Government

Patrick Hill: Persistent Inflation Threatens the Recovery

Persistent Inflation Threatens the Recovery

"Our company has had to deal with import delays due to backlogged West Coast ports, higher domestic freight costs, and a labor shortage at distribution centers that has prompted wage increases. Earlier…

Persistent Inflation Threatens the Recovery

“Our company has had to deal with import delays due to backlogged West Coast ports, higher domestic freight costs, and a labor shortage at distribution centers that has prompted wage increases. Earlier this year, we thought, or maybe we hoped, that some of the industrywide supply-chain issues would have started to settle down by now. But that clearly hasn’t happened. In fact, the whole global supply situation seems to have gotten maybe even a little bit worse.”

John Crimmins, chief financial officer of Burlington Stores Inc., 5/27/21

Crimmins’s observation summarizes how business costs are driving persistent inflation due to multiple factors. Labor shortages are severe in the manufacturing, warehousing, retail, leisure, and hospitality sectors. Lack of workers drives wages up across thousands of businesses forcing management to raise prices to end customers and consumers. Leasing and rent costs have skyrocketed for warehousing-dependent manufacturers, e-commerce, and transportation companies. Container cargo from Asia to the U.S. has been bottlenecked since the pandemic began in the spring of 2020. Analysts think a mismatch of demand in Asia and the U.S. has caused too many empty containers in low-demand ports. Shipping bottlenecks forced manufacturers to buy more inventory than they needed to maintain sales. The hoarding is triggering price increases for many raw materials and finished goods.

Federal Reserve Forecast of Transitory Inflation Seems More Unlikely

At the June FOMC meeting, Federal Reserve Chairman Jerome Powell repeated his forecast that inflation is rising but will be ‘transitory’ as supply systems meet demand. Demand from workers returning to the office, shoppers returning to buying, and people traveling will ensure companies add production capabilities. Yet, supply bottlenecks and commodity shortages are causing long-term inflation. Sales are increasing dramatically in pandemic impacted sectors like hotels and restaurants as consumers resume traveling and eating out. Labor shortages are forcing many restaurant and hotel operators to open partially until they achieve full staffing. The shift to remote work has empowered workers to seek jobs from home at present or higher wages in other sectors. Plus, consumers are reeling from new and used car prices rapidly rising. Regardless of Fed forecasts of transitory inflation, executives and consumers in the real economy are experiencing persistent inflationary pressures.

In this post, we will examine these labor and supply-side trends embedding inflation into the economy. We’ll start by reviewing labor shortages in several industries.

Labor Shortages Drive Wage Gains

Wage gains can lead to embedded inflation. Workers will not settle for salary cuts. During a recession, executives may cut salaries to hold onto workers. Management hoping the pandemic would be short-lived furloughed workers. But the pandemic continued through 2020, forcing worker layoffs.

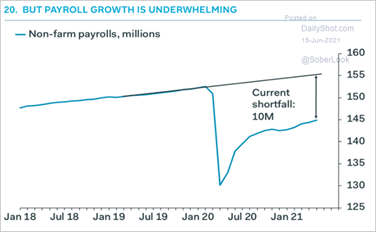

The fast vaccination rollout has jump-started consumer spending and economic growth. However, payroll growth and hiring have not kept up with hiring demand. The following chart shows a projection of baseline of payroll growth pre-pandemic versus where hiring is today. About 4.5M workers have been rehired though there is still a 10M worker gap versus baseline levels.

Source: The Daily Shot – 6/15/21

In May, Indeed reported that job openings have increased by 25% from February of 2020. But there are still 14.5M workers receiving continuing unemployment. There is a vast gap of hundreds of thousands of unemployed workers to jobs in hospitality in part due to hiring by Amazon, Federal Express, and UPS totaling 500k positions last year. In addition, there is a significant mismatch between thousands of unemployed worker skills and new jobs in high-growth sectors like software systems. Other reasons for lack of hiring are worker hesitancy related to COVID infection risk, lack of childcare, and poor wages.

Many Sectors Have Fewer Than One Unemployed Worker Per Job

The labor shortage is exemplified by the unusually few number of workers unemployed per job. This situation is made worse because 2.5M workers retired from the work force and about 1.7M women have not returned due to career changes and lack of childcare. The worst imbalance of jobs to unemployed people in the following chart is seen in leisure – hospitality, professional services, education – health and manufacturing.

Sources: Oxford Economics, Bloomberg – 6-30-21

To resolve the mismatch will require investments in job training, career development, and counseling on a significant scale. The process of matching workers to jobs is likely to take years, not months. Many workers are not going back to their old jobs after having a good experience working from home.

Workers Feel Empowered After Working from Home

When the pandemic hit, workers examined their jobs, family life, and tradeoffs with the income and hassle of commutes. We noted in a recent post on massive job churn that 37% of all workers changed jobs. Of that total, 26% of job changers moved to new employers. Many people changed industries to be able to work from home or have more family time. Newly empowered workers are driving a new set of job expectations with management. The rise in the quits rate reveals newfound confidence in workers’ ability to find the job they want on their terms. Lockdowns forced implementation of remote work on 70% of the workforce, providing them with the opportunity to explore new job options. The high number of job openings supports their reluctance to accept any job, not on their terms.

Quits Rate Indicates Higher Employer Costs Are Coming

The Department of Labor reports that the quits rate is the highest it has been in 20 years. The following two charts show how the quits rate is a leading indicator of a rise in the Employer Cost Index (ECI). The ECI leads to price increases that companies expect to pass along to customers.

Job seekers rejecting job offers forces employers into a hiring bind. To close the job search, companies sweeten their offers. Sweetened job offers may include increased wages, benefits, bonuses, and remote or hybrid work arrangements. Hard-pressed recruiters are dangling remote work as a sign-on bonus. Bret Taylor, COO of Salesforce, says employees are calling the shots, “There’s like a free market of the future of work, and employees are choosing which path that they want to go on.”

Labor Shortages Create Supply Bottlenecks Resulting in Price Increases

Supply shortages that economists are calling transitory maybe actually turn into persistent inflation. Supplier delivery times are at the worst level since 1951!

Sources: Arbor Research, Bloomberg, The Daily Shot – 6/23/21

Supply bottlenecks are in part caused by two, three, four steps or more in manufacturing processes to the final product. Companies selling to successive businesses face delays due to materials. Often, they are short on labor to fabricate, assemble, and deliver their product to the next-level manufacturer. Much of the increase in prices is due to input ‘upfront’ loading of inventories by manufacturers to have supplies available as materials continue to be scarce. The scarcity of intermediate goods causes input price increases that manufacturers pass along to customers.

Commodities Price Increases Drive Inflation

Prices for raw materials needed for manufacturing, processed goods, and energy are rising to record levels in the commodities price chart below. The Bloomberg Commodity Index includes prices for 23 futures contracts of physical commodities in energy, agriculture, and metals. Some commodity prices have declined due to consumer demand easing, yet the index has bounced back recently.

Source: Bloomberg – 6/28/21

Oil prices have risen to the highest level since 2018 as drivers return to traveling and go on summer vacations. Limited supplies of raw materials are due to pre-pandemic tariffs, extraction company worker layoffs during the pandemic, and shipping bottlenecks. Last year lumber prices rose 75% from pre-pandemic levels but are still about 60% above February 2020. New home prices rose 20% in the previous year in part due to the high rise in lumber prices. Adding to the demand for homes is the 5.5M lack of housing inventory. However, housing demand has slowed over the past few months due to increasing interest rates and surging prices.

Reopening Drives Consumer Demand & Commodity Prices

Reopening economies worldwide have triggered a surge in demand for a variety of consumer goods. Diverse consumer products companies like Sherwin-Williams, Masonite International, Levi Strauss, and Conagra Brands have announced price increases. As high prices reduce demand, commodity prices may decline, though it is unclear if they will return to pre-pandemic levels. The planned $1T in infrastructure spending bill now before Congress will add to demand for commodities as well.

Warehouse Rents Soar

Ecommerce demand for more warehouse space is driving the cost of large warehouses, particularly near coastal metro centers. The most significant increases are for 500k sq. ft warehouses as noted in the following chart at 13.2% in the last 12 months.

Source: CBRE – 6/25/21

Tenants taking rent prices surge due to multiple offers. Base rents are rising above asking rent prices in areas like Northern New Jersey, where prices jumped 33%, and Southern California at 27%. Coastal locations are in hot demand to deploy same-day delivery services in major markets.

The concern with soaring rent increases is that leases are set of 3 – 5 years and establish a baseline fixed cost for retail and distribution companies. Building leases are unlikely to be re-negotiated unless there is a significant recession. So, these rent increases are likely to drive persistent inflation for several years. Consumers are seeing major rent increases as well.

CPI Housing Component Is Forecast to Rise Significantly

Rent costs comprise about 40% and owner equivalent house prices of the Consumer Price Index (CPI). CoreLogic-Case-Shiller reported a 14.5% year-over-year price increase for homes in April. Due to the significant component housing plays in CPI, it is helpful to monitor the direction of inflation for the next several years. Here is a chart noting the CPI impact of housing and rent costs for recent movers.

Sources: Macrobond, Nordea, The Daily Shot – 6/14/21

Erica Brescia, an economist at Fannie Mae, comments on the impact of housing on CPI into 2022:

“Due to the heavy weight given to shelter, housing could contribute more than 2 percentage points to core CPI inflation by the end of 2022 and about 1 percentage point to the core PCE. Both would be the strongest contributions since 1990.”

In her estimate, housing will drive inflation into 2022, that trend seems to be long-term inflation. House prices may moderate in a slowing economy, but they rarely come down. Rents are rising across the country as well.

Rent Prices Rise Across the U.S.

Rents are rising in suburban, exurban, and spread-out cities like Denver, Dallas, and Los Angeles. These rent increases are primarily due to landlords looking to recoup losses from unpaid rent debts totaling about $70B during the pandemic. Offsetting the expected rise in rents across most households are rent declines of 11-14% in commuter-oriented cities like New York, Chicago, and San Francisco. States like California are planning on reimbursing landlords for 100% of their debt incurred during the pandemic using federal funding. Federal agencies in charge of the reimbursement process have been slow in delivering the funds. If funding delays continue, landlords will be forced to raise rents on lease price options. New move-in renters will experience higher rent prices as well.

New & Used Car Sales Prices Skyrocket

Workers from cities moving to suburbs and exurbs need cars. These relocated workers are buying cars at a quick pace. Used car prices rocketed up 27% in April, with forecasts to rise by 30% in May. J.D. Power reports that in 2021 75% of all new car sales were at MSRP or above. The following charts show the dramatic climb in prices.

Sources: BLS, UBS, J.D. Power, Wolfstreet – 6/28/21

A key reason used car prices have soared is the declining inventory of new cars. Computer chip shortages caused car manufacturers to reduce production. Dealers chose to raise prices on existing inventories and used vehicles on their lots. Computer chip shipments to auto manufacturers have fallen due to a shift in chip deliveries to electronic and computer system firms. Semiconductor chip manufacturers responded to pandemic lockdowns by closing plans. Then as the economy reopened, they are finding fewer job applicants.

Before the pandemic, U.S. tariffs on Chinese imports implemented by the Trump administration caused chip supply disruptions. Meantime, China has focused on building its semiconductor manufacturing capability to control innovation and boost its domestic car market. U.S. chip manufacturers are investing in new plants. But it will take years to balance chip supplies with auto industry demand. Chip prices will continue to rise for several years due to shortages.

FOMC Begins to See Increasing Inflation

We have reviewed how significant labor shortages, commodity price increases, chip shortages for cars, industrial and consumer rent increases are becoming embedded into the economy. While Fed Chairman Jerome Powell reiterated his forecast for transitory inflation, the Federal Open Market Committee (FOMC) sees persistent inflation emerging. At that meeting, FOMC participants’ inflation forecast shows their concern about rising inflation.

Sources: Federal Reserve, The Daily Shot – 6/28/21

Also, the FOMC saw an increasing level of uncertainty on whether inflation will rise or fall. If interest rates are kept extremely low, and liquidity is maintained, inflation is likely to build combined with possible further infrastructure spending. Already, monetary injections and fiscal spending combined are at the highest level since WWII as a percentage of GDP. The Federal Reserve’s characterization of inflation as ‘transitory’ is becoming less likely. In an op-ed article, Mohammed El-Erian, economic advisor at Allianz S.E., noted the FOMC participants’ weakening forecast for transitory inflation. Data trends continue to show persistent inflation factors building putting the recovery at risk. El- Erian advocates tightening monetary policies sooner and concludes:

“Most important, however, relative to what is needed, the Fed continues to fall further behind the curve, compounding an unnecessary risk facing a recovery that needs to be strong, long, inclusive, sustainable and not vulnerable to unsettling financial market instability.”

Author

Patrick Hill is the Editor of The Future Economy, https://thefutureconomy.com/, the site hosts analysis of the real economy, ideas on a new economy, indicators, and posts to start a dialog. He writes from the heart of Silicon Valley, leveraging 20 years of experience as an executive at firms like H.P., Genentech, Verigy, Informatica, and Okta to provide investment and economic insights. Twitter: @PatrickHill1677, email: patrickhill@thefutureconomy.com

The post Patrick Hill: Persistent Inflation Threatens the Recovery appeared first on RIA.

recession unemployment pandemic economic growth reopening fomc open market committee fed federal reserve congress trump spread tariffs gdp recovery interest rates consumer spending commodities oil chinaGovernment

Are Voters Recoiling Against Disorder?

Are Voters Recoiling Against Disorder?

Authored by Michael Barone via The Epoch Times (emphasis ours),

The headlines coming out of the Super…

Authored by Michael Barone via The Epoch Times (emphasis ours),

The headlines coming out of the Super Tuesday primaries have got it right. Barring cataclysmic changes, Donald Trump and Joe Biden will be the Republican and Democratic nominees for president in 2024.

With Nikki Haley’s withdrawal, there will be no more significantly contested primaries or caucuses—the earliest both parties’ races have been over since something like the current primary-dominated system was put in place in 1972.

The primary results have spotlighted some of both nominees’ weaknesses.

Donald Trump lost high-income, high-educated constituencies, including the entire metro area—aka the Swamp. Many but by no means all Haley votes there were cast by Biden Democrats. Mr. Trump can’t afford to lose too many of the others in target states like Pennsylvania and Michigan.

Majorities and large minorities of voters in overwhelmingly Latino counties in Texas’s Rio Grande Valley and some in Houston voted against Joe Biden, and even more against Senate nominee Rep. Colin Allred (D-Texas).

Returns from Hispanic precincts in New Hampshire and Massachusetts show the same thing. Mr. Biden can’t afford to lose too many Latino votes in target states like Arizona and Georgia.

When Mr. Trump rode down that escalator in 2015, commentators assumed he’d repel Latinos. Instead, Latino voters nationally, and especially the closest eyewitnesses of Biden’s open-border policy, have been trending heavily Republican.

High-income liberal Democrats may sport lawn signs proclaiming, “In this house, we believe ... no human is illegal.” The logical consequence of that belief is an open border. But modest-income folks in border counties know that flows of illegal immigrants result in disorder, disease, and crime.

There is plenty of impatience with increased disorder in election returns below the presidential level. Consider Los Angeles County, America’s largest county, with nearly 10 million people, more people than 40 of the 50 states. It voted 71 percent for Mr. Biden in 2020.

Current returns show county District Attorney George Gascon winning only 21 percent of the vote in the nonpartisan primary. He’ll apparently face Republican Nathan Hochman, a critic of his liberal policies, in November.

Gascon, elected after the May 2020 death of counterfeit-passing suspect George Floyd in Minneapolis, is one of many county prosecutors supported by billionaire George Soros. His policies include not charging juveniles as adults, not seeking higher penalties for gang membership or use of firearms, and bringing fewer misdemeanor cases.

The predictable result has been increased car thefts, burglaries, and personal robberies. Some 120 assistant district attorneys have left the office, and there’s a backlog of 10,000 unprosecuted cases.

More than a dozen other Soros-backed and similarly liberal prosecutors have faced strong opposition or have left office.

St. Louis prosecutor Kim Gardner resigned last May amid lawsuits seeking her removal, Milwaukee’s John Chisholm retired in January, and Baltimore’s Marilyn Mosby was defeated in July 2022 and convicted of perjury in September 2023. Last November, Loudoun County, Virginia, voters (62 percent Biden) ousted liberal Buta Biberaj, who declined to prosecute a transgender student for assault, and in June 2022 voters in San Francisco (85 percent Biden) recalled famed radical Chesa Boudin.

Similarly, this Tuesday, voters in San Francisco passed ballot measures strengthening police powers and requiring treatment of drug-addicted welfare recipients.

In retrospect, it appears the Floyd video, appearing after three months of COVID-19 confinement, sparked a frenzied, even crazed reaction, especially among the highly educated and articulate. One fatal incident was seen as proof that America’s “systemic racism” was worse than ever and that police forces should be defunded and perhaps abolished.

2020 was “the year America went crazy,” I wrote in January 2021, a year in which police funding was actually cut by Democrats in New York, Los Angeles, San Francisco, Seattle, and Denver. A year in which young New York Times (NYT) staffers claimed they were endangered by the publication of Sen. Tom Cotton’s (R-Ark.) opinion article advocating calling in military forces if necessary to stop rioting, as had been done in Detroit in 1967 and Los Angeles in 1992. A craven NYT publisher even fired the editorial page editor for running the article.

Evidence of visible and tangible discontent with increasing violence and its consequences—barren and locked shelves in Manhattan chain drugstores, skyrocketing carjackings in Washington, D.C.—is as unmistakable in polls and election results as it is in daily life in large metropolitan areas. Maybe 2024 will turn out to be the year even liberal America stopped acting crazy.

Chaos and disorder work against incumbents, as they did in 1968 when Democrats saw their party’s popular vote fall from 61 percent to 43 percent.

Views expressed in this article are opinions of the author and do not necessarily reflect the views of The Epoch Times or ZeroHedge.

Government

Veterans Affairs Kept COVID-19 Vaccine Mandate In Place Without Evidence

Veterans Affairs Kept COVID-19 Vaccine Mandate In Place Without Evidence

Authored by Zachary Stieber via The Epoch Times (emphasis ours),

The…

Authored by Zachary Stieber via The Epoch Times (emphasis ours),

The U.S. Department of Veterans Affairs (VA) reviewed no data when deciding in 2023 to keep its COVID-19 vaccine mandate in place.

VA Secretary Denis McDonough said on May 1, 2023, that the end of many other federal mandates “will not impact current policies at the Department of Veterans Affairs.”

He said the mandate was remaining for VA health care personnel “to ensure the safety of veterans and our colleagues.”

Mr. McDonough did not cite any studies or other data. A VA spokesperson declined to provide any data that was reviewed when deciding not to rescind the mandate. The Epoch Times submitted a Freedom of Information Act for “all documents outlining which data was relied upon when establishing the mandate when deciding to keep the mandate in place.”

The agency searched for such data and did not find any.

“The VA does not even attempt to justify its policies with science, because it can’t,” Leslie Manookian, president and founder of the Health Freedom Defense Fund, told The Epoch Times.

“The VA just trusts that the process and cost of challenging its unfounded policies is so onerous, most people are dissuaded from even trying,” she added.

The VA’s mandate remains in place to this day.

The VA’s website claims that vaccines “help protect you from getting severe illness” and “offer good protection against most COVID-19 variants,” pointing in part to observational data from the U.S. Centers for Disease Control and Prevention (CDC) that estimate the vaccines provide poor protection against symptomatic infection and transient shielding against hospitalization.

There have also been increasing concerns among outside scientists about confirmed side effects like heart inflammation—the VA hid a safety signal it detected for the inflammation—and possible side effects such as tinnitus, which shift the benefit-risk calculus.

President Joe Biden imposed a slate of COVID-19 vaccine mandates in 2021. The VA was the first federal agency to implement a mandate.

President Biden rescinded the mandates in May 2023, citing a drop in COVID-19 cases and hospitalizations. His administration maintains the choice to require vaccines was the right one and saved lives.

“Our administration’s vaccination requirements helped ensure the safety of workers in critical workforces including those in the healthcare and education sectors, protecting themselves and the populations they serve, and strengthening their ability to provide services without disruptions to operations,” the White House said.

Some experts said requiring vaccination meant many younger people were forced to get a vaccine despite the risks potentially outweighing the benefits, leaving fewer doses for older adults.

“By mandating the vaccines to younger people and those with natural immunity from having had COVID, older people in the U.S. and other countries did not have access to them, and many people might have died because of that,” Martin Kulldorff, a professor of medicine on leave from Harvard Medical School, told The Epoch Times previously.

The VA was one of just a handful of agencies to keep its mandate in place following the removal of many federal mandates.

“At this time, the vaccine requirement will remain in effect for VA health care personnel, including VA psychologists, pharmacists, social workers, nursing assistants, physical therapists, respiratory therapists, peer specialists, medical support assistants, engineers, housekeepers, and other clinical, administrative, and infrastructure support employees,” Mr. McDonough wrote to VA employees at the time.

“This also includes VA volunteers and contractors. Effectively, this means that any Veterans Health Administration (VHA) employee, volunteer, or contractor who works in VHA facilities, visits VHA facilities, or provides direct care to those we serve will still be subject to the vaccine requirement at this time,” he said. “We continue to monitor and discuss this requirement, and we will provide more information about the vaccination requirements for VA health care employees soon. As always, we will process requests for vaccination exceptions in accordance with applicable laws, regulations, and policies.”

The version of the shots cleared in the fall of 2022, and available through the fall of 2023, did not have any clinical trial data supporting them.

A new version was approved in the fall of 2023 because there were indications that the shots not only offered temporary protection but also that the level of protection was lower than what was observed during earlier stages of the pandemic.

Ms. Manookian, whose group has challenged several of the federal mandates, said that the mandate “illustrates the dangers of the administrative state and how these federal agencies have become a law unto themselves.”

Government

Low Iron Levels In Blood Could Trigger Long COVID: Study

Low Iron Levels In Blood Could Trigger Long COVID: Study

Authored by Amie Dahnke via The Epoch Times (emphasis ours),

People with inadequate…

Authored by Amie Dahnke via The Epoch Times (emphasis ours),

People with inadequate iron levels in their blood due to a COVID-19 infection could be at greater risk of long COVID.

A new study indicates that problems with iron levels in the bloodstream likely trigger chronic inflammation and other conditions associated with the post-COVID phenomenon. The findings, published on March 1 in Nature Immunology, could offer new ways to treat or prevent the condition.

Long COVID Patients Have Low Iron Levels

Researchers at the University of Cambridge pinpointed low iron as a potential link to long-COVID symptoms thanks to a study they initiated shortly after the start of the pandemic. They recruited people who tested positive for the virus to provide blood samples for analysis over a year, which allowed the researchers to look for post-infection changes in the blood. The researchers looked at 214 samples and found that 45 percent of patients reported symptoms of long COVID that lasted between three and 10 months.

In analyzing the blood samples, the research team noticed that people experiencing long COVID had low iron levels, contributing to anemia and low red blood cell production, just two weeks after they were diagnosed with COVID-19. This was true for patients regardless of age, sex, or the initial severity of their infection.

According to one of the study co-authors, the removal of iron from the bloodstream is a natural process and defense mechanism of the body.

But it can jeopardize a person’s recovery.

“When the body has an infection, it responds by removing iron from the bloodstream. This protects us from potentially lethal bacteria that capture the iron in the bloodstream and grow rapidly. It’s an evolutionary response that redistributes iron in the body, and the blood plasma becomes an iron desert,” University of Oxford professor Hal Drakesmith said in a press release. “However, if this goes on for a long time, there is less iron for red blood cells, so oxygen is transported less efficiently affecting metabolism and energy production, and for white blood cells, which need iron to work properly. The protective mechanism ends up becoming a problem.”

The research team believes that consistently low iron levels could explain why individuals with long COVID continue to experience fatigue and difficulty exercising. As such, the researchers suggested iron supplementation to help regulate and prevent the often debilitating symptoms associated with long COVID.

“It isn’t necessarily the case that individuals don’t have enough iron in their body, it’s just that it’s trapped in the wrong place,” Aimee Hanson, a postdoctoral researcher at the University of Cambridge who worked on the study, said in the press release. “What we need is a way to remobilize the iron and pull it back into the bloodstream, where it becomes more useful to the red blood cells.”

The research team pointed out that iron supplementation isn’t always straightforward. Achieving the right level of iron varies from person to person. Too much iron can cause stomach issues, ranging from constipation, nausea, and abdominal pain to gastritis and gastric lesions.

1 in 5 Still Affected by Long COVID

COVID-19 has affected nearly 40 percent of Americans, with one in five of those still suffering from symptoms of long COVID, according to the U.S. Centers for Disease Control and Prevention (CDC). Long COVID is marked by health issues that continue at least four weeks after an individual was initially diagnosed with COVID-19. Symptoms can last for days, weeks, months, or years and may include fatigue, cough or chest pain, headache, brain fog, depression or anxiety, digestive issues, and joint or muscle pain.

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoIndustrial Production Decreased 0.1% in January

-

International2 days ago

International2 days agoWalmart launches clever answer to Target’s new membership program

-

International2 days ago

International2 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex