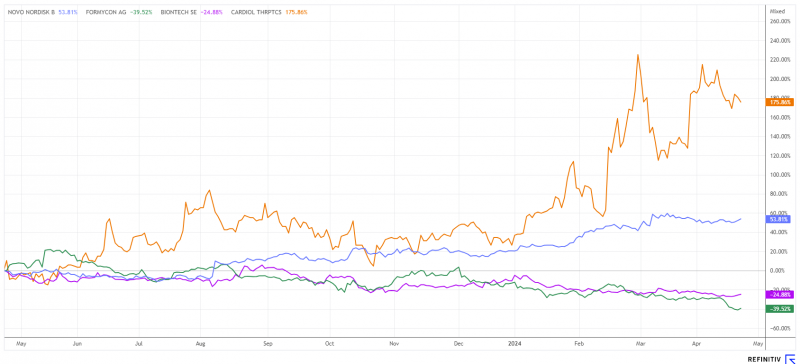

The biotech sector has significantly lagged behind the performance of artificial intelligence and high-tech this year. This is because of high inflation, which in turn has made an imminent interest rate cut unlikely. Nevertheless, Germany’s economic conditions are deteriorating dramatically, particularly because of the ongoing geopolitical conflicts. It should, therefore, come as no surprise if the ECB announces an “emergency interest rate cut” in the summer. That would then be the starting signal for a major reshuffle out of the best performers of recent months and into the long-neglected biotech segment. We have selected a few interesting stocks.

BioNTech and Formycon – now on sale

BioNTech’s shares (NDAQ:BNTX) have yet to gain momentum in 2024. The share price has fallen by 23% since January, and all hopes are pinned on the cancer-fighting pipeline that has been conjured up in various places. Business with COVID-19 vaccines is slowly running towards zero, meaning that the Mainz-based company will likely be in the red again this year. It is still completely unclear whether the emerging lawsuits in connection with the controversial vaccinations will come to the table at some point.

Behind the scenes, however, the company is returning to its roots and is increasingly focusing on cancer drugs. The vision is to develop new types of mRNA vaccines against cancer that can be adapted to patients as required and may even provide a cure without surgical intervention. At EUR 82.90, the share price is not far off its low for the year of EUR 78.54, giving shareholders little reason to rejoice.

The opinions of experts are also becoming increasingly skeptical, as only 8 out of 16 analysts on the Refinitiv Eikon platform are still positive and recommend the share as a “Buy”, with an average price expectation of EUR 106, which still represents a potential upside of 27%.

Munich-based biosimilar specialist Formycon will hold a conference call tomorrow, April 25, to present its figures for 2023. Revenues rose from EUR 42.5 million to EUR 77.7 million in 2023. Despite a previously formulated negative EBITDA forecast, the company reported a return to profitability with EUR 1.5 million. This was due to the pause in the development of FYB207 in 2023, resulting in unspent research funds.

The EBITDA outlook for 2024 again indicates an intensification of investments in the biosimilar pipeline. Formycon aims to achieve sales of EUR 55 to 65 million, but research expenses will again have a strong negative impact on earnings of EUR -15 to -25 million.

The share price fell back to EUR 39 Tuesday and is thus only marginally above the mid-April low of EUR 37.65. The analyst consensus on the Refinitiv Eikon platform still sees a price target of EUR 101.75. This is surprisingly far from the current share price and will likely decrease with upcoming updates.

Cardiol Therapeutics – Plus 100% is just the beginning

We are moving from the rather consolidating stocks to a top shooter in the biotech sector. The Canadian company Cardiol Therapeutics Inc. (TSX:CRDL) has developed a promising drug candidate called CardiolRx™ in recent years. With its pharmaceutically manufactured, oral solution formulation, the company is again making headlines because CardiolRx blocks the activation of the inflammasome signaling pathway.

After investing heavily in the product pipeline, CEO David Elsley summarizes 2023 and the aspirations for 2024 as follows: “Cardiol Therapeutics made significant progress in 2023 and early 2024 as we pursued our primary goal of providing new therapeutic options for patients with poorly treated heart disease.”

To support the ongoing clinical programs, Cardiol recently attended several scientific conferences where promising preclinical results were presented. In addition, the experts gained deep insights into the molecular and cellular mechanisms of action and benefits of the drug candidates. In February 2024, CardiolRx received Orphan Drug Designation (ODD) from the US Food and Drug Administration (FDA) for the treatment of pericarditis. With this tailwind, the company is well positioned to achieve significant milestones in 2024 and further advance their goal helping people affected by underserved debilitating heart diseases.

Significant milestones in the MAvERIC, ARCHER, and CRD-38 programs are to be achieved in the current year, which should give the company’s valuation further momentum. The Cardiol share price has risen by almost 175% in the last 12 months without consolidating significantly. With sufficient cash, there is no need to refinance at this level. This means that there is no further dilution and shareholders can continue to benefit from the success of the programs. Cardiol is likely only at the beginning of a long-term revaluation.

Novo Nordisk – What the analysts say

Novo Nordisk (OTCPK:NONOF) continues to grow and expand its product portfolio. The company is known worldwide for its innovations in the field of diabetes and obesity with leading products such as Wegovy and Ozempic. Now, the German Federal Cartel Office has approved the acquisition of Cardior Pharmaceuticals, leading the Danish pharmaceutical giant into a new era of cardiology research.

With this strategic decision, Novo Nordisk underlines its recently emphasized ambition to expand its therapeutic offering beyond its core areas and further strengthens its position as an innovation leader in the healthcare sector. The Danish company also sees the opportunity to expand its portfolio with key therapeutic approaches in the field of cardiology.

The share has taken a pause in its upward trajectory in recent weeks. At a price of DKK 884 or EUR 118.9, the market capitalization now stands at EUR 518 billion. This makes Novo Nordisk one of the largest listed stocks in Europe.

The analyst consensus on Refinitiv Eikon, with 17 recommendations out of 28 assessments, reflects high confidence in its future growth. The 12-month price targets have recently reached a consensus of DKK 945, which is around 6% higher than yesterday’s price.

Typically, experts may adjust their forecasts after new financial results, which are due to be released in a few days on May 2. It will be exciting to see whether the share price will then continue unabated or whether profit-taking will dominate the picture.

(Source: Refinitiv Eikon)

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as “Relevant Persons”) currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a “Transaction”). Transactions may thereby influence the respective price of the shares or other financial instruments of the company. In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships. For this reason, there is also a concrete conflict of interest. The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.

Join the discussion: Head over to the Bullboards at Stockhouse’s stock forums and message boards to share your market outlook and hear what everyone is saying about these and other stocks.

This article is submitted contributor content. The material provided in this article is for information only and should not be treated as investment advice. For full disclaimer information, please click here.

The post Takeover rumours: BioNTech, Cardiol Therapeutics and Novo Nordisk in focus appeared first on The Market Online Canada.

tsx

stocks

covid-19

rate cut

treatment

fda

preclinical

canada

europe

germany

Read More