Uncategorized

Comments on March Employment Report

The headline jobs number in the March employment report was above expectations; and January and February payrolls were revised up by 22,000 combined. The participation rate and the employment population ratio both increased, and the unemployment rate…

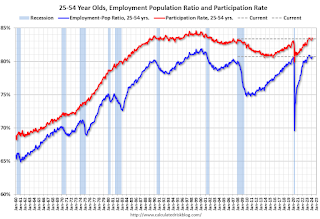

Prime (25 to 54 Years Old) Participation

Since the overall participation rate is impacted by both cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.

The 25 to 54 years old participation rate decreased in March to 83.4% from 83.5% in February, and the 25 to 54 employment population ratio was unchanged at to 80.7% from 80.7% the previous month.

Average Hourly Wages

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees from the Current Employment Statistics (CES).

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees from the Current Employment Statistics (CES). Wage growth has trended down after peaking at 5.9% YoY in March 2022 and was at 4.1% YoY in March.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:"The number of people employed part time for economic reasons, at 4.3 million, changed little in March. These individuals, who would have preferred full-time employment, were working part time because their hours had been reduced or they were unable to find full-time jobs."The number of persons working part time for economic reasons decreased in March to 4.31 million from 4.36 million in February. This is at pre-pandemic levels.

These workers are included in the alternate measure of labor underutilization (U-6) that was unchanged at 7.3% from 7.3% in the previous month. This is down from the record high in April 2020 of 23.0% and up from the lowest level on record (seasonally adjusted) in December 2022 (6.5%). (This series started in 1994). This measure is above the 7.0% level in February 2020 (pre-pandemic).

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 1.246 million workers who have been unemployed for more than 26 weeks and still want a job, up from 1.203 million the previous month.

This is close to pre-pandemic levels.

Job Streak

| Headline Jobs, Top 10 Streaks | ||

|---|---|---|

| Year Ended | Streak, Months | |

| 1 | 2019 | 100 |

| 2 | 1990 | 48 |

| 3 | 2007 | 46 |

| 4 | 1979 | 45 |

| 5 | 20241 | 39 |

| 6 tie | 1943 | 33 |

| 6 tie | 1986 | 33 |

| 6 tie | 2000 | 33 |

| 9 | 1967 | 29 |

| 10 | 1995 | 25 |

| 1Currrent Streak | ||

Summary:

The headline jobs number in the March employment report was above expectations; and January and February payrolls were revised up by 22,000 combined. The participation rate and the employment population ratio both increased, and the unemployment rate decreased to 3.8%. Another strong report.

Uncategorized

Another key telecom firm files Chapter 11 bankruptcy, liquidating

A leading provider solutions for wireless, cable and fixed broadband networks seeks bankruptcy court approvals to sell all of its assets.

Financial distress in the telecommunications industry continues to grow in 2024 after several firms filed for bankruptcy protection last year.

Chapter 11 filings in 2023 included data center colocation, interconnection services and digital infrastructure provider Cyxtera Technologies, 5G wireless and telecom solutions provider QualTek Services, cloud-based data center provider Internap Holding, and licensed fixed wireless technology developer and internet service provider Starry Group.

Related: Troubled wireless technology pioneer files Chapter 11 bankruptcy

Bankruptcy filings are also ramping up in 2024, as Airspan Networks Holdings MIMO on March 31 filed for a prepackaged Chapter 11 bankruptcy in the U.S. Bankruptcy Court for the District of Delaware with a plan to hand majority ownership to its senior secured prepetition lender Fortress Investment Group.

The debtor in the latest telecom bankruptcy, however, might not be as lucky as Airspan.

Casa Systems files bankruptcy to sell all of its assets

Casa Systems (CASA) , a leading provider of physical and cloud-native infrastructure technology solutions for wireless, cable and fixed broadband networks, on April 3 filed for Chapter 11 bankruptcy protection in the U.S. Bankruptcy Court for the District of Delaware, seeking approval of sales of its assets and a plan of liquidation to wind down the company's operations.

The Andover, Mass.-based communications technology company reached a restructuring support agreement with the ad hoc group of holders of the debtor's superpriority term loan claims and sub term loan claims. The debtor also entered into an asset purchase agreement to sell its 5G Mobile Core and RAN businesses, which include its Axyom Cloud Native 5G core software and RAN assets, to Lumine Group, the company said in an April 3 statement.

Lumine Group is a global acquirer of communications and media software businesses.

Casa Systems additionally entered into a stalking-horse asset purchase agreement to sell its cable business to an affiliate of Vecima Networks (VNWTF) , a global leader in delivering scalable software, services, and integrated technology platforms for broadband access and content delivery. The deadline for bids for an auction of the cable assets is May 13, with an auction to be held May 15 if necessary. A sale hearing will be held May 31 to approve a sale with the deal proposed to close June. 6.

Lenders unwilling to provide DIP loan

The debtor's prepetition lenders were unwilling to provide debtor-in-possession financing to fund the Chapter 11 case and also unwilling to allow the debtor to seek DIP financing from a third-party. The Ad Hoc group, however, agreed to allow the debtor to use its cash collateral to fund its Chapter 11 case.

The debtor listed $262.5 million in assets and $315.9 million in total debts in its petition.

Casa Systems faced financial distress caused by shifting market dynamics, customer spending delays, customer losses, the Covid pandemic, substantial debt and the company's inability to meet a liquidity covenant under its superpriority credit agreement in June 2023, forcing it to file bankruptcy, according to a declaration by CFO Edward Durkin filed on April 3.

“Like many in our sector, Casa has experienced a significant decline in revenue and profits due in large part to industry-wide downward capital investment and procurement trends in the cable and telco markets," CEO Michael Glickman said in a statement. "We also have incurred significant investments to bring our 5G Mobile Core and RAN products to market. We believe the sales of our businesses through a Chapter 11 process will maximize value, preserve jobs and minimize disruption for our customers.”

Related: Veteran fund manager picks favorite stocks for 2024

bankruptcy pandemic stocks

Uncategorized

Rural students’ access to Wi-Fi is in jeopardy as pandemic-era resources recede

While the COVID-19 pandemic spurred significant progress in expanding rural home internet access, these gains are proving temporary as resources dwind…

Students in rural America still lack access to high-speed internet at home despite governmental efforts during the pandemic to fill the void. This lack of access negatively affects their academic achievement and overall well-being. The situation has been getting worse as the urgency of the pandemic has receded.

Those findings are based on a new study we did to determine the post-pandemic outlook on internet access for rural students.

During the pandemic, school districts quickly deployed emergency resources such as Wi-Fi hot spots to facilitate remote learning. In rural Michigan, student home internet connectivity soared to 96% by the end of 2021, a remarkable 16 percentage-point increase from 2019.

However, these gains are proving temporary. By 2022, student access in rural Michigan began to decline. Today, many more students are disconnected than during the height of the crisis. The downward trend is likely to continue as resources from pandemic emergency measures diminish

We surveyed students in grades 8-11 from 18 rural Michigan schools before and after the pandemic, tracking changes in their digital access, educational outcomes and well-being. We found that one-third of rural students still lack high-speed broadband internet at home.

Why it matters

Our recent report highlights how rural gaps in access to the internet, mainly the lack of broadband home internet access, were not resolved over the pandemic. And these persistent access gaps could affect students’ digital skills, academic performance and well-being.

Rural students lacking adequate home internet face significant educational disadvantages compared with their better-connected peers. These disadvantages include lower classroom grades, lower standardized test scores, lower educational aspirations and lower interest in STEM careers. Our findings link these adverse outcomes, which start with access gaps, to subsequent gaps in digital skills. These digital skills are less likely to develop without reliable broadband connectivity at home.

In early 2020, schools mobilized state and federal relief to provide students with home internet and laptops. Our study demonstrates the success of these initiatives in rural areas, where school-provided Wi-Fi hot spots accounted for nearly all of the 16 percentage-point increase in home internet access during the pandemic’s peak. Importantly, as hot spot funding has ended, many households maintained access by subscribing to local internet service providers.

The success in transitioning students from school-provided Wi-Fi hot spots to paid subscriptions is now at risk. Many low-income households rely on the Affordable Connectivity Program, the nation’s largest internet affordability initiative, created under the Bipartisan Infrastructure Law of 2021. This program provides a monthly discount of up to US$30 for eligible households and up to $75 for households on Native American tribal lands. The program is set to expire in April 2024.

We found that internet access among rural students had begun to decline in 2022. This trend is likely to accelerate with the end of the Affordable Connectivity Program.

Young people’s time spent online – such as surfing the internet, playing video games and interacting on social media- helps them develop valuable skills. These skills include problem-solving, information literacy and creative expression. These skills apply across both digital and offline environments. Our research shows that digital skills helped rural students maintain their interest in STEM fields and their goals of pursuing college, even as these interests declined during the pandemic.

Additionally, rural adolescents are at a heightened level of risk for social isolation. While adolescent mental health within our study – as measured by self-esteem – returned to pre-pandemic levels, rural students without adequate home internet remain at higher risk.

What still isn’t known

A major challenge in bridging the access divide is pinpointing underserved areas. Accurate maps are crucial to direct billions of dollars in funding from programs such as the Broadband Equity Access and Deployment Program, also known as BEAD, and the Rural Digital Opportunity Fund toward truly underserved communities. As part of the process to receive BEAD funding, each state must identify unserved and underserved homes. Local governments, nonprofit organizations and internet service providers can also develop scientifically rigorous and reliable approaches to challenge the accuracy of these maps.

Maps must be finalized and grants must be made to states before large-scale infrastructure improvements will commence. However, some other early initiatives are now coming online. For example, in 2022, the Quello Center at Michigan State University, in partnership with a regional education network nonprofit, started the Michigan MOON-Light project. Funded with a $10.5 million grant from the Broadband Infrastructure Program, this project increases the bandwidth on Michigan’s education network that is being made available to local service providers. These providers will deliver reliable high-speed internet to 17,000 previously unserved households by the end of 2024.

Still, other major infrastructure improvements across the country will not be realized for several years.

The Research Brief is a short take on interesting academic work.

Keith N. Hampton receives funding from Merit Network, Inc, and The Pew Charitable Trusts.

Gabriel E. Hales does not work for, consult, own shares in or receive funding from any company or organization that would benefit from this article, and has disclosed no relevant affiliations beyond their academic appointment.

grants pandemic linkUncategorized

Yields Are Correct To Assume Jobs Market Has Not Yet Cracked

Yields Are Correct To Assume Jobs Market Has Not Yet Cracked

Authored by Simon White, Bloomberg macro strategist,

The widening gap between…

Authored by Simon White, Bloomberg macro strategist,

The widening gap between household employment and payrolls is causing concern the weaker message from the household survey is the more accurate. However, the reality probably lies somewhere in between, and the jobs market is not yet weak enough to justify significantly lower yields.

Jobs day has come round again and focus will be on the mounting difference between the number of jobs recorded by the household survey and the establishment survey, i.e. payrolls. The household data is looking increasingly weak, prompting speculation we are on the precipice of a jobs market that’s about to crack.

But there are reasons to think the household survey may be stronger than the data currently suggest, and also that payrolls may be weaker. Overall, that would mean the “true” state of the jobs market is somewhere in between the two surveys, i.e. this is a slowing jobs market, but not one that is going to trigger an imminent recession, nor corner the Federal Reserve into making near-term rate cuts.

1) The household survey may not be properly accounting for increased immigration. A recent Brookings paper posits that the survey may be using too a low an estimate for the civilian population. That would bias employment growth lower, and unemployment rates (both national and state) too high if the estimate of the size the workforce is too low.

2) The BLS adjusts the household data to take account of the differences between the two surveys (orange line in the chart above). This series is also showing weakness, leading to speculation that even payrolls data is inherently soft. But the very jobs taken out of the payrolls survey to make the adjustment (agriculture, the unincorporated self-employed, unpaid family workers in family-owned businesses) are among those that are predisposed to having a bias towards immigrants.

3) On the other hand, payrolls – as it tracks jobs rather than employees as with the household survey – is doing more double counting. The number of multiple job holders is at a 30-year high. Payrolls could thus fall more quickly than household employment when the labor-market decisively turns.

4) The birth-death adjustment for payrolls, to account for new and closed businesses, is making an unusually large contribution to the data, adding 2.8 million jobs since March 2022. That has happened at the same time as survey response rates have dropped notably since the pandemic. It’s conceivable the adjustment is flattering payrolls, and it will eventually be revised away.

Today’s data will shed some light (and probably some heat too), but we would need to see a decisive weakening in both surveys to justify a significant turn lower in yields.

-

International2 weeks ago

International2 weeks agoParexel CEO to retire; CAR-T maker AffyImmune promotes business leader to chief executive

-

Spread & Containment3 weeks ago

Spread & Containment3 weeks agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

International4 weeks ago

International4 weeks agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

International4 weeks ago

International4 weeks agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized3 days ago

Uncategorized3 days agoVaccinated People Show Long COVID-Like Symptoms With Detectable Spike Proteins: Preprint Study

-

Uncategorized1 month ago

Uncategorized1 month agoEvidence And Insights About Gold’s Long-Term Uptrend

-

Spread & Containment2 days ago

Spread & Containment2 days agoOura Ring launches genius new feature to take on Apple Watch

-

Spread & Containment2 weeks ago

Spread & Containment2 weeks agoJapanese Preprint Calls For mRNA VaccinesTo Be Suspended Over Blood Bank Contamination Concerns