Futures Grind Higher After Powell Vows To Keep The Punchbowl Spiked For Years

Futures Grind Higher After Powell Vows To Keep The Punchbowl Spiked For Years

Global shares rose for a ninth day in a row on Thursday, just off record highs, with much of Asia closed as investors digested recent gains, while bulls received…

Global shares rose for a ninth day in a row on Thursday, just off record highs, with much of Asia closed as investors digested recent gains, while bulls received a twofer of food news after a benign U.S. inflation report and a dovish Federal Reserve outlook. Nasdaq 100 Index futures reversed yesterday's losses and technology stocks led the advance in Europe. S&P 500 futures were 0.3% higher following Powell’s "sobering" comments on the labor market that should continue to fuel stimulus optimism, reinforce the Fed put, and assuage some inflation concerns. Powell said the true unemployment rate is 10% (when normalizing for covid losses) implying that there are years to go before tightening is needed.

Among notable premarket movers, Pinterest rose 7.8% after an FT report said Microsoft approached the image-sharing company in recent months about a potential buyout. The negotiations were, however, currently not active, according to the report. PepsiCo rose 0.6% in light volumes after the snack and beverage giant topped analyst estimates for fourth-quarter revenue and said it expects organic revenue to grow in 2021 as economies reopen and COVID-19 vaccinations roll out. Casino operator MGM Resorts dropped about 4% after posting a bigger-than-expected loss, hurt by COVID-19 travel restrictions but signaled a pickup in demand later this year.

After a sharp run-up in equities at the start of February, which sent Wall Street’s main indexes to record highs recently on prospects of a $1.9 trillion coronavirus relief package to jumpstart the economy, traders took on a more subdued stance, as there’s still a debate over whether more U.S. stimulus, the vaccine rollout and the government’s determination to kickstart growth will cause the American economy to overheat. Fourth-quarter earnings have also largely topped analysts’ expectations, quelling fears of lofty valuations. Pictet Group expects the S&P 500 to rise 10% from its current levels with improving economic growth and easy monetary policy helping to extend its rally.

“The story really is still U.S. equities first and foremost,” said James Athey, investment director at Aberdeen Standard Investments. “Earnings season has been especially strong in the U.S., the fiscal stimulus coming from the Biden administration is getting bigger in the market’s mind and most of the big winners from the pandemic are U.S. listed. Only the Fed can rock the boat and with yesterday’s disappointing inflation print that prospect has just slipped even further into the future.”

The MSCI world equity index was 0.1% higher, not far from peaks reached the day before and just sustaining a nine-day streak of gains, a first since October 2017.

In Europe, the Stoxx 600 Index was 0.3% higher buoyed by strong results from Royal Mail Plc and Credit Agricole SA. Trading volumes for the Euro Stoxx 50 were about 15% below the 30-day average. Here are some of the biggest European movers today:

- Credit Agricole gains as much as 5.7%, the most since Dec. 1, after the French lender posted results that Jefferies said were strong, with underlying net income beat on stronger revenue, lower provisions.

- Danone shares climb as much as 4.2% after a top shareholder said the French yogurt maker needs a fundamental turnaround and should separate the chairman and CEO roles.

- Unibail shares fall as much as 15%, the most intraday since September, dragging peers lower. Analysts see no positives in the mall operator’s FY20 results and say it will be a long and difficult road to recovery for the sector.

- UniCredit shares drop as much as 3.4% after the Italian lender reported a larger loss than expected in the fourth quarter. Questions on outlook could remain, Jefferies wrote, while analysts at Citi said the results show better loan-loss provisions and capital generation.

- Commerzbank shares slide the most in three months, down as much as 7.9%, after the German lender warned that revenue will shrink this year and management could not fully convince analysts about its new strategy during the earnings call.

Earlier in the session, Asian stocks climbed 0.2% in a subdued session as markets in China, Japan, South Korea and Taiwan were closed for holidays. The gain followed a strong four-day rally. Tencent Holdings was the biggest drag on the Hang Seng Index, falling 0.5% after a Wall Street Journal report said a company executive is being held by Chinese authorities as part of a probe into a high-profile corruption case. The index itself climbed 0.5%. Meanwhile, Ping An Healthcare & Technology surged 21% in Hong Kong after New York-based Ark Investment Management’s $6.8 million bet drove a flood of buy orders from copycat investors. Stocks in the Philippines closed down 1.3%, snapping a five-day rally, ahead of the central bank’s interest rate announcement after the Thursday. Policy makers kept the key rate unchanged for a second straight meeting. Overall volumes were thin across the region. Shares in energy and real estate rose the most. Hong Kong, Malaysia and Singapore ended cash trading earlier today while markets in China, Japan, South Korea, Taiwan and Vietnam are closed

Investors were also reflecting on the first phone call between U.S. President Joe Biden and his Chinese counterpart, Xi Jinping, where Biden said a free and open Indo-Pacific was a priority while Xi warned confrontation would be a “disaster” for both nations.

With Chinese markets closed, there was little reaction to news the Biden administration will look at adding “new targeted restrictions” on certain sensitive technology exports to China and would maintain tariffs for now.

Amid growing concerns of economic overheating, on Wednesday Jerome Powell reassured investors on Wednesday that interest rates will remain low for some time as the U.S. jobs market remains a long way from a full recovery, and that monetary policy would remain very accommodative until there was "substantial further progress" on employment and inflation. Powell said he wanted to see inflation reach 2% or more before even thinking of tapering the bank’s super-easy policies. The Fed chair emphasized that once pandemic effects were stripped out, unemployment was nearer 10% than the reported 6.3% and thus a long way from full employment. As a result, Powell called for a “society-wide commitment” to reducing unemployment, which analysts saw as strong support for President Joe Biden $1.9 trillion stimulus package.

“While inflation is not showing up in the data right now, inflation is on its way thanks to fiscal and monetary stimulus and pent-up consumer demand that should intensify as the economy reopens,” Nancy Davis, founder of Quadratic Capital Management, said in a note.

Meanwhile, Westpac economist Elliot Clarke estimated over $5 trillion in cumulative stimulus, worth 23% of GDP, would be required to repair the damage done by the pandemic. “Financial conditions are expected to remain highly supportive of the U.S. economy and global financial markets in 2021, and likely through 2022,” he said.

In rates, the mix of bottomless Fed funds and a tame inflation report encouraged bond markets, leaving 10-year yields at 1.14%, down from a 1.20% high early in the week. Treasuries were little changed inside Wednesday’s ranges, off lows reached in London trading after muted Asia session due to Japan holiday. Refunding auctions conclude with $27BN 30-year new issue, following good reception for Wednesday’s 10-year sale. 2-year Treasury bond yields briefly print a record low of 0.0972% as cash trading gets underway after being closed in Asia hours due to Japan holiday. Yield fall as much as 1bp to breach 10bps, though the move is short lived with yields settling back to around 0.107%.Notably, ahead of the coming flood of reserves, two-year yields briefly printing a record low under 0.1% as cash trading got underway in London after a holiday in Asia

Italian bond yields remained near recent lows before a long-term bond auction and as Mario Draghi was expected to present his new government coalition in the next few days. Italy’s 10-year BTP, or government bond, yield was down one basis point down at 0.490%, near its lowest since early January.

In FX, after the U.S. inflation report and the Fed’s Powell reiterating that rates could stay lower for longer, the U.S. dollar slipped before steadying during European trading. The Bloomberg Dollar Spot Index fell a fifth consecutive day, the longest streak since November as the dollar traded mixed versus Group-of-10 peers; traders mulled Federal Reserve Chair Jerome Powell’s comments that the U.S. job market remains a long way from a full recovery. Commodity currencies led gains among Group-of-10 peers, with the exception of the Norwegian krone; the euro edged up and European yield curves bull flattened, with the core outperforming the periphery. The pound slipped against the dollar following a week- long rally, as the U.K.’s relationship with the European Union returned to weigh on sentiment. The Australian dollar rose after Secretary to the Treasury Steven Kennedy said the country’s economic recovery will weather the expiry of the government’s JobKeeper wage subsidy in March. The yen was sold broadly in European trading after being little changed in Asia as Japan is shut for a holiday.

In commodities, oil edged lower, capping the longest run of gains in two years after the IEA said the oil market recovery was still fragile as pandemic persists; as a result it cut global demand forecasts for 2021 by 200k b/d, to 96.4m b/d. Brent crude futures eased back 39 cents to $61.07. U.S. crude dipped 36 cents to $58.31 a barrel. Gold was up 0.1% at $1,845.26 per ounce, as investors drove platinum to a six-year peak on bets of more demand from car makers.

Today, the macro focus will be on jobless claims and continuing claims, where the market expects 760k new claims and 4.42mm existing claims. While the trend continues to improve, incrementally, new claims remain above the GFC high watermark of 665k set the week ending March 27, 2009. PepsiCo, Kraft Heinz, Tyson Foods, Kellogg and Walt Disney are among companies reporting earnings.

Market Snapshot

- S&P 500 futures up 0.3% to 3,914.75

- MXAP up 0.1% to 218.11

- MXAPJ up 0.2% to 733.44

- Nikkei up 0.2% to 29,562.93

- Topix up 0.3% to 1,930.82

- Hang Seng Index up 0.4% to 30,173.57

- Shanghai Composite up 1.4% to 3,655.09

- Sensex up 0.4% to 51,509.02

- Australia S&P/ASX 200 little changed at 6,850.11

- Kospi up 0.5% to 3,100.58

- German 10Y yield down 4 bps to -0.47%

- Euro up 0.1% to $1.2132

- Brent futures down 0.5% to $61.15/bbl

- Gold spot little changed at $1,841.86

- U.S. Dollar Index little changed at 90.41

Top Overnight News from Bloomberg

- The European Central Bank should introduce climate criteria for its corporate bond-buying program, Bank of France Governor Francois Villeroy de Galhau said, opening a new front in a controversial debate over how to make monetary policy greener

- Economist Lisa Cook has the backing of several key White House officials and allies outside the administration as a possible choice for President Joe Biden in filling a vacancy on the Federal Reserve Board of Governors, according to people familiar with the matter

- Federal Reserve Chair Jerome Powell says he has nothing but affection for his work, suggesting that the 68-year-old central banker could be open to a second term if asked

- Joe Biden, in his first conversation as president with the Chinese leader Xi Jinping, spoke of his concern about China’s “coercive and unfair economic practices” as well as human rights abuses in the Xinjiang region, according to a White House account of their telephone call

- Chancellor Angela Merkel warned that aggressive coronavirus mutations will gain the upper hand in Germany sooner or later, threatening to destroy progress made in containing the pandemic

- The re-balancing of global oil markets remains “fragile” amid weaker estimates for demand and a recovery in supplies, the International Energy Agency said

A look at global markets courtesy of Newsquawk

Asia-Pac lacked firm direction as risk appetite was sapped by holiday closures for many key markets in the region and following an uninspired handover from the US where the major indices finished flat after having mostly recovered from an initial sell-programme slump. ASX 200 (-0.1%) was choppy as advances in miners were offset by underperformance in tech and a subdued financials sector, with earnings results the main catalysts for today’s biggest movers including Newcrest Mining which was the best performer following a jump in H1 net, while AMP shares were at the other end of the spectrum with double-digit percentage losses due to weaker FY results and news that Ares Management abandoned its pursuit for the financial services company. Hang Seng (+0.5%) was indecisive in half-day trade for Lunar New Year’s Eve and amid a lack of Stock Connect flows with mainland bourses already shut for a week, while losses in index heavyweight Tencent added to the initial downbeat mood after an executive was reported to be under investigation related to a corruption case in China. However, losses in the index were later pared amid dialogue between US President Biden and Chinese President Xi which was the first call between the leaders since Biden took office and in which Biden noted the US priority was to preserve a free and open Indo-Pacific and wants to ensure they have an opportunity for an open line of communication, while Chinese President Xi also suggested that cooperation is the only correct choice between the two countries. As a reminder, Japan, China, South Korea, Taiwan and Vietnam were all closed for holidays.

Top Asian News

- Philippines Keeps Rate Steady With Inflation Concerns Rising

- Tokyo Olympics Chief Mori Intends to Resign, Reports Say

- Crown CEO Pressured to Quit After Scathing Casino Report

European equities have kicked off the with modest upside across the board before the gains somewhat dispersed, with the region now seeing mixed trade (Euro Stoxx 50 +0.4%). US equity futures meanwhile also vary with the ES (+0.3%), NQ (+0.5%) and YM (+0.3%) modestly firmer whilst the RTY (+0.2%) narrowly lags its peers – but again the breadth of the price action remains shallow. The tone around the market is relatively tentative post-Powell and amid a lack of fresh catalysts, thus earnings take the helm in the interim with the season in full swing in Europe – as such the major bourses see diverging performances. UK’s FTSE 100 (+0.3%) is buoyed as one of the largest weighted stocks AstraZeneca (+1.8%/6% weighting) stands firm after topping Q4 revenue estimates and declared a stable second interim dividend of USD 1.9/shr. The gravitas of AstraZeneca’s gains also keeps the Healthcare sector among one of the top performers in Europe, second only to IT. The tech sector experiences a rebound after yesterday’s losses, with potential added impetus to the growth/momentum narrative after Fed Chair Powell downplayed the significance of an increase in inflation, whilst the constructive steps taken by US and China via presidential communication opens the door for a more civil diplomatic relationship. On the flip side, Banks give up ground as yields decline following the US CPI figure yesterday and commentary from the Fed Chair – however Credit Agricole (+4%) bucks the trend after topping revenue expectations. However, in a similar vein to SocGen, the bank noted a decline in FICC activities “due to a slowdown in hedging activities caused by a massive return of liquidity and lower volatility.” Back to the sectors, Oil & Gas reside as the laggard amid overnight losses in crude prices. Individual movers are largely earnings-oriented: Pernod Ricard (-1.8%), ArcelorMittal (-1%), Clarient (-2.5%), Commerzbank (-5.8%), UniCredit (-2.7%). Finally, Volkswagen (+0.8%) is firmer following reports the Co. has teamed up with Microsoft (MSFT) to accelerate the development of automated driving.

Top European News

- London’s Top Investors Warn on Post-Brexit Easing of IPO Rules

- Suez Loses Court Bid to Challenge Veolia’s $4.1 Billion Stake

- Credit Agricole to Resume Payouts as Covid Provisions Fall

In FX, resistance around 0.7750 vs the Greenback is still capping Aud/Usd, but the Aussie is forming a firm platform above 0.7700 and consolidating gains on the 1.0700 handle against its Antipodean counterpart in wake of a rather bullish update on economic developments from Treasury Secretary Kennedy overnight. In short, the recovery is exceeding expectations and the return to record labour market participation is somewhat surprising, while public spending is elevated and seen rising. Meanwhile, the Kiwi is hovering in the low 0.7200 area awaiting NZ’s January manufacturing PMI and FPI for some independent direction, and the Loonie has retained 1.2700+ status ahead of Canadian wholesale trade and the BoC’s Q4 Senior Loan Officer Survey on Friday.

- USD - Aside from the aforementioned mild Aussie outperformance, the Dollar is narrowly mixed vs major peers and the scant DXY range (90.471-323) highlights the lack of price action or inclination to venture far in holiday-thinned volumes due to full or half day market closures in various Asian centres beyond China that has started its Lunar New Year vacation. However, the Buck still appears prone to further downside after dovish/downbeat remarks from Fed chair Powell, benign US CPI another unwind of Treasury curve bear-steepening following another solid leg of this week’s Quarterly Refunding. Ahead, IJC and the 3rd auction plus details of the upcoming 20 year note and 30 year TIPS offerings.

- EUR/GBP/CHF/JPY - The Euro has recoiled into an even tighter band inside 1.2150-00, while the Pound continues to hover above 1.3800, the Franc rotate around 0.8900 and Yen meander between 104.55-77, with the latter still capped by the 100 DMA on forays through 104.50, but supported into 105.00 where decent option expiry interest resides (1.1 bn from the round number to 105.05).

- EM - Broad gains vs the Usd, but the Zar trading with an extra spring in its step near 14.6500 post-SA mining production data showing a surprise rebound in output and pre-President Ramaphosa’s State of the Nation address, while the Mxn has breached the psychological 20.0000 mark in the run up to Banxico.

In commodities, WTI and Brent front month futures consolidate in early European trade following some overnight losses, whereby the former the former pulled back from its USD 58.90/bbl high and the latter waned from its USD 61.70/bbl best. That being said, the complex still remains elevated in the grander scheme as vaccine and stimulus hopes couple with OPEC+ support to underpin the complex. The morning also saw the release of the IEA Oil Market Report ahead of the OPEC’s release later today (time TBC). The IEA left its 2021 forecast unchanged, but downgraded its prior forecast by -200k BPD due to changes in historical data. The agency noted that demand expected to fall by 1mln in Q1 2021 from low Q4 levels, but is set to rise strongly thereafter. IEA also warned of rapid stock drawdown expected in H2 2021. However, oil prices largely side-lined the release as markets are pricing in the rise in demand in the latter part of the year. Earlier this week, the EIA STEO downgraded their forecast for 2021 world oil demand growth by 180k BPD, which sees some 5.38mln BPD Y/Y increase. EIA did however increase its 2022 forecast for world oil demand growth by 190k BPD. Further adding to the demand narrative, the European Commission winter forecasts suggested the “EU economy would reach the pre-crisis level of output earlier than anticipated back in the Autumn Forecast”. Meanwhile, eyes are kept on geopolitics, namely surrounding Iran and its nuclear activity as Russian Foreign Minister Ryabkov expect a compromise on a return to the nuclear deal before the February 21st date to avoid escalation, according to Al Jazeera. On a more constructive note, the phone call between US President Biden and his Chinese counterpart Xi expressed mutual respect in a call that set the tone for US-Sino relations. Turning to metals, spot gold and silver are relatively uneventful amid a lack of fresh catalysts, with spot gold around the unchanged mark at 1840/oz as inflationary hopes are simmered down or at least more controlled. Finally, LME copper trades lacklustre awaiting fundamental developments for further direction as Shanghai copper and Dalian iron ore observe Chinese Lunar New Year.

US Event Calendar

- 8:30am: Jan. Continuing Claims, est. 4.42m, prior 4.59m

- 8:30am: Feb. Initial Jobless Claims, est. 760,000, prior 779,000

- 9:45am: Feb. Bloomberg Consumer Comfort, prior 44.6

DB's Jim Reid concludes the overnight wrap

The highlight in a slow past 24 hours at work, and at home as the lockdown drags on, has been Fed Chair Powell’s speech to the Economic Club of New York yesterday after Europe went home. In it he called on both the federal government and private industry to do more to support the recovery in the labour market, saying that “achieving and sustaining maximum employment will require more than supportive monetary policy.” When discussing the “hidden slack” in the labour market, chair Powell indicated that a broader measure of unemployment would be about 10%, while the pandemic continues to impact younger workers, women, low-income earners and minorities harder. He also pushed back on the idea that US economy could overheat if there were to be too much fiscal injection, saying that it could be “many years” before the scars of long-term unemployment would be overcome and that the overall size of fiscal support should be left to the President and Congress. He also added that at this time last year, there were very few signs of inflation even as the jobless rate sat at multi-decade lows of 3.5%. On the topic of the Fed balance sheet, he again noted the Fed will continue providing support and that they are not thinking about changing the pace of purchases.

Ahead of Powell’s comments, US Treasury yields had already fallen back for a second day running thanks to weaker-than-expected CPI data, with yields dipping further after Powell’s message. 10yr Treasuries were down -3.4bps to 1.123% at the close. In terms of the CPI numbers, the release showed that although consumer prices had risen by +0.3% month-on-month in January as expected, the December reading was revised down two-tenths to +0.2%, while core inflation also came in lower-than-expected at 0.0% (vs. +0.2% expected). Indeed, the latest data sent year-on-year core inflation down to +1.4%, its lowest level since last June. The data helped to dampen some of the concerns over an imminent spike in inflation that’s been circulating among the economics profession in light of the extra stimulus, which in turn has led some investors to become fearful of higher interest rates from the Fed much earlier than expected. The release also led to a fall in market-based inflation expectations, with 10yr US breakevens falling back -1.6bps from the 6-year high reached on Tuesday. Having said all this if we are going to get inflation this year it was never likely to lift its head above the parapet in January.

On the topic of stimulus, the bill continues to move through the various committees in the House of Representatives as the Senate splits its time between the spending package and former President Trump’s impeachment proceedings. Yesterday the House Ways and Means Committee pushed through a key measure of $400 weekly supplemental unemployment benefits through the end of August, while also expanding the eligibility requirement to the self-employed and part-time “gig” workers. Votes are still pending on the other key measures in the Biden proposal including checks to individuals and households, state and local government aid and money for Covid-19 vaccine and testing. These are all likely to come by Friday, with Speaker Pelosi still expecting to get a vote on the house floor of the full bill during the week of February 22, giving the Senate time to vote on the measure well before March 14 – the day that the current expanded benefits are scheduled to lapse.

With questions on how the additional stimulus will affect the future outlook of the US economy, my COTD (link here) from yesterday looked at whether in theory the US authorities would ever allow a recession again given how easily they’ve managed to pull the economy out of one where there has been a savage global pandemic. This recession will go down as the shortest in history and follows four of the longest cycles in history. Basically the chart shows that the longest cycles in 170 years of history have all occurred in periods of deficit spending with the last forty years seeing aggressive structural deficits and long business cycles. The only thing stopping the authorities from making every cycle long and every recession short is inflation or political constraints. The former is far more likely to be the impediment for the reasons we state in the report. This chart is one of my favourite I’ve done in this series so humour me and take a look. If you want to be added to the daily chart email jim-reid.thematicresearch@db.com.

Back to markets and the subdued overall tone was visible in US equity markets, with the S&P 500 (-0.03%) largely unchanged but registering a loss for a second day. In spite of the S&P treading water, nearly 60% of the index’s members were actually trading higher, as bigger names like Tesla (-5.26%) and Cisco (-2.60%) struggled. Many of the biggest tech stocks that have been the big winners of the last year faded relative to more cyclical industries such as energy (+1.84%) and semiconductors (+0.77%). The sagging tech sentiment weighed on the Nasdaq, which fell back -0.25%, though unlike the S&P most of the index traded lower. Even Bitcoin had a bad day, falling -4.85% from Tuesday’s record high. European indices witnessed modest declines similar to that seen in the US, with the STOXX 600 down -0.23%.The cyclical trade remained in vogue in Europe as Miners and bank stocks outperformed, which coincided with steepening curves and higher rates here.

Even though risk assets were overall a bit soggy, both Brent Crude (+0.62%) and WTI (+0.55%) oil prices just held on to their daily gains and ascended to a 1-year high of $61.47/bbl and $58.68/bbl respectively. They have now rallied for 9 and 8 days in a row, the longest streaks since late December 2018 and early February 2019.

One of the main stories overnight has been the US President Biden’s call with his Chinese counterpart Xi Jinping where Biden expressed concerns over China’s “coercive and unfair economic practices” as well as human rights abuses in the Xinjiang region. Biden also expressed concerns about the country’s growing restrictions on political freedoms in Hong Kong and “increasingly assertive actions in the region, including toward Taiwan.” Meanwhile, China’s official state news agency Xinhua reported that during the call Chinese President Xi said that China and the U.S. should re-establish mechanisms for dialogue so that there would be an accurate understanding of each other’s policy intentions and to avoid misunderstanding and miscalculation. On Taiwan, Hong Kong and Xinjiang, Xinhua repeated that these were China’s internal affairs and the US should respect China’s core interests and act with caution. Before the call took place, a Biden administration official said that the US would work with its allies to develop a joint strategy on restricting sensitive high-tech exports and Chinese investment in critical industries.

Overnight, Asian markets that are open are trading up with the Hang Seng (+0.45%) and India’s Nifty (+0.27%) both posting gains. Japanese, Chinese and South Korean markets are all closed for a holiday. Futures on the S&P 500 are up a small +0.04%. Brent and WTI crude oil prices are down -0.55% this morning after their great run.

Back in the European session, Italian sovereign bonds outperformed once again, with 10yr yields falling -0.9bps to an all-time low of 0.504%, as their spread over bunds also tightened to a 5-year low of 0.94%. There hasn’t been a great deal of news on the government formation process however, with former ECB President Draghi meeting with trade unions and business associations yesterday. Today M5S will be holding an online vote on whether to support a government led by Mario Draghi while urging its members to vote yes. Draghi does not need their votes as almost all the parties except M5S have already backed him. Elsewhere, other European countries saw yields move higher, with yields on 10yr bunds (+0.9bps) climbing to a 5-month high of -0.44% as the German 2s10s curve steepened to an 8-month high. And similarly in the UK, yields on 10yr gilts (+2.6bps) and the 2s10s curve both reached a 10-month high.

In terms of the latest on the pandemic, yesterday saw the World Health Organization recommend that the AstraZeneca vaccine be used on all adults over 18, as they also endorsed the move by the UK to increase the length between doses. That move is likely to encourage its use, particularly after some EU countries did not recommend it for the elderly because of insufficient data. Meanwhile in Hong Kong, officials said that conditional on the virus remaining under control through the Lunar New Year, then they were planning to reopen sports venues from February 18, and also allow dining in at restaurants for up to 4 people per table. Over in the UK, the 7-day case average fell to a 2-month low of 16,191, and that’s in spite of testing being at substantially higher levels than it was pre-Christmas. In Germany, it was announced that schools and kindergartens may reopen as soon as next week, with state leaders being granted the power to relax restrictions if cases numbers continue to improve. This seems to be against Merkel’s more cautious instincts. In the US, New York Governor Cuomo announced that large entertainment venues and stadiums will be allowed to reopen to fans with testing requirements and capacity limits. Overall cases continue to fall overall in the US, as new cases were under 100K for a third straight day – the first time that has happened since early November.

To the day ahead now, there isn’t much in the way of data releases, though the weekly initial jobless claims from the US will be a highlight. From central banks, we’ll hear from ECB Vice President de Guindos, along with the ECB’s Villeroy and Knot. Elsewhere, the European Commission will be publishing its latest economic forecasts, and earnings releases include Disney, PepsiCo, Duke Energy, and Kraft Heinz.

Uncategorized

Comments on February Employment Report

The headline jobs number in the February employment report was above expectations; however, December and January payrolls were revised down by 167,000 combined. The participation rate was unchanged, the employment population ratio decreased, and the …

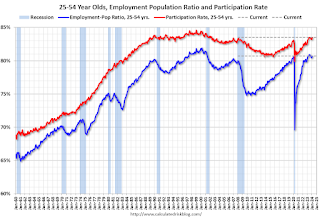

Prime (25 to 54 Years Old) Participation

Since the overall participation rate is impacted by both cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.

The 25 to 54 years old participation rate increased in February to 83.5% from 83.3% in January, and the 25 to 54 employment population ratio increased to 80.7% from 80.6% the previous month.

Average Hourly Wages

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees from the Current Employment Statistics (CES).

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees from the Current Employment Statistics (CES). Wage growth has trended down after peaking at 5.9% YoY in March 2022 and was at 4.3% YoY in February.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:"The number of people employed part time for economic reasons, at 4.4 million, changed little in February. These individuals, who would have preferred full-time employment, were working part time because their hours had been reduced or they were unable to find full-time jobs."The number of persons working part time for economic reasons decreased in February to 4.36 million from 4.42 million in February. This is slightly above pre-pandemic levels.

These workers are included in the alternate measure of labor underutilization (U-6) that increased to 7.3% from 7.2% in the previous month. This is down from the record high in April 2020 of 23.0% and up from the lowest level on record (seasonally adjusted) in December 2022 (6.5%). (This series started in 1994). This measure is above the 7.0% level in February 2020 (pre-pandemic).

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 1.203 million workers who have been unemployed for more than 26 weeks and still want a job, down from 1.277 million the previous month.

This is close to pre-pandemic levels.

Job Streak

| Headline Jobs, Top 10 Streaks | ||

|---|---|---|

| Year Ended | Streak, Months | |

| 1 | 2019 | 100 |

| 2 | 1990 | 48 |

| 3 | 2007 | 46 |

| 4 | 1979 | 45 |

| 5 | 20241 | 38 |

| 6 tie | 1943 | 33 |

| 6 tie | 1986 | 33 |

| 6 tie | 2000 | 33 |

| 9 | 1967 | 29 |

| 10 | 1995 | 25 |

| 1Currrent Streak | ||

Summary:

The headline monthly jobs number was above consensus expectations; however, December and January payrolls were revised down by 167,000 combined. The participation rate was unchanged, the employment population ratio decreased, and the unemployment rate was increased to 3.9%. Another solid report.

Uncategorized

Immune cells can adapt to invading pathogens, deciding whether to fight now or prepare for the next battle

When faced with a threat, T cells have the decision-making flexibility to both clear out the pathogen now and ready themselves for a future encounter.

How does your immune system decide between fighting invading pathogens now or preparing to fight them in the future? Turns out, it can change its mind.

Every person has 10 million to 100 million unique T cells that have a critical job in the immune system: patrolling the body for invading pathogens or cancerous cells to eliminate. Each of these T cells has a unique receptor that allows it to recognize foreign proteins on the surface of infected or cancerous cells. When the right T cell encounters the right protein, it rapidly forms many copies of itself to destroy the offending pathogen.

Importantly, this process of proliferation gives rise to both short-lived effector T cells that shut down the immediate pathogen attack and long-lived memory T cells that provide protection against future attacks. But how do T cells decide whether to form cells that kill pathogens now or protect against future infections?

We are a team of bioengineers studying how immune cells mature. In our recently published research, we found that having multiple pathways to decide whether to kill pathogens now or prepare for future invaders boosts the immune system’s ability to effectively respond to different types of challenges.

Fight or remember?

To understand when and how T cells decide to become effector cells that kill pathogens or memory cells that prepare for future infections, we took movies of T cells dividing in response to a stimulus mimicking an encounter with a pathogen.

Specifically, we tracked the activity of a gene called T cell factor 1, or TCF1. This gene is essential for the longevity of memory cells. We found that stochastic, or probabilistic, silencing of the TCF1 gene when cells confront invading pathogens and inflammation drives an early decision between whether T cells become effector or memory cells. Exposure to higher levels of pathogens or inflammation increases the probability of forming effector cells.

Surprisingly, though, we found that some effector cells that had turned off TCF1 early on were able to turn it back on after clearing the pathogen, later becoming memory cells.

Through mathematical modeling, we determined that this flexibility in decision making among memory T cells is critical to generating the right number of cells that respond immediately and cells that prepare for the future, appropriate to the severity of the infection.

Understanding immune memory

The proper formation of persistent, long-lived T cell memory is critical to a person’s ability to fend off diseases ranging from the common cold to COVID-19 to cancer.

From a social and cognitive science perspective, flexibility allows people to adapt and respond optimally to uncertain and dynamic environments. Similarly, for immune cells responding to a pathogen, flexibility in decision making around whether to become memory cells may enable greater responsiveness to an evolving immune challenge.

Memory cells can be subclassified into different types with distinct features and roles in protective immunity. It’s possible that the pathway where memory cells diverge from effector cells early on and the pathway where memory cells form from effector cells later on give rise to particular subtypes of memory cells.

Our study focuses on T cell memory in the context of acute infections the immune system can successfully clear in days, such as cold, the flu or food poisoning. In contrast, chronic conditions such as HIV and cancer require persistent immune responses; long-lived, memory-like cells are critical for this persistence. Our team is investigating whether flexible memory decision making also applies to chronic conditions and whether we can leverage that flexibility to improve cancer immunotherapy.

Resolving uncertainty surrounding how and when memory cells form could help improve vaccine design and therapies that boost the immune system’s ability to provide long-term protection against diverse infectious diseases.

Kathleen Abadie was funded by a NSF (National Science Foundation) Graduate Research Fellowships. She performed this research in affiliation with the University of Washington Department of Bioengineering.

Elisa Clark performed her research in affiliation with the University of Washington (UW) Department of Bioengineering and was funded by a National Science Foundation Graduate Research Fellowship (NSF-GRFP) and by a predoctoral fellowship through the UW Institute for Stem Cell and Regenerative Medicine (ISCRM).

Hao Yuan Kueh receives funding from the National Institutes of Health.

stimulus covid-19 yuan vaccine stimulusGovernment

President Biden Delivers The “Darkest, Most Un-American Speech Given By A President”

President Biden Delivers The "Darkest, Most Un-American Speech Given By A President"

Having successfully raged, ranted, lied, and yelled through…

Having successfully raged, ranted, lied, and yelled through the State of The Union, President Biden can go back to his crypt now.

Whatever 'they' gave Biden, every American man, woman, and the other should be allowed to take it - though it seems the cocktail brings out 'dark Brandon'?

Tl;dw: Biden's Speech tonight ...

-

Fund Ukraine.

-

Trump is threat to democracy and America itself.

-

Abortion is good.

-

American Economy is stronger than ever.

-

Inflation wasn't Biden's fault.

-

Illegals are Americans too.

-

Republicans are responsible for the border crisis.

-

Trump is bad.

-

Biden stands with trans-children.

-

J6 was the worst insurrection since the Civil War.

(h/t @TCDMS99)

Tucker Carlson's response sums it all up perfectly:

"that was possibly the darkest, most un-American speech given by an American president. It wasn't a speech, it was a rant..."

Carlson continued: "The true measure of a nation's greatness lies within its capacity to control borders, yet Bid refuses to do it."

"In a fair election, Joe Biden cannot win"

And concluded:

“There was not a meaningful word for the entire duration about the things that actually matter to people who live here.”

Victor Davis Hanson added some excellent color, but this was probably the best line on Biden:

"he doesn't care... he lives in an alternative reality."

— Tucker Carlson (@TuckerCarlson) March 8, 2024

* * *

Watch SOTU Live here...

* * *

Mises' Connor O'Keeffe, warns: "Be on the Lookout for These Lies in Biden's State of the Union Address."

On Thursday evening, President Joe Biden is set to give his third State of the Union address. The political press has been buzzing with speculation over what the president will say. That speculation, however, is focused more on how Biden will perform, and which issues he will prioritize. Much of the speech is expected to be familiar.

The story Biden will tell about what he has done as president and where the country finds itself as a result will be the same dishonest story he's been telling since at least the summer.

He'll cite government statistics to say the economy is growing, unemployment is low, and inflation is down.

Something that has been frustrating Biden, his team, and his allies in the media is that the American people do not feel as economically well off as the official data says they are. Despite what the White House and establishment-friendly journalists say, the problem lies with the data, not the American people's ability to perceive their own well-being.

As I wrote back in January, the reason for the discrepancy is the lack of distinction made between private economic activity and government spending in the most frequently cited economic indicators. There is an important difference between the two:

-

Government, unlike any other entity in the economy, can simply take money and resources from others to spend on things and hire people. Whether or not the spending brings people value is irrelevant

-

It's the private sector that's responsible for producing goods and services that actually meet people's needs and wants. So, the private components of the economy have the most significant effect on people's economic well-being.

Recently, government spending and hiring has accounted for a larger than normal share of both economic activity and employment. This means the government is propping up these traditional measures, making the economy appear better than it actually is. Also, many of the jobs Biden and his allies take credit for creating will quickly go away once it becomes clear that consumers don't actually want whatever the government encouraged these companies to produce.

On top of all that, the administration is dealing with the consequences of their chosen inflation rhetoric.

Since its peak in the summer of 2022, the president's team has talked about inflation "coming back down," which can easily give the impression that it's prices that will eventually come back down.

But that's not what that phrase means. It would be more honest to say that price increases are slowing down.

Americans are finally waking up to the fact that the cost of living will not return to prepandemic levels, and they're not happy about it.

The president has made some clumsy attempts at damage control, such as a Super Bowl Sunday video attacking food companies for "shrinkflation"—selling smaller portions at the same price instead of simply raising prices.

In his speech Thursday, Biden is expected to play up his desire to crack down on the "corporate greed" he's blaming for high prices.

In the name of "bringing down costs for Americans," the administration wants to implement targeted price ceilings - something anyone who has taken even a single economics class could tell you does more harm than good. Biden would never place the blame for the dramatic price increases we've experienced during his term where it actually belongs—on all the government spending that he and President Donald Trump oversaw during the pandemic, funded by the creation of $6 trillion out of thin air - because that kind of spending is precisely what he hopes to kick back up in a second term.

If reelected, the president wants to "revive" parts of his so-called Build Back Better agenda, which he tried and failed to pass in his first year. That would bring a significant expansion of domestic spending. And Biden remains committed to the idea that Americans must be forced to continue funding the war in Ukraine. That's another topic Biden is expected to highlight in the State of the Union, likely accompanied by the lie that Ukraine spending is good for the American economy. It isn't.

It's not possible to predict all the ways President Biden will exaggerate, mislead, and outright lie in his speech on Thursday. But we can be sure of two things. The "state of the Union" is not as strong as Biden will say it is. And his policy ambitions risk making it much worse.

* * *

The American people will be tuning in on their smartphones, laptops, and televisions on Thursday evening to see if 'sloppy joe' 81-year-old President Joe Biden can coherently put together more than two sentences (even with a teleprompter) as he gives his third State of the Union in front of a divided Congress.

President Biden will speak on various topics to convince voters why he shouldn't be sent to a retirement home.

The state of our union under President Biden: three years of decline. pic.twitter.com/Da1KOIb3eR

— Speaker Mike Johnson (@SpeakerJohnson) March 7, 2024

According to CNN sources, here are some of the topics Biden will discuss tonight:

Economic issues: Biden and his team have been drafting a speech heavy on economic populism, aides said, with calls for higher taxes on corporations and the wealthy – an attempt to draw a sharp contrast with Republicans and their likely presidential nominee, Donald Trump.

Health care expenses: Biden will also push for lowering health care costs and discuss his efforts to go after drug manufacturers to lower the cost of prescription medications — all issues his advisers believe can help buoy what have been sagging economic approval ratings.

Israel's war with Hamas: Also looming large over Biden's primetime address is the ongoing Israel-Hamas war, which has consumed much of the president's time and attention over the past few months. The president's top national security advisers have been working around the clock to try to finalize a ceasefire-hostages release deal by Ramadan, the Muslim holy month that begins next week.

An argument for reelection: Aides view Thursday's speech as a critical opportunity for the president to tout his accomplishments in office and lay out his plans for another four years in the nation's top job. Even though viewership has declined over the years, the yearly speech reliably draws tens of millions of households.

Sources provided more color on Biden's SOTU address:

The speech is expected to be heavy on economic populism. The president will talk about raising taxes on corporations and the wealthy. He'll highlight efforts to cut costs for the American people, including pushing Congress to help make prescription drugs more affordable.

Biden will talk about the need to preserve democracy and freedom, a cornerstone of his re-election bid. That includes protecting and bolstering reproductive rights, an issue Democrats believe will energize voters in November. Biden is also expected to promote his unity agenda, a key feature of each of his addresses to Congress while in office.

Biden is also expected to give remarks on border security while the invasion of illegals has become one of the most heated topics among American voters. A majority of voters are frustrated with radical progressives in the White House facilitating the illegal migrant invasion.

It is probable that the president will attribute the failure of the Senate border bill to the Republicans, a claim many voters view as unfounded. This is because the White House has the option to issue an executive order to restore border security, yet opts not to do so

Maybe this is why?

Most Americans are still unaware that the census counts ALL people, including illegal immigrants, for deciding how many House seats each state gets!

— Elon Musk (@elonmusk) March 7, 2024

This results in Dem states getting roughly 20 more House seats, which is another strong incentive for them not to deport illegals.

While Biden addresses the nation, the Biden administration will be armed with a social media team to pump propaganda to at least 100 million Americans.

"The White House hosted about 70 creators, digital publishers, and influencers across three separate events" on Wednesday and Thursday, a White House official told CNN.

Not a very capable social media team...

The State of Confusion https://t.co/C31mHc5ABJ

— zerohedge (@zerohedge) March 7, 2024

The administration's move to ramp up social media operations comes as users on X are mostly free from government censorship with Elon Musk at the helm. This infuriates Democrats, who can no longer censor their political enemies on X.

Meanwhile, Democratic lawmakers tell Axios that the president's SOTU performance will be critical as he tries to dispel voter concerns about his elderly age. The address reached as many as 27 million people in 2023.

"We are all nervous," said one House Democrat, citing concerns about the president's "ability to speak without blowing things."

The SOTU address comes as Biden's polling data is in the dumps.

BetOnline has created several money-making opportunities for gamblers tonight, such as betting on what word Biden mentions the most.

As well as...

We will update you when Tucker Carlson's live feed of SOTU is published.

Fuck it. We’ll do it live! Thursday night, March 7, our live response to Joe Biden’s State of the Union speech. pic.twitter.com/V0UwOrgKvz

— Tucker Carlson (@TuckerCarlson) March 6, 2024

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoIndustrial Production Decreased 0.1% in January

-

Government1 month ago

Government1 month agoWar Delirium

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges