Pulling Forward Growth No Longer An Option.

Pulling forward growth over the last decade remains the Federal Reserve’s primary tool for keeping financial markets stable while economic growth rates…

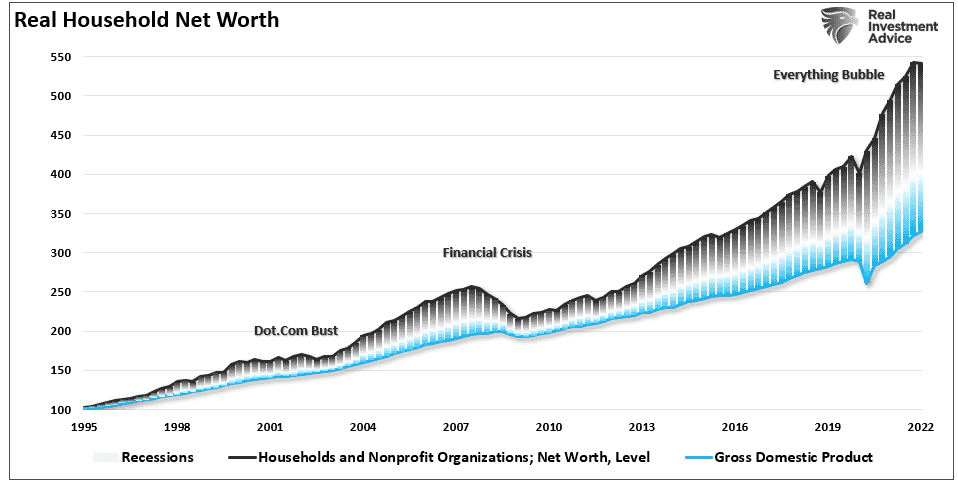

Pulling forward growth over the last decade remains the Federal Reserve’s primary tool for keeping financial markets stable while economic growth rates and inflation remained weak. From repeated rounds of monetary and fiscal interventions, asset markets surged, increasing investor wealth and confidence, which, as Ben Bernanke stated in 2010, would support economic growth. To wit:

“This approach eased financial conditions in the past and, so far, looks to be effective again. Stock prices rose and long-term interest rates fell when investors began to anticipate the most recent action. Easier financial conditions will promote economic growth. For example, lower mortgage rates will make housing more affordable and allow more homeowners to refinance. Lower corporate bond rates will encourage investment. And higher stock prices will boost consumer wealth and help increase confidence, which can also spur spending.” – Ben Bernanke

That certainly seemed to be the case as each time the economy stumbled; Federal Reserve interventions kept the financial markets and economy stable. However, there is sufficient evidence that “monetary policy” leads to other problems, most notably a surge in wealth inequality without a corresponding increase in economic growth.

As noted in the previous articles, current monetary policy has its roots in Keynesian economic theory. To wit:

“A general glut would occur when aggregate demand for goods was insufficient, leading to an economic downturn resulting in losses of potential output due to unnecessarily high unemployment, which results from the defensive (or reactive) decisions of the producers.”

In such a situation, Keynesian economics states that fiscal policies could increase aggregate demand, thus expanding economic activity and reducing unemployment.

The only problem is that it didn’t work as planned because “monetary policy” is NOT expansionary.

“Since 2008, the total cumulative growth of the economy is just $4.05 trillion. In other words, for each dollar of economic growth since 2008, it required nearly $11 of monetary stimulus. Such sounds okay until you realize it came solely from debt issuance.“

The question is whether pulling forward growth through monetary policy is sustainable.

The Unsustainability Of Monetary Policy

We have previously noted an inherent problem with ongoing monetary interventions. Notably, the fiscal policies implemented post the pandemic-driven economic shutdown created a surge in demand that created an unprecedented surge in corporate earnings.

Here is the problem. As shown below, the surge in the M2 money supply is now over. Without further stimulus, earnings must eventually revert to economically sustainable levels.

While the media often states that “stocks are not the economy,” economic activity creates corporate revenues and earnings. As such, stocks can not indefinitely grow faster than the economy over long periods.

When stocks deviate from the underlying economy, the eventual resolution is lower stock prices. Over time, there is a close relationship between the economy, earnings, and asset prices. For example, the chart below compares the three from 1947 through 2021.

Since 1947, earnings per share have grown at 7.72%, while the economy has expanded by 6.35% annually. That close relationship in growth rates is logical given the significant role that consumer spending has in the GDP equation.

The slight differentials are due to periods where earnings can grow faster than the economy. Such a period occurs when the economy is emerging from a recession. However, while nominal stock prices have averaged 9.35% (including dividends), reversions to actual economic growth eventually occur. Such is because corporate earnings are a function of consumptive spending, corporate investments, imports, and exports.

The market disconnect from underlying economic activity is apparent in the chart below. Since the peak in 2007, successive rounds of monetary interventions led to a cumulative increase of 219% for the stock market. However, real economic growth grew only 28% as corporate revenue rose by just 67%. In other words, stock prices rose nearly 8x more than the economy and 3.2x corporate revenue.

There is a problem in pulling forward economic activity.

The Fed Is Investors Biggest Problem

For investors, the most significant risk remains the Fed. Many hope the Fed will “pivot” from its battle against surging inflation to support stocks. However, such is unlikely in the near term, with inflation running at the highest level in 40 years.

However, even if the Fed does give up its fight against inflation in terms of hiking interest rates, it is unlikely they will immediately return to successive rounds of monetary policy without financial instability. So far, in 2022, markets are down, but not violently so. As we discussed previously, the Fed views markets very differently from investors. To wit:

“While the market has declined this year, the market remains higher than in 2020. To reduce excess market speculations, the Fed doesn’t mind some ‘disinflation’ in asset prices. Furthermore, the market decline also contributes to its tightening monetary policy to mitigate inflationary pressures.”

Absent a disorderly meltdown; the Fed will remain focused on stocks being still above their pre-crisis peak. As BofA notes:

“Since in a typical consumption model, households react to sustained changes in prices over a period of three years or so, the Fed is convinced the wealth effect is still positive.”

As noted above, the deviation from long-term growth trends is unsustainable. Repeated financial interventions were the cause. Therefore, unless the Federal Reverse is committed to a never-ending program of zero interest rates and quantitative easing, the eventual reversion of returns to their long-term means is inevitable.

Such will solely result in profit margins and earnings returning to levels that align with actual economic activity. As Jeremy Grantham once noted:

“Profit margins are probably the most mean-reverting series in finance. And if profit margins do not mean-revert, then something has gone badly wrong with capitalism. If high profits do not attract competition, there is something wrong with the system, and it is not functioning properly.” – Jeremy Grantham

The post Pulling Forward Growth No Longer An Option. appeared first on RIA.

recession unemployment pandemic stimulus economic growth stocks monetary policy fed federal reserve mortgage rates gdp interest rates consumer spendingGovernment

Low Iron Levels In Blood Could Trigger Long COVID: Study

Low Iron Levels In Blood Could Trigger Long COVID: Study

Authored by Amie Dahnke via The Epoch Times (emphasis ours),

People with inadequate…

Authored by Amie Dahnke via The Epoch Times (emphasis ours),

People with inadequate iron levels in their blood due to a COVID-19 infection could be at greater risk of long COVID.

A new study indicates that problems with iron levels in the bloodstream likely trigger chronic inflammation and other conditions associated with the post-COVID phenomenon. The findings, published on March 1 in Nature Immunology, could offer new ways to treat or prevent the condition.

Long COVID Patients Have Low Iron Levels

Researchers at the University of Cambridge pinpointed low iron as a potential link to long-COVID symptoms thanks to a study they initiated shortly after the start of the pandemic. They recruited people who tested positive for the virus to provide blood samples for analysis over a year, which allowed the researchers to look for post-infection changes in the blood. The researchers looked at 214 samples and found that 45 percent of patients reported symptoms of long COVID that lasted between three and 10 months.

In analyzing the blood samples, the research team noticed that people experiencing long COVID had low iron levels, contributing to anemia and low red blood cell production, just two weeks after they were diagnosed with COVID-19. This was true for patients regardless of age, sex, or the initial severity of their infection.

According to one of the study co-authors, the removal of iron from the bloodstream is a natural process and defense mechanism of the body.

But it can jeopardize a person’s recovery.

“When the body has an infection, it responds by removing iron from the bloodstream. This protects us from potentially lethal bacteria that capture the iron in the bloodstream and grow rapidly. It’s an evolutionary response that redistributes iron in the body, and the blood plasma becomes an iron desert,” University of Oxford professor Hal Drakesmith said in a press release. “However, if this goes on for a long time, there is less iron for red blood cells, so oxygen is transported less efficiently affecting metabolism and energy production, and for white blood cells, which need iron to work properly. The protective mechanism ends up becoming a problem.”

The research team believes that consistently low iron levels could explain why individuals with long COVID continue to experience fatigue and difficulty exercising. As such, the researchers suggested iron supplementation to help regulate and prevent the often debilitating symptoms associated with long COVID.

“It isn’t necessarily the case that individuals don’t have enough iron in their body, it’s just that it’s trapped in the wrong place,” Aimee Hanson, a postdoctoral researcher at the University of Cambridge who worked on the study, said in the press release. “What we need is a way to remobilize the iron and pull it back into the bloodstream, where it becomes more useful to the red blood cells.”

The research team pointed out that iron supplementation isn’t always straightforward. Achieving the right level of iron varies from person to person. Too much iron can cause stomach issues, ranging from constipation, nausea, and abdominal pain to gastritis and gastric lesions.

1 in 5 Still Affected by Long COVID

COVID-19 has affected nearly 40 percent of Americans, with one in five of those still suffering from symptoms of long COVID, according to the U.S. Centers for Disease Control and Prevention (CDC). Long COVID is marked by health issues that continue at least four weeks after an individual was initially diagnosed with COVID-19. Symptoms can last for days, weeks, months, or years and may include fatigue, cough or chest pain, headache, brain fog, depression or anxiety, digestive issues, and joint or muscle pain.

Uncategorized

February Employment Situation

By Paul Gomme and Peter Rupert The establishment data from the BLS showed a 275,000 increase in payroll employment for February, outpacing the 230,000…

By Paul Gomme and Peter Rupert

The establishment data from the BLS showed a 275,000 increase in payroll employment for February, outpacing the 230,000 average over the previous 12 months. The payroll data for January and December were revised down by a total of 167,000. The private sector added 223,000 new jobs, the largest gain since May of last year.

Temporary help services employment continues a steep decline after a sharp post-pandemic rise.

Average hours of work increased from 34.2 to 34.3. The increase, along with the 223,000 private employment increase led to a hefty increase in total hours of 5.6% at an annualized rate, also the largest increase since May of last year.

The establishment report, once again, beat “expectations;” the WSJ survey of economists was 198,000. Other than the downward revisions, mentioned above, another bit of negative news was a smallish increase in wage growth, from $34.52 to $34.57.

The household survey shows that the labor force increased 150,000, a drop in employment of 184,000 and an increase in the number of unemployed persons of 334,000. The labor force participation rate held steady at 62.5, the employment to population ratio decreased from 60.2 to 60.1 and the unemployment rate increased from 3.66 to 3.86. Remember that the unemployment rate is the number of unemployed relative to the labor force (the number employed plus the number unemployed). Consequently, the unemployment rate can go up if the number of unemployed rises holding fixed the labor force, or if the labor force shrinks holding the number unemployed unchanged. An increase in the unemployment rate is not necessarily a bad thing: it may reflect a strong labor market drawing “marginally attached” individuals from outside the labor force. Indeed, there was a 96,000 decline in those workers.

Earlier in the week, the BLS announced JOLTS (Job Openings and Labor Turnover Survey) data for January. There isn’t much to report here as the job openings changed little at 8.9 million, the number of hires and total separations were little changed at 5.7 million and 5.3 million, respectively.

As has been the case for the last couple of years, the number of job openings remains higher than the number of unemployed persons.

Also earlier in the week the BLS announced that productivity increased 3.2% in the 4th quarter with output rising 3.5% and hours of work rising 0.3%.

The bottom line is that the labor market continues its surprisingly (to some) strong performance, once again proving stronger than many had expected. This strength makes it difficult to justify any interest rate cuts soon, particularly given the recent inflation spike.

unemployment pandemic unemploymentSpread & Containment

Another beloved brewery files Chapter 11 bankruptcy

The beer industry has been devastated by covid, changing tastes, and maybe fallout from the Bud Light scandal.

Before the covid pandemic, craft beer was having a moment. Most cities had multiple breweries and taprooms with some having so many that people put together the brewery version of a pub crawl.

It was a period where beer snobbery ruled the day and it was not uncommon to hear bar patrons discuss the makeup of the beer the beer they were drinking. This boom period always seemed destined for failure, or at least a retraction as many markets seemed to have more craft breweries than they could support.

Related: Fast-food chain closes more stores after Chapter 11 bankruptcy

The pandemic, however, hastened that downfall. Many of these local and regional craft breweries counted on in-person sales to drive their business.

And while many had local and regional distribution, selling through a third party comes with much lower margins. Direct sales drove their business and the pandemic forced many breweries to shut down their taprooms during the period where social distancing rules were in effect.

During those months the breweries still had rent and employees to pay while little money was coming in. That led to a number of popular beermakers including San Francisco's nationally-known Anchor Brewing as well as many regional favorites including Chicago’s Metropolitan Brewing, New Jersey’s Flying Fish, Denver’s Joyride Brewing, Tampa’s Zydeco Brew Werks, and Cleveland’s Terrestrial Brewing filing bankruptcy.

Some of these brands hope to survive, but others, including Anchor Brewing, fell into Chapter 7 liquidation. Now, another domino has fallen as a popular regional brewery has filed for Chapter 11 bankruptcy protection.

Image source: Shutterstock

Covid is not the only reason for brewery bankruptcies

While covid deserves some of the blame for brewery failures, it's not the only reason why so many have filed for bankruptcy protection. Overall beer sales have fallen driven by younger people embracing non-alcoholic cocktails, and the rise in popularity of non-beer alcoholic offerings,

Beer sales have fallen to their lowest levels since 1999 and some industry analysts

"Sales declined by more than 5% in the first nine months of the year, dragged down not only by the backlash and boycotts against Anheuser-Busch-owned Bud Light but the changing habits of younger drinkers," according to data from Beer Marketer’s Insights published by the New York Post.

Bud Light parent Anheuser Busch InBev (BUD) faced massive boycotts after it partnered with transgender social media influencer Dylan Mulvaney. It was a very small partnership but it led to a right-wing backlash spurred on by Kid Rock, who posted a video on social media where he chastised the company before shooting up cases of Bud Light with an automatic weapon.

Another brewery files Chapter 11 bankruptcy

Gizmo Brew Works, which does business under the name Roth Brewing Company LLC, filed for Chapter 11 bankruptcy protection on March 8. In its filing, the company checked the box that indicates that its debts are less than $7.5 million and it chooses to proceed under Subchapter V of Chapter 11.

"Both small business and subchapter V cases are treated differently than a traditional chapter 11 case primarily due to accelerated deadlines and the speed with which the plan is confirmed," USCourts.gov explained.

Roth Brewing/Gizmo Brew Works shared that it has 50-99 creditors and assets $100,000 and $500,000. The filing noted that the company does expect to have funds available for unsecured creditors.

The popular brewery operates three taprooms and sells its beer to go at those locations.

"Join us at Gizmo Brew Works Craft Brewery and Taprooms located in Raleigh, Durham, and Chapel Hill, North Carolina. Find us for entertainment, live music, food trucks, beer specials, and most importantly, great-tasting craft beer by Gizmo Brew Works," the company shared on its website.

The company estimates that it has between $1 and $10 million in liabilities (a broad range as the bankruptcy form does not provide a space to be more specific).

Gizmo Brew Works/Roth Brewing did not share a reorganization or funding plan in its bankruptcy filing. An email request for comment sent through the company's contact page was not immediately returned.

bankruptcy pandemic social distancing

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoIndustrial Production Decreased 0.1% in January

-

International1 day ago

International1 day agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges