Retirement Income Planning Truth with Jim Otar. Part 2.

Retirement Income Planning Truth with Jim Otar. Part 2.

In Part 2, we continue our exploration of retirement income planning truth with Jim Otar. We draw from the later chapters of Jim Otar’s new book about retiree income challenges. (Read Part 1 Here)

Luck Is More Than A Four-Letter Word!

Where one retires in a market cycle is the spin of a roulette wheel.

Many investors are convinced the ‘when’ of retirement is a complex concept.

Once comprehensive planning (preferably years before) lays the groundwork, timeframes crystallize, and end dates become less nebulous. As time closes in on the ‘right’ year, month, day, a stir in the retiree’s gut, perhaps considered nature’s timing, motivates action.

Unfortunately, markets don’t always cooperate with holistic financial planning because here, one retires in a stock trend, either a tailwind or headwind, is, unfortunately out of our control.

What are the warning signs of imminent diminishing luck? Jim explains:

Retirees Shouldn’t Ignore The Red Flags Of Retirement Income Planning.

After a portfolio withdrawal rate, luck is the second-largest determinant to portfolio longevity.

Jim identifies several warning signals. One is based on technical analysis, which employs moving-average crossovers. RIA’s investment team incorporates technical analysis. Also, to determine if a poor sequence of returns was experienced at the beginning of retirement, Jim recommends a fourth-year portfolio withdrawal review.

Readers may recall from Part 1 that a poor series of returns early into retirement results in rapid depreciation of capital and subsequently tough to overcome. Our team prefers a three-year analysis of portfolio distributions, which is a year sooner than Jim’s rule; however, the sentiment and concern are the same.

Valuations Ultimately Matter.

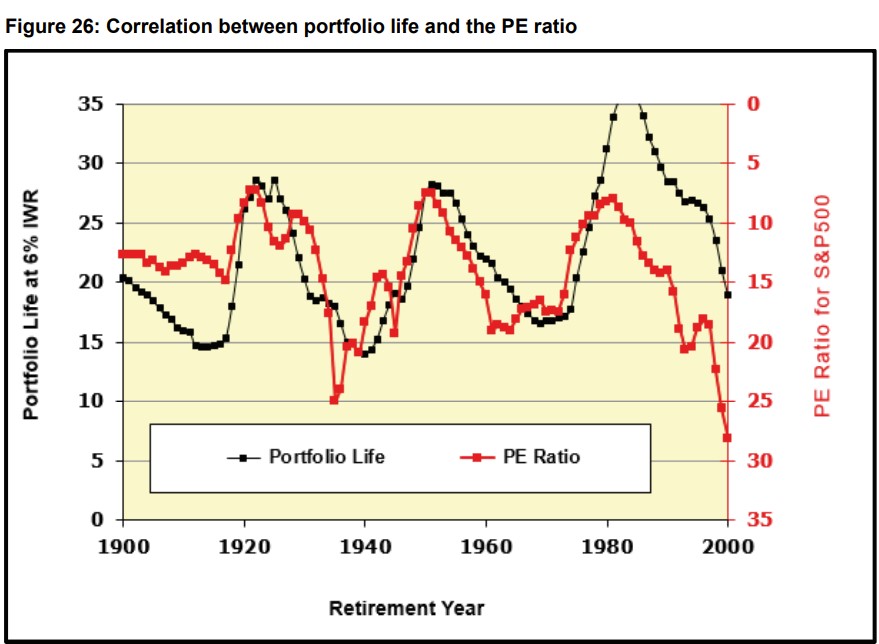

Jim’s number one warning sign is the S&P 500’s price-to-earnings ratio because a strong correlation exists between portfolio life and average market PEs.

In his illustration below, an unsustainable portfolio withdrawal rate (for a 60/40 allocation), such as 6% and lofty PEs do not mix. Generally, the higher the PE, the greater the risk of a shorter portfolio life. In the graph below, Jim uses a 6% portfolio distribution, which may be feasible when PEs are roughly 10X.

However, a 6% withdrawal rate for an extended period is dangerous to portfolio longevity when PEs exceed 10X. Keep in mind, the Shiller PE at the time of this writing is 31X.

So, what should a retiree do in the face of current conditions? Reassess his or her portfolio withdrawal rate as soon as possible!

Jim’s Retirement Guidelines Are as Follows:

- If the IWR (Initial Withdrawal Rate) is larger than 6%, portfolio life will be short;

- However, if the IWR is near sustainable (between 3.5% and 4%), the data is too scattered for a reliable formula to estimate the portfolio life; and

- Assuming the IWR is below sustainable, i.e., under 3.5%, then you have –in effect- an

accumulation portfolio, and it should provide lifelong income.

Again, to stay on track, and remain confident in your distribution strategy, complete a portfolio withdrawal rate checkup every three years.

Sum your cumulative net portfolio gains minus withdrawals, including advisor fees, if applicable. If a surplus exists, which means you’ve experienced more gains than withdrawals, consider an annual pay raise! Work closely with a financial planner to determine specifics and create ‘what-if’ scenarios to test withdrawal-rate parameters.

The Initial Four-Year Checkup.

According to Jim, retirees should review portfolio withdrawals after the initial four-year distribution period to identify a poor early start. He uses four years to match cyclical or shorter-term trends in markets.

To ensure clients remain on track in the face of the ongoing pandemic, we initiate portfolio withdrawal reviews every three years.

Monitor Your PERSONAL Sustainable Withdrawal Rate.

The SWR is the maximum amount of money a retiree may withdraw from a variable asset portfolio for a lifetime with an acceptable risk of depletion. A popular financial ‘rule of thumb’ is the 4% portfolio withdrawal rule.

Recently, some of the most influential academics shed new light on the 4% rule and determined it closer to a 2.4% rule. This development will be an unwelcome surprise to many older Americans who primarily generate retirement paychecks from investment portfolios.

Realistically, this whole SWR thing is an educated guess at best, which is why monitoring is mandatory. Jim suggests every five years or soon after a life-altering event or imminent large expenditure, such as long-term care. At RIA, we stick with the three-year checkup overall. Either way, retirees need to examine their SWRs on a scheduled basis.

Every Client Is Unique

Furthermore, every client is unique. Every retiree household maintains its own SWR. Financial publications depending on their input variables, outline acceptable withdrawal rates from 2-6%. Financial planning Monte Carlo simulations that incorporate historical asset class and market data will most likely allow for overly-optimistic withdrawal rates and ostensibly, nasty surprises later.

It’s a financial professional’s responsibility to study trends, valuations and adjust financial planning software inputs for forward-looking returns so a retiree may deal realistically with the likelihood of lower future SWRs.

Our group examines and uses valuation metrics to adjust asset class returns as warranted. For example, in early 2018, we adjusted downward portfolio returns—a timely decision in hindsight. Today, RIA clients with financial plans are prepared to retire with little inconvenience because we set their spending and lifestyle expectations in the face of future lower portfolio returns.

Also, per Jim, the SWR is based on a specific degree of ‘acceptable’ risk within a given time horizon, but the definition of acceptable varies widely. For example, one academic study allows a 25% failure in their SWR tables. However, that is not an acceptable metric for real life. To deal with the conundrum of ‘acceptable’ risk, Jim examines what goals the money needs to achieve.

Needs, Wants, and Wishes.

Essential expenses are those necessary for survival. They are the needs. The probability of portfolio depletion must be zero for these expenses. Think housing, insurance, taxes, and most of the expenses that keep you and yours alive! What do you think the ‘acceptable’ risk is here? You are correct: Zero.

For basic or lifestyle expenses (wants) such as vacations and additional non-essential spending, Jim’s tenet is the probability of portfolio depletion should not exceed 10%. Discretionary aspirations (wishes) such as donations, multiple vacations, financial assistance to relatives can be considered just as long as needs are 100% assured, and portfolio depletion for ‘wants’ doesn’t exceed 10%.

Jim Suggests Annuities As Lifelines.

When it comes to risk management, annuities hold advantages over variable asset portfolios. Annuities can establish a ‘personalized pension,’ a bolster to Social Security, and a guaranteed income for single and joint lives. Market risk, longevity risk is mitigated, and the peace of mind from never running out of money or turbulence of markets increases.

No need to run stress tests, Monte Carlo simulations for adverse market conditions because lifelong payments are guaranteed regardless of market cycles and portfolio performance.

At RIA, we believe all annuities should be planned, not sold. Comprehensive financial planning must be undertaken first to determine whether a guaranteed income stream is required to complement Social Security.

Specifically, income annuities are solely designed to provide a stream of income now or later that recipients cannot outlive. These annuities are simple to understand and generally lower cost compared to their variable and indexed brethren.

Deferred income products where owners and/or annuitants can wait at least 5 years before withdrawals, may participate in market index gains (subject to caps) and have an opportunity to receive higher non-guaranteed annual income withdrawals depending on market performance.

Withdrawals can never be less than the guaranteed withdrawal benefit established by the insurance company but may be higher depending on annual market returns. As with all annuities, there is never stock market risk. The purest form of annuity is the SPIA. It’s the “Ivory Soap” of insurance products.

Single-Premium Immediate Annuities – “The Pension Replacement.”

SPIAs are splendidly simple – Provide a life insurance company a lump sum, and they pay you or you and a spouse for life. That’s it. I consider SPIAs the best replacement for the pension your company no longer provides. You, as an employee, must create a pension on your own.

The Rationale for Income Annuities In Retirement

There are several valid reasons to allocate a portion of an investment portfolio to an income annuity. I’ll list them in the order of importance:

- Above-average life expectancies. On average, American males live to 76.1 years; females add 5 years to 81.1. If you or you and a spouse have a family history of longevity and enjoy excellent health along with life-prolonging habits like exercise and a healthy diet, a SPIA may be a viable addition to a traditional stock and bond portfolio.

- Retirement plan survival deficiency. Life has a way of altering good financial intentions. If lucky, you have a solid 20 years to save uninterrupted. Along that path may come unexpected life changes like divorce, a major illness, job loss, and let’s not forget the portfolio-busting bear markets or worse. If working longer, saving more, part-time employment in retirement, and smart Social Security decisions don’t dramatically improve the probability of financial plan success, then a SPIA can be purchased to ensure, along with Social Security, your household never runs out of money.

- A legacy intent. Studies indicate that purchasing an inflation-indexed SPIA at retirement reduces portfolio depletion and allows for a larger inheritance for those who believe leaving a legacy to children and grandchildren is an important goal.

Although SPIAs are simple in theory, consumers have difficulty grasping how they provide return or yield. Prospective SPIA owners should swap the word “return” for the concept of payout.

A Simple Illustration.

An investor purchases a high-quality $100,000 bond for five years that pays 2.25% annually. Easy, right? The bond purchaser earns $2,250 every year for five years, then at the end of the period or upon maturity, $100,000 is returned. Obviously, the return is the interest earned.

Consider now $100,000 in a SPIA. Not so easy. A couple provides $100,000 to an insurance company and expects payments to begin the following month. Here, there’s no return per se; there’s a payout rate that distributes principal and interest. From there, the internal rate of return can be calculated. Not to be morbid; however, the insurance company’s best thing is income recipients pass early or within age ranges the life insurance actuaries expect.

The worst that can occur for the organization is that income recipients live long lives. Way beyond the years the mathematics dictate. SPIAs are primarily designed to manage or hedge longevity risk.

Back To My Example

A 65-year-old male and his 62-year-old spouse invest $100,000 in a non-qualified (after-tax) SPIA with an increasing payout option (indexed for inflation at 3% per annum) and will receive every month beginning next month, $291.01. The taxable portion of each payment (interest) will be $80.61, the remainder – a return of principal. Thus, the tax exclusion ratio is 72.3%.

The 12-month income figure is $3,492.12, which makes the annuity payout rate of 3.49%. The internal rate of return or IRR after 21 years is .012%, after 25 years – 1.722%, 30 years – 3.101%. You get the picture. The longer you live, the greater the “return” on an SPIA. The IRR here is negative for 20 years and shorter timeframes.

The SPIA, along with Social Security, generates a combined lifetime income stream, which should permit a lower withdrawal rate from a stock and bond portfolio, especially through sequences of low or poor market returns, thus reducing the risk of portfolio depletion.

The use of a SPIA allows retirees to increase stock allocations, especially if capital isn’t required to be distributed during corrections and bear markets due to the guaranteed income the SPIA provides.

Gary Mettler, the author of the book “Always Keep Your Hands Up!” exclusively about SPIAs, shared his 35-years “in the SPIA business” perspective:

“SPIAs exist to keep you from going broke. While going broke may happen towards the end of life at age 85+, it can happen very early on too. Adverse changes in mental health, business collapse, marriage failure, unreimbursed casualty losses, medical/care costs, litigation expense, etc. you want to make sure you continue to receive an uninterrupted flow of retirement income. After all, at age 60+, you no longer have time to make up for portfolio losses.”

RIA’s Rules or Financial Guardrails for the Purchase of SPIAs:

- Nothing happens without comprehensive planning. A financial plan will expose portfolio longevity concerns that may require the use of income annuities. Working longer, part-time employment, downsizing, boosting savings, and maximizing Social Security may be sufficient to improve portfolio survivability. If not, annuitizing a portion of a portfolio will ensure lifetime income. If there’s a 30% or greater probability of outliving retirement assets, purchasing a SPIA makes sense.

- Think of SPIAs primarily as “longevity insurance.” It can take many years, possibly decades, to exceed your original investment in a SPIA. Living a very long life, 35 years or longer through retirement, makes SPIAs a smart choice. Put your life expectancy to the test at livingto100.com.

- Inflation-adjusted SPIAs vs. fixed SPIAs – When to choose. Fixed SPIAs are not adjusted for inflation. Income remains the same throughout the payout period. So, why would I choose a fixed SPIA over one that accounts for inflation? At a 3% inflation rate, the fixed SPIA provides a 45% larger initial retirement date payout than the inflation-adjusted selection for my retiring couple. In other words, with the fixed SPIA, there’s a greater chance of recovering and exceeding their $100,000 investment in a shorter timeframe when compared to the 21 years required for the inflation-adjusted alternative. Your choice would depend on your: 1). Personal expectations of inflation throughout retirement, 2). Life expectancy assessment. The longer your life expectancy, the greater the benefits of an inflation-adjusted option. Professor Wade Pfau provides back-up to this analysis in his blog post “Efficient Frontiers: Inflation Assumptions, Fixed SPIAs, & Inflation-Adjusted SPIAs.”

Are SPIAs Right For You?

The guidelines provided are designed to illustrate how single-premium immediate annuities can be incorporated into a holistic retirement income strategy.

I hope you gain from the wisdom of Jim Otar because he helped me gain a fresh perspective on retirement income planning.

The post Retirement Income Planning Truth with Jim Otar. Part 2. appeared first on RIA.

Uncategorized

People Who Received Ivermectin Were Better Off, Study Finds

People Who Received Ivermectin Were Better Off, Study Finds

Authored by Zachary Stieber via The Epoch Times (emphasis ours),

People who tested…

Authored by Zachary Stieber via The Epoch Times (emphasis ours),

People who tested positive for COVID-19 and took ivermectin as a treatment recovered faster than a comparison group, a new study found.

The time to self-reported recovery was a median of two days faster among the ivermectin recipients, according to the large UK study.

The quicker recovery period was statistically significant.

People who received ivermectin were also less likely to be hospitalized or die, with 1.6 percent of ivermectin recipients being hospitalized or dying versus 4 percent of the comparison group, which received typical care, which in the UK is largely focused on managing symptoms.

Ivermectin recipients also enjoyed a reduction of severe symptoms and sustained recovery, according to the study.

The paper was published by the Journal of Infection on Feb. 29.

The study covered an open-label trial that involved 2,157 ivermectin recipients and 3,256 who received typical care from June 23, 2021, to July 1, 2022. Participants were randomized and reported symptoms and recovery.

Researchers Say Findings Don’t Support Using Ivermectin

The authors, including Christopher Butler, a University of Oxford professor and joint chief investigator of the trial, downplayed the positive findings in part because the hazard ratio of 1.14 was lower than what authors pre-specified as a meaningful ratio, or 1.2. Hazard ratios are a way to determine whether a treatment is beneficial.

The authors also focused on the lack of differences in the number of days participants felt sick in the previous two weeks, impact on work, and likelihood of using the health care system at 3, 6, and 12 months following treatment.

“Overall, these findings, while evidencing a small benefit in symptom duration, do not support the use of ivermectin as treatment for COVID-19 in the community among a largely vaccinated population at the dose and duration we used,” the authors said.

Funding for the research came from the UK government.

Conflicts of interest included one researcher receiving grants from pharmaceutical companies, including AstraZeneca, and other authors receiving grants from the University of Oxford.

The trial, known as PRINCIPLE, was touted by investigators as “the world’s largest clinical trial of possible COVID-19 treatments for recovery at home and in other non-hospital settings.”

“Ivermectin is readily available globally, has been in wide use for many other infectious conditions so it’s a well-known medicine with a good safety profile, and because of the early promising results in some studies it is already being widely used to treat COVID-19 in several countries,” Dr. Christopher Butler, a University of Oxford professor and joint chief investigator of the trial, said when it was announced ivermectin would be assessed. “By including ivermectin in a large-scale trial like PRINCIPLE, we hope to generate robust evidence to determine how effective the treatment is against COVID-19, and whether there are benefits or harms associated with its use.”

Doctors Weigh In

Dr. Pierre Kory, an American physician who was not involved in the trial, said that the authors wrongly downplayed how ivermectin improved recovery from COVID-19.

“PRINCIPLE was a profoundly positive study that was instead analyzed and written up as a negative one,” Dr. Kory, who has long promoted ivermectin as a COVID-19 treatment, wrote in an essay.

He accused the authors of undertaking “statistical chicanery” by coming up with the pre-specified hazard ratio (HR), noting that no such level was used in other parts of the PRINCIPLE trial.

“A hazard ratio does not need a pre-specified level. If the HR is > 1.0, and it is statistically significant, it is a robust finding,” he said.

The positive findings should also be interpreted in the context of recipients only receiving one dose per day across three days and being directed not to eat food before ivermectin, Dr. Kory said.

Dr. Butler and his co-authors said “no food should be taken two hours before or after administration” despite previous research finding that taking ivermectin with food increases plasma concentration.

Participants also received ivermectin a median of five days after symptom onset, a period of time considered by some to be too late to have much of an impact. Ivermectin works best when applied within 24 hours of symptom manifestation, according to a meta-regression of ivermectin studies.

Dr. Butler did not respond to a request for comment.

There have been additional studies that found ivermectin worked against COVID-19. The drug, commonly used for purposes such as combating malaria, has divided scientists since 2020, when doctors around the world began using it to treat COVID-19.

Some other research, including a U.S. trial, has found that ivermectin did not improve time to recovery.

Dr. David Boulware, another American doctor, who helped run that trial, argued on X that the faster recovery recorded in the UK trial was similar to the quicker recovery reported in an open-label trial of molnupiravir, an antiviral sometimes used to treat COVID-19.

“Molnupiravir also had a 2 day faster improvement in symptoms over ‘usual care’ yet no benefit existed in double-blind trial,” Dr. Boulware said on X. “Placebo effect influences self-reported symptoms.”

Uncategorized

COVID-19 May Lead To Persistent Cognitive Impairment, Brain Fog, And Lower IQ Scores

COVID-19 May Lead To Persistent Cognitive Impairment, Brain Fog, And Lower IQ Scores

Authored by Megan Redshaw via The Epoch Times (emphasis…

Authored by Megan Redshaw via The Epoch Times (emphasis ours),

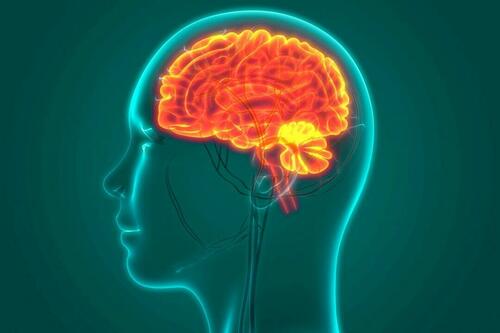

A new study found that COVID-19 infection can cause cognitive deficits that persist for over a year and lower IQ scores in severe cases. Those with persistent symptoms that resolved had small cognitive deficits similar to those with a shorter illness duration.

In a large-scale observational study published on Feb. 29 in the New England Journal of Medicine (NEJM), researchers invited 800,000 people with varying levels of COVID-19 exposure and duration to take an online cognitive assessment and follow-up survey. Cognitive difficulties have been implicated in numerous syndromes following COVID-19, including long COVID, suggesting infection may have lasting effects on the mental processes of the brain.

The study’s authors hypothesized there would be measurable cognitive deficits after COVID-19 that would scale with the severity and duration of the illness. They also speculated that objective impairments in executive and memory function, especially poor memory and brain fog, would be observable in those with persistent symptoms.

Using an assessment tool for cognitive function, researchers estimated global cognitive scores among participants with a history of previous SARS-CoV-2 infection who had symptoms for at least 12 weeks—whether resolved or not—and among a control group of uninfected participants. While cognitive and memory deficits were small for people with mild infection who recovered from COVID-19 quickly, impairments were more pronounced in those with severe disease.

Greater Impairment With More Severe Disease

Of 112,964 participants who completed the survey, those who recovered from COVID-19 with symptoms that resolved in less than four weeks or by 12 weeks post-infection had similar small deficits in global cognition compared with those who had never had COVID-19.

Participants who had mild COVID-19 with resolved symptoms experienced a 3-point drop in IQ compared to uninfected participants. Those with unresolved persistent symptoms had a 6-point loss in IQ, and those with COVID-19 admitted to the intensive care unit experienced a 9-point loss in IQ. Reinfection with SARS-CoV-2 caused an additional loss in IQ of nearly 2 points compared to those who were not reinfected. An IQ, or intelligence quotient, is a number used to represent the relative intelligence of an individual.

According to the study, memory, reasoning, and executive function tasks were the strongest indicators of impaired cognitive function, and these scores correlated with brain fog symptoms reported by participants. More significant deficits were seen in those with unresolved persistent symptoms and those infected with earlier variants of the SARS-CoV-2 virus compared with those who never had COVID-19. Additionally, study participants who were hospitalized had greater deficits in cognitive function compared to those who were not hospitalized.

“By using an innovative cognitive test which has also been completed by people who did not have COVID-19, this important and well-conducted study provides the first accurate quantification of the scale of cognitive deficits in people who had COVID-19,” Maxime Taquet, a fellow in psychiatry at the National Institute for Health and Care Research at the University of Oxford, said in a statement.

Mr. Taquet said researchers found a small but obvious association between COVID-19 and cognition that was more pronounced at extremes.

“The risk of having more severe cognitive problems was almost twice as high in those who had COVID-19 compared to those who did not, and three times as high in those who were hospitalized with COVID-19,” he noted.

In an editorial published Feb. 29 in the NEJM, Drs. Ziyad Al-Aly and Clifford Rosen said the study’s results are concerning and have broad implications that require further evaluation to determine the functional impact of a 3-point loss in IQ and why one group of participants was more severely affected than another.

“Whether these cognitive deficits persist or resolve along with predictors and trajectory of recovery should be investigated. Will Covid-19-associated cognitive deficits confer a predisposition to a higher risk of Alzheimer’s disease or other forms of dementia later in life? The effects on educational attainment, work performance, accidental injury, and other activities that require intact cognitive abilities should also be evaluated,” they wrote.

Study Implications for People With Long COVID

The study’s participants were part of a larger community sample of nearly 3 million people in the Real-time Assessment of Community Transmission (REACT) study assessing SARS-CoV-2 transmission in England. Although the researchers did not say whether participants in the study had long COVID, people with long COVID frequently report persistent cognitive impairment.

There is no accepted universal definition for the condition, but the Centers for Disease Control and Prevention (CDC) broadly defines long COVID as “signs, symptoms, and conditions that continue to develop after acute COVID-19 infection” that can last for “weeks, months, or years.” The term “long COVID” also includes post-acute sequelae of SARS-CoV-2 infection, long-haul COVID, and post-acute COVID-19.

Nearly 7 percent of U.S. adults surveyed by the CDC in 2022 said they’ve experienced long COVID. Although U.S. regulatory agencies claim vaccinating against COVID-19 can reduce the risk of developing long COVID and the current paper suggests vaccination with two or more doses may provide a slight cognitive advantage, a recent paper published in the Journal of Clinical Medicine did not find a significant link between the presence of comorbidities or infection severity and the emergence of long COVID symptoms.

The NEJM study has several limitations, including reliance on subjective reporting to identify individuals with ongoing symptoms and self-selection bias. People with long COVID may have enrolled in the study, but those with more severe impairments may not have been able to participate in the survey. Additionally, certain groups were overrepresented in the study compared with the base population. Baseline cognitive data before SARS-CoV-2 infection was also unavailable, so researchers could not assess cognitive change or infer causality.

Uncategorized

Watch: President Biden Delivers The “Darkest, Most Un-American Speech Given By A President”

Watch: President Biden Delivers The "Darkest, Most Un-American Speech Given By A President"

Having successfully raged, ranted, lied, and yelled…

Having successfully raged, ranted, lied, and yelled through the State of The Union, President Biden can go back to his crypt now.

Whatever 'they' gave Biden, every American man, woman, and the other should be allowed to take it - though it seems the cocktail brings out 'dark Brandon'?

Tl;dw: Biden's Speech tonight ...

-

Fund Ukraine.

-

Trump is threat to democracy and America itself.

-

Abortion is good.

-

American Economy is stronger than ever.

-

Inflation wasn't Biden's fault.

-

Illegals are Americans too.

-

Republicans are responsible for the border crisis.

-

Trump is bad.

-

Biden stands with trans-children.

-

J6 was the worst insurrection since the Civil War.

(h/t @TCDMS99)

Tucker Carlson's response sums it all up perfectly:

"that was possibly the darkest, most un-American speech given by an American president. It wasn't a speech, it was a rant..."

Carlson continued: "The true measure of a nation's greatness lies within its capacity to control borders, yet Bid refuses to do it."

"In a fair election, Joe Biden cannot win"

And concluded:

“There was not a meaningful word for the entire duration about the things that actually matter to people who live here.”

Victor Davis Hanson added some excellent color, but this was probably the best line on Biden:

"he doesn't care... he lives in an alternative reality."

— Tucker Carlson (@TuckerCarlson) March 8, 2024

* * *

Watch SOTU Live here...

* * *

Mises' Connor O'Keeffe, warns: "Be on the Lookout for These Lies in Biden's State of the Union Address."

On Thursday evening, President Joe Biden is set to give his third State of the Union address. The political press has been buzzing with speculation over what the president will say. That speculation, however, is focused more on how Biden will perform, and which issues he will prioritize. Much of the speech is expected to be familiar.

The story Biden will tell about what he has done as president and where the country finds itself as a result will be the same dishonest story he's been telling since at least the summer.

He'll cite government statistics to say the economy is growing, unemployment is low, and inflation is down.

Something that has been frustrating Biden, his team, and his allies in the media is that the American people do not feel as economically well off as the official data says they are. Despite what the White House and establishment-friendly journalists say, the problem lies with the data, not the American people's ability to perceive their own well-being.

As I wrote back in January, the reason for the discrepancy is the lack of distinction made between private economic activity and government spending in the most frequently cited economic indicators. There is an important difference between the two:

-

Government, unlike any other entity in the economy, can simply take money and resources from others to spend on things and hire people. Whether or not the spending brings people value is irrelevant

-

It's the private sector that's responsible for producing goods and services that actually meet people's needs and wants. So, the private components of the economy have the most significant effect on people's economic well-being.

Recently, government spending and hiring has accounted for a larger than normal share of both economic activity and employment. This means the government is propping up these traditional measures, making the economy appear better than it actually is. Also, many of the jobs Biden and his allies take credit for creating will quickly go away once it becomes clear that consumers don't actually want whatever the government encouraged these companies to produce.

On top of all that, the administration is dealing with the consequences of their chosen inflation rhetoric.

Since its peak in the summer of 2022, the president's team has talked about inflation "coming back down," which can easily give the impression that it's prices that will eventually come back down.

But that's not what that phrase means. It would be more honest to say that price increases are slowing down.

Americans are finally waking up to the fact that the cost of living will not return to prepandemic levels, and they're not happy about it.

The president has made some clumsy attempts at damage control, such as a Super Bowl Sunday video attacking food companies for "shrinkflation"—selling smaller portions at the same price instead of simply raising prices.

In his speech Thursday, Biden is expected to play up his desire to crack down on the "corporate greed" he's blaming for high prices.

In the name of "bringing down costs for Americans," the administration wants to implement targeted price ceilings - something anyone who has taken even a single economics class could tell you does more harm than good. Biden would never place the blame for the dramatic price increases we've experienced during his term where it actually belongs—on all the government spending that he and President Donald Trump oversaw during the pandemic, funded by the creation of $6 trillion out of thin air - because that kind of spending is precisely what he hopes to kick back up in a second term.

If reelected, the president wants to "revive" parts of his so-called Build Back Better agenda, which he tried and failed to pass in his first year. That would bring a significant expansion of domestic spending. And Biden remains committed to the idea that Americans must be forced to continue funding the war in Ukraine. That's another topic Biden is expected to highlight in the State of the Union, likely accompanied by the lie that Ukraine spending is good for the American economy. It isn't.

It's not possible to predict all the ways President Biden will exaggerate, mislead, and outright lie in his speech on Thursday. But we can be sure of two things. The "state of the Union" is not as strong as Biden will say it is. And his policy ambitions risk making it much worse.

* * *

The American people will be tuning in on their smartphones, laptops, and televisions on Thursday evening to see if 'sloppy joe' 81-year-old President Joe Biden can coherently put together more than two sentences (even with a teleprompter) as he gives his third State of the Union in front of a divided Congress.

President Biden will speak on various topics to convince voters why he shouldn't be sent to a retirement home.

The state of our union under President Biden: three years of decline. pic.twitter.com/Da1KOIb3eR

— Speaker Mike Johnson (@SpeakerJohnson) March 7, 2024

According to CNN sources, here are some of the topics Biden will discuss tonight:

Economic issues: Biden and his team have been drafting a speech heavy on economic populism, aides said, with calls for higher taxes on corporations and the wealthy – an attempt to draw a sharp contrast with Republicans and their likely presidential nominee, Donald Trump.

Health care expenses: Biden will also push for lowering health care costs and discuss his efforts to go after drug manufacturers to lower the cost of prescription medications — all issues his advisers believe can help buoy what have been sagging economic approval ratings.

Israel's war with Hamas: Also looming large over Biden's primetime address is the ongoing Israel-Hamas war, which has consumed much of the president's time and attention over the past few months. The president's top national security advisers have been working around the clock to try to finalize a ceasefire-hostages release deal by Ramadan, the Muslim holy month that begins next week.

An argument for reelection: Aides view Thursday's speech as a critical opportunity for the president to tout his accomplishments in office and lay out his plans for another four years in the nation's top job. Even though viewership has declined over the years, the yearly speech reliably draws tens of millions of households.

Sources provided more color on Biden's SOTU address:

The speech is expected to be heavy on economic populism. The president will talk about raising taxes on corporations and the wealthy. He'll highlight efforts to cut costs for the American people, including pushing Congress to help make prescription drugs more affordable.

Biden will talk about the need to preserve democracy and freedom, a cornerstone of his re-election bid. That includes protecting and bolstering reproductive rights, an issue Democrats believe will energize voters in November. Biden is also expected to promote his unity agenda, a key feature of each of his addresses to Congress while in office.

Biden is also expected to give remarks on border security while the invasion of illegals has become one of the most heated topics among American voters. A majority of voters are frustrated with radical progressives in the White House facilitating the illegal migrant invasion.

It is probable that the president will attribute the failure of the Senate border bill to the Republicans, a claim many voters view as unfounded. This is because the White House has the option to issue an executive order to restore border security, yet opts not to do so

Maybe this is why?

Most Americans are still unaware that the census counts ALL people, including illegal immigrants, for deciding how many House seats each state gets!

— Elon Musk (@elonmusk) March 7, 2024

This results in Dem states getting roughly 20 more House seats, which is another strong incentive for them not to deport illegals.

While Biden addresses the nation, the Biden administration will be armed with a social media team to pump propaganda to at least 100 million Americans.

"The White House hosted about 70 creators, digital publishers, and influencers across three separate events" on Wednesday and Thursday, a White House official told CNN.

Not a very capable social media team...

The State of Confusion https://t.co/C31mHc5ABJ

— zerohedge (@zerohedge) March 7, 2024

The administration's move to ramp up social media operations comes as users on X are mostly free from government censorship with Elon Musk at the helm. This infuriates Democrats, who can no longer censor their political enemies on X.

Meanwhile, Democratic lawmakers tell Axios that the president's SOTU performance will be critical as he tries to dispel voter concerns about his elderly age. The address reached as many as 27 million people in 2023.

"We are all nervous," said one House Democrat, citing concerns about the president's "ability to speak without blowing things."

The SOTU address comes as Biden's polling data is in the dumps.

BetOnline has created several money-making opportunities for gamblers tonight, such as betting on what word Biden mentions the most.

As well as...

We will update you when Tucker Carlson's live feed of SOTU is published.

Fuck it. We’ll do it live! Thursday night, March 7, our live response to Joe Biden’s State of the Union speech. pic.twitter.com/V0UwOrgKvz

— Tucker Carlson (@TuckerCarlson) March 6, 2024

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoIndustrial Production Decreased 0.1% in January

-

International1 month ago

International1 month agoWar Delirium

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges