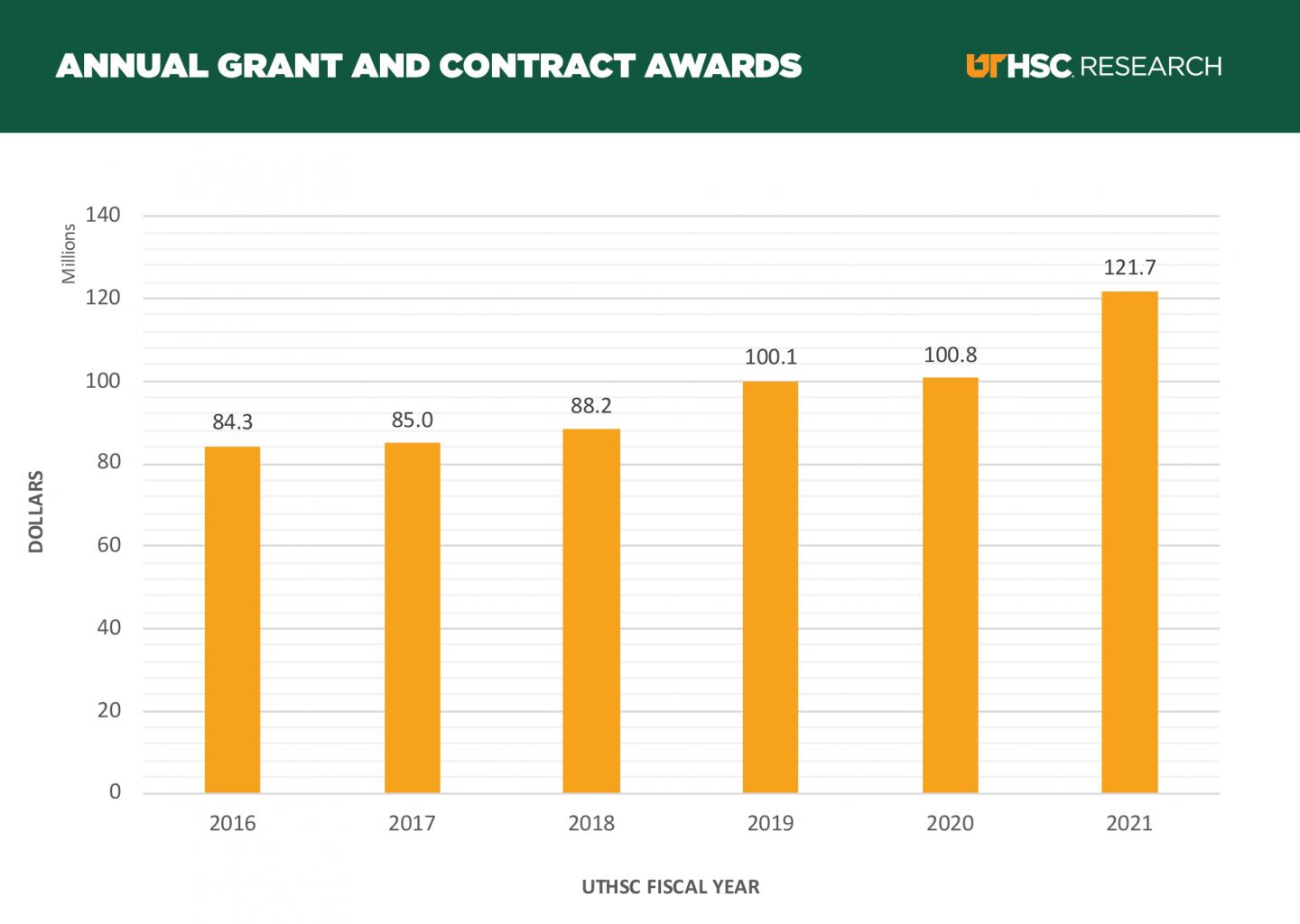

Memphis, Tenn. (July 20, 2021) – The University of Tennessee Health Science Center’s Office of Research announced that annual research grant and contract awards for FY21, which ended June 30, total more than $121 million, a 20.6% increase from last year.

The FY21 research award total is $121,700,667. Roughly half of these funds come from federal sources. The faculty of all six colleges and four campuses broke records in a number of categories, including grant proposal count by fiscal year and quarter. Additionally, the UTHSC College of Pharmacy moved up to Number 14 nationally among colleges and schools of pharmacy in grant funding from the National Institutes of Health.

Year-over-year metrics show a total increase from $85 million in FY17 to today’s $121.7 million in research awards for the university. This represents a 43% growth in research grants and contracts in five years.

During this same period, UTHSC’s all-source, non-clinical grant and contract expenditures (sponsored programs, research, and education grants and contracts) were more than $300 million, showing strong growth in all grant and contract portfolios.

The infrastructure overhaul, accomplished by the UTHSC Office of Research and led by Vice Chancellor for Research Steven Goodman, PhD, as part of the five-year Operational Strategic Plan for Research written in 2016, allowed the UTHSC research enterprise to remain fully functional during the pandemic, despite the fact that the campuses were operating primarily remotely. Increased staffing, improved resources, and new streamlined and automated processes allowed researchers to successfully adapt and advance their projects, despite the physical restrictions in place on all campuses. Additionally, a part of the research strategic plan, the Office of Research’s Collaborative Research Network (CORNET) seed grant funding program is credited by the faculty as driving major collaborative grant efforts.

Many programs and faculty had exceptional performance over that period, which added to the growth in funding. A few recently include:

The UT Institute for the Study of Host Pathogen Systems (ISHPS) led by Colleen Jonsson, PhD, Van Fleet Endowed Professor and director of the UTHSC Regional Biocontainment Laboratory (RBL), received a multiyear national grant for nearly $23 million in 2017.

The Tennessee Heart Health Network led by Jim Bailey, MD, Robert S. Pearce Endowed Chair in Internal Medicine and director of the Tennessee Population Health Consortium, received a $4.5 million multiyear grant in May from the U.S. Agency for Healthcare Research and Quality.

Sam Dagogo-Jack, MD, A.C. Mullins professor of medicine, director of the General Clinical Research Center, and chief of the Division of Endocrinology and Metabolism, along with Nawajes Mandal, PhD, associate professor in the Departments of Ophthalmology, Anatomy and Neurobiology, and Pharmaceutical Sciences, received $1.99 million in April from the National Institute of Diabetes and Digestive and Kidney Diseases for their work to advance understanding of the pathophysiology of prediabetes, diabetes, and related complications.

Jonathan H. Jaggar, PhD, Maury Bronstein Endowed Professor in the Department of Physiology, received a $2.3 million grant from the National Heart, Lung, and Blood Institute in March for blood pressure research.

Francesca-Fang Liao, PhD, and Fu-Ming Zhou, PhD, both professors in the Department of Pharmacology, Addiction Science, and Toxicology, received $1.9 million in March from the National Institute of Neurological Disorders and Stroke to study possible causes of dementia.

Since its launch in 2018, the Clinical Trials Network of Tennessee (CTN2) has brought more than 200 clinical trial opportunities, including three related to COVID-19, to the university and the citizens of Tennessee, generating more than $10 million in awards to the university.

###

As Tennessee’s only public, statewide, academic health system, the mission of the University of Tennessee Health Science Center is to bring the benefits of the health sciences to the achievement and maintenance of human health through education, research, clinical care, and public service, with a focus on the citizens of Tennessee and the region. The main campus in Memphis includes six colleges: Dentistry, Graduate Health Sciences, Health Professions, Medicine, Nursing and Pharmacy. UTHSC also educates and trains medicine, pharmacy, and/or health professions students, as well as medical residents and fellows, at major sites in Knoxville, Chattanooga and Nashville. For more information, visit http://www.