Patrick Hill: The Twilight Zone Economy

The Twilight Zone Economy

“It is a dimension as vast as space and as timeless as infinity. It is the middle ground between light and shadow, between science (reality) and superstition (bubbles), and it lies between the pit of man’s fears and…

The Twilight Zone Economy

“It is a dimension as vast as space and as timeless as infinity. It is the middle ground between light and shadow, between science (reality) and superstition (bubbles), and it lies between the pit of man’s fears and the summit of his knowledge (fundamentals). This is the dimension of (economic) imagination. It is an area which we call The Twilight Zone.” Rod Serling, introduction to the TV series, 1959 [our comments in ( )]

Our economy has entered the twilight zone. Today, economic leaders base policies on a hoped-for utopia with bubbles called ‘growing markets’ and greed termed ‘good valuations’. The twilight zone economy is a place where fundamentals have disappeared. It is a utopian world of no moral hazard for business, financial or economic mistakes. In the last year, the Federal Reserve has injected over $4.1T into the banking, hedge fund, Wall Street complex of the financial elite. Vast injections of dollars have sent stock valuations to record highs. Yet, the pandemic-driven economy is real for 19M Americans out of work, others who lost 540,000 loved ones, and millions carrying housing debt due to missed rent and house payments.

Policymakers Disconnected From the Real Economy

Yet, policymakers continue to become further disconnected from the real economy where people work and spend. These leaders imagine an economy of full employment forever, risk assets continually rising in price (not value) with virtually no market corrections. It is an economic wonderland for corporations to use low-cost debt to finance infinite profits and stock buybacks. Wall Street is only too pleased to hype this corporate financial engineering. Goldman Sachs forecasts a GDP surge to 8% in the 4th quarter of this year due to the $1.9T American Rescue Bill. Bond king Bill Gross predicts interest rates surge to 3 – 4 % by year end. Does all this monetary and fiscal stimulus result in a healthy solid economy or the most catastrophic inflationary bubble in modern times? Our post identifies the dimensions of the Twilight Zone Economy.

Astronomical Public Debt Drags Growth

The country is drowning in low-interest debt. But, this liquidity ‘soma’ drug is putting investors to sleep, thinking everything will be ok. Now, public debt is at levels not seen since WWII and projected to go to 200% of GDP by 2051.

Source: CBO, The Daily Shot – 3/15/21

Sources: Blackrock, IMF, OECD, The Daily Shot – 3/15/21

During WWII, debt supported production capacity for building weapons, planes, and infrastructure to support the war effort. When the war was over, the US was the only major economy intact, leading to a high growth productive economy. The investment in productive industries increased the standard of living for most Americans.

Are the present monetary debt and fiscal stimulus programs of relief payments resulting in productive investment? This chart, by Lance Roberts, shows how increasing public debt has resulted in a continuing decline in real economic growth.

Source: RIA, Lance Roberts, 3/17/21

Public debt not used for solid investments in infrastructure, basic research for innovation, or productivity has resulted in an ever-growing debt level to achieve a continuing decline in economic growth. This cycle of low-cost ballooning debt to finance debt service and transfer payments will likely result in economic stagnation or worse.

Negative Yielding Debt Triggers Speculation

Sovereign negative-yielding debt reached a record high of $17.8T last month. Thus, a massive level of worldwide debt is not repaying the entire principal to debt holders. Correlated to soaring negative-yielding debt is the meteoric rise of trader speculation in Bitcoin and other cryptocurrencies.

Sources: Daily Feather, Bloomberg – 3/22/21

Such parabolic moves in debt and speculative digital currencies like Bitcoin are candidates for a significant reversion in value at some date in the near future.

Equity Markets Are In An Alternate Reality

Why is a firm like Tesla valued at the same level as the next six largest car companies or the oil industry’s total market capitalization? Isn’t Tesla’s valuation in the economic twilight zone? Analysts value Tesla at $1M per vehicle produced versus GM at $5000 per vehicle. While VW is building six battery factories in the EU, and vows by 2025 to produce over 1.2M EVs in 2022, matching Tesla’s total output. VW has now taken over the dominant market share in Europe and is opening EV plants in Asia and North America.

There are 15 major car manufacturers, including GM, Ford, Toyota, Honda, Nissan, BMW, Mercedes, investing billions into EV production plants and battery facilities. Tesla may have a first-mover advantage in the EV market, but it may wind up like Yahoo, losing out to Google in the internet search sector. The following chart shows S&P valuations at Dotcom Crash levels in 2000.

Source: Topdown Charts, Refinitiv Datastream. – 3/17/21

The following chart shows the record valuation of stocks as a percentage of GDP back to 1952!

Sources: Charles Schwab, Bloomberg – 12/31/20

Traders are using ever-increasing levels of margin to buy stocks. Corporate executives with record levels of cash are resuming stock buybacks as the Dow and S&P continue to set new record highs. Yet, corporate sales and economic fundamentals don’t support this extreme valuation case.

This chart from Real Investment Advisors notes the divergence of stock valuations growing to 164% versus corporate sales growth of 42% and GDP growth at 22% since 2007.

Source: Real Investment Advisors – 3/20/21

Investors, executives, and the Federal Reserve are addicted to low-interest rates. And just like physical addiction, the time will come when the zero-interest economic drug won’t work anymore, and withdrawal sets in spiraling into a market crash.

Bubbles Bubbles Everywhere

Another sign of an alternative reality is bubbles in non-financial markets. For example, Christie’s just sold a digital work of art by an artist known as Beepie for $69.3M with a non-fungible (exchangeable) token (NFT) when the bidding started at just $100. NFT collectible prices have sky rocked, providing the buyer with ownership rights indicating their purchase is authentic. Beepi knows he’s riding a soaring market, observing, ‘Absolutely it’s a bubble, to be honest.”

An NFT buyer purchased 351 Top NBA Shot videos for $5,000 last January in the video clip market. Based on social media chatter, Momentranks.com values the videos at $67,000 today. Sneaker reselling has soared as the collectible marketplace, StockX, announced that Nike Dunks sold for $33,400 two months ago. StockX disclosed that a Tom Brady rookie trading card sold for a record $1.3M in January. Even innocuous things like Twitter CEO Jack Dorsey’s first tweet sold for $2.9M. Venture capitalists Marc Andreessen and Ben Horowitz note what motivates mania buyers at a collectible forum:

Andreessen: “A big part of the entire point of life is aesthetics. The way that we live and the design of things around us and artistic creativity.”

Horowitz: “It’s a feeling. You’re buying a feeling. And what’s that worth?”

Writer Ben Carlson notes in his analysis of bubble markets that:

“We’re emotional. We lead with our feelings. We’re superstitious.”

Superstition is a characteristic of the Twilight Zone Economy.

Core City Life Is Changed Forever

Many think life will go back to the way things were in February 2020. We disagree. Life has changed forever in America. The lack of commuters changes core city life where they are the heartbeat of neighborhoods surrounded by office towers. Millions of small businesses and restaurants dependent on commuter patronage are scrambling to survive. When they had the opportunity, millions of workers worked from home and found they could perform successfully remotely. Hundreds of thousands of workers left cities to move to another less costly city or region. Some analysts think 99% of commuters will come back to city offices.

Yet, surveys show that from 20 – 25 % of professionals in dense city centers like New York and San Francisco want to work from home at least 3 – 4 days a week or work from home full time. Based on remote worker management experience companies are restructuring their reporting hierarchy. Global corporations to startups are moving to a distributed worker organization, further flattening the reporting structure for improved performance and business agility.

The lack of office workers leaves 20% of offices in core cities vacant, putting banks and commercial office space landlords at risk for billions of dollars in lease income. Plus, small businesses in these core cities have lost 50- 60% of their sales. Business owners hold billions of dollars in lease debt which must be paid off even after 80% of commuters return. Innovative new small businesses and restaurants will emerge to support these commuters. Plus, new attractions and business models will bring back visitors crucial for the leisure and hospitality sectors.

Millions of Workers Are Long Term Unemployed

About 19M workers collect continuing unemployment, of which 39.5% have been unemployed over 27 weeks. These permanently unemployed workers will have a difficult time finding their next job. While Indeed reports that job openings are up 3.7 % from January 2020, millions of workers are still unemployed. Many of these workers do not have the job skills to be hired for many new manufacturing and services jobs. Bank of America completed an analysis of unemployment pre – COVID to the trajectory of employment post COVID showing a lingering decline in the labor force.

Sources: Bank of America, CBO, Zerohedge, Real Investment Advisors – 2/12/21

The BofA analysis shows a permanent loss of employment in labor force size in Phase 3 of the recovery. The reality of the economy that workers and consumers will likely live in is an economy of debt dragging economic growth with poor job prospects. Job prospects for millions of workers will be limited by their lack of marketable skills. A major workforce segment faces a long financial recovery time from either the loss of their business or job. Lack of consumer spending by the permanently unemployed will slow the recovery.

Corporate Executives Join In the Party

In the 1950s, CEO pay to average worker pay was 50 times. Today, CEO pay is 350 times average worker pay, with Wall Street applauding stock buybacks totaling 1.4T in 2019. While buybacks fell to $450B in 2020, Bloomberg forecasts stock buybacks to resume $150B per quarter in 2021. Stock buybacks create overvalued markets. Ned Davis Research estimates the SPX as overvalued by at least 20% due to stock buybacks distorting prices in 2019. A company gooses prices by using cash to purchase shares in the open market, thereby reducing the stock pool for public investors. If demand stays the same, prices go up.

Yet, the company has not increased in substantive value. Many executives used low-cost debt to make stock purchases that saddle the company with major debt obligations. Executives must refinance these debt obligation or pay them off in the near future. In January 2020, corporate debt hit a 30-year record 49% of GDP, while interest rates were low. Fitch forecasts a jump in corporate loan defaults in 2021 to 8 – 9% from a 2020 default range of 5 – 6%.

Sources: Fitch Ratings, Vuk Vukovic – 9/22/20

A significant default storm looms in the coming years as interest rates rise.

Another cash flow squeeze is developing in profit margins. Prices paid for goods and services are increasing at a rate far faster than corporations can raise end customer prices in the following chart.

Sources: Mizuho Securities, The Federal Reserve Bank of Philadelphia, The Daily Shot – 3/19/21

Note the gap between prices paid and prices received in 2009 just before the 2009 fall. A similar cash flow squeeze seems to be strengthening.

Policy Makers Are Missing Solid Economic Landmarks

To pilot a ship along a coast and into a safe harbor, a captain needs recognizable landmarks and beacons. Our policy – captains are in a twilight zone fog. Many key economic indicators do not actually measure what policymakers tell us they do. Stock earnings per share reports are financially manipulated by stock buybacks misleading investors as to the actual earnings per share compared to pre-buybacks. The Fed holds interest rates artificially low with the resulting liquidity injections distorting debt markets. Unemployment rates are not accurate when the Bureau of Labor Statistics shows a rate of 6.7%. But, according to state unemployment reports, 19M workers are on continuing unemployment. Thus, the unemployment rate is more like 12.6%.

The Fed’s inflation consumer price index figures exclude ‘volatile energy and food prices, which are expenses consumers experience every day. Since the federal government in 1999 changed to a ‘consumer lifestyle buying pattern’ approach rather than a standard price comparison, inflation has consistently been under-reported. In 1998 the Bureau of Labor Statistics shifted to an ‘owner equivalent rental cost’ for homeownership. Using the Case-Shiller Home Price Index since 2019 shows the BLS OER-based approach understates CPI dramatically at 1.0% vs. the Case-Shiller model at 2.5%.

Industry Research On The Real Economy Is More Accurate

Chapwood Investments publishes a biannual index including 50 cities comparing consumer goods and services prices on 500 consumer items. Their analysis showed the top ten cities in the US with an average inflation rate of 10% in the second half of 2020. A marketing industry research firm compared price changes for 220 often purchased consumer products at Target and Walmart comparing 2018 to 2019 prices on average, the increase was 5 – 6% for both stores. Corporate marketing executives must have accurate information to make reasonable sales forecasts and plans for investment. Our policy leaders can learn from their example.

The Way Out of the Twilight Zone

To leave the Twilight Zone grip requires policymakers to recognize financial and real economy fundamentals. They need to drop the no economic pain utopia model. Policymakers need to get real with their statistics and tracking systems to base their policy initiatives on the real economy. Analysts need to use fundamentals for stock market and financial valuations. The Fed should stop rescuing failing hedge funds, zombie companies and end the addiction to low-cost debt. Washington can start paying for new spending programs with increased focused taxes, ending government waste and lower spending. The focus needs to be on a monetary and fiscal set of policies sustaining entrepreneurship, hard work, and allowing the economic consequences of business failure to run their course.

To avoid the inevitable market crash, these programs need to be phased in over several years to allow for investors, executives, and consumers to make adjustments to their portfolios. It is as if economic leaders have sent investors up an infinite ‘wall of price’ like a free solo climber, with no safety rope leaving them to the inevitable fate of fundamental economic gravity.

Patrick Hill is the Editor of The Future Economy, https://thefutureconomy.com/, the site hosts analysis of the real economy, ideas on a new economy, indicators, and posts to start a dialog. He writes from the heart of Silicon Valley, leveraging 20 years of experience as an executive at firms like HP, Genentech, Verigy, Informatica, and Okta to provide investment and economic insights. Twitter: @PatrickHill1677, email: patrickhill@thefutureconomy.com.

The post Patrick Hill: The Twilight Zone Economy appeared first on RIA.

stocks pandemic bitcoin currencies oilInternational

United Airlines adds new flights to faraway destinations

The airline said that it has been working hard to "find hidden gem destinations."

Since countries started opening up after the pandemic in 2021 and 2022, airlines have been seeing demand soar not just for major global cities and popular routes but also for farther-away destinations.

Numerous reports, including a recent TripAdvisor survey of trending destinations, showed that there has been a rise in U.S. traveler interest in Asian countries such as Japan, South Korea and Vietnam as well as growing tourism traction in off-the-beaten-path European countries such as Slovenia, Estonia and Montenegro.

Related: 'No more flying for you': Travel agency sounds alarm over risk of 'carbon passports'

As a result, airlines have been looking at their networks to include more faraway destinations as well as smaller cities that are growing increasingly popular with tourists and may not be served by their competitors.

Shutterstock

United brings back more routes, says it is committed to 'finding hidden gems'

This week, United Airlines (UAL) announced that it will be launching a new route from Newark Liberty International Airport (EWR) to Morocco's Marrakesh. While it is only the country's fourth-largest city, Marrakesh is a particularly popular place for tourists to seek out the sights and experiences that many associate with the country — colorful souks, gardens with ornate architecture and mosques from the Moorish period.

More Travel:

- A new travel term is taking over the internet (and reaching airlines and hotels)

- The 10 best airline stocks to buy now

- Airlines see a new kind of traveler at the front of the plane

"We have consistently been ahead of the curve in finding hidden gem destinations for our customers to explore and remain committed to providing the most unique slate of travel options for their adventures abroad," United's SVP of Global Network Planning Patrick Quayle, said in a press statement.

The new route will launch on Oct. 24 and take place three times a week on a Boeing 767-300ER (BA) plane that is equipped with 46 Polaris business class and 22 Premium Plus seats. The plane choice was a way to reach a luxury customer customer looking to start their holiday in Marrakesh in the plane.

Along with the new Morocco route, United is also launching a flight between Houston (IAH) and Colombia's Medellín on Oct. 27 as well as a route between Tokyo and Cebu in the Philippines on July 31 — the latter is known as a "fifth freedom" flight in which the airline flies to the larger hub from the mainland U.S. and then goes on to smaller Asian city popular with tourists after some travelers get off (and others get on) in Tokyo.

United's network expansion includes new 'fifth freedom' flight

In the fall of 2023, United became the first U.S. airline to fly to the Philippines with a new Manila-San Francisco flight. It has expanded its service to Asia from different U.S. cities earlier last year. Cebu has been on its radar amid growing tourist interest in the region known for marine parks, rainforests and Spanish-style architecture.

With the summer coming up, United also announced that it plans to run its current flights to Hong Kong, Seoul, and Portugal's Porto more frequently at different points of the week and reach four weekly flights between Los Angeles and Shanghai by August 29.

"This is your normal, exciting network planning team back in action," Quayle told travel website The Points Guy of the airline's plans for the new routes.

stocks pandemic south korea japan hong kong europeanInternational

Walmart launches clever answer to Target’s new membership program

The retail superstore is adding a new feature to its Walmart+ plan — and customers will be happy.

It's just been a few days since Target (TGT) launched its new Target Circle 360 paid membership plan.

The plan offers free and fast shipping on many products to customers, initially for $49 a year and then $99 after the initial promotional signup period. It promises to be a success, since many Target customers are loyal to the brand and will go out of their way to shop at one instead of at its two larger peers, Walmart and Amazon.

Related: Walmart makes a major price cut that will delight customers

And stop us if this sounds familiar: Target will rely on its more than 2,000 stores to act as fulfillment hubs.

This model is a proven winner; Walmart also uses its more than 4,600 stores as fulfillment and shipping locations to get orders to customers as soon as possible.

Sometimes, this means shipping goods from the nearest warehouse. But if a desired product is in-store and closer to a customer, it reduces miles on the road and delivery time. It's a kind of logistical magic that makes any efficiency lover's (or retail nerd's) heart go pitter patter.

Walmart rolls out answer to Target's new membership tier

Walmart has certainly had more time than Target to develop and work out the kinks in Walmart+. It first launched the paid membership in 2020 during the height of the pandemic, when many shoppers sheltered at home but still required many staples they might ordinarily pick up at a Walmart, like cleaning supplies, personal-care products, pantry goods and, of course, toilet paper.

It also undercut Amazon (AMZN) Prime, which costs customers $139 a year for free and fast shipping (plus several other benefits including access to its streaming service, Amazon Prime Video).

Walmart+ costs $98 a year, which also gets you free and speedy delivery, plus access to a Paramount+ streaming subscription, fuel savings, and more.

If that's not enough to tempt you, however, Walmart+ just added a new benefit to its membership program, ostensibly to compete directly with something Target now has: ultrafast delivery.

Target Circle 360 particularly attracts customers with free same-day delivery for select orders over $35 and as little as one-hour delivery on select items. Target executes this through its Shipt subsidiary.

We've seen this lightning-fast delivery speed only in snippets from Amazon, the king of delivery efficiency. Who better to take on Target, though, than Walmart, which is using a similar store-as-fulfillment-center model?

"Walmart is stepping up to save our customers even more time with our latest delivery offering: Express On-Demand Early Morning Delivery," Walmart said in a statement, just a day after Target Circle 360 launched. "Starting at 6 a.m., earlier than ever before, customers can enjoy the convenience of On-Demand delivery."

Walmart (WMT) clearly sees consumers' desire for near-instant delivery, which obviously saves time and trips to the store. Rather than waiting a day for your order to show up, it might be on your doorstep when you wake up.

Consumers also tend to spend more money when they shop online, and they remain stickier as paying annual members. So, to a growing number of retail giants, almost instant gratification like this seems like something worth striving for.

Related: Veteran fund manager picks favorite stocks for 2024

stocks pandemic mexicoUncategorized

Comments on February Employment Report

The headline jobs number in the February employment report was above expectations; however, December and January payrolls were revised down by 167,000 combined. The participation rate was unchanged, the employment population ratio decreased, and the …

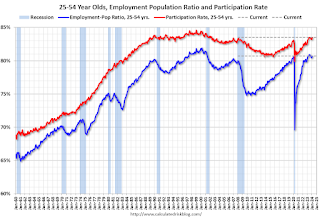

Prime (25 to 54 Years Old) Participation

Since the overall participation rate is impacted by both cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.

The 25 to 54 years old participation rate increased in February to 83.5% from 83.3% in January, and the 25 to 54 employment population ratio increased to 80.7% from 80.6% the previous month.

Average Hourly Wages

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees from the Current Employment Statistics (CES).

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees from the Current Employment Statistics (CES). Wage growth has trended down after peaking at 5.9% YoY in March 2022 and was at 4.3% YoY in February.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:"The number of people employed part time for economic reasons, at 4.4 million, changed little in February. These individuals, who would have preferred full-time employment, were working part time because their hours had been reduced or they were unable to find full-time jobs."The number of persons working part time for economic reasons decreased in February to 4.36 million from 4.42 million in February. This is slightly above pre-pandemic levels.

These workers are included in the alternate measure of labor underutilization (U-6) that increased to 7.3% from 7.2% in the previous month. This is down from the record high in April 2020 of 23.0% and up from the lowest level on record (seasonally adjusted) in December 2022 (6.5%). (This series started in 1994). This measure is above the 7.0% level in February 2020 (pre-pandemic).

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 1.203 million workers who have been unemployed for more than 26 weeks and still want a job, down from 1.277 million the previous month.

This is close to pre-pandemic levels.

Job Streak

| Headline Jobs, Top 10 Streaks | ||

|---|---|---|

| Year Ended | Streak, Months | |

| 1 | 2019 | 100 |

| 2 | 1990 | 48 |

| 3 | 2007 | 46 |

| 4 | 1979 | 45 |

| 5 | 20241 | 38 |

| 6 tie | 1943 | 33 |

| 6 tie | 1986 | 33 |

| 6 tie | 2000 | 33 |

| 9 | 1967 | 29 |

| 10 | 1995 | 25 |

| 1Currrent Streak | ||

Summary:

The headline monthly jobs number was above consensus expectations; however, December and January payrolls were revised down by 167,000 combined. The participation rate was unchanged, the employment population ratio decreased, and the unemployment rate was increased to 3.9%. Another solid report.

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoIndustrial Production Decreased 0.1% in January

-

International1 month ago

International1 month agoWar Delirium

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges