Want Double-Digit Returns? Hold Cash.

So, you want double-digit returns in 2022? Hold cash. Sounds crazy, I know.

Especially today with the mainstream financial media headlines and big shots like Ray Dalio, who laments how ravaged cash is due to inflation. While that is indeed true for…

So, you want double-digit returns in 2022? Hold cash. Sounds crazy, I know.

Especially today with the mainstream financial media headlines and big shots like Ray Dalio, who laments how ravaged cash is due to inflation. While that is indeed true for a long-term investment portfolio to a degree, maintaining a decent cash emergency reserve and going a step further with a financial vulnerability cushion can get you to double-digit returns.

Want to see how? I’ll show you.

First, let me share a broad perspective concerning the state of household cash coffers. According to a 2021 survey from Bankrate, only 39% of Americans say they could cover an unexpected expense of $1,000. Moreover, the Personal Saving Rate, which skyrocketed to 13.1% in 2020, has retreated to 6.9% as of September 2021. Moreover, real wages, which account for inflation, have declined by 1%. Consequently, the overall state of most Americans is cash poor.

Keep in mind, the decision to hold cash is a conscious tradeoff. The reasons to have cash are as diverse as people are. For some, it’s an emotional Snuggie to smooth out portfolio volatility or ‘dry powder’ for future purchases. Perhaps, you’re an investor dependent on portfolio cash to recreate a retirement paycheck.

Regardless of your motivations, maintaining a cash position is the ultimate protection against unforeseen events, and we seem to have quite a few of them over the last decade or so. Wall Street seeks to grab every dollar we possess, so they employ entire marketing departments to pick your pockets.

Even better, they’re persuasive enough for us to pick our own pockets because they disseminate scary stories about cash vs. the inflation monster. And while cash indeed can succumb to the inflation beast, it depends entirely upon the arena in which cash fights your financial battles. In many cases, cash rises victorious.

Cash is fungible – it channels through every financial category and keeps your household functioning – Sort of like oil in an engine. Therefore, breaking down the mental accounting barriers around cash Wall Street built in your head is crucial. In many cases, cash can provide attractive returns just because it’s available, ready for the taking because you need it!

How valuable are liquidity and preservation to robust financial health? Crucial.

One: Cash provides an attractive alternative in case of emergencies.

The Personal Savings Rate has dropped precipitously since March 2020. Household cash accumulated during the pandemic is dwindling. As a result, credit card usage to service daily needs is increasing. In the case of a financial emergency, would I want cash eroded by inflation or maintain a credit card balance?

Per Bankrate.com, the current three-month trend for credit card interest rates is 16.3%, and with the Federal Funds Rate forecasted to increase at least three times this year, interest rates on credit cards will inevitably go higher as well. So isn’t it worth maintaining six months of living expenses in cash instead of turning to high-interest alternatives?

It seems like a rudimentary question, but it’s common for our brains to categorize financial decisions and make them in a vacuum. For example, some consumers maintain a credit card balance yet have cash in reserves to pay it off. Unfortunately, mental walls prevent the flow of cash to its highest and best use in some instances! One small move and double-digit returns come from holding cash and parting with it at an opportune time.

Two: Cash is an asset class and a respected addition to your portfolio.

In a portfolio strategy for retirees in the distribution stage, it makes sense to hold cash, perhaps a year’s worth. After all, periodic distribution of cash, cash flow in general, is the life’s blood of retirement.

However, what about younger investors with over a decade left to retirement? Cash is still worth a place in an accumulation portfolio. Here’s why:.’

Brokers lament – “Cash isn’t working for you! Cash will lose to inflation!” Well, there are times when cash will do just that. However, it’s the responsibility of your money manager to make portfolio adjustments. The ebb and flow of portfolios to adjust for risk is a responsibility most brokers will not undertake; therefore, they must trash cash regardless of valuations and the market’s overall health.

REMEMBER – It’s not cash forever; it’s cash for now. Can you imagine telling your broker that double-digit returns can come from holding cash?

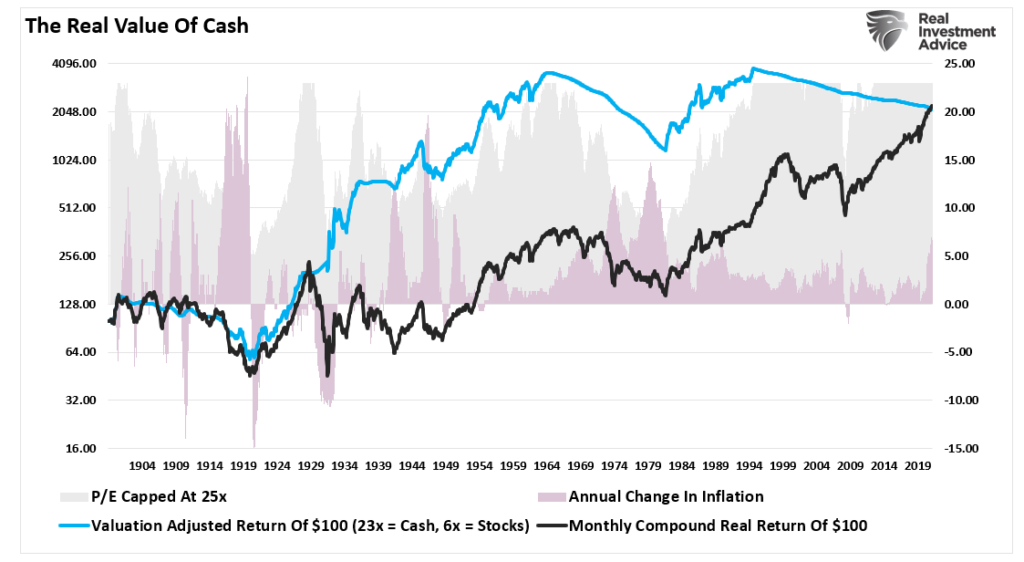

Here, RIA’s Chief Investment Strategist Lance Roberts outlines the inflation-adjusted return of $100 invested in the S&P 500 (capital appreciation only using data provided by Dr. Robert Shiller). The chart also shows Dr. Shiller’s CAPE ratio. Lance caps the CAPE ratio at 23x earnings which has historically been the peak of secular bull markets. He then conducts a simple cash/stock switching model which buys stocks at a CAPE ratio of 6x or less and moves back to cash at a ratio of 23x.

During the significant inflation of the 1970s in the United States, the value of cash experienced downward pressure. In other words, although the CAPE ratio in 1970 was roughly 23x, a switch to cash didn’t work so well, which validates the erosion of returns on cash. However, the sentiment of this chart validates the fact that holding an allocation to cash during a period of nose-bleed valuation levels is a formidable risk management tactic. As of this writing, the Shiller P/E is 39X.

An idea for a do-it-yourself investor is to maintain a minimum of 5% cash to add to opportunities slowly; I expect significant volatility in 2022 as the Fed clumsily severs its love affair with risk assets by pulling liquidity and increasing short term rates.

As Lance so eloquently states –

“While no individual could effectively manage money this way, the importance of “cash” as an asset class is revealed. While cash did lose relative purchasing power, due to inflation, the benefits of having capital to invest at lower valuations produced substantial outperformance over waiting for previously destroyed investment capital to recover.

Time frames are crucial in the discussion of cash as an asset class. If an individual is “literally” burying cash in their backyard, then the discussion of the loss of purchasing power is appropriate.

However, if cash is a “tactical” holding to avoid short-term destruction of capital, then the protection afforded outweighs the loss of purchasing power in the distant future.”

Much of the mainstream media will quickly disagree with the concept of holding cash and tout long-term returns as the reason to remain invested in both good times and bad. The problem is it is YOUR money at risk. Furthermore, most individuals lack the “time” necessary to capture 30 to 60-year return averages truly.

So, if you want double-digit returns, hold cash because it allows you to pounce on opportunities. Again, cash is an emotional salve since it smooths the overall portfolio ride. Thus cash may prevent a novice investor from bailing out of markets entirely at the absolute worst time.

Three: Cash can magnify your purchasing power.

Mark Cuban recently shared with Vanity Fair magazine that having cash can save money. In the article, he mentions how “negotiating with cash is a far better way to get a return on your investment.” A valid point. Ironically, cash provides leverage. Yet, leverage or debt places a borrower below a creditor in the financial pecking order of things.

For example, I worked with clients through the financial crisis who possessed tremendous leverage and deployed for real estate property offered at distressed prices because of overindebted owners. One client specifically headed to Florida and purchased four Naples and Fort Myers properties for 60 cents on the dollar because he possessed cash and waited for an opportunity. Today, those houses, townhomes provide robust rental income and have appreciated tremendously since early 2010.

Cash is boring; cash is not a riveting topic for cocktail party fodder.

But double-digit returns can come from holding cash.

Are you smart and patient enough to know when to release it?

The post Want Double-Digit Returns? Hold Cash. appeared first on RIA.

sp 500 stocks pandemic fed real estate interest rates oilUncategorized

Shipping company files surprise Chapter 7 bankruptcy, liquidation

While demand for trucking has increased, so have costs and competition, which have forced a number of players to close.

The U.S. economy is built on trucks.

As a nation we have relatively limited train assets, and while in recent years planes have played an expanded role in moving goods, trucks still represent the backbone of how everything — food, gasoline, commodities, and pretty much anything else — moves around the country.

Related: Fast-food chain closes more stores after Chapter 11 bankruptcy

"Trucks moved 61.1% of the tonnage and 64.9% of the value of these shipments. The average shipment by truck was 63 miles compared to an average of 640 miles by rail," according to the U.S. Bureau of Transportation Statistics 2023 numbers.

But running a trucking company has been tricky because the largest players have economies of scale that smaller operators don't. That puts any trucking company that's not a massive player very sensitive to increases in gas prices or drops in freight rates.

And that in turn has led a number of trucking companies, including Yellow Freight, the third-largest less-than-truckload operator; J.J. & Sons Logistics, Meadow Lark, and Boateng Logistics, to close while freight brokerage Convoy shut down in October.

Aside from Convoy, none of these brands are household names. but with the demand for trucking increasing, every company that goes out of business puts more pressure on those that remain, which contributes to increased prices.

Image source: Shutterstock

Another freight company closes and plans to liquidate

Not every bankruptcy filing explains why a company has gone out of business. In the trucking industry, multiple recent Chapter 7 bankruptcies have been tied to lawsuits that pushed otherwise successful companies into insolvency.

In the case of TBL Logistics, a Virginia-based national freight company, its Feb. 29 bankruptcy filing in U.S. Bankruptcy Court for the Western District of Virginia appears to be death by too much debt.

"In its filing, TBL Logistics listed its assets and liabilities as between $1 million and $10 million. The company stated that it has up to 49 creditors and maintains that no funds will be available for unsecured creditors once it pays administrative fees," Freightwaves reported.

The company's owners, Christopher and Melinda Bradner, did not respond to the website's request for comment.

Before it closed, TBL Logistics specialized in refrigerated and oversized loads. The company described its business on its website.

"TBL Logistics is a non-asset-based third-party logistics freight broker company providing reliable and efficient transportation solutions, management, and storage for businesses of all sizes. With our extensive network of carriers and industry expertise, we streamline the shipping process, ensuring your goods reach their destination safely and on time."

The world has a truck-driver shortage

The covid pandemic forced companies to consider their supply chain in ways they never had to before. Increased demand showed the weakness in the trucking industry and drew attention to how difficult life for truck drivers can be.

That was an issue HBO's John Oliver highlighted on his "Last Week Tonight" show in October 2022. In the episode, the host suggested that the U.S. would basically start to starve if the trucking industry shut down for three days.

"Sorry, three days, every produce department in America would go from a fully stocked market to an all-you-can-eat raccoon buffet," he said. "So it’s no wonder trucking’s a huge industry, with more than 3.5 million people in America working as drivers, from port truckers who bring goods off ships to railyards and warehouses, to long-haul truckers who move them across the country, to 'last-mile' drivers, who take care of local delivery."

The show highlighted how many truck drivers face low pay, difficult working conditions and, in many cases, crushing debt.

"Hundreds of thousands of people become truck drivers every year. But hundreds of thousands also quit. Job turnover for truckers averages over 100%, and at some companies it’s as high as 300%, meaning they’re hiring three people for a single job over the course of a year. And when a field this important has a level of job satisfaction that low, it sure seems like there’s a huge problem," Oliver shared.

The truck-driver shortage is not just a U.S. problem; it's a global issue, according to IRU.org.

"IRU’s 2023 driver shortage report has found that over three million truck driver jobs are unfilled, or 7% of total positions, in 36 countries studied," the global transportation trade association reported.

"With the huge gap between young and old drivers growing, it will get much worse over the next five years without significant action."

Related: Veteran fund manager picks favorite stocks for 2024

bankruptcy bankruptcies pandemic stocks commoditiesUncategorized

Wendy’s has a new deal for daylight savings time haters

The Daylight Savings Time promotion slashes prices on breakfast.

Daylight Savings Time, or the practice of advancing clocks an hour in the spring to maximize natural daylight, is a controversial practice because of the way it leaves many feeling off-sync and tired on the second Sunday in March when the change is made and one has one less hour to sleep in.

Despite annual "Abolish Daylight Savings Time" think pieces and online arguments that crop up with unwavering regularity, Daylight Savings in North America begins on March 10 this year.

Related: Coca-Cola has a new soda for Diet Coke fans

Tapping into some people's very vocal dislike of Daylight Savings Time, fast-food chain Wendy's (WEN) is launching a daylight savings promotion that is jokingly designed to make losing an hour of sleep less painful and encourage fans to order breakfast anyway.

Image source: Wendy's.

Promotion wants you to compensate for lost sleep with cheaper breakfast

As it is also meant to drive traffic to the Wendy's app, the promotion allows anyone who makes a purchase of $3 or more through the platform to get a free hot coffee, cold coffee or Frosty Cream Cold Brew.

More Food + Dining:

- Taco Bell menu tries new take on an American classic

- McDonald's menu goes big, brings back fan favorites (with a catch)

- The 10 best food stocks to buy now

Available during the Wendy's breakfast hours of 6 a.m. and 10:30 a.m. (which, naturally, will feel even earlier due to Daylight Savings), the deal also allows customers to buy any of its breakfast sandwiches for $3. Items like the Sausage, Egg and Cheese Biscuit, Breakfast Baconator and Maple Bacon Chicken Croissant normally range in price between $4.50 and $7.

The choice of the latter is quite wide since, in the years following the pandemic, Wendy's has made a concerted effort to expand its breakfast menu with a range of new sandwiches with egg in them and sweet items such as the French Toast Sticks. The goal was both to stand out from competitors with a wider breakfast menu and increase traffic to its stores during early-morning hours.

Wendy's deal comes after controversy over 'dynamic pricing'

But last month, the chain known for the square shape of its burger patties ignited controversy after saying that it wanted to introduce "dynamic pricing" in which the cost of many of the items on its menu will vary depending on the time of day. In an earnings call, chief executive Kirk Tanner said that electronic billboards would allow restaurants to display various deals and promotions during slower times in the early morning and late at night.

Outcry was swift and Wendy's ended up walking back its plans with words that they were "misconstrued" as an intent to surge prices during its most popular periods.

While the company issued a statement saying that any changes were meant as "discounts and value offers" during quiet periods rather than raised prices during busy ones, the reputational damage was already done since many saw the clarification as another way to obfuscate its pricing model.

"We said these menuboards would give us more flexibility to change the display of featured items," Wendy's said in its statement. "This was misconstrued in some media reports as an intent to raise prices when demand is highest at our restaurants."

The Daylight Savings Time promotion, in turn, is also a way to demonstrate the kinds of deals Wendy's wants to promote in its stores without putting up full-sized advertising or posters for what is only relevant for a few days.

Related: Veteran fund manager picks favorite stocks for 2024

stocks pandemicInternational

United Airlines adds new flights to faraway destinations

The airline said that it has been working hard to "find hidden gem destinations."

Since countries started opening up after the pandemic in 2021 and 2022, airlines have been seeing demand soar not just for major global cities and popular routes but also for farther-away destinations.

Numerous reports, including a recent TripAdvisor survey of trending destinations, showed that there has been a rise in U.S. traveler interest in Asian countries such as Japan, South Korea and Vietnam as well as growing tourism traction in off-the-beaten-path European countries such as Slovenia, Estonia and Montenegro.

Related: 'No more flying for you': Travel agency sounds alarm over risk of 'carbon passports'

As a result, airlines have been looking at their networks to include more faraway destinations as well as smaller cities that are growing increasingly popular with tourists and may not be served by their competitors.

Shutterstock

United brings back more routes, says it is committed to 'finding hidden gems'

This week, United Airlines (UAL) announced that it will be launching a new route from Newark Liberty International Airport (EWR) to Morocco's Marrakesh. While it is only the country's fourth-largest city, Marrakesh is a particularly popular place for tourists to seek out the sights and experiences that many associate with the country — colorful souks, gardens with ornate architecture and mosques from the Moorish period.

More Travel:

- A new travel term is taking over the internet (and reaching airlines and hotels)

- The 10 best airline stocks to buy now

- Airlines see a new kind of traveler at the front of the plane

"We have consistently been ahead of the curve in finding hidden gem destinations for our customers to explore and remain committed to providing the most unique slate of travel options for their adventures abroad," United's SVP of Global Network Planning Patrick Quayle, said in a press statement.

The new route will launch on Oct. 24 and take place three times a week on a Boeing 767-300ER (BA) plane that is equipped with 46 Polaris business class and 22 Premium Plus seats. The plane choice was a way to reach a luxury customer customer looking to start their holiday in Marrakesh in the plane.

Along with the new Morocco route, United is also launching a flight between Houston (IAH) and Colombia's Medellín on Oct. 27 as well as a route between Tokyo and Cebu in the Philippines on July 31 — the latter is known as a "fifth freedom" flight in which the airline flies to the larger hub from the mainland U.S. and then goes on to smaller Asian city popular with tourists after some travelers get off (and others get on) in Tokyo.

United's network expansion includes new 'fifth freedom' flight

In the fall of 2023, United became the first U.S. airline to fly to the Philippines with a new Manila-San Francisco flight. It has expanded its service to Asia from different U.S. cities earlier last year. Cebu has been on its radar amid growing tourist interest in the region known for marine parks, rainforests and Spanish-style architecture.

With the summer coming up, United also announced that it plans to run its current flights to Hong Kong, Seoul, and Portugal's Porto more frequently at different points of the week and reach four weekly flights between Los Angeles and Shanghai by August 29.

"This is your normal, exciting network planning team back in action," Quayle told travel website The Points Guy of the airline's plans for the new routes.

stocks pandemic south korea japan hong kong european-

Uncategorized2 weeks ago

Uncategorized2 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoIndustrial Production Decreased 0.1% in January

-

International2 hours ago

International2 hours agoWalmart launches clever answer to Target’s new membership program

-

Government1 month ago

Government1 month agoWar Delirium

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex