The Black-white wealth gap left Black households more vulnerable

The COVID-19 pandemic has inflicted devastating effects on the U.S. economy, with job losses especially concentrated among women, minorities, and low-wage workers. Economists have described the uneven and unequal economic recovery from the COVID-19…

By Emily Moss, Kriston McIntosh, Wendy Edelberg, Kristen E. Broady

The COVID-19 pandemic has inflicted devastating effects on the U.S. economy, with job losses especially concentrated among women, minorities, and low-wage workers. Economists have described the uneven and unequal economic recovery from the COVID-19 recession as a “K-shaped” recovery, characterized by divergent recovery trajectories for the affluent relative to those of less means. While considerable attention has been devoted to examining the preexisting disparities in labor market outcomes that left some households more vulnerable than others to the COVID-19 recession, less attention has been paid to the role of wealth in determining a household’s ability to buffer the pandemic’s economic shocks.

Wealth (defined as the difference between a household’s assets and debt) provides a critical safety net to households during economic downturns. Wealth holds several advantages over wages as an economic resource: In particular, income from wealth is taxed at much lower rates than income from work, and wealth can serve as a source of savings to absorb temporary setbacks such as a loss of employment income.

A previous Hamilton Project analysis revealed staggering inequalities in wealth held by white versus Black households. Using updated data from the Survey of Consumer Finances (SCF) for 2019, we find that the Black-white wealth gap persisted heading into the COVID-19 pandemic, leaving Black households with far fewer resources to weather the storm.

Wealth Inequality Preceding COVID-19

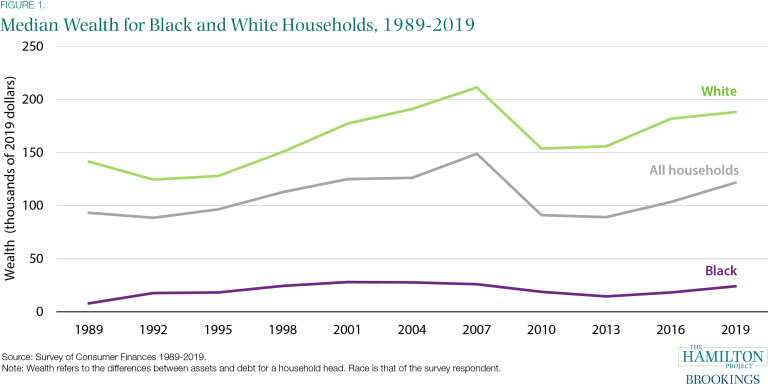

In 2019 the median white household held $188,200 in wealth—7.8 times that of the typical Black household ($24,100; figure 1). It is worth noting that levels of average wealth, which are more heavily skewed by households with the greatest amounts of wealth, are higher: white households reported average wealth of $983,400, which is 6.9 times that of Black households ($142,500; SCF). While median wealth is more reflective of the typical household, the scale of average wealth is indicative of the outsized levels of wealth held by the richest households.

The Black-white wealth gap today is a continuation of decades-long trends in wealth inequality, as shown in figure 1. Over the past 30 years, the median wealth of white households has consistently dwarfed that of Black households—ranging from a gap of $106,900 in 1992 to $185,400 in 2007 (both adjusted for inflation to 2019 dollars). Furthermore:

- In the second quarter of 2020, white households—who account for 60 percent of the U.S. population—held 84 percent ($94 trillion) of total household wealth in the U.S.

- Comparatively, Black households—who account for 13.4 percent of the U.S. population—held just 4 percent ($4.6 trillion) of total household wealth.

Buffering Economic Shocks during Downturns

The ability of wealth to buffer economic shocks can provide critical support to households during economic downturns—yet not all households have equal holdings of wealth at their disposal. The Black-white wealth gap serves as an important factor in understanding how economic recoveries can become uneven and unequal across demographics. Black and white households both experienced a reduction in median wealth from 2007 to 2010 during the Great Recession. Despite white households holding higher levels of wealth than Black households throughout the Great Recession, the decline in median wealth for white and Black households was nearly equal during this period: the median white household experienced a 27 percent decline in wealth from 2007 to 2010 compared to a 28 percent decline for the median Black household (figure 1; authors’ calculations).

Yet in the aftermath of the Great Recession, white households began to recover the wealth they had lost: wealth for the median white household rose by 1 percent from 2010 to 2013. By contrast, wealth for the median Black household continued to fall—declining by 23 percent during this period (figure 1; authors’ calculations). These divergent changes in wealth in the years immediately following the Great Recession illustrate how recoveries from recessions do not necessarily benefit all households equally. In fact, the Great Recession exacerbated the Black-white wealth gap and left Black households more vulnerable to the current COVID-19 recession.

The Intersection of the Black-White and Gender Wealth Gaps

In addition to the Black-white wealth gap, a gender wealth gap (and its intersections with race) reveals another dimension of wealth inequality. We use microdata from the 2019 Survey of Consumer Finances (SCF) to analyze how the Black-white wealth gap varies by gender throughout the life cycle. Because the SCF is a household-level survey and the vast majority of householder respondents within married couples are men, our analyses involving gender are limited to single households. In single households, male and female respondents are each representative of their personal holdings of wealth.

Figure 2 shows that single white men start with the highest median wealth, which continues to outpace that of single white women and single Black men and women throughout the life cycle. The median wealth of single white men under the age of 35 ($22,640) is 3.5 times greater than that of single white women ($6,470), 14.6 times greater than that of single Black men ($1,550), and 224.2 times greater than that of single Black women ($101). By the age of 55 and older, single white men hold 1.3 times more wealth than single white women and 8.1 times more wealth than single Black men. The median wealth of single Black women trails slightly behind that of single Black men until the age of 55, when single Black women hold $40,760 in median wealth compared to single Black men with $27,100.

Evaluating wealth gaps by race as well as gender provides clear evidence of the relatively meager resources that women—Black women, in particular—have to withstand the economic shocks of the COVID-19 recession. Labor market data show how women have been hit particularly during the COVID-19 recession: of the 1.1 million people who left the labor market in September 2020, over 860,000 were women. Black women have faced especially large job losses; the share of Black women with a job decreased by 11.0 percentage points from February to April 2020 compared to a 9.9 percentage point reduction in the share of white women with a job and a 9.2 percentage point decline in the share of white men with a job.

It is important to note that these racial and gender wealth gaps cannot simply be attributed to differences in household savings patterns or cashflow management challenges; rather, they are the outcome of public policy decisions spanning centuries throughout U.S. history. For example, landmark progressive laws, ranging from the New Deal to the formation of Social Security, excluded many occupations (such as domestic workers) widely held by Black women—the majority of whom remain excluded from Social Security today. Accordingly, it is imperative to evaluate wealth gaps by both race and gender to fully understand the depth and breadth of continued wealth inequality in the U.S. today.

Inherited Wealth

Though wealth accumulates with age, the persistence of wealth gaps at every stage of the life cycle further reflects disparities in the intergenerational transfer of wealth via inheritances. White households are substantially more likely to expect and receive inheritances than Black households. Figure 3 shows that in 2019, 17 percent of white households expected to receive an inheritance compared to just 6 percent of Black households. These differing expectations of inheritance receipt comport with disparities in the actual occurrence and magnitude of intergenerational wealth transfers: 30 percent of white households received an inheritance in 2019 at an average level of $195,500 compared to 10 percent of Black households at an average level of $100,000. Because inheritances are lightly taxed, inequalities in inheritances play a significant role in perpetuating a Black-white wealth gap that spans generations.

The Black-White Wealth Gap Intensifies the Effects of Labor Market Disparities

Racial disparities in wealth can intensify the severity of income shocks, as households with lower levels of wealth have fewer resources available to temper the adverse economic impacts of job loss. For Black households who have reported disproportionately high levels of unemployment—and even more so during the COVID-19 recession—this means the Black-white wealth gap can exacerbate the effects of the negative labor market outcomes that Black households are more likely to face.

When comparing the labor market distress of Black families relative to white families, it is important to consider trends in both unemployment and underemployment rates. Unemployment—the number of people who do not have a job and are actively seeking work—is a common indicator of labor market strength. However, an equally important measure is underemployment, defined as the number of people who currently work part-time but would rather have a full-time job and people who want and are able to take a job but have not sought work in the last four weeks. Underemployment can more broadly capture the share of the population that is ready and willing to work more if employers were hiring.

Rates of unemployment for Black individuals—whether measured by the traditional, narrower metric of unemployment (“U-3”) or the broader metric of underemployment (“U-6”)—have been consistently higher than unemployment among white individuals in every year since 1994 (authors’ calculations). Figure 4 focuses on unemployment and underemployment rates beginning in January 2019 through September 2020 of the COVID-19 recession. At the onset of the pandemic, unemployment and underemployment rates for Black and white Americans more than doubled from March to April 2020. Unemployment and underemployment peaked in April 2020 for both groups, but these rates were significantly higher for Black Americans. More than one quarter of Black Americans were classified as underemployed at its peak—1.5 times the underemployment rate for white Americans. Notably, even the narrower measure of unemployment for Black Americans surpassed the broader measure of underemployment for white Americans since June 2020. As of September 2020, the unemployment rate of Black Americans was still 5.5 percentage points higher than that of white Americans, while the underemployment rate of Black Americans was 7.2 percentage points higher than that of white Americans.

One reason that labor market outcomes in the COVID-19 recession have been worse for Black workers is that they are more likely to be employed in industries hit hardest by the COVID-19 recession. Three of the hardest-hit industries by the pandemic in terms of job loss—retail trade, transportation and warehousing, and leisure and hospitality—are among the top ten employers of Black workers. When it comes to outcomes for Black-owned businesses during the COVID-19 recession, the statistics are also grim: analysis by the Economic Policy Institute found that 28 percent of Black-owned businesses were in industries with the largest total job losses relative to just 20 percent of white-owned businesses. Although Black-owned businesses only represent a minority of all businesses, they are disproportionately likely to operate in sectors most severely affected by the COVID-19 pandemic and associated shutdowns.

Black Households Face Higher Rates of Distress during COVID-19

With lower levels of wealth prior to the pandemic, compounded by continued labor market disparities during the pandemic, access to emergency savings and other assets are crucial for Black households to withstand the COVID-19 recession. Yet black households have substantially less emergency savings than white households: the average value of liquid assets among white households was $8,100 in 2019 compared to $1,500 for Black households. Furthermore, 72 percent of white households say they could get $3,000 from family or friends compared to 41 percent of Black households.

Racial disparities between Black and white households are present in holdings of nonliquid assets as well. In 2019, 73 percent of white families compared to 42 percent of Black families owned a home. Black families are not only less likely to own a home, but their homeownership also yields lower levels of assets. In 2019 the typical white families’ home value was $230,000 compared to $150,000 for Black families. Similarly, of the $30.8 trillion in total real estate assets reported in the second quarter of 2020, white households held 78 percent ($23.9 trillion) compared to 5 percent ($1.6 trillion) held by Black households.

With fewer nonliquid assets to borrow against or sell, Black households were particularly vulnerable to economic shocks heading into the COVID-19 pandemic. For some Black households, this has led to taking extraordinary measures to stay afloat. Leveraging data from the Survey of Household Economics and Decisionmaking (SHED) along with the SCF, we can observe how families have been utilizing their retirement assets to weather the COVID-19 recession.

Despite holding lower levels of retirement assets, young Black families were more likely to borrow from or cash out their retirement savings during the current crisis. Among households with positive retirement equity, figure 5 shows that the median value of retirement equity for households with a household head under the age of 35 in 2019 was $5,000 for Black Americans compared to $7,500 for white Americans. Although Black households tended to hold lower levels of retirement equity at this age, 14 percent of Black Americans under the age of 35 borrowed from or cashed out their retirement savings compared to just 4 percent of white Americans under the age of 35 in July 2020 (SHED; authors’ calculations). Figure 5 shows that the median value of retirement equity among white households with a household head at least 55 with retirement assets was 2.4 times that among Black households—yet only 10 percent of white Americans over the age of 55 borrowed from or cashed out their retirement savings compared to 22 percent of Black Americans over the age of 55 (SHED; authors’ calculations).

Conclusion

In the short-term, renewed fiscal support is needed to curb the economic pain many households are experiencing because they are unable to absorb the economic shocks of the COVID-19 recession. More specifically, policies aimed at providing income support and strengthening the safety net, along with implementing automatic stabilizers that trigger expansions of economic aid during fiscal crises, are critical during this time.

Yet while a stronger safety net and additional income support can provide families with immediate protection against economic crises, it is unlikely to provide them with the long-term stability to prepare for future shocks in the same way that wealth can. Accordingly, when designing policies to reduce the Black-white wealth gap, avoiding the conflation of income with wealth is imperative. In fact, our previous Hamilton Project analysis showed that the Black-white wealth gap remains even among households of similar incomes. Neither differences in income nor differences in educational attainment, indebtedness, or a host of other demographic and socioeconomic indicators can fully account for the persistence of the Black-white wealth gap.

Indeed, closing the Black-white wealth gap will require that the deep and systemic economic disparities brought about by centuries of discriminatory policies are addressed through significant structural changes across a range of policy areas. As discussed in a previous Hamilton Project analysis, these policies range from redlining and the denial of financial services to minority communities, to the Jim Crow Era’s “Black Codes” strictly limiting opportunities in many southern states—all of which contributed to the disproportionate accumulation of wealth held by white households while exacerbating the economic fragility of many Black households. Overcoming the effects of these policies will necessitate substantive and systemic changes in education, small business, healthcare, broadband access, tax reform, and broader place-based policies.

The COVID-19 pandemic underscores the importance of the Black-white wealth gap and its impact on the ability of households to weather the economic shocks caused by recessions. By expanding policymakers’ focus not only on strengthening the safety net and income supports, but also on the inclusion of systemic and structural public policy changes across a range of areas to close the Black-white wealth gap, disparities in the ability of Black and white households to weather the next economic storm will be greatly reduced.

Spread & Containment

The Coming Of The Police State In America

The Coming Of The Police State In America

Authored by Jeffrey Tucker via The Epoch Times,

The National Guard and the State Police are now…

Authored by Jeffrey Tucker via The Epoch Times,

The National Guard and the State Police are now patrolling the New York City subway system in an attempt to do something about the explosion of crime. As part of this, there are bag checks and new surveillance of all passengers. No legislation, no debate, just an edict from the mayor.

Many citizens who rely on this system for transportation might welcome this. It’s a city of strict gun control, and no one knows for sure if they have the right to defend themselves. Merchants have been harassed and even arrested for trying to stop looting and pillaging in their own shops.

The message has been sent: Only the police can do this job. Whether they do it or not is another matter.

Things on the subway system have gotten crazy. If you know it well, you can manage to travel safely, but visitors to the city who take the wrong train at the wrong time are taking grave risks.

In actual fact, it’s guaranteed that this will only end in confiscating knives and other things that people carry in order to protect themselves while leaving the actual criminals even more free to prey on citizens.

The law-abiding will suffer and the criminals will grow more numerous. It will not end well.

When you step back from the details, what we have is the dawning of a genuine police state in the United States. It only starts in New York City. Where is the Guard going to be deployed next? Anywhere is possible.

If the crime is bad enough, citizens will welcome it. It must have been this way in most times and places that when the police state arrives, the people cheer.

We will all have our own stories of how this came to be. Some might begin with the passage of the Patriot Act and the establishment of the Department of Homeland Security in 2001. Some will focus on gun control and the taking away of citizens’ rights to defend themselves.

My own version of events is closer in time. It began four years ago this month with lockdowns. That’s what shattered the capacity of civil society to function in the United States. Everything that has happened since follows like one domino tumbling after another.

It goes like this:

1) lockdown,

2) loss of moral compass and spreading of loneliness and nihilism,

3) rioting resulting from citizen frustration, 4) police absent because of ideological hectoring,

5) a rise in uncontrolled immigration/refugees,

6) an epidemic of ill health from substance abuse and otherwise,

7) businesses flee the city

8) cities fall into decay, and that results in

9) more surveillance and police state.

The 10th stage is the sacking of liberty and civilization itself.

It doesn’t fall out this way at every point in history, but this seems like a solid outline of what happened in this case. Four years is a very short period of time to see all of this unfold. But it is a fact that New York City was more-or-less civilized only four years ago. No one could have predicted that it would come to this so quickly.

But once the lockdowns happened, all bets were off. Here we had a policy that most directly trampled on all freedoms that we had taken for granted. Schools, businesses, and churches were slammed shut, with various levels of enforcement. The entire workforce was divided between essential and nonessential, and there was widespread confusion about who precisely was in charge of designating and enforcing this.

It felt like martial law at the time, as if all normal civilian law had been displaced by something else. That something had to do with public health, but there was clearly more going on, because suddenly our social media posts were censored and we were being asked to do things that made no sense, such as mask up for a virus that evaded mask protection and walk in only one direction in grocery aisles.

Vast amounts of the white-collar workforce stayed home—and their kids, too—until it became too much to bear. The city became a ghost town. Most U.S. cities were the same.

As the months of disaster rolled on, the captives were let out of their houses for the summer in order to protest racism but no other reason. As a way of excusing this, the same public health authorities said that racism was a virus as bad as COVID-19, so therefore it was permitted.

The protests had turned to riots in many cities, and the police were being defunded and discouraged to do anything about the problem. Citizens watched in horror as downtowns burned and drug-crazed freaks took over whole sections of cities. It was like every standard of decency had been zapped out of an entire swath of the population.

Meanwhile, large checks were arriving in people’s bank accounts, defying every normal economic expectation. How could people not be working and get their bank accounts more flush with cash than ever? There was a new law that didn’t even require that people pay rent. How weird was that? Even student loans didn’t need to be paid.

By the fall, recess from lockdown was over and everyone was told to go home again. But this time they had a job to do: They were supposed to vote. Not at the polling places, because going there would only spread germs, or so the media said. When the voting results finally came in, it was the absentee ballots that swung the election in favor of the opposition party that actually wanted more lockdowns and eventually pushed vaccine mandates on the whole population.

The new party in control took note of the large population movements out of cities and states that they controlled. This would have a large effect on voting patterns in the future. But they had a plan. They would open the borders to millions of people in the guise of caring for refugees. These new warm bodies would become voters in time and certainly count on the census when it came time to reapportion political power.

Meanwhile, the native population had begun to swim in ill health from substance abuse, widespread depression, and demoralization, plus vaccine injury. This increased dependency on the very institutions that had caused the problem in the first place: the medical/scientific establishment.

The rise of crime drove the small businesses out of the city. They had barely survived the lockdowns, but they certainly could not survive the crime epidemic. This undermined the tax base of the city and allowed the criminals to take further control.

The same cities became sanctuaries for the waves of migrants sacking the country, and partisan mayors actually used tax dollars to house these invaders in high-end hotels in the name of having compassion for the stranger. Citizens were pushed out to make way for rampaging migrant hordes, as incredible as this seems.

But with that, of course, crime rose ever further, inciting citizen anger and providing a pretext to bring in the police state in the form of the National Guard, now tasked with cracking down on crime in the transportation system.

What’s the next step? It’s probably already here: mass surveillance and censorship, plus ever-expanding police power. This will be accompanied by further population movements, as those with the means to do so flee the city and even the country and leave it for everyone else to suffer.

As I tell the story, all of this seems inevitable. It is not. It could have been stopped at any point. A wise and prudent political leadership could have admitted the error from the beginning and called on the country to rediscover freedom, decency, and the difference between right and wrong. But ego and pride stopped that from happening, and we are left with the consequences.

The government grows ever bigger and civil society ever less capable of managing itself in large urban centers. Disaster is unfolding in real time, mitigated only by a rising stock market and a financial system that has yet to fall apart completely.

Are we at the middle stages of total collapse, or at the point where the population and people in leadership positions wise up and decide to put an end to the downward slide? It’s hard to know. But this much we do know: There is a growing pocket of resistance out there that is fed up and refuses to sit by and watch this great country be sacked and taken over by everything it was set up to prevent.

Government

Low Iron Levels In Blood Could Trigger Long COVID: Study

Low Iron Levels In Blood Could Trigger Long COVID: Study

Authored by Amie Dahnke via The Epoch Times (emphasis ours),

People with inadequate…

Authored by Amie Dahnke via The Epoch Times (emphasis ours),

People with inadequate iron levels in their blood due to a COVID-19 infection could be at greater risk of long COVID.

A new study indicates that problems with iron levels in the bloodstream likely trigger chronic inflammation and other conditions associated with the post-COVID phenomenon. The findings, published on March 1 in Nature Immunology, could offer new ways to treat or prevent the condition.

Long COVID Patients Have Low Iron Levels

Researchers at the University of Cambridge pinpointed low iron as a potential link to long-COVID symptoms thanks to a study they initiated shortly after the start of the pandemic. They recruited people who tested positive for the virus to provide blood samples for analysis over a year, which allowed the researchers to look for post-infection changes in the blood. The researchers looked at 214 samples and found that 45 percent of patients reported symptoms of long COVID that lasted between three and 10 months.

In analyzing the blood samples, the research team noticed that people experiencing long COVID had low iron levels, contributing to anemia and low red blood cell production, just two weeks after they were diagnosed with COVID-19. This was true for patients regardless of age, sex, or the initial severity of their infection.

According to one of the study co-authors, the removal of iron from the bloodstream is a natural process and defense mechanism of the body.

But it can jeopardize a person’s recovery.

“When the body has an infection, it responds by removing iron from the bloodstream. This protects us from potentially lethal bacteria that capture the iron in the bloodstream and grow rapidly. It’s an evolutionary response that redistributes iron in the body, and the blood plasma becomes an iron desert,” University of Oxford professor Hal Drakesmith said in a press release. “However, if this goes on for a long time, there is less iron for red blood cells, so oxygen is transported less efficiently affecting metabolism and energy production, and for white blood cells, which need iron to work properly. The protective mechanism ends up becoming a problem.”

The research team believes that consistently low iron levels could explain why individuals with long COVID continue to experience fatigue and difficulty exercising. As such, the researchers suggested iron supplementation to help regulate and prevent the often debilitating symptoms associated with long COVID.

“It isn’t necessarily the case that individuals don’t have enough iron in their body, it’s just that it’s trapped in the wrong place,” Aimee Hanson, a postdoctoral researcher at the University of Cambridge who worked on the study, said in the press release. “What we need is a way to remobilize the iron and pull it back into the bloodstream, where it becomes more useful to the red blood cells.”

The research team pointed out that iron supplementation isn’t always straightforward. Achieving the right level of iron varies from person to person. Too much iron can cause stomach issues, ranging from constipation, nausea, and abdominal pain to gastritis and gastric lesions.

1 in 5 Still Affected by Long COVID

COVID-19 has affected nearly 40 percent of Americans, with one in five of those still suffering from symptoms of long COVID, according to the U.S. Centers for Disease Control and Prevention (CDC). Long COVID is marked by health issues that continue at least four weeks after an individual was initially diagnosed with COVID-19. Symptoms can last for days, weeks, months, or years and may include fatigue, cough or chest pain, headache, brain fog, depression or anxiety, digestive issues, and joint or muscle pain.

Uncategorized

February Employment Situation

By Paul Gomme and Peter Rupert The establishment data from the BLS showed a 275,000 increase in payroll employment for February, outpacing the 230,000…

By Paul Gomme and Peter Rupert

The establishment data from the BLS showed a 275,000 increase in payroll employment for February, outpacing the 230,000 average over the previous 12 months. The payroll data for January and December were revised down by a total of 167,000. The private sector added 223,000 new jobs, the largest gain since May of last year.

Temporary help services employment continues a steep decline after a sharp post-pandemic rise.

Average hours of work increased from 34.2 to 34.3. The increase, along with the 223,000 private employment increase led to a hefty increase in total hours of 5.6% at an annualized rate, also the largest increase since May of last year.

The establishment report, once again, beat “expectations;” the WSJ survey of economists was 198,000. Other than the downward revisions, mentioned above, another bit of negative news was a smallish increase in wage growth, from $34.52 to $34.57.

The household survey shows that the labor force increased 150,000, a drop in employment of 184,000 and an increase in the number of unemployed persons of 334,000. The labor force participation rate held steady at 62.5, the employment to population ratio decreased from 60.2 to 60.1 and the unemployment rate increased from 3.66 to 3.86. Remember that the unemployment rate is the number of unemployed relative to the labor force (the number employed plus the number unemployed). Consequently, the unemployment rate can go up if the number of unemployed rises holding fixed the labor force, or if the labor force shrinks holding the number unemployed unchanged. An increase in the unemployment rate is not necessarily a bad thing: it may reflect a strong labor market drawing “marginally attached” individuals from outside the labor force. Indeed, there was a 96,000 decline in those workers.

Earlier in the week, the BLS announced JOLTS (Job Openings and Labor Turnover Survey) data for January. There isn’t much to report here as the job openings changed little at 8.9 million, the number of hires and total separations were little changed at 5.7 million and 5.3 million, respectively.

As has been the case for the last couple of years, the number of job openings remains higher than the number of unemployed persons.

Also earlier in the week the BLS announced that productivity increased 3.2% in the 4th quarter with output rising 3.5% and hours of work rising 0.3%.

The bottom line is that the labor market continues its surprisingly (to some) strong performance, once again proving stronger than many had expected. This strength makes it difficult to justify any interest rate cuts soon, particularly given the recent inflation spike.

unemployment pandemic unemployment-

Uncategorized2 weeks ago

Uncategorized2 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoIndustrial Production Decreased 0.1% in January

-

International1 day ago

International1 day agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges