International

Futures Drop, Record November Rally Fizzles As Election Gets Increasingly Contested

Futures Drop, Record November Rally Fizzles As Election Gets Increasingly Contested

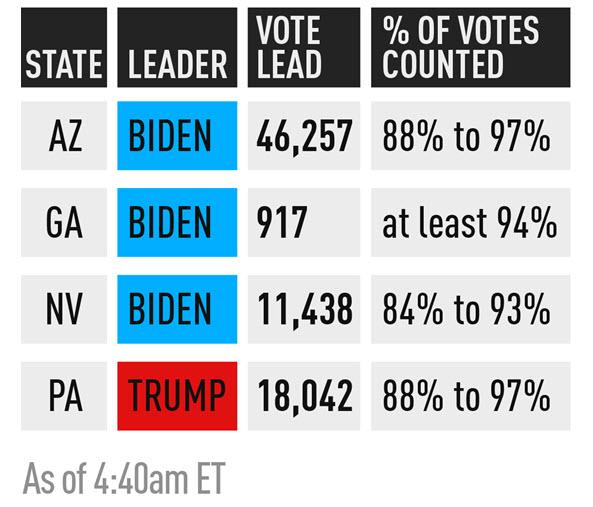

The blistering November rally, which pushed the S&P higher by nearly 8% in the first 4 days of the month, the biggest advance in the first days of the month on record, finally reversed and pared some of this week’s gains as the vote count continued but got increasingly more contested amid mounting legal complaints from President Donald Trump’s campaign. Meanwhile, just around 4am, Joe Biden edged ahead of Donald Trump in the latest batch of Georgia results, a major shift in the Republican stronghold that hasn't backed a Democrat for president since 1992. Biden also got closer in Pennsylvania and is still ahead in Nevada and Arizona, though Trump is catching up.

S&P futures slid 25 points, or 0.7%, to 3,480 while global stocks were in the red but near all-time highs ahead of what some expect will be a downbeat jobs report underlining the scale of the economic challenge awaiting America’s next president (full preview here).

The dollar and U.S. bond yields remained subdued on Friday amid a "bullish" reversal in Blue Wave expectations according to which a divided Congress - previously seen as a doomsday scenario - would limit fiscal stimulus which would pave the way for even more central bank stimulus.

MSCI's all-country index was fractionally red after gains earlier in the week, still close to the record reached in September. At 730 a.m. ET, Dow e-minis were down 171 points, or 0.6%, S&P 500 e-minis were down 24.5 points, or 0.7%, and Nasdaq 100 e-minis were down 127 points, or 1.1%. Tech mega-caps including the FAAMGs fell about a percent in premarket trading after logging strong gains this week. The drop follows the Fed's Thursday announcement keeping its loose monetary policy intact and again pledging to do whatever it can to sustain an economy crippled by the COVID-19 pandemic. Cannabis-related stocks, which have been identified by analysts as potential winners under a Biden administration, were among the rare gainers in early premarket trading.

“It’s not that the market is expecting something dramatic to happen, but just de-risking after a strong performance,” said Ingo Schachel, head of equity research at Commerzbank in Germany.

Despite today's soggy moody, the S&P 500 is on course for its best week since April, while the tech-heavy Nasdaq has jumped 6.5% since the Nov. 3 election as the prospect of a policy gridlock in Washington eased worries about tighter regulations on companies.

“From here, we believe the impact of the presidential result should be relatively small,” said Lars Kreckel, global equity strategist at LGIM. "Whether Biden or Trump are in the White House, governing with a Congress that is very likely to be divided would be difficult and mean very little policy that could significantly move equity markets would be passed."

And with Biden having taken the lead in Georgia, absent a remarkable reversal of results in the courts, risk sentiment was also underpinned by a sense that a Biden presidency would be more predictable than Trump’s even though investors saw no quick rapprochement between the United States and China on trade and other issues.

Biden had a 253 to 214 lead in the state-by-state Electoral College vote that determines the winner, according to most major television networks, putting him closer to the 270 Electoral College votes needed to win. In Pennsylvania, which has 20 electoral votes, Biden cut Trump’s lead to just over 18,000 by the early hours of Friday. Shortly after 4am, Biden also went ahead in Georgia, which has 16 electoral votes, leading by some 900 votes.

“The market reaction to the unfolding election news suggests that financial markets would prefer to see a constrained Biden presidency,” said Paul O’Connor, head of multi-asset at Janus Henderson Investors. “The economic backdrop to this election is one of an incomplete global recovery that remains threatened by the continued spread of Covid-19 in many major economies as well as fast-fading fiscal support measures.“

Matt Sherwood, head of investment strategy at Perpetual in Sydney, said markets had already moved to price in a Biden presidency and a divided Congress: "We can get all of the good things about a Biden presidency, such as stable leadership and foreign policy, without any of the bad things from the far Left of his party, such as taxation," he said.

Europe's Stoxx 600 opened 0.4% lower, with investor sentiment dimmed by the economic toll of new lockdowns in Europe to contain the coronavirus. Italy and France registered record numbers of COVID-19 cases. Deutsche Lufthansa fell 7% amid a resurgence in coronavirus cases. IT services firm Netcompany slumped more than 6% after a downbeat earnings report. On the plus side, luxury goods maker Richemont surged as much as 12% after sales rebounded in China.

Earlier in the session, Asian stocks gained, led by the energy and materials sectors as MSCI's index of Asian Pacific shares ex-Japan rising 0.3%, near a three-year high. Most markets in the region were up, with Indonesia's Jakarta Composite advancing 1.4% and India's S&P BSE Sensex Index rising 1.2%, while China's Shanghai Composite slid 0.2%. Trading volume for MSCI Asia Pacific Index members was 27% above the monthly average for this time of the day. The Topix added 0.5%, with Daikin and Kubota contributing the most to the move. Japan's Nikkei average rose 0.9% to a 29-year high while. The Shanghai Composite Index retreated 0.2%, driven by China Life and Kweichow Moutai

On the covid front, the US became the first country to top 100,000 coronavirus infections in a single day, with Fed Chair Powell warning that mounting infection rates are a risk to the recovery. Meanwhile, France warned of a “violent” second wave as it joined European countries including Italy and Poland in reporting new highs in daily infections.

The Labor Department’s closely watched report is likely to show U.S. employers hired the fewest workers in five months in October in the absence of new fiscal stimulus and as COVID-19 infections surged.

In FX, the Bloomberg Dollar Spot Index extended declines to the lowest since May 2018 as investors waited on results from narrowing vote races in key U.S. battleground states.

The dollar traded mixed versus Group-of-10 peers; the euro climbed for the fourth day, rising past $1.1850. The New Zealand dollar led G-10 gains on the back of an improved reading on the nation’s inflation expectations, while the Aussie weakened as trade tensions with China hurt sentiment. The pound fluctuated between modest gains and losses, as optimism that a Brexit trade deal will be reached offset concern over the negative impact of a nationwide lockdown. The yen hovered near the strongest level since March after breaching a key chart level from 2016 that had only been broken in March in the years since.

U.S. bond yields drifted lower, with the 10-year Treasury yield falling to 0.773%, below the pre-U.S. election level on Tuesday. It had struck a three-week low of 0.7180% on Thursday.

Elsewhere, crude oil declined and gold edged higher. Emerging-market stocks were on track for a fifth day of gains.

Looking at the day ahead, the US jobs report is likely to be the data highlight, but there’ll also be the Canadian employment report for October, along with German industrial production and Italian retail sales for September. From central banks, we’ll hear from Bank of Canada Governor Macklem and the ECB’s Holzmann.

Market Snapshot

- S&P 500 futures down 1.2% to 3,461.75

- STOXX Europe 600 down 0.6% to 365.10

- German 10Y yield fell 0.8 bps to -0.645%

- Euro up 0.2% to $1.1848

- Italian 10Y yield fell 2.0 bps to 0.556%

- Spanish 10Y yield fell 0.3 bps to 0.088%

- MXAP up 0.5% to 181.98

- MXAPJ up 0.4% to 603.59

- Nikkei up 0.9% to 24,325.23

- Topix up 0.5% to 1,658.49

- Hang Seng Index up 0.07% to 25,712.97

- Shanghai Composite down 0.2% to 3,312.16

- Sensex up 1.3% to 41,874.76

- Australia S&P/ASX 200 up 0.8% to 6,190.18

- Kospi up 0.1% to 2,416.50

- Brent futures down 2.4% to $39.97/bbl

- Gold spot little changed at $1,947.97

- U.S. Dollar Index little changed at 92.45

A quick look at global markets courtesy of NewsSquawk

Asian equity markets traded mixed with the region only partially sustaining the momentum from Wall Street where the post-election rally persisted despite no declared winner yet, although Biden does remain on the cusp with 6 electoral votes shy of victory at 264 votes vs. President Trump at 214 votes. The key states still to be declared include Nevada (6 votes), Georgia (16 votes), North Carolina (15 votes) and Pennsylvania (20 votes) with Biden leading in Nevada, while the former VP dramatically caught up with President Trump in Georgia and narrowed the gap in Pennsylvania. ASX 200 (+0.8%) was lifted by strength in mining names and as financials were kept afloat, with the largest-weighted sector and shares in Macquarie unfazed by the slump in the latter’s H1 earnings, while Nikkei 225 (+1.0%) extended on gains to breach October 2018 highs and briefly print its best levels in nearly 3 decades with slight encouragement from better than expected household spending. Conversely, Hang Seng (-+0.1%) and Shanghai Comp. (-0.2%) lagged after the PBoC refrained from open market operations which resulted to a net daily drain of CNY 100bln and weekly drain of CNY 590bln, while the central bank also set the strongest currency fix in more than 2 years. Finally, 10yr JGBs were flat as prices took a breather from the mid-week surge to above the 152.00 level and with further upside capped by the gains in stocks and mixed results at the 10yr inflation-indexed JGB auction.

Top Asian News

- China Starts Thinking About Stimulus Exit as Economy Recovers

- World’s Largest Pension Fund Gains With Assets Near Record

- Japan’s Households Raise Quarterly Spending by Most Since 2000

- Yuan Is Halfway Through Erasing Losses Since Trade War Began

Equities across Europe trade lower across the board (Euro Stoxx 50 -0.6%), albeit off worst levels following a mixed APAC session as sentiment deteriorates throughout the European morning – with the US Presidential race winner still undeclared but tilting further towards Biden. The latest update from some poll-watchers suggested a blue flip in the state of Georgia with over 99% of votes tallied. Assuming this tally corresponds with the final outcome for Georgia (16 EC votes) and if Arizona (11 EC votes) is awarded to Biden (as some desks have), this would place the Democratic candidate on 280 votes and thus surpassing the 270 required for Presidency. However, if you omit Arizona, then Biden would be on 269 electoral college votes. As a reminder, officials in the state have remarked that it could be several weeks before we get a final result given how close the race is regarding Georgia. Meanwhile, the latest implied probabilities from Betfair Exchange point to a +90% chance of a Biden victory. Elsewhere, the Senate rate remains neck and neck as each side clutch 48 seats, with 4 still hanging in the balance. US equity futures (ES -0.8%, NQ -1.2%, YM -0.6%, RTY -0.5%) have been drifting lower since European players entered the fray, with traders also weighing a contested outcome as Trump continues to condemn the legitimacy of the voting system. Back to Europe, the region conforms to the risk aversion as bourses extended on the downside seen at the cash open, whilst losses remain relatively broad-based across. Sectors are now all in the red after a mixed open, with Travel & Leisure at the bottom of the pile as it continues to bear the brunt of COVID-related lockdown measures, with IAG’s (-1.8%) British Airways also cancelling all flights from Gatwick airport for the month amid England’s restrictions. Meanwhile, losses in the Telecoms sectors are cushioned on the back of stellar earnings from T-Mobile (+6.4% pre-mkt) which in turn bolstered its majority shareholder Deutsche Telekom (+2.4%), who owns some 43.5% of TMUS. The insurance sector is also faring better than some of its peers as Allianz (+0.1%) rose post-earnings, but the stock has waned off highs. Other earnings-related movers include Richemont (+8.3%) who saw a positive trend in Q2 following the sharp decline in the prior month, in turn supporting its peer Swatch (+1.0%).

Top European News

- German Industrial Production Rose for Fifth Month in September

- EU’s Green Bonds Set to Preempt Rules That Will Govern Them

- Novo Nordisk Agrees to Buy Emisphere in $1.8 Billion Deal

- U.K. House Prices Climb Most Since 2016 Ahead of New Lockdown

In FX, the Kiwi is consolidating recent gains in the high 0.6700 zone vs its US counterpart and has peered just above 0.6800 in wake of an uptick in NZ Q4 inflation expectations overnight, but the Nzd is also benefiting from tailwinds via the Aussie cross amidst more angst between China and its Antipodean neighbour on the trade front. Indeed, Aud/Nzd has retreated to test 1.0700 from around 1.0760 at one stage and Aud/Usd is losing momentum have topped out a few pips over 0.7280 despite another firm PBoC Cny fix. For the record, the RBA’s SOMP merely underscored dovish guidance that came alongside Tuesday’s multi-pronged policy stimulus, so hardly impacted.

- USD – Little respite for the Dollar or reprieve from the FOMC, as the wait to see final results of the US Presidential Election continues. In fact, the DXY has slipped into another lower range even though several major peers are losing momentum independently or in line with a downturn in broad risk sentiment. The index has bounced off worst levels within a 92.823-435 range, and perhaps looking idle sideways into NFP unless any of the last remaining states declare and push front-runner Biden technically through the tape.

- CAD/GBP – The Loonie has lost traction from oil, but retaining grip of the 1.3000 handle vs its US rival in the run up to Canadian jobs data, but the Pound appears a bit more precarious above 1.3100 given latest Brexit updates from EU chief negotiator Barnier effectively laying the blame for no progress on fishing or the LPF at the UK’s door.

- EUR/CHF/JPY – All firmer against the Buck, with the Euro still within striking distance of a cluster of late October peaks that stand in the way of last month’s apex circa 1.1880, while the Franc is hovering just shy of 0.9000 and Yen has accelerated beyond 103.50 following firmer than forecast Japanese household spending data and somewhat dismissive rhetoric from PM Suga on exchange rates aside from expressing the importance of stability.

- SCANDI/EM – Collapsing crude prices and contagion in stocks, or vice-versa are obvious factors behind a rebound in Eur/Nok through 10.9000, but a fall in Norwegian manufacturing output hot on the heels of yesterday’s downbeat Norges Bank economic outlook is also weighing on the Crown. Elsewhere, the Rub is also weaker alongside Brent that has slipped under Usd 40/brl, but the Try is not gleaning any comfort from cheaper oil at all.

- RBA Statement on Monetary Policy noted the board is prepared to expand bond buying if required and that it is not contemplating further lowering rates with little to be gained from moving to negative rates. Furthermore, it committed to not increase rates until inflation is sustainably in 2%-3% target band, Furthermore, it sees GDP Y/Y growth at -4% in Q4 2020, +5% in Q4 2021 and +4% in Q4 2022, while it sees Trimmed Mean CPI Y/Y at 1% in Q4 2020, 1% in Q4 2021 and 1.5% in Q4 2022. (Newswires)

In commodities, WTI and Brent front-month futures post losses in tandem with the overall sentiment across the market and with complex-specific news flow on the lighter side. Again, price action throughout the day is likely to be dictated by macro-themes in the absence of OPEC/OPEC+ updates as producers continue to balance supply and demand risks heading into a crucial month for the members. Consensus thus far points to an extension of current cuts through Q1 21, with some murmurs of deeper cuts, albeit this has not been agreed on nor confirmed by ministers. WTI Dec loses ground below USD 38/bbl (vs. high 38.61/bbl) while Brent Jan yielded the USD 40/bbl handle (vs. high 40.70/bbl). Elsewhere, spot gold and silver drift off worst levels on the back of a softer Buck, with the former now north of 1950/oz to the upside after climbing from a low of ~1935/oz, whilst spot silver gains ground above USD 25.50/oz. The softer Dollar has also benefitted LME copper, which remains around session highs heading into the US open.

US Event Calendar

- 8:30am: Change in Nonfarm Payrolls, est. 592,500, prior 661,000

- Change in Private Payrolls, est. 685,000, prior 877,000

- Change in Manufact. Payrolls, est. 55,000, prior 66,000

- Unemployment Rate, est. 7.6%, prior 7.9%

- Average Hourly Earnings MoM, est. 0.2%, prior 0.1%

- Average Hourly Earnings YoY, est. 4.5%, prior 4.7%

- Average Weekly Hours All Employees, est. 34.7, prior 34.7

- Labor Force Participation Rate, est. 61.5%, prior 61.4%

- Underemployment Rate, prior 12.8%

- 10am: Wholesale Inventories MoM, est. -0.1%, prior -0.1%; Wholesale Trade Sales MoM, est. 1.05%, prior 1.4%

- 3pm: Consumer Credit, est. $7.75b, prior $7.22b deficit

Top Overnight news from Bloomberg

- The hard-fought presidential contest between Donald Trump and Joe Biden now depends on the outcomes of a handful of states, each with varying rules on counting votes and contesting results -- delaying the declaration of a winner

- The Justice Department is looking into allegations by President Donald Trump’s campaign of voter fraud in Nevada. Democratic nominee Joe Biden is closing in on the 270 electoral votes he needs to win the presidency, while Trump’s path to re-election has narrowed

- U.K. house prices climbed the most since 2016 last month, pushing average values to a record ahead of the renewed restrictions to contain coronavirus

- The U.K. is imposing a two-week quarantine on travelers from Denmark, following an outbreak of a rare mutation of Covid-19 in the Nordic country’s mink farms

- The Bank of England and U.K. Treasury are both investigating a possible leak detailing the central bank’s plans to expand its bond buying by a surprising amount

- Hard-pressed commodity traders will get no respite at all next week as the U.S. electoral drama plays out ahead of a very busy agenda. There’ll be key insights into energy markets, a raft of top central bank speakers, and the latest on crop markets just as foodstuffs stage a powerful rally. The backdrop is the rapidly escalating coronavirus pandemic

DB's Jim Reid concludes the overnight wrap

On the third day of counting votes we saw Joe Biden continue to close the gap in Pennsylvania, now trailing President Trump by 0.6% with 6% of the vote to go. Yesterday at the same time Biden trailed by 3%, with 11% of the vote left to be counted. That vote continues to come from predominately Democratic counties and is almost entirely mail-in votes which Democratic voters favoured. A win in Pennsylvania would give Mr Biden over 270 electoral college votes and clinch the presidency, regardless of the outcomes in other states. We’re not sure if they’ll stop the count overnight but if not at this run rate Biden could be in front by around 8am London time and effectively called as the new President.

Biden has also made up ground in Georgia, where yesterday he was behind by 0.6% with 5% uncounted, he now is essentially tied – less than 0.1% behind – with under 2% of the vote to go. It is going to be very tight and likely go to a recount. Nevada drifted toward Biden as well with his lead moving from 0.6% to 0.9% in the last day, though 11% of the vote is still remaining and there may not be a full count until the end of the weekend. There was no movement from North Carolina but most continue to expect President Trump to carry the state. Lastly there was some positive movement for President Trump, who was down 3% to Biden in Arizona yesterday and has closed to within 1.5% as of now.

On the Senate front, we learned that the second Georgia Senate seat will go to a runoff in January. This means that both senate seats in that state will be in play on January 5th. While Republican candidates likely come in as slight favourites into those races, the Democrats could be competitive. Also without President Trump or Mr Biden at the top of the ticket there may be a very different level of voter enthusiasm and turnout. Either way they are likely to be heavily competitive and expensive Senate races as Democrats will see it as an outside shot at getting slim control of the Senate (50:50 with VP breaking the tie) if Mr Biden wins the presidency.

Back to normal life and yesterday’s Fed meeting received the lowest amount of fanfare in quite some time as attention remained on the election counts. The FOMC kept the fed funds target rate at 0-0.25%, where it’s been since March, while maintaining their bond purchases at $120bn per month. For a second meeting in a row, Fed Chair Powell stressed the need for further fiscal stimulus. “I think we’ll have a stronger recovery if we can just get at least some more fiscal support,” Powell said in the ensuing press conference. He also noted that the recent rise in covid-19 cases both domestically and abroad represent risks to the economic outlook over the medium term. Notably, market participants were clearly focused on the election count as there was little market movement on the back of the release and presser.

Against this backdrop, global equity markets continued to surge, with the S&P 500 up another +1.95% and to a 3-week high, while the VIX fell by a further -2.0pts to bring its decline since the start of the week to over 9pts (now 27.6). It was a similar story in Europe too, where the STOXX 600 climbed +1.05% with the DAX (+1.98%) and the CAC 40 (+1.24%) also seeing major advances. Over in sovereign bond markets, US Treasuries pared back early gains as 10yr yields closed flat at 0.763%, while in Europe, yields on 10yr bunds (+0.1bps) and gilts (+2.7bps) also moved higher. And in FX, the dollar continued to weaken, with the dollar index falling -0.94% in its worst day since July.

Overnight in Asia the rally has run out of a bit of steam with futures on the S&P 500 and Nasdaq down -0.61% and -1.08% respectively. Other markets are also largely trading lower outside of the Nikkei which is up +0.97%. The Hang Seng (-0.25%), Shanghai Comp (-0.75%) and Kospi (-0.13%) are all down. Elsewhere, crude oil prices are down c.-2.50%. In other news, the Daily Mail has reported that Russian President Putin could quit in January amidst reports that he has Parkinson’s disease.

Though it’s likely to get a lot less attention than usual thanks to the election, we do have the US jobs report for October coming out later. Our US economists expect that nonfarm payrolls will rise by +600k, which would imply ongoing improvements in the labour market, but also be the slowest pace of job growth since the labour market recovery began in May. That should also lower the unemployment rate down to a post-pandemic low of 7.7%.

Back on central banks, the Bank of England’s MPC voted unanimously to increase their asset purchases by a further £150bn, which was above the consensus expectation for an extra £100bn, and left Bank Rate unchanged at 0.1%. Our UK economists (link here) say that the policy statement was “undoubtedly dovish”, with lower growth forecasts and stronger language on forward guidance. Indeed in the BoE’s Monetary Policy Report that was also released yesterday, they forecasted a contraction in Q4 GDP, which comes as the UK entered its second lockdown yesterday, with non-essential shops along with bars and restaurants closed once again. Oh and Golf Courses! In response to the new lockdown, Chancellor Sunak also unveiled further support for affected workers, with the furlough scheme extended until the end of March, which pays workers 80% of their salary for hours not worked.

On the coronavirus, it was announced that a national lockdown would be imposed in Greece for 3 weeks starting Saturday morning in response to rising case numbers. As part of this, primary schools would remain open, but secondary schools would close. Elsewhere, a number of other European countries reported record case numbers, including France, Italy, Poland, Austria and Romania. France’s health minister said that Covid-19 patients now account for more than 85% of French hospitals’ initial intensive-care capacity. The US saw another record number of daily infections at 126,210 in the past 24 hours with Illinois, Ohio and Michigan reporting record number of new cases amongst other states, Ohio’s governor has called state’s numbers as “shockingly high.” Meanwhile, New York state reported a positivity rate of 1.86% on Wednesday, the highest since June. Across the other side of world, Japan recorded 1046 cases yesterday the highest since August. Hokkaido, the prefecture which is seeing the most number of cases is planning to raise its coronavirus alert as soon as tomorrow and will reportedly ask restaurants in the nightlife district of Susukino to close at 10 pm.

Looking at yesterday’s data, German factory orders for September grew by a smaller-than-expected +0.5% (vs. +2.0% expected), while Euro Area retail sales in September also fell by a more-than-expected -2.0% (vs. -1.5% expected). The figures came as the European Commission’s autumn economic forecast projected a smaller economic contraction this year of -7.8% for the Euro Area (vs. -8.7% in the summer), though they revised down their 2021 forecast to +4.2% (vs. +6.1% previously). Meanwhile in the US, the weekly initial jobless claims for the week through October 31 fell to 751k (vs. 735k expected), down from an upwardly revised 758k the previous week. The continuing claims reading for the week through October 24 also fell to 7.285m, which is a post-pandemic low.

To the day ahead now, and the aforementioned US jobs report is likely to be the data highlight, but there’ll also be the Canadian employment report for October, along with German industrial production and Italian retail sales for September. From central banks, we’ll hear from Bank of Canada Governor Macklem and the ECB’s Holzmann.

Government

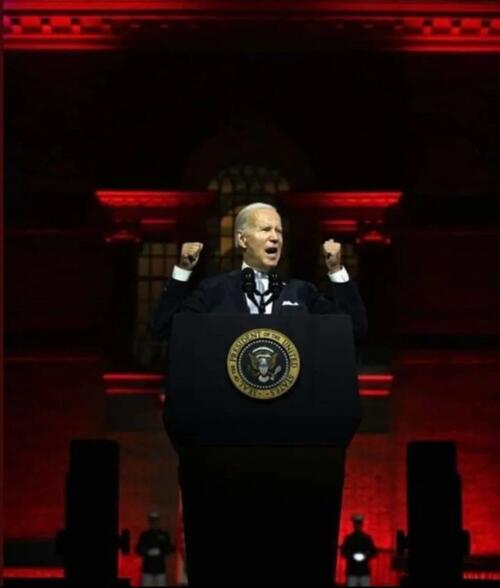

President Biden Delivers The “Darkest, Most Un-American Speech Given By A President”

President Biden Delivers The "Darkest, Most Un-American Speech Given By A President"

Having successfully raged, ranted, lied, and yelled through…

Having successfully raged, ranted, lied, and yelled through the State of The Union, President Biden can go back to his crypt now.

Whatever 'they' gave Biden, every American man, woman, and the other should be allowed to take it - though it seems the cocktail brings out 'dark Brandon'?

Tl;dw: Biden's Speech tonight ...

-

Fund Ukraine.

-

Trump is threat to democracy and America itself.

-

Abortion is good.

-

American Economy is stronger than ever.

-

Inflation wasn't Biden's fault.

-

Illegals are Americans too.

-

Republicans are responsible for the border crisis.

-

Trump is bad.

-

Biden stands with trans-children.

-

J6 was the worst insurrection since the Civil War.

(h/t @TCDMS99)

Tucker Carlson's response sums it all up perfectly:

"that was possibly the darkest, most un-American speech given by an American president. It wasn't a speech, it was a rant..."

Carlson continued: "The true measure of a nation's greatness lies within its capacity to control borders, yet Bid refuses to do it."

"In a fair election, Joe Biden cannot win"

And concluded:

“There was not a meaningful word for the entire duration about the things that actually matter to people who live here.”

Victor Davis Hanson added some excellent color, but this was probably the best line on Biden:

"he doesn't care... he lives in an alternative reality."

— Tucker Carlson (@TuckerCarlson) March 8, 2024

* * *

Watch SOTU Live here...

* * *

Mises' Connor O'Keeffe, warns: "Be on the Lookout for These Lies in Biden's State of the Union Address."

