Uncategorized

Buyers are struggling to compete in the white-hot Cincinnati market

Rising prices, higher interest rates, low inventory and investor activity are keeping agent in Cincinnati on their toes.

Monika DeRoussel was in a meeting, away from her phone and email, when a client messaged her that a property in their price range and desired neighborhood had a for-sale sign in the yard. When the meeting concluded, DeRoussel quickly reached out to the seller’s agent to see if her client could get in for a tour, but it was too late.

“I called the listing agent and it was listed three hours ago, but it was sold,” the Cincinnati, Ohio-based eXp Realty agent said. “We couldn’t even see it. There is no way you can stay on top of things unless you hire someone to watch new listings pop up every 10 minutes.

“And it was a solid cash offer, no contingency and was going to close within a week. It is so hard to compete with that.”

While DeRoussel’s experience sounds exactly like many of the stories that emerged from the pandemic-fueled homebuying frenzy of 2020 and 2021, this happened just a few weeks ago in early April 2024.

“It is extremely competitive,” DeRoussel said of the Cincinnati housing market. “We wrote five offers this weekend and out of five, four were rejected. Buyers are really struggling.”

According to data from Altos Research, the Cincinnati metro area (which includes portions of Ohio, Kentucky and Indiana) currently has a Market Action Index score of 54, while the state of Ohio has a score of 55. Altos considers anything above a 30 to be a seller’s market.

“Cincinnati is a great place to live,” said Julie Back, the executive sales vice president of Sibcy Cline Realtors. “The cost of living is low, it is a fabulous city with all the big city amenities — we have all the arts, the culture, so many Fortune 500 companies. … It is a wonderful area of the United States and people are starting to realize it.”

Although there is no doubt among local real estate professionals that demand is high in the Cincinnati housing market, agents say the area’s low inventory situation is only adding to the challenge facing consumers.

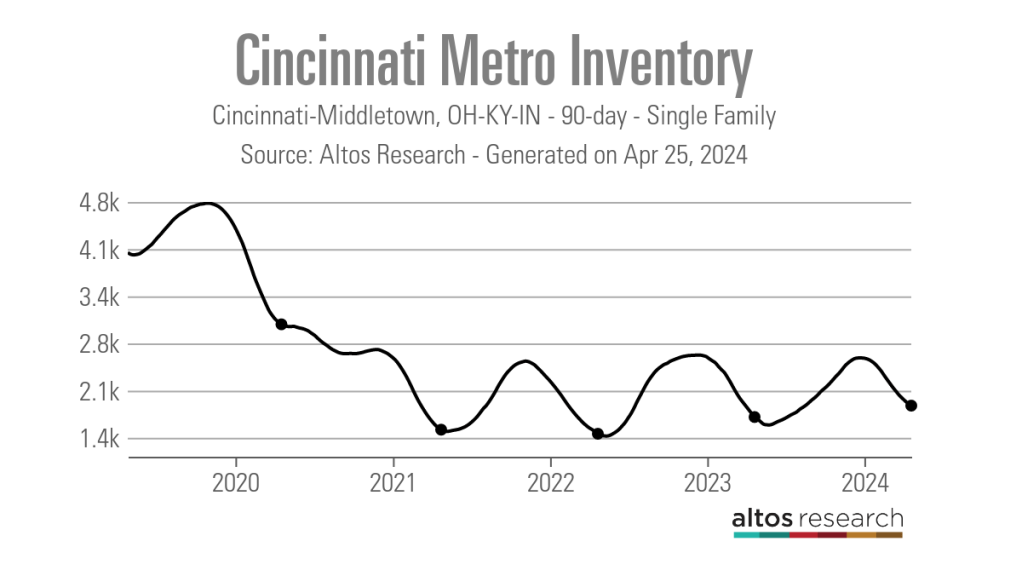

As of April 19, the Cincinnati metro area had a 90-day average of 1,864 single-family active listings, according to data from Altos Research. Although this is up from an all-time low of 1,429 active listings in early May 2022, it is down from the 3,021 listings recorded in late April 2020, a little over a month into the COVID-19 pandemic.

Additionally, while the number of new listings hitting the market each week in the Cincinnati metro area is certainly on the rise — jumping from a 90-day average of 214 in late February to 252 in late April of this year — the number is still well below the average of 367 new listings recorded in late April 2020.

“I think a lot of it has to do with there are just fewer houses available,” said Mark Meinhardt, a senior vice president at Sibcy Cline Realtors. “Baby boomers are not moving. They are staying put in their houses longer, plus you have a rate-lock effect. The interest rates are a huge factor.

“There are so many people who made a decision in the past 24 months to improve their house rather than move because it didn’t make sense with the interest rates unless they had to. So, they are just hunkering down.”

Looking further into the spring and summer months, agents are optimistic that more inventory will hit the market, but they do not believe it will be enough to satiate demand.

“We are going to see an increase in inventory. Cincinnati is a very predictable market since it has a lot of families,” DeRoussel said. “The typical Cincinnati consumer decides to list their house right before school gets out with this idea that they will sell their house, go on vacation and then move into their new house. So, we are expecting an additional two or three listings to hit the market each week now, but it is still extremely low.”

As would be expected, the tight inventory and high level of demand frequently results in bidding wars that drive up home prices. Data from Altos Research shows that the 90-day average median list price for single-family homes in the Cincinnati metro area has risen from $284,800 in April 2019, prior to the onset of the pandemic, to $389,250 as of April 24, 2024.

“I have some families that bought houses four or five years ago for $225,000, and they want something bigger and are excited that they can sell now for $300,000, but their budget for the new house is $350,000,” DeRoussel said. “With that budget, they aren’t really moving up. They are just getting the same house and maybe not even in as good of condition. If you want to move up at that price point, you have to be able to look at something that is like $500,000.”

Agents say they are also seeing a lot of appraisal gap clauses, inspection waivers and free leasebacks popping up in offers as buyers look to improve their chance of winning a house in the current market.

But rising prices are not the only financial challenge buyers are having to contend with right now. In addition to keeping prospective home sellers in their houses longer, higher mortgage rates are also taking a toll on buyers.

“Interest rates being higher hasn’t really necessarily slowed down demand,” Meinhardt said. “But buyers have had to adjust their expectations or their strategies when it comes to mortgage financing.”

Meinhardt and DeRoussel also noted the large number of investors currently active in the Cincinnati housing market. They are also making it hard for owner-occupant buyers, especially those looking in the $500,000-and-under price points.

“We are seeing a lot of investors and some flippers, but others are buying and holding,” Meinhardt said. “I think within the Midwest, our prices are certainly more conducive for investors than on one of the coasts. But it is really hard for those first-time homebuyers at the lower prices because they are competing with both institutional and mom-and-pop investors.”

Despite the challenges, local agents feel that things will continue to heat up as the market moves further into the spring.

“We are just getting fired up,” Back said. “It is not going to slow down. You are just going to have to learn to deal with it. Bankers are getting their interest rates, sellers are getting their prices and buyers are learning to step up to the plate.”

mortgage rates real estate housing market pandemic covid-19 interest ratesUncategorized

U.S. growth slowdown, with inflation spike, raises early stagflation risks

The economy is slowing but inflation isn’t. That’s not good for anyone.

Growth in the U.S. economy slowed notably last quarter as consumers tightened their belts and companies ran down inventories amid concern about a broad slump in demand over the coming months.

The world's biggest economy expanded by an annualized rate of 1.6%, down from the 3.4% pace recorded over fourth-quarter 2023, data from the Commerce Department showed on April 25. The latest figure was well south of Wall Street's 2.5% forecast.

Perhaps more worrying for both government officials and policy makers at the Federal Reserve, however, was the parallel spike in inflation pressure, with the central bank's preferred gauge rising by a faster-than-expected 3.7% over the three-month period.

Mike Reynolds, vice president of investment strategy at Glenmede, says President Joe Biden might need to accelerate government spending, "as is typical in years when a sitting president seeks reelection." The idea would be to offset the impact of the Fed's elevated lending rate, which currently sits at a two-decade high of between 5.25% and 5.5%.

"Another positive GDP print adds another notch to the belt for the soft-landing argument, though the risk of recession still remains higher than normal given the tight stance of monetary policy," he said.

"Fiscal stimulus has, so far, provided an offset to monetary-policy headwinds and is likely to continue to help broaden the pathway to soft landing." A soft landing for the economy would show slowing inflation but no recession.

But the overall leap in price pressures followed a series of warnings from Fed officials over the past few weeks that they're still seeking "confidence" in the notion that inflation is heading back toward the central bank's preferred 2% target.

And that has markets even more concerned.

'Stubborn inflation and stifled growth': Stagflation

"It’s one thing to have moderate inflation with above-average growth," said Bret Kenwell, U.S. investment analyst at eToro. "It’s another thing to have stubborn inflation and stifled growth, which has to be the Fed’s top concern at this point in the rate cycle."

Slowing growth and faster inflation raise the specter of stagflation in an economy that, given its reliance on consumer spending, can be significantly damaging.

“Stagflation is a growing risk after GDP missed and the price index surprised to the upside," said David Russell, global head of marketing strategy at TradeStation. "If inflation isn’t getting better with such a weak growth, you have to wonder if the trend toward lower prices will continue."

Related: Wall Street faces make-or-break week with Tesla, GDP, inflation on deck

"The bump in [Treasury-security] yields after the report suggests rate cuts are increasingly in doubt,” he added.

Yields on benchmark 2-year notes, the most-sensitive to changes in interest-rate forecasts, rose 9 basis points (0.09 percentage point) following the GDP and inflation data to change hands at 5.014%, their highest since last November. Ten-year yields hit a fresh five-month peak of 4.731%

Rate traders also responded to the Commerce Department data by pushing back their forecasts for a Fed rate cut until at least November and possibly beyond. They also pared the number of rate reductions expected this year to just one.

A speed-up in Q1 inflation has now delayed the first, and only cut this year to December pic.twitter.com/slqfFPa2qc

— Ole S Hansen (@Ole_S_Hansen) April 25, 2024

"The hot inflation print is the real story in this report," Fitch Ratings analysts wrote. "If growth continues to slowly decelerate but inflation strongly takes off again in the wrong direction, the expectation of a Fed interest rate cut in 2024 is starting to look increasingly more out of reach."

The odds of a June rate cut, a virtual lock earlier this year, have collapsed to just 9.4%, based on data from CME Group's FedWatch. None of the four Fed meetings between July and December indicate a higher than 45% chance of a quarter-point reduction.

Sharper consumer-spending slowdown?

Jeffrey Roach, chief economist for LPL Financial in Charlotte, says details of the first-quarter GDP estimate suggest a weaker growth rate on the horizon. But he sees inflation pressure moderating at the same time.

"The economy will likely decelerate further in the following quarters as consumers are likely near the end of their spending splurge," he said. "Savings rates are falling as sticky inflation puts greater pressure on the consumer."

"We should expect inflation will ease throughout this year as aggregate demand slows, although the path to the Fed’s 2% target still looks a long ways off," Roach said.

Related: No landing, no Fed rate cuts: the markets' new bet on 2024

Ian Shepherdson of Pantheon Macroeconomics agrees that pandemic-era savings have largely been depleted. He noted that "only the very wealthiest households still have substantial excess that can be tapped to support consumption," which also leads to slower consumption over the back half of the year.

More Economic Analysis:

- Watch out for 8% mortgage rates

- Hot inflation report batters stocks; here's what happens next

- Inflation report will disappoint markets (and the Fed)

He also argues that this should help blunt inflation pressure, as wage gains moderate and year-on-year comparisons support lower overall readings.

"It’s a close call, but we still see a path to the first Fed rate cut in June if, as we expect, the next two labor-market reports show job growth is slowing markedly and the [consumer-price index] reports are benign," he said.

The Bureau of Economic Analysis will publish its March PCE inflation report on Friday, April 26. Analysts are looking for a core and headline reading of 2.6%, down from 2.8% and 2.5% respectively over the month of February.

Related: Veteran fund manager picks favorite stocks for 2024

recession pandemic stimulus stocks monetary policy rate cut fed federal reserve recession gdp consumer spending stimulusUncategorized

Cashless Society: WEF Boasts That 98% Of Central Banks Are Adopting CBDCs

Cashless Society: WEF Boasts That 98% Of Central Banks Are Adopting CBDCs

Whatever happened to the WEF? One minute they were everywhere…

Whatever happened to the WEF? One minute they were everywhere in the media and now they have all but disappeared from public discourse. After the pandemic agenda was defeated and the plan to exploit public fear to create a perpetual medical autocracy was exposed, Klaus Schwab and his merry band of globalists slithered back into the woodwork. To be sure, we'll be seeing them again one day, but for now the WEF has relegated itself away from the spotlight and into the dark recesses of the Davos echo chamber.

Much of their discussions now focus on issues like climate change or DEI (Diversity, Equity, Inclusion), but one vital subject continues to pop up in the white papers of global think tanks and it's a program that was introduced very publicly during covid. Every person that cares about economic freedom should be wary of Central Bank Digital Currencies (CBDCs) as perhaps the biggest threat to human liberty since the attempted introduction of vaccine passports.

The WEF recently boasted in a new white paper that 98% of all central banks are now pursuing CBDC programs. The report, titled 'Modernizing Financial Markets With Wholesale Central Bank Digital Currency', notes:

“CeBM is ideal for systemically important transactions despite the emergence of alternative payment instruments...Wholesale central bank digital currency (wCBDC) is a form of CeBM that could unlock new economic models and integration points that are not possible today.”

The paper primarily focuses on the streamlining of crossborder transactions, an effort which the Bank for International Settlements (BIS) has been deeply involved in for the past few years. It also highlights an odd concept of differentiated CBDC mechanisms, each one specifically designed to be used by different institutions for different reasons. Wholesale CBDCs would be used only by banking institutions, governments and some global corporations, as opposed to Retail CBDCs which would be reserved for the regular population.

How the value and buying power of Wholesale CBDCs would differ is not clear, but it's easy to guess that these devices would give banking institutions a greater ability homogenize international currencies and transactions. In other words, it's the path to an eventual global currency model. By extension, the adoption of CBDCs by governments and global banks will ultimately lead to what the WEF calls "dematerialization" - The removal of physical securities and money. The WEF states:

"As with the Bank of England’s (BOE) RTGS modernization programme, the intention is to introduce a fully digitized securities system that is future-proofed for incremental adoption of DLT (Distributed Ledger Technology). The tokenization of assets involves creating digital tokens representing underlying assets like real estate, equities, digital art, intellectual property and even cash. Tokenization is a key use case for blockchain, with some estimates pointing towards $4-5 trillion in tokenized securities on DLTa by 2030."

Finally, they let the cat out of the bag:

"The BIS proposed two models for bringing tokenization into the monetary system: 1) Bring CBDCs, DTs and tokenized assets on to a common unified ledger, and 2) pursue incremental progress by creating interlinking systems.

They determined the latter option was more feasible given that the former requires a reimagination of financial systems. Experimentation with the unified ledger concept is ongoing."

To interpret this into decoded language - The unified ledger is essentially another term for a one world digital currency system completely centralized and under the control of global banks like the BIS and IMF. The WEF and BIS are acknowledging the difficulty of introducing such a system without opposition, so, they are recommending incremental introduction using "interlinking systems" (attaching CBDCs to paper currencies and physical contracts and then slowly but surely dematerializing those assets and making digital the new norm). It's the totalitarian tip-toe.

The BIS predicts there will be at least 9 major CBDCs in circulation by the year 2030; this is likely an understatement of the intended plan. Globalists have hinted in the past that they prefer total digitization by 2030.

A cashless society would be the end game for economic anonymity and freedom in trade. Unless alternative physical currencies are widely adopted in protest, CBDCs would make all transactions traceable and easily interrupted by governments and banks. Imagine a world in which all trade is monitored, all revenues are monitored and transactions can be blocked if they are found to offend the mandates of the system. Yes, these things do happen today, but with physical cash they can be circumvented.

Imagine a world where your ability to spend money can be limited to certain retailers, certain services, certain products and chosen regions based on your politics, your social credit score and your background. The control that comes with CBDCs is immense and allows for complete micromanagement of the population. The fact that 98% of central banks are already adopting this technology should be one of the biggest news stories of the decade, yet, it goes almost completely ignored.

Uncategorized

Bankrupt fast-food chain exits Chapter 11; to expand size 4 times

The Boston-based fast-food chain said it will exit bankruptcy this week with plans to expand its locations by four times over a five-year period.

Financial distress in the restaurant industry has led several fast-food and fast casual chains to file for bankruptcy, with businesses reorganizing, selling their assets or shutting down permanently.

Fast-casual Tex-Mex chain Tijuana Flats Restaurants on April 19 filed for Chapter 11 bankruptcy in the U.S. Bankruptcy Court for the Middle District of Florida, with ambitious plans to turn around the company that included selling the company to a new ownership group and closing 11 of its locations.

Related: Luxury appliance retailer files Chapter 7 bankruptcy to liquidate

The new owners, Flatheads LLC, purchased the restaurant chain from TJF USA LLC with a plan to revitalize its restaurants and reinvigorate the customer experience.

Another restaurant chain had more depressing plans, as fast casual restaurant chain Foxtrot and Dom’s Kitchen & Market, with 33 locations across the nation, on April 23 revealed that it was abruptly filing Chapter 7 bankruptcy liquidation and shutting down all of its locations immediately. The reason for the filing was unclear, according to reports.

While struggling restaurant chains file bankruptcy, close down locations, and in some cases go out of business, a popular Boston fast-food chain is bucking that trend and intends to emerge from Chapter 11 with a plan to expand its footprint in New England by four times.

Clover Food Lab

Fast food restaurant emerges from bankruptcy

Boston-based vegetarian fast-food restaurant chain Clover Food Lab filed for Chapter 11 Subchapter 5 bankruptcy in the U.S. Bankruptcy Court for District of Delaware on Nov. 3, 2023, to reorganize its business as its sales did not fully recovered from the effects of the Covid pandemic, according to its website.

In addition to lower than expected sales, the company in court papers said that high rent for its locations and inadequate funding as a result of the failure of Silicon Valley Bank contributed to the chain's distress.

The restaurant chain had planned to raise capital to expand in New England and into New York but the fallout from the failure of Silicon Valley Bank resulted in its financing plans to collapse. The debtor said that high rents and low sales at three of its locations led it to seek lease concessions from its landlords, which was unsuccessful and forced the company to file bankruptcy.

The restaurant chain opened in 2008 as a single food truck on the Massachusetts Institute of Technology campus in Cambridge, Mass., and offers an organic, vegetarian menu that "changes by the minute to keep up with daily available produce from farms in New England," according to Clover Food Lab's website. The company had 15 locations when it filed its Chapter 11 petition, but closed locations in Boston's Copley Square and Somerville's Assembly Row during its reorganization.

Clover Food Lab in a April 24 statement said that it will emerge from Chapter 11 Subchapter V bankruptcy this week with a five-year plan to add 47 new stores, initially opening locations in the Greater Boston area and then elsewhere in New England. It will focus on smaller outlets in urban areas and around universities, the statement said according to Boston Restaurant Talk. The expansion will grow the chain from 15 locations when it filed bankruptcy to 60 outlets after a five-year period.

Related: Veteran fund manager picks favorite stocks for 2024

bankruptcy pandemic stocks-

International1 month ago

International1 month agoParexel CEO to retire; CAR-T maker AffyImmune promotes business leader to chief executive

-

Government3 weeks ago

Government3 weeks agoClimate-Con & The Media-Censorship Complex – Part 1

-

International6 days ago

International6 days agoJ&J’s AI head jumps to Recursion; Doug Williams resigns as Sana’s R&D chief

-

Government2 days ago

Government2 days agoCOVID-19 Vaccine Emails: Here’s What The CDC Hid Behind Redactions

-

International2 weeks ago

International2 weeks agoWHO Official Admits Vaccine Passports May Have Been A Scam

-

Spread & Containment2 weeks ago

Spread & Containment2 weeks agoFDA Finally Takes Down Ivermectin Posts After Settlement

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoVaccinated People Show Long COVID-Like Symptoms With Detectable Spike Proteins: Preprint Study

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCan language models read the genome? This one decoded mRNA to make better vaccines.