Uncategorized

Judge offers early win for Arbutus as Moderna vaccine patent spat heats up

A Delaware federal judge has sided with Arbutus’ interpretation of three patent claim terms in its case against Moderna, giving the biotech a small win…

A Delaware federal judge has sided with Arbutus’ interpretation of three patent claim terms in its case against Moderna, giving the biotech a small win in a drawn-out patent dispute.

Arbutus and Genevant filed suit against Moderna in 2022, alleging the company’s historic mRNA vaccine used lipid nanoparticle (LNP) technology developed and patented by Arbutus. While plaintiffs agreed that the Covid-19 pandemic would have been “immeasurably worse” without the widespread availability of Moderna’s vaccine, they argued that the achievement was made possible by Arbutus’ discoveries around LNPs.

LNPs are bubbles of fat that protect and escort mRNA into cells. Arbutus said its technology was “developed with great effort and at great expense,” and is now seeking royalties on Moderna’s Spikevax sales. The vaccine generated $6.7 billion last year alone.

Judge Mitchell Goldberg, who rejected Moderna’s effort to toss the case last year, issued an opinion Wednesday on arguments around the interpretation of several patent claims. The judge sided mostly with plaintiffs, giving Arbutus a potential advantage in the overall case. Goldberg sided with Moderna on one of the terms. Arbutus’ stock $ABUS rose nearly 16% on Wednesday.

“We are pleased with how the Court construed the disputed claim terms,” Arbutus interim president and CEO Michael McElhaugh said in a news release. “We remain committed to protecting and defending our intellectual property and look forward to the next steps in the litigation.”

Jefferies analysts said Wednesday that the opinion bodes well for Arbutus, and “should help derisk” a trial coming next year.

Moderna denied infringement of Arbutus patents in a statement to Endpoints News on Thursday, adding that its LNP system is “the result of our independent research and development.”

“We are confident in our position and look forward to presenting our case at trial next year,” the spokesperson said.

Arbutus and Genevant filed similar claims against Pfizer and BioNTech last April. That case is ongoing.

vaccine pandemic covid-19Uncategorized

Popular shoe brand files for Chapter 11 bankruptcy

The company has between $500,000 million and $1 billion in debt.

Competing in the footwear space has traditionally been incredibly hard.

That's because in the casual and sneaker space, Nike has dominated so thoroughly. It's a situation where to be a successful shoe company you need a niche.

The challenge of filling a niche is that you're still competing for mindshare and shelf space with much larger players. It's a very competitive market where there have been a lot more British Knights and LA Gears than there have been companies that have made it.

Related: Struggling mall retailer could file for Chapter 11 bankruptcy

Skechers and Crocs, for example, managed to stake out territory that was underserved by Nike and other casual footwear players. Both companies had to spend a lot of money to carve out their niche, and it's fair to say that both remain financially vulnerable.

It's a market that has been littered with failures and companies that have invested millions, sometimes hundreds of millions to not make much of a dent. Under Armour (UA) , a challenger to Nike in many areas, has failed to make its mark in sneakers despite a high-profile partnership with Steph Curry,

Breaking into the market presents huge challenges, but it can be equally difficult to stay afloat. A handful of brands, like the aforementioned British Knights, had viral moments, but then quickly fell out of fashion.

That's not exactly what happened with Shoes for Crews, a brand founded in 1984 that found a niche and filled it well. The company, however, has hit a major inflection point where its survival is not assured.

Image source: Pixabay

Shoe company fills a need

Shoes for Crews may not be a name everyone knows, but it has been a strong player that provides much-needed products. The company may not be as high-profile as other footwear makers, but it serves a major need for its customers.

"40 years ago, our founder Stan Smith noticed a rise in workplace injuries caused by slip and falls and discovered a need to create a solution that would eliminate the problem. In 1984, the Shoes For Crews brand was formed, and our slip-resistant outsole technology was invented," the company shared on its website.

Any company that has operated that long and Shoes for Crews has built a large following.

"Since then, we’ve protected millions of workers and lowered workers’ compensation costs for thousands of businesses across the globe. Today, Shoes For Crews is the industry standard and trusted leader in safety footwear solutions for more than 150,000 companies around the world," the company added.

Shoes for Crews files Chapter 11 bankruptcy

Shoes for Crews filed voluntary petitions for Chapter 11 relief in the United States Bankruptcy Court for the District of Delaware. The filing includes a plan for a "value-maximizing sale transaction that will allow for the continued operation of the business, with the resources to invest in growth across key markets globally."

The company reported in the filing that it had $100 million in assets and $500 million to $1 billion in liabilities.

Shoes for Crews Chief Financial Officer Christopher Sim said “a confluence of factors” led to the Chapter 11 bankruptcy filing.

"They include inflation; a general downturn in retail; a shift away from brick-and-mortar shopping to online buying; and the pandemic, which forced retailers to eat the expense of supporting brick-and-mortar assets," Retail Dive reported.

“Over time, these factors have tightened the Debtors’ liquidity and complicated their vendor relationships, culminating in a liquidity crisis by the fourth quarter of 2023, when the Debtors faced dwindling cash flows and the inability to access even incremental liquidity,” Sim said.

Shoes for Crews shared in its bankruptcy filing that it has the support of its first lien-secured lenders and that it has entered an agreement to receive $30 million of debtor-in-possession financing. That would, according to a press release allow the company to continue its normal operations.

"The company intends to enter into a stalking horse asset purchase agreement with its first lien-secured lenders to sell the business and enable the continued operation of the business as a going concern under new ownership," the company shared.

In the "Stalking Horse" process, the court will supervise the sale process to make sure Shoes for Crews gets the "best bids" possible to maximize value for all stakeholders. The process is expected to take two months.

bankruptcy pandemicUncategorized

Essential drug company to liquidate in Chapter 11 bankruptcy

The biopharmaceutical company will liquidate in Chapter 11 bankruptcy after sale.

Bankruptcy filings in the healthcare sector rose significantly over the last three years, rising from 25 in 2021 to 46 in 2022 and 79 in 2023, which was the highest level in five years, according to a Gibbins Advisors report.

For the first two months of the year, bankruptcies rose from about five filings in January to 12 more in February, according to data from S&P Global Market Intelligence. The most notable Chapter 11 filings in February were Cano Health, which filed on Feb. 4 with over $1 billion in assets and liabilities, and Invitae Corp., which filed on Feb. 13 with $500 million to $1 billion in assets and over $1 billion in liabilities.

Related: Troubled wireless technology pioneer files Chapter 11 bankruptcy

Chapter 11 filings are not slowing down yet, as a major biopharmaceutical company that sells essential drugs for serious life-threatening diseases has filed for bankruptcy in April.

Parkinson's, multiple sclerosis drug company files bankruptcy

Pearl River, N.Y.-based Acorda Therapeutics (ACOR) , maker of Parkinson's disease and multiple sclerosis therapies, on April 1 filed for Chapter 11 bankruptcy in the U.S. Bankruptcy Court for the Southern District of New York with a restructuring support agreement backed by its ad hoc noteholder group that seeks a sale to stalking-horse bidder Merz Therapeutics for a $185 million bid and an eventual confirmation of a liquidation plan to wind down operations after a sale.

The drug company will also seek $60 million in debtor-in-possession financing to fund operations during bankruptcy from its ad hoc noteholders, consisting of $10 million available on interim approval by the court, $10 million provided on final approval and a roll up of $40 million in debt.

The debtor listed $266.2 million in debt and $108.5 million in assets in its petition.

Acorda, founded in 1995, markets its Ampyra drug, which improves walking in adults with multiple sclerosis. The company manages the production and distribution of the drug through a third-party contract with Pantheon Inc. The drug is known as Fampyra outside the U.S. and produced and distributed by Biogen International GmbH, though the parties' contract is set to terminate on Jan. 1, 2025.

The biopharmaceutical company's other product is Inbrija, the first and only levodopa inhalation powder approved by the Food and Drug Administration for intermittent treatment of episodic motor fluctuations in adults with Parkinson's disease treated with carbidopa/levodopa regimen. Catalent Massachusetts manufactures the drug under contract through 2030.

Shutterstock

Pharmaceutical company purchase failed to generate revenue

Several factors caused the company's financial distress, according to a declaration by CFO Michael Gesser, including the company's 2016 acquisition of Biotie Therapies for about $363 million, which did not generate any revenue for the company and instead had net operating losses of $120 million.

The company also suffered an adverse court ruling that invalidated several of its Ampyra patents, which allowed generic versions of the drug to enter the U.S. market in late 2018 and caused a rapid loss of substantial revenue, the declaration said.

Finally, slower than expected sales of its Inbrija drug, due to the Covid-19 pandemic and prescribing challenges had a material adverse effect of the company's business and the inability to invest in its pipeline of drugs and other development opportunities also harmed the company financially.

The debtor seeks to set a May 16 deadline for potential qualified bids for an auction to be held May 22. A sale hearing to approve a sale would be scheduled for May 31 if an auction is held and on May 24 if no auction is held.

Related: Veteran fund manager picks favorite stocks for 2024

bankruptcy bankruptcies pandemic covid-19 stocks treatment

Uncategorized

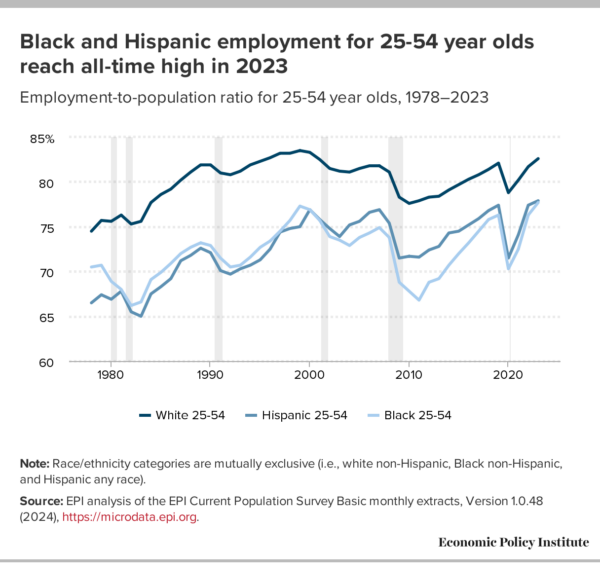

A record-breaking recovery for Black and Hispanic workers: Prime-age employment rates have hit an all-time high alongside tremendous wage growth

U.S. labor market strength in the recovery has been extraordinary because policymakers addressed the pandemic and subsequent recession at the scale of…

U.S. labor market strength in the recovery has been extraordinary because policymakers addressed the pandemic and subsequent recession at the scale of the problem. Unemployment has been at or below 4.0% for 27 months running, the longest such stretch since the late 1960s. Low-wage workers experienced an unprecedented surge in wage growth over the last four years, as shown in our new report.

These historically robust outcomes extended to Black and Hispanic workers. In 2023, the share of Black and Hispanic people ages 25-54 with a job hit an all-time high. Further, real wage growth among Black and Hispanic workers experienced a significant turnaround from the stagnant wage growth they suffered in much of the prior four decades.

Record-breaking employment-to-population ratio

The share of the population ages 25-54 with a job—the prime-age employment-to-population ratio (PA EPOP)—rose to 80.7% in 2023, surpassing the pre-pandemic high of 80.0% in 2019 and marking the highest level since 2000. Historically marginalized workers are hit harder than other workers in recessions. In tight labor markets like today’s, historically marginalized workers experience more improved labor market outcomes and faster wage growth. In fact, Black and Hispanic workers hit all-time high employment rates in 2023: The Black PA EPOP hit 77.7% in 2023, better than its previous high in 1999 (77.3%). The Hispanic PA EPOP reached 77.9%, better than its pre-pandemic high of 77.4% in 2019.

Figure A displays Black, Hispanic, and white PA EPOPs between 1978 and 2023. Prime age is a key demographic to analyze because it is less influenced by the aging population or increases in college attendance (which may depress the employment rates of younger workers relative to earlier historical periods when college attendance was less common). On average, white workers have always experienced better labor market outcomes—specifically lower unemployment and higher EPOPs—than Black and Hispanic workers. Further, Black and Hispanic workers experience larger swings in labor market outcomes in business cycles, clearly shown in the larger dips in employment in and after the shaded recessions in the figure.

Due largely to the more robust policy response, it took only four years for Black and Hispanic workers to hit pre-pandemic employment peaks in this business cycle compared with the prolonged recovery from the Great Recession—when Black and Hispanic employment only hit pre-recession levels after 11 and 12 years, respectively.

Faster wage growth for Black and Hispanic workers over the last four years

Black and Hispanic workers have also experienced stronger wage growth during this recovery. Because of long-standing patterns of discrimination and occupational segregation, faster wage growth among Black and Hispanic workers is due in part to their disproportionate representation in the low-wage labor market relative to their shares within the overall workforce.

Figure B shows wage growth by race and ethnicity over the last four years compared with the prior 40 years. Because of the different periods of time, the growth rates here are annualized to better compare apples to apples. While there were short periods of decent wage growth for Black and Hispanic workers—particularly in the late 1990s and the years leading up to the pre-pandemic labor market peak in 2019—the overall impression of the 1979 to 2019 period is one of slower wage growth. In comparison, real wage growth—which accounts for high inflation—was particularly strong for these historically marginalized groups between 2019 and 2023. Black workers in particular experienced wage growth far above their historical norm: 1.4% annually over the last four years.

In our latest State of Working America Wages report, we show how the Black-white and Hispanic-white wage gaps remain much larger now than in 1979 even as the narrowing over the last four years has been significant. We also show how Black men experienced particularly fast growth relative to past performance, increasing 1.5% annualized over the last four years, compared with 0.0% on average over the prior 40 years.

While overall low unemployment and high EPOPs are certainly positive indicators of labor market strength right now, allowing the economy to recover and keep growing has translated into significant gains for historically marginalized Black and Hispanic workers. Policymakers need to keep pushing to keep the labor market pinned very tightly near full employment. The evidence is clear: If the Federal Reserve keeps interest rates higher than is needed to normalize inflation, the result may be an avoidable recession. Even a mild recession will do significant harm to Black and Hispanic workers’ opportunities for employment and wage growth.

recession unemployment pandemic federal reserve recession recovery interest rates unemployment-

International2 weeks ago

International2 weeks agoParexel CEO to retire; CAR-T maker AffyImmune promotes business leader to chief executive

-

Spread & Containment3 weeks ago

Spread & Containment3 weeks agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

International4 weeks ago

International4 weeks agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

International4 weeks ago

International4 weeks agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized2 days ago

Uncategorized2 days agoVaccinated People Show Long COVID-Like Symptoms With Detectable Spike Proteins: Preprint Study

-

Uncategorized1 month ago

Uncategorized1 month agoEvidence And Insights About Gold’s Long-Term Uptrend

-

Uncategorized1 month ago

Uncategorized1 month agoA Global, Digital Coup d’État

-

Spread & Containment23 hours ago

Spread & Containment23 hours agoOura Ring launches genius new feature to take on Apple Watch