We’re In A Bubble That’s Too Big To Fail

We’re In A Bubble That’s Too Big To Fail

Authored by Mark Jeftovic via BombThrower.com,

I’ve been hearing the phrase “Everything Bubble” come up more often lately.

This isn’t a new phrase, Graham Summers was among the first to…

Authored by Mark Jeftovic via BombThrower.com,

I’ve been hearing the phrase “Everything Bubble” come up more often lately.

This isn’t a new phrase, Graham Summers was among the first to coin it in his 2017 book “The Everything Bubble: The Endgame for Central Bank Policy”:

“The Everything Bubble chronicles the creation and evolution of the US financial system, starting with the founding of the US Federal Reserve in 1913 and leading up to the present era of serial bubbles: the Tech Bubble of the ‘90s, the Housing Bubble of the early ‘00s and the current bubble in US sovereign bonds, which are also called Treasuries.

Because these bonds serve as the foundation of our current financial system, when they are in a bubble, it means that all risk assets (truly EVERYTHING), are in a bubble, hence our title, The Everything Bubble. In this sense, the Everything Bubble represents the proverbial end game for central bank policy: the final speculative frenzy induced by Federal Reserve overreach.”

Most recently the idea of the Everything Bubble came up on Coindesk’s Breakdown with NLW edition about NFT’s and the record setting sale of Beeple’s The First Five Thousand Days for $69 million USD. I say this as a guy who has been into crypto since 2013 and is getting even more involved today: I don’t get NFTs. Or rather, it only makes sense why they’re selling for such excessive valuations when you consider it to be a phenomenon occurring within the dynamics of an Everything Bubble.

Endgame is another theme asserting itself, that’s what Grant Williams and Bill Fleckenstein call their podcast (it recently went premium, but the first bunch of episodes are widely available across all major platforms). In Grant Williams’ February newsletter (“Let Them Eat Risk”), he afforded a lot of coverage to Bitcoin, including a piece by Ray Dalio and Rana Faroohar’s “Bitcoin’s Rise Reflects America’s Decline” (originally an op ed for the Financial Times).

What struck me about her piece, and to a similar extent, Dalio’s, was this recognition that even if they hadn’t themselves embraced the idea of crypto, it would be a mistake to dismiss crypto-currencies as merely a speculative bubble. Said differently, even Bitcoin skeptics are beginning to understand that Bitcoin’s rise means something. It portends a shift. A big one:

“A little over 100 years ago, there was a bubble asset that rose and fell wildly over the course of a decade. People who held it would have lost 100 per cent of their money five different times. They would have, at various points, made huge fortunes, or seen the value of their asset destroyed by hyperinflation.

The asset I’m referring to is gold priced in Weimar marks. If this reminds you of bitcoin, you are not alone. In his newsletter Tree Rings, analyst Luke Gromen looked at the startling similarities in the volatility of gold in Weimar Germany and bitcoin today. His conclusion? Bitcoin isn’t so much a bubble as “the last functioning fire alarm” warning us of some very big geopolitical changes ahead.” (emphasis added)

The entire piece is quite good and I recommend reading it, she concludes:

“None of this makes me want to buy bitcoin. But I also don’t see it as a normal bubble. It was unclear at the beginning of the 20th century which of the hundreds of automakers would win the race to replace the horse and buggy. Now, who knows whether bitcoin, ethereum, or diem, or some yet-to-be-invented digital currency will win out long term. For now, the bitcoin boom may best be viewed as a canary in the coal mine…”

This resonated with me and reminded me of a comment left on my “This Time is Different: What Bitcoin Isn’t“ piece when it ran on Zerohedge back in 2017 (the ZH copy is behind their premium archive now).

“Bitcoin is a hole …in a burning building

I had the thought that Bitcoin is like a hole in the wall of a burning building. The burning building is the petrodollar. The Bitcoin hole in the wall doesn’t meet any standard definition of a door. It wouldn’t pass a building inspection and it may not last long. It will most certainly be replaced by something else in the long run. But in the short term, no one inside that burning building really cares about any of that and the ones that first smelled smoke are already pouring through it. Many more will follow and some, sadly, will die in the fire. There are other exits from the building too, some may be safer than others, but the most important thing is getting out of the burning building as quickly as possible.”

I’ve been pulling together numerous threads so far from disparate sources, many of whom are Bitcoin and crypto-currency skeptics, all of whom are people I think are worth following anyway because they’re super smart and put out extremely high signal content.

The last one I’ll pull in is where the title for today’s post came from. I heard Diego Parrilla say this phrase on the Macro Voices podcast, in an almost off-the-cuff manner. My brain did a sort of physical convulsion that is hard to describe but has only happened maybe a half-dozen times in my life. Maybe that’s where the expression “mind blown” originates.

He said “we’re in an everything bubble that’s too big to fail”.

It’s not an institution, it’s not an asset class, it’s not a political ideology, a social media platform or a monetary regime. It is everything.

When you consider that, it explains why policy makers are behaving in the way they are. We’ve painted ourselves not into a corner, but into a bubble. There are no soft-landing scenarios out of which we can extricate ourselves from this bubble, and under no circumstances can this bubble be allowed to deflate, let alone pop.

I’ve been treating the rise of Bitcoin and gold as a flight out of fiat for some time. I’ve known that policy makers were motivated to keep the system on the rails for as long as humanly possible. None of this is new to me. But what really got me was that particular phrasing all of us being in a bubble that’s too big to fail.

It means in all of the language and trial balloons around The New Normal, the Great Reset, Build Back Better, the backdrop of desperation that seems to permeate it came into clearer focus for me.

Some kind of Great Reset is, in policy makers’ minds, the only way forward to get out of The Bubble. I looks like they want to do it in a way in which they get to keep living like they’re inside The Bubble and still run the show, while everybody else has to get used to living life under a drastically reduced standard of living and submit to rapidly emerging social credit systems.

In other words, it almost looks like the plan to softly deflate The Bubble is to kick everybody who isn’t part of the establishment elite and its support systems, out of it.

They walked it back pretty quickly… but they did put it out there…

It’s The Great Bifurcation, pulled forward about 20 or 50 years by a virus that would have otherwise been somewhere between a nothingburger and SARS…

“Even in the worst-case horrendous scenario, COVID-19 will kill far fewer people than the Great Plagues, including the Black Deaths, or World War II did… [but] changes that would have seemed inconceivable before the pandemic struck, such as new forms of monetary policy like helicopter money (already a given), the reconsideration/recalibration of some of our social priorities and augmented search for the common good as a policy objective, the notion of fairness acquiring political potency, radical welfare and taxation measures, and drastic geopolitical realignments.

The broader point is this: the possibilities for change and the resulting new order are now unlimited and only bound by our imagination, for better or for worse. “

— Klaus Schwab, experiencing near-fatal orgasm in his COVID-19: The Great Reset

The escape valves from The Everything Bubble

But there are escape valves from The Everything Bubble, ones that can be used by normal everyday people who aren’t elites, who don’t get invited to Davos every year to “reimagine” everybody else’s lives, who don’t take private jets to work, who just want to be able to mind their own business, live their own lives and preserve the wealth they’ve worked hard and fairly to build up over their lives.

Those valves are to move out of the fiat money system and into “stuff” like commodities, real estate, agriculture, like gold and precious metals. And crypto. This is why all of these things are blasting off (Gold is less than 20% off of its all time highs. Crypto can dump more than that overnight. These two asset classes are not mutually exclusive, they are just on different wavelengths).

* * *

To receive future posts in your mailbox join the Bombthrower mailing list or follow me on Twitter.

International

United Airlines adds new flights to faraway destinations

The airline said that it has been working hard to "find hidden gem destinations."

Since countries started opening up after the pandemic in 2021 and 2022, airlines have been seeing demand soar not just for major global cities and popular routes but also for farther-away destinations.

Numerous reports, including a recent TripAdvisor survey of trending destinations, showed that there has been a rise in U.S. traveler interest in Asian countries such as Japan, South Korea and Vietnam as well as growing tourism traction in off-the-beaten-path European countries such as Slovenia, Estonia and Montenegro.

Related: 'No more flying for you': Travel agency sounds alarm over risk of 'carbon passports'

As a result, airlines have been looking at their networks to include more faraway destinations as well as smaller cities that are growing increasingly popular with tourists and may not be served by their competitors.

Shutterstock

United brings back more routes, says it is committed to 'finding hidden gems'

This week, United Airlines (UAL) announced that it will be launching a new route from Newark Liberty International Airport (EWR) to Morocco's Marrakesh. While it is only the country's fourth-largest city, Marrakesh is a particularly popular place for tourists to seek out the sights and experiences that many associate with the country — colorful souks, gardens with ornate architecture and mosques from the Moorish period.

More Travel:

- A new travel term is taking over the internet (and reaching airlines and hotels)

- The 10 best airline stocks to buy now

- Airlines see a new kind of traveler at the front of the plane

"We have consistently been ahead of the curve in finding hidden gem destinations for our customers to explore and remain committed to providing the most unique slate of travel options for their adventures abroad," United's SVP of Global Network Planning Patrick Quayle, said in a press statement.

The new route will launch on Oct. 24 and take place three times a week on a Boeing 767-300ER (BA) plane that is equipped with 46 Polaris business class and 22 Premium Plus seats. The plane choice was a way to reach a luxury customer customer looking to start their holiday in Marrakesh in the plane.

Along with the new Morocco route, United is also launching a flight between Houston (IAH) and Colombia's Medellín on Oct. 27 as well as a route between Tokyo and Cebu in the Philippines on July 31 — the latter is known as a "fifth freedom" flight in which the airline flies to the larger hub from the mainland U.S. and then goes on to smaller Asian city popular with tourists after some travelers get off (and others get on) in Tokyo.

United's network expansion includes new 'fifth freedom' flight

In the fall of 2023, United became the first U.S. airline to fly to the Philippines with a new Manila-San Francisco flight. It has expanded its service to Asia from different U.S. cities earlier last year. Cebu has been on its radar amid growing tourist interest in the region known for marine parks, rainforests and Spanish-style architecture.

With the summer coming up, United also announced that it plans to run its current flights to Hong Kong, Seoul, and Portugal's Porto more frequently at different points of the week and reach four weekly flights between Los Angeles and Shanghai by August 29.

"This is your normal, exciting network planning team back in action," Quayle told travel website The Points Guy of the airline's plans for the new routes.

stocks pandemic south korea japan hong kong europeanInternational

Walmart launches clever answer to Target’s new membership program

The retail superstore is adding a new feature to its Walmart+ plan — and customers will be happy.

It's just been a few days since Target (TGT) launched its new Target Circle 360 paid membership plan.

The plan offers free and fast shipping on many products to customers, initially for $49 a year and then $99 after the initial promotional signup period. It promises to be a success, since many Target customers are loyal to the brand and will go out of their way to shop at one instead of at its two larger peers, Walmart and Amazon.

Related: Walmart makes a major price cut that will delight customers

And stop us if this sounds familiar: Target will rely on its more than 2,000 stores to act as fulfillment hubs.

This model is a proven winner; Walmart also uses its more than 4,600 stores as fulfillment and shipping locations to get orders to customers as soon as possible.

Sometimes, this means shipping goods from the nearest warehouse. But if a desired product is in-store and closer to a customer, it reduces miles on the road and delivery time. It's a kind of logistical magic that makes any efficiency lover's (or retail nerd's) heart go pitter patter.

Walmart rolls out answer to Target's new membership tier

Walmart has certainly had more time than Target to develop and work out the kinks in Walmart+. It first launched the paid membership in 2020 during the height of the pandemic, when many shoppers sheltered at home but still required many staples they might ordinarily pick up at a Walmart, like cleaning supplies, personal-care products, pantry goods and, of course, toilet paper.

It also undercut Amazon (AMZN) Prime, which costs customers $139 a year for free and fast shipping (plus several other benefits including access to its streaming service, Amazon Prime Video).

Walmart+ costs $98 a year, which also gets you free and speedy delivery, plus access to a Paramount+ streaming subscription, fuel savings, and more.

If that's not enough to tempt you, however, Walmart+ just added a new benefit to its membership program, ostensibly to compete directly with something Target now has: ultrafast delivery.

Target Circle 360 particularly attracts customers with free same-day delivery for select orders over $35 and as little as one-hour delivery on select items. Target executes this through its Shipt subsidiary.

We've seen this lightning-fast delivery speed only in snippets from Amazon, the king of delivery efficiency. Who better to take on Target, though, than Walmart, which is using a similar store-as-fulfillment-center model?

"Walmart is stepping up to save our customers even more time with our latest delivery offering: Express On-Demand Early Morning Delivery," Walmart said in a statement, just a day after Target Circle 360 launched. "Starting at 6 a.m., earlier than ever before, customers can enjoy the convenience of On-Demand delivery."

Walmart (WMT) clearly sees consumers' desire for near-instant delivery, which obviously saves time and trips to the store. Rather than waiting a day for your order to show up, it might be on your doorstep when you wake up.

Consumers also tend to spend more money when they shop online, and they remain stickier as paying annual members. So, to a growing number of retail giants, almost instant gratification like this seems like something worth striving for.

Related: Veteran fund manager picks favorite stocks for 2024

stocks pandemic mexicoUncategorized

Comments on February Employment Report

The headline jobs number in the February employment report was above expectations; however, December and January payrolls were revised down by 167,000 combined. The participation rate was unchanged, the employment population ratio decreased, and the …

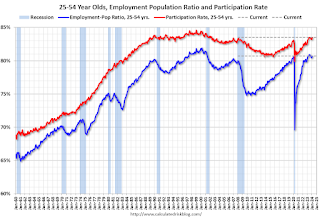

Prime (25 to 54 Years Old) Participation

Since the overall participation rate is impacted by both cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.

The 25 to 54 years old participation rate increased in February to 83.5% from 83.3% in January, and the 25 to 54 employment population ratio increased to 80.7% from 80.6% the previous month.

Average Hourly Wages

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees from the Current Employment Statistics (CES).

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees from the Current Employment Statistics (CES). Wage growth has trended down after peaking at 5.9% YoY in March 2022 and was at 4.3% YoY in February.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:"The number of people employed part time for economic reasons, at 4.4 million, changed little in February. These individuals, who would have preferred full-time employment, were working part time because their hours had been reduced or they were unable to find full-time jobs."The number of persons working part time for economic reasons decreased in February to 4.36 million from 4.42 million in February. This is slightly above pre-pandemic levels.

These workers are included in the alternate measure of labor underutilization (U-6) that increased to 7.3% from 7.2% in the previous month. This is down from the record high in April 2020 of 23.0% and up from the lowest level on record (seasonally adjusted) in December 2022 (6.5%). (This series started in 1994). This measure is above the 7.0% level in February 2020 (pre-pandemic).

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 1.203 million workers who have been unemployed for more than 26 weeks and still want a job, down from 1.277 million the previous month.

This is close to pre-pandemic levels.

Job Streak

| Headline Jobs, Top 10 Streaks | ||

|---|---|---|

| Year Ended | Streak, Months | |

| 1 | 2019 | 100 |

| 2 | 1990 | 48 |

| 3 | 2007 | 46 |

| 4 | 1979 | 45 |

| 5 | 20241 | 38 |

| 6 tie | 1943 | 33 |

| 6 tie | 1986 | 33 |

| 6 tie | 2000 | 33 |

| 9 | 1967 | 29 |

| 10 | 1995 | 25 |

| 1Currrent Streak | ||

Summary:

The headline monthly jobs number was above consensus expectations; however, December and January payrolls were revised down by 167,000 combined. The participation rate was unchanged, the employment population ratio decreased, and the unemployment rate was increased to 3.9%. Another solid report.

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoIndustrial Production Decreased 0.1% in January

-

International1 month ago

International1 month agoWar Delirium

-

International1 hour ago

International1 hour agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex