Government

The idea that US interest rates will stay higher for longer is probably wrong

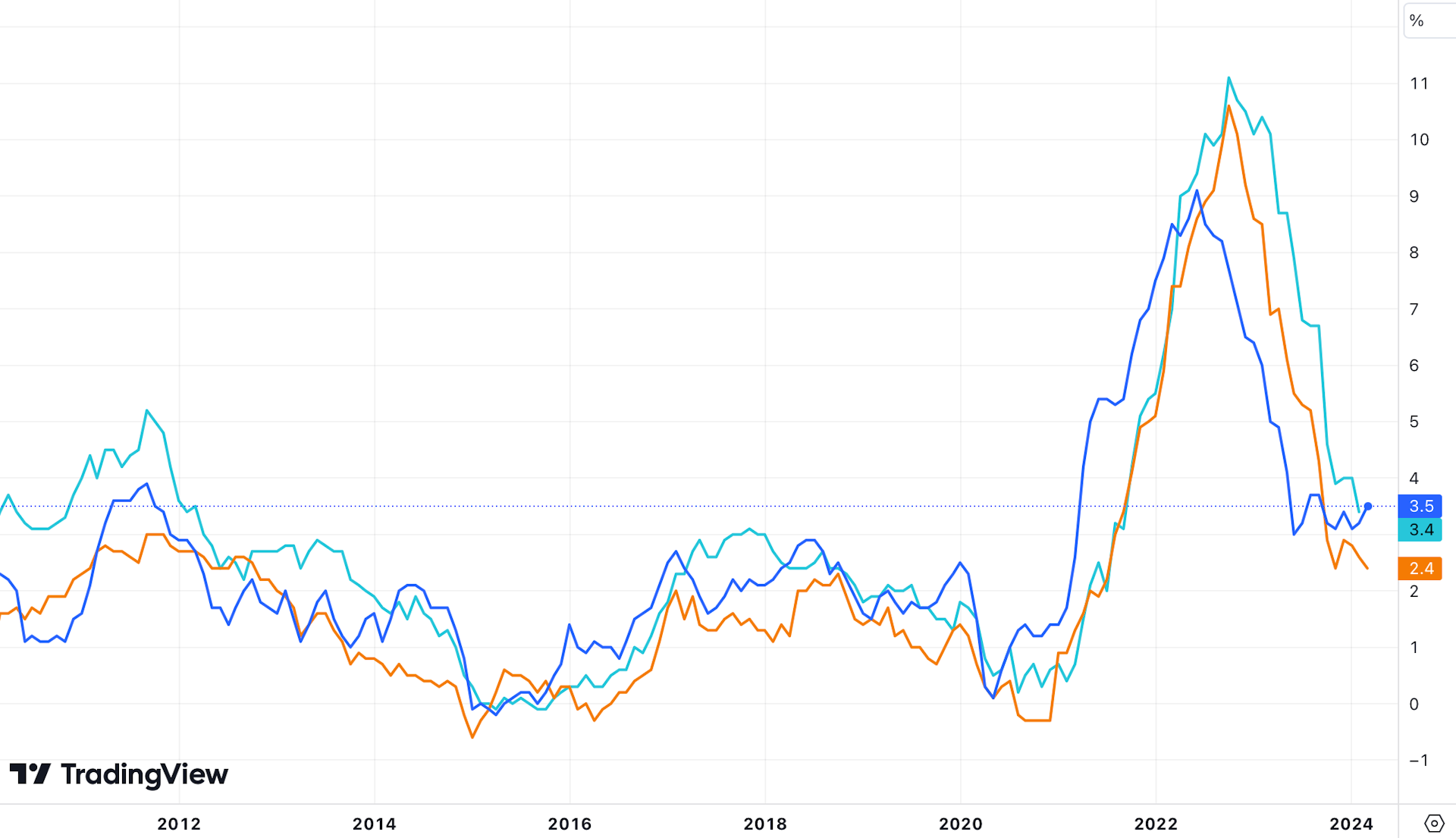

A gap has opened up between inflation in the US compared to other regions like Europe and China.

The 0.4% rise in US consumer prices in March didn’t look like headline news. It was the same as the February increase, and the year-on-year rise of 3.5% is still sharply down from 5% a year ago.

All the same, this modest uptick in annual inflation from 3.2% in February has cast doubt on whether the US central bank, the Federal Reserve, can afford to cut headline interest rates as fast as it has been signalling. To further complicate matters, a gap has opened up between the US inflation rate and that of other regions, notably the EU.

US inflation vs EU and UK

Financial markets’ instant reaction was bearish. They dumped stocks while buying EU government bonds, in expectation of a boost from the European Central Bank cutting its rates sooner. They also bought the US dollar, anticipating it will strengthen when European rates come down. But how is this likely to play out?

Can they all be right?

The US economy has returned to steady expansion after the COVID-19 pandemic disruption of 2020-22, while Europe is struggling to achieve any growth. This helps to explain the difference in the inflation figures.

The strength of the US economy was already putting pressure on the Fed to cut less quickly. A higher interest rate helps to stop strong demand straining supply chains and making prices rise too fast. The quickening of consumer-price inflation gives the Fed an added incentive to be hawkish on rates – to convince businesses and households that it will keep monetary conditions tight until inflation falls back to the 2% target.

The interest rates on advance purchases of US debt (the “Fed futures” market) show that a majority of traders now expect the Fed will not drop its interest rate from the current level (of 5.25% to 5.5%) to below 5% until December. A week ago, most thought this would have happened by September.

The trouble is that an extended period of higher rates could be very damaging because there’s so much debt in the system. In particular, last year’s wobbles in the US banking sector, and wider concerns about institutional investors exposed to a slump in commercial real estate, are strong incentives to reduce credit costs before too long.

Consequently, few believe the US headline interest rate will still be at present levels a year from now. Yet the longer that inflation endures, the more the pressure to delay further rate cuts. Most Americans now believe inflation will stay around 3% for the next year, an expectation echoed in markets for assets viewed as protecting against inflation (such as gold and cryptocurrencies).

Election-year inflation dangers

An especially fraught presidential election race also limits the Fed’s manoeuvring room. The White House has pitched its 2024-25 federal budget as helping to subdue inflation, by lowering working families’ living costs and forcing companies to pass-on cost savings.

But while Joe Biden aims to spend US$7.3 trillion (£5.8 trillion) in pursuit of his plans, congressional opponents are likely to block many of the tax increases intended to pay for them.

That’s likely to mean a continued widening of the US federal deficit, injecting more demand and keeping up inflationary pressure. That pressure could be worsened by the punitive tariffs that Republicans want to impose on cheap imports, to which many Democrats are sympathetic. An increasingly bipartisan push for tighter border controls would also raise US inflation risk, by stemming the inflow of cheap labour that has kept unskilled wages down.

US federal deficit

The case for cutting anyway

Despite these caveats, financial markets could well still be proved wrong about the speed of US rate cuts. Besides the private-sector debt concerns, one additional potential justification for cutting sooner actually relates to inflation. While central banks respect the conventional wisdom that higher interest rates reduce inflation, they cannot disregard evidence that the effect may be reversed if rates are kept high for too long.

When businesses expect interest rates to stay high, they raise prices to compensate, especially if heavier debt repayments spur employees to ask for more pay. Notably, the rising cost of mortgages in the US was one of the factors in March’s inflation surprise. The Fed can best tackle this by maintaining the assurance of lower interest rates, so that accommodation costs can fall.

Meanwhile, China is grappling with falling prices, which can do even worse damage than an inflation overshoot. There is still a possibility of China trying to escape this situation by flooding the world with cheap goods, and energy costs falling sharply when the Russia-Ukraine war ends. This would leave central banks in Europe and America concerned to stop their inflation falling too far, by cutting rates faster than the market currently expects.

The Fed must finally factor in the global downside of holding firm while other central banks’ interest rates fall. This would deal a double blow to the many countries, and non-US companies, that have borrowed in US dollars to finance their expansion plans. They would pay relatively more on their dollar debt, while their local currency revenues would buy fewer dollars, since the dollar strengthens as US interest rates move relatively higher.

The dollar’s global reach means that if the Fed doesn’t let headline rates fall, it could exacerbate a global slowdown. That would rebound against American producers, especially those now reliant on Europe, Latin America and Asia as major export markets. So when the ECB cuts rates, the Fed can be still expected to follow, even if it means US inflation remaining above target into 2025. This could mean another boost to stock prices, fresh incentives to borrow more money, and greater instability for the years ahead.

Alan Shipman does not work for, consult, own shares in or receive funding from any company or organisation that would benefit from this article, and has disclosed no relevant affiliations beyond their academic appointment.

bonds government bonds pandemic covid-19 stocks fed federal reserve real estate mortgages us dollar white house tariffs interest rates gold european europe uk russia ukraine eu chinaInternational

Cyclical Rally Could Look Very Different From Here

Cyclical Rally Could Look Very Different From Here

By Michael Msika, Bloomberg Markets Live reporter and strategist

A months-long rally in…

By Michael Msika, Bloomberg Markets Live reporter and strategist

A months-long rally in European cyclicals has left some stocks looking outright expensive, raising risks for them as the earnings season is about to start.

Cyclical sectors such as autos, industrials and financials have beaten the overall market hands down so far this year, with a 9% gain. Since the end of October, the Stoxx 600 Cyclical index has added 26%, beating defensive sectors by nearly 20 percentage points. That’s put them into the danger zone for profit-taking, amid signs the group is hitting overbought levels.

JPMorgan strategist Mislav Matejka notes cyclicals have in fact outperformed defensives for 18 months and trade at a significant premium. Other than energy, which he sees as a good hedge against elevated geopolitical risk, Matejka is neutral or bearish on most cyclical shares. “Defensives could look better from here, especially if the overall market starts to weaken, and if earnings growth acceleration expectations do not materialize,” he says.

Not all cyclicals are in the same boat, though. Gains on energy and mining shares follow a long period of underperformance and are driven by geopolitics as well as a brightening world economy. Nor do share valuations seem excessive for commodities and banking shares.

This segment of cyclicals is likely to outperform, according to Goldman Sachs strategists Peter Oppenheimer and Sharon Bell. They recently upgraded banks and energy to overweight and miners to neutral. However, they cut their view on industrials, citing expensive valuations.

Trading at nearly 20 times forward earnings — a 40% premium to the broader market and in the 90th percentile relative to their history — European industrials do look pricey. They also appear to have seriously overshot the recovery in PMIs — the last time the sector traded at such levels was just after the pandemic when European manufacturing was expanding rapidly. The fear is that companies pricing so much good news risk punishment if they disappoint in the upcoming earnings season.

Bank of America strategists are among those sticking to a very cautious stance. Wary of recent winners such as capital goods, BofA’s Sebastian Raedler sees scope for rotation into beaten-down defensives such as as food and beverages, though he remains overweight miners and chemicals. “Cyclicals overall are priced for sharp EPS upgrades,” he adds.

Cyclicals still have their fans, who point out the recent outperformance was driven by improved earnings estimates and that the overall group only trades at slightly above-average valuations compared with defensives. With interest-rate cuts due to kick off in the coming months, cyclical shares could enjoy further gains, many strategists, including at Barclays and Natixis, expect.

“Don’t fight the soft-landing narrative,” say Natixis strategists Florent Pochon and Emilie Tetard. They like European cyclicals tactically, in anticipation of a pick-up in European and Chinese economic growth, and the first European Central Bank rate cut in June.

Spread & Containment

Stuck On Failure At The WHO

Stuck On Failure At The WHO

Authored by Kevin Roberts and Robert Redfield via The Epoch Times (emphasis ours),

Four years have passed since…

Authored by Kevin Roberts and Robert Redfield via The Epoch Times (emphasis ours),

Four years have passed since the onset of COVID-19 and the global mishandling of its spread. Now, the same governments and international organizations that lied about the last pandemic are negotiating a new pandemic agreement and amendments to the International Health Regulations (IHR) at the World Health Organization (WHO).

The main culprit hasn’t changed. Although the Chinese Communist Party (CCP) has never been held accountable for its complete refusal to adhere to previous IHR agreements or its ongoing obstruction of a thorough investigation into the virus’s origins, Beijing is now collaborating with the Biden administration on this new accord.

So naturally, the new agreement advances China’s interests. Successive drafts focus on everything, from sending taxpayer dollars overseas to weakening intellectual property rights and empowering the WHO over the national sovereignty of the United States. Yes, that’s the same WHO that failed to insert a team of global experts in the first few weeks of the COVID-19 outbreak in China (as required by IHR), instead capitulating to the CCP and allowing it to define the international response.

The latest version of the agreement even mandates that parties provide financial and technical assistance to developing countries. Of course, the United States has a long, robust history of providing such assistance—President George W. Bush’s President’s Emergency Plan for AIDS Relief (PEPFAR) is one good example—but such assistance has always been voluntary, not obligatory.

Unsurprisingly, China stands to benefit from these provisions intended to help “poor” countries. Despite having the second-largest economy in the world, the United Nations considers China to be a “developing country.” That’s right. The country that started the COVID-19 pandemic will not only suffer zero consequences for its actions but, should the United States sign this agreement, stand to benefit from mandatory transfers of funds from U.S. taxpayers.

China would also benefit from other provisions in the agreement that push governments to promote “sustainable and geographically diversified production” of pandemic-related products (like vaccines), invest in developing country capacity and access to proprietary research, use the “flexibilities” of the Agreement on Trade-Related Aspects of Intellectual Property Rights to override patents, and encourage rights holders to forego or reduce royalties and consider time-bound waivers of intellectual property rights.

China, notorious for its theft of intellectual property, would be sure to exploit this privilege.

All this would severely curtail future investment in health research—exactly the opposite incentive that should be applied if we are to be prepared for a future pandemic. And to make matters worse, the agreement almost entirely ignores addressing the countless shortcomings of current international processes in responding to pandemics, such as obligating governments to grant immediate access to international health expert teams to assess the threat of suspected outbreaks and to provide full and timely disclosure of genomic data.

Of course, overseeing sustainable and geographically diversified production, massive transfers, and distribution of up to 20 percent of diagnostics, therapeutics, or vaccines during a pandemic comes with a hefty price tag. The exact amount is not specified, but it is sure to include several commas.

In addition, the agreement would take a sledgehammer to American First Amendment free speech rights. The willingness of governments to use the pandemic to clamp down on unpopular ideas and opinions to “protect” public health and safety has proven durable. And this new agreement instructs governments to “cooperate, in accordance with national law, in preventing misinformation and disinformation.” China and Russia need no encouragement to censor speech. However, such language in an international agreement will encourage those in free countries who similarly wish to suppress unpopular opinions under the guise of countering misinformation and disinformation.

Indeed, the WHO itself seems offended by criticism. Earlier this year, Director-General Tedros Adhanom Ghebreyesus said that negotiations were occurring in a very difficult environment, facing a “torrent of fake news, lies, and conspiracy theories.” Ironically, this argument was the same one used against conservatives who subscribed to the increasingly credible lab leak theory.

In short, the new pandemic agreement should alarm all Americans. It is far more focused on redistributing income, transferring technology, and weakening intellectual property than on preventing, detecting, and responding to pandemics in the first place. It failed to address the elephant in the room—the total lack of enforcement in the IHR—and as written, it is nothing short of a power grab by the CCP-controlled WHO.

Our government must wholly reject it.

Views expressed in this article are opinions of the author and do not necessarily reflect the views of The Epoch Times or ZeroHedge.

International

Immigration And Its Impact On Employment

Is immigration why employment reports from the Bureau of Labor Statistics (BLS) continue defying mainstream economists’ estimates? Many are asking this…

Is immigration why employment reports from the Bureau of Labor Statistics (BLS) continue defying mainstream economists’ estimates? Many are asking this question as the U.S. experiences a flood of immigrants across the southern border. Concurrently, many young college graduates continue to complain about the inability to receive a job offer. As noted recently by CNBC:

The job market looks solid on paper. According to government data, U.S. employers added 2.7 million people to their payrolls in 2023. Unemployment hit a 54-year low of 3.4% in January 2023 and ticked up just slightly to 3.7% by December.

But active job seekers say the labor market feels more difficult than ever. A 2023 survey from staffing agency Insight Global found that recently unemployed full-time workers had applied to an average of 30 jobs only to receive an average of four callbacks or responses.”

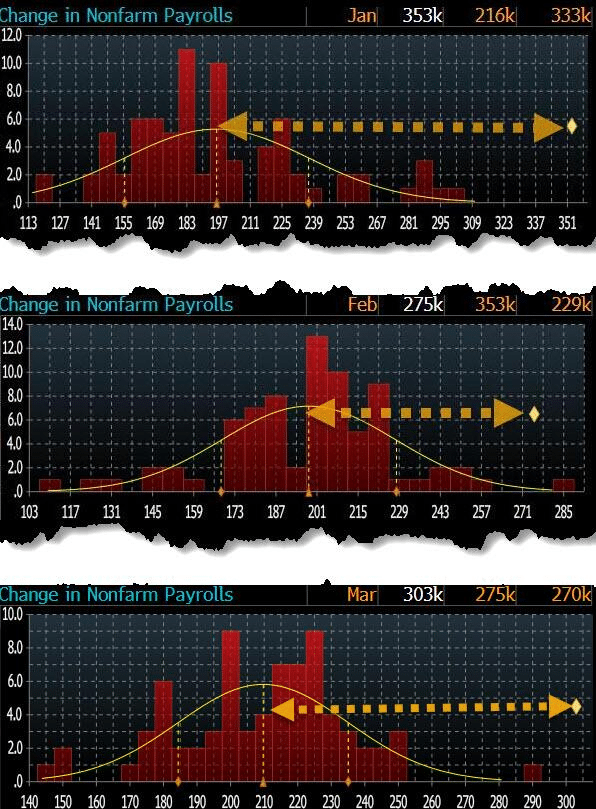

These stories are not unique. If you Google “Can’t find a job,” you will get many article links. Yet employment reports have been exceedingly strong for the past several months. In March, the U.S. economy added 303,000 jobs, exceeding every economist’s estimate by four standard deviations. In terms of statistics, a single four-standard deviation event should be rare. Three months in a row is a near statistical impossibility.

Despite weakness in manufacturing and services, with many companies recently announcing layoffs, we have near-record-low jobless claims and employment. According to official government data, the economy has rarely been more robust.

Such a situation begs an obvious question: How are college graduates struggling to find employment while the labor market remains so strong?

We may find the answer in immigration.

Immigrations Impact By The Numbers

A recent study by Wendy Edelberg and Tara Watson at the Brookings Institution found that illegal immigrants in the country helped boost the labor market, steering the economy from a downturn. Data from the Congressional Budget Office shows a massive uptick of 2.4 million “other immigrants” who don’t fall into the category of lawful immigrants or those on temporary visas. The chart below shows how this figure has spiked from a level of less than 500,000 at the beginning of the 2020s.

The most significant change relative to the past stems from CBO’s other non-immigrant category, which includes immigrants with a nonlegal or pending status.

“We indicate our estimates of ‘likely stayers’ by diamonds in Figure 2. In FY 2023, almost a million people encountered at the border were given a ‘notice to appear,’ meaning they have permission to petition a court for asylum or other immigration relief. Most of these individuals are waiting in the U.S. for the asylum court queue, which has over a million case backlog. In addition, over 800,000 have been granted humanitarian parole (mostly immigrants from Ukraine, Haiti, Cuba, Nicaragua, and Venezuela). These 1.8 million ‘likely stayers’ in FY 2023 may or may not remain in the U.S. permanently, but most are currently living in the U.S. and participating in the economy. CBO estimates that there were 2 million such entries over the calendar year 2023, which is consistent with higher encounters at the end of the calendar year.”

According to the CBO’s estimates for 2023, the categories of lawful permanent resident migration, INA non-immigrant, and other non-immigrant equated to 3.3 million net entries. However, the number is likely much higher than estimates, subject to uncertainty about unencountered border crossings, visa overstays, and “got-aways.”

As such, this influx of immigrants has significantly added to payroll growth and has accounted for the uptick in economic growth starting in 2022. While the uptick in border encounters began in earnest in 2021, as the current Administration repealed previous border security actions, there is a “lag effect” of immigration on economic growth.

However, not all jobs are created equal.

Immigration’s Impact On Job Availability

Since 1980, the U.S. economy has shifted from a manufacturing-based economy to a service-oriented one. The reason is that the “cost of labor” in the U.S. to manufacture goods is too high. Domestic workers want high wages, benefits, paid vacations, personal time off, etc. On top of that are the numerous regulations on businesses from OSHA to Sarbanes-Oxley, FDA, EPA, and many others. All those additional costs are a factor in producing goods or services. Therefore, corporations must offshore production to countries with lower labor costs and higher production rates to manufacture goods competitively.

In other words, for U.S. consumers to “afford” the latest flat-screen television, iPhone, or computer, manufacturers must “export” inflation (the cost of labor and production) to import “deflation” (cheaper goods.) There is no better example of this than a previous interview with Greg Hays of Carrier Industries. Following the 2016 election, President Trump pushed for reshoring U.S. manufacturing. Carrier Industries was one of the first to respond. Mr. Hays discussed the reasoning for moving a plant from Mexico to Indiana.

“So what’s good about Mexico? We have a very talented workforce in Mexico. Wages are obviously significantly lower. About 80% lower on average. But absenteeism runs about 1%. Turnover runs about 2%. Very, very dedicated workforce. Which is much higher versus America. And I think that’s just part of these — the jobs, again, are not jobs on an assembly line that [Americans] really find all that attractive over the long term.“

The need to lower costs by finding cheaper and plentiful sources of labor continues. While employment continues to increase, the bulk of the jobs created are in areas with lower wages and skill requirements.

As noted by CNBC:

“The continued rebound of these jobs, along with strong months for sectors like construction, could be a sign that immigration is helping the labor market grow without putting too much upward pressure on wages.”

This is a crucial point. If there is strong employment growth, wages should increase commensurately as the demand for labor increases. However, that isn’t happening, as the cost of labor is suppressed by hiring workers willing to work for less compensation. In other words, the increase in illegal immigrants is lowering the “average” wage for Americans.

Nonetheless, in the last year, 50% of the labor force growth came from net immigration. The U.S. added 5.2 million jobs last year, which boosted economic growth without sparking inflationary pressures.

While immigration has positively impacted economic growth and disinflation, this story has a dark side.

The Profit Motive

In a previous article, I discussed an interview by Fed Chair Jerome Powell discussing immigration during a 60-Minutes Interview. To wit:

“SCOTT PELLEY: Why was immigration important?

FED CHAIR POWELL: Because, you know, immigrants come in, and they tend to work at a rate that is at or above that for non-immigrants. Immigrants who come to the country tend to be in the workforce at a slightly higher level than native Americans. But that’s primarily because of the age difference. They tend to skew younger.“

You should read that comment again carefully. As noted by Greg Hayes, immigrants tend to work harder and for less compensation than non-immigrants. That suppression of wages and increased productivity, which reduces the amount of required labor, boosts corporate profitability.

The move to hire cheaper labor should be unsurprising. Following the pandemic-related shutdown, corporations faced multiple threats to profitability from supply constraints, a shift to increased services, and a lack of labor. At the same time, mass immigration (both legal and illegal) provided a workforce willing to fill lower-wage paying jobs and work regardless of the shutdown. Since 2019, the cumulative employment change has favored foreign-born workers, who have gained almost 2.5 million jobs, while native-born workers have lost 1.3 million. Unsurprisingly, foreign-born workers also lost far fewer jobs during the pandemic shutdown.

Given that the bulk of employment continues to be in lower-wage paying service jobs (i.e., restaurants, retail, leisure, and hospitality) such is why part-time jobs have dominated full-time in recent reports. Since last year, part-time jobs have risen by 1.8 million while full-time employment has declined by 1.35 million.

Not dismissing the implications of the shift to part-time employment is crucial.

Personal consumption, what you and I spend daily, drives nearly 70% of economic growth in the U.S. Therefore, Americans require full-time employment to consume at an economically sustainable rate. Full-time jobs provide higher wages, benefits, and health insurance to support a family, whereas part-time jobs do not.

Notably, given the surge in immigration into the U.S. over the last few years, the all-important ratio of full-time employees relative to the population has dropped sharply. As noted, given that full-time employment provides the resources for excess consumption, that ratio should increase for the economy to continue growing strongly.

However, the reality is that the full-time employment rate is falling sharply. Historically, when the annual rate of change in full-time employment dropped below zero, the economy entered a recession.

While there is much debate over immigration, most of the arguments do not differentiate between legal and illegal immigration. There are certainly arguments that can be made on both sides. However, what is less debatable is the impact that immigration is having on employment and wages. Of course, as native-born workers continue to demand higher wages, benefits, and other tax-funded support, those costs must be passed on by the companies creating those products and services. At the same time, consumers are demanding lower prices.

That imbalance between input costs and selling price drives companies to aggressively seek options to reduce the highest cost to any business – labor.

Such is why full-time employment has declined since 2000 despite the surge in the Internet economy, robotics, and artificial intelligence. It is also why wage growth fails to grow fast enough to sustain the cost of living for the average American. These technological developments increased employee productivity, reducing the need for additional labor.

Unfortunately, college graduates expecting high-paying jobs will likely continue to find it increasingly frustrating. Such is particularly the case as “Artificial Intelligence” gains traction and displaces “white collar” work, further squeezing the demand for “native-born” workers.

The post Immigration And Its Impact On Employment appeared first on RIA.

recession unemployment pandemic economic growth fed trump fda suppression unemployment mexico ukraine-

International3 weeks ago

International3 weeks agoParexel CEO to retire; CAR-T maker AffyImmune promotes business leader to chief executive

-

Spread & Containment1 month ago

Spread & Containment1 month agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

Spread & Containment6 days ago

Spread & Containment6 days agoClimate-Con & The Media-Censorship Complex – Part 1

-

Spread & Containment4 days ago

Spread & Containment4 days agoFDA Finally Takes Down Ivermectin Posts After Settlement

-

Uncategorized1 week ago

Uncategorized1 week agoVaccinated People Show Long COVID-Like Symptoms With Detectable Spike Proteins: Preprint Study

-

Uncategorized7 days ago

Uncategorized7 days agoCan language models read the genome? This one decoded mRNA to make better vaccines.

-

Uncategorized4 days ago

Uncategorized4 days agoWhat’s So Great About The Great Reset, Great Taking, Great Replacement, Great Deflation, & Next Great Depression?

-

International3 weeks ago

International3 weeks agoJapanese Preprint Calls For mRNA VaccinesTo Be Suspended Over Blood Bank Contamination Concerns