International

Week Ahead – Election Time!

Week Ahead – Election Time!

The week we’ve all been waiting for

What a week we have in store. The US jobs report is typically the headline act the first week of the month but next week it won’t even make the top three. Covid-19 is wreaking havoc once again, the Fed, BoE and RBA will look to reassure and, of course, the US election will be front and centre.

US election adds to market uncertainty

US Politics

Election Day is finally upon us. A stunning total of early ballots are in and all early signs are pointing to a blue wave. Democrats voted early, while many Republicans appear to be planning to vote on Election Day. Some political pundits argue that President Trump could surprise everyone like he did in 2016, but it seems very unlikely. Most public opinion polls have attempted to account for a significant portion of President Trump’s base and the number of undecided voters is considerably smaller.

For many traders, the Senate Race is almost just as important as the presidency. If Biden is victorious and Democrats win the Senate, he will be able to easily deliver higher taxes, tougher regulation, massive infrastructure spending and launch his clean energy initiatives. A Biden presidency with Republicans keeping the Senate would derail sweeping changes and deliver a lot less stimulus to the economy. If President Trump pulls off a big upset, the next stimulus package will be much smaller than the currently discussed $1.88 trillion package, but tax cuts and a lax stance on regulation should support risky assets.

US

This FOMC rate decision could mirror the ECB rate decision that telegraphed further action in December. The Fed will not cut rates and it is unlikely that they will increase their asset purchases just yet. What could be on the table is the continued discussion of keeping rates lower for longer and adopting yield curve control. The Fed will have to address the deterioration to the economic outlook due to the virus spread and the inability of Congress to deliver much needed fiscal support. The Fed will keep nagging Congress to deliver aid and likely have to settle on increasing purchases at the December meeting.

Lost in the madness of election week and central bank rate decisions is earnings results from many important pharmaceutical companies. Updates from AstraZeneca, Bristol-Myers Squibb, and Regeneron could provide further insight into how certain critical COVID-19 treatment and vaccine trials are performing and when to expect updates.

EU

The EU is slowly going into lockdown, with France fully in and Germany currently opting for a lighter version. But the trend is clear and it seems only a matter of time until more countries follow. The ECB acknowledged this on Thursday as it laid the groundwork for more easing in December, warning that Q3 may have been better than anticipated but Q4 will be worse and risks remain tilted to the downside.

The move is understandable given it will have new projections, know whether there’s a Brexit deal or not and who the next President of the US will be, not to mention just how much damage the second wave is wreaking on the economy. More bond buying is a given, the scale is to be determined.

Brexit

Silence is bliss. Not only because we’ve had four years of this fight being carried out in public, much to the annoyance of everyone who’s listened, but because it almost certainly means the hard work is now going on that will lead to compromises and a deal being reached. The bravado is over. The serious negotiations have started that will enable a deal to be reached that both sides can declare a success to their respective voters.

Mid-November is now being talked about as the point at which a deal needs to be reached in order for it to be ratified before the end of the year and for the first time in four years, it’s a deadline I have faith in. The reason is simple, it’s now a target for both sides to agree to the details of their new partnership, rather than for one side to buckle. The narrative is important to both parties and it is now in place for a deadline to finally be achieved.

UK

The government is resisting going into a national lockdown as much as possible, despite others in Europe starting to do just that. It’s eerily reminiscent of earlier this year. Despite the resistance, more and more regions are seeing their tiers increase and it seems inevitable that at least most, if not all, of the country will be in tier three before we know it.

All the more reason why the BoE will be forced to ease monetary policy again before the end of the year. Bond buying will likely remain the preferred option, with the last top up running dry at the end of the year, but negative rates remain on the table, for some reason.

Still, the meeting next week could be when they pull the trigger, coming alongside new economic projections. The road ahead is clear for all to see, more restrictions and a double dip recession. The argument for waiting, similar to the ECB, is Brexit and the time to assess Covid damage, which may be enough to keep them on hold another month.

Turkey

The Turkish central bank is facing a crisis of confidence, as the lira suffered another torrid week, following the CBRT’s decision not to raise rates last week. The central bank claimed that financial conditions had tightened sufficiently but those in the markets clearly disagree, with the talk once again being centred around political influence in their decision making.

President Erdogan has been very clear in his opinion on the link between interest rates and inflation and it doesn’t exactly align with the consensus view. With the lira in freefall, the central bank will need to act. An emergency rate hike may be on the cards prior to the next meeting on 19 November.

China

China PMI released tomorrow (Saturday), Caixin on Monday. Underperformance risks Asia markets sell-off Monday morning. Pan-Asia PMI’s also released. Expected to outperform.

Ant Financial starts trading on Nov 5th. If it doesn’t immediately rally then Chinese stocks could suffer.

US election results cloud Asia picture next week. Asia stocks and currencies have been resilient on the back of strong China performance. Poor data as above could threaten a sudden correction if the US election result is also messy.

Hong Kong

All eyes will be on the Ant Financial IPO. Bullishness on IPO should mollify any risk based selling ahead of the US election.

USD/HKD remains at the bottom of its trading band with heavy buying from the HKMA. The demand for HKD is due to the Ant Financial IPO this week.

No important data but a Biden win should be positive for HK equities.Highly leveraged retail buyers of Ant Financial IPO could exit rapidly if prices do not rise on the day, Hang Seng negative.

India

Manufacturing and services PMI’s expected to strengthen into expansionary territory this week. The domestic economy remains in a deep recession due to Covid-19.

Indian Rupee continues to weaken after appalling GDP data. Rampant Covid-19 continues to crush economic activity and India’s potential recovery. Weak BoP, monetary and fiscal positions with stagflation potentially India’s biggest headache. Continues to be Asia’s weakest link along with Indonesia.

An uncertain US election will add downward pressure on the INR.

New Zealand

No significant data. NZD/USD threatened by dollar-bloc risk reduction and uncertain US election results risk next week. Strongly bearing NZD/USD. NZD/USD threatened support at 0.6600, suggesting further losses to 0.6500 soon. Ramp up in the risk environment next week could extend the NZD/USD fall to 0.6400.

Australia

Australia PMI’s and Balance of Trade expected to show further strong recoveries, boosted by domestic activity and China iron ore exports. China/Australia trade conflicts have died from the headlines.

RBA rate decision on Tuesday 3rd, 50/50 on another cut to 0.10% from 0.25%, or more QE. RBA is extremely dovish and if not Tuesday, the next meeting will be live. Bearish AUD, bullish Australian stocks.

AUD vulnerable to any China PMI underperformance tomorrow and Monday. AUD underperforms as global investors unwind dollar-bloc risk into the US election. Uncertain results in the US are strongly negative.

AUD/USD is threatening major support at 0.7000 with 0.6800 the next target, possibly extending to 0.6600 on a risk meltdown next week.

Japan

Japan PMI’s and Household Spending are expected to show the domestic economy remains weak. Policy vacuum from new government with BoJ holding this week in typical possum in headlights style.

USD/JPY volatile and will be bounced around on the risk environment of the US election. Yen should outperform as a haven currency leading to downward pressure on USD/JPY. USD/JPY is threatening support at 104.00, and could quickly collapse to 102.00, possibly 101.00 if the risk environment internationally intensifies into Wednesday Asian time.

Oil

Oil saw some profit taking after falling back to its lowest level since late May, as Europe increasingly adopts new lockdowns and hits the demand outlook for crude. With WTI back around $35 and Brent coming close to $37, OPEC+ is going to start getting a little anxious. The next JMMC meeting is in a couple of weeks time; should the group hold out that long, I expect the January increase will be pushed back in order to support prices and rebalance the market.

Until then, barring any more verbal intervention, crude prices could broadly remain under pressure, with $40 providing a ceiling for any Brent rallies. The Saudi Energy Minister has previously warned against shorting the market, suggesting that it will be a painful exercise. Traders aren’t deterred just yet but it may provide some support to the market and stop it falling as far as it otherwise would. $35 will be an interesting psychological test for Brent.

Gold

The dollar is firmly back in favour as traders seek out safety at the expense of riskier assets. It still feels strange to put gold in that category but the evidence is there for all to see. The dollar has surged in recent days, although it is seeing some profit taking today, while gold has tumbled out of the lower end of its range and is testing its late summer lows, around $1,850.

A break below here could be a psychological blow for the yellow metal but I don’t think it will be devastating. The next couple of years should be very kind to gold so any big drops are always going to pique the interest of traders. The next test will come around $1,800, should $1,850 fall, which I expect it probably will.

Key Economic Events

Saturday, Oct. 31

-ECB Executive Board member Fabio Panetta participates in the online conference “Festival dell’ottimismo 2020.”

-Brexit trade-deal talks between the UK and EU continue.

Economic Data

China Oct Manufacturing PMI: 51.3eyed v 51.5 prior

Sunday, Nov. 1

– The US and Canada return to standard time, moving clocks back one hour at 2:00 a.m. ET.

Monday, Nov. 2

– ECB Governing Council member Olli Rehn speaks at a webinar on the central bank’s strategy review.

Economic Data

US Markit manufacturing PMI, ISM Oct Manufacturing PMI: 55.6 eyed v 55.4 prior, construction spending

Canada Markit manufacturing PMI

New Zealand building permits

Australia AiG performance of manufacturing index, Melbourne Institute inflation, building approvals, ANZ job advertisements

Markit PMI India, Turkey, Czech, Poland, Euro-area, UK

Japan Jibun Bank PMI, vehicle sales

China Caixin PMI manufacturing

Hong Kong retail sales

Manufacturing PMI: South Africa, Hungary

Tuesday, November 3rd

– Election Day for the US. The presidential election race is widely expected to be won by Democrat Joe Biden. Senate races appear to be much tighter and are expected to shift the power balance to the Democrats.

– Euro-area finance ministers meet to discuss Covid-19, the digital euro, and the banking union. Through Nov. 4.

– Bank of Sweden Governor Stefan Ingves delivers a speech online and participates in a panel discussion on the Riksbank’s response to the coronavirus crisis and monetary policy.

Economic Data

US factory orders, durable goods, Wards total vehicle sales

Mexico Markit PMI manufacturing

Turkey CPI

Australia rate decision: Expected to cut Cash Target Rate 15bps to 0.10%

Singapore purchasing managers index

Wednesday, November 4th

– President Xi Jinping will deliver the keynote address via video at China’s third International Import Expo in Shanghai.

– EIA Crude Oil Inventory Report

Economic Data

U.S. ADP employment change, trade balance

Brazil industrial production

Canada international merchandise trade

Australia retail sales

New Zealand ANZ commodity prices, unemployment

Japan monetary base

Services PMI: Euro-area, U.K.

Poland rate decision: Expected to keep Base Rate unchanged at 0.10%

Spain unemployment

Markit PMI: Hong Kong, Singapore, Mozambique

PMI: South Africa

Philippines trade

China Caixin services PMI

Thursday, November 5th

– The FOMC is expected to pave the way for an increase with the pace of asset purchases at the December meeting. Fed Chair Powell will reiterate the urgency for Congress to deliver fiscal support.

– Bank of England expected to keep rates steady, update forecasts for economic growth and inflation and possibly increase in bond purchases to provide more stimulus as unemployment rises.

– European Commission publishes updated economic forecasts.

– ECB Governing Council members Muller and Holzmann speak at an online conference organized by Austria’s central bank.

Economic Data

US initial jobless claims

Germany Sept Factory Orders M/M: 2.0%e v 4.5 prior

New Zealand ANZ business confidence

Australia trade

Japan Jibun Bank services PMI

Norway rate decision: Expected to keep Deposit Rates steady at 0.00%

Czech rate decision: Expected to keep Repurchase Rate steady at 0.25%

Hungary rate decision: No changed expected with the One-Week Deposit Rate

Singapore retail sales

Friday, November 6th

– Bank of Canada Governor Tiff Macklem and Deputy Governor Lawrence Schembri deliver opening remarks at a BOC event

– The US hiring is expected to deliver 610,000 new jobs in October, down from the prior reading 661,000, and confirming the labor market recovery has stalled.

Economic Data

US unemployment, wholesale inventories

Canada unemployment

Australia AiG performance of services index

Japan cash earnings

New Zealand two-year inflation expectation

Industrial production: Germany, Spain

Foreign reserves: Switzerland, Hong Kong

South Africa gross/net reserves

Sovereign Rating Updates

– Germany (Fitch)

– Greece (Moody’s)

– Italy (Moody’s)

– Finland (DBRS)

International

United Airlines adds new flights to faraway destinations

The airline said that it has been working hard to "find hidden gem destinations."

Since countries started opening up after the pandemic in 2021 and 2022, airlines have been seeing demand soar not just for major global cities and popular routes but also for farther-away destinations.

Numerous reports, including a recent TripAdvisor survey of trending destinations, showed that there has been a rise in U.S. traveler interest in Asian countries such as Japan, South Korea and Vietnam as well as growing tourism traction in off-the-beaten-path European countries such as Slovenia, Estonia and Montenegro.

Related: 'No more flying for you': Travel agency sounds alarm over risk of 'carbon passports'

As a result, airlines have been looking at their networks to include more faraway destinations as well as smaller cities that are growing increasingly popular with tourists and may not be served by their competitors.

Shutterstock

United brings back more routes, says it is committed to 'finding hidden gems'

This week, United Airlines (UAL) announced that it will be launching a new route from Newark Liberty International Airport (EWR) to Morocco's Marrakesh. While it is only the country's fourth-largest city, Marrakesh is a particularly popular place for tourists to seek out the sights and experiences that many associate with the country — colorful souks, gardens with ornate architecture and mosques from the Moorish period.

More Travel:

- A new travel term is taking over the internet (and reaching airlines and hotels)

- The 10 best airline stocks to buy now

- Airlines see a new kind of traveler at the front of the plane

"We have consistently been ahead of the curve in finding hidden gem destinations for our customers to explore and remain committed to providing the most unique slate of travel options for their adventures abroad," United's SVP of Global Network Planning Patrick Quayle, said in a press statement.

The new route will launch on Oct. 24 and take place three times a week on a Boeing 767-300ER (BA) plane that is equipped with 46 Polaris business class and 22 Premium Plus seats. The plane choice was a way to reach a luxury customer customer looking to start their holiday in Marrakesh in the plane.

Along with the new Morocco route, United is also launching a flight between Houston (IAH) and Colombia's Medellín on Oct. 27 as well as a route between Tokyo and Cebu in the Philippines on July 31 — the latter is known as a "fifth freedom" flight in which the airline flies to the larger hub from the mainland U.S. and then goes on to smaller Asian city popular with tourists after some travelers get off (and others get on) in Tokyo.

United's network expansion includes new 'fifth freedom' flight

In the fall of 2023, United became the first U.S. airline to fly to the Philippines with a new Manila-San Francisco flight. It has expanded its service to Asia from different U.S. cities earlier last year. Cebu has been on its radar amid growing tourist interest in the region known for marine parks, rainforests and Spanish-style architecture.

With the summer coming up, United also announced that it plans to run its current flights to Hong Kong, Seoul, and Portugal's Porto more frequently at different points of the week and reach four weekly flights between Los Angeles and Shanghai by August 29.

"This is your normal, exciting network planning team back in action," Quayle told travel website The Points Guy of the airline's plans for the new routes.

stocks pandemic south korea japan hong kong europeanInternational

Walmart launches clever answer to Target’s new membership program

The retail superstore is adding a new feature to its Walmart+ plan — and customers will be happy.

It's just been a few days since Target (TGT) launched its new Target Circle 360 paid membership plan.

The plan offers free and fast shipping on many products to customers, initially for $49 a year and then $99 after the initial promotional signup period. It promises to be a success, since many Target customers are loyal to the brand and will go out of their way to shop at one instead of at its two larger peers, Walmart and Amazon.

Related: Walmart makes a major price cut that will delight customers

And stop us if this sounds familiar: Target will rely on its more than 2,000 stores to act as fulfillment hubs.

This model is a proven winner; Walmart also uses its more than 4,600 stores as fulfillment and shipping locations to get orders to customers as soon as possible.

Sometimes, this means shipping goods from the nearest warehouse. But if a desired product is in-store and closer to a customer, it reduces miles on the road and delivery time. It's a kind of logistical magic that makes any efficiency lover's (or retail nerd's) heart go pitter patter.

Walmart rolls out answer to Target's new membership tier

Walmart has certainly had more time than Target to develop and work out the kinks in Walmart+. It first launched the paid membership in 2020 during the height of the pandemic, when many shoppers sheltered at home but still required many staples they might ordinarily pick up at a Walmart, like cleaning supplies, personal-care products, pantry goods and, of course, toilet paper.

It also undercut Amazon (AMZN) Prime, which costs customers $139 a year for free and fast shipping (plus several other benefits including access to its streaming service, Amazon Prime Video).

Walmart+ costs $98 a year, which also gets you free and speedy delivery, plus access to a Paramount+ streaming subscription, fuel savings, and more.

If that's not enough to tempt you, however, Walmart+ just added a new benefit to its membership program, ostensibly to compete directly with something Target now has: ultrafast delivery.

Target Circle 360 particularly attracts customers with free same-day delivery for select orders over $35 and as little as one-hour delivery on select items. Target executes this through its Shipt subsidiary.

We've seen this lightning-fast delivery speed only in snippets from Amazon, the king of delivery efficiency. Who better to take on Target, though, than Walmart, which is using a similar store-as-fulfillment-center model?

"Walmart is stepping up to save our customers even more time with our latest delivery offering: Express On-Demand Early Morning Delivery," Walmart said in a statement, just a day after Target Circle 360 launched. "Starting at 6 a.m., earlier than ever before, customers can enjoy the convenience of On-Demand delivery."

Walmart (WMT) clearly sees consumers' desire for near-instant delivery, which obviously saves time and trips to the store. Rather than waiting a day for your order to show up, it might be on your doorstep when you wake up.

Consumers also tend to spend more money when they shop online, and they remain stickier as paying annual members. So, to a growing number of retail giants, almost instant gratification like this seems like something worth striving for.

Related: Veteran fund manager picks favorite stocks for 2024

stocks pandemic mexicoInternational

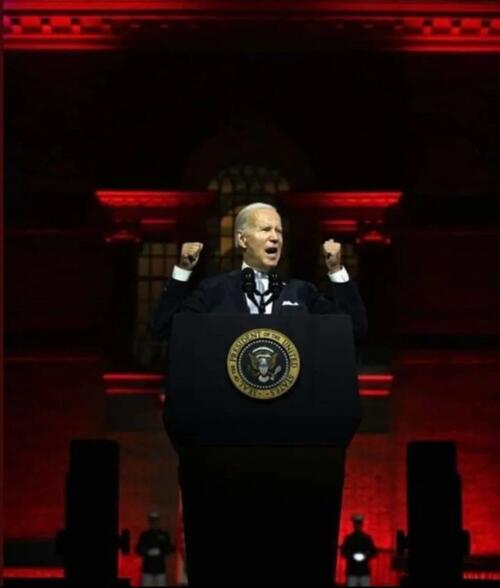

President Biden Delivers The “Darkest, Most Un-American Speech Given By A President”

President Biden Delivers The "Darkest, Most Un-American Speech Given By A President"

Having successfully raged, ranted, lied, and yelled through…

Having successfully raged, ranted, lied, and yelled through the State of The Union, President Biden can go back to his crypt now.

Whatever 'they' gave Biden, every American man, woman, and the other should be allowed to take it - though it seems the cocktail brings out 'dark Brandon'?

Tl;dw: Biden's Speech tonight ...

-

Fund Ukraine.

-

Trump is threat to democracy and America itself.

-

Abortion is good.

-

American Economy is stronger than ever.

-

Inflation wasn't Biden's fault.

-

Illegals are Americans too.

-

Republicans are responsible for the border crisis.

-

Trump is bad.

-

Biden stands with trans-children.

-

J6 was the worst insurrection since the Civil War.

(h/t @TCDMS99)

Tucker Carlson's response sums it all up perfectly:

"that was possibly the darkest, most un-American speech given by an American president. It wasn't a speech, it was a rant..."

Carlson continued: "The true measure of a nation's greatness lies within its capacity to control borders, yet Bid refuses to do it."

"In a fair election, Joe Biden cannot win"

And concluded:

“There was not a meaningful word for the entire duration about the things that actually matter to people who live here.”

Victor Davis Hanson added some excellent color, but this was probably the best line on Biden:

"he doesn't care... he lives in an alternative reality."

— Tucker Carlson (@TuckerCarlson) March 8, 2024

* * *

Watch SOTU Live here...

* * *

Mises' Connor O'Keeffe, warns: "Be on the Lookout for These Lies in Biden's State of the Union Address."

On Thursday evening, President Joe Biden is set to give his third State of the Union address. The political press has been buzzing with speculation over what the president will say. That speculation, however, is focused more on how Biden will perform, and which issues he will prioritize. Much of the speech is expected to be familiar.

The story Biden will tell about what he has done as president and where the country finds itself as a result will be the same dishonest story he's been telling since at least the summer.

He'll cite government statistics to say the economy is growing, unemployment is low, and inflation is down.

Something that has been frustrating Biden, his team, and his allies in the media is that the American people do not feel as economically well off as the official data says they are. Despite what the White House and establishment-friendly journalists say, the problem lies with the data, not the American people's ability to perceive their own well-being.

As I wrote back in January, the reason for the discrepancy is the lack of distinction made between private economic activity and government spending in the most frequently cited economic indicators. There is an important difference between the two:

-

Government, unlike any other entity in the economy, can simply take money and resources from others to spend on things and hire people. Whether or not the spending brings people value is irrelevant

-

It's the private sector that's responsible for producing goods and services that actually meet people's needs and wants. So, the private components of the economy have the most significant effect on people's economic well-being.

Recently, government spending and hiring has accounted for a larger than normal share of both economic activity and employment. This means the government is propping up these traditional measures, making the economy appear better than it actually is. Also, many of the jobs Biden and his allies take credit for creating will quickly go away once it becomes clear that consumers don't actually want whatever the government encouraged these companies to produce.

On top of all that, the administration is dealing with the consequences of their chosen inflation rhetoric.

Since its peak in the summer of 2022, the president's team has talked about inflation "coming back down," which can easily give the impression that it's prices that will eventually come back down.

But that's not what that phrase means. It would be more honest to say that price increases are slowing down.

Americans are finally waking up to the fact that the cost of living will not return to prepandemic levels, and they're not happy about it.

The president has made some clumsy attempts at damage control, such as a Super Bowl Sunday video attacking food companies for "shrinkflation"—selling smaller portions at the same price instead of simply raising prices.

In his speech Thursday, Biden is expected to play up his desire to crack down on the "corporate greed" he's blaming for high prices.

In the name of "bringing down costs for Americans," the administration wants to implement targeted price ceilings - something anyone who has taken even a single economics class could tell you does more harm than good. Biden would never place the blame for the dramatic price increases we've experienced during his term where it actually belongs—on all the government spending that he and President Donald Trump oversaw during the pandemic, funded by the creation of $6 trillion out of thin air - because that kind of spending is precisely what he hopes to kick back up in a second term.

If reelected, the president wants to "revive" parts of his so-called Build Back Better agenda, which he tried and failed to pass in his first year. That would bring a significant expansion of domestic spending. And Biden remains committed to the idea that Americans must be forced to continue funding the war in Ukraine. That's another topic Biden is expected to highlight in the State of the Union, likely accompanied by the lie that Ukraine spending is good for the American economy. It isn't.

It's not possible to predict all the ways President Biden will exaggerate, mislead, and outright lie in his speech on Thursday. But we can be sure of two things. The "state of the Union" is not as strong as Biden will say it is. And his policy ambitions risk making it much worse.

* * *

The American people will be tuning in on their smartphones, laptops, and televisions on Thursday evening to see if 'sloppy joe' 81-year-old President Joe Biden can coherently put together more than two sentences (even with a teleprompter) as he gives his third State of the Union in front of a divided Congress.

President Biden will speak on various topics to convince voters why he shouldn't be sent to a retirement home.

The state of our union under President Biden: three years of decline. pic.twitter.com/Da1KOIb3eR

— Speaker Mike Johnson (@SpeakerJohnson) March 7, 2024

According to CNN sources, here are some of the topics Biden will discuss tonight:

Economic issues: Biden and his team have been drafting a speech heavy on economic populism, aides said, with calls for higher taxes on corporations and the wealthy – an attempt to draw a sharp contrast with Republicans and their likely presidential nominee, Donald Trump.

Health care expenses: Biden will also push for lowering health care costs and discuss his efforts to go after drug manufacturers to lower the cost of prescription medications — all issues his advisers believe can help buoy what have been sagging economic approval ratings.

Israel's war with Hamas: Also looming large over Biden's primetime address is the ongoing Israel-Hamas war, which has consumed much of the president's time and attention over the past few months. The president's top national security advisers have been working around the clock to try to finalize a ceasefire-hostages release deal by Ramadan, the Muslim holy month that begins next week.

An argument for reelection: Aides view Thursday's speech as a critical opportunity for the president to tout his accomplishments in office and lay out his plans for another four years in the nation's top job. Even though viewership has declined over the years, the yearly speech reliably draws tens of millions of households.

Sources provided more color on Biden's SOTU address:

The speech is expected to be heavy on economic populism. The president will talk about raising taxes on corporations and the wealthy. He'll highlight efforts to cut costs for the American people, including pushing Congress to help make prescription drugs more affordable.

Biden will talk about the need to preserve democracy and freedom, a cornerstone of his re-election bid. That includes protecting and bolstering reproductive rights, an issue Democrats believe will energize voters in November. Biden is also expected to promote his unity agenda, a key feature of each of his addresses to Congress while in office.

Biden is also expected to give remarks on border security while the invasion of illegals has become one of the most heated topics among American voters. A majority of voters are frustrated with radical progressives in the White House facilitating the illegal migrant invasion.

It is probable that the president will attribute the failure of the Senate border bill to the Republicans, a claim many voters view as unfounded. This is because the White House has the option to issue an executive order to restore border security, yet opts not to do so

Maybe this is why?

Most Americans are still unaware that the census counts ALL people, including illegal immigrants, for deciding how many House seats each state gets!

— Elon Musk (@elonmusk) March 7, 2024

This results in Dem states getting roughly 20 more House seats, which is another strong incentive for them not to deport illegals.

While Biden addresses the nation, the Biden administration will be armed with a social media team to pump propaganda to at least 100 million Americans.

"The White House hosted about 70 creators, digital publishers, and influencers across three separate events" on Wednesday and Thursday, a White House official told CNN.

Not a very capable social media team...

The State of Confusion https://t.co/C31mHc5ABJ

— zerohedge (@zerohedge) March 7, 2024

The administration's move to ramp up social media operations comes as users on X are mostly free from government censorship with Elon Musk at the helm. This infuriates Democrats, who can no longer censor their political enemies on X.

Meanwhile, Democratic lawmakers tell Axios that the president's SOTU performance will be critical as he tries to dispel voter concerns about his elderly age. The address reached as many as 27 million people in 2023.

"We are all nervous," said one House Democrat, citing concerns about the president's "ability to speak without blowing things."

The SOTU address comes as Biden's polling data is in the dumps.

BetOnline has created several money-making opportunities for gamblers tonight, such as betting on what word Biden mentions the most.

As well as...

We will update you when Tucker Carlson's live feed of SOTU is published.

Fuck it. We’ll do it live! Thursday night, March 7, our live response to Joe Biden’s State of the Union speech. pic.twitter.com/V0UwOrgKvz

— Tucker Carlson (@TuckerCarlson) March 6, 2024

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoIndustrial Production Decreased 0.1% in January

-

International6 hours ago

International6 hours agoWalmart launches clever answer to Target’s new membership program

-

International1 month ago

International1 month agoWar Delirium

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex