing trust in their products, enhancing safety measures and focusing on sustainability and environmentally friendly practices.

The post Five Ride-Hailing Stocks to Consider Purchasing appeared first on Stock Investor.

sp 500 nasdaq stocks pandemic covid-19 recovery singapore africa brazil mexico canada europe chinaInternational

The UK is poorer without Erasmus – it’s time to rejoin the European exchange programme

The arrival of international students provides opportunities for intercultural exchange within UK universities.

The United Kingdom’s withdrawal from the Erasmus+ scheme – a reciprocal exchange process that let UK students study at European universities, and European students come to the UK – is again under the spotlight.

Campaigns for the UK’s re-entry to the scheme are ongoing. But diplomat Nick Leake told a committee meeting in Brussels that the terms for the UK to remain part of Erasmus+ were too expensive, and that Brits’ poor language skills caused an imbalance between the numbers of UK students travelling abroad and EU students coming to the UK.

My research focuses on language and intercultural education. The British are not inherently bad at learning languages, but there has been a decline in international language learning among young people. However, this should not be a pretext to justify the withdrawal from the Erasmus+ programme.

Meanwhile, the post-Brexit replacement for Erasmus+, the Turing scheme, has fallen short in several key aspects.

Unlike Erasmus+, which organises student exchanges across European countries with streamlined administrative processes and established partnerships, the Turing scheme lacks the same level of infrastructure and network. The scope of the Turing scheme is more narrow, as it focuses on outbound mobility from the UK rather than reciprocal exchanges.

It also seems to be less accessible than Erasmus+. Institutions wanting to take part are faced with a complicated application process. In short, this scheme is a wheel that did not need to be re-invented – especially not in such a suboptimal way.

Universities across the UK pride themselves on their international status, striving to equip graduates with the skills needed to navigate and shape a globalised world. But the UK’s withdrawal from Erasmus+ seems to undermine this aspiration.

Participating in international exchange programmes offers a plethora of benefits, ranging from personal growth to academic enrichment and professional development. For more than a decade, I have witnessed first-hand the transformative impact Erasmus+ has had on my students. I can attest to its profound role in shaping well-rounded individuals equipped with the skills to thrive in today’s interconnected world.

Benefits on both sides

There are many benefits enjoyed by students participating in international exchange programmes. But welcoming international exchange students to UK campuses also offers huge advantages to universities and broader society. It provides students with opportunities for intercultural exchange right at their doorstep. International exchange students bring with them unique perspectives, skills and experiences that enrich the learning environment for everyone.

As a languages academic, I am naturally interested in the relationship between language learning and international mobility. Studying or working abroad is often a compulsory part of a languages student’s degree programme. For many students the year abroad is life-changing.

During the pandemic and since Brexit, this experience has become significantly harder for universities to facilitate. Rejoining the Erasmus+ scheme would make these processes a lot simpler, and more affordable for students.

However, language and intercultural skills are not just important for languages students. Language learning and international mobility go hand in hand in fostering essential qualities such as curiosity, empathy and effective communication. Without a doubt, being immersed in different linguistic and cultural contexts helps you improve your language skills. But importantly, it also creates a deeper understanding of diverse perspectives.

Halting decline

The ongoing decline in language learning in the UK is concerning. Academics and teachers are trying to address this and have been creating initiatives to re-think how we approach language teaching.

For example, I am a member of a group of academics from different universities who have teamed up with teachers to create new types of language learning materials, hoping to inspire students studying for their A-levels.

Fortunately, there have also been political interventions such as the National Consortium for Languages Education – a £15m investment by the Department for Education.

While these developments signal a step in the right direction, the decision not to rejoin Erasmus+ seems to contradict such efforts and is a missed opportunity to prioritise language and intercultural education. To truly ensure equitable access to language learning, further investment is needed, coupled with a renewed commitment to international mobility.

I believe that now is the time to rejoin Erasmus+. It is time to shift our mindset towards valuing language skills and international experiences, ensuring that future generations won’t lose out.

Sascha Stollhans is affiliated with the Linguistics in Modern Foreign Languages project. The related research mentioned in the article was funded by Language Acts and Worldmaking, part of the Arts and Humanities Research Council's Open World Research Initiative, an Impact Accelerator Grant from the University of Bristol and a Research Start-up Grant from the Faculty of Humanities and Social Sciences, Newcastle University.

european uk eu pandemic-

International4 weeks ago

International4 weeks agoParexel CEO to retire; CAR-T maker AffyImmune promotes business leader to chief executive

-

Government2 weeks ago

Government2 weeks agoClimate-Con & The Media-Censorship Complex – Part 1

-

International5 days ago

International5 days agoWHO Official Admits Vaccine Passports May Have Been A Scam

-

Spread & Containment2 weeks ago

Spread & Containment2 weeks agoFDA Finally Takes Down Ivermectin Posts After Settlement

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoVaccinated People Show Long COVID-Like Symptoms With Detectable Spike Proteins: Preprint Study

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoCan language models read the genome? This one decoded mRNA to make better vaccines.

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoWhat’s So Great About The Great Reset, Great Taking, Great Replacement, Great Deflation, & Next Great Depression?

-

Uncategorized3 days ago

Uncategorized3 days agoRed States Fight Growing Efforts To Give “Basic Income” Cash To Residents