Uncategorized

Popular fast-food chain files Chapter 11 bankruptcy; faces lawsuits

A stack of legal problems has pushed a popular fast-food restaurant chain to file Chapter 11 bankruptcy.

The restaurant industry continues navigating through the aftermath of the Covid-19 pandemic, as many fast-food and fast-casual chains battle financial distress related to reduced foot traffic, as well as inflated food prices and rising interest rates.

Fast-casual Tex-Mex chain Tijuana Flats Restaurants on April 19 filed for Chapter 11 bankruptcy in the U.S. Bankruptcy Court for the Middle District of Florida, after launching a strategic review in November 2023 seeking answers for turning around the struggling chain.

Related: Bankrupt fast-food chain exits Chapter 11; to expand size 4 times

The company sold the company to a new ownership group, closed 11 of its locations and filed for a bankruptcy reorganization to revitalize its restaurants and reinvigorate the customer experience.

Reorganization, however, is not an option for another restaurant chain, as Foxtrot and Dom’s Kitchen & Market, with 33 locations across the U.S., filed for Chapter 7 liquidation on April 23 after failing to recover from financial distress dating back to the Covid pandemic.

Another restaurant chain, Sticky's, will have a chance to recover from the Covid pandemic's effects through a reorganization plan.

Sticky's to reorganize in Chapter 11

Sticky's Holdings, the parent company of New York-based chicken fingers fast-food chain Sticky's, filed for Chapter 11 bankruptcy on April 25 to reorganize its business after suffering financial distress from reduced traffic following the Covid pandemic, rising commodity prices, and lawsuits.

The debtor listed $5.75 million in assets and $4.67 million in liabilities in its petition. It's largest unsecured creditor is US Foods, owed over $449,000.

Sticky's, which opened in 2012, grew in sales from about $500,000 in 2013 to $22 million in 2023, but the Covid pandemic that significantly affected the restaurant industry starting in 2020 depressed store traffic. Revenue suffered and foot traffic has not returned to pre-pandemic levels even after the pandemic subsided, according to a declaration filed by Sticky's CEO Jamie Greer.

Rising inflation caused commodity prices to increase, forcing Sticky's to raise its menu prices, which further stifled traffic to the restaurant chain. As part of its efforts to reduce costs, the company in early 2021 exited its corporate offices on East 33rd Street in New York before its lease expired, according to the declaration.

Related: Luxury appliance retailer files Chapter 7 bankruptcy to liquidate

Legal problems drive restaurant chain to bankruptcy

The debtor's landlord filed a summary judgment on June 22, 2021, to recover the remaining rent and legal fees, which a court granted with a $600,000 award. The debtor has appealed the judgment costing the company more in legal fees.

More legal problems fell on Sticky's as on June 30, 2022, Sticky Fingers Restaurants LLC filed a lawsuit against Sticky's Holdings in the U.S. District Court for the Southern District of New York for alleged trademark infringement violations. The costs and expenses related to the ongoing litigation has imposed significant further financial hardship on the debtor, court papers said.

The debtor on Feb. 23, 2024, entered into an equity financing transaction that converted $2.42 million in convertible notes issued Nov. 9, 2022, and due March 31, 2024. The transaction substantially reduced the debtor's short-term liquidity needs, the declaration said. However, the company's financial headwinds prevented the debtor from continuing operations leading it to file bankruptcy to seek a reorganization.

Sticky's is a chain of chicken fingers and sandwich restaurants that serves fresh, never frozen and antibiotic-free chicken. It offers 18 in-house sauces for its chicken products.

Sticky's currently operates 12 locations, with nine in New York and three in New Jersey. It has closed two locations in New York and one each in New Jersey and Pennsylvania. The company had established a franchise entity to operate potential franchise operations, but none opened.

Related: Veteran fund manager picks favorite stocks for 2024

bankruptcy pandemic covid-19 stocks interest ratesUncategorized

The 2024 NFL Draft: TV ratings, player contracts, and fan attendance

The NFL has made its draft a massive spectacle that many flock to see.

The 2024 NFL Draft could be a league-defining one.

There are a slew of star quarterbacks at the top, including projected first overall pick Caleb Williams, who many are saying could become a generational player in the NFL.

The NFL Draft — which begins on April 25 at 8 p.m. Eastern time on ABC, ESPN, and the NFL Network — provides an opportunity for NFL teams to bolster their roster with young talent, but it also has a slew of off-the-field effects.

Related: Bill Belichick's post-coaching career plans are finally being revealed

The NFL has made the draft a three-day spectacle that rakes in tens of millions of viewers and brings in a ton of fans to the host city. Here are just some of the business-related topics that surround the NFL Draft.

Draftees are receiving life-changing money (How much exactly?)

Getting drafted to play sports professionally is not just the fulfillment of a dream, but, in the case of players getting drafted to one of the major sports leagues, it tends to come with a contract worth millions of dollars.

More often than not, that's life-changing money for the draft picks. It may seem a little less so now because the NCAA has allowed college athletes to profit off of their name, image, and likeness since July 2021 — and Williams notoriously has lived in a penthouse apartment in Los Angeles while being a college player for USC.

But even projected Top 10 pick Rome Odunze explained that he never received millions to play in college, so his and the 256 other players who will be picked in the 2024 NFL Draft are about to see a complete lifestyle shift because of their new financial stability.

According to Spotrac, the No. 1 pick in the 2024 NFL Draft, which will go to the Chicago Bears, will receive a contract worth $38.5 million That comes over four years, putting the average annual value at over $9.6 million.

TheStreet

The first pick makes nearly $2 million more than the second pick – which will be made by the Washington Commanders – who will receive a little under $36.9 million, which is an annual salary of $9.2 million.

There are 32 picks in the first round — which is technically one per team, though trades affect which teams make each selection — and the drop off in salary to be made by the No. 1 pick and the No. 32 pick is massive.

The No. 1 pick actually makes over three times more than the final pick of the first round, who is set to make about $12.1 million over four years, or $3.04 million annually.

And falling out of the first round also takes a huge chunk out of a player's salary. The No. 33 pick in the draft, which is the first pick of Day 2 of the draft, makes $9.9 million in total — over two million less than the person picked right before him.

Mr. Irrelevant — the term given to the last player selected in the seventh round, which this year is pick No. 257 by the New York Jets — is still going to be a millionaire based on his contract of $4.1 million, or about 1.025 million annually.

However, not all of the late round picks make the final roster, so those players will need to secure one of the 53 roster spots on their team to ensure themselves of those millions.

Related: How Much Money Do NFL Draft Picks Make?

The NFL Draft is not a game — but it still brings in millions of viewers.

There are zero total snaps of the football during the NFL Draft. Unless you count the highlights of all the draftees from their college games — in which case, there are a ton.

But there are no live ones. And yet the NFL Draft draws more viewers than most of the championship games of other major sports leagues.

Last year's NFL Draft averaged six million viewers across the three days — but had 11.29 million on Day 1 across the three channels. That Day 1 total is higher than the number of fans who watched the 2023 MLB World Series, and was around the average of all five games of the 2023 NBA Finals.

TheStreet/Getty Images

The draft saw its viewership explode in 2020, hitting over 15 million, but that was during the start of the pandemic when there was an unprecedented lack of sporting events.

It will be interesting to see whether this year's draft will bring in more viewers considering the strong quarterback field that also includes LSU's Jayden Daniels, UNC's Drake Maye, and Michigan's J.J. McCarthy. There are also big name teams picking at the top outside of the Bears as the New England Patriots hold the third selection, while the New York Giants have the sixth pick in the draft.

Will you watch the NFL Draft?

— TheStreet (@TheStreet) April 25, 2024

Related: A powerful politician wants to bring the Super Bowl, WrestleMania across the pond

The NFL has turned the draft into a spectacle, even in person

Detroit is the host city for this year's NFL Draft, and the city is expecting over 300,000 people at Campus Martius on the Detroit Riverfront over the next three days.

According to consulting firm Anderson Economic Group, the city is "expected to exceed $160 million" in net economic effect, which is inline with the $164.3 million that was generated in Kansas City from last year's draft.

The Draft used to be exclusively held at New York City's Radio City Music Hall, but since 2015, it has expanded to other NFL team's cities and has turned into a tentpole event that cities could bid on similar to the Super Bowl or NBA All-Star Game.

Related: Veteran fund manager picks favorite stocks for 2024

stocks pandemicUncategorized

Bankrupt mall retailer back from dead with cheap, viral product line

The once struggling store is making its return with a new capsule.

A lot of things are true about the retail industry, but saying malls are a boom town for large, legacy stores certainly isn't one of them.

The fact of the matter is that malls have been something of a death sentence for stores that take up larger spaces and rely mostly on spillover foot traffic from mall customers to support their bottom line.

Related: Popular restaurant chain filing for bankruptcy, closing all locations

It's not all due to covid, either. While the pandemic certainly accelerated the decline of shopping malls across the United States, in reality that trend had been going on quite a while before any of us really even knew what the coronavirus was.

Thanks to a rise in prices, the soaring popularity of online shopping, and a saturation of the market, shopping malls across the country were quickly looking more like something out of a zombie apocalypse movie than the booming, glittery beacon of capitalism more closely associated with the 1980s.

Of course, with the onset of the pandemic, even more malls started to falter, taking their high-rent tenants along with them. Everyone from mall operators like Simon Property Group (SPG) to larger flagships, such as JC Penney and Macy's begin to falter, and hushed words about bankruptcy and store closures echoed through increasingly empty hallways.

Forever 21 has had a rough several years

One such retailer that struggled through the pandemic was Forever 21, a discount clothing store devoted mostly to younger women. In the 2010s, Forever 21 was beloved for its cheaper than cheap crop tops, sun dresses, and accessories. But as folks stopped going to malls -- and in 2020 when people stopped going anywhere -- sales came to a screeching halt.

The retailer filed for Chapter 11 bankruptcy in September 2019, shuttering stores and ceasing operations in 40 countries. In early 2020, it sold all $81 of its remaining assets to Simon Property Group, Brookfield Properties, and Authentic Brands, determined to focus more on its central U.S. operations. A month later, it shuttered its stores due to covid.

Forever 21 back from the dead

Since the takeover (which Brookfield has since exited from), Forever 21 has been busy reinventing its name in fast fashion. It's partnered with big name designers like Herve Leger and blockbuster cultural phenomena like Barbie.

And on April 24, the mall retailer announced it would launch its own bridal line, signaling its intent to diversify away from clothing meant just for teens or the 20-something bar scene.

The introductory collection features 22 individual styles intended both for the bride and her bridesmaids. Some of the pieces in the line include:

- Dresses

- Hair accessories

- Swimsuits and lingerie

- Shape wear

- Pajamas

- Cowboy hats

- Jewelry and accessories

- Shoes

- Handbags

The items range in price from $8.99 to $47.99 and sizes from XS to XL.

Most of the items are casual or meant to cater to wedding-adjacent activities, such as bachelorette parties, wedding showers, receptions, and more casual ceremonies.

Bridal seems to be the future for more than one mall retailer. Earlier in 2023, Abercrombie & Fitch (ANF) said it would launch its own bridal line, featuring a line of about 100 dresses and accessories with a price range of $70-$200.

bankruptcy pandemic coronavirusUncategorized

Buyers are struggling to compete in the white-hot Cincinnati market

Rising prices, higher interest rates, low inventory and investor activity are keeping agent in Cincinnati on their toes.

Monika DeRoussel was in a meeting, away from her phone and email, when a client messaged her that a property in their price range and desired neighborhood had a for-sale sign in the yard. When the meeting concluded, DeRoussel quickly reached out to the seller’s agent to see if her client could get in for a tour, but it was too late.

“I called the listing agent and it was listed three hours ago, but it was sold,” the Cincinnati, Ohio-based eXp Realty agent said. “We couldn’t even see it. There is no way you can stay on top of things unless you hire someone to watch new listings pop up every 10 minutes.

“And it was a solid cash offer, no contingency and was going to close within a week. It is so hard to compete with that.”

While DeRoussel’s experience sounds exactly like many of the stories that emerged from the pandemic-fueled homebuying frenzy of 2020 and 2021, this happened just a few weeks ago in early April 2024.

“It is extremely competitive,” DeRoussel said of the Cincinnati housing market. “We wrote five offers this weekend and out of five, four were rejected. Buyers are really struggling.”

According to data from Altos Research, the Cincinnati metro area (which includes portions of Ohio, Kentucky and Indiana) currently has a Market Action Index score of 54, while the state of Ohio has a score of 55. Altos considers anything above a 30 to be a seller’s market.

“Cincinnati is a great place to live,” said Julie Back, the executive sales vice president of Sibcy Cline Realtors. “The cost of living is low, it is a fabulous city with all the big city amenities — we have all the arts, the culture, so many Fortune 500 companies. … It is a wonderful area of the United States and people are starting to realize it.”

Although there is no doubt among local real estate professionals that demand is high in the Cincinnati housing market, agents say the area’s low inventory situation is only adding to the challenge facing consumers.

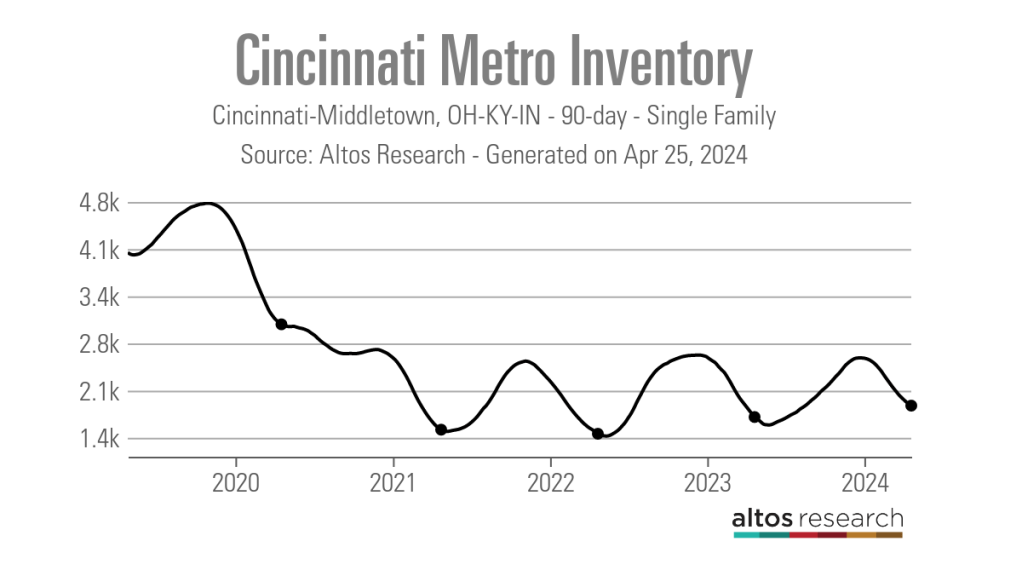

As of April 19, the Cincinnati metro area had a 90-day average of 1,864 single-family active listings, according to data from Altos Research. Although this is up from an all-time low of 1,429 active listings in early May 2022, it is down from the 3,021 listings recorded in late April 2020, a little over a month into the COVID-19 pandemic.

Additionally, while the number of new listings hitting the market each week in the Cincinnati metro area is certainly on the rise — jumping from a 90-day average of 214 in late February to 252 in late April of this year — the number is still well below the average of 367 new listings recorded in late April 2020.

“I think a lot of it has to do with there are just fewer houses available,” said Mark Meinhardt, a senior vice president at Sibcy Cline Realtors. “Baby boomers are not moving. They are staying put in their houses longer, plus you have a rate-lock effect. The interest rates are a huge factor.

“There are so many people who made a decision in the past 24 months to improve their house rather than move because it didn’t make sense with the interest rates unless they had to. So, they are just hunkering down.”

Looking further into the spring and summer months, agents are optimistic that more inventory will hit the market, but they do not believe it will be enough to satiate demand.

“We are going to see an increase in inventory. Cincinnati is a very predictable market since it has a lot of families,” DeRoussel said. “The typical Cincinnati consumer decides to list their house right before school gets out with this idea that they will sell their house, go on vacation and then move into their new house. So, we are expecting an additional two or three listings to hit the market each week now, but it is still extremely low.”

As would be expected, the tight inventory and high level of demand frequently results in bidding wars that drive up home prices. Data from Altos Research shows that the 90-day average median list price for single-family homes in the Cincinnati metro area has risen from $284,800 in April 2019, prior to the onset of the pandemic, to $389,250 as of April 24, 2024.

“I have some families that bought houses four or five years ago for $225,000, and they want something bigger and are excited that they can sell now for $300,000, but their budget for the new house is $350,000,” DeRoussel said. “With that budget, they aren’t really moving up. They are just getting the same house and maybe not even in as good of condition. If you want to move up at that price point, you have to be able to look at something that is like $500,000.”

Agents say they are also seeing a lot of appraisal gap clauses, inspection waivers and free leasebacks popping up in offers as buyers look to improve their chance of winning a house in the current market.

But rising prices are not the only financial challenge buyers are having to contend with right now. In addition to keeping prospective home sellers in their houses longer, higher mortgage rates are also taking a toll on buyers.

“Interest rates being higher hasn’t really necessarily slowed down demand,” Meinhardt said. “But buyers have had to adjust their expectations or their strategies when it comes to mortgage financing.”

Meinhardt and DeRoussel also noted the large number of investors currently active in the Cincinnati housing market. They are also making it hard for owner-occupant buyers, especially those looking in the $500,000-and-under price points.

“We are seeing a lot of investors and some flippers, but others are buying and holding,” Meinhardt said. “I think within the Midwest, our prices are certainly more conducive for investors than on one of the coasts. But it is really hard for those first-time homebuyers at the lower prices because they are competing with both institutional and mom-and-pop investors.”

Despite the challenges, local agents feel that things will continue to heat up as the market moves further into the spring.

“We are just getting fired up,” Back said. “It is not going to slow down. You are just going to have to learn to deal with it. Bankers are getting their interest rates, sellers are getting their prices and buyers are learning to step up to the plate.”

mortgage rates real estate housing market pandemic covid-19 interest rates-

International1 month ago

International1 month agoParexel CEO to retire; CAR-T maker AffyImmune promotes business leader to chief executive

-

Government3 weeks ago

Government3 weeks agoClimate-Con & The Media-Censorship Complex – Part 1

-

Spread & Containment7 days ago

Spread & Containment7 days agoJ&J’s AI head jumps to Recursion; Doug Williams resigns as Sana’s R&D chief

-

Government2 days ago

Government2 days agoCOVID-19 Vaccine Emails: Here’s What The CDC Hid Behind Redactions

-

Spread & Containment2 weeks ago

Spread & Containment2 weeks agoWHO Official Admits Vaccine Passports May Have Been A Scam

-

Spread & Containment2 weeks ago

Spread & Containment2 weeks agoFDA Finally Takes Down Ivermectin Posts After Settlement

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoVaccinated People Show Long COVID-Like Symptoms With Detectable Spike Proteins: Preprint Study

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCan language models read the genome? This one decoded mRNA to make better vaccines.