Uncategorized

Private Equity Leaders Converge in Bozeman as Ecommerce Shows a Bright Spot in Economy

Private Equity Leaders Converge in Bozeman as Ecommerce Shows a Bright Spot in Economy

PR Newswire

BOZEMAN, Mont., Oct. 18, 2022

Private equity leaders were invited to an event to explore emerging opportunities in ecommerce despite economic headwin…

Private Equity Leaders Converge in Bozeman as Ecommerce Shows a Bright Spot in Economy

PR Newswire

BOZEMAN, Mont., Oct. 18, 2022

Private equity leaders were invited to an event to explore emerging opportunities in ecommerce despite economic headwinds as the sector shows no sign of slowing down.

BOZEMAN, Mont., Oct. 18, 2022 /PRNewswire/ -- Tadpull, the ecommerce service and software solution that is helping brands grow and produce predictable results for private equity investors using data science, presented a new event alongside BigCommerce titled Mountains, Capital, and Commerce. Additional sponsors included Canaccord Genuity, ZaneRay Group, Klaviyo, and Bolt. This event, one of the first of its kind, was specifically curated for private equity leaders and investment bankers involved in acquiring and exiting ecommerce businesses.

Recent data from the Federal Reserve shows ecommerce continuing its post-pandemic growth of 7% year over year despite economic headwinds. In 20 years, the ecommerce space has experienced positive growth across almost every recession. In light of this trend, the conference showcased the keys to identifying high potential investments in the ecommerce space and how successful private equity leaders backed exits from various ecommerce CEOs.

Attendees were able to learn firsthand from Tadpull leadership and partners who are experts in due diligence and value creation in this emerging niche.

World-renowned marketing leader, Dr. Peter Fader of The Wharton School and co-founder of Theta, a leading predictive customer value analytics company, shared insights from his recent research that focuses on the use of customer behavioral data to drive more accurate company valuations. This emerging but widely recognized modeling approach, called Customer Based Corporate Valuation (CBCV), is the process of valuing a company from "the bottom up" by forecasting customer acquisition, retention, repeat purchasing, and spending in conjunction with traditional financial data. Dr. Fader shared how the CBCV model enables private equity firms to leverage deeper customer insights to better identify and leverage sources of value through every stage of the investment process.

"At Theta, we've honed a variety of analytical methods that can help investors make tough decisions on where to deploy capital by shedding light on inherent risks to growth and illuminating opportunities to create value,'' said Fader. "Having partners like Tadpull who can help companies act on these findings for value creation in ecommerce is truly exciting."

Robert Alvarez, CFO of BigCommerce discussed how their emerging SaaS architectures are not only lowering cost of ownership but also providing brands the tools to build remarkable digital experiences at a fraction of the cost from traditional workflows thus allowing private equity investors to see quicker returns all the while lowering capital and operational expenses.

"Headless commerce means PE investors can modernize and scale remarkable B2C and B2B ecommerce businesses faster and for much less than legacy proprietary systems, which is obviously good news to any investor," said Alvarez. "However, achieving this vision requires a diverse team of true ecommerce experts, and we're excited to see BigCommerce trusted partners like Tadpull and ZaneRay leading this conversation in the private equity space."

Prior to the conference, attendees participated in a survey that resulted in new data specific to what investors are interested in and looking to learn more about in the ecommerce industry. The results from the survey are as follows:

- 75% of respondents were interested in benchmarks for top performing digital properties

- 61% were interested in frameworks for creating digital business flywheels

- 52% were interested in CEO perspectives for successful partnerships and technology stacks for eCommerce and lowering costs

Additional topics of interest included hidden variables in value creation for eCommerce exits and emerging trends for acquiring traffic to a site across paid, SEO, email/SMS, and influencers.

The conference created a dialogue on the latest trends and methods that have been shown to build resilient ecommerce properties despite the recent upheavals of Apple's tracking policies and the fallout from Meta's ad platforms. Remarkable success stories highlighted the opportunities during a downturn economy around managing diverse digital campaigns while also using predictive analytics to tackle inventory glut. This trend, once implemented, has resulted in significant growth across business sectors for boosting returning customer rates and operating cash flows.

The conference has proved the critical value Tadpull and its partners bring to the ecommerce community by providing top-tier equity leaders the ability to share data that simply cannot be obtained anywhere else, while also showcasing frameworks and AI insights that will help grow businesses of any size.

Co-founder, and CEO of Tadpull, Jake Cook, says, "We're still in the early innings of ecommerce and much of the private equity playbook is being written as we speak. While the opportunity for investors and companies is enormous it does require brands to harness a variety of datasets and execute flawlessly in light of increasing competition to achieve great returns. Tadpull is honored to help host these types of conversations with our fantastic partner ecosystem and private equity clients."

For more information on how Tadpull can help identify data opportunities in your ecommerce business, or help guide future strategic investing efforts within the ecommerce space, please visit www.tadpull.com.

About Tadpull

Tadpull was founded by data scientists and marketing professors Jake and Eulalie Cook, Ph.D. in 2013. For nearly a decade now, they have been creating and perfecting a proprietary software aptly named The Ecommerce Data Pond. This software is designed exclusively to serve mid-market companies, providing them with the same AI tools and domain expertise that the big tech firms have at their fingertips while reducing and even eliminating the dependency on third-party players.

View original content to download multimedia:https://www.prnewswire.com/news-releases/private-equity-leaders-converge-in-bozeman-as-ecommerce-shows-a-bright-spot-in-economy-301652343.html

SOURCE Tadpull LLC

Uncategorized

Signs of a thaw in the frozen existing homes market, but a very long way to go

– by New Deal democratThere’s no big economic news today, but yesterday existing home sales were released. While they have historically constituted…

- by New Deal democrat

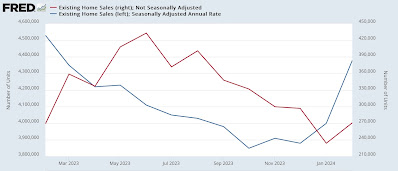

There’s no big economic news today, but yesterday existing home sales were released. While they have historically constituted up to 90% of the entire market, they have much less economic impact than new home sales, which involve all sorts of construction activity, followed by landscaping, furnishings, and other sales.

Uncategorized

Retirement Crisis Faces Government And Corporate Pensions

It is long past the time that we face the fact that "Social Security" is facing a retirement crisis. In June 2022, we touched on this issue, discussing…

It is long past the time that we face the fact that “Social Security” is facing a retirement crisis. In June 2022, we touched on this issue, discussing the stark realities confronting Social Security.

“The program’s payouts have exceeded revenue since 2010, but the recent past is nowhere near as grim as the future. According to the latest annual report by Social Security’s trustees, the gap between promised benefits and future payroll tax revenue has reached a staggering $59.8 trillion. That gap is $6.8 trillion larger than it was just one year earlier. The biggest driver of that move wasn’t Covid-19, but rather a lowering of expected fertility over the coming decades.” – Stark Realities

Note the last sentence.

When President Roosevelt first enacted social security in 1935, the intention was to serve as a safety net for older adults. However, at that time, life expectancy was roughly 60 years. Therefore, the expectation was that participants would not be drawing on social security for very long on an actuarial basis. Furthermore, according to the Social Security Administration, roughly 42 workers contributed to the funding pool for each welfare recipient in 1940.

Of course, given that politicians like to use government coffers to buy votes, additional amendments were added to Social Security to expand participation in the program. This included adding domestic labor in 1950 and widows and orphans in 1956. They lowered the retirement age to 62 in 1961 and increased benefits in 1972. Then politicians added more beneficiaries, from disabled people to immigrants, farmers, railroad workers, firefighters, ministers, federal, state, and local government employees, etc.

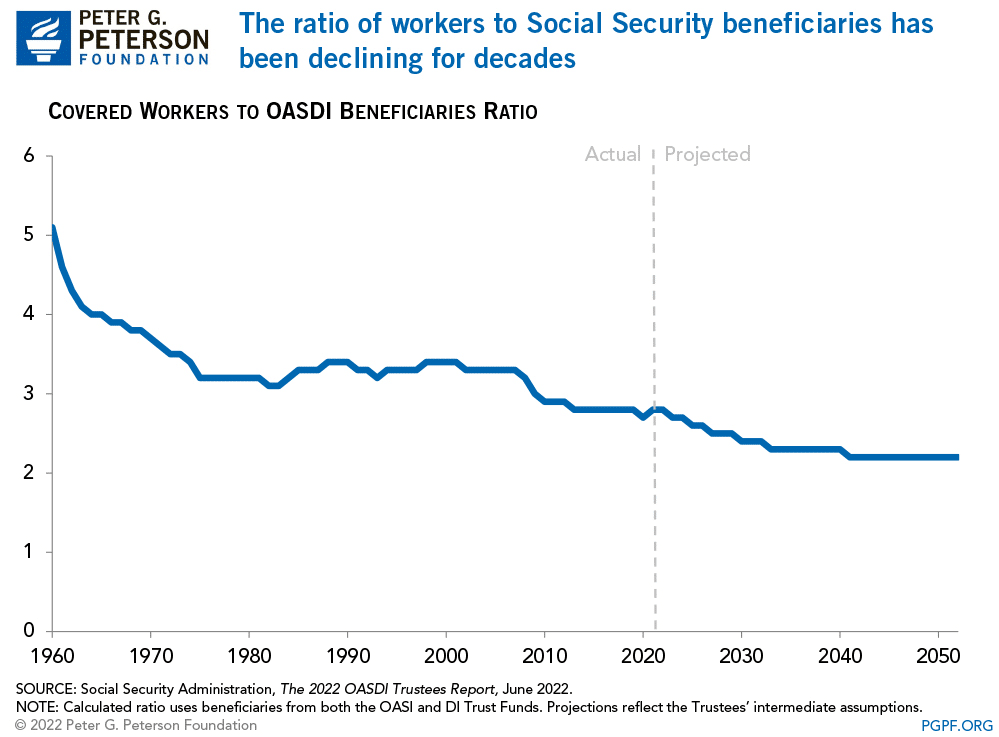

While politicians and voters continued adding more beneficiaries to the welfare program, workers steadily declined. Today, there are barely 2-workers for each beneficiary. As noted by the Peter G. Peterson Foundation:

“Social Security has been a cornerstone of economic security for almost 90 years, but the program is on unsound footing. Social Security’s combined trust funds are projected to be depleted by 2035 — just 13 years from now. A major contributor to the unsustainability of the current Social Security program is that the number of workers contributing to the program is growing more slowly than the number of beneficiaries receiving monthly payments. In 1960, there were 5.1 workers per beneficiary; that ratio has dropped to 2.8 today.”

As we will discuss, the collision of demographics and math is coming to the welfare system.

A Massive Shortfall

The new Financial Report of the United States Government (February 2024) estimates that the financial position of Social Security and Medicare are underfunded by roughly $175 Trillion. Treasury Secretary Janet Yellin signed the report, but the chart below details the problem.

The obvious problem is that the welfare system’s liabilities massively outweigh taxpayers’ ability to fund it. To put this into context, as of Q4-2023, the GDP of the United States was just $22.6 trillion. In that same period, total federal revenues were roughly $4.8 trillion. In other words, if we applied 100% of all federal revenues to Social Security and Medicare, it would take 36.5 years to fill the gap. Of course, that is assuming that nothing changes.

However, therein lies the actuarial problem.

All pension plans, whether corporate or governmental, rely on certain assumptions to plan for future obligations. Corporate pensions, for example, rely on certain portfolio return assumptions to fund planned employee retirements. Most pension plans assume that portfolios will return 7% a year. However, a vast difference exists between “average returns” and “compound returns” as shown.

Social Security, Medicare, and corporate pension plans face a retirement crisis. A shortfall arises if contributions and returns don’t meet expectations or demand increases on the plans.

For example, given real-world return assumptions, pension funds SHOULD lower their return estimates to roughly 3-4% to potentially meet future obligations and maintain some solvency. However, they can’t make such reforms because “plan participants” won’t let them. Why? Because:

- It would require a 30-40% increase in contributions by plan participants they can not afford.

- Given many plan participants will retire LONG before 2060, there isn’t enough time to solve the issues and;

- Any bear market will further impede the pension plan’s ability to meet future obligations without cutting future benefits.

Social Security and Medicare face the same intractable problem. While there is ample warning from the Trustees that there are funding shortfalls to the plans, politicians refuse to make the needed changes and instead keep adding more participants to the rolls.

However, all current actuarial forecasts depend on a steady and predictable pace of age and retirement. But that is not what is currently happening.

A Retirement Crisis In The Making

The single biggest threat that faces all pension plans is demographics. That single issue can not be fixed as it takes roughly 25 years to grow a taxpayer. So, even if we passed laws today that required all women of birthing age to have a minimum of 4 children over the next 5 years, we would not see any impact for nearly 30 years. However, the problem is running in reverse as fertility rates continue to decline.

Interestingly, researchers from the Center For Sexual Health at Indiana University put forth some hypotheses behind the decline in sexual activity:

- Less alcohol consumption (not spending time in bars/restaurants)

- More time on social media and playing video games

- Lower wages lead to lower rates of romantic relationships

- Non-heterosexual identities

The apparent problem with less sex and non-heterosexual identities is fewer births.

No matter how you calculate the numbers, the problem remains the same. Too many obligations and a demographic crisis. As noted by official OECD estimates, the aging of the population relative to the working-age population has already crossed the “point of no return.”

To compound that situation, there has been a surge in retirees significantly higher than estimates. As noted above, actuarial tables depend on an expected rate of retirees drawing from the system. If that number exceeds those estimates, a funding shortfall increases to provide the required benefits.

The decline in economic prosperity discussed previously is caused by excessive debt and declining income growth due to productivity increases. Furthermore, the shift from manufacturing to a service-based society will continue to lead to reduced taxable incomes.

This employment problem is critical.

By 2025, each married couple will pay Social Security retirement benefits for one retiree and their own family’s expenses. Therefore, taxes must rise, and other government services must be cut.

Back in 1966, each employee shouldered $555 of social benefits. Today, each employee has to support more than $18,000 in benefits. The trend is unsustainable unless wages or employment increases dramatically, and based on current trends, such seems unlikely.

The entire social support framework faces an inevitable conclusion where wishful thinking will not change that outcome. The question is whether elected leaders will make needed changes now or later when they are forced upon us.

For now, we continue to “Whistle past the graveyard” of a retirement crisis.

The post Retirement Crisis Faces Government And Corporate Pensions appeared first on RIA.

gdp covid-19Uncategorized

After 625 Days, The Longest Yield Curve Inversion In History

After 625 Days, The Longest Yield Curve Inversion In History

Today is a historic day, as last night – DB’s Jim Reid reminds us – we quietly…

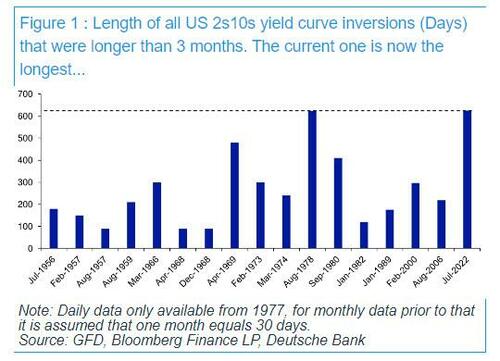

Today is a historic day, as last night - DB's Jim Reid reminds us - we quietly passed the longest continuous US 2s10s inversion in history. After the 2s10s first inverted at the end of March 2022, it has now been continuously inverted for 625 days since July 5th 2022. That exceeds the 624 day inversion from August 1978, which previously held the record.

As regular readers are aware, an inverted yield curve has been the best predictor of a US downturn of any variable through history: the yield curve has always inverted before all of the last 10 US recessions, with a lag that is usually 12-18 months, but some cycles - certainly this one - take longer.... much longer.

In fact, the lack of a recession so far has prompted Red to ask - in his latest Chart of the Day note - if the inverted yield curve recession indicator has failed this cycle?

"Possibly", the DB strategist responds, "but in many ways the yield curve has already accurately predicted many of the drivers that would normally lead to a recession. However, these variables haven't then created recessionary conditions as they normally would have done." He explains:

It led, as it always does, the very sharp deterioration in bank lending standards, and led the declines in bank credit and money supply that are almost unique to this cycle. It was also at the heart of why we had some of the largest bank failures on record with SVB, Signature Bank and First Republic collapsing. A significant part of their failure was a big carry trade that went wrong when the curve inverted.

However, even with the above, a recession - according to the highly political "recession authority" known as the NBER - hasn't materialised. This is perhaps because of the following.

- When lending standards were at their tightest, the borrowing needs of the economy were low relative to previous cycles.

- Excess savings have been unusually high in this cycle (and were revised higher with the GDP revisions last September), so consumers haven't been as exposed to tight credit as they normally are.

- The Fed unveiled a huge series of measures to ensure the regional bank crisis didn't naturally unravel as it would have done in a free market or perhaps in many previous cycles.

- Whilst the Fed’s tightening has been reducing demand, the supply-side of the economy has bounced back strongly from the pandemic disruption, which has further supported growth and made this cycle unique.

So far so good, however, an inverted yield curve should ultimately be a significant headwind for an economy, as capitalism works best when there is a positive return for taking more risk with lending and investments further out the curve. As such, Reid notes, "the rational investor should be prepared to keep more of their money at the front end, or not lend long-term when the curve is inverted" as you are not giving up yield for being able to sleep at night.

So thanks to a historic flood of fiscal stimulus and a daily orgy of new record debt as discussed earlier...

... which means that the US is now running a 6.5% deficit with unemployment near "historical lows", an unheard of event....

... the economy has not succumbed to the inverted yield curve to date, but while it remains inverted the Fed is encouraging more defensive behavior at some point if sentiment changes. As such, the DB strategist concludes that "the quicker we get back to a normal sloping yield curve the safer the system is."

-

Spread & Containment1 week ago

Spread & Containment1 week agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International2 weeks ago

International2 weeks agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized1 month ago

Uncategorized1 month agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

International2 weeks ago

International2 weeks agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized1 month ago

Uncategorized1 month agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized1 month ago

Uncategorized1 month agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges