International

How the national living wage helps the UK’s poorest households: new research

Since being introduced in 2016, the UK national living wage has risen to become one of the highest in the world.

The UK’s national living wage has just been raised by 10% to £11.44 per hour. It is now payable for all workers aged 21 and over, where previously it was for those aged 23 and over. Introduced by the Conservative government in 2016 as the flagship policy for boosting the wages of low-paid workers, the national living wage is now one of the highest minimum wages in the world.

It reached 63% of the median wage in the UK in 2023, having been 52% as recently as 2015, and compares favourably to rivals such as France and Germany.

What have been the consequences? Researchers at the Institute for Fiscal Studies (IFS) and University College London and I have sought to comprehensively evaluate the effects on wages, employment and household income. In a new paper published in the Journal of Labor Economics, we looked at the period between 2016 and the last pre-pandemic increase in 2019 (during this time the national living wage was legally binding only for those aged 25 and over, with lower rates applying to younger workers).

Many previous studies have focused on the effects on jobs, but we have analysed this using a new empirical methodology, while for household incomes we used an IFS model of tax and benefits called Taxben, which is the most accurate of its kind in the UK.

Few previous studies have investigated how the distributions of wages and household incomes are affected by minimum wage policies, and most have focused on the US. Minimum wage levels in the US are comparably low, at least at federal level, so we were interested to see how the UK results might differ.

Minimum wage by country (US$)

How jobs have been affected

As you might expect, each increase in the national living wage during 2016-19 benefited those whose pay had to be increased. On average, 5.4% of low-paid workers received the raises each time.

We find almost equivalent increases in the number of jobs paid at the new minimum wage level and up to approximately £2 per hour above it. So not only has the policy raised wages for low-paid workers, there have been spillover effects on those slightly above the minimum.

Our research suggests that this was achieved with minimal negative effects on employment. Each wage increase reduced employment for those aged 25 and over by an estimated 0.1% of the level of employment before the policy was introduced. This finding aligns with previous studies both in the UK and elsewhere.

Household income

Our analysis reveals that increases in the national living wage considerably benefit poorer households. Every £1 increase in the minimum wage results in an average 0.6% increase in income for households in the bottom half of household incomes, with positive effects fading out rapidly in the upper half.

This effect is similar across the lower half, meaning that the poorest households don’t seem to benefit proportionally more than somewhat richer ones. This is partly because earnings represent a lower share of total income for many poor households, since they often do not have anyone in work and so cannot gain from the minimum wage increase.

The poorest households’ wage increases are also often offset by benefit reductions. For a £1 increase in the minimum wage, the average increase in earnings among existing minimum wage workers is £30.68 per week. However, after accounting for taxes and reductions in means-tested benefits such as universal credit, net household income increases by £21.60 per week.

Effect by household income bracket

It’s worth noting that our results differ from what was documented by this 2019 study of the US, which showed that the minimum wage only benefited earners with the very lowest household incomes. This difference is partly because minimum wage workers in the US are predominantly located at the lower end of household incomes, whereas in the UK they tend to be concentrated in the middle (meaning they might be more likely to be living with a higher earning partner, for instance).

Also, minimum wage workers in the UK in the lowest income households tend to gain less from wage increases than in the US because of the simultaneous reduction in benefits, and because they work fewer hours. They also tend to derive a significant proportion of their income from self-employment, which falls outside the scope of the minimum wage.

What it means

Although our analysis only looks at minimum wages in the late 2010s, it hopefully gives a strong indication of how more recent increases will have affected workers’ finances and employment overall. However, it will be trickier to separate out effects during the pandemic period because it created such a huge economic upheaval.

Our findings indicate that the minimum wage can be a successful policy tool in delivering what it was intended for: boosting the wages of low wage earners.

The fact that this has occurred without reducing overall employment levels, both in the UK and elsewhere, removes one of the main potential objections to the policy.

The effectiveness of minimum wages as policy levers to support the working poor requires careful consideration of how such policies interact with tax and benefit systems. If the UK government wanted to tweak the current system so that the national living wage was more beneficial to the lowest earners, one option would be to reform the tax system so that they paid less tax on each additional £1 of income than they do at present.

Giulia Giupponi receives funding from the the Low Pay Commission (grant number CR20017), the Open Research Area programme (grant number ES/X008339/1), the Economic and Social Research Council through the Centre for the Microeconomic Analysis of Public Policy at IFS (ES/T014334/1) and through the UKRI Strategic Priorities Fund under grant reference ES/ W010453/1.

uk france italy germany sweden pandemicInternational

New government guidance for PE lets teachers and pupils down

Two hours a week is not enough.

The UK government recently published guidance for physical education (PE) aimed at all schools in England. The guidance is non-statutory, meaning it is not compulsory by law for schools to follow. Instead, it is intended as inspiration to help schools change their PE provision to benefit all pupils.

Initially, this document seems like a catalyst for positive change. Those, like us, who research and work in school PE have advocated for more high-level support and focus on the subject for years. But on closer inspection, the guidance seems like a missed opportunity. It shows that PE is still undervalued and misunderstood, particularly by the government.

A key recommendation set out in the guidance is that every pupil should take part in a minimum of two hours of PE a week. This, however, falls considerably short of the target set by the UK’s chief medical officer of 60 minutes per day of moderate-to-vigorous physical activity for children.

Not only is two hours a week not enough, it’s also nothing new. The Labour government set this as a target for young people in 2002, and set up a specific strategy to achieve it in 2008.

PE could be at the core of a curriculum that promotes embodied learning – learning through all the body’s senses, rather than sitting still and thinking.

The latest government guidance offers examples of schools that have prioritised active learning as models. But it also suggests that PE teachers need to use evidence to persuade school leadership and the school community of the need to include two hours of PE in the weekly timetable. Teachers deserve better than the expectation that they should have to fight for their subject.

Focus on sporting success

The guidance also emphasises that PE should be more inclusive. This includes equal provision for girls in PE, to ensure that boys and girls have access to the same sports and activities. But a big problem with PE’s inclusivity is how closely it is tied to sport and sporting success.

PE isn’t the same thing as sport. It’s an opportunity for children to learn about physical movement, health and fitness, and to gain social and emotional skills. But it isn’t appreciated as a standalone subject in this way.

For many, PE is only worth talking about when it is a way to emulate sporting success or create more successful sportspeople. This can be seen, for instance, in the links emphasised by the government between the success of England’s women’s football team, the Lionesses, and improving PE for girls. It’s also in the education secretary Gillian Keegan’s comment on the new PE guidance: “As the Women’s Six Nations kicks off, I’m delighted that we’re taking the next step to support schools to help boys and girls follow their sporting role models.”

A lack of interest or appreciation for the PE curriculum by school leadership can mean that what is on offer is driven by individual teachers’ sporting interests – with a focus on competitive sport (and often associated gender stereotypes) reinforced along the way.

Of course, increasing access to organised sport is good for the girls who want to play it. But many girls – and boys – don’t. They may feel judged by their classmates if they are less skilled, or that teachers prefer the pupils who are better at competitive sport. Children who don’t have an affinity for competitive sport are pushed out.

Lifetime benefits

PE should increase children’s physicality in learning by offering them a choice of activities that engage, motivate and inspire them to continue a lifetime love of movement. This would require a step-change in the planning and delivery of PE, as well as the training required for teachers. This new guidance will not change attitudes, access and pupil motivation.

Good quality PE can enhance children’s mental, social, emotional and physical development. But this new guidance does little to advance the state and status of PE. It will continue to be pushed aside in favour of the subjects that pupils go on to take compulsory exams in.

Children are still experiencing the mental and physical fallout from pandemic lockdowns, and pupil absence is at an alarming high. PE could and should be at the forefront of making a real and lasting difference to children’s lives and education.

PE as a curricular subject must not be viewed just as a platform for sport. To better foster the movement of young people, it should be at the centre of a curriculum that is dedicated to supporting holistic development, health and wellbeing, and improving life chances.

The authors do not work for, consult, own shares in or receive funding from any company or organisation that would benefit from this article, and have disclosed no relevant affiliations beyond their academic appointment.

uk pandemicInternational

Euro Extends Decline After ECB Holds Rates At Highs, Hints At Cuts To Come

Euro Extends Decline After ECB Holds Rates At Highs, Hints At Cuts To Come

After yesterday’s US CPI print – and the dramatic adjustment to…

After yesterday's US CPI print - and the dramatic adjustment to market expectations of Fed policy action (timing and extent) - this morning's ECB was expected to be a nothing-burger with all eyes out for any confirmation that June is 'go-time' for Lagarde to cut (albeit a rare occurrence without a concomitant Fed cut) - which she will likely push her to stress the ECB's independence from The Fed.

Indeed, as expected, The ECB held rates at record highs for a fifth straight meeting.

The ECB added a new opening line to the statement:

“The Governing Council’s future decisions will ensure that its policy rates will stay sufficiently restrictive for as long as necessary..."

And it appears The ECB is laying the groundwork for a rate-cut sooner than later...

“If the Governing Council’s updated assessment of the inflation outlook, the dynamics of underlying inflation and the strength of monetary policy transmission were to further increase its confidence that inflation is converging to the target in a sustained manner, it would be appropriate to reduce the current level of monetary policy restriction.”

One notable change in the statement, from this...

“The Governing Council’s future decisions will ensure that policy rates will be set at sufficiently restrictive levels for as long as necessary.”

...to this...

“The Governing Council’s future decisions will ensure that its policy rates will stay sufficiently restrictive for as long as necessary.”

Suggesting something is about to change.

Finally, The ECB reports that most measures of underlying inflation are easing.

Wage growth is moderating and firms are absorbing parts of these costs in their profits.

But, it says, domestic price pressures continue to be strong.

In short, the ECB remains data-dependent and isn’t committing to anything but if the progress of inflation and other factors has progressed sufficiently by June’s forecasts than reducing the level of policy restriction “would be appropriate”.

Not much movement in the bond space but the euro extended losses modestly on the ECB news...

Source: Bloomberg

As The FT notes, some eurozone policymakers, as in the UK, may want to avoid cutting rates much more aggressively than their counterparts in the US, partly out of fear of weakening their currencies and so further stoking inflation. But Peter Schaffrik, a strategist at RBC Capital Markets, said:

“The ECB has nailed its colours to the mast and shifting the guidance at this stage when actual inflation numbers are currently not far away from their own forecasts seems difficult to imagine.”

Now, we wait to see what Christine Lagarde says in the presser. You can bet someone a warm beer that she raises the fact that the ECB is independent of The Fed (when everyone knows, she is ultimately beholden to what Powell says and does)...

Read the full statement below:

The Governing Council today decided to keep the three key ECB interest rates unchanged. The incoming information has broadly confirmed the Governing Council’s previous assessment of the medium-term inflation outlook. Inflation has continued to fall, led by lower food and goods price inflation. Most measures of underlying inflation are easing, wage growth is gradually moderating, and firms are absorbing part of the rise in labour costs in their profits. Financing conditions remain restrictive and the past interest rate increases continue to weigh on demand, which is helping to push down inflation. But domestic price pressures are strong and are keeping services price inflation high.

The Governing Council is determined to ensure that inflation returns to its 2% medium-term target in a timely manner. It considers that the key ECB interest rates are at levels that are making a substantial contribution to the ongoing disinflation process. The Governing Council’s future decisions will ensure that its policy rates will stay sufficiently restrictive for as long as necessary. If the Governing Council’s updated assessment of the inflation outlook, the dynamics of underlying inflation and the strength of monetary policy transmission were to further increase its confidence that inflation is converging to the target in a sustained manner, it would be appropriate to reduce the current level of monetary policy restriction. In any event, the Governing Council will continue to follow a data-dependent and meeting-by-meeting approach to determining the appropriate level and duration of restriction, and it is not pre-committing to a particular rate path.

Key ECB interest rates

The interest rate on the main refinancing operations and the interest rates on the marginal lending facility and the deposit facility will remain unchanged at 4.50%, 4.75% and 4.00% respectively.

Asset purchase programme (APP) and pandemic emergency purchase programme (PEPP)

The APP portfolio is declining at a measured and predictable pace, as the Eurosystem no longer reinvests the principal payments from maturing securities.

The Governing Council intends to continue to reinvest, in full, the principal payments from maturing securities purchased under the PEPP during the first half of 2024. Over the second half of the year, it intends to reduce the PEPP portfolio by €7.5 billion per month on average. The Governing Council intends to discontinue reinvestments under the PEPP at the end of 2024.

The Governing Council will continue applying flexibility in reinvesting redemptions coming due in the PEPP portfolio, with a view to countering risks to the monetary policy transmission mechanism related to the pandemic.

Refinancing operations

As banks are repaying the amounts borrowed under the targeted longer-term refinancing operations, the Governing Council will regularly assess how targeted lending operations and their ongoing repayment are contributing to its monetary policy stance.

***

The Governing Council stands ready to adjust all of its instruments within its mandate to ensure that inflation returns to its 2% target over the medium term and to preserve the smooth functioning of monetary policy transmission. Moreover, the Transmission Protection Instrument is available to counter unwarranted, disorderly market dynamics that pose a serious threat to the transmission of monetary policy across all euro area countries, thus allowing the Governing Council to more effectively deliver on its price stability mandate.

The President of the ECB will comment on the considerations underlying these decisions at a press conference starting at 14:45 CET today.

International

Silver and Gold: The Winning Bet

Source: Michael Ballanger 04/08/2024

Michael Ballanger of GGM Advisory Inc. shares his thoughts on the current state of the gold and silver market, as…

Source: Michael Ballanger 04/08/2024

Michael Ballanger of GGM Advisory Inc. shares his thoughts on the current state of the gold and silver market, as well as a few junior stocks he believes are worth looking into.

Before I begin with my weekly assessment of market conditions, I have a story that needs to be told because as I glided around the blogosphere and Twitterverse and saturated world of ever-repeating podcasts, there was a distinct mixture of elation, excitement, and greed inundating the precious metals space with a particular pungency for silver and the PM miners.

A few decades ago, I had a brilliant, highly successful client who luxuriated in the practice of correcting me whenever I would offer him investment ideas. Be they my grammatical errors or factual oversights, no conversation went uncritiqued by this self-anointed wonderchild of intellectual superiority as interruption upon interruption became the order of the day whenever I dared make the call.

One particular conversation in February of 2020 involved gold and how I believed that it was a suitable place for investment capital given the ludicrous extremes to which the leaders of the Free World would devolve in order to protect their citizens from certain ruin and "death by microbe" after news of a strange new strain of virus was emerging from central China.

After multiple stops and starts, my esteemed client punctuated the conversation by embarking upon a lecture in which he dismissed the notion of gold being the "asset of choice" and opined that if I was worth the fees he paid me, I would know that the better place to be was silver.

No bull market in gold can ever survive without the company of its little sister, silver.

Now, it wasn't that I didn't know about silver. I played silver early in my career when it made the first Hunt brothers-driven assault on a $50 an ounce, only to be soundly and violently repelled by a massive collusion by the government, Wall Street, the CFTC, SEC, and DOJ.

After barely escaping that margin-calling hurricane that befell commodity traders the world over, I decided that despite the fact that nothing is more fun for me than "playing the ponies" at Woodbine on a sunny summer afternoon, silver would be far too "risky" for clients. However, given that this client had an IQ somewhat larger than his considerably inflated ego, it became apparent that by the end of my pitch, he had already mapped out his own strategy for taming the inflationary beast being conjured up by the central-planning pandemic battlers.

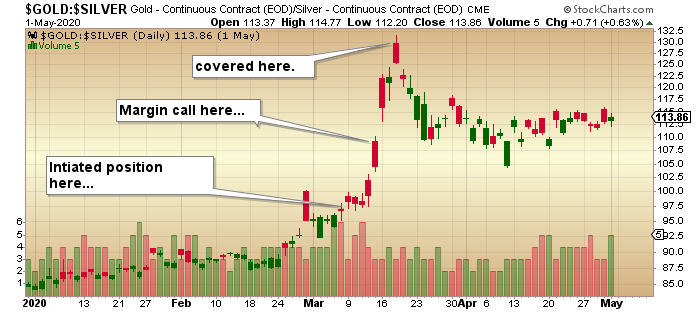

A few days later, I was instructed to deposit $100,000 into his futures account and initiate a position in July silver while taking on an equally notional short position in June gold. The idea was that if gold was to move higher, silver would obviously outperform it as it had done in every major bull market in precious metals since the Dawn of Margin Calls. In effect, he was shorting the Gold-to-Silver ratio (the "GSR") at around 90 because, as he so forcefully insisted, "the historic ratio for gold to silver is 15, and if you had done your homework, you would know that."

As you can guess, the rest, as they say, is history.

I cautioned my gifted client with the super-enlarged forehead that there was an inherent risk in assuming that silver would immediately scream ahead of gold because even in the 1970s, there was a "lag effect" where silver played catch-up to gold before it actually took the lead.

As I had suggested in February, the central banks and governments around the world hit the panic button when cases of COVID-19 arrived in Europe and North America, delivered handily by busloads of curious tourists from all over China all collectively spewing out infected microbes as they snapped photos of the Louvre, the Washington Monument, and Niagara Falls.

Gold responded with vigor and leaped to the fore, rising sharply of its own volition and, unfortunately for my client, without the merry accompaniment of silver. The first margin call came four days later, to which more funds were transferred, with the second a week later, after which the client demanded a "meeting" to discuss why he was losing his shirt on "my" recommendation.

Well, I turned to the notes I had written in my journal as he was instructing me like a constipated school marm to enter his orders and reminded him that it gold that was "my recommendation" and that being short, the GSR was a brilliant idea, but a very risky one, despite his obvious intellectual advantage over a plebe like me. By the middle of March, after one of the briefest ownership periods in futures trading history, the trade was liquidated with a sizable loss of both equity and self-esteem, once again proving the time-tested truism that says that when one is trading the silver market, expect the unexpected and never let a loss get out of control because silver, it is said, is a very cruel and unforgiving mistress.

The client survived, and after a few months of therapy and extensive rehab, he returned to the markets, preferring to invest in bonds and utility stocks. He called me to report his jubilation every time a coupon or dividend was paid. Pax tibi! ("Peace be with you.")

Since the very early months of 2023, I have been of the opinion that there would be only two metals that had any chance of dodging the ...

Full story available on Benzinga.com

bonds pandemic covid-19 stocks junior stocks therapy gold europe china-

International3 weeks ago

International3 weeks agoParexel CEO to retire; CAR-T maker AffyImmune promotes business leader to chief executive

-

Spread & Containment4 weeks ago

Spread & Containment4 weeks agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

International1 month ago

International1 month agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Government5 days ago

Government5 days agoClimate-Con & The Media-Censorship Complex – Part 1

-

International1 month ago

International1 month agoWalmart launches clever answer to Target’s new membership program

-

Spread & Containment2 days ago

Spread & Containment2 days agoFDA Finally Takes Down Ivermectin Posts After Settlement

-

Uncategorized1 week ago

Uncategorized1 week agoVaccinated People Show Long COVID-Like Symptoms With Detectable Spike Proteins: Preprint Study

-

Uncategorized6 days ago

Uncategorized6 days agoCan language models read the genome? This one decoded mRNA to make better vaccines.