International

Futures Rebound From Overnight Tech Wreck

Futures Rebound From Overnight Tech Wreck

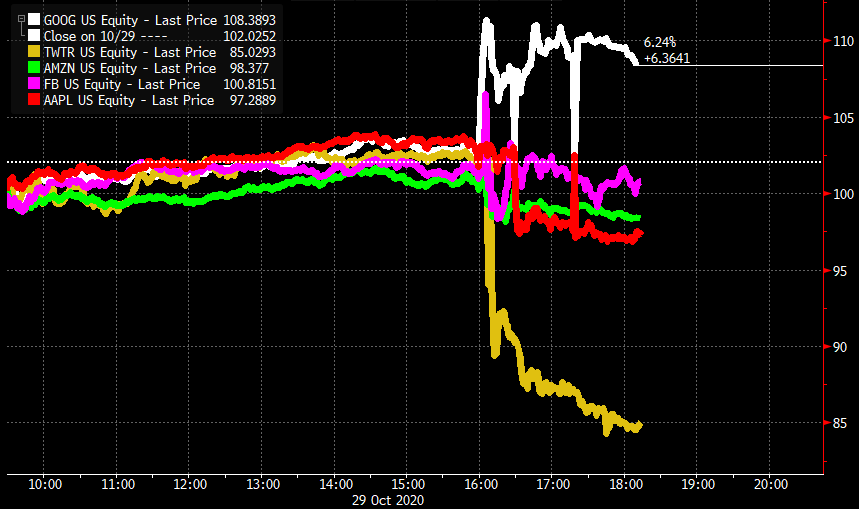

On Monday we presented readers with the latest observations from BofA quants who pointed out that Q3 earnings "smacked of the tech bubble" because despite impressive beats, in many cases stocks dropped (or outright tumbled) in kneejerk response as virtually everything has now been priced to (and beyond) perfection with little chance of upside surprise. Nowhere was this more evident than on Thursday afternoon when the world's 4 biggest tech companies all reported blockbuster earnings and yet all sank subsequently with the exception of Alphabet which popped after hours (while Twitter cratered as countless conservatives bailed on the ultra-liberal and openly pro-Biden social network).

Nasdaq futures fell about 1%, erasing more than half of what was a 2.7% slide earlier after Apple’s iPhone sales and Twitter’s user growth both missed estimates. The two stocks sank in pre-market trading. Amazon.com fell 1.4% after it forecast a jump in costs related to COVID-19, while Facebook shed 2% as it warned of a tougher 2021. Google parent Alphabet was the only bright star among the FAAMGs with its shares jumping 7% after it beat estimates for quarterly sales as businesses resumed advertising.

Ahead of the overnight tech rout, global stock were already on course for the worst weekly decline since March as lockdown measures and the collapse of stimulus talks (which "nobody" could have predicted) crippled trader optimism. Treasuries, the dollar, oil and gold were little changed.

Third-quarter earnings season is past its halfway mark and about 84.8% of S&P 500 companies have beaten estimates for earnings, according to Refinitiv data. Overall, profit is expected to tumble 13.4% from a year ago.

The broad-based weakness in the market-leading giga-tech stocks added to trader concerns about a surge in coronavirus cases, and hammered stock futures on Friday, although futures are now off their worst levels of the day.

S&P e-minis fell 25.00 points or 0.9% and Nasdaq 100 E-minis were down 121 points, or 1.1%. A longer-term chart shows the precarious positioning for the S&P, with any further declines set to take out the Sept 24 lows and open up a trapdoor to much lower levels.

Shares of tech heavyweights had jumped ahead of tech results on Thursday, helping the S&P 500 close higher. Still, the benchmark index is set to wrap up its worst week since mid-June, while Wall Street's fear gauge held at a 20-week high, also on fears of a contested election next week. Ahead of the final weekend before Election Day on Tuesday, President Donald Trump and Democratic challenger Joe Biden will barnstorm across battleground states in the Midwest where the coronavirus pandemic has exploded anew.

"Our short-term risk-appetite indicator is firmly in negative territory,” said Credit Agricole CIB head of global markets research Jean-Francois Paren. "The adjustment of risky asset prices to the weaker epidemic and economic outlook could continue, which is not encouraging for risk asset prices in the coming days, especially given the uncertainty regarding the U.S. elections."

European shares fluctuated amid a string of mixed earnings reports. Europe's Stoxx 600 Index erased declines of as much as 0.9%, climbing 0.3%, led by energy and banks, with E&P giants Total and Shell among biggest gainers; Total posted 3Q profit that exceeded the highest analyst estimate; Barclays raised Shell to equalweight, saying newly presented financial framework addresses main concerns. Tech stocks faltered as did Danish drug giant Novo Nordisk A/S, whose earnings underwhelmed analysts. Bank stocks advanced after Spain’s BBVA SA and the U.K.’s NatWest Group Plc reported improved pictures for soured loans.

Earlier in the session, Asian stocks fell, led by the health care and IT sectors. Trading volume for MSCI Asia Pacific Index members was 28% above the monthly average for this time of the day. The Topix lost 2%, with Takeda and Hoya contributing the most to the move. The Shanghai Composite Index retreated 1.5%, driven by China Life and Yili Industrial.

As Bloomberg notes, weakness in technology shares has added to volatility that’s likely to remain elevated heading into next week’s U.S. election. Global equities are on course for the worst weekly decline since March as lockdown measures in some countries and the lack of an agreement on U.S. stimulus dent sentiment. New U.S. coronavirus cases topped 89,000, setting a daily record.

In FX, the Bloomberg Dollar Spot Index steadied after swinging between gains and losses; the euro steadied but was set for its biggest weekly drop against the dollar since September. Sweden’s krona led gains among Group-of-10 peers, though the Japanese yen remained supported on haven demand. The Australian dollar advanced on month-end flows, with a stronger yuan also spurring appetite for the commodity-linked currency.

In rates, Treasuries were unchanged with long-end supported ahead of month-end. Yields are off richest levels of the day as e-minis recouped some early losses. Treasury yields are within a basis point of Thursday’s close, slightly lower across the curve; 10-year yields around 0.82%, remain toward cheaper end of 0.74% to 0.84% weekly range and outperforming bunds, gilts by almost a basis point each. Treasuries rallied in early Asia session as Apple stock fell over 4% in after-market trading on Thursday; into early U.S. session Nasdaq e-minis remain lower by 1.2%, S&P e-minis are off 0.9%.

In commodities, oil was flat after suffering a recent rout, while spot gold headed for its third consecutive monthly decline. Crude oil was little changed in New York.

On today's calendar AbbVie, Exxon and Charter Communications are among Friday’s scheduled earnings. Personal spending, U. of Michigan sentiment are due.

Market Snapshot

- S&P 500 futures down 1.4% to 3,257.75

- STOXX Europe 600 up 0.1% to 342.16

- MXAP down 1.3% to 172.21

- MXAPJ down 1.2% to 572.11

- Nikkei down 1.5% to 22,977.13

- Topix down 2% to 1,579.33

- Hang Seng Index down 2% to 24,107.42

- Shanghai Composite down 1.5% to 3,224.53

- Sensex down 0.6% to 39,523.90

- Australia S&P/ASX 200 down 0.6% to 5,927.58

- Kospi down 2.6% to 2,267.15

- Brent Futures down 0.03% to $37.64/bbl

- Gold spot up 0.2% to $1,871.30

- U.S. Dollar Index down 0.04% to 93.92

- German 10Y yield rose 1.4 bps to -0.622%

- Euro down 0.05% to $1.1668

- Brent Futures down 0.03% to $37.64/bbl

- Italian 10Y yield fell 7.3 bps to 0.489%

- Spanish 10Y yield rose 1.7 bps to 0.15%

Top Overnight News from Bloomberg

- Germany and the rest of the euro area’s biggest economies surged in the third quarter, in a rebound that’s now being derailed by an intensifying pandemic and new government restrictions on businesses

- European Central Bank policy maker Robert Holzmann said it is right to assume that President Christine Lagarde signaled more monetary stimulus is coming, though not until December

- U.K. house prices posted their biggest annual gain since 2015 this month as a revival in the housing market defied a wider economic malaise

- Jeremy Corbyn’s suspension from the U.K. Labour Party he led until April threatened to re-open divisions in the party after six months of relative calm under new leader Keir Starmer

- Treasury Secretary Steven Mnuchin accused House Speaker Nancy Pelosi of pulling a “political stunt” and holding up a new stimulus bill by refusing to offer compromises, in an escalation of acrimonious finger-pointing over stalled virus-relief negotiations

- U.S. new virus cases topped 89,000, setting a new daily record, as the outbreak intensifies ahead of next week’s presidential election. The U.S. is seeing a jump in cases in New York and New Jersey again, and a record outbreak across the Midwest states

- France is aiming to limit the drop in economic activity to 15% during the country’s second coronavirus lockdown starting on Friday, Finance Minister Bruno Le Maire said in a government briefing on Thursday

- German Chancellor Angela Merkel delivered a wake-up call to fellow leaders in the 27-nation European Union, saying they all failed to step in quickly enough to control the pandemic as the cost of a second lockdown begins to come into focus

- Oil is poised for the biggest monthly decline since March as a resurgent coronavirus across the U.S. and Europe raised concerns the fragile demand recovery will be derailed.

Here's a quick look at global markets courtesy of NewsSquawk

Asian equity markets weakened heading into month-end and after US stock index futures faded the recovery seen on Wall Street amid disappointment from the big tech earnings despite Apple, Alphabet, Amazon, Facebook and Twitter all beating on top and bottom lines. Apple shares declined over 4% in extended trade with investors discouraged by the miss on iPhone sales and lack of guidance, as well as a 29% Y/Y drop in its Chinese revenue which pressured its supply Chain in Asia and Twitter slumped nearly 18% after hours on slower user growth. ASX 200 (-0.6%) and Nikkei 225 (-1.5%) were weaker with industrials and tech frontrunning the declines in Australia although losses in the index were briefly pared by financials as AMP shares surged over 20% following a takeover approach by Ares Management, while the mood in Tokyo was clouded by currency effects and soft inflation data but with Panasonic shares a notable gainer on reports it is working with Tesla to build a new battery cell production line at the Gigafactory. Elsewhere, the Hang Seng (-2.0%) and Shanghai Comp. (-1.5%) remained cautious amid a plethora of large-cap earnings and with participants mulling over the initial details of the 5-year plan which seeks to build the nation into a technological powerhouse and emphasized quality growth over speed but refrained from specifying a targeted pace of growth. Finally, 10yr JGBs were lower and fell below support near 152.00 on spillover selling from T-notes as Wall Street initially nursed losses and following an uninspiring 7yr auction stateside, although the downside for JGBs was cushioned with the BoJ in the market for nearly JPY 1.3tln of JGBs with up to 10yr maturities.

Top Asian News

- Hong Kong Economy Shows Early Signs of Revival as Exports Jump

- Singapore Overtakes Thailand to Become Asia’s Worst Stock Market

- BOJ Widens Buying Ranges While Cutting Frequency for Short Bonds

European equities (Eurostoxx 50 -0.1%) have trimmed opening losses throughout the session despite underpeformance of Stateside peers. After a mixed close yesterday, equities in the region initially succumbed to some of the heavy selling pressure seen after the Wall St. close in the wake of earnings from US tech mega-caps. Despite the likes of Apple, Alphabet, Amazon, Facebook and Twitter recording beats on top and bottom lines, earnings (ex-Alphabet; up 5.6% pre-market) were received poorly with Apple shares currently lower by 4.5% in pre-market trade following a miss on iPhone sales and lack of guidance, as well as a 29% Y/Y drop in its Chinese revenue. Social media names Facebook (-2.4%) and Twitter (-17.5%) are seen lower ahead of the cash open, whilst e-commerce giant Amazon (-2.1%) are also lagging with some citing soft operating income guidance for December. In Europe, given the gravitational pull of the aforementioned large-caps, stocks across the continent commenced the session on the backfoot before staging a mild recovery with little in the way of clear fundamentals behind the move; as context the Eurostoxx 50 is lower by 6.4% on the week. Sectoral performance is somewhat mixed with oil & gas names the clear outperformer in the wake of earnings from Total (+2.3%) who reported a heavy beat on Q3 net income and maintained its dividend despite the likes of BP, Shell and Eni trimming theirs in 2020. Elsewhere, banking names are also performing well this morning following Q3 results from Natwest Group (+5.6%) which saw the Co. beat expectations for quarterly pre-tax profits and suggest that FY impairments are seen at the lower end of the range. IAG (+2.6%) have lent some support to the travel & leisure sector despite reporting a wider than expected loss for Q3 operating income with the CEO noting that his top priority will be reducing the Co.’s cost base. To the downside, underperformance has been observed in personal & household goods and food & beverage names. Health care names are also softer on the session following earnings from Novo Nordisk (-1.5%) with the insulin producer missing on expectations for EBIT and net profits.

Top European News

- Spanish Banks Join EU Peers in Painting Rosier Bad Loans Picture

- Continental CEO Degenhart to Resign, Citing Health Reasons

- Italy in Talks With Paschi on $1.75 Billion Capital Increase

- U.K. House Prices Jump Most in Five Years as Boom Gathers Pace

In FX, the Dollar remains relatively firm and resilient given a loss of safe-haven status or less demand amidst a fragile recovery in risk sentiment, month end portfolio rebalancing and positioning ahead of next week’s US Presidential Election. However, the index is back below 94.000 and Thursday’s 94.105 high within a 93.983-762 range as several major counterparts claw back some lost ground before another raft of data, the Chicago PMI and final Michigan sentiment.

- JPY/AUD – Leading the aforementioned G10 recovery in spite of somewhat mixed Japanese CPI, unemployment and ip updates, the Yen is back above 104.50 and a key Fib at the half round number alongside hefty option expiry interest (2.2 bn). On the flip-side, 1.4 bn expiries at the 104.00 strike will act as a barrier and support for Usd/Jpy after the pair got to within 2-3 pips of the level yesterday, and conversely the Aussie appears to be drawing comfort from the fact that it survived an equally close shave with 0.7000 to probe 0.7050 with assistance from ANZ’s CEO arguing against an RBA ease next week on the grounds it would flood the financial system with more liquidity, impair bank profitability and only boost the economy and jobs marginally.

- GBP – Also firmer vs the Buck after losing 1.2900+ status on Wednesday and maintaining momentum against the Euro close to 0.9000 in wake of the ECB, though wary of ongoing Brexit uncertainty and end of month Eur/Gbp cross flows that can deviate from RHS to LHS quite sporadically.

- NZD/EUR/CAD/CHF – All narrowly mixed vs the Greenback, as the Kiwi regains hold of the 0.6600 handle in wake of another upbeat sentiment survey (ANZ consumer confidence up to 108.7 in October from 100.0 previously), and the Euro pares some post-ECB losses after basing at 1.1650. Note, this coincided with the 100 DMA, which is now 5 pips firmer and the 2 chart points also align with 1.5 bn option expiries for today’s NY cut. Perhaps predictably, market contacts tout stops on a break of 1.1650 that would expose a virtual double bottom from late September (1.1615-12). Elsewhere, the Loonie is deriving a degree of comfort from stability in oil prices and the generally less risk averse tone to retest 1.3300 from 1.3390 or so, but the Franc is still lagging below 0.9150 and hovering near 1.0700 against the Euro.

In commodities, WTI and brent are modestly firmer this morning in a pull-back from some of the overnight losses after sentiment took a hit on the earnings-spurred downside in US equities last night. Following this, the crude complex has continued to lift off lows throughout the session alongside sentiment in general; WTI and Brent are currently firmer by around USD 0.30/bbl. Turning to OPEC where the Iraq oil minister pushed back on reports that the country and others are considering a rollover of existing OPEC+ output cuts into 2021 given developments on both the demand & supply side. While the remark is interesting there is still over a month until the next OPEC+ gathering and as such a pushback on such commentary at this stage is perhaps not too surprising. Elsewhere, the BSEE report of 43-companies had just shy of 85% of oil shut-in for the Gulf given Storm Zeta; its worth noting the storm is continuing to dissipate and as such production should be restored to the Gulf over the next few days – assuming no damage occurred. Moving to metals, spot gold is modestly firmer this morning as the USD has dipped as sentiment sees a moderate pick up from a European perspective. Separately, mining updates saw Glencore confirm their FY production guidance with the exception of coal given strike action at the Cerrjeon site; additionally, their YTD copper production is -8% vs. the prior period.

US Event Calendar

- 8:30am: Personal Income, est. 0.4%, prior -2.7%

- 8:30am: Personal Spending, est. 1.0%, prior 1.0%

- 8:30am: Employment Cost Index, est. 0.5%, prior 0.5%

- 8:30am: PCE Core Deflator YoY, est. 1.7%, prior 1.6%

- 9:45am: MNI Chicago PMI, est. 58, prior 62.4

- 10am: U. of Mich. Sentiment, est. 81.2, prior 81.2; Current Conditions, est. 84.9, prior 84.9; Expectations, est. 78.8, prior 78.8

DB's Jim Reid concludes the overnight wrap

For the first 40-odd years of my life Halloween was a minor curiosity. My Dad’s dislike of trick or treaters didn’t help cement it in my social calendar as a kid. However since we’ve had kids my wife has slowly ensured it’s become a bigger and bigger event. Last night I learnt that she has gone into overdrive and bought what I thought were pretty expensive costumes ahead of us going to a pumpkin picking Halloween themed afternoon tomorrow at a local farm. Apparently I have an extravagant ghost costume and the twins have matching baby ghost costumes. My wife and Maisie have mother and daughter witch costumes and broomsticks. I’m not sure what the Halloween version of bah humbug is (maybe boooo humbug), but I’m slowly having it drummed out of me.

Over the last 24 hours we’ve gone from treat to trick as the prospect of big tech earnings first lured investors back in and then disappointed when they arrived after the bell. The S&P 500 was up over +2% late in the actual session last night prior to a sharp 70bp pullback in the last half hour of trading. It still closed +1.19%, with the NASDAQ rising a greater +1.64%.

After the close, Apple (+4.53% daily gain) fell over -4% even as its quarterly results beat estimates with record sales of Macs and services. However the largest US company also revealed that iPhone revenues fell -21% with revenue in Greater China, one of the company’s most important regions, falling by -29% to the lowest level since 2014. Amazon (+2.33% earlier) was down nearly -2% after giving up an immediate postmarket gain as revenue and earnings both solidly beat analyst estimates. The dip came after the CFO indicated that covid-related expenses will go up to $4 billion. Facebook’s (+5.75% earlier) shares were down over -2.5% in the after-market, even as revenues and user growth both beat estimates. On a more positive note, Google’s (+4.16% earlier) parent company, Alphabet, gained over +6% in after-market trading with news that the company’s digital advertising profits bounced back strongly from the previous quarter.

As a result, S&P 500 and Nasdaq futures are down -1.39% and -1.90% respectively as we type. Asian markets have also taken another leg lower with the Nikkei (-0.84%), Hang Seng ( -0.50%), Asx (-0.55%) and Kospi (-1.43%) all down. Chinese markets are more mixed with the Shanghai Comp up +0.08% while the CSI is down -0.09%. In FX, cable is down -0.18% to $1.2907 as more and more areas in England are moving to the topmost tier of restrictions. Meanwhile, yields on 10yr USTs are down -1.8bps this morning

Overnight, we also got a look into some details of China’s new five-year economic plan, which had tech in focus. The new plan elevated China’s self-reliance in technology into a national strategic pillar. Senior party officials of the Communist Party said that the nation would accelerate development of the kind of technology needed to spur the next stage of economic development with focus on bold measures to cut reliance on foreign know-how.

Back to yesterday and European stocks tried to turn positive after three straight days of declines to start the week as ECB President Lagarde outlined steps the central bank could take in December to recalibrate monetary policy in light of the worsening pandemic (more below). Her comments saw the STOXX 600 rise +1.76% off the lows of the day, however part of those gains were given back in the last half hour of trading with the index ending down -0.12% on the day. While the DAX (+0.32%) gained, other bourses such as the CAC (-0.03%) and FTSE (-0.02%) were not able to stay above water. European futures are down around -1.2% this morning.

As our economists point out (see their note here) this was a unique ECB meeting as for the first time we saw a unanimous post-dated decision to act at the next meeting (December in this case). The composition of that action remains to be determined however, and will be a function of events, both pandemic and economic, over the next six weeks. Our economists suggest that the emphasis on “all instruments” being under consideration is a message to think beyond just PEPP. The sensitivity to weak private credit implies changes to the TLTRO framework. For the time being, they hold onto their view of a composite easing strategy in December: a package of measures, including tweaks to the TLTRO framework, to complement more PEPP in one form or another to address the pandemic risk and more APP to address the persistent low inflation problem.

As they also point out, six weeks can be a long time in a non-linear pandemic. However, post-dated action is not to be confused for ECB inactivity for the next six weeks. ECB President Lagarde emphasised the flexibility of existing programmes like PEPP to respond to any downside surprises. There is still more than half the PEPP available and it is flexible enough to be deployed on an "anytime, anyplace, anywhere" basis. The pace of purchases can re-accelerate if necessary.

The euro fell -0.61% by the end of the day to one month lows but that was as much due to dollar strength as half the move occurred before the ECB meeting. 10yr bund yields fell -1.1bps to -0.64%. With the signal of added ECB support peripheral bond yields fell, with Italian (-6.2bps), Spanish (-3.4bps), Greek (-10.7bps) and Portuguese (-3.5bps) 10yr bonds all tightening to 10yr bunds. US Treasuries fell with the risk on sentiment, as yields rose +5.2bps to 0.823%, the largest one day rise in over three weeks.

In terms of data, the US economy expanded at a record 33.1% (annualised) pace off the lows of the pandemic, with business reopening and consumer spending powered by stimulus injections. The rise in GDP, which on a quarterly basis is 7.4%, slightly beat market expectations of 32.0%, and comes after Q2’s also record decline of -31.4%. Overall, GDP is now -3.5% below pre-virus (Q4 2019) levels. In terms of components, consumer services spending was -7.7% below pre-virus levels, but consumer goods spending +6.7% above. There was also initial jobless claims out of the US, where claims in regular state programs totaled 751k in the week ended Oct. 24, down 40k from the prior week. Continuing claims decreased 709k to 7.76mn in the week ended Oct. 1, having now fallen for five straight weeks. Overall these were positive data points, but the virus’s progression may impact the winter readings going forward.

With less than five full days before polls close in the US elections, former Vice President Joe Biden is currently in a strong position with the fivethirtyeight.com model giving him an 89% chance of winning, the highest so far, and a national polling average lead of +8.8. Biden holds strong polling leads in the key Midwest swing states of Pennsylvania (+5.2pts), Wisconsin (+8.4pts), and Michigan (+8.1pts), and is also leading to a smaller degree in the Sunbelt swing states of Florida (+2.1pts), North Carolina (+2.2pts) and Arizona (+2.7pts). Biden can win by just carrying the Midwest but, as has been highlighted before, we are likely to know results from the latter group of states earlier because they process mail-in ballots ahead of the election and both Florida and North Carolina will also be allowed to count votes ahead of time. A quick win there for Biden and the “Blue Wave” could materialise rapidly, but a Trump win in that part of the map and we could be waiting until the end of the week at least. The Secretary of State in Pennsylvania has said that the “overwhelming majority” of votes should be counted by next Friday, but that is still at least 3 days of uncertainty and that is before we get to any implications of Supreme Court rulings.

Staying on politics EU Commission President Ursula von der Leyen stated that Brexit talks are 'making good progress' and are now 'boiling down to the two topics that are the most important - Level Playing Field and fisheries'. These two issues as well as a mechanism in the final treaty for resolving future disputes are among the most important outstanding points. European Council President Michel, expressed the expectation that the state of the negotiations would probably be assessed next week with his hope being to start the ratification process in mid-November.

On the coronavirus, hospitalisation rates in some countries are approaching peak levels seen during the first wave. Belgium reported 5,924 patients currently hospitalised, surpassing its previous peak from back in April. While in Portugal, the number of ICU patients is now 269, just short of its previous peak of 271. Similarly in Italy, there are now 17,615 patients in hospitals, though capacity still remains there compared to the nearly 29,000 back in April. This is why countries throughout Europe have been enacting new restrictions to try to flatten the curve again. Yesterday Sweden, whose actions have been among the most scrutinised, announced that residents in Stockholm are to avoid shops, gyms and any other indoor venues that don’t provide essential services. This comes as the country has seen around 3,000 new cases, a record daily rise. In the US, weekly cases have hit record highs as the virus continues to spread through the Southern and Midwestern regions. However yesterday there was troubling news out of the northeast, which had been resistant to a second wave, as New Jersey’s and New York’s positivity rates of covid-19 tests hit their highest levels since May. Lastly Dr Fauci predicted yesterday that normality may not return until late 2021 even with an effective vaccine broadly distributed.

Looking ahead to today there will be readings of France, German, Italian and Euro Area Q3 GDP. As well as CPI data for France and Italy and unemployment data for Italy and the Euro Area. In the US, we will get personal spending and income data along with PCE core deflator. There is also the MNI Chicago PMI and final University of Michigan sentiment reading for October. In terms of Central Banks, the ECB’s Weidmann is expected to speak. About halfway through earnings, we will see results today from Novo Nordisk, AbbVie, ExxonMobil, Charter Communications, Chevron, Total and NatWest Group.

International

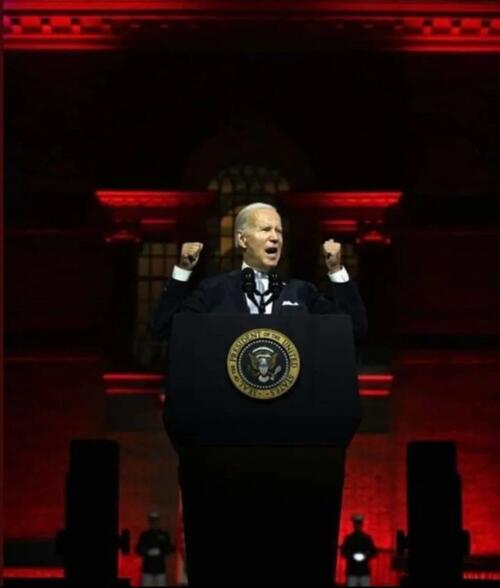

President Biden Delivers The “Darkest, Most Un-American Speech Given By A President”

President Biden Delivers The "Darkest, Most Un-American Speech Given By A President"

Having successfully raged, ranted, lied, and yelled through…

Having successfully raged, ranted, lied, and yelled through the State of The Union, President Biden can go back to his crypt now.

Whatever 'they' gave Biden, every American man, woman, and the other should be allowed to take it - though it seems the cocktail brings out 'dark Brandon'?

Tl;dw: Biden's Speech tonight ...

-

Fund Ukraine.

-

Trump is threat to democracy and America itself.

-

Abortion is good.

-

American Economy is stronger than ever.

-

Inflation wasn't Biden's fault.

-

Illegals are Americans too.

-

Republicans are responsible for the border crisis.

-

Trump is bad.

-

Biden stands with trans-children.

-

J6 was the worst insurrection since the Civil War.

(h/t @TCDMS99)

Tucker Carlson's response sums it all up perfectly:

"that was possibly the darkest, most un-American speech given by an American president. It wasn't a speech, it was a rant..."

Carlson continued: "The true measure of a nation's greatness lies within its capacity to control borders, yet Bid refuses to do it."

"In a fair election, Joe Biden cannot win"

And concluded:

“There was not a meaningful word for the entire duration about the things that actually matter to people who live here.”

Victor Davis Hanson added some excellent color, but this was probably the best line on Biden:

"he doesn't care... he lives in an alternative reality."

— Tucker Carlson (@TuckerCarlson) March 8, 2024

* * *

Watch SOTU Live here...

* * *

Mises' Connor O'Keeffe, warns: "Be on the Lookout for These Lies in Biden's State of the Union Address."

On Thursday evening, President Joe Biden is set to give his third State of the Union address. The political press has been buzzing with speculation over what the president will say. That speculation, however, is focused more on how Biden will perform, and which issues he will prioritize. Much of the speech is expected to be familiar.

The story Biden will tell about what he has done as president and where the country finds itself as a result will be the same dishonest story he's been telling since at least the summer.

He'll cite government statistics to say the economy is growing, unemployment is low, and inflation is down.

Something that has been frustrating Biden, his team, and his allies in the media is that the American people do not feel as economically well off as the official data says they are. Despite what the White House and establishment-friendly journalists say, the problem lies with the data, not the American people's ability to perceive their own well-being.

As I wrote back in January, the reason for the discrepancy is the lack of distinction made between private economic activity and government spending in the most frequently cited economic indicators. There is an important difference between the two:

-

Government, unlike any other entity in the economy, can simply take money and resources from others to spend on things and hire people. Whether or not the spending brings people value is irrelevant

-

It's the private sector that's responsible for producing goods and services that actually meet people's needs and wants. So, the private components of the economy have the most significant effect on people's economic well-being.

Recently, government spending and hiring has accounted for a larger than normal share of both economic activity and employment. This means the government is propping up these traditional measures, making the economy appear better than it actually is. Also, many of the jobs Biden and his allies take credit for creating will quickly go away once it becomes clear that consumers don't actually want whatever the government encouraged these companies to produce.

On top of all that, the administration is dealing with the consequences of their chosen inflation rhetoric.

Since its peak in the summer of 2022, the president's team has talked about inflation "coming back down," which can easily give the impression that it's prices that will eventually come back down.

But that's not what that phrase means. It would be more honest to say that price increases are slowing down.

Americans are finally waking up to the fact that the cost of living will not return to prepandemic levels, and they're not happy about it.

The president has made some clumsy attempts at damage control, such as a Super Bowl Sunday video attacking food companies for "shrinkflation"—selling smaller portions at the same price instead of simply raising prices.

In his speech Thursday, Biden is expected to play up his desire to crack down on the "corporate greed" he's blaming for high prices.

In the name of "bringing down costs for Americans," the administration wants to implement targeted price ceilings - something anyone who has taken even a single economics class could tell you does more harm than good. Biden would never place the blame for the dramatic price increases we've experienced during his term where it actually belongs—on all the government spending that he and President Donald Trump oversaw during the pandemic, funded by the creation of $6 trillion out of thin air - because that kind of spending is precisely what he hopes to kick back up in a second term.

If reelected, the president wants to "revive" parts of his so-called Build Back Better agenda, which he tried and failed to pass in his first year. That would bring a significant expansion of domestic spending. And Biden remains committed to the idea that Americans must be forced to continue funding the war in Ukraine. That's another topic Biden is expected to highlight in the State of the Union, likely accompanied by the lie that Ukraine spending is good for the American economy. It isn't.

It's not possible to predict all the ways President Biden will exaggerate, mislead, and outright lie in his speech on Thursday. But we can be sure of two things. The "state of the Union" is not as strong as Biden will say it is. And his policy ambitions risk making it much worse.

* * *

The American people will be tuning in on their smartphones, laptops, and televisions on Thursday evening to see if 'sloppy joe' 81-year-old President Joe Biden can coherently put together more than two sentences (even with a teleprompter) as he gives his third State of the Union in front of a divided Congress.

President Biden will speak on various topics to convince voters why he shouldn't be sent to a retirement home.

The state of our union under President Biden: three years of decline. pic.twitter.com/Da1KOIb3eR

— Speaker Mike Johnson (@SpeakerJohnson) March 7, 2024

According to CNN sources, here are some of the topics Biden will discuss tonight:

Economic issues: Biden and his team have been drafting a speech heavy on economic populism, aides said, with calls for higher taxes on corporations and the wealthy – an attempt to draw a sharp contrast with Republicans and their likely presidential nominee, Donald Trump.

Health care expenses: Biden will also push for lowering health care costs and discuss his efforts to go after drug manufacturers to lower the cost of prescription medications — all issues his advisers believe can help buoy what have been sagging economic approval ratings.

Israel's war with Hamas: Also looming large over Biden's primetime address is the ongoing Israel-Hamas war, which has consumed much of the president's time and attention over the past few months. The president's top national security advisers have been working around the clock to try to finalize a ceasefire-hostages release deal by Ramadan, the Muslim holy month that begins next week.

An argument for reelection: Aides view Thursday's speech as a critical opportunity for the president to tout his accomplishments in office and lay out his plans for another four years in the nation's top job. Even though viewership has declined over the years, the yearly speech reliably draws tens of millions of households.

Sources provided more color on Biden's SOTU address:

The speech is expected to be heavy on economic populism. The president will talk about raising taxes on corporations and the wealthy. He'll highlight efforts to cut costs for the American people, including pushing Congress to help make prescription drugs more affordable.

Biden will talk about the need to preserve democracy and freedom, a cornerstone of his re-election bid. That includes protecting and bolstering reproductive rights, an issue Democrats believe will energize voters in November. Biden is also expected to promote his unity agenda, a key feature of each of his addresses to Congress while in office.

Biden is also expected to give remarks on border security while the invasion of illegals has become one of the most heated topics among American voters. A majority of voters are frustrated with radical progressives in the White House facilitating the illegal migrant invasion.

It is probable that the president will attribute the failure of the Senate border bill to the Republicans, a claim many voters view as unfounded. This is because the White House has the option to issue an executive order to restore border security, yet opts not to do so

Maybe this is why?

Most Americans are still unaware that the census counts ALL people, including illegal immigrants, for deciding how many House seats each state gets!

— Elon Musk (@elonmusk) March 7, 2024

This results in Dem states getting roughly 20 more House seats, which is another strong incentive for them not to deport illegals.

While Biden addresses the nation, the Biden administration will be armed with a social media team to pump propaganda to at least 100 million Americans.

"The White House hosted about 70 creators, digital publishers, and influencers across three separate events" on Wednesday and Thursday, a White House official told CNN.

Not a very capable social media team...

The State of Confusion https://t.co/C31mHc5ABJ

— zerohedge (@zerohedge) March 7, 2024

The administration's move to ramp up social media operations comes as users on X are mostly free from government censorship with Elon Musk at the helm. This infuriates Democrats, who can no longer censor their political enemies on X.

Meanwhile, Democratic lawmakers tell Axios that the president's SOTU performance will be critical as he tries to dispel voter concerns about his elderly age. The address reached as many as 27 million people in 2023.

"We are all nervous," said one House Democrat, citing concerns about the president's "ability to speak without blowing things."

The SOTU address comes as Biden's polling data is in the dumps.

BetOnline has created several money-making opportunities for gamblers tonight, such as betting on what word Biden mentions the most.

As well as...

We will update you when Tucker Carlson's live feed of SOTU is published.

Fuck it. We’ll do it live! Thursday night, March 7, our live response to Joe Biden’s State of the Union speech. pic.twitter.com/V0UwOrgKvz

— Tucker Carlson (@TuckerCarlson) March 6, 2024

International

What is intersectionality and why does it make feminism more effective?

The social categories that we belong to shape our understanding of the world in different ways.

The way we talk about society and the people and structures in it is constantly changing. One term you may come across this International Women’s Day is “intersectionality”. And specifically, the concept of “intersectional feminism”.

Intersectionality refers to the fact that everyone is part of multiple social categories. These include gender, social class, sexuality, (dis)ability and racialisation (when people are divided into “racial” groups often based on skin colour or features).

These categories are not independent of each other, they intersect. This looks different for every person. For example, a black woman without a disability will have a different experience of society than a white woman without a disability – or a black woman with a disability.

An intersectional approach makes social policy more inclusive and just. Its value was evident in research during the pandemic, when it became clear that women from various groups, those who worked in caring jobs and who lived in crowded circumstances were much more likely to die from COVID.

A long-fought battle

American civil rights leader and scholar Kimberlé Crenshaw first introduced the term intersectionality in a 1989 paper. She argued that focusing on a single form of oppression (such as gender or race) perpetuated discrimination against black women, who are simultaneously subjected to both racism and sexism.

Crenshaw gave a name to ways of thinking and theorising that black and Latina feminists, as well as working-class and lesbian feminists, had argued for decades. The Combahee River Collective of black lesbians was groundbreaking in this work.

They called for strategic alliances with black men to oppose racism, white women to oppose sexism and lesbians to oppose homophobia. This was an example of how an intersectional understanding of identity and social power relations can create more opportunities for action.

These ideas have, through political struggle, come to be accepted in feminist thinking and women’s studies scholarship. An increasing number of feminists now use the term “intersectional feminism”.

The term has moved from academia to feminist activist and social justice circles and beyond in recent years. Its popularity and widespread use means it is subjected to much scrutiny and debate about how and when it should be employed. For example, some argue that it should always include attention to racism and racialisation.

Recognising more issues makes feminism more effective

In writing about intersectionality, Crenshaw argued that singular approaches to social categories made black women’s oppression invisible. Many black feminists have pointed out that white feminists frequently overlook how racial categories shape different women’s experiences.

One example is hair discrimination. It is only in the 2020s that many organisations in South Africa, the UK and US have recognised that it is discriminatory to regulate black women’s hairstyles in ways that render their natural hair unacceptable.

This is an intersectional approach. White women and most black men do not face the same discrimination and pressures to straighten their hair.

“Abortion on demand” in the 1970s and 1980s in the UK and USA took no account of the fact that black women in these and many other countries needed to campaign against being given abortions against their will. The fight for reproductive justice does not look the same for all women.

Similarly, the experiences of working-class women have frequently been rendered invisible in white, middle class feminist campaigns and writings. Intersectionality means that these issues are recognised and fought for in an inclusive and more powerful way.

In the 35 years since Crenshaw coined the term, feminist scholars have analysed how women are positioned in society, for example, as black, working-class, lesbian or colonial subjects. Intersectionality reminds us that fruitful discussions about discrimination and justice must acknowledge how these different categories affect each other and their associated power relations.

This does not mean that research and policy cannot focus predominantly on one social category, such as race, gender or social class. But it does mean that we cannot, and should not, understand those categories in isolation of each other.

Ann Phoenix does not work for, consult, own shares in or receive funding from any company or organisation that would benefit from this article, and has disclosed no relevant affiliations beyond their academic appointment.

africa uk pandemicGovernment

Biden defends immigration policy during State of the Union, blaming Republicans in Congress for refusing to act

A rising number of Americans say that immigration is the country’s biggest problem. Biden called for Congress to pass a bipartisan border and immigration…

President Joe Biden delivered the annual State of the Union address on March 7, 2024, casting a wide net on a range of major themes – the economy, abortion rights, threats to democracy, the wars in Gaza and Ukraine – that are preoccupying many Americans heading into the November presidential election.

The president also addressed massive increases in immigration at the southern border and the political battle in Congress over how to manage it. “We can fight about the border, or we can fix it. I’m ready to fix it,” Biden said.

But while Biden stressed that he wants to overcome political division and take action on immigration and the border, he cautioned that he will not “demonize immigrants,” as he said his predecessor, former President Donald Trump, does.

“I will not separate families. I will not ban people from America because of their faith,” Biden said.

Biden’s speech comes as a rising number of American voters say that immigration is the country’s biggest problem.

Immigration law scholar Jean Lantz Reisz answers four questions about why immigration has become a top issue for Americans, and the limits of presidential power when it comes to immigration and border security.

1. What is driving all of the attention and concern immigration is receiving?

The unprecedented number of undocumented migrants crossing the U.S.-Mexico border right now has drawn national concern to the U.S. immigration system and the president’s enforcement policies at the border.

Border security has always been part of the immigration debate about how to stop unlawful immigration.

But in this election, the immigration debate is also fueled by images of large groups of migrants crossing a river and crawling through barbed wire fences. There is also news of standoffs between Texas law enforcement and U.S. Border Patrol agents and cities like New York and Chicago struggling to handle the influx of arriving migrants.

Republicans blame Biden for not taking action on what they say is an “invasion” at the U.S. border. Democrats blame Republicans for refusing to pass laws that would give the president the power to stop the flow of migration at the border.

2. Are Biden’s immigration policies effective?

Confusion about immigration laws may be the reason people believe that Biden is not implementing effective policies at the border.

The U.S. passed a law in 1952 that gives any person arriving at the border or inside the U.S. the right to apply for asylum and the right to legally stay in the country, even if that person crossed the border illegally. That law has not changed.

Courts struck down many of former President Donald Trump’s policies that tried to limit immigration. Trump was able to lawfully deport migrants at the border without processing their asylum claims during the COVID-19 pandemic under a public health law called Title 42. Biden continued that policy until the legal justification for Title 42 – meaning the public health emergency – ended in 2023.

Republicans falsely attribute the surge in undocumented migration to the U.S. over the past three years to something they call Biden’s “open border” policy. There is no such policy.

Multiple factors are driving increased migration to the U.S.

More people are leaving dangerous or difficult situations in their countries, and some people have waited to migrate until after the COVID-19 pandemic ended. People who smuggle migrants are also spreading misinformation to migrants about the ability to enter and stay in the U.S.

3. How much power does the president have over immigration?

The president’s power regarding immigration is limited to enforcing existing immigration laws. But the president has broad authority over how to enforce those laws.

For example, the president can place every single immigrant unlawfully present in the U.S. in deportation proceedings. Because there is not enough money or employees at federal agencies and courts to accomplish that, the president will usually choose to prioritize the deportation of certain immigrants, like those who have committed serious and violent crimes in the U.S.

The federal agency Immigration and Customs Enforcement deported more than 142,000 immigrants from October 2022 through September 2023, double the number of people it deported the previous fiscal year.

But under current law, the president does not have the power to summarily expel migrants who say they are afraid of returning to their country. The law requires the president to process their claims for asylum.

Biden’s ability to enforce immigration law also depends on a budget approved by Congress. Without congressional approval, the president cannot spend money to build a wall, increase immigration detention facilities’ capacity or send more Border Patrol agents to process undocumented migrants entering the country.

4. How could Biden address the current immigration problems in this country?

In early 2024, Republicans in the Senate refused to pass a bill – developed by a bipartisan team of legislators – that would have made it harder to get asylum and given Biden the power to stop taking asylum applications when migrant crossings reached a certain number.

During his speech, Biden called this bill the “toughest set of border security reforms we’ve ever seen in this country.”

That bill would have also provided more federal money to help immigration agencies and courts quickly review more asylum claims and expedite the asylum process, which remains backlogged with millions of cases, Biden said. Biden said the bipartisan deal would also hire 1,500 more border security agents and officers, as well as 4,300 more asylum officers.

Removing this backlog in immigration courts could mean that some undocumented migrants, who now might wait six to eight years for an asylum hearing, would instead only wait six weeks, Biden said. That means it would be “highly unlikely” migrants would pay a large amount to be smuggled into the country, only to be “kicked out quickly,” Biden said.

“My Republican friends, you owe it to the American people to get this bill done. We need to act,” Biden said.

Biden’s remarks calling for Congress to pass the bill drew jeers from some in the audience. Biden quickly responded, saying that it was a bipartisan effort: “What are you against?” he asked.

Biden is now considering using section 212(f) of the Immigration and Nationality Act to get more control over immigration. This sweeping law allows the president to temporarily suspend or restrict the entry of all foreigners if their arrival is detrimental to the U.S.

This obscure law gained attention when Trump used it in January 2017 to implement a travel ban on foreigners from mainly Muslim countries. The Supreme Court upheld the travel ban in 2018.

Trump again also signed an executive order in April 2020 that blocked foreigners who were seeking lawful permanent residency from entering the country for 60 days, citing this same section of the Immigration and Nationality Act.

Biden did not mention any possible use of section 212(f) during his State of the Union speech. If the president uses this, it would likely be challenged in court. It is not clear that 212(f) would apply to people already in the U.S., and it conflicts with existing asylum law that gives people within the U.S. the right to seek asylum.

Jean Lantz Reisz does not work for, consult, own shares in or receive funding from any company or organization that would benefit from this article, and has disclosed no relevant affiliations beyond their academic appointment.

congress senate trump pandemic covid-19 mexico ukraine-

Uncategorized2 weeks ago

Uncategorized2 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoIndustrial Production Decreased 0.1% in January

-

International1 month ago

International1 month agoWar Delirium

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges