Uncategorized

The five-step wellness model that really works – and the psychology behind it

Wellness actually often involves a lot of effort.

The wellness movement appears to have the answers that our burnt-out minds need. However, psychological research and practice suggests that a superficial focus on candles, juice cleanses, and a “good vibes only” approach to life is unlikely to create meaningful changes to your wellbeing.

It’s not a surprise that wellness culture has become so popular, especially among women and young people. A US$4.4 trillion (£3.5 trillion) wellness industry promises that clean beauty, clean eating and energy-boosting supplements will provide happiness, meaning and a stress-free existence. But if wellness can be bought, why aren’t we all happier?

Purchases may make us happy (and even reduce some lingering sadness) but genuine changes to wellbeing are probably limited. In fact, feminist critics, journalists and psychologists have expressed concerns that wellness culture may exacerbate destructive perfectionism, promote an unhealthy relationship with our bodies, and even draw people into conspiracy theories and multi-level marketing scams.

Wellness culture focuses on what feels good for you as an individual, providing only a surface level experience of wellbeing. Mihalyi Csikszentmihalyi, one of the founders of the positive psychology movement, said in his 1991 book Flow, that “it is by being fully involved with every detail of our lives, whether good or bad, that we find happiness”.

Read more: Why so serious? The untapped value of positive psychology

Indeed, psychological research suggests that long-term wellbeing comes from a committed pursuit of both pleasure and meaning. Consider the psychologist Martin Seligman’s model of flourishing: Perma. Seligman’s model breaks wellbeing into distinct, workable “elements”, which gives us an idea as to how to make wellbeing more achievable.

A 2016 study of 1,624 participants recruited online found an intervention based on the Perma model increased levels of happiness and helped decrease depression symptoms, although the intervention seemed to work best for people around the middle range of wellbeing.

Studies have also found Perma-based interventions promoted wellbeing in university students following the Covid pandemic, seem to improve the emotional states of lung cancer patients and decrease anxiety in breast cancer patients. And researchers have tested this model across different contexts, ages, and cultures.

Perma is an acronym that stands for what Seligman considers the five pillars of wellbeing: positive emotions, engagement, relationships, meaning and achievement. This model suggests that rather than spending money to focus on “self-care”, we should aim to meet what psychologists consider our fundamental, psychological needs for competence, autonomy, and relatedness.

Perma suggests we ask ourselves: Am I acting in ways that make me feel competent, in control, and connected with others? Here are some wellness tips that work, based on the five pillars of Perma:

1. Positive emotions

The broaden-and-build theory states that we are at our most psychologically creative, responsive and flexible when we are experiencing positive emotions. However, it’s important to move beyond momentary hedonic pleasure and aim to reap the rewards of a range of positive emotions. This allows us to experience more positive emotion, as part of an upward spiral effect.

Take one (or more) of psychologist Barbara Fredrickson’s top ten positive emotions, and find ways to cultivate more of it in your life. These emotions include awe, joy, inspiration, gratitude and love. For example, to cultivate gratitude try the three good things exercise: take time to list three good things that happened in your day, or three things that you felt grateful for. You can also write about the cause of those things.

Maybe combine this with nature’s wellbeing benefits by looking for three good things in nature. If it’s difficult to find green space in your area, there are creative ways to incorporate connection with nature into your daily life, such as taking the time to look at the stars at night. Notice the bumblebees or count the different types of plants you see on your walk to work.

2. Engagement

Find an activity that gets you into flow, a state of deep engagement in an intentional, inherently rewarding activity in which we lose track of time and feel at one with what we are doing. It’s also sometimes known as “getting into the zone”.

Flow activities stretch us just enough to keep us engaged, but not so much that we become bored or demotivated. High flow activities include music, sports and even gaming.

3. Relationships

It’s quality over quantity when it comes to personal relationships. It sounds simple, but look to (or find) people who are eager to celebrate your successes and be wary of those who belittle them.

This will help you prolong the good feelings that go along with life’s little wins. Personal connection is important, and features as a core component in most theories of wellbeing.

4. Meaning

Find a way to connect with something larger than yourself. Volunteer, join a community group or perform a random act of kindness.

Thinking about a future best possible self can help you set goals and help you understand what gives you purpose in life.

5. Achievement

Do something challenging; something that stretches your abilities. You may want to identify and use your strengths. Some strengths, such as perseverance, are related to achievement. True positivity is not just about feeling good, but about rising to the challenges that life sets us.

Just remember: Perma pillars are independent paths to wellbeing, but they’re also highly related. Taking up dancing, for example, might be a way to experience positive emotions and flow, allowing you to make new connections so that you stick at it long enough to develop a sense of purpose or achievement.

The authors do not work for, consult, own shares in or receive funding from any company or organisation that would benefit from this article, and have disclosed no relevant affiliations beyond their academic appointment.

depression pandemicUncategorized

National Emergency: Executive Order 6102 and the Heist of the Century

A comprehensive history of the events leading up to the historic Executive Order 6102 under FDR that led to widespread gold confiscation in the United…

Introduction

Ninety-one years ago today, President Franklin D. Roosevelt pulled off the greatest heist in American history.

Unlike most robberies, this one was entirely legal. No safe-cracking was required; no ski masks, guns, or getaway cars. Just a pen and some White House letterhead.

On April 5 1933, FDR issued Executive Order 6102, making it illegal for anyone in the United States to own gold. By penalty of up to a $10,000 fine or 10 years in prison, everyone in the country was ordered to turn in their gold to the government, by the end of the month.1

EO 6102 is one of the most important milestones in the history of money. Book-ended by the creation of the Federal Reserve in 1913, and the end of the Bretton Woods system in 1971, it was a pivotal part of the process by which the USA abandoned gold for a fiat standard.

As such, it’s a milestone in Bitcoin history too. Though Bitcoiners’ interest in EO 6102 extends beyond the merely historical: because it’s the quintessential cautionary tale of arbitrary government seizure of personal property, it’s also one of the best real case studies to illustrate the value of Bitcoin self-custody.

Realizing that the government is not your friend is like learning that Santa Claus isn’t real. A necessary part of growing up, but a potentially traumatic fact that needs to be introduced to children carefully.

Nonetheless, adulthood requires coming to grips with the fact that there’s no jolly fat man coming down the chimney with gifts in hand. In the real world, the strange fat man wears a frown and comes through your front door with an arrest warrant if you don’t pay your taxes.

For many people, the story of Executive Order 6102 brings them into collision with this reality. It teaches us that the United States Government has not hesitated to brazenly confiscate its citizens' wealth at the barrel of a gun, and under the right circumstances would absolutely do it again.

However, most discussion of 6102 focuses on why FDR did it and whether it was justified. This debate is framed around FDR’s overall handling of the Great Depression. On one side you have (essentially) FDR hagiography which says that he was an unmitigated American hero; that “without his New Deal, we would all have been lost.”2

On the other side, you have the (somewhat milquetoast) Republican criticism which says, well maybe FDR went too far, or maybe he actually hurt the economy as much as he helped it. Sometimes a spicy Libertarian will get hot under the collar and tell you FDR sent America down the path to welfare-statism and “accustomed Americans to the pernicious dole.”3

All of this misses the most important lesson from EO 6102, which is how FDR pulled the whole thing off. I mean, technically. Legally.

This is because, despite the fact that FDR’s Presidency could justifiably be characterized as a quasi-dictatorship and, in the words of America’s foremost FDR disrespector Curtis Yarvin (aka Mencius Moldbug), “rule by personal decree”4, there were specific legal precedents and tools of executive power that he relied on to make EO 6102 kosher.

This legality (fig leaf for tyranny as it may have been), is crucially important to understand. It was one of the foundational steps in codifying what would go on to become a technique for abusing Americans’ rights favored by almost every President, and has been implemented literally dozens of times in the decades since.

If we have any hope of putting a stop to it, we must first learn to see it from a distance, and then stomp it out preemptively.

The Use and Abuse of the National Emergency

“Now, in a well-ordered republic it should never be necessary to resort to extra-constitutional measures; for although they may for the time be beneficial, yet the precedent is pernicious, for if the practice is once established of disregarding the laws for good objects, they will in a little while be disregarded under that pretext for evil purposes”

- Machiavelli, The Prince and the Discourses

I’m not sure anyone’s ever said that the conduct of American Presidents has on the whole not been Machiavellian enough, but in this case the historical record is clear.

Dating back at least to Abraham Lincoln’s suspension of habeas corpus in 1862 (so he could lock people up without trial during the Civil War), ‘disregarding the laws for good objects’ has been practically a job requirement of the oval office.

Carl Schmitt said that “Sovereign is he who decides on the exception.” Every US President since Lincoln has made absolutely sure, when necessary, to create and exploit ‘extra-constitutional’ exceptions for their own ends. In Schmitt’s case, well, you can Google him to see how he put principle into practice.

In order to manufacture these exceptions in America, Presidents have almost always resorted to the incantation of a particular phrase, which reliably summons the special powers they seek. Much like coaxing a genie from a lamp.

The phrase is “national emergency”. Likely, it is familiar to you. If you’re an American adult, it’s been invoked in your lifetime to help grease the skids for a colorful variety of constitutionally suspect legislation, from the ‘anti-terrorism’ provisions of the Patriot Act to the public health emergency measures of Covid-19.

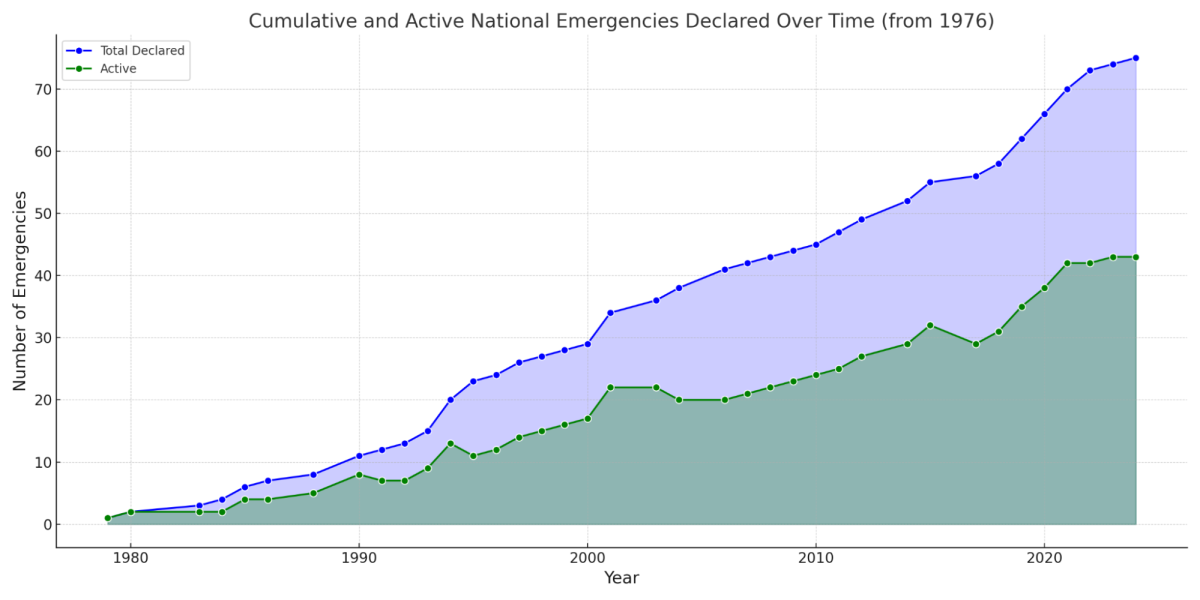

In fact, it’s such a mainstay of the government toolkit that use of the ‘national emergency’ has been officially sanctioned since the The 1976 National Emergencies Act. Since that date, 82 such emergencies have been declared, and 42 are still in effect today.5

To give you a sense of the temporal nature of these ‘emergencies’, there are still in effect: 9 from the Obama administration, 10 from Bush II, 5 from Clinton, and even one from Jimmy Carter in 1979!

This is what Milton Friedman was talking about when he said “Nothing is so permanent as a temporary government program.”

This is also the story of Executive Order 6102, for it too sprouted from an official national emergency.

You can read this in order itself, where FDR states in the preamble: “I, Franklin D. Roosevelt, President of the United States of America, do declare that said national emergency still continues to exist…”

But still, the story goes deeper. It’s not just enough to declare a national emergency and then do whatever you want. That certainly wasn’t the case in 1933.

So what was FDR’s national emergency? What on earth could legally justify the seizure of all American gold?

The short answer is the Great Depression and looming financial crises in 1933. But in order to really understand the twisted history of national emergencies, we have to go back another 120 years first.

The Beginning: Principled Piracy

In 1812, the United States was at war with Great Britain. Prior to the war, an American citizen Jabez Harrison purchased some goods in England and stashed them on an island off the coast of the United States, near Nova Scotia.

About a month after the war broke out, Harrison chartered a boat, the Rapid, to retrieve the cargo and bring it to the mainland. While en route, it was captured by an American privateer called the Jefferson, who claimed the ship’s goods as a prize.

Harrison felt, as you might expect, pretty aggrieved by this and sued the owner of the Jefferson. Unhappily for Harrison, he did not win back his cargo.

The law was clear and unambiguous according to Supreme Court Justice William Johnson: under the well established rules of war, Harrison was “trading with the enemy”, and therefore everything he had acquired from said enemy was essentially up for grabs for the government.6

Thus the seed was planted in American law: if you trade with an enemy during war time, expect a visit from Uncle Sam with his hand out. This, believe it or not, is the legal foundation for Executive Order 6102.

“But”, (I hear you interject), “By what definition could an ‘American with gold’ be reasonably classed as an enemy of the state? And besides, there wasn’t even a war in 1933!” Fantastic points, and you’re right to make them.

To preface the answer, let’s first take a detour into some high level American jurisprudence. In the murky but politically charged arena of Constitutional interpretation, there are several major ‘philosophies’ that you might subscribe to.

Because the Constitution was written a long time ago, we need to find a way to apply it to the present day. Where, for example, we might have new technologies or social problems today that didn’t exist when the Constitution was written (like e.g. social media, or automatic rifles, or abortion pills). In such cases, these ‘philosophies’ help judges decide the ‘right’ way of interpreting the Constitution (which also usually aligns with their personal political views, but that’s another story).

If you woke up tomorrow as a Supreme Court Justice and needed a cheat sheet to help you crack a tough Constitutional nut, here are the main schools of interpretation you might rely on: 1) Textualism: where you focus on the ‘meaning’ of the law at the time, 2) Originalism: where you focus on what the framers actually intended, or 3) A ‘Living Constitution’ approach: where you basically say, ‘to hell with that old rag, we should just update it according to the demands of today’.

The third approach is more or less how the law around ‘national emergencies’ has evolved. And not, like, a slow and deliberate ‘natural selection’ evolution either. More like a Frankensteinian chimera lab rat fed plutonium for breakfast.

So, what began as a recognition of the simple idea that doing business with enemies during a war is bad and the government can stop it, eventually mutated into FDR seizing the gold.

Now let’s fill in the gaps and show how that happened.

1917: National Emergencies Go Up

There are some great contenders for Worst Year Ever in the history of abuses of individual rights in America. 1917 might be in the top five.

One piece of legislation passed in 1917, the Espionage Act, was of such fine vintage that its ability to justify obscene government overreach is still being put to good use today.

This package of laws was passed to, more or less, enable the government to do whatever it wanted, to anyone, who got in the way of its efforts to prosecute WWI. More than a century later, this would be the law which both Julian Assange and Edward Snowden were criminally charged under.

1917 was also the first time the phrase “national emergency” passed into the formal language of the Presidency. Invoked by Woodrow Wilson first in his Proclamation 1354, the emergency at hand was that there were apparently not enough boats to ship out all of America’s exports to customers around the world. As a result, Wilson gave the Shipping Board the power to control the sale and use of freight ships in America.7 Leasing your cargo ship to foreign interests? You just did a heckin’ violation.

This would not be the last national emergency of 1917, however. After America declared war on Germany on April 6, the administration now had a number of new problems to deal with.

Aside from fighting the war itself, there was the issue of what to do with all the German business interests in America, and vice-versa. In the years since The Rapid, global trade and commerce had advanced substantially. Now, there was a vast web of commercial relationships between America and its new enemy, which would take quite a bit of effort to disentangle.

The solution was the Trading with the Enemy Act, which brought the principle of The Rapid into legislation and vastly expanded it. The official purpose of the TWEA was to “define, regulate, and punish trading with the enemy.”8 In practice, the goal was twofold: to confiscate German resources for the benefit of the US war effort, and to prevent Germany from doing the converse.9

Democratic Congressman Andrew Montague argued in favor of the Bill by saying, “perhaps in no former war was trade ever so potential a weapon in the hands of a belligerent as in the present conflict. This is not a war of soldiers so much as a war of economic forces.”10 This, three years into a war that had already cost many millions of lives.

For obvious reasons, history has largely forgotten what German businesses and civilians endured in America for the rest of the war. Estimates are that 6000 men were sent to internment camps, and around half a billion dollars in assets permanently confiscated.11

This was all authorized by the Trading with the Enemy Act. One section of it in particular, however, would go on to be the lynchpin in the Executive Order 6102 story.

That was Section 5b, which gave the President complete power to investigate, regulate, or prohibit any transactions dealing in “foreign exchange”, or by any foreign country.12

You might sense now that we’re getting warmer. The TWEA power is evolving, and EO 6102 beginning to take shape, gradually getting clearer like a shadowy apparition emerging from the darkness.

But we’re not there yet. There was one more hurdle to get over, for the President’s power in 1917 was still limited to “during the time of war.”13

It would take another catastrophe more urgent even than World War One to get over it.

Great Depression: FDR’s Opportunity

That catastrophe would come in 1933, following four years of unimaginable suffering during the Great Depression and a quickly spiraling financial crisis.

Three days before FDR was inaugurated, on 1 March 1933, the head of the New York Federal Reserve branch, George Harrison, was in panic mode. The bank’s gold reserve had fallen below the legal limit. Harrison sent a memo to Washington saying that he would “no longer take responsibility” for the bank’s “deficient reserves”.14

What was going on?

Well, in 1913 when the Federal Reserve was created, a ‘gold standard’ was built into its framework. The Fed was required to hold gold equal to 40 percent of the value of the dollars it issued, and to convert those dollars into gold at a fixed price.15

The problem was, the US was in the middle of a deflationary crisis. The economy had been going backward for years. Gradually then suddenly, people began to seek the safety of gold, and withdraw it from banks all over the country.

However, there was one big problem: there was simply not enough gold. As FDR would admit publicly a couple of months later, the government’s debts amounted to $30 billion in gold, and private gold-denominated debt totaled another $60-70B.

Meanwhile, “all of the gold in the United States amounted to only between three and four billions and that all of the gold in all of the world amounted to only about eleven billions.”16

FDR’s interpretation of the moment is recorded in his inaugural address. He used the speech to wage a broad attack against the excesses of capitalism which he (and history) would scapegoat for causing the 1929 and Great Depression.

He called out the “unscrupulous money changers”, and the “falsity of material wealth”, and demanded that “there must be a strict supervision of all banking and credits and investments; there must be an end to speculation with other people's money, and there must be provision for an adequate but sound currency.”17

Now, if you’ve been paying attention, you shouldn’t be surprised by what he said next. Yes - it was indeed a national emergency. One so severe that it required a “broad Executive power to wage a war against the emergency, as great as the power that would be given to me if we were in fact invaded by a foreign foe.”18

It was all downhill from there.

Two days after FDR’s term began, he took action to stop the gold run by simply closing the banks. The March 6 Proclamation 2039 instituted a ‘Bank Holiday’ from 6-9 March, outlawing any withdrawal of gold, to stop the “hoarding”.19

Stopping the run wasn’t enough, though. Hoarders were now enemies of the State, and the Fed wanted names. On March 8, the St. Louis Fed sent a memo to member banks, requesting “the names and addresses of all persons who have withdrawn gold from your bank since February 1, 1933.”20

On March 9 1933, Congress passed the Emergency Banking Relief Act, granting FDR almost full personal control over the entire banking system. It gave him authority to regulate “any transactions in foreign exchange, transfers of credit between or payments by banking institutions as defined by the President, and export, hoarding, melting, or earmarking of gold or silver coin.”21

Now, here is our link back to 1917. As we mentioned earlier, the Trading with the Enemy Act restricted this power to war time operations. But as was foreshadowed in FDR’s inaugural address, the Emergency Banking Act (EBA) would help FDR get past this technicality.

Specifically, it amended the TWEA to ensure that FDR had the power to regulate commerce “during time of war”, or crucially, “during any other period of national emergency declared by the President.”

FDR had his crisis, and now he had his emergency powers. A couple of weeks after the passage of the EBA he would issue Executive Order 6102, and then the job was mostly done.

By and large, everyone complied. The day after the Order, the New York Times ran an article on the front page with the headline: “HOARDERS IN FRIGHT TURN IN $30,000,000; Gold Pours Into Banks and the Federal Reserve as Owners Act to Avoid Penalty”22

This brings us to the end of the story. From The Rapid, to the Trading with the Enemy Act, to the Emergency Banking Act, to Executive Order 6102.

The evolution was complete, and enshrined the national emergency exception into Presidential powers from then on. Natural disasters, foreign wars, domestic wars, public health emergencies.

This is the story of two hundred years of Presidential power. The law is the law, until it isn’t.

Conclusion: Could It Happen Again?

Ultimately, this is really what everyone should ask about EO 6102. Could it happen again? Could some unholy triumvirate of the Fed, Treasury Department, and Elizabeth Warren channel the spirit of FDR and attempt a mass seizure of Bitcoin?

Nobody can really know, but the best way I can answer the question is with the help of the trusty Midwit meme (see below), which gives us three ways of predicting the likely outcomes.

The Left Curve answer is to do a basic pattern match between 1933 and today. People had money the government couldn’t control; Government wasn’t happy; Government stole the money. No more analysis required: the Feds will steal your stuff.

The Midwit answer is to carefully compare and contrast the nature of Gold with respect to the American economy of April 1933, versus Bitcoin and today, and to distinguish between the ruthlessly efficient dictatorial powers of FDR and the bungling and incompetent bureaucratic oligarchy of 2024.

This isn’t exactly wrong, as the Midwit never quite is. The particular problem for the government in 1933 was that almost every commercial contract in the country was backed by gold, as was the dollar, and a breakneck run on Gold was threatening to implode the economy. None of these things is true about Bitcoin. But the Midwit is never quite right either.

The Right Curve answer (if I may humbly submit), is presented in this essay. The meaning of the Executive Order 6102 story is not in the exactness of the analogy from Gold in 1933 to Bitcoin in 2024.

Rather, it is the nature of the legal power wielded by FDR to expropriate the property of American citizens, the ubiquity and breadth of its use by every President since, and the likelihood of it being used again in the future.

History has shown that the invocation of national emergencies has, time and time again, given the United States government almost unlimited capacity to encroach on civil liberties.

What does the next national emergency look like?

A mass flight to safety from the US dollar into the hardest asset ever known? Could 175T of unfunded liabilities23 trigger a catastrophic restructuring of American debt? Or perhaps another hot war or three?

We don’t know what the crisis will be; only that there will be one. As the state debases the currency at an accelerating rate, and its liabilities balloon out of control, it will get desperate.

In late-stage Fiat, just as in the Kingdom of Alice in Wonderland’s Red Queen, the state must run faster and faster just to stay in the same place. And when the moment of crisis comes, the Right Curve prediction is simple: the Feds will steal your stuff.

Only this time, it might be different. For the first time, sovereign custody of Bitcoin has a chance at keeping private wealth safe from public expropriation.

So to conclude, the lesson as always is: not your keys, not your coins.

And see you in hell, FDR.

Sources:

1 Executive Order 6102, https://en.wikisource.org/wiki/Executive_Order_6102

2 Shlaes, Amity, The Forgotten Man, Introduction

3 Shlaes, Amity, The Forgotten Man, Introduction

4 Mencius Moldbug, March 19 2010, The true election: a practical option for political change, https://www.unqualified-reservations.org/2010/03/true-election-practical-option-for-real/

5 List of national emergencies in the United States, https://en.wikipedia.org/wiki/List_of_national_emergencies_in_the_United_States

6 The Rapid, 12 U.S. 155 (1814), https://supreme.justia.com/cases/federal/us/12/155/

7 Proclamation 1354, https://www.presidency.ucsb.edu/documents/proclamation-1354-emergency-water-transportation-the-united-states

8 Trading with the Enemy Act of 1917, https://en.wikipedia.org/wiki/Trading_with_the_Enemy_Act_of_1917

9 The Secret Life of Statutes: A Century of the Trading with the Enemy Act, https://www.cambridge.org/core/journals/modern-american-history/article/secret-life-of-statutes-a-century-of-the-trading-with-the-enemy-act/77DD7CF528D3190CFC8CF8FF6DDAACB0#fn68

10 Congressional Record — House, July 9 1917, 4842, https://www.congress.gov/bound-congressional-record/1917/07/09/house-section

11 The U.S. Confiscated Half a Billion Dollars in Private Property During WWI, https://www.smithsonianmag.com/history/us-confiscated-half-billion-dollars-private-property-during-wwi-180952144/

12 Trading with the Enemy Act 1917, https://www.govinfo.gov/content/pkg/USCODE-2011-title50/pdf/USCODE-2011-title50-app-tradingwi.pdf

13 Trading with the Enemy Act 1917, https://www.govinfo.gov/content/pkg/USCODE-2011-title50/pdf/USCODE-2011-title50-app-tradingwi.pdf

14 Bank Holiday of 1933, https://www.federalreservehistory.org/essays/bank-holiday-of-1933

15 ‘Roosevelt's Gold Program’, https://www.federalreservehistory.org/essays/roosevelts-gold-program

16 FDR’s Second Fireside Chat, https://millercenter.org/the-presidency/presidential-speeches/may-7-1933-fireside-chat-2-progress-during-first-two-months

17 First Inaugural Address of Franklin D. Roosevelt, https://avalon.law.yale.edu/20th_century/froos1.asp

18 First Inaugural Address of Franklin D. Roosevelt, https://avalon.law.yale.edu/20th_century/froos1.asp

19 Proclamation 2039, https://en.wikisource.org/wiki/Proclamation_2039

20 Federal Reserve Bank of St. Louis, https://fraser.stlouisfed.org/title/banking-holiday-1933-486/member-banks-addressed-18942

21 Emergency Banking Relief Act, https://en.wikisource.org/wiki/Emergency_Banking_Relief_Act

22 New York Times, https://www.nytimes.com/1933/03/10/archives/hoarders-in-fright-turn-in-30000000-gold-pours-into-banks-and-the.html

23 Medicare and Social Security face $175 trillion shortfall, risking future generations, https://abc3340.com/news/nation-world/medicare-and-social-security-face-175-trillion-shortfall-risking-future-generations-treasury-department-inflation-economy

This is a guest post by Julian Fahrer. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

bitcoin btc link covid-19 us dollar goldUncategorized

The Bay Area is the country’s 4th-hottest housing market

We talked to Bay Area agents to learn how they are navigating a low-inventory market characterized by bidding wars, pricing games and high interest ra…

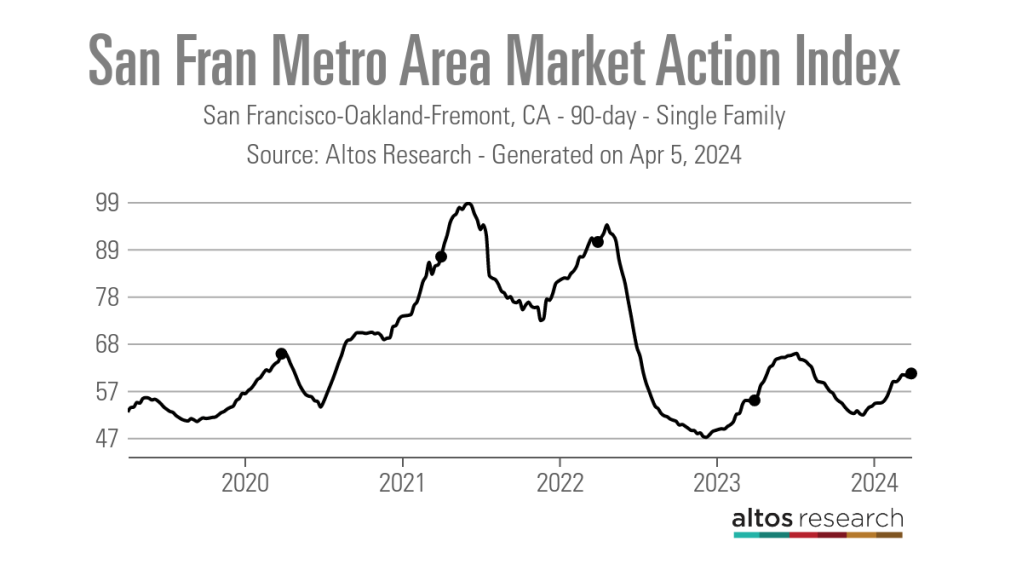

As of March 29, the San Francisco-Oakland-Fremont metropolitan area was the fourth-hottest housing market in the country. The Bay Area metro had a 90-day average Market Action Index score of 61.19, according to data from Altos Research. In comparison, Seattle-Tacoma-Bellevue, the top-ranked metro area, had a score of 64.53. Altos considers anything above a Market Action Index of 30 to be a seller’s market.

While the San Francisco-Oakland-Fremont housing market may be decently hot, local real estate agents feel that it could be hotter.

“There has been a little bit of a downturn, it was a little bit frothier earlier in the year,” said Andrea Gordon, an Oakland-based Compass agent. “The weather situation hasn’t been ideal, consumer confidence in the real estate market has weakened, interest rates are an issue and inventory is tight.”

Although other local agents said they wouldn’t characterize the market as being in a lull, they agree that interest rates and inventory are two major challenges to overcome.

“When interest rates were increasing, we saw a slowdown on inventory and buyers because sellers were afraid to bring homes on the market as they didn’t think there was going to be a big buyer pool and then buyers were hoping to wait it out and get the 4% interest rate their friends were bragging about,” Nicole Wilhelm, one half of Compass-brokered The Wilhelms Team, said. “But they’ve realized that maybe rates aren’t going to come down, so we are starting to see people coming back to the market both on the sell side and the buy side.”

Local agents believe that if the Federal Reserve lowers interest rates later this year, that will further help increase activity in the market. Regardless of the Fed’s decision, Nicole Wilhelm believes 2024 is still a good time for buyers to be in the housing market.

“I love election years coupled with high interest rates,” Nicole Wilhelm said. “I believe it is the best time for buyers to get a deal because everyone is scared, they don’t know what will happen so fewer buyers are looking, and you never want to be in a scenario where everyone wants to purchase because the competition will be high. If you are on the fence, just buy now and you can always refinance later.”

While Nicole Wilhelm feels that this may be a good time to buy, higher interest rates would keep many would be sellers on the sidelines, further pressuring an already tight inventory market.

“A lot of the sellers in our area refinanced their houses when they could get a loan rate of like 2.75%,” Gordon said. “If they want stay in the Bay Area, it doesn’t make financial sense to move across town and end up with a 7% mortgage rate.”

As of March 29, Altos data shows that the 90-day average of single-family listing in the San Francisco-Oakland-Fremont metro area was at 1,643 active listings, up from an all-time low of 1,229 active listings in early March of 2022, but below the 1,894 active listings reported a year ago and the pre-pandemic level of 2,083 active listings.

Additionally, the metro area had just 370 new single-family listings hit the market during the week ending March 29. This is up from 319 listings a year ago, but down from 466 listings at the onset of the COVID-19 pandemic. Although agents are grateful for the additional inventory coming to market, the believe it isn’t enough to keep up with demand.

“Even if we got an extra three or four houses every week, it would barely make a dent in the need,” Amanda Jones, a San Francisco-based Compass agent, said.

As such, Jones said it isn’t uncommon to see multiple offers on properties throughout the metro area.

“It is pretty competitive, but there is a little bit of whiplash right now,” Jones said. “On the one hand you may write an offer and be the only offer on something in South Beach or Soma, but then you’ll go and write an offer on a house in the western part of the city and there will be 16 offers on a property. You are navigating these realities everyday with buyers and we are still in a situation where some sellers expect us to waive everything.”

Although agents say buyer demand remains strong, some are becoming frustrated.

“It can sometimes be hard to be a buyer in this market because inventory levels are so low and there are multiple offers,” Shalini Sadda, a San Francisco-based City Real Estate broker associate, said. “If you are a buyer and you are not well positioned to present a competitive offer, it can be exhausting. So, we are seeing some buyer fatigue, especially in certain neighborhoods.”

Agents say a common Bay Area practice of pricing homes below market value has also contributed to the rampant multiple offer situation in some parts of the city.

“Historically there are known to be some neighborhoods in San Francisco that use a low-price strategy, but now I am seeing more and more neighborhoods using that because you don’t want to undercut your seller,” Sadda said. “You want to make sure you are getting them top dollar, so you don’t want to go in all the way up at the price that you think it may necessarily sell at, especially if you don’t have a comp.”

Local agents say using this strategy allows the market to dictate how much you can sell a given property for and it enables agents to set an offer deadline, allowing them to control how long the house sits on the market. However, there are some drawbacks, especially for buyers who are unaware of this custom.

“You can have clients that can afford to go to whatever stratospheric height they have to go to, but they need to know and understand what the parameters are,” Gordon said. “There are a few agents out there that are pricing everything at $899,000 or $1.299 million and expecting offers that are going to be 10% to 30% above that and it is really hard for buyers to gauge and it’s not fair to force them to spend their time and energy going to look at houses that are probably going to end up out of their capability to purchase.”

The high level of the demand and low inventory in the metro area, coupled with this pricing strategy, has led to a rapid increase in the median list price. Data from Altos Research shows that the 90-day average median list price of a single family home was $1.3 million as of March 29, up from $1.2 million a year ago and $999,888 just prior to the onset of the COVID-19 pandemic.

Despite the challenges facing them and their clients, agents are optimistic about the upcoming spring housing market.

“The level of demand is trickling in, and properties are also starting to come to the market as well,” Michael Wilhelm said. “Usually, the spring market is when we see this big rush of inventory coming in. We are seeing it at a slower pace this time around because sellers are waiting for when we can have even more bidding wars again.”

fed federal reserve pandemic covid-19 real estate housing market interest ratesUncategorized

Comments on March Employment Report

The headline jobs number in the March employment report was above expectations; and January and February payrolls were revised up by 22,000 combined. The participation rate and the employment population ratio both increased, and the unemployment rate…

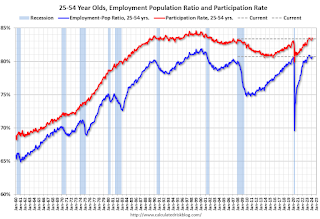

Prime (25 to 54 Years Old) Participation

Since the overall participation rate is impacted by both cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.

The 25 to 54 years old participation rate decreased in March to 83.4% from 83.5% in February, and the 25 to 54 employment population ratio was unchanged at to 80.7% from 80.7% the previous month.

Average Hourly Wages

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees from the Current Employment Statistics (CES).

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees from the Current Employment Statistics (CES). Wage growth has trended down after peaking at 5.9% YoY in March 2022 and was at 4.1% YoY in March.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:"The number of people employed part time for economic reasons, at 4.3 million, changed little in March. These individuals, who would have preferred full-time employment, were working part time because their hours had been reduced or they were unable to find full-time jobs."The number of persons working part time for economic reasons decreased in March to 4.31 million from 4.36 million in February. This is at pre-pandemic levels.

These workers are included in the alternate measure of labor underutilization (U-6) that was unchanged at 7.3% from 7.3% in the previous month. This is down from the record high in April 2020 of 23.0% and up from the lowest level on record (seasonally adjusted) in December 2022 (6.5%). (This series started in 1994). This measure is above the 7.0% level in February 2020 (pre-pandemic).

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 1.246 million workers who have been unemployed for more than 26 weeks and still want a job, up from 1.203 million the previous month.

This is close to pre-pandemic levels.

Job Streak

| Headline Jobs, Top 10 Streaks | ||

|---|---|---|

| Year Ended | Streak, Months | |

| 1 | 2019 | 100 |

| 2 | 1990 | 48 |

| 3 | 2007 | 46 |

| 4 | 1979 | 45 |

| 5 | 20241 | 39 |

| 6 tie | 1943 | 33 |

| 6 tie | 1986 | 33 |

| 6 tie | 2000 | 33 |

| 9 | 1967 | 29 |

| 10 | 1995 | 25 |

| 1Currrent Streak | ||

Summary:

The headline jobs number in the March employment report was above expectations; and January and February payrolls were revised up by 22,000 combined. The participation rate and the employment population ratio both increased, and the unemployment rate decreased to 3.8%. Another strong report.

-

International2 weeks ago

International2 weeks agoParexel CEO to retire; CAR-T maker AffyImmune promotes business leader to chief executive

-

Spread & Containment3 weeks ago

Spread & Containment3 weeks agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

International4 weeks ago

International4 weeks agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

International4 weeks ago

International4 weeks agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized3 days ago

Uncategorized3 days agoVaccinated People Show Long COVID-Like Symptoms With Detectable Spike Proteins: Preprint Study

-

Uncategorized1 month ago

Uncategorized1 month agoEvidence And Insights About Gold’s Long-Term Uptrend

-

Spread & Containment2 weeks ago

Spread & Containment2 weeks agoJapanese Preprint Calls For mRNA VaccinesTo Be Suspended Over Blood Bank Contamination Concerns

-

Spread & Containment2 days ago

Spread & Containment2 days agoOura Ring launches genius new feature to take on Apple Watch