Uncategorized

Cashless Society: WEF Boasts That 98% Of Central Banks Are Adopting CBDCs

Cashless Society: WEF Boasts That 98% Of Central Banks Are Adopting CBDCs

Whatever happened to the WEF? One minute they were everywhere…

Whatever happened to the WEF? One minute they were everywhere in the media and now they have all but disappeared from public discourse. After the pandemic agenda was defeated and the plan to exploit public fear to create a perpetual medical autocracy was exposed, Klaus Schwab and his merry band of globalists slithered back into the woodwork. To be sure, we'll be seeing them again one day, but for now the WEF has relegated itself away from the spotlight and into the dark recesses of the Davos echo chamber.

Much of their discussions now focus on issues like climate change or DEI (Diversity, Equity, Inclusion), but one vital subject continues to pop up in the white papers of global think tanks and it's a program that was introduced very publicly during covid. Every person that cares about economic freedom should be wary of Central Bank Digital Currencies (CBDCs) as perhaps the biggest threat to human liberty since the attempted introduction of vaccine passports.

The WEF recently boasted in a new white paper that 98% of all central banks are now pursuing CBDC programs. The report, titled 'Modernizing Financial Markets With Wholesale Central Bank Digital Currency', notes:

“CeBM is ideal for systemically important transactions despite the emergence of alternative payment instruments...Wholesale central bank digital currency (wCBDC) is a form of CeBM that could unlock new economic models and integration points that are not possible today.”

The paper primarily focuses on the streamlining of crossborder transactions, an effort which the Bank for International Settlements (BIS) has been deeply involved in for the past few years. It also highlights an odd concept of differentiated CBDC mechanisms, each one specifically designed to be used by different institutions for different reasons. Wholesale CBDCs would be used only by banking institutions, governments and some global corporations, as opposed to Retail CBDCs which would be reserved for the regular population.

How the value and buying power of Wholesale CBDCs would differ is not clear, but it's easy to guess that these devices would give banking institutions a greater ability homogenize international currencies and transactions. In other words, it's the path to an eventual global currency model. By extension, the adoption of CBDCs by governments and global banks will ultimately lead to what the WEF calls "dematerialization" - The removal of physical securities and money. The WEF states:

"As with the Bank of England’s (BOE) RTGS modernization programme, the intention is to introduce a fully digitized securities system that is future-proofed for incremental adoption of DLT (Distributed Ledger Technology). The tokenization of assets involves creating digital tokens representing underlying assets like real estate, equities, digital art, intellectual property and even cash. Tokenization is a key use case for blockchain, with some estimates pointing towards $4-5 trillion in tokenized securities on DLTa by 2030."

Finally, they let the cat out of the bag:

"The BIS proposed two models for bringing tokenization into the monetary system: 1) Bring CBDCs, DTs and tokenized assets on to a common unified ledger, and 2) pursue incremental progress by creating interlinking systems.

They determined the latter option was more feasible given that the former requires a reimagination of financial systems. Experimentation with the unified ledger concept is ongoing."

To interpret this into decoded language - The unified ledger is essentially another term for a one world digital currency system completely centralized and under the control of global banks like the BIS and IMF. The WEF and BIS are acknowledging the difficulty of introducing such a system without opposition, so, they are recommending incremental introduction using "interlinking systems" (attaching CBDCs to paper currencies and physical contracts and then slowly but surely dematerializing those assets and making digital the new norm). It's the totalitarian tip-toe.

The BIS predicts there will be at least 9 major CBDCs in circulation by the year 2030; this is likely an understatement of the intended plan. Globalists have hinted in the past that they prefer total digitization by 2030.

A cashless society would be the end game for economic anonymity and freedom in trade. Unless alternative physical currencies are widely adopted in protest, CBDCs would make all transactions traceable and easily interrupted by governments and banks. Imagine a world in which all trade is monitored, all revenues are monitored and transactions can be blocked if they are found to offend the mandates of the system. Yes, these things do happen today, but with physical cash they can be circumvented.

Imagine a world where your ability to spend money can be limited to certain retailers, certain services, certain products and chosen regions based on your politics, your social credit score and your background. The control that comes with CBDCs is immense and allows for complete micromanagement of the population. The fact that 98% of central banks are already adopting this technology should be one of the biggest news stories of the decade, yet, it goes almost completely ignored.

Uncategorized

Bankrupt fast-food chain exits Chapter 11; to expand size 4 times

The Boston-based fast-food chain said it will exit bankruptcy this week with plans to expand its locations by four times over a five-year period.

Financial distress in the restaurant industry has led several fast-food and fast casual chains to file for bankruptcy, with businesses reorganizing, selling their assets or shutting down permanently.

Fast-casual Tex-Mex chain Tijuana Flats Restaurants on April 19 filed for Chapter 11 bankruptcy in the U.S. Bankruptcy Court for the Middle District of Florida, with ambitious plans to turn around the company that included selling the company to a new ownership group and closing 11 of its locations.

Related: Luxury appliance retailer files Chapter 7 bankruptcy to liquidate

The new owners, Flatheads LLC, purchased the restaurant chain from TJF USA LLC with a plan to revitalize its restaurants and reinvigorate the customer experience.

Another restaurant chain had more depressing plans, as fast casual restaurant chain Foxtrot and Dom’s Kitchen & Market, with 33 locations across the nation, on April 23 revealed that it was abruptly filing Chapter 7 bankruptcy liquidation and shutting down all of its locations immediately. The reason for the filing was unclear, according to reports.

While struggling restaurant chains file bankruptcy, close down locations, and in some cases go out of business, a popular Boston fast-food chain is bucking that trend and intends to emerge from Chapter 11 with a plan to expand its footprint in New England by four times.

Clover Food Lab

Fast food restaurant emerges from bankruptcy

Boston-based vegetarian fast-food restaurant chain Clover Food Lab filed for Chapter 11 Subchapter 5 bankruptcy in the U.S. Bankruptcy Court for District of Delaware on Nov. 3, 2023, to reorganize its business as its sales did not fully recovered from the effects of the Covid pandemic, according to its website.

In addition to lower than expected sales, the company in court papers said that high rent for its locations and inadequate funding as a result of the failure of Silicon Valley Bank contributed to the chain's distress.

The restaurant chain had planned to raise capital to expand in New England and into New York but the fallout from the failure of Silicon Valley Bank resulted in its financing plans to collapse. The debtor said that high rents and low sales at three of its locations led it to seek lease concessions from its landlords, which was unsuccessful and forced the company to file bankruptcy.

The restaurant chain opened in 2008 as a single food truck on the Massachusetts Institute of Technology campus in Cambridge, Mass., and offers an organic, vegetarian menu that "changes by the minute to keep up with daily available produce from farms in New England," according to Clover Food Lab's website. The company had 15 locations when it filed its Chapter 11 petition, but closed locations in Boston's Copley Square and Somerville's Assembly Row during its reorganization.

Clover Food Lab in a April 24 statement said that it will emerge from Chapter 11 Subchapter V bankruptcy this week with a five-year plan to add 47 new stores, initially opening locations in the Greater Boston area and then elsewhere in New England. It will focus on smaller outlets in urban areas and around universities, the statement said according to Boston Restaurant Talk. The expansion will grow the chain from 15 locations when it filed bankruptcy to 60 outlets after a five-year period.

Related: Veteran fund manager picks favorite stocks for 2024

bankruptcy pandemic stocksUncategorized

Philly Fed: State Coincident Indexes Increased in 44 States in March (3-Month Basis)

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for March 2024. Over the

past three months, the indexes increased in 44 states, decreased in five states, and remained stable in one,…

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for March 2024. Over the past three months, the indexes increased in 44 states, decreased in five states, and remained stable in one, for a three-month diffusion index of 78. Additionally, in the past month, the indexes increased in 41 states, decreased in two states, and remained stable in seven, for a one-month diffusion index of 78. For comparison purposes, the Philadelphia Fed has also developed a similar coincident index for the entire United States. The Philadelphia Fed’s U.S. index increased 0.7 percent over the past three months and 0.3 percent in March.Note: These are coincident indexes constructed from state employment data. An explanation from the Philly Fed:

emphasis added

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing by production workers, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.Click on map for larger image.

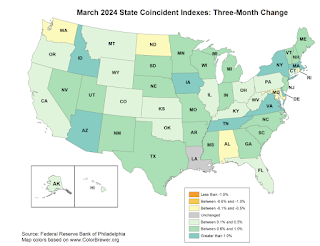

Here is a map of the three-month change in the Philly Fed state coincident indicators. This map was all red during the worst of the Pandemic and also at the worst of the Great Recession.

The map is almost all positive on a three-month basis.

Source: Philly Fed.

And here is a graph is of the number of states with one month increasing activity according to the Philly Fed.

And here is a graph is of the number of states with one month increasing activity according to the Philly Fed. In March, 44 states had increasing activity including minor increases.

Uncategorized

Target store introduces a new ‘over 18’ policy

The retailer is mandating a new rule about unaccompanied minors.

The contraction and expansion of retailers in this decade has been something to marvel at.

On the one hand, many specialty retailers that made large footprints and catered to niche consumer interests have struggled since the covid pandemic, which forced most shoppers to stay at home and take up hobbies.

Related: Popular restaurant chain filing for bankruptcy, closing all locations

Joann Fabrics, Body Shop, Bed Bath & Beyond, and Party City all filed for bankruptcy in the past year.

The pandemic may be behind us, but it has permanently shifted how we think about shopping. Now, most of us prefer to shop online for things we know we like, such as party supplies or home decor.

And for the things we're open to being influenced on, as with a new fragrance or specialty body lotion, we also look online, seeking others' opinions on forums and social media, often before going in and discovering for ourselves.

Retailers take more precautions

But the past several years have shifted the way that surviving retailers think about the shopping experience, too.

Retail crime, be it theft or violence, has surged. For example, smash-and-grabs jumped in metropolitan areas where some stores took softer policies on shoplifting.

Other stores struggled to keep robust workforces, opting instead for more autonomous technology like self-checkout kiosks to help customers move more quickly with their purchases.

But more self-checkouts created more inventory shrink, the industry term for a loss of product. This occurs in part when customers accidentally or purposely fail to properly scan items and aren't caught by a security system.

Image source: John Smith/VIEWpress.

Target institutes an under-18 policy

Large stores like Target (TGT) and Walmart (WMT) have been hit particularly hard by inventory shrink, with some CEOs calling the levels of it unsustainable for business and profitability.

This forced Target in March to limit self-checkout to customers with 10 items or fewer during normal business operations.

And a Target location in the Columbia Heights neighborhood of Washington is now implementing a stricter policy, mandating that anybody under age 18 must be accompanied by an adult to enter the store.

Some cities like Washington have seen an uptick in juvenile crime, especially when it comes to attempted robbery, carjacking and petty theft.

Earlier this year customers noticed a sign posted outside the Columbia Heights Target on 14th Street, which is a part of a massive retail complex also housing a Best Buy, Old Navy and Lidl.

"All guests under the age of 18 must be accompanied by an adult at this Target store," the sign reads at the entrance.

View the original article to see embedded media.

Customers note that some departments within the Target store are under lock and key, including personal-care products and menswear like socks, boxers and undershirts.

The location, which is a part of the DC USA shopping complex, serves more than 36,000 people a day and is the largest retail development in the city.

The greater DC USA shopping complex has similar signs posted throughout the area, mandating that minors must be accompanied by legal adults.

TheStreet has reached out to Target for comment.

bankruptcy pandemic-

International1 month ago

International1 month agoParexel CEO to retire; CAR-T maker AffyImmune promotes business leader to chief executive

-

Government3 weeks ago

Government3 weeks agoClimate-Con & The Media-Censorship Complex – Part 1

-

International6 days ago

International6 days agoJ&J’s AI head jumps to Recursion; Doug Williams resigns as Sana’s R&D chief

-

Government1 day ago

Government1 day agoCOVID-19 Vaccine Emails: Here’s What The CDC Hid Behind Redactions

-

International2 weeks ago

International2 weeks agoWHO Official Admits Vaccine Passports May Have Been A Scam

-

Spread & Containment2 weeks ago

Spread & Containment2 weeks agoFDA Finally Takes Down Ivermectin Posts After Settlement

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoVaccinated People Show Long COVID-Like Symptoms With Detectable Spike Proteins: Preprint Study

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCan language models read the genome? This one decoded mRNA to make better vaccines.