International

Five Ride-Hailing Stocks to Consider Purchasing

Five ride-hailing stocks to consider purchasing are aided by software applications that help the world of mobility. Since 2009, when Uber Technologies,…

Five ride-hailing stocks to consider purchasing are aided by software applications that help the world of mobility.

Since 2009, when Uber Technologies, Inc. (NYSE: UBER) introduced the first ride-hailing app, transportation has been dramatically disrupted by creating a low-cost and convenient form of motorized mobility. Now, instead of ordering a taxi ride, many customers opt for not only for Uber but for other ride-sharing services such as Lyft (NASDAQ: LYFT), Didi (NYSE: DIDI), Grab (NASDAQ: GRAB), Swvl Holdings Corp. (NASDAQ: SWVL) and privately owned companies like Bolt or Cabify.

Ride-hailing apps have become a staple on almost every phone device worldwide. Many praise the service for its ease of use, pricing transparency and convenience. As a result, the taxi business’s lack of adaptability to market changes led to its decline despite efforts to adapt. In the United States alone, nearly a third of its population, 86.7 million, is expected to use ride-hailing applications by 2027, according to research by eMarketer.

With constant efforts to adapt to evolving customer needs, ride-hailing is the future. Beyond expanding into different regions, ride-hailing has also diversified its offerings beyond passenger transportation to include food delivery, package delivery and health care services. This diversification aims to broaden its revenue streams and provide unique value to app users. At the same time, investment and experimentation with new technologies, such as autonomous vehicle deliveries, position ride-hailing as a growth industry in the next decade.

Five Ride-Hailing Stocks to Consider Purchasing Helped by Market Trends

The software application industry is huge. According to Yahoo Finance, it has a market capitalization of $1.858 trillion, about 253 companies and almost 709,000 employees.

Over the last decade, ride-hailing, which encompasses e-hailing, car sharing and car rental services, has evolved into a substantial global industry. According to a report from Mordor Intelligence, the market’s total size is currently estimated at $194.98 billion in 2024 and is projected to soar to $296.57 billion over the next five years. Despite experiencing a downturn during the COVID-19 pandemic, the market is now rebounding, with a surge in demand for ride-hailing services worldwide.

Five Ride-Hailing Stocks to Consider Purchasing: UBER

The first way to consider purchasing ride-hailing stocks is through Uber Technologies Inc.

Uber is a software application technology company, formerly known as Ubercab, Inc., founded in 2009 and headquartered in San Francisco, California. The company employs over 30,400 people, with 6.8 million monthly active drivers who collectively make 28 million trips per day and serve over 150 million monthly active users in 10,000-plus cities across 70 countries. Uber also develops and operates proprietary technology applications in the United States, Canada, Latin America, Europe, the Middle East, Africa and Asia. It does not operate in China or Southeast Asia. The company also had $150 billion in annualized run-rate gross booking for the quarter ending in Dec. 2023.

Uber operates across three segments: mobility, delivery, and freight, providing diverse transportation options and financial partnerships. The mobility segment offers ride-sharing, car-sharing, micro-mobility, rentals, public transit, taxis and more. The delivery segment facilitates ordering from restaurants, grocery stores, and retailers, including a white-label Delivery-as-a-Service for businesses and advertising. Lastly, the freight segment manages a digital marketplace connecting shippers and carriers for streamlined logistics, including upfront pricing and shipment booking.

Some ride services also include Uber Rent, Uber Reserve, Uber Green, UberX, UberXSaver, Hourly Uber Intercity, Uber Comford, Uber XL, Uber Black, Auto, Bike and Bicycle.

“We think the fundamentals here on UBER are strong, and definitely strong enough to keep driving the shares higher from here, especially when you consider that last quarter’s earnings per share growth was a whopping 128% versus the prior year,” wrote Jim Woods and Dr. Mark Skousen in the February 26, 2024, issue of Fast Money Alert, recommending to buy the stock.

In the latest Q4 and Full Year 2023 press release results, Uber recorded a 22% increase in gross bookings year over year (YoY), as well as 24% and 15% growth in trips and monthly active platform customers year over year, respectively. Additionally, the company had a net income of $1.4 billion and income from operations of $652 million in Q4. The first-quarter 2024 results conference call for Uber is set for Wednesday, May 8, at 8 a.m. Eastern Time.

“2023 was an inflection point for Uber, proving that we can continue to generate strong, profitable growth at scale,” said Dara Khosrowshahi, CEO of Uber in a press release from February 7, 2024. “Our audiences are larger and more engaged than ever, with our platform powering an average of nearly 26 million daily trips last year.”

The 17% annual revenue growth, 19% gross bookings increase and 24% trip increase further support Uber’s growth.

In the meantime, Uber is looking for other ways to grow its revenue. One of the ways is displaying more high-margin ads that could provide the company with additional revenue sources. UBER expects to reach over $1 billion in ad revenue in 2024, according to the Wall Street Journal. As a part of this strategy, Uber is trying to use personalized ads and experiment with push alerts.

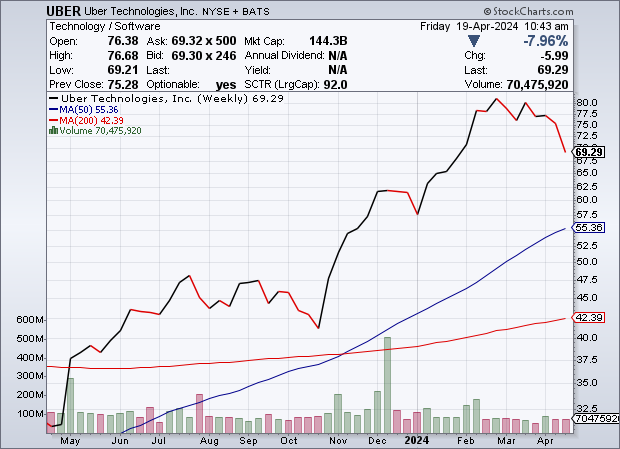

Uber boasts a market capitalization of $149.7 billion, with a price-to-earnings ratio of 82.69 as of April 2024. The stock shows good performance with a +16.84% year-to-date (YTD) return and +5.29% on the S&P 500, according to Yahoo Finance. The stock has a strong buy evaluation from the analysts.

The stock also received an overall rating of 85/100, according to Stock Rover. Uber performs particularly well in efficiency (85), financial strategy (81) and momentum (86) ratings, while it lags on growth (65) and valuation (22) ratings.

In March 2024, the Wall Street Journal reported on the potential doubling of reservation fares as a result of booking fees introduced by Uber and Lyft to airport airlines, hotels, car rental companies and other locations.

Uber’s major competitors include Intuit Inc. (NASDAQ: INTU), Servicenow Inc. (NYSE: NOW) and Sap (NYSE: SAP).

Chart courtesy of StockCharts.com

Five Ride-Hailing Stocks to Consider Purchasing: Lyft Inc.

The second way to consider purchasing ride-hailing stocks is through Lyft, Inc. (NASDAQ: LYFT.

Lyft is a U.S.-based technology company incorporated in 2007 and headquartered in San Francisco, California. The company operates a peer-to-peer marketplace for on-demand ridesharing in the United States and Canada.

Lyft, employing around 3,000 people, operates multimodal transportation networks via its platform and mobile apps, connecting drivers and riders through ridesharing, car rentals and shared bikes/scooters. Additionally, the company provides enterprise solutions like concierge transportation, subscription plans, commuter programs and university-safe rides.

“Shares of Lyft Inc. (LYFT) are showing new upside momentum after the second-largest ride-sharing company posted better-than-expected quarterly results while also upping forward guidance,” said Bryan Perry in the March 8, 2024 issue of Hi-Tech Trader. He recommended buying it given its strong Q4 performance.

Despite the net loss of $26.3 million, revenue of $1.2 billion was in line (+4% year over year). Additionally, gross booking grew by 17% year over year ($3.7 billion). Lyft also saw 191 million rides in Q4, marking growth of 26% year over year. In 2023, there were 709 million rides overall, an increase of 18% year over year.

“In 2023, the Lyft team set ambitious goals and the results speak for themselves. We reached the highest level of annual riders in our history, delivered over 700 million rides, and helped drivers take home over $8 billion,” said CEO David Risher in a press release from February 13, 2024.

The press release originally had a typo that mistakenly projected earnings margin to expand by 500 basis points, while in reality, it was only 50 basis points. The addition of an extra zero to this key metric meant that the stock of Lyft increased by more than 60% after hours. Its CEO Risher responded to this mistake during a Bloomberg Television interview saying, “First of all, it’s on me.”

Despite the press release error, both RBC and Angus analysts upgraded the stock. They cited the strong leadership of Lyft’s CEO on cost and execution, which made the company leaner and more efficient.

“We’ve entered 2024 with a lot of momentum and a clear focus on operational excellence, which positions the company to drive meaningful margin expansion and our first full year of positive free cash flow,” said its CFO Erin Brewer.

Lyft further has new initiatives in store to boost its revenue.

“This year we’ve already launched a new pay standard for drivers and expanded Women+ Connect to over 240 markets — and it’s only Feb. 13,” said Risher in a press release referring to the plans for Lyft in the upcoming year. Lyft is also set to host its first Investor Day on June 6, 2024, in New York City.

The company currently boasts a market capitalization of $6.921 billion and has a forward P/E ratio of 20.6. According to Yahoo Finance, 32 analysts recommend to Hold the stock, while seven recommend to Buy. In terms of performance, the stock’s year-to-date performance was up by 15.48% and up by 5.29% on the S&P 500.

Skepticism about the buy option is also reflected in the rating versus peers’ evaluation of Stock Rover, which received an overall rating of 40 out of 100. Despite increased driver supply, the use of competitive pricing, and cost-cutting, analysts remain wary about the liquidity of Lyft’s stock.

As reported by Zacks Equity Research, key risks associated with buying the stock at the moment include the impact of potential hikes in labor costs. Furthermore, the workforce reduction of 13% of Lyft employees in November 2022, as well as liquidity concerns raised in Q4 2023, show difficulty in meeting the company’s debt obligation. Such factors can influence the stock in the future.

The main competitors of Lyft, according to Stock Rover, include monday.com Ltd. (NASDAQ: MNDY), Elastic N.V. (NYSE: ESTC) and Dayforce Inc. (NYSE: DAY).

Chart courtesy of StockCharts.com

Five Ride-Hailing Stocks to Consider Purchasing: Grab

The third way to consider purchasing ride-hailing stocks is through Grab Holdings Limited (NASDAQ: GRAB). Grab Holdings Limitedis a Singaporean software application company founded in 2012. The super app ecosystem provides ridesharing and ride-hailing services, food and grocery delivery, and financial services in eight South Asian countries, including Cambodia, Indonesia, Malaysia, Myanmar, the Philippines, Singapore, Thailand and Vietnam.

The company partners with riders and merchants, connecting them with customers and charging commission fees. Around 89% of its revenue comes from ridesharing and food delivery. It employs around 12,000 people.

GRAB released its unaudited Q4 and full-year 2023 financial results on February 22, 2024. The Q4 results showed revenue growth of 30% year over year to $653 million.

“2023 was a pivotal year for us. We generated over $11 billion of earnings for our partners, achieved strong top-line growth as we exited the year with Mobility GMV above pre-COVID levels and Deliveries GMV growth re-accelerating, and reached Adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) profitability in the year,” said Grab’s Group Chief Executive Officer and Co-Founder Anthony Tan, in a press release.

In terms of full-year 2023 results, the company recorded revenue growth of 65% YoY, attributed to growth across all segments, continued incentive optimization, and a business model change for delivery offerings in one of the markets. Additionally, per the press release, the company’s Board of Directors has authorized the repurchase of up to $500 million of GRAB’s Class A ordinary shares.

Furthermore, in an article published by the Wall Street Journal on Feb. 23, Grab’s Chief Financial Officer Peter Oey revealed that this year the company plans to focus on artificial intelligence (AI), organic growth and building new products to boost its revenue and increase its efficiency. One of the recent adoptions of such technology includes an AI translation for its Help Center.

According to Yahoo Finance, the company’s market capitalization is $12.665 billion. The stock’s year-to-date performance on the S&P 500 was up by 5.29%. As of April 2024, a total of 22 analysts suggest a strong buy or buy option for the stock.

The company’s main competitors, according to Stock Rover, include Dynatrace Inc. (NYSE: DT), DocuSign Inc. (NASDAQ: DOCU) and Bentley Systems Incorporated (NASDAQ: BSY). It also competes with privately held companies like Foodpanda and Gojek.

Chart courtesy of StockCharts.com

Five Ride-Hailing Stocks to Consider Purchasing: Didi Global Inc.

The fourth way to consider purchasing ride-hailing stocks is through Didi Global.

Didi Global Inc. (DIDIY) is a China-based software application company founded in 2012 and headquartered in Beijing. Employing over 20,000 people, the company operates a mobility tech platform that provides ride-hailing and other services in China, Brazil, Mexico and elsewhere.

DIDIY provides ride-hailing, taxi-hailing, chauffeur, hitch and other shared mobility services, along with auto solutions like leasing and maintenance. Additionally, it offers electric vehicle leasing, bike sharing, freight services, food delivery and financial services. It also has a strategic partnership with XPENG Inc. to promote smart electric vehicle adoption and technologies.

As of Q1 2023, the company had 587 million annual active users in the last 12 months and 45 million average daily transactions in March 2023.

“Benefitting from the recovery in domestic demand for mobility services, our businesses have grown steadily in the third quarter as we further strengthened our strategic focus on mobility. At the same time, we have made significant progress in exploring new opportunities in mobility, developing autonomous driving technology, and our international businesses,” said Chairman and Chief Executive Officer Will Wei Cheng, of DiDi, in a press release on November 13, 2023.

According to the unaudited Q4 and Full Year 2023 financial results, the company reported a full year total revenue of $26.5 billion (RMB 192.4 billion), an increase of 36.6% from 2022. The net income for 2023 finished around $69 million (RMB 0.5 billion).

“In 2023, the potential of the mobility market continued to be realized. Benefiting from this, our business maintained its healthy growth and saw continued efficiency improvements. We are fully confident in our future progress,” Cheng stated in a press release. He added that in 2024, DIDIY plans to continue to focus on its core businesses, promote the healthy development of its domestic and international businesses, as well as foster technological, product and service innovations.

Compared to its peers, the company scores 87/100 on Stock Rover. The company performs well on valuation (72), momentum (85) and financial strategy (86) ratings. Additionally, analysts rated the stock as a strong buy.

In recent news[1] reported by Reuters on March 14, 2024, the Chinese company will face a U.S. investor lawsuit over its initial public offering (IPO). In a 54-page decision, Judge Kaplan found DiDi officials aimed to defraud investors by concealing a Chinese order to delay its 2021 IPO due to cybersecurity issues, with investors alleging the company raised over $4.4 billion fraudulently in the June 30 IPO. This means that the company is essentially valued at less than one-third of its IPO worth.

Therefore, investors should be aware of the heavy risks involved prior to investing due to some of its legal and regulatory issues. TipRanks summarizes the risks involved in its risk factors analysis.

The company’s main competitors, according to Seeking Alpha, include Grab Holdings Limited (NASDAQ: GRAB), Lyft, Inc. (NASDAQ: LYFT) and Avis Budget Group, Inc. (NASDAQ: CAR).

Chart courtesy of StockCharts.com

Five Ride-Hailing Stocks to Consider Purchasing: Swvl Holdings

The fifth way to consider purchasing ride-hailing stocks is through Swvl Holdings.

Swvl Holdings Corp. (NASDAQ: SWVL), founded in 2017, is a provider of mass transit ridesharing services based in Dubai, United Arab Emirates. It operates in 115 cities across Europe, Africa, Asia, the Middle East, and Latin America.

SWVL offers various services including B2C Swvl Retail, which provides riders with a network of minibusses and other vehicles running on fixed or semi-fixed routes within cities; Swvl Travel, which allows riders to book rides on long-distance intercity routes on vehicles available through the Swvl platform or through third-party services; and Swvl Business, a transport as a service enterprise product for businesses, schools, municipal transit agencies and other customers.

“I’m proud of the Swvl team and how we managed this transformation in only a few months, despite the macroeconomic downturn, achieving all the objectives set in our portfolio optimization strategy,” said Mostafa Kandil, CEO of Swvl.

In September 2023, the company announced through its press release the sale of one of its subsidiaries, Urbvan, which it acquired in July 2022, to Kolors, a tech platform focusing on intelligent intercity mobility of bus transportation in Latin America. SWVL received $12 million for the sale. This move reflects the company’s strategic focus on growing higher-priority markets.

Based on its financial results for the first half of 2023 released on December 27, 2023, in H1 2023, the company recorded an operating cash inflow of $2.2 million, gross profit of $1.8 million, operating profit of $13.4 million and net profit of $2.1 million, resulting in an increase in total equity to $5.0 million from $2.6 million, as of December 31, 2022.

According to Yahoo Finance, the company’s market capitalization was $51.412 million and P/E ratio of 0.56, as of April 2024. In terms of performance, the stock is doing well with +352.21% YTD and +5.29% on the S&P 500. The stock is undervalued.

Investors should be wary of the financial risks and keep an eye on the latest financial results of the company.

Chart courtesy of StockCharts.com

The Innovation Future of Ride-Hailing

Over the past decade, ride-hailing has been on the rise, and there is no sign of the market slowing down. As companies continue to introduce innovative ideas into the industry, embracing the electric vehicle (EV) revolution, experimenting with autonomous vehicles, enhancing personalization features, and integrating artificial intelligence (AI), they are creating new revenue opportunities. This is achieved by increasing trust in their products, enhancing safety measures and focusing on sustainability and environmentally friendly practices.

The post Five Ride-Hailing Stocks to Consider Purchasing appeared first on Stock Investor.

sp 500 nasdaq stocks pandemic covid-19 recovery singapore africa brazil mexico canada europe chinaInternational

The UK is poorer without Erasmus – it’s time to rejoin the European exchange programme

The arrival of international students provides opportunities for intercultural exchange within UK universities.

The United Kingdom’s withdrawal from the Erasmus+ scheme – a reciprocal exchange process that let UK students study at European universities, and European students come to the UK – is again under the spotlight.

Campaigns for the UK’s re-entry to the scheme are ongoing. But diplomat Nick Leake told a committee meeting in Brussels that the terms for the UK to remain part of Erasmus+ were too expensive, and that Brits’ poor language skills caused an imbalance between the numbers of UK students travelling abroad and EU students coming to the UK.

My research focuses on language and intercultural education. The British are not inherently bad at learning languages, but there has been a decline in international language learning among young people. However, this should not be a pretext to justify the withdrawal from the Erasmus+ programme.

Meanwhile, the post-Brexit replacement for Erasmus+, the Turing scheme, has fallen short in several key aspects.

Unlike Erasmus+, which organises student exchanges across European countries with streamlined administrative processes and established partnerships, the Turing scheme lacks the same level of infrastructure and network. The scope of the Turing scheme is more narrow, as it focuses on outbound mobility from the UK rather than reciprocal exchanges.

It also seems to be less accessible than Erasmus+. Institutions wanting to take part are faced with a complicated application process. In short, this scheme is a wheel that did not need to be re-invented – especially not in such a suboptimal way.

Universities across the UK pride themselves on their international status, striving to equip graduates with the skills needed to navigate and shape a globalised world. But the UK’s withdrawal from Erasmus+ seems to undermine this aspiration.

Participating in international exchange programmes offers a plethora of benefits, ranging from personal growth to academic enrichment and professional development. For more than a decade, I have witnessed first-hand the transformative impact Erasmus+ has had on my students. I can attest to its profound role in shaping well-rounded individuals equipped with the skills to thrive in today’s interconnected world.

Benefits on both sides

There are many benefits enjoyed by students participating in international exchange programmes. But welcoming international exchange students to UK campuses also offers huge advantages to universities and broader society. It provides students with opportunities for intercultural exchange right at their doorstep. International exchange students bring with them unique perspectives, skills and experiences that enrich the learning environment for everyone.

As a languages academic, I am naturally interested in the relationship between language learning and international mobility. Studying or working abroad is often a compulsory part of a languages student’s degree programme. For many students the year abroad is life-changing.

During the pandemic and since Brexit, this experience has become significantly harder for universities to facilitate. Rejoining the Erasmus+ scheme would make these processes a lot simpler, and more affordable for students.

However, language and intercultural skills are not just important for languages students. Language learning and international mobility go hand in hand in fostering essential qualities such as curiosity, empathy and effective communication. Without a doubt, being immersed in different linguistic and cultural contexts helps you improve your language skills. But importantly, it also creates a deeper understanding of diverse perspectives.

Halting decline

The ongoing decline in language learning in the UK is concerning. Academics and teachers are trying to address this and have been creating initiatives to re-think how we approach language teaching.

For example, I am a member of a group of academics from different universities who have teamed up with teachers to create new types of language learning materials, hoping to inspire students studying for their A-levels.

Fortunately, there have also been political interventions such as the National Consortium for Languages Education – a £15m investment by the Department for Education.

While these developments signal a step in the right direction, the decision not to rejoin Erasmus+ seems to contradict such efforts and is a missed opportunity to prioritise language and intercultural education. To truly ensure equitable access to language learning, further investment is needed, coupled with a renewed commitment to international mobility.

I believe that now is the time to rejoin Erasmus+. It is time to shift our mindset towards valuing language skills and international experiences, ensuring that future generations won’t lose out.

Sascha Stollhans is affiliated with the Linguistics in Modern Foreign Languages project. The related research mentioned in the article was funded by Language Acts and Worldmaking, part of the Arts and Humanities Research Council's Open World Research Initiative, an Impact Accelerator Grant from the University of Bristol and a Research Start-up Grant from the Faculty of Humanities and Social Sciences, Newcastle University.

european uk eu pandemicSpread & Containment

J&J’s AI head jumps to Recursion; Doug Williams resigns as Sana’s R&D chief

Najat Khan

Recursion Pharmaceuticals has poached Najat Khan from Johnson & Johnson, where she led AI efforts at one of healthcare’s giants.

Khan…

Recursion Pharmaceuticals has poached Najat Khan from Johnson & Johnson, where she led AI efforts at one of healthcare’s giants.

Khan will serve as chief R&D and commercial officer, along with joining Recursion’s board. The move comes at a critical time for Recursion, as its stock price has fallen 75% since going public in 2021, currently commanding a market capitalization of $1.75 billion. The Utah biotech expects its first Phase 2 readouts later this year for two rare disease drug candidates.

Khan’s hiring comes shortly after the departure of Shafique Virani, Recursion’s former chief business officer. Virani left earlier this year to join Noetik, a biotech startup led by two ex-Recursion scientists.

Khan most recently served as chief data science officer and global head of strategy and portfolio organization for J&J’s Janssen R&D group. Khan earned a PhD in organic chemistry from the University of Pennsylvania and spent about six-and-a-half years at Boston Consulting Group before joining J&J in 2018.

“Najat brings a unique blend of leadership in biological, chemical, and medical sciences, data science, and business,” CEO Chris Gibson said in a statement. “More importantly, she has a vision and passion for transforming drug discovery and development that complements ours and she has a strong sense of urgency to accelerate the industry’s future. We are excited to welcome her as a Recursionaut to drive our portfolio pipeline, as well as create commercial strategies as we continue to industrialize the creation of high impact medicines.”

Khan will earn a $570,000 base salary with the potential for a yearly bonus of up to half her salary. Recursion also agreed to pay a $500,000 sign-on bonus along with an equity package of restricted shares and stock options expected to be valued at $8 million, according to a regulatory filing.

— Andrew Dunn

Doug Williams

Doug Williams→ An SEC filing on Thursday indicated that Doug Williams has resigned as Sana Biotechnology’s president of R&D “for personal reasons.” Williams turned the page quickly last April, joining longtime friend Steve Harr at Sana two weeks after Codiak BioSciences filed for Chapter 11 bankruptcy. Data for two allogeneic CAR-T therapies — SC291 and SC262 — are expected later this year at Sana, which decided to concentrate on its ex vivo cell therapies last fall and laid off 29% of its employees.

Corinne Le Goff

Corinne Le Goff→ Corinne Le Goff resigned from her first CEO gig at Imunon a month ago. Now, she’s back in Peer Review as chief commercial officer of Viatris. Le Goff held the same title at Moderna for only a year, but it was a crucial year for the mRNA biotech during which its Covid-19 vaccine would be administered to millions around the world. Viatris paid $350 million upfront to Idorsia in February for two late-stage candidates — selatogrel for acute myocardial infarction and cenerimod for systemic lupus erythematosus — as the company turns its gaze to product development and away from generics. Scott Smith has been busy constructing the leadership team since he took over at Viatris last April, bringing in former Celgene exec Philippe Martin as chief R&D officer and Doretta Mistras as CFO.

→ Three months into his tenure, Tony Johnson is out as CEO of GPCR biotech Domain Therapeutics. The former Goldfinch Bio chief has been replaced by Sean MacDonald, with no explanation given for the departure. MacDonald just took the CBO job at Domain in February.

Peter DiLaura

Peter DiLaura→ Peter DiLaura has been hired away from Sonoma Biotherapeutics to become CEO of South San Francisco-based Initial Therapeutics. Founding chief Spiros Liras, a venture partner at Apple Tree Partners, maintains his seats on the board of directors and scientific advisory board. DiLaura had been Sonoma’s chief business & strategy officer since its February 2020 launch, and he’s the former CEO of Second Genome. Co-founded by UCSF’s Kevan Shokat, Initial scored a $75 million Series A last May as it takes aim at “undruggable” protein targets. “Undruggable is only at a given point in time,” Shokat told Lei Lei Wu. “Hopefully, nothing is undruggable, but we may not have the technology until after a while.”

Brent Warner

Brent Warner→ Brent Warner wrote in a LinkedIn post that he’s moved on to San Diego-based Protego Biopharma as CEO. Endpoints News featured Warner in last year’s 20(+2) under 40 while he was Poseida’s president, gene therapy; he resigned from the role on April 1. Earlier, Warner spent more than two years with Novartis as VP, gene therapy and rare disease, and led the strategy and execution for the spinal muscular atrophy drug Spinraza at Biogen. There’s been nary a peep from Protego since Lightspeed Venture Partners, Vida Ventures and MPM Capital pitched in on the company’s $51 million Series A in November 2021.

Stacy Lindborg

Stacy Lindborg→ That’s a wrap on Stacy Lindborg’s 15-month tenure as co-CEO of BrainStorm Cell Therapeutics, but she’ll still be on the board of directors. Development chief Bob Dagher has also been promoted to CMO. An adcomm recommended the FDA reject BrainStorm’s ALS cell therapy NurOwn by a 17-1 vote, and the company later withdrew the BLA. But BrainStorm has one more card to play, saying earlier this month that it will launch a new Phase 3b study to potentially get the therapy approved in a last-ditch effort.

Nageatte Ibrahim

Nageatte Ibrahim→ Nageatte Ibrahim has ended a nearly 10-year career at Merck, to become the oncology CMO for Innovent. Ibrahim was elevated to VP, global clinical development, oncology at Merck in 2021 as the megablockbuster Keytruda continues to rack up approvals across a panoply of indications in the face of an approaching patent cliff. Innovent and Eli Lilly posted positive Phase 3 results in China with mazdutide in the increasingly competitive obesity space, but their PD-1 sintilimab couldn’t pass regulatory muster in the US a couple years ago because of China-only data.

Javier San Martin

Javier San Martin→ Based in the Seattle suburb of Bothell, WA, Athira Pharma has recruited Amgen and Lilly alum Javier San Martin as CMO. San Martin ends a four-year run in the RNAi world as CMO of Arrowhead Pharmaceuticals, and he was head of global clinical development at Ultragenyx when Crysvita got a green light for patients with a rare disease called X-linked hypophosphatemia. Now he’ll tackle neurodegenerative disorders at Athira, which is testing the small molecule fosgonimeton in Alzheimer’s and the preclinical ATH-1105 in ALS.

Jason Hoitt

Jason Hoitt→ Stoke Therapeutics’ Dravet syndrome data dazzled investors in late March as shares $STOK surged by 118% in two days. With the possibility of an FDA approval for STK-001 in sight, Stoke has welcomed Jason Hoitt as chief commercial officer. Hoitt devised the launch strategy for Tzield while he was chief commercial officer for Provention Bio, which Sanofi bought for $2.9 billion last year. He’s also a Gilead and Vertex marketing vet who served as head of US sales for both Sarepta and Insmed.

Dale Hooks

Dale Hooks→ Former Reata Pharmaceuticals execs continue to find new landing spots after selling to Biogen, and Dale Hooks is up next, taking the role of chief commercial officer at Applied Therapeutics. A 10-year Genentech vet in sales and marketing, Hooks led global commercial operations at Reata, which made history with the first-ever approval of a Friedreich’s ataxia drug for Skyclarys in February 2023. Other ex-Reata leaders who have gone elsewhere include accounting chief Bhaskar Anand (to Summit Therapeutics) and CMO Seemi Khan (to Joshua Boger–chaired Alkeus Pharmaceuticals). The FDA said earlier this month it would postpone its decision on Applied’s galactosemia drug govorestat from Aug. 28 to Nov. 28.

Joshua Reed

Joshua Reed→ According to an SEC filing, Omega Therapeutics has decided to “terminate” CFO Joshua Reed’s employment, effective May 31. The Bristol Myers Squibb alum will be replaced by Barbara Chen, the Flagship company’s SVP of finance. In its Q4 report from late March, Omega said that it made some adjustments to its pipeline and laid off 35% of its staff.

Yrjö Wichmann

Yrjö Wichmann→ Faron Pharmaceuticals announced its father-to-son CEO transition last week, but there’s another vacancy they’ll have to attend to: The CFO departures in recent weeks haven’t let up as James O’Brien says goodbye “to pursue another career opportunity.” Yrjö Wichmann has returned to Faron on an interim basis after handling CFO duties from 2014-19.

→ Obesity company Xeno Biosciences has not only picked up $1.15 million, but also Dennis Kim as its new CEO. Kim comes to Xeno with a number of CMO stints at CymaBay, Emerald Biosciences and Zafgen. He formerly served as SVP of medical affairs at Orexigen Therapeutics and held a number of roles at Amylin Pharmaceuticals.

Jeffrey Trigilio

Jeffrey Trigilio→ Obsidian Therapeutics, the cancer-focused cell and gene therapy player that just pulled in a $160.5 million Series C two weeks ago, has tapped Jeffrey Trigilio as CFO. Trigilio left Cullinan Oncology on March 29 after more than three and a half years as finance chief, and its controller Nate Nguyen is filling in until a successor is named. Cullinan announced its foray into autoimmune diseases (and a name change to Cullinan Therapeutics) this week.

→ Javelin Biotech has brought in Jacques Banchereau as CSO. Banchereau joins the Woburn, MA-based team after a stint as science chief at Immunai. At Roche, he was CSO, discovery and translational area head of inflammation & virology.

Chris Krueger

Chris Krueger→ A month removed from the appointments of president Enoch Kariuki and CFO Vishaal Turakhia, Endeavor BioMedicines has welcomed Chris Krueger as COO. Krueger had held the CBO post at Ventyx Biosciences since its inception and has been an executive with several other companies that Ventyx chief Raju Mohan founded, including Oppilan Pharma and Zomagen Biosciences.

→ Contract manufacturer KBI Biopharma has recruited Jean-Baptiste Agnus as CBO. Agnus was most recently business chief of AGC Biologics. Before that, he was VP, global head of sales and marketing and held a number of roles at Novasep, culminating in his stint as head of business development, CMO services.

Charlotte Marmousez-Tartar

Charlotte Marmousez-Tartar→ Servier has promoted Charlotte Marmousez-Tartar to EVP, corporate strategy & transformation, and Hani Friedman Bouganim to EVP, manufacturing, quality & supply chain. Marmousez-Tartar joined Servier in 2006 and had been head of the group transformation & programs office since 2021. When she closed out a 16-year career with Teva, Bouganim was VP of operations and general manager of its Ulm and Weiler sites in Germany. She then came to Servier in 2022 as deputy EVP of industrial operations.

→ Evotec has selected 12-year Novartis vet Aurélie Dalbiez as chief people officer. Before her most recent role as chief human resources officer of Dutch bio-based ingredients company Corbion, Dalbiez was promoted to head of HR, capsules and health ingredients at Lonza.

Kristian Humer

Kristian Humer→ Citi alum Kristian Humer has taken over as CFO of Foghorn Therapeutics, permanently replacing current Prime Medicine finance chief Allan Reine. Humer spent two years as Viridian’s CFO and CBO until a new regime arrived last fall from Magenta Therapeutics. Stephen DiPalma from Danforth Advisors had been interim CFO at Foghorn, which got a boost from Lilly when the Indianapolis pharma said in February that it would send the BRM selective inhibitor FHD-909 into the clinic.

→ UPenn spinout and Peer Review first-timer Vittoria Biotherapeutics has named ex-Iveric Bio COO Keith Westby to the same position. Westby is the latest former Iveric Bio leader to find a new home post-buyout after regulatory and product strategy exec Snehal Shah joined Oculis last week. Vittoria raised $15 million last November to propel its lead CAR-T cell therapy VIPER-101 into clinical trials; it lists Carl June as a scientific advisor and Zenas BioPharma CEO Lonnie Moulder as a member of its board.

Sam Rasty

Sam Rasty→ Now under the direction of former Cedilla CEO Alexandra Glucksmann, Sensorium Therapeutics has introduced Sam Rasty as CBO. After three years as COO of Homology Medicines, Rasty was CEO of PlateletBio and a board member at Oxford Biomedica. From 2011-16, Rasty worked for Shire as VP and head of new products.

→ IO Biotech is appointing Marjan Shamsaei as SVP, commercial development and portfolio lead for its cancer vaccine candidate IO102-IO103. Shamsaei had a 15-year career at Genentech and joins the team from Allogene, where she was head of commercial from 2021-23. IO Biotech said last week that it hired business chief Faiçal Miyara from Ipsen.

→ Likarda has rolled out the welcome mat for Shelly Adams as chief commercial officer. She most recently served as VP of sales at Erbi Biosystems, part of Millipore Sigma. Adams brings experience from Gallus BioPharmaceuticals, Avecia Biologics and Abzena.

Deborah Dunsire

Deborah Dunsire→ Ex-Lundbeck CEO Deborah Dunsire is now chairing the board at Blackstone biotech Neurvati Neurosciences. Just before Dunsire retired last summer, Lundbeck and Otsuka notched another FDA approval for the antipsychotic Rexulti, this time for agitation associated with Alzheimer’s dementia. She’s also on the boards of Syros Pharmaceuticals and Ultragenyx.

Ramy Farid

Ramy Farid→ Biogen co-founder Phillip Sharp and ex-Cubist Pharmaceuticals CEO Rob Perez won’t be up for reelection on Vir Biotechnology’s board of directors, but Marianne De Backer has two potential board members waiting in the wings. Kronos Bio CEO Norbert Bischofberger and Schrödinger CEO Ramy Farid will make their way to the board if they’re elected at Vir’s shareholders meeting on May 29.

→ Cargo Therapeutics has reserved space for Roche oncology vet Kapil Dhingra on the board of directors. Dhingra chairs the board at Lava Therapeutics, owns a spot on the board of supervisors at Servier, and has board seats at Black Diamond, Replimune and Mariana Oncology. Cargo was the final entrant in biotech’s IPO class of 2023, raising $281 million.

Simba Gill

Simba Gill→ Former Evelo Biosciences chief Simba Gill has been named executive chairman of Serina Therapeutics, a biotech out of Huntsville, AL that has a candidate for early-stage Parkinson’s in the clinic. Evelo shut down last fall after a cascade of trial failures.

→ Ligand Pharmaceuticals subsidiary Pelthos Therapeutics has assembled its board of directors, starting with CEO Scott Plesha. It also includes Aurinia Pharmaceuticals CEO Peter Greenleaf, Ligand chief Todd Davis, Savara CEO Matt Pauls and Richard Baxter, Ligand’s SVP of investment operations.

→ Last July, Turnstone Biologics rode the IPO train. Now, the company has elected ex-Calithera Biosciences CFO William Waddill to its board of directors, replacing Patrick Machado. Waddill currently sits on the boards of Protagonist Therapeutics, Arrowhead Pharmaceuticals and Annexon.

bankruptcy covid-19 vaccine testing fda clinical trials preclinical therapy germany chinaInternational

World Bank Report Highlights Advantage Of Central Bank Gold Revaluation Accounts

World Bank Report Highlights Advantage Of Central Bank Gold Revaluation Accounts

By Jan Nieuwenhuijs of Gainesville Coins

Recently the World…

By Jan Nieuwenhuijs of Gainesville Coins

Recently the World Bank released a handbook for asset managers on why to invest in gold. At Gainesville Coins I have written numerous articles on gold revaluation accounts and how these can be deployed by central banks to absorb losses in case of emergency. The World Bank has taken notice of my research as they allude to this practice in a chapter on reserve accounting and reference to my work.

The World Bank publication underlines the fact that gold is the only financial asset without counterparty risk, and due to its scarcity relative to fiat currencies its price in the long run always increases. Central banks that own gold for an extended period can reap the benefits of their gold revaluation account without having to sell any gold.

Introduction

The Gold Investing Handbook for Asset Managers document published earlier this year by the World Bank Treasury is an interesting read for investors. It covers the gold market structure, optimal portfolio assessments, geopolitical aspects, a trading and liquidity guide, and a discussion on gold accounting, among other subjects.

The World Bank Treasury is tasked to manage the World Bank’s finances and contribute to the Bank’s twin goals of “ending extreme poverty and promoting shared prosperity.” As such it acts as a trusted advisor to its member countries to support financial stability and provide “thought leadership in the broader treasury and financial management arena.” With this mission in mind the Bank’s Treasury writes that:

Throughout history, gold has played a vital role as a financial asset in the global financial system. ... In the modern era, gold continues to play a critical role in the global financial system, serving as a hedge against inflation, a safe haven asset, and a reserve asset for central banks. … The role of gold in the global financial system has evolved over time, with changes in monetary policy, economic conditions, and technological advancements influencing demand and supply dynamics. Despite these changes, gold remains a crucial component of the global financial system and is likely to continue to play an essential role in the future. … The market disruptions brought about by the 2008 Global Financial Crisis (GFC), the US and China trade war, Brexit, and the COVID-19 pandemic, as well as a prolonged period of negative real interest rates and geopolitical uncertainties caused by financial sanctions imposed on Russia to freeze its foreign reserves, reinforced the strategic importance of gold as a buffer against financial instability.

Central Bank Gold Revaluation Accounts

After the central banks of advanced economies such as the Netherlands and Germany stated their gold revaluation accounts (GRAs) guarantee their solvency in 2013, the World Bank now joins the discussion on GRAs. On page 57 of its report there is a summary of my article on how the central bank of Curaçao and Saint Martin utilized its GRA to cover losses in 2021.

Simplified, a GRA is an accounting entry on the liability side of a central bank’s balance sheet that records unrealized gains in gold. Because central banks are the root of the modern money tree, they can use these entries to pay for expenses. A GRA, if sufficient, can prevent a central bank from going into negative capital in times of financial stress without having to sell gold (for more details read my article here).

All in all, the World Bank’s reporting of GRAs is bullish for gold as it once again confirms gold’s position front and center in the monetary system. Gold—as per International Monetary Fund (IMF), the World Bank’s sister institute—is the only universally accepted financial asset that is not someone else’s liability. From the IMF (BPM6):

Financial assets are economic assets that are financial instruments. Financial assets include financial claims and, by convention, monetary gold held in the form of gold bullion … A financial claim is a financial instrument that has a counterpart liability. Gold bullion is not a claim and does not have a corresponding liability. It is treated as a financial asset, however, because of its special role as a means of financial exchange in international payments by monetary authorities and as a reserve asset held by monetary authorities.

Gold has no counterparty risk and can’t be arbitrarily devalued. Hence, the IMF lists gold at the very top of reserve assets, which makes gold the hardest asset for central banks to own and creates significant unrealized gains over time through the debasement of the currency they issue. And as I have explained previously these unrealized gains can be turned into realized gains to pay for expenses.

Conclusion

In the past years more and more central banks from both the global South and North—and international financial institutions like the World Bank—are pitching gold as an imperative asset with multiple functions. Gold is a safe haven asset, inflation hedge, backup currency, its revaluation accounts can be used, etcetera.

If one looks at the order of the IMF’s list of reserve assets the similarities with Exter’s inverse pyramid is easily seen. Gold truly underpins the global financial system. In my view, though, the value of all financial assets resting on gold has grown too large in the past decades. For stabilizing the pyramid (financial system), the value of the gold needs to increase accordingly.

But we will explore these imbalances more in depth in my next article.

Further Reading

- German Central Bank Doesn’t Rule Out Gold Revaluation

- Governor Dutch Central Bank States Gold Revaluation Account Is Solvency Backstop

- How a Central Bank in the Caribbean Recently Used Its Gold Revaluation Account to Cover Losses

- German Central Bank: Gold Revaluation Account Underlines Soundness of Balance Sheet

- How Central Banks Can Use Gold Revaluation Accounts in Times of Financial Stress

-

International4 weeks ago

International4 weeks agoParexel CEO to retire; CAR-T maker AffyImmune promotes business leader to chief executive

-

Government2 weeks ago

Government2 weeks agoClimate-Con & The Media-Censorship Complex – Part 1

-

International5 days ago

International5 days agoWHO Official Admits Vaccine Passports May Have Been A Scam

-

Spread & Containment2 weeks ago

Spread & Containment2 weeks agoFDA Finally Takes Down Ivermectin Posts After Settlement

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoVaccinated People Show Long COVID-Like Symptoms With Detectable Spike Proteins: Preprint Study

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoCan language models read the genome? This one decoded mRNA to make better vaccines.

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoWhat’s So Great About The Great Reset, Great Taking, Great Replacement, Great Deflation, & Next Great Depression?

-

Uncategorized3 days ago

Uncategorized3 days agoRed States Fight Growing Efforts To Give “Basic Income” Cash To Residents