Government

Fauci Adviser Secretly Messaged Zoologist Who Funneled Money to Chinese Lab: Emails

Fauci Adviser Secretly Messaged Zoologist Who Funneled Money to Chinese Lab: Emails

Authored by Zachary Stieber via The Epoch Times,

A top…

Authored by Zachary Stieber via The Epoch Times,

A top adviser to Dr. Anthony Fauci secretly messaged a zoologist who funneled money from Dr. Fauci’s agency to a laboratory in the Chinese city where the first COVID-19 cases appeared, according to newly disclosed emails.

Peter Daszak speaks to media upon arriving at the Wuhan Institute of Virology in China's central Hubei province, on Feb. 3, 2021. (Hector Retamal/AFP via Getty Images)

Dr. David Morens, the adviser, sent at least four messages to Peter Daszak, the zoologist, the emails show. Images of the email headers were obtained and released by the U.S. House of Representatives Select Subcommittee on the Coronavirus Pandemic.

Dr. Morens, who was messaging from his personal email, wrote to Mr. Daszak, the president of EcoHealth Alliance, and others on April 26, 2020; July 13, 2020; and Feb. 20, 2022. At least three of the messages were about a grant from the U.S. National Institute of Allergy and Infectious Diseases (NIAID) to EcoHealth to study bat coronaviruses. Money from that grant was funneled by EcoHealth to the Wuhan Institute of Virology.

“Please read and acknowledge receipt -- Actions needed regarding 2R01AI110964-06,” the subject line of one message stated.

In another, Dr. Morens was responding after Mr. Daszak told him an NIAID grant officer said “he’s unable to talk with me anymore about our suspended [grant].”

The grant was suspended on April 24, 2020, by former President Donald Trump’s administration after the COVID-19 pandemic started. President Joe Biden’s administration restored funding in 2023, although it suspended and later banned the Wuhan lab from receiving money.

An inspector general determined in a 2023 report that EcoHealth and the National Institutes of Health (NIH) failed to properly monitor research being done in Wuhan. EcoHealth also failed to obtain documents the NIH requested following the emergence of COVID-19, which EcoHealth blamed on a lack of cooperation from Chinese officials. The NIH is the NIAID’s parent agency.

Dr. Morens in a previously released email said that he “retained very few emails or documents” on the origins of COVID-19 “and continue to request that correspondence on sensitive issues be sent to me at my gmail address.”

He said in another email that “I try to always communicate on gmail because my NIH email is FOIA’d constantly“ and that ”I will delete anything I don’t want to see in the New York Times.”

The newly acquired emails, sourced from a whistleblower, show “further attempts by Dr. Morens to subvert public transparency,” Rep. Brad Wenstrup (R-Ohio), chairman of the subcommittee, said on April 1

He was writing to Dr. Gerald Keusch, director of the National Emerging Infectious Diseases Laboratory Institute at Boston University.

Dr. Keusch was part of the emails between Dr. Morens and Mr. Daszak.

Dr. Wenstrup asked Dr. Keusch to provide all communications between Dr. Keusch and Dr. Morens about the origins of COVID-19, EcoHealth, or the Wuhan lab, in addition to communications between Dr. Keusch and government agencies on the same topics.

Dr. Keusch, Dr. Morens, and EcoHealth did not respond to requests for comment.

Some experts and government agencies believe that COVID-19 originated at the Wuhan lab, which was conducting risky experiments on coronaviruses. Some others favor the natural origin theory. No animal intermediary has been identified as of yet.

Dr. Morens answered questions from the House subcommittee in January. According to a readout of the interview, Dr. Morens said Mr. Daszak is a close friend. He said that he “stood with 100% certainty behind the zoonotic origin of COVID-19, ”even though he acknowledged not exploring any evidence supporting the lab theory. Dr. Morens also denied deleting material on the origins of COVID-19 or making attempts to skirt the Freedom of Information Act.

“The select subcommittee has serious questions about the legitimacy of these claims,” the panel said at the time. “Chairman Wenstrup plans to receive access to Dr. Morens’s personal email account.”

Government

Louisiana’s housing market has an insurance problem

Agents across the state are lamenting rapidly rising homeowners insurance costs that hamper clients’ purchasing power

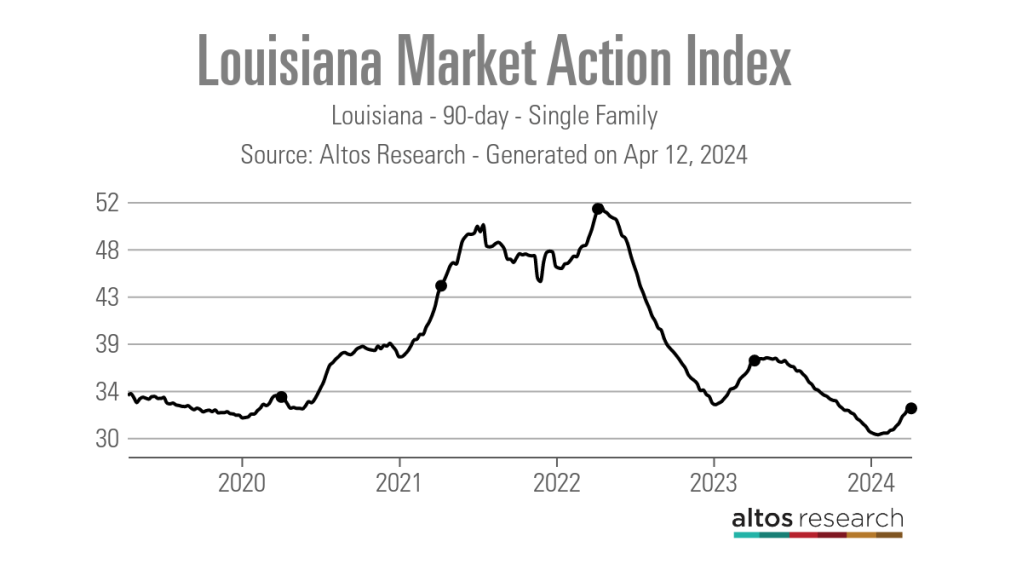

After heating up like the rest of the country, the Louisiana housing market has continued to cool since interest rates began to rise in the second half of 2022. While the slowdown has resulted in a return to pre-pandemic levels of market activity, real estate agents across the state believe that an issue far greater than 7% mortgage rates may cause the housing market to slow further.

“We have an insurance problem,” said Charlotte Johnson, a Keller Williams agent based in Mandeville. “Our insurance is pricing people out of their homes.”

Between 2018 and 2023, homeowners insurance rates in Louisiana jumped 24.9%, according to an analysis by S&P Global. From 2022 to 2023 alone, rates jumped 21.2%. This has been a hard pill for many homebuyers and owners to swallow.

Marx Sterbcow, a real estate lawyer and managing attorney at Sterbcow Law Group, based roughly 40 miles north of New Orleans, insurance costs have created a rapid run-up in his annual premium. He paid $4,700 in 2022, $11,500 in 2023 and received a quote of $28,000 for 2024.

“I’m not sure what else can be done to lower the costs other than to increase the deductibles. My house has never had a claim, has all the added bells and whistles to help mitigate against any potential claim,” Sterbcow said.

Although Sterbcow is relatively close to the coast in the New Orleans metro area, increasing his property’s risk for hurricane damage, the challenge of rising insurance costs is a statewide issue.

“There are some legislative issues with insurance and taxes on insurance, but there is no doubt that we have had more severe natural disasters,” said Stephen Lovecchio, the owner of the New Orleans branch of insurance firm The Woodlands Financial Group. “The insurance companies are only trying to make a nickel on every dollar, but if we have to pay out for a $100 million or $200 million storm, rates have to go up accordingly.”

Across the state, agents feel these rising insurance costs on top of higher mortgage rates and list prices. According to Altos Research data, 90-day median list prices have risen from roughly $230,000 in April 2020 to $275,000 in early April 2024, contributing to the slowdown in home sales.

According to data from Redfin, 2,491 homes were sold in Louisiana in February 2024, down 6.2% year over year, and nearly identical to the 2,492 homes sold in February 2020 prior to the COVID-19 pandemic.

Additionally, the state’s 90-day average Altos Market Action Index score was 32.75 as of April 5, 2024 — down from 37.21 one year earlier, but nearly identical to the score of 32.77 recorded in mid-February 2020. Altos classifies scores above 30 to be indicative of a sellers’ market.

“Sellers will want top dollar for their property, but we are seeing buyers starting to look at negotiating things like closing costs or buying down their interest rate,” said Jessica Huber, a Keller Williams Realty First Choice agent based in Prairieville. “I’ve seen buyers ask for and get between $8,000 and $10,000 in closing costs covered. Prices are still higher than they were previously, but at least in my area, sellers are working with buyers.”

Another indicator of the slower market conditions is the statewide rise in inventory. After the 90-day average reached a floor of 5,010 single-family active listings in mid-April 2022, it has increased to 12,028 as of early April 2024. In comparison, statewide inventory was at 14,129 active listings in mid-February 2020.

While inventory is clearly headed in the right direction, local agents say that it is still hard for buyers at certain price points to find quality listings.

“Inventory feels pretty balanced,” said Josh Foster, an EXIT Realty Southern agent based in Sulphur. “I think we are running close to about a six-month supply, but one of the things we are still running into is that there is still not a lot of homes in that sweet spot for most buyers — right at the $200,000 to $300,000 mark, two acres with three or four bedrooms. It’s just not out there.”

With these “sweet spot”-type properties, when one does come on the market, Foster said he has seen some multiple-offer situations, but nothing like the post-pandemic surge of 2020 and 2021.

With transaction volume slowing, agents are doing everything they can to make sure the deals they have close successfully. For most, this means bringing a homeowners insurance agent into the transaction much sooner than they used to.

“Now we are getting the insurance quote before we even submit an offer on a house, so that they know what their total payment is going to be,” Johnson said. “It is a lot more legwork than before, but at least we know before we make an offer if the client can even afford their monthly payment, or even if they can get the mortgage because the insurance premium will impact their debt-to-income ratio.”

In addition to helping current buyers, agents are also working with past clients to help them manage their homeowners insurance costs.

“I’ve had people call me to list their house because they can no longer afford their insurance. So, I have been teaching people about the need to shop around for insurance,” Johnson said. “I’ve been fortunate that I’ve been able to help them find better rates so that they can stay in their home. Your insurance company doesn’t have to be your insurance company forever.”

Although the insurance challenges facing Louisiana’s real estate market will not disappear overnight, agents are hopeful for the future. Under current state laws, insurance carriers are banned from dropping homeowners who have been customers for at least three years.

In late March, however, the Louisiana House of Representatives voted to allow insurance companies more leeway in dropping homeowner policies. The bill still needs to be passed by the state Senate, but agents are hopeful the change would entice more carriers to offer coverage in higher-risk areas, giving homeowners and buyers more choices.

“The reinsurers see this rule and they don’t want to be part of things in Louisiana — they don’t want to come here,” Johnson said. “So, we have a situation where we don’t have competition and so that is driving up the prices even higher.”

Lovecchio also noted that he expects insurance premiums to decline in the coming years.

“The new insurance commissioner is allowing companies to raise and lower rates a lot quicker, so hopefully consumers will see less lag time on their rate changes,” Lovecchio said.

“I think prices will moderate a bit moving forward. We’ve seen them stop going up, so that is good — it is the first step. But we also hope some more carriers will enter our markets and bring them lower because we really need rates to go down.”

home sales mortgage rates real estate housing market pandemic covid-19 senate house of representatives interest ratesInternational

The idea that US interest rates will stay higher for longer is probably wrong

A gap has opened up between inflation in the US compared to other regions like Europe and China.

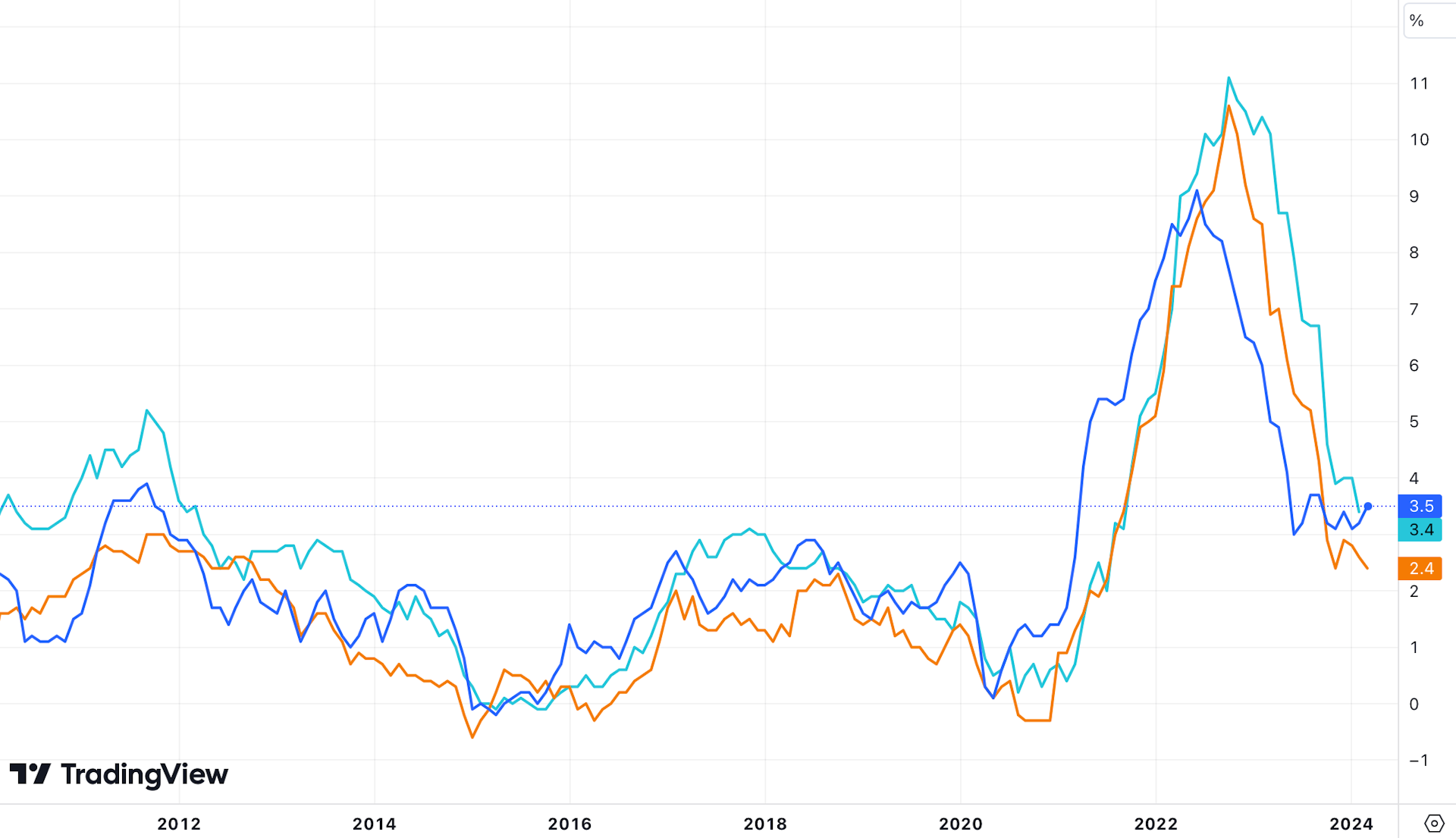

The 0.4% rise in US consumer prices in March didn’t look like headline news. It was the same as the February increase, and the year-on-year rise of 3.5% is still sharply down from 5% a year ago.

All the same, this modest uptick in annual inflation from 3.2% in February has cast doubt on whether the US central bank, the Federal Reserve, can afford to cut headline interest rates as fast as it has been signalling. To further complicate matters, a gap has opened up between the US inflation rate and that of other regions, notably the EU.

US inflation vs EU and UK

Financial markets’ instant reaction was bearish. They dumped stocks while buying EU government bonds, in expectation of a boost from the European Central Bank cutting its rates sooner. They also bought the US dollar, anticipating it will strengthen when European rates come down. But how is this likely to play out?

Can they all be right?

The US economy has returned to steady expansion after the COVID-19 pandemic disruption of 2020-22, while Europe is struggling to achieve any growth. This helps to explain the difference in the inflation figures.

The strength of the US economy was already putting pressure on the Fed to cut less quickly. A higher interest rate helps to stop strong demand straining supply chains and making prices rise too fast. The quickening of consumer-price inflation gives the Fed an added incentive to be hawkish on rates – to convince businesses and households that it will keep monetary conditions tight until inflation falls back to the 2% target.

The interest rates on advance purchases of US debt (the “Fed futures” market) show that a majority of traders now expect the Fed will not drop its interest rate from the current level (of 5.25% to 5.5%) to below 5% until December. A week ago, most thought this would have happened by September.

The trouble is that an extended period of higher rates could be very damaging because there’s so much debt in the system. In particular, last year’s wobbles in the US banking sector, and wider concerns about institutional investors exposed to a slump in commercial real estate, are strong incentives to reduce credit costs before too long.

Consequently, few believe the US headline interest rate will still be at present levels a year from now. Yet the longer that inflation endures, the more the pressure to delay further rate cuts. Most Americans now believe inflation will stay around 3% for the next year, an expectation echoed in markets for assets viewed as protecting against inflation (such as gold and cryptocurrencies).

Election-year inflation dangers

An especially fraught presidential election race also limits the Fed’s manoeuvring room. The White House has pitched its 2024-25 federal budget as helping to subdue inflation, by lowering working families’ living costs and forcing companies to pass-on cost savings.

But while Joe Biden aims to spend US$7.3 trillion (£5.8 trillion) in pursuit of his plans, congressional opponents are likely to block many of the tax increases intended to pay for them.

That’s likely to mean a continued widening of the US federal deficit, injecting more demand and keeping up inflationary pressure. That pressure could be worsened by the punitive tariffs that Republicans want to impose on cheap imports, to which many Democrats are sympathetic. An increasingly bipartisan push for tighter border controls would also raise US inflation risk, by stemming the inflow of cheap labour that has kept unskilled wages down.

US federal deficit

The case for cutting anyway

Despite these caveats, financial markets could well still be proved wrong about the speed of US rate cuts. Besides the private-sector debt concerns, one additional potential justification for cutting sooner actually relates to inflation. While central banks respect the conventional wisdom that higher interest rates reduce inflation, they cannot disregard evidence that the effect may be reversed if rates are kept high for too long.

When businesses expect interest rates to stay high, they raise prices to compensate, especially if heavier debt repayments spur employees to ask for more pay. Notably, the rising cost of mortgages in the US was one of the factors in March’s inflation surprise. The Fed can best tackle this by maintaining the assurance of lower interest rates, so that accommodation costs can fall.

Meanwhile, China is grappling with falling prices, which can do even worse damage than an inflation overshoot. There is still a possibility of China trying to escape this situation by flooding the world with cheap goods, and energy costs falling sharply when the Russia-Ukraine war ends. This would leave central banks in Europe and America concerned to stop their inflation falling too far, by cutting rates faster than the market currently expects.

The Fed must finally factor in the global downside of holding firm while other central banks’ interest rates fall. This would deal a double blow to the many countries, and non-US companies, that have borrowed in US dollars to finance their expansion plans. They would pay relatively more on their dollar debt, while their local currency revenues would buy fewer dollars, since the dollar strengthens as US interest rates move relatively higher.

The dollar’s global reach means that if the Fed doesn’t let headline rates fall, it could exacerbate a global slowdown. That would rebound against American producers, especially those now reliant on Europe, Latin America and Asia as major export markets. So when the ECB cuts rates, the Fed can be still expected to follow, even if it means US inflation remaining above target into 2025. This could mean another boost to stock prices, fresh incentives to borrow more money, and greater instability for the years ahead.

Alan Shipman does not work for, consult, own shares in or receive funding from any company or organisation that would benefit from this article, and has disclosed no relevant affiliations beyond their academic appointment.

bonds government bonds pandemic covid-19 stocks fed federal reserve real estate mortgages us dollar white house tariffs interest rates gold european europe uk russia ukraine eu chinaInternational

Cyclical Rally Could Look Very Different From Here

Cyclical Rally Could Look Very Different From Here

By Michael Msika, Bloomberg Markets Live reporter and strategist

A months-long rally in…

By Michael Msika, Bloomberg Markets Live reporter and strategist

A months-long rally in European cyclicals has left some stocks looking outright expensive, raising risks for them as the earnings season is about to start.

Cyclical sectors such as autos, industrials and financials have beaten the overall market hands down so far this year, with a 9% gain. Since the end of October, the Stoxx 600 Cyclical index has added 26%, beating defensive sectors by nearly 20 percentage points. That’s put them into the danger zone for profit-taking, amid signs the group is hitting overbought levels.

JPMorgan strategist Mislav Matejka notes cyclicals have in fact outperformed defensives for 18 months and trade at a significant premium. Other than energy, which he sees as a good hedge against elevated geopolitical risk, Matejka is neutral or bearish on most cyclical shares. “Defensives could look better from here, especially if the overall market starts to weaken, and if earnings growth acceleration expectations do not materialize,” he says.

Not all cyclicals are in the same boat, though. Gains on energy and mining shares follow a long period of underperformance and are driven by geopolitics as well as a brightening world economy. Nor do share valuations seem excessive for commodities and banking shares.

This segment of cyclicals is likely to outperform, according to Goldman Sachs strategists Peter Oppenheimer and Sharon Bell. They recently upgraded banks and energy to overweight and miners to neutral. However, they cut their view on industrials, citing expensive valuations.

Trading at nearly 20 times forward earnings — a 40% premium to the broader market and in the 90th percentile relative to their history — European industrials do look pricey. They also appear to have seriously overshot the recovery in PMIs — the last time the sector traded at such levels was just after the pandemic when European manufacturing was expanding rapidly. The fear is that companies pricing so much good news risk punishment if they disappoint in the upcoming earnings season.

Bank of America strategists are among those sticking to a very cautious stance. Wary of recent winners such as capital goods, BofA’s Sebastian Raedler sees scope for rotation into beaten-down defensives such as as food and beverages, though he remains overweight miners and chemicals. “Cyclicals overall are priced for sharp EPS upgrades,” he adds.

Cyclicals still have their fans, who point out the recent outperformance was driven by improved earnings estimates and that the overall group only trades at slightly above-average valuations compared with defensives. With interest-rate cuts due to kick off in the coming months, cyclical shares could enjoy further gains, many strategists, including at Barclays and Natixis, expect.

“Don’t fight the soft-landing narrative,” say Natixis strategists Florent Pochon and Emilie Tetard. They like European cyclicals tactically, in anticipation of a pick-up in European and Chinese economic growth, and the first European Central Bank rate cut in June.

-

International3 weeks ago

International3 weeks agoParexel CEO to retire; CAR-T maker AffyImmune promotes business leader to chief executive

-

Spread & Containment1 month ago

Spread & Containment1 month agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

Government6 days ago

Government6 days agoClimate-Con & The Media-Censorship Complex – Part 1

-

Spread & Containment4 days ago

Spread & Containment4 days agoFDA Finally Takes Down Ivermectin Posts After Settlement

-

Uncategorized1 week ago

Uncategorized1 week agoVaccinated People Show Long COVID-Like Symptoms With Detectable Spike Proteins: Preprint Study

-

Uncategorized7 days ago

Uncategorized7 days agoCan language models read the genome? This one decoded mRNA to make better vaccines.

-

Uncategorized5 days ago

Uncategorized5 days agoWhat’s So Great About The Great Reset, Great Taking, Great Replacement, Great Deflation, & Next Great Depression?

-

International3 weeks ago

International3 weeks agoJapanese Preprint Calls For mRNA VaccinesTo Be Suspended Over Blood Bank Contamination Concerns