On Thursday evening, President Joe Biden is set to give his third State of the Union address. The political press has been buzzing with speculation over what the president will say. That speculation, however, is focused more on how Biden will perform, and which issues he will prioritize. Much of the speech is expected to be familiar.

The story Biden will tell about what he has done as president and where the country finds itself as a result will be the same dishonest story he's been telling since at least the summer.

He'll cite government statistics to say the economy is growing, unemployment is low, and inflation is down.

Something that has been frustrating Biden, his team, and his allies in the media is that the American people do not feel as economically well off as the official data says they are. Despite what the White House and establishment-friendly journalists say, the problem lies with the data, not the American people's ability to perceive their own well-being.

As I wrote back in January, the reason for the discrepancy is the lack of distinction made between private economic activity and government spending in the most frequently cited economic indicators. There is an important difference between the two:

-

Government, unlike any other entity in the economy, can simply take money and resources from others to spend on things and hire people. Whether or not the spending brings people value is irrelevant

-

It's the private sector that's responsible for producing goods and services that actually meet people's needs and wants. So, the private components of the economy have the most significant effect on people's economic well-being.

Recently, government spending and hiring has accounted for a larger than normal share of both economic activity and employment. This means the government is propping up these traditional measures, making the economy appear better than it actually is. Also, many of the jobs Biden and his allies take credit for creating will quickly go away once it becomes clear that consumers don't actually want whatever the government encouraged these companies to produce.

On top of all that, the administration is dealing with the consequences of their chosen inflation rhetoric.

Since its peak in the summer of 2022, the president's team has talked about inflation "coming back down," which can easily give the impression that it's prices that will eventually come back down.

But that's not what that phrase means. It would be more honest to say that price increases are slowing down.

Americans are finally waking up to the fact that the cost of living will not return to prepandemic levels, and they're not happy about it.

The president has made some clumsy attempts at damage control, such as a Super Bowl Sunday video attacking food companies for "shrinkflation"—selling smaller portions at the same price instead of simply raising prices.

In his speech Thursday, Biden is expected to play up his desire to crack down on the "corporate greed" he's blaming for high prices.

In the name of "bringing down costs for Americans," the administration wants to implement targeted price ceilings - something anyone who has taken even a single economics class could tell you does more harm than good. Biden would never place the blame for the dramatic price increases we've experienced during his term where it actually belongs—on all the government spending that he and President Donald Trump oversaw during the pandemic, funded by the creation of $6 trillion out of thin air - because that kind of spending is precisely what he hopes to kick back up in a second term.

If reelected, the president wants to "revive" parts of his so-called Build Back Better agenda, which he tried and failed to pass in his first year. That would bring a significant expansion of domestic spending. And Biden remains committed to the idea that Americans must be forced to continue funding the war in Ukraine. That's another topic Biden is expected to highlight in the State of the Union, likely accompanied by the lie that Ukraine spending is good for the American economy. It isn't.

It's not possible to predict all the ways President Biden will exaggerate, mislead, and outright lie in his speech on Thursday. But we can be sure of two things. The "state of the Union" is not as strong as Biden will say it is. And his policy ambitions risk making it much worse.

* * *

The American people will be tuning in on their smartphones, laptops, and televisions on Thursday evening to see if 'sloppy joe' 81-year-old President Joe Biden can coherently put together more than two sentences (even with a teleprompter) as he gives his third State of the Union in front of a divided Congress.

President Biden will speak on various topics to convince voters why he shouldn't be sent to a retirement home.

The state of our union under President Biden: three years of decline. pic.twitter.com/Da1KOIb3eR

— Speaker Mike Johnson (@SpeakerJohnson) March 7, 2024

According to CNN sources, here are some of the topics Biden will discuss tonight:

Economic issues: Biden and his team have been drafting a speech heavy on economic populism, aides said, with calls for higher taxes on corporations and the wealthy – an attempt to draw a sharp contrast with Republicans and their likely presidential nominee, Donald Trump.

Health care expenses: Biden will also push for lowering health care costs and discuss his efforts to go after drug manufacturers to lower the cost of prescription medications — all issues his advisers believe can help buoy what have been sagging economic approval ratings.

Israel's war with Hamas: Also looming large over Biden's primetime address is the ongoing Israel-Hamas war, which has consumed much of the president's time and attention over the past few months. The president's top national security advisers have been working around the clock to try to finalize a ceasefire-hostages release deal by Ramadan, the Muslim holy month that begins next week.

An argument for reelection: Aides view Thursday's speech as a critical opportunity for the president to tout his accomplishments in office and lay out his plans for another four years in the nation's top job. Even though viewership has declined over the years, the yearly speech reliably draws tens of millions of households.

Sources provided more color on Biden's SOTU address:

The speech is expected to be heavy on economic populism. The president will talk about raising taxes on corporations and the wealthy. He'll highlight efforts to cut costs for the American people, including pushing Congress to help make prescription drugs more affordable.

Biden will talk about the need to preserve democracy and freedom, a cornerstone of his re-election bid. That includes protecting and bolstering reproductive rights, an issue Democrats believe will energize voters in November. Biden is also expected to promote his unity agenda, a key feature of each of his addresses to Congress while in office.

Biden is also expected to give remarks on border security while the invasion of illegals has become one of the most heated topics among American voters. A majority of voters are frustrated with radical progressives in the White House facilitating the illegal migrant invasion.

It is probable that the president will attribute the failure of the Senate border bill to the Republicans, a claim many voters view as unfounded. This is because the White House has the option to issue an executive order to restore border security, yet opts not to do so

Maybe this is why?

Most Americans are still unaware that the census counts ALL people, including illegal immigrants, for deciding how many House seats each state gets!

— Elon Musk (@elonmusk) March 7, 2024

This results in Dem states getting roughly 20 more House seats, which is another strong incentive for them not to deport illegals.

While Biden addresses the nation, the Biden administration will be armed with a social media team to pump propaganda to at least 100 million Americans.

"The White House hosted about 70 creators, digital publishers, and influencers across three separate events" on Wednesday and Thursday, a White House official told CNN.

Not a very capable social media team...

The State of Confusion https://t.co/C31mHc5ABJ

— zerohedge (@zerohedge) March 7, 2024

The administration's move to ramp up social media operations comes as users on X are mostly free from government censorship with Elon Musk at the helm. This infuriates Democrats, who can no longer censor their political enemies on X.

Meanwhile, Democratic lawmakers tell Axios that the president's SOTU performance will be critical as he tries to dispel voter concerns about his elderly age. The address reached as many as 27 million people in 2023.

"We are all nervous," said one House Democrat, citing concerns about the president's "ability to speak without blowing things."

The SOTU address comes as Biden's polling data is in the dumps.

BetOnline has created several money-making opportunities for gamblers tonight, such as betting on what word Biden mentions the most.

As well as...

We will update you when Tucker Carlson's live feed of SOTU is published.

Fuck it. We’ll do it live! Thursday night, March 7, our live response to Joe Biden’s State of the Union speech. pic.twitter.com/V0UwOrgKvz

— Tucker Carlson (@TuckerCarlson) March 6, 2024

International

What is intersectionality and why does it make feminism more effective?

The social categories that we belong to shape our understanding of the world in different ways.

The way we talk about society and the people and structures in it is constantly changing. One term you may come across this International Women’s Day is “intersectionality”. And specifically, the concept of “intersectional feminism”.

Intersectionality refers to the fact that everyone is part of multiple social categories. These include gender, social class, sexuality, (dis)ability and racialisation (when people are divided into “racial” groups often based on skin colour or features).

These categories are not independent of each other, they intersect. This looks different for every person. For example, a black woman without a disability will have a different experience of society than a white woman without a disability – or a black woman with a disability.

An intersectional approach makes social policy more inclusive and just. Its value was evident in research during the pandemic, when it became clear that women from various groups, those who worked in caring jobs and who lived in crowded circumstances were much more likely to die from COVID.

A long-fought battle

American civil rights leader and scholar Kimberlé Crenshaw first introduced the term intersectionality in a 1989 paper. She argued that focusing on a single form of oppression (such as gender or race) perpetuated discrimination against black women, who are simultaneously subjected to both racism and sexism.

Crenshaw gave a name to ways of thinking and theorising that black and Latina feminists, as well as working-class and lesbian feminists, had argued for decades. The Combahee River Collective of black lesbians was groundbreaking in this work.

They called for strategic alliances with black men to oppose racism, white women to oppose sexism and lesbians to oppose homophobia. This was an example of how an intersectional understanding of identity and social power relations can create more opportunities for action.

These ideas have, through political struggle, come to be accepted in feminist thinking and women’s studies scholarship. An increasing number of feminists now use the term “intersectional feminism”.

The term has moved from academia to feminist activist and social justice circles and beyond in recent years. Its popularity and widespread use means it is subjected to much scrutiny and debate about how and when it should be employed. For example, some argue that it should always include attention to racism and racialisation.

Recognising more issues makes feminism more effective

In writing about intersectionality, Crenshaw argued that singular approaches to social categories made black women’s oppression invisible. Many black feminists have pointed out that white feminists frequently overlook how racial categories shape different women’s experiences.

One example is hair discrimination. It is only in the 2020s that many organisations in South Africa, the UK and US have recognised that it is discriminatory to regulate black women’s hairstyles in ways that render their natural hair unacceptable.

This is an intersectional approach. White women and most black men do not face the same discrimination and pressures to straighten their hair.

“Abortion on demand” in the 1970s and 1980s in the UK and USA took no account of the fact that black women in these and many other countries needed to campaign against being given abortions against their will. The fight for reproductive justice does not look the same for all women.

Similarly, the experiences of working-class women have frequently been rendered invisible in white, middle class feminist campaigns and writings. Intersectionality means that these issues are recognised and fought for in an inclusive and more powerful way.

In the 35 years since Crenshaw coined the term, feminist scholars have analysed how women are positioned in society, for example, as black, working-class, lesbian or colonial subjects. Intersectionality reminds us that fruitful discussions about discrimination and justice must acknowledge how these different categories affect each other and their associated power relations.

This does not mean that research and policy cannot focus predominantly on one social category, such as race, gender or social class. But it does mean that we cannot, and should not, understand those categories in isolation of each other.

Ann Phoenix does not work for, consult, own shares in or receive funding from any company or organisation that would benefit from this article, and has disclosed no relevant affiliations beyond their academic appointment.

africa uk pandemicInternational

Biden defends immigration policy during State of the Union, blaming Republicans in Congress for refusing to act

A rising number of Americans say that immigration is the country’s biggest problem. Biden called for Congress to pass a bipartisan border and immigration…

President Joe Biden delivered the annual State of the Union address on March 7, 2024, casting a wide net on a range of major themes – the economy, abortion rights, threats to democracy, the wars in Gaza and Ukraine – that are preoccupying many Americans heading into the November presidential election.

The president also addressed massive increases in immigration at the southern border and the political battle in Congress over how to manage it. “We can fight about the border, or we can fix it. I’m ready to fix it,” Biden said.

But while Biden stressed that he wants to overcome political division and take action on immigration and the border, he cautioned that he will not “demonize immigrants,” as he said his predecessor, former President Donald Trump, does.

“I will not separate families. I will not ban people from America because of their faith,” Biden said.

Biden’s speech comes as a rising number of American voters say that immigration is the country’s biggest problem.

Immigration law scholar Jean Lantz Reisz answers four questions about why immigration has become a top issue for Americans, and the limits of presidential power when it comes to immigration and border security.

1. What is driving all of the attention and concern immigration is receiving?

The unprecedented number of undocumented migrants crossing the U.S.-Mexico border right now has drawn national concern to the U.S. immigration system and the president’s enforcement policies at the border.

Border security has always been part of the immigration debate about how to stop unlawful immigration.

But in this election, the immigration debate is also fueled by images of large groups of migrants crossing a river and crawling through barbed wire fences. There is also news of standoffs between Texas law enforcement and U.S. Border Patrol agents and cities like New York and Chicago struggling to handle the influx of arriving migrants.

Republicans blame Biden for not taking action on what they say is an “invasion” at the U.S. border. Democrats blame Republicans for refusing to pass laws that would give the president the power to stop the flow of migration at the border.

2. Are Biden’s immigration policies effective?

Confusion about immigration laws may be the reason people believe that Biden is not implementing effective policies at the border.

The U.S. passed a law in 1952 that gives any person arriving at the border or inside the U.S. the right to apply for asylum and the right to legally stay in the country, even if that person crossed the border illegally. That law has not changed.

Courts struck down many of former President Donald Trump’s policies that tried to limit immigration. Trump was able to lawfully deport migrants at the border without processing their asylum claims during the COVID-19 pandemic under a public health law called Title 42. Biden continued that policy until the legal justification for Title 42 – meaning the public health emergency – ended in 2023.

Republicans falsely attribute the surge in undocumented migration to the U.S. over the past three years to something they call Biden’s “open border” policy. There is no such policy.

Multiple factors are driving increased migration to the U.S.

More people are leaving dangerous or difficult situations in their countries, and some people have waited to migrate until after the COVID-19 pandemic ended. People who smuggle migrants are also spreading misinformation to migrants about the ability to enter and stay in the U.S.

3. How much power does the president have over immigration?

The president’s power regarding immigration is limited to enforcing existing immigration laws. But the president has broad authority over how to enforce those laws.

For example, the president can place every single immigrant unlawfully present in the U.S. in deportation proceedings. Because there is not enough money or employees at federal agencies and courts to accomplish that, the president will usually choose to prioritize the deportation of certain immigrants, like those who have committed serious and violent crimes in the U.S.

The federal agency Immigration and Customs Enforcement deported more than 142,000 immigrants from October 2022 through September 2023, double the number of people it deported the previous fiscal year.

But under current law, the president does not have the power to summarily expel migrants who say they are afraid of returning to their country. The law requires the president to process their claims for asylum.

Biden’s ability to enforce immigration law also depends on a budget approved by Congress. Without congressional approval, the president cannot spend money to build a wall, increase immigration detention facilities’ capacity or send more Border Patrol agents to process undocumented migrants entering the country.

4. How could Biden address the current immigration problems in this country?

In early 2024, Republicans in the Senate refused to pass a bill – developed by a bipartisan team of legislators – that would have made it harder to get asylum and given Biden the power to stop taking asylum applications when migrant crossings reached a certain number.

During his speech, Biden called this bill the “toughest set of border security reforms we’ve ever seen in this country.”

That bill would have also provided more federal money to help immigration agencies and courts quickly review more asylum claims and expedite the asylum process, which remains backlogged with millions of cases, Biden said. Biden said the bipartisan deal would also hire 1,500 more border security agents and officers, as well as 4,300 more asylum officers.

Removing this backlog in immigration courts could mean that some undocumented migrants, who now might wait six to eight years for an asylum hearing, would instead only wait six weeks, Biden said. That means it would be “highly unlikely” migrants would pay a large amount to be smuggled into the country, only to be “kicked out quickly,” Biden said.

“My Republican friends, you owe it to the American people to get this bill done. We need to act,” Biden said.

Biden’s remarks calling for Congress to pass the bill drew jeers from some in the audience. Biden quickly responded, saying that it was a bipartisan effort: “What are you against?” he asked.

Biden is now considering using section 212(f) of the Immigration and Nationality Act to get more control over immigration. This sweeping law allows the president to temporarily suspend or restrict the entry of all foreigners if their arrival is detrimental to the U.S.

This obscure law gained attention when Trump used it in January 2017 to implement a travel ban on foreigners from mainly Muslim countries. The Supreme Court upheld the travel ban in 2018.

Trump again also signed an executive order in April 2020 that blocked foreigners who were seeking lawful permanent residency from entering the country for 60 days, citing this same section of the Immigration and Nationality Act.

Biden did not mention any possible use of section 212(f) during his State of the Union speech. If the president uses this, it would likely be challenged in court. It is not clear that 212(f) would apply to people already in the U.S., and it conflicts with existing asylum law that gives people within the U.S. the right to seek asylum.

Jean Lantz Reisz does not work for, consult, own shares in or receive funding from any company or organization that would benefit from this article, and has disclosed no relevant affiliations beyond their academic appointment.

congress senate trump pandemic covid-19 mexico ukraine-

Uncategorized2 weeks ago

Uncategorized2 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoIndustrial Production Decreased 0.1% in January

-

International1 month ago

International1 month agoWar Delirium

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges