Uncategorized

The labor report gives the Fed a clear pathway to land the plane

Friday’s jobs report beat estimates, but the internals show the labor market is softening, as the Federal Reserve wants.

Today’s jobs report beat estimates, but the internals show the labor market is softening, as the Federal Reserve wants. The data shows that wage growth is cooling down and the job opening quits rate is below pre-COVID-19 levels. This bodes well for those hoping to see a soft landing, and for those hoping for lower mortgage rates.

The 10-year yield has had a wild ride today, but now is an excellent time to look at my macro take on the labor market and explain what the Fed is looking for with the jobs data. The Fed recently said that the labor market getting weaker would force them to act more dovish on rate cuts, and that seeing vigorous job creation wasn’t a big concern. So, let’s look at where we are today with all the labor data and why mortgage rates are still high while the labor market is getting softer.

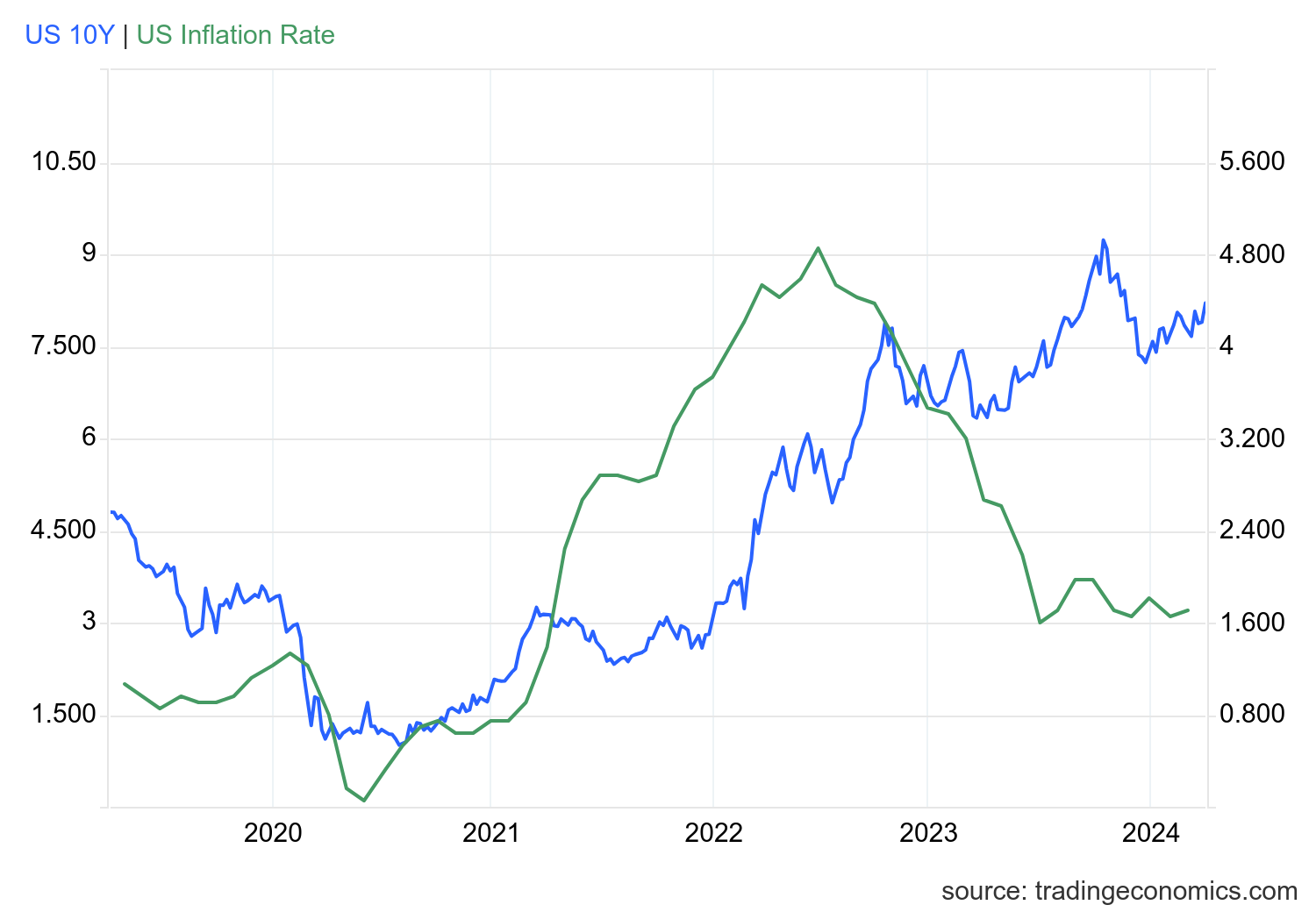

Since 2022, I haven’t believed the Fed would pivot until the labor market breaks. I believe too many people put too much weight on the inflation growth rate slowing as the primary driver for lower mortgage rates. Instead, I have focused on jobless claims data. My target has always been the same: jobless claims breaking above 323,000 on the four-week moving average is recessionary. We are far from that, and as you can see below, the growth rate of inflation has fallen, but bond yields and mortgage rates are still elevated because the labor market hasn’t broken yet.

Below, CPI inflation’s growth rate is at 3.2%, while the 10-year yield is at 3.36%. I know it’s wild to think, but we had lower rates with hotter inflation data.

The one data line that has been improving, which Chairmen Powell mentioned at the last press meeting, is jobless claims, which have been falling for months. If this data line ran above 300,000, we would have a different mortgage rate discussion today. Remember, the labor market is getting softer, but it’s not breaking. Once it breaks, that will force the Fed to move,and bond yields will have already gone lower.

How did we get here with the labor market? Here’s my explanation, which all started during COVID-19.

1. I wrote the COVID-19 recovery model on April 7, 2020, and retired it on Dec. 9, 2020. By that time, the upfront recovery phase was done, and I needed to model out when we would get the jobs lost back.

2. Early in the labor market recovery, when we saw weaker job reports, I doubled and tripled down on my assertion that job openings would get to 10 million in this recovery. Job openings rose all the way to 12 million and are currently over 9 million. Even with the massive miss on a job report in May 2021, I didn’t waver.

Currently, the job openings, quit percentage, and hires data are below pre-COVID-19 levels, which means the labor market isn’t as tight as it once was. The employment cost index has slowed recently as well. Today’s jobs report showed slower wage growth than earlier in the cycle.

3. I wrote that we should get back all the jobs lost to COVID-19 by September 2022. This would be a speedy labor market recovery at the time, and it happened on schedule, too.

4. This is the key one right now: If COVID-19 hadn’t happened, we would have between 157 million and 159 million jobs today, which is in line with the job growth rate in February 2020. Today, we are at 158,133,000.This is important because job growth should be cooling down now. We are more in line with where the labor market should be when the average is 140,000 to 165,000 monthly. So, for now, the fact that we aren’t trending between 140,000-165,000 means we still have a bit more recovery kick left before we get down to those levels.

From BLS: Total nonfarm payroll employment rose by 303,000 in March, and the unemployment rate changed little at 3.8 percent, the U.S. Bureau of Labor Statistics reported today. Job gains occurred in health care, government, and construction.

Here are the jobs that were created and lost in the previous month:

In this jobs report, the unemployment rate for education levels looks like this:

- Less than a high school diploma: 4.9%

- High school graduate and no college: 4.1%

- Some college or associate degree: 3.4%

- Bachelor’s degree or higher: 2.1%

A positive trend for the Fed with a softer labor market is that wage growth is cooling down. The Fed can live with 3% wage growth and 1% productivity growth, and now that wage growth is slowly moving under 4%, they will feel more like pilots who can land the plane.

Productivity data has indeed been more robust recently. Still, the Fed doesn’t believe in the more robust productivity numbers, so wage growth closer to 3%- 3.5% is more in their comfort zone.

On a side note, a positive story in housing this year is that the mortgage spreads are improving, and we haven’t had a stress market event like last year to push them higher. This is a huge plus because if the spreads can get back to normal with lower yields, we have a sub-6% mortgage rate market and we can certainly work with that.

All in all, the labor report is showing the same trend I have been seeing for some time now: the labor market is getting softer, but we are still creating more jobs than I was expecting at this point of the cycle. If we are still growing jobs over 165K once we break over 159,000,000 then my forecast model was incorrect, and the labor dynamics are more robust than I anticipated, so less than 1,000,000 jobs left before we cross that bridge.

However, after considering all the drama we had to deal with this week, we came out okay on this jobs report. It does provide a path for the Federal Reserve to see the softer wage growth data and land the plane.

unemployment covid-19 fed federal reserve mortgage rates recovery unemploymentUncategorized

Catalent had several suitors, including another of its business partners, before Novo won out

In 2022, about nine months before Novo Holdings first reached out to Catalent about a potential deal, the contract manufacturer was in talks with another…

In 2022, about nine months before Novo Holdings first reached out to Catalent about a potential deal, the contract manufacturer was in talks with another company with which it had an “existing commercial relationship,” according to a securities filing with background on the $16.5 billion transaction.

And the mysterious “Party A” wasn’t the only business partner that took a look, according to the SEC filing. In addition to Party A, a “Party B” — another “existing commercial relationship” of Catalent’s — took a look as well (though never bid).

While it’s not clear whether unnamed Parties A and B were drugmakers like Novo, or other types of companies, there were multiple other potential buyers listed in the filing who all took a look at Catalent during the many months of negotiating and shopping before the ultimate sale to Novo.

Catalent and Novo declined to comment on the identity of Party A.

Many of those talks came in the middle of a well-chronicled and particularly tumultuous time for Catalent, after it disclosed operational missteps at multiple facilities, financial issues and made leadership changes.

And Novo’s final offer didn’t come easily. It took Catalent CEO Alessandro Maselli and his board about four months to convince Novo Holdings CEO Kasim Kutay to go from a “mid to high $50s” per-share range to the final, signed deal of $63.50 per share.

In Wednesday’s filing, Catalent also disclosed that Novo refiled the merger documents with the FTC’s antitrust unit to give the regulator more time to review the deal, which the companies continue to expect will close by the end of this year. In response to an Endpoints News inquiry on Friday morning, spokespeople for Novo and Catalent declined to comment on the timing of the deal close beyond the filing.

Shooting for $100 a share (and missing)

Catalent almost got far more than the $16.5 billion in cash it would eventually sign for. In December of 2022, with the stock trading in the 40s, Party A made an offer of $75 a share, then on Jan. 20 upped it to $87 a share.

Shortly after, on Feb. 4, 2023, Bloomberg News reported that life sciences company Danaher was exploring a potential takeover of Catalent, sending the stock up. Catalent told Party A it wanted at least $100 per share “in light of Catalent’s then-existing opportunities and unique position in its industry.”

It’s not clear if Party A was Danaher, and Danaher didn’t immediately respond to a request for comment on Friday.

A month later, Catalent’s finance chief informed the board about operational issues at its Baltimore and Bloomington, IN, sites. Party A was kept abreast, and on April 3, it informed Catalent it had a “lack of confidence in Catalent’s 2023 fiscal year forecasts for the remainder of the year.”

Catalent was also facing a steep decline in revenue from making Covid-19 products as the pandemic subsided. On April 14, it announced its CFO would depart, and it warned of the impairments to production. Its stock plummeted 25%.

Later that summer, Catalent forged an agreement with activist investor Elliott Investment Management. The move led to the addition of four new independent directors to Catalent’s board.

It wasn’t until late September that Novo Holdings came into the picture and informed Catalent it was interested in a potential deal.

What unfolded was months of discussions to hammer out a higher price, adjust the size of the termination fee and iron out other parts of the deal structure.

During that time, Maselli also attempted to drum up interest from other potential buyers. He called the CEOs of Party A and undisclosed Party F.

Catalent was met with a stinging reply by its first suitor: “Party A would require that Catalent demonstrate additional periods of recovery and stability before it would consider possibly engaging.” Party F, meanwhile, didn’t want to acquire the whole business.

Eventually, Maselli would get Novo’s Kutay to increase the drugmaker’s “best and final” offer of $62.50 on Dec. 19 to $63.50 on Feb. 4. The companies disclosed the deal the next day.

recovery pandemic covid-19Uncategorized

Hundreds Of 99 Cents Only Stores Liquidated, Failed Bidenomics & Retail Theft Blamed

Hundreds Of 99 Cents Only Stores Liquidated, Failed Bidenomics & Retail Theft Blamed

A combination of failed ‘Bidenomics,’ i.e., elevated…

A combination of failed 'Bidenomics,' i.e., elevated inflation, disastrous progressive social justice reforms that ignited a tsunami of retail theft nationwide, and snarled supply chains left over from the Covid era have led to the demise of "99 Cents Only" stores nationwide, which began the liquidation process on Friday.

"This was an extremely difficult decision and is not the outcome we expected or hoped to achieve," interim company CEO Mike Simoncic said in a statement.

Simoncic said, "Unfortunately, the last several years have presented significant and lasting challenges in the retail environment, including the unprecedented impact of the COVID-19 pandemic, shifting consumer demand, rising levels of shrink, persistent inflationary pressures and other macroeconomic headwinds, all of which have greatly hindered the company's ability to operate. We deeply appreciate the dedicated employees, customers, partners, and communities who have collectively supported 99 Cents Only Stores for decades."

99 Cents Only's press release stated the retail company began liquidating "all 371 of the Company's store locations" on Friday and is using Hilco Real Estate to manage the sale of real estate assets.

The liquidation will result in the closing of all stores across California, Arizona, Nevada, and Texas.

Founded in 1982, the store initially offered consumers "closeout branded merchandise, general merchandise, and fresh foods."

The cost of doing business in the era of failed Bidenomics and disastrous social justice reforms makes it hard for even the most seasoned companies to operate.

Uncategorized

The five-step wellness model that really works – and the psychology behind it

Wellness actually often involves a lot of effort.

The wellness movement appears to have the answers that our burnt-out minds need. However, psychological research and practice suggests that a superficial focus on candles, juice cleanses, and a “good vibes only” approach to life is unlikely to create meaningful changes to your wellbeing.

It’s not a surprise that wellness culture has become so popular, especially among women and young people. A US$4.4 trillion (£3.5 trillion) wellness industry promises that clean beauty, clean eating and energy-boosting supplements will provide happiness, meaning and a stress-free existence. But if wellness can be bought, why aren’t we all happier?

Purchases may make us happy (and even reduce some lingering sadness) but genuine changes to wellbeing are probably limited. In fact, feminist critics, journalists and psychologists have expressed concerns that wellness culture may exacerbate destructive perfectionism, promote an unhealthy relationship with our bodies, and even draw people into conspiracy theories and multi-level marketing scams.

Wellness culture focuses on what feels good for you as an individual, providing only a surface level experience of wellbeing. Mihalyi Csikszentmihalyi, one of the founders of the positive psychology movement, said in his 1991 book Flow, that “it is by being fully involved with every detail of our lives, whether good or bad, that we find happiness”.

Read more: Why so serious? The untapped value of positive psychology

Indeed, psychological research suggests that long-term wellbeing comes from a committed pursuit of both pleasure and meaning. Consider the psychologist Martin Seligman’s model of flourishing: Perma. Seligman’s model breaks wellbeing into distinct, workable “elements”, which gives us an idea as to how to make wellbeing more achievable.

A 2016 study of 1,624 participants recruited online found an intervention based on the Perma model increased levels of happiness and helped decrease depression symptoms, although the intervention seemed to work best for people around the middle range of wellbeing.

Studies have also found Perma-based interventions promoted wellbeing in university students following the Covid pandemic, seem to improve the emotional states of lung cancer patients and decrease anxiety in breast cancer patients. And researchers have tested this model across different contexts, ages, and cultures.

Perma is an acronym that stands for what Seligman considers the five pillars of wellbeing: positive emotions, engagement, relationships, meaning and achievement. This model suggests that rather than spending money to focus on “self-care”, we should aim to meet what psychologists consider our fundamental, psychological needs for competence, autonomy, and relatedness.

Perma suggests we ask ourselves: Am I acting in ways that make me feel competent, in control, and connected with others? Here are some wellness tips that work, based on the five pillars of Perma:

1. Positive emotions

The broaden-and-build theory states that we are at our most psychologically creative, responsive and flexible when we are experiencing positive emotions. However, it’s important to move beyond momentary hedonic pleasure and aim to reap the rewards of a range of positive emotions. This allows us to experience more positive emotion, as part of an upward spiral effect.

Take one (or more) of psychologist Barbara Fredrickson’s top ten positive emotions, and find ways to cultivate more of it in your life. These emotions include awe, joy, inspiration, gratitude and love. For example, to cultivate gratitude try the three good things exercise: take time to list three good things that happened in your day, or three things that you felt grateful for. You can also write about the cause of those things.

Maybe combine this with nature’s wellbeing benefits by looking for three good things in nature. If it’s difficult to find green space in your area, there are creative ways to incorporate connection with nature into your daily life, such as taking the time to look at the stars at night. Notice the bumblebees or count the different types of plants you see on your walk to work.

2. Engagement

Find an activity that gets you into flow, a state of deep engagement in an intentional, inherently rewarding activity in which we lose track of time and feel at one with what we are doing. It’s also sometimes known as “getting into the zone”.

Flow activities stretch us just enough to keep us engaged, but not so much that we become bored or demotivated. High flow activities include music, sports and even gaming.

3. Relationships

It’s quality over quantity when it comes to personal relationships. It sounds simple, but look to (or find) people who are eager to celebrate your successes and be wary of those who belittle them.

This will help you prolong the good feelings that go along with life’s little wins. Personal connection is important, and features as a core component in most theories of wellbeing.

4. Meaning

Find a way to connect with something larger than yourself. Volunteer, join a community group or perform a random act of kindness.

Thinking about a future best possible self can help you set goals and help you understand what gives you purpose in life.

5. Achievement

Do something challenging; something that stretches your abilities. You may want to identify and use your strengths. Some strengths, such as perseverance, are related to achievement. True positivity is not just about feeling good, but about rising to the challenges that life sets us.

Just remember: Perma pillars are independent paths to wellbeing, but they’re also highly related. Taking up dancing, for example, might be a way to experience positive emotions and flow, allowing you to make new connections so that you stick at it long enough to develop a sense of purpose or achievement.

The authors do not work for, consult, own shares in or receive funding from any company or organisation that would benefit from this article, and have disclosed no relevant affiliations beyond their academic appointment.

depression pandemic-

International2 weeks ago

International2 weeks agoParexel CEO to retire; CAR-T maker AffyImmune promotes business leader to chief executive

-

Spread & Containment3 weeks ago

Spread & Containment3 weeks agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

International4 weeks ago

International4 weeks agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

International4 weeks ago

International4 weeks agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized4 days ago

Uncategorized4 days agoVaccinated People Show Long COVID-Like Symptoms With Detectable Spike Proteins: Preprint Study

-

Uncategorized1 month ago

Uncategorized1 month agoEvidence And Insights About Gold’s Long-Term Uptrend

-

Spread & Containment2 weeks ago

Spread & Containment2 weeks agoJapanese Preprint Calls For mRNA VaccinesTo Be Suspended Over Blood Bank Contamination Concerns

-

Spread & Containment2 days ago

Spread & Containment2 days agoOura Ring launches genius new feature to take on Apple Watch