Uncategorized

Bankrupt fast-food chain exits Chapter 11; to expand size 4 times

The Boston-based fast-food chain said it will exit bankruptcy this week with plans to expand its locations by four times over a five-year period.

Financial distress in the restaurant industry has led several fast-food and fast casual chains to file for bankruptcy, with businesses reorganizing, selling their assets or shutting down permanently.

Fast-casual Tex-Mex chain Tijuana Flats Restaurants on April 19 filed for Chapter 11 bankruptcy in the U.S. Bankruptcy Court for the Middle District of Florida, with ambitious plans to turn around the company that included selling the company to a new ownership group and closing 11 of its locations.

Related: Luxury appliance retailer files Chapter 7 bankruptcy to liquidate

The new owners, Flatheads LLC, purchased the restaurant chain from TJF USA LLC with a plan to revitalize its restaurants and reinvigorate the customer experience.

Another restaurant chain had more depressing plans, as fast casual restaurant chain Foxtrot and Dom’s Kitchen & Market, with 33 locations across the nation, on April 23 revealed that it was abruptly filing Chapter 7 bankruptcy liquidation and shutting down all of its locations immediately. The reason for the filing was unclear, according to reports.

While struggling restaurant chains file bankruptcy, close down locations, and in some cases go out of business, a popular Boston fast-food chain is bucking that trend and intends to emerge from Chapter 11 with a plan to expand its footprint in New England by four times.

Clover Food Lab

Fast food restaurant emerges from bankruptcy

Boston-based vegetarian fast-food restaurant chain Clover Food Lab filed for Chapter 11 Subchapter 5 bankruptcy in the U.S. Bankruptcy Court for District of Delaware on Nov. 3, 2023, to reorganize its business as its sales did not fully recovered from the effects of the Covid pandemic, according to its website.

In addition to lower than expected sales, the company in court papers said that high rent for its locations and inadequate funding as a result of the failure of Silicon Valley Bank contributed to the chain's distress.

The restaurant chain had planned to raise capital to expand in New England and into New York but the fallout from the failure of Silicon Valley Bank resulted in its financing plans to collapse. The debtor said that high rents and low sales at three of its locations led it to seek lease concessions from its landlords, which was unsuccessful and forced the company to file bankruptcy.

The restaurant chain opened in 2008 as a single food truck on the Massachusetts Institute of Technology campus in Cambridge, Mass., and offers an organic, vegetarian menu that "changes by the minute to keep up with daily available produce from farms in New England," according to Clover Food Lab's website. The company had 15 locations when it filed its Chapter 11 petition, but closed locations in Boston's Copley Square and Somerville's Assembly Row during its reorganization.

Clover Food Lab in a April 24 statement said that it will emerge from Chapter 11 Subchapter V bankruptcy this week with a five-year plan to add 47 new stores, initially opening locations in the Greater Boston area and then elsewhere in New England. It will focus on smaller outlets in urban areas and around universities, the statement said according to Boston Restaurant Talk. The expansion will grow the chain from 15 locations when it filed bankruptcy to 60 outlets after a five-year period.

Related: Veteran fund manager picks favorite stocks for 2024

bankruptcy pandemic stocksUncategorized

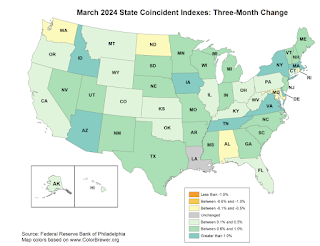

Philly Fed: State Coincident Indexes Increased in 44 States in March (3-Month Basis)

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for March 2024. Over the

past three months, the indexes increased in 44 states, decreased in five states, and remained stable in one,…

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for March 2024. Over the past three months, the indexes increased in 44 states, decreased in five states, and remained stable in one, for a three-month diffusion index of 78. Additionally, in the past month, the indexes increased in 41 states, decreased in two states, and remained stable in seven, for a one-month diffusion index of 78. For comparison purposes, the Philadelphia Fed has also developed a similar coincident index for the entire United States. The Philadelphia Fed’s U.S. index increased 0.7 percent over the past three months and 0.3 percent in March.Note: These are coincident indexes constructed from state employment data. An explanation from the Philly Fed:

emphasis added

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing by production workers, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.Click on map for larger image.

Here is a map of the three-month change in the Philly Fed state coincident indicators. This map was all red during the worst of the Pandemic and also at the worst of the Great Recession.

The map is almost all positive on a three-month basis.

Source: Philly Fed.

And here is a graph is of the number of states with one month increasing activity according to the Philly Fed.

And here is a graph is of the number of states with one month increasing activity according to the Philly Fed. In March, 44 states had increasing activity including minor increases.

Uncategorized

Target store introduces a new ‘over 18’ policy

The retailer is mandating a new rule about unaccompanied minors.

The contraction and expansion of retailers in this decade has been something to marvel at.

On the one hand, many specialty retailers that made large footprints and catered to niche consumer interests have struggled since the covid pandemic, which forced most shoppers to stay at home and take up hobbies.

Related: Popular restaurant chain filing for bankruptcy, closing all locations

Joann Fabrics, Body Shop, Bed Bath & Beyond, and Party City all filed for bankruptcy in the past year.

The pandemic may be behind us, but it has permanently shifted how we think about shopping. Now, most of us prefer to shop online for things we know we like, such as party supplies or home decor.

And for the things we're open to being influenced on, as with a new fragrance or specialty body lotion, we also look online, seeking others' opinions on forums and social media, often before going in and discovering for ourselves.

Retailers take more precautions

But the past several years have shifted the way that surviving retailers think about the shopping experience, too.

Retail crime, be it theft or violence, has surged. For example, smash-and-grabs jumped in metropolitan areas where some stores took softer policies on shoplifting.

Other stores struggled to keep robust workforces, opting instead for more autonomous technology like self-checkout kiosks to help customers move more quickly with their purchases.

But more self-checkouts created more inventory shrink, the industry term for a loss of product. This occurs in part when customers accidentally or purposely fail to properly scan items and aren't caught by a security system.

Image source: John Smith/VIEWpress.

Target institutes an under-18 policy

Large stores like Target (TGT) and Walmart (WMT) have been hit particularly hard by inventory shrink, with some CEOs calling the levels of it unsustainable for business and profitability.

This forced Target in March to limit self-checkout to customers with 10 items or fewer during normal business operations.

And a Target location in the Columbia Heights neighborhood of Washington is now implementing a stricter policy, mandating that anybody under age 18 must be accompanied by an adult to enter the store.

Some cities like Washington have seen an uptick in juvenile crime, especially when it comes to attempted robbery, carjacking and petty theft.

Earlier this year customers noticed a sign posted outside the Columbia Heights Target on 14th Street, which is a part of a massive retail complex also housing a Best Buy, Old Navy and Lidl.

"All guests under the age of 18 must be accompanied by an adult at this Target store," the sign reads at the entrance.

View the original article to see embedded media.

Customers note that some departments within the Target store are under lock and key, including personal-care products and menswear like socks, boxers and undershirts.

The location, which is a part of the DC USA shopping complex, serves more than 36,000 people a day and is the largest retail development in the city.

The greater DC USA shopping complex has similar signs posted throughout the area, mandating that minors must be accompanied by legal adults.

TheStreet has reached out to Target for comment.

bankruptcy pandemicUncategorized

Rishi Sunak wants to cut the cost of ‘sicknote’ Britain. But we’ve found a strong economic case for benefits

Welfare reforms targeted at the sick and disabled won’t boost government coffers. In fact, spending on those who need support and investing in less conditional…

Prime minister Rishi Sunak has announced a crackdown on sickness and disability benefits in order to end a “sicknote culture” and “over-medicalising the everyday challenges and worries of life”, in part because he claims that “good work” can actually improve mental and physical health. He instead wants to focus on “what people can do with the right support in place, rather than what they can’t do”.

Taxpayers and recipients of sickness and disability benefits might feel like they’ve heard all this before. Back in 2015 then-work and pensions secretary Iain Duncan Smith promised to “end sicknote culture” by supporting “a system focused on what a claimant can do … and not just on what they can’t”.

And there are echoes too of 2007 when then-work and pensions secretary Peter Hain promised to end “sicknote culture” to focus on what people “can do rather than what they cannot do”, in part because of a belief that being in work “is usually good for people with all types of mental health problems”.

Given their unquestioning belief in the efficacy of such measures, it must be confounding for politicians to learn that the numbers of disabled people and people claiming disability benefits continues to rise.

In the last ten years, the percentage of working-age adults who are disabled has increased from 16% to 23%, while among children it has gone from 7% to 11%. Interestingly, for people of state-pension age, the figure has remained relatively stable (43% to 45%).

In April, the Institute for Fiscal Studies reported that the proportion of working-age people claiming disability benefits increased from 1.5 million in 2002/03 to 2.3 million in 2019/20, before spiking to 3.3 million in 2023/24.

It is this trend that Rishi Sunak claims needs to be addressed, with mental health conditions a growing component of new disability benefit claims. The point, though, as the figures demonstrate, is that reforms that focus on tightening eligibility criteria and stringent assessment do nothing to reduce the number of people claiming.

Rather, we can point to a real economic case for government investment in infrastructure and day-to-day spending to keep people well and – where possible – working.

There is a tendency in announcements, too, to conflate means-tested incapacity benefits with non-means-tested disability benefits, such as the personal independence payment. In reality, the latter is used by many people to support their engagement with full-time paid work and other forms of health-promoting activity through adaptations and activities that manage their conditions. Without these, even part-time employment might be impossible.

But even with regard to means-tested benefits, studies have found that sanctions on benefits, which the government has promoted as a means of getting more people into the workforce, do not actually increase employment levels.

There is, on the other hand, very good reason to suggest that imposing strict eligibility criteria and sanctions can be very harmful to disabled people’s health, activity and financial situation. What is really driving these reforms, as ever, is ideology and electoral concerns.

Changing attitudes

But people receiving such benefits are no longer an out-group that the public wishes to punish. We have been through a pandemic during which people who had believed their jobs and income to be secure were suddenly left either on government-funded furlough or universal credit.

Senior managers were exposed to Britain’s Byzantine welfare system, and people who had never taken a day off found their employers unwilling or unable to repay that loyalty.

The effect of this is that the old “strivers versus scroungers” argument simply doesn’t appeal as it once did. In the latest British Social Attitudes Survey, just 19% agreed that “most people who get social security don’t really deserve any help” – less than half the figure of 40% in 2005.

So what can we do to address the rapid increase in disability and mental ill-health? First, we must acknowledge that the pandemic has had lasting physical and mental health consequences for many, whether directly as a result of COVID infection or indirectly due to behavioural and socioeconomic effects.

We must create a system that enables people to build a productive life in their best health, wellbeing and economic interests. Just as the social economist Lord Beveridge proposed in his 1942 report, we need cradle-to-grave social security that supports that ambition, rather than forced participation in harmful insecure employment.

The cost of illness and disability from such employment is felt in our overburdened NHS and the ever-growing number of people unable to re-enter the workforce once conditions develop.

Investing in people is good

It is not tenable for the government to argue for stricter criteria and more assessment. Rather, there is good evidence for implementing less conditional systems of welfare, which have no work disincentives, for economic, health, and wellbeing reasons.

Something like basic income (a system of regular, fixed payments made to everyone in society) can provide the economic and financial stability to allow people to find sustainable employment. There is also strong evidence to invest in reactive healthcare to ensure that people with long-term conditions receive the treatment they need to be as active as possible.

The prime minister suggested that some people with mental health conditions might be better supported through talking therapies or respite care than cash transfers. That might be the case had government funding for these services not failed to keep up with demand.

There is ample evidence that investment in securing the social determinants of health, such as income, housing, education and the environment, is highly popular with voters – and affordable, too.

Funding this sort of system is not wasteful. Based on strong underpinning research, our analysis assumes indirect returns on investment of 2.74 times government spending on infrastructure, and 0.91 on day-to-day spending. There is both an economic and social reason to invest in people and the country.

Common sense tells us that Britain is not a sicknote nation, but a sick one. We need to act now to create a better system – because the current one is benefiting very few of us.

Elliott Johnson is affiliated with the Common Sense Policy Group.

Howard Reed is affiliated with the Common Sense Policy Group.

Matthew T. Johnson is affiliated with the Common Sense Policy Group

treatment pandemic-

International1 month ago

International1 month agoParexel CEO to retire; CAR-T maker AffyImmune promotes business leader to chief executive

-

Government3 weeks ago

Government3 weeks agoClimate-Con & The Media-Censorship Complex – Part 1

-

International6 days ago

International6 days agoJ&J’s AI head jumps to Recursion; Doug Williams resigns as Sana’s R&D chief

-

Government1 day ago

Government1 day agoCOVID-19 Vaccine Emails: Here’s What The CDC Hid Behind Redactions

-

International1 week ago

International1 week agoWHO Official Admits Vaccine Passports May Have Been A Scam

-

Spread & Containment2 weeks ago

Spread & Containment2 weeks agoFDA Finally Takes Down Ivermectin Posts After Settlement

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoVaccinated People Show Long COVID-Like Symptoms With Detectable Spike Proteins: Preprint Study

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCan language models read the genome? This one decoded mRNA to make better vaccines